Content

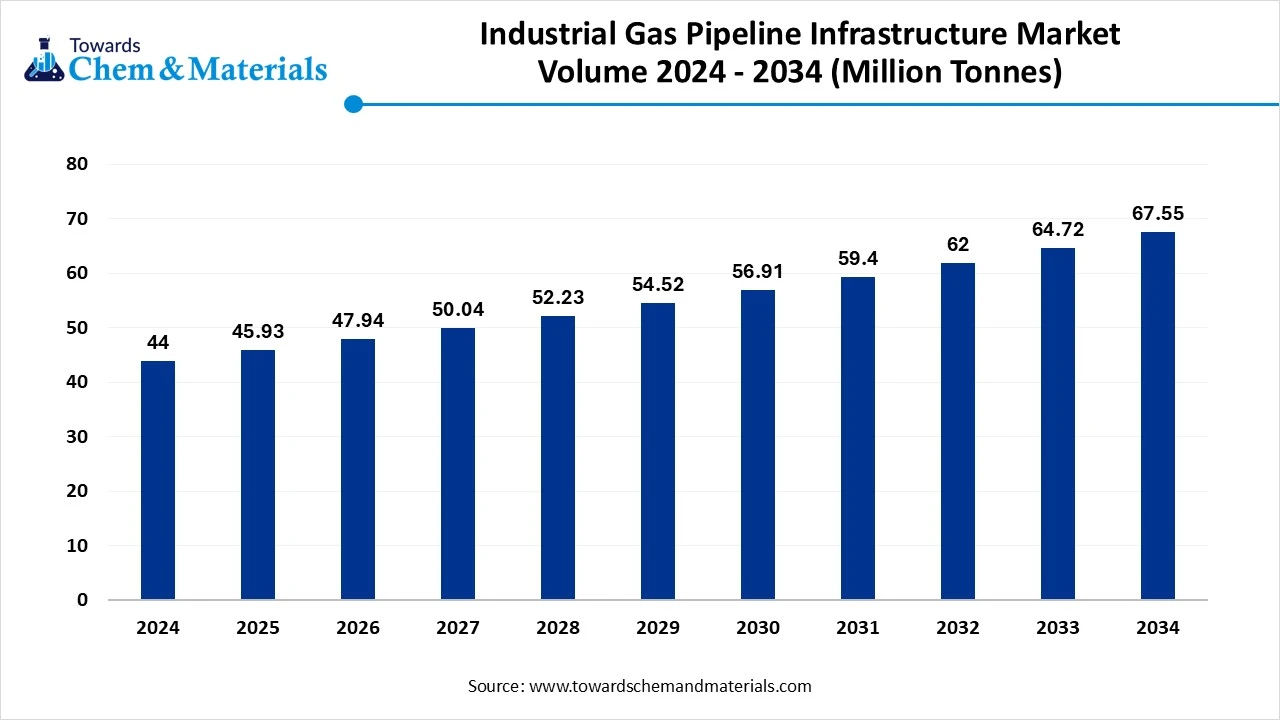

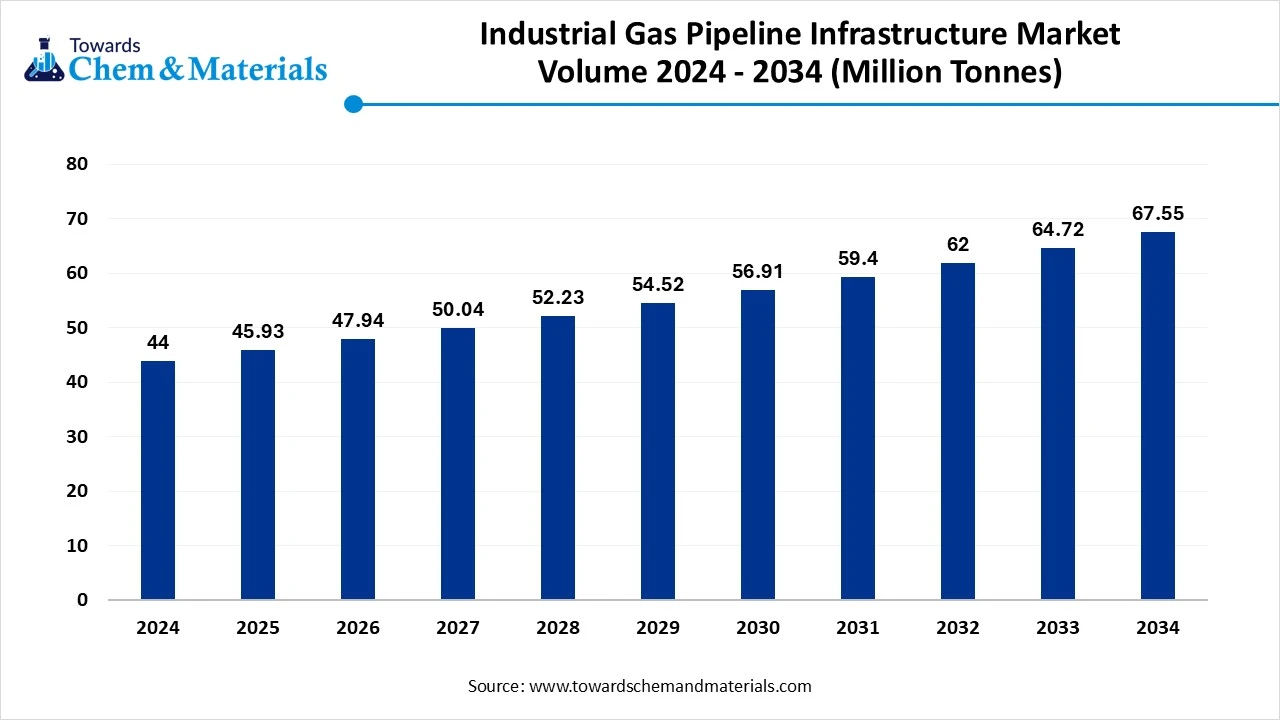

Industrial Gas Pipeline Infrastructure Market Volume and Growth 2025 to 2034

The global industrial gas pipeline infrastructure market volume was reached at USD 44.00 million tonnes in 2024 and is expected to be worth around USD 67.55 million tonnes by 2034, growing at a compound annual growth rate (CAGR) of 4.38% over the forecast period 2025 to 2034. The increased need for energy security has been a key enabler of industry development.

Key Takeaways

- By region, Asia Pacific dominated the industrial gas pipeline infrastructure market in 2024, akin to greater energy needs and huge industries.

- By region, Middle East and Africa are expected to grow at a fastest rate in the future, owing to the region being known as a major natural gas exporter in recent years.

- By pipeline type, the onshore transmission pipelines segment led the market in 2024, due to factors such as cost-effectiveness and easy installation.

- By pipeline type, the offshore subsea pipelines segment is expected to grow at the fastest rate in the market during the forecast period, akin to a shift towards deepwater gas exploration.

- By material/pipe technology, the carbon low alloy steel segment emerged as the top-performing segment in the market in 2024, due to its cost-effectiveness and wide availability.

- By material/pipe technology, the high-strength line pipe projects segment is expected to lead the market in the coming years, as pipeline projects become larger and more complex.

- By function/operation, the transmission segment led the industrial gas pipeline infrastructure market in 2024, because it forms the backbone of the entire gas supply chain.

- By function/operation, the distribution segment is expected to capture the biggest portion of the market in the coming years, owing to as urban gas demand grows rapidly.

- By equipment/asset type, the pipelines segment led the market in 2024, because pipes themselves are the most essential and capital-intensive part of any project.

- By equipment/asset type, the inspection/monitoring & digital SCADA segment is expected to grow at the fastest rate in the market during the forecast period, because safety and efficiency are becoming top priorities.

- By end-use industry, the power generation segment led the market in 2024 because natural gas is now the leading alternative to coal for electricity production.

- By end-use industry, the CNG and transport fueling stations segment is expected to capture the biggest portion of the market in the coming years, due to the global shift toward clean mobility.

