December 2025

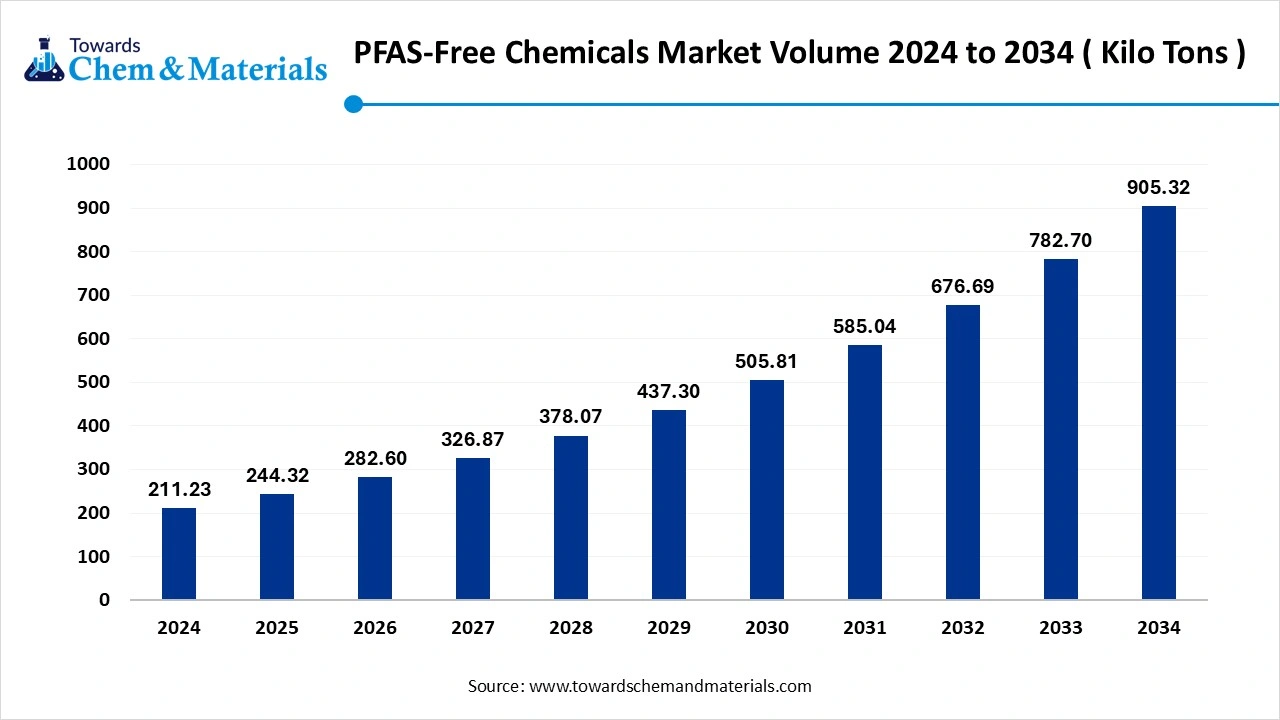

The global PFAS free chemicals market volume was valued at 211.23 kilo tons in 2024 and is expected to reach around 905.32 kilo tons by 2034, growing at a CAGR of 15.67% from 2025 to 2034. The growing concerns regarding the health impact of polyfluoroalkyl substances (PFAS) are the key factor driving the growth of the market. Also, rising consumer demand for safer solutions, coupled with the stringent regulations imposed by the government, can fuel market growth further.

PFAS-Free Chemicals Market refers to the global industry focused on the production, formulation, and application of chemical substances that do not contain Per- and Polyfluoroalkyl Substances (PFAS). These alternatives are designed to deliver performance comparable to traditional PFAS in applications such as water repellency, grease resistance, surfactancy, and durability, without the persistent environmental and health hazards associated with PFAS. The surge in green chemistry initiatives is supporting the development of products and processes that reduce the utilisation of hazardous substances, further impacting positive market growth.

| Report Attribute | Details |

| Market Volume in 2025 | 244.32 Kilo Tons |

| Expected Volume by 2034 | 905.32 Kilo Tons |

| Growth Rate from 2025 to 2034 | 15.67% |

| Base Year of Estimation | 2024 |

| Forecast Period | 2025 - 2034 |

| Dominant Region | North America |

| Segment Covered | By Chemical Type, By Functionality, By Application, By End-Use Industry, By Region |

| Key Companies Profiled | 3M (transitioning to PFAS-free alternatives), Chemours, Daikin Industries, Arkema, Clariant, Croda International, Cargill, BASF SE, Sasol Chemicals, Evonik Industries, Solvay, Huntsman Corporation, Wacker Chemie AG, Shin-Etsu Chemical, DuPont, Celanese Corporation, Momentive Performance Materials, Ingevity Corporation, Stepan Company, DIC Corporation |

