Content

What is the Current Propylene Carbonate Market Size and Volume?

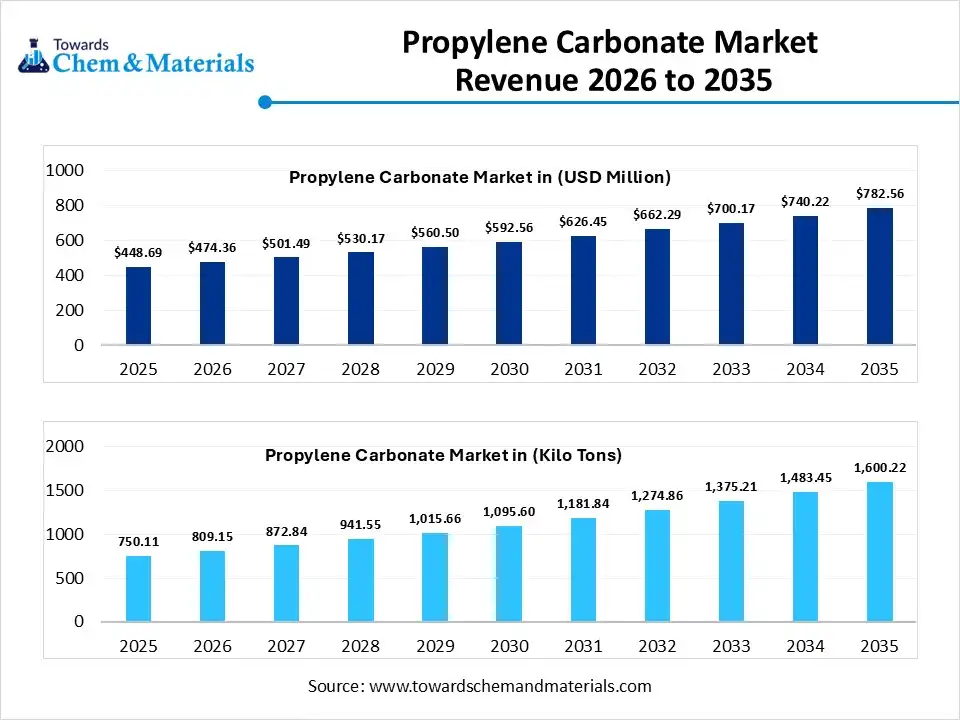

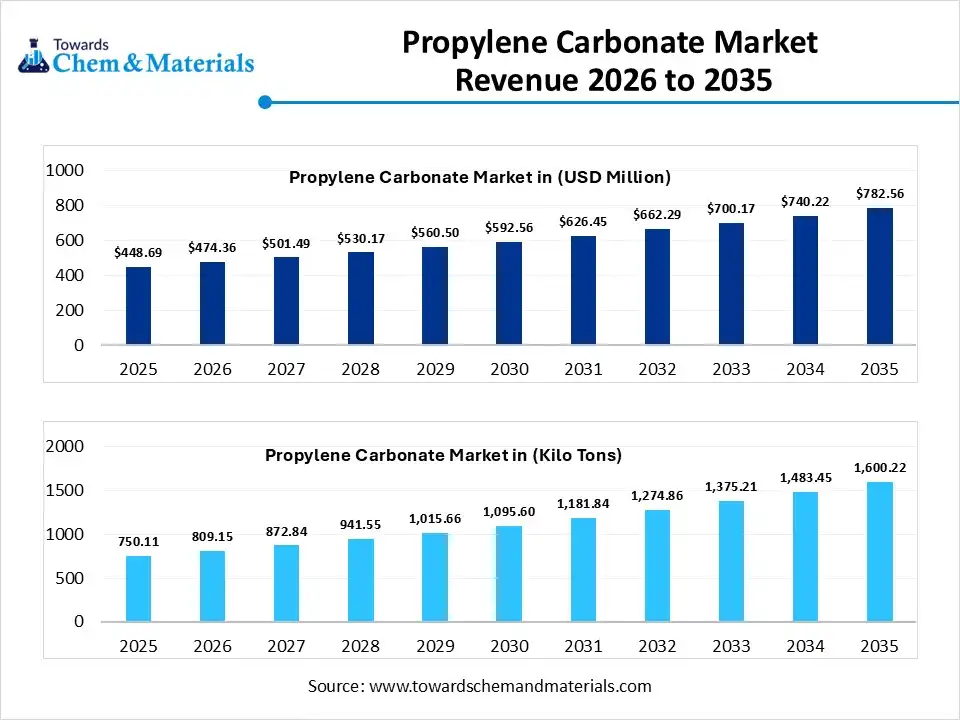

The global propylene carbonate market size was estimated at USD 448.69 million in 2025 and is expected to increase from USD 474.36 million in 2026 to USD 782.56 million by 2035, growing at a CAGR of 5.72% from 2026 to 2035. In terms of volume, the market is projected to grow from 750.11 kilo tons in 2025 to 1600.22 kilo tons by 2035. growing at a CAGR of 7.87% from 2026 to 2035. Asia Pacific dominated the propylene carbonate market with the largest volume share of 46% in 2025. The revolution in the electric vehicle industry and the booming cosmetics industry drive the market growth.