Market Overview

Connecting Energy: Inside the Booming Industrial Gas Pipeline Network

The global industrial gas pipeline infrastructure market has experienced significant growth in recent years. The network of engineered pipelines and associated facilities (transmission lines, distribution mains, compressor/booster stations, meter/odourization stations, valve stations, pigging/inspection systems, storage interconnects and related SCADA/telemetry and safety systems) used to transport industrial gases (natural gas, process gases and emerging gases such as hydrogen) from production/terminal points to industrial users, power plants, storage sites and distribution networks.

Reliable Pipelines for a Cleaner, Energy-Secure Future

The increased need for energy security and a stable gas supply has actively created profitable pathways for sector participants in recent years. As the major sectors such the steel, power generation, and chemicals are heavily dependent on industrial and natural gas nowadays. Also, by providing the uninterrupted and low-cost delivery of gases, the gas pipeline infrastructure has been widely discussed in technological forums and white papers globally. Also, the global shift towards cleaner fuel and gas pipelines is expected to attract increased capital and investment in manufacturing.

- For instance, In August 2025, China installed gas pipelines in its eastern region as the country is trying to boost energy security and regional development via these advanced installations, as per the latest report.(Source: www.globaltimes.cn)

The growing demand for the hydrogen-ready pipeline infrastructure has enabled the sector to explore untapped potential in recent times. Several regions are seen under the heavy updation of the traditional gas pipelines to handle hydrogen blends. The increased integration of advanced digital monitoring and automation technologies in modern pipeline infrastructure is being embraced as a transformation trend in the market.

Report Scope

| Report Attributes | Details |

| Market Volume in 2025 | USD 45.93 Million Tonnes |

| Expected Volume by 2034 | USD 67.55 Million Tonnes |

| Growth Rate from 2025 to 2034 | CAGR 4.38% |

| Base Year of Estimation | 2024 |

| Forecast Period | 2025 - 2034 |

| Dominant Region | Asia Pacific |

| Segment Covered | By Pipeline Type, By Material/Pipe Technology, By Function/Operation, By Equipment/Asset Type, By End-User Industry, By Region |

| Key Companies Profiled | Kinder Morgan, Inc. , Enbridge Inc. , TC Energy / TransCanada, Energy Transfer, LP , Williams Companies, Bechtel Corporation ,, Saipem SpA , TechnipFMC / Technip Energies, McDermott International, Fluor Corporation , Worley / John Wood Group (Wood PLC) , Samsung Engineering , Hyundai Engineering (Petrofac Limited) |

Market Opportunity

Future Ready Pipelines for Natural Gas and Hydrogen Delivery

The development of the flexible and modular pipeline infrastructure is set to create competitive advantages in the global production spaces during the forecast period, as the modern industries are demanding scalable solutions that have the capacity to expand in phases. Also, by creating the modular compressor stations and quick installation pipeline system, which is capable of both natural gas and hydrogen, manufacturers are likely to gain prominence in innovation-led sectors in the upcoming years.

Market Challenge

Crucial Materials and Compliance Issues Hamper Development

The regulatory hurdles and expensive raw materials are likely to prevent firms from capitalizing on emerging opportunities in the coming years. As raw materials like steel, special alloys, and advanced coatings are considered as the crucial raw materials in pipeline development, which are expensive, the small and mid-sized companies are likely to face cost barriers. Also, global governments are seen under heavy limitations of safety and environmental rules are projected to obstruct innovation and development efforts.

Regional Insights

Asia Pacific Industrial Gas Pipeline Infrastructure Market Trends

Asia Pacific dominated the industrial gas pipeline infrastructure market in 2024, akin to its energy needs and huge industries. Moreover, the sectors such as the petroleum, steel, and power generation industries are driving the strategic transformation and sectoral scalability in the region. Also, the large-scale government-backed projects have allowed stakeholders to capitalize on growth opportunities in the regional countries like India, China, and Japan in the past few years.

- For Instance, In February 2025, India installed an enlarged LPG pipeline in June. The motive behind the pipeline installation was to cut down costs and avoid deadly road accidents.(Source: economictimes.indiatimes.com)

Is China Redefining Global Gas Pipeline Infrastructure?