The ongoing technological innovations in green packaging and bio-based packaging materials are rapidly creating lucrative opportunities in the market. Next-generation solutions, such as molded fiber trays, compostable films, and plant-based coatings, are replacing PFAS-treated solutions. Furthermore, Packaging innovators and materials scientists are developing alternatives that meet both sustainability and functionality criteria, supporting market growth soon.

Eliminating PFAS from production processes may necessitate substantial changes to current equipment and production lines, which is a major factor hindering market growth. Moreover, PFAS regulations are increasingly becoming stricter, requiring businesses to adapt to constantly changing standards and potentially face restrictions and bans, constraining market growth further.

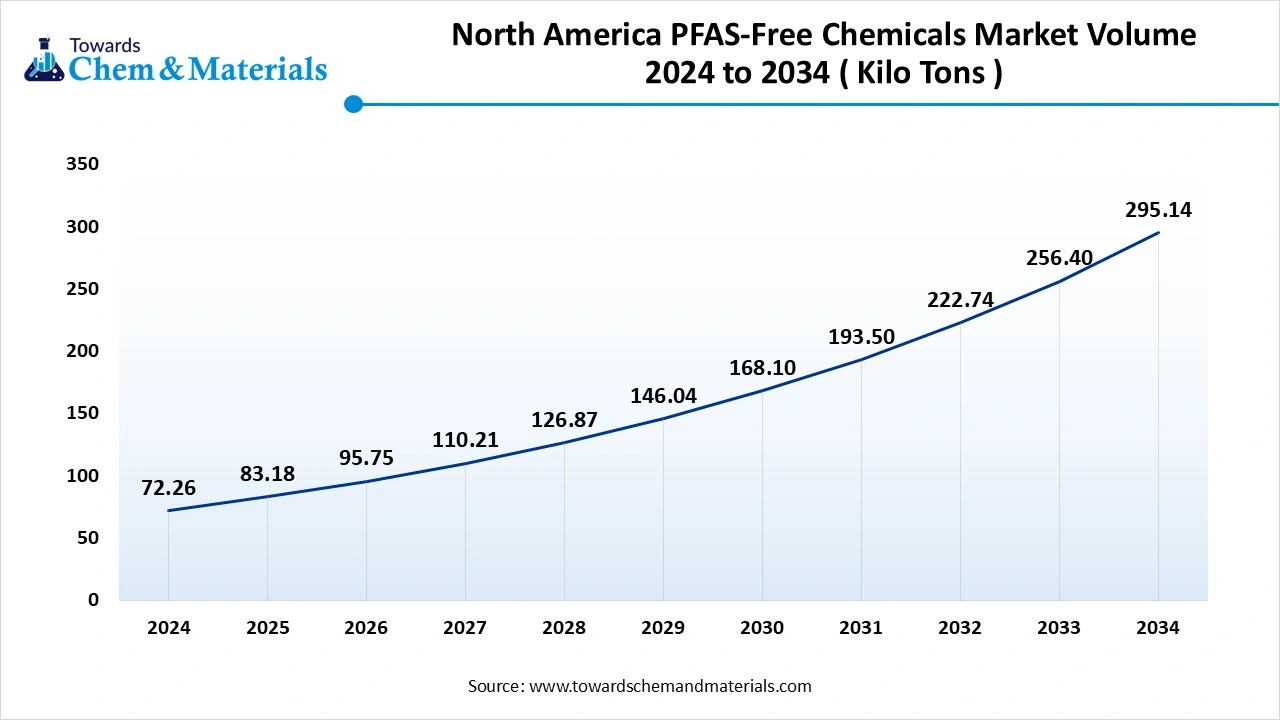

The North America PFAS free chemicals market volume was estimated at 72.26 kilotons in 2024 and is anticipated to reach 295.14 Kilo Tons by 2034, growing at a CAGR of 15.11% from 2025 to 2034.

The growth of the region can be credited to the ongoing research and development activities emphasized on creating sustainable, effective PFAS-free alternatives, such as surfactants and new coatings. Furthermore, the development of innovative filtration technologies such as nanofiltration and reverse osmosis in the region is boosting positive market growth in the region shortly.