The propylene carbonate (PC) market growth is driven by the increasing use of ESS, the development of low-VOC coatings, growing adhesives use, higher production of polyurethane foam, growth in gas purification, increasing sales of EVs, the rise in utilization of natural cosmetics products, and surging construction projects. Propylene carbonate is colorless organic liquid and highly polar with a chemical formula C4H6O3. It is biodegradable, colorless, and non-corrosive in nature. PC consists of low toxicity, low melting point, and high power of solvency. PC is chemically stable and has a high dielectric constant. Propylene carbonate is widely used across applications like electrolyte making, cleaning agents, industrial solvents, coatings, chemical processing, and gas absorption.

Market Highlights

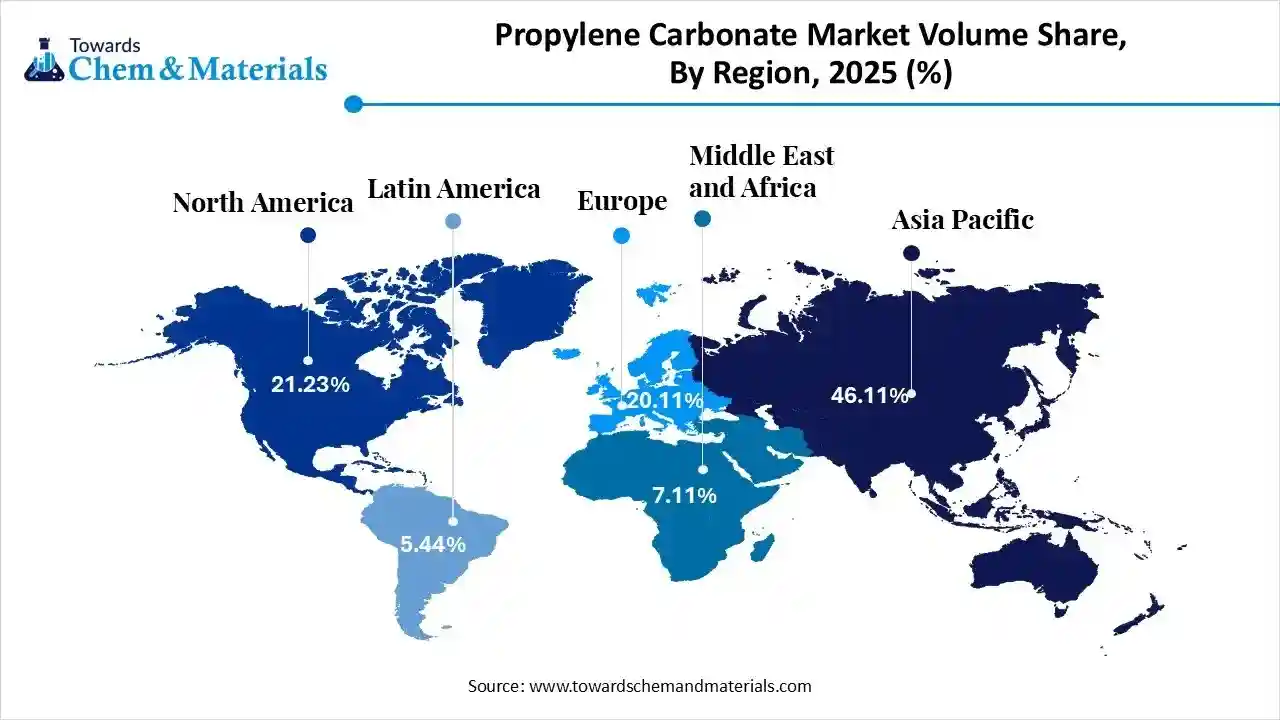

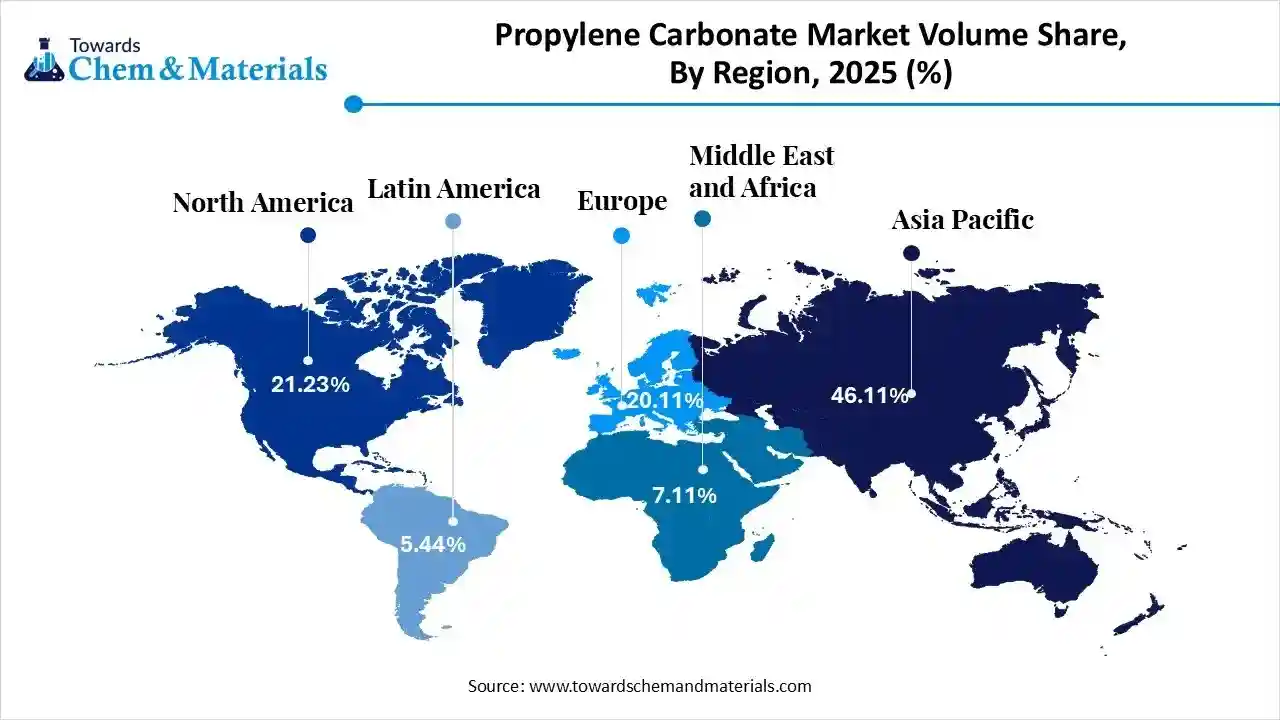

- The Asia Pacific dominated the global propylene carbonate market with the largest volume share of 46% in 2025.

- The propylene carbonate market in North America is expected to grow at a substantial CAGR of 9.81% from 2026 to 2035.

- The Europe sustainable propylene carbonate market segment accounted for the major volume share of 20.11% in 2025.

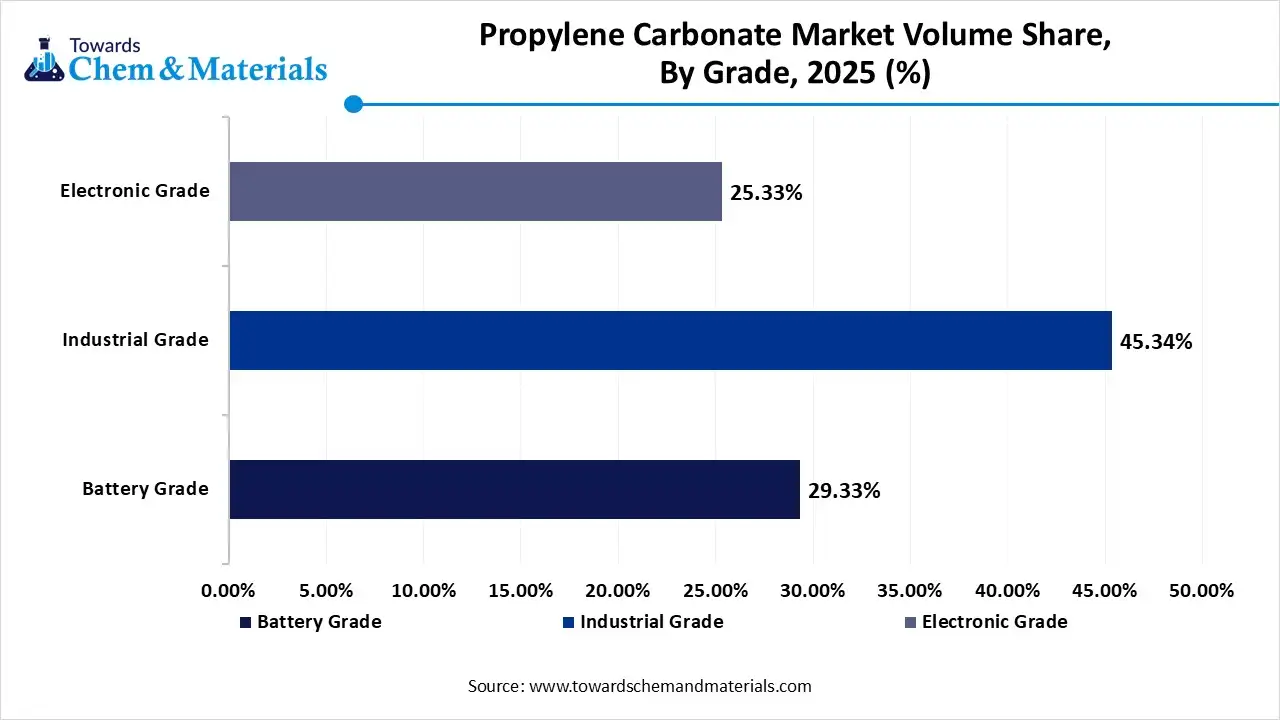