China maintained its dominance in the industrial gas pipeline infrastructure market, owing to the enlarged and aggressive infrastructure investments. Moreover, China has one of the longest and massive gas pipelines connecting Russia and Central Asia, which has earned attention for reshaping industry norms.

Furthermore, China is actively trying to reduce its dependence on imports, where the manufacturers can gain a major industry share by establishing domestic pipeline manufacturing plants in the coming years.

Middle East & Africa Industrial Gas Pipeline Infrastructure Market Trends

The Middle East & Africa are expected to capture a major share of the industrial gas pipeline infrastructure market, owing to the region being known as a major natural gas exporter in recent years. Moreover, the regional countries like Qatar, Saudi Arabia, and Nigeria are seen under the advanced extensive gas pipeline networks are expected to create favorable conditions for long-term business planning in the upcoming years.

In addition, the African region is emerging as a hub with its latest cross-border pipelines, which connect to Europe, and can facilitate strategic positioning for manufacturing firms during the projected period.

Segmental Insights

Pipeline Type Insights

How did the Onshore Transmission Pipelines Segment Dominate the Industrial Gas Pipeline Infrastructure Market in 2024?

The onshore transmission pipelines segment held the largest share of the market in 2024, due to factors such as cost-effectiveness and easy installation. Moreover, the sectors such as the power plants, chemical industries, and steel factories are generally located on the grounds where the onshore transmission pipelines have gained industrial attention in the past few years. Furthermore, several regional governments preferring the onshore transmission pipelines owing to lower maintenance and faster approvals.

The offshore subsea pipelines segment is expected to grow at a notable rate during the predicted timeframe, akin to a shift towards deepwater gas exploration. Moreover, the gas-rich nations like Qatar, Brazil, and others are actively seen under the heavy investment in offshore gas extraction practice in recent years. Also, reliable and cost-effective methods can create a favorable environment for the offshore subsea pipeline in the upcoming years, as per the future industry expectations.

Material/Pipe Technology Insights

Why Does the Carbon/Low Alloy Steel Segment Dominate the Industrial Gas Pipeline Infrastructure Market by Technology?

The carbon/low alloy steel segment held the largest share of the market in 2024, due to its durability and wide availability. They have been the traditional choice for building large-scale transmission pipelines, especially in countries where cost efficiency is a priority. These materials provide good strength and resistance to pressure, making them reliable for transporting natural gas over long distances.

The high-strength line pipe segment is expected to grow at a notable rate as pipeline projects become larger and more complex. Long-distance cross-border pipelines and offshore subsea systems require materials that can withstand extreme pressures, harsh climates, and corrosive environments. High-strength pipes offer superior durability, reduced wall thickness, and higher efficiency in gas flow, which lowers operating costs over time.

Function/Operation Insights

How Did the Transmission Segment Dominate the Industrial Gas Pipeline Infrastructure Market in 2024?

The transmission segment dominated the market with the largest share in 2024 because it forms the backbone of the entire gas supply chain. Transmission pipelines carry huge volumes of natural gas across long distances, connecting gas fields to refineries, power plants, and major industrial users. They are critical for ensuring national and regional energy security, especially in large countries like the United States, China, and Russia.

The distribution segment is expected to grow at a significant rate owing to as urban gas demand grows rapidly. Cities across Asia, Africa, and Latin America are expanding their local pipeline networks to deliver gas directly to households, small industries, and commercial users. With natural gas being adopted as a cleaner alternative to coal and oil in residential heating and cooking, local distribution pipelines are seeing major investment.

Equipment/Asset Type Insights

Are Steel Pipelines the Backbone of Industrial Gas Projects?

The pipelines segment held the largest share of the market in 2024 because pipes themselves are the most essential and capital-intensive part of any project. Without the steel pipelines, other equipment like compressors or sensors cannot function. Investments in pipeline construction form the bulk of project costs, making pipes the dominant equipment category.

The inspection/monitoring & digital SCADA segment is expected to grow at a notable rate during the predicted timeframe because safety and efficiency are becoming top priorities. Pipelines face risks of leakage, corrosion, and accidents, which can cause huge financial and environmental losses. Governments are enforcing stricter regulations that require real-time monitoring.