PFAS Free Chemicals Market in the U.S.

In North America, the U.S. dominated the market by holding the largest market share, due to growing consumer demand for sustainable products coupled with the rising regulatory pressure for green chemistry initiatives. Additionally, companies across various sectors, such as textiles, food packaging, and non-stick cookware, are increasingly shifting towards PFAS-free options to fulfil consumer preferences and environmental regulations.

Europe is expected to grow at the fastest CAGR over the forecast period. Europe is expected to grow at the fastest CAGR over the forecast period. The dominance of the region can be attributed to the implementation of stringent regulations that focus on environmental protection and consumer safety. In addition, innovations in green chemistry, especially in areas such as bio-based polymers and interfacial polymerization, are allowing the development of PFAS-free formulations that can exceed the performance of conventional PFAS chemicals, driving regional growth soon.

PFAS Free Chemicals Market in Germany

In Europe, Germany led the market owing to the surge in consumer awareness, rising environmental regulations, and ongoing innovations in sustainable technologies. Also, Germany is implementing stringent regulations on PFAS in water and other applications, further propelling the adoption of PFAS-free solutions in the country.

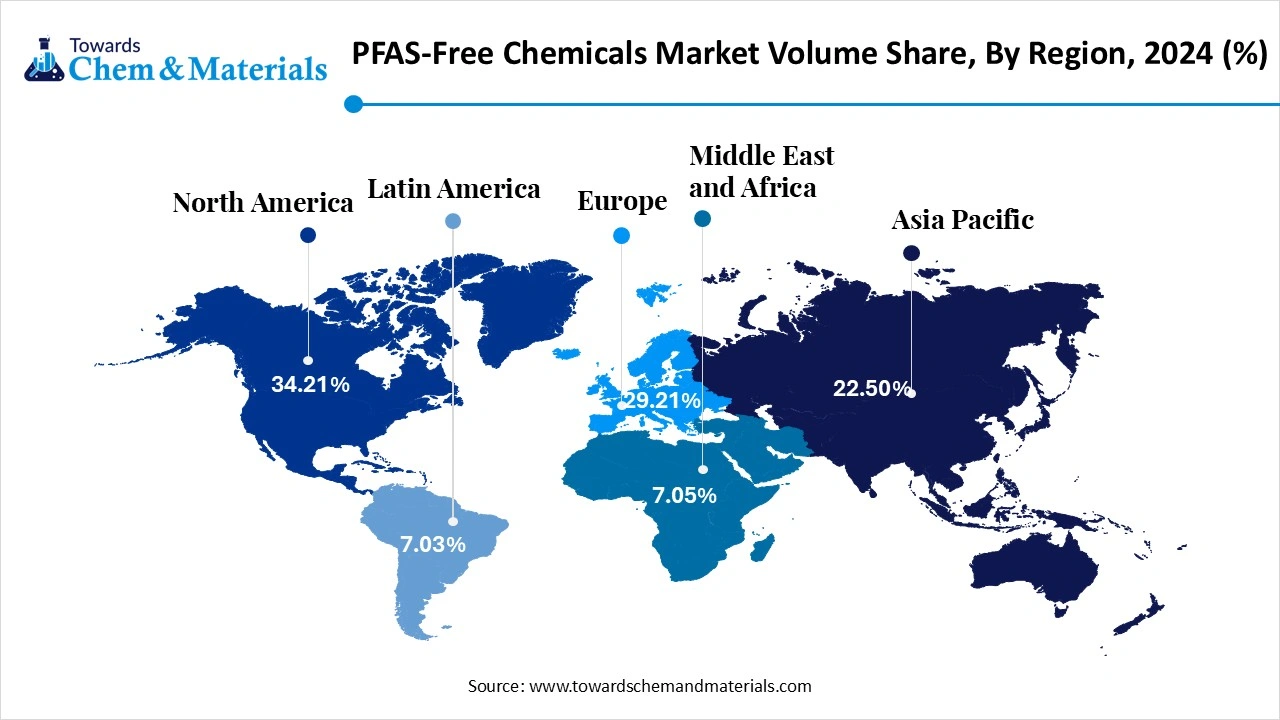

PFAS Free Chemicals Market Volume Share, By Region, 2024-2034 (%)

| By Region | Volume Share, 2024 (%) | Market Volume - 2024 | Volume Share, 2034 (%) | Market Volume - 2034 | CAGR (2025 - 2034) |