End Use Industry Insights

Could Gas-Fired Power Plants Be the Key to a Cleaner Energy Future?

The power generation segment dominated the market with the largest share in 2024 because natural gas is now the leading alternative to coal for electricity production. Gas-fired power plants are cleaner, more efficient, and quicker to build compared to coal plants, making them the top choice for countries aiming to reduce emissions. Industrial gas pipelines supply massive amounts of gas to these plants, ensuring stable electricity production for cities and industries.

The CNG and transport fueling stations segment is expected to grow at a significant rate due to the global shift toward clean mobility. Governments are promoting compressed natural gas (CNG) as a low-emission alternative to diesel and petrol in public transport and commercial vehicles. Pipelines directly supplying CNG refueling stations reduce fuel costs and ensure uninterrupted availability.

Industrial Gas Pipeline Infrastructure Market Value Chain Analysis

- Distribution to Industrial Users : The distribution of industrial gas pipelines is heavily reliant on regulatory bodies like PNGRB and major companies.

- Key Players : Air Liquide SA, Linde Group, and others

- Chemical Synthesis and Processing : The processing of chemical synthesis of the industrial gas pipeline is mainly dependent on the major processes, such as steam reforming and partial oxidation.

- Regulatory Compliance and Safety Monitoring : The regional regulatory bodies can play a major role in the regulatory and safety monitoring of the industrial gas pipeline infrastructure, where the regional government can decide its regional safety standards.

Recent Developments

- In August 2025, ONEOK created a strategic collaboration with Eiger Express. Also, the collaboration aims to enhance the strategic initiatives in natural gas transportation by constructing greater pipeline infrastructure. Also, the company is trying to expand in the United States and the global industry, as per the report published by the company recently.(Source : simplywall.st)

- In July 2025, the Boskalis and Allseas consortium was honored for their offshore natural gas pipeline with received an award in Taiwan. Moreover, the value of the contract was EUR 1.2 billion as per the report published by the company.(Source: www.globenewswire.com/news-release)

Industrial Gas Pipeline Infrastructure Market Top Companies

- Kinder Morgan, Inc.

- Enbridge Inc.

- TC Energy / TransCanada

- Energy Transfer, LP

- Williams Companies

- Bechtel Corporation

- Saipem SpA

- TechnipFMC / Technip Energies

- McDermott International

- Fluor Corporation

- Worley / John Wood Group (Wood PLC)

- Samsung Engineering

- Hyundai Engineering (Petrofac Limited)

Segment Covered

By Pipeline Type

- Onshore transmission pipelines (high-pressure, long-distance)

- Onshore distribution pipelines (low/medium pressure, local networks)

- Offshore subsea pipelines (export/import, trunklines)

- Gathering/feeder pipelines (field collection)

By Material/Pipe Technology

- Carbon/low-alloy steel (welded ERW, seamless)

- High-strength linepipe (X70, X80, higher grades)

- Polyethylene (PE) / HDPE (distribution & low-pressure)

- Composite & fiber-reinforced pipes (specialty)

- Coatings & lining (3LPE, epoxy, internal liners)

By Function/Operation

- Transmission (long distance, high pressure)

- Distribution (city/industrial distribution networks)

- Gathering & Field Collection

- Storage interconnect & line-pack operations

By Equipment/Asset Type

- Pipelines (linepipe)

- Compressor/booster stations (gas turbines/electric drivers)

- Metering & pressure-regulation skids

- Valve stations & pigging facilities (launchers/receivers)

- Inspection, monitoring & SCADA systems (pigging services, sensors, leak detection)

- Cathodic protection & coatings services

By End-User Industry

- Power generation (utility & IPP)

- Petrochemical & refinery feedstock

- Heavy industries (steel, cement, chemicals)

- Residential & commercial (via distribution networks)

- CNG & transport fuelling stations (industrial fleet)

By Region

- North America

- U.S.

- Canada

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Sweden

- Denmark

- Norway

- Asia Pacific

- China

- Japan

- India

- South Korea

- Thailand

- Latin America

- Brazil

- Mexico

- Argentina

- Middle East and Africa (MEA)

- South Africa

- UAE

- Saudi Arabia