| North America | 34.21% | 72.26 | 28.32% | 256.39 | 15.11% |

| Europe | 29.21% | 61.70 | 27.01% | 244.53 | 16.53% |

| Asia Pacific | 22.50% | 47.53 | 31.23% | 282.73 | 21.91% |

| Latin America | 7.03% | 14.85 | 6.55% | 59.30 | 16.63% |

| Middle East & Africa | 7.05% | 14.89 | 6.89% | 62.38 | 17.25% |

| Total | 100% | 211.23 | 100% | 905.32 | 15.67% |

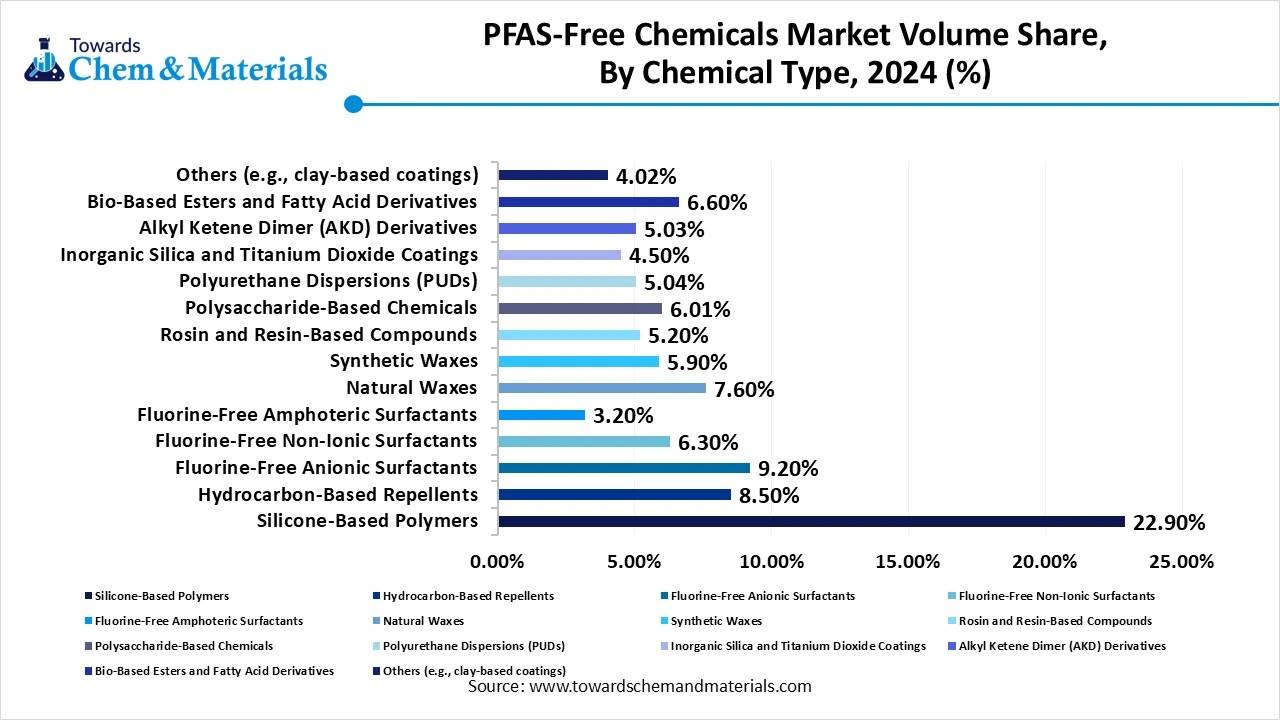

Which Chemical Type Segment Dominated the PFAS Free Chemicals Market in 2024?

The silicone-based compounds segment dominated the PFAS free chemicals market with 27% market share in 2024. The dominance of the segment can be attributed to the growing consumer demand for safer and more convenient alternatives and a surge in regulatory pressure globally. Silicone-based compounds are widely known for their performance and durability and are often considered as a viable alternative to PFAS in various applications.

The fluorine-free amphoteric surfactants segment is expected to grow at the fastest CAGR over the forecast period. The growth of the segment can be credited to the rapid advancements in fluorine-free surfactant technologies, along with the growing consumer preference for organic and natural personal care products. Also, major players such as Syensqo and DIC Corporation are actively manufacturing and commercializing PFAS-free surfactants.

PFAS Free Chemicals Market Volume Share, By Chemical Type, 2024-2034 (%)

| By Chemical Type | Volume Share, 2024 (%) | Market Volume - 2024 | Volume Share, 2034 (%) | Market Volume - 2034 | CAGR (2025 - 2034) |

| Silicone-Based Polymers | 22.90% | 48.37 | 16.47% | 149.11 | 13.32% |

| Hydrocarbon-Based Repellents | 8.50% | 17.95 | 9.03% | 81.75 | 18.34% |

| Fluorine-Free Anionic Surfactants | 9.20% | 19.43 | 10.50% | 95.06 | 19.29% |

| Fluorine-Free Non-Ionic Surfactants | 6.30% | 13.31 | 7.10% | 64.28 | 19.12% |

| Fluorine-Free Amphoteric Surfactants | 3.20% | 6.76 | 3.80% | 34.40 | 19.82% |

| Natural Waxes | 7.60% | 16.05 | 6.20% | 56.13 | 14.92% |

| Synthetic Waxes | 5.90% | 12.46 | 5.50% | 49.79 | 16.64% |

| Rosin and Resin-Based Compounds | 5.20% | 10.98 | 6.50% | 58.85 | 20.50% |

| Polysaccharide-Based Chemicals | 6.01% | 12.69 | 7.80% | 70.61 | 21.01% |

| Polyurethane Dispersions (PUDs) | 5.04% | 10.65 | 4.40% | 39.83 | 15.79% |

| Inorganic Silica and Titanium Dioxide Coatings | 4.50% | 9.51 | 5.20% | 47.08 | 19.45% |

| Alkyl Ketene Dimer (AKD) Derivatives | 5.03% | 10.62 | 4.20% | 38.02 | 15.22% |

| Bio-Based Esters and Fatty Acid Derivatives | 6.60% | 13.94 | 8.20% | 74.24 | 20.42% |

| Others (e.g., clay-based coatings) | 4.02% | 8.49 | 5.10% | 46.17 | 20.70% |

| Total | 100% | 211.23 | 100% | 905.32 | 15.67% |

Why Did the Water Repellent Agent Segment Dominated the PFAS Free Chemicals Market in 2024?

The water repellent agent segment held a 24% market share in 2024. The dominance of the segment can be linked to the growing emphasis on using and developing alternatives to PFAS for creating water-repellent coatings, especially in the packaging and textiles sectors. Research and development are increasingly focusing on using bio-based materials such as cellulose, starches, and proteins to create water-repellent coatings, further impacting positive market growth.

The surfactants for cleaning & emulsification segment is expected to grow at the fastest CAGR over the forecast period. The growth of the segment is owing to the increasing adoption of PFAS-free surfactants across various industries, along with the stringent government regulations associated with PFAS chemicals. These surfactants are widely known for their excellent washing, wetting, and emulsifying properties, which make them suitable for different applications.

How Much Share Did the Textile Segment Held in 2024?

The textiles segment led the market by holding 31% PFAS free chemicals market share in 2024. The dominance of the segment can be driven by rising consumer awareness about PFAS-free textile materials, coupled with the health risks associated with them. Moreover, the industry is increasingly advancing and adopting less harmful chemical substitutes for PFAS, especially in waterproof membranes and coatings, leading to segment growth soon.

The paper & paperboard segment expects the fastest CAGR during the forecast period. The growth of the segment is due to its biodegradable nature and the capability to be recycled easily. These materials are extensively utilized in packaging formats like boxes, cartons, and wraps. The foodservice industry, especially takeout/delivery services, is a major driver of demand for PFAS-free packaging solutions.

Why the Cosmetics & Personal Care Products Segment Dominated the PFAS Free Chemicals Market in 2024?

The cosmetics & personal care products segment led the market with 22% market share in 2024. The dominance of the segment can be credited to the rising consumer awareness regarding the potential environmental and health risks associated with PFAS. Furthermore, cosmetic products such as skincare, oral care, and makeup are witnessing a shift towards organic, natural, and clean-label products, with market players actively promoting PFAS-free alternatives.

The food & beverage packaging segment is expected to grow at the fastest CAGR during the study period. The growth of the segment can be attributed to the growing consumer concerns regarding environmental impact and food safety. This segment includes products like frozen foods, snacks, ready-to-eat meals, and other pre-packaged goods that need protective packaging to prevent contamination and maintain freshness.

By Chemical Type

By Functionality

By Application

By End-Use Industry

By Region

December 2025

December 2025

November 2025

November 2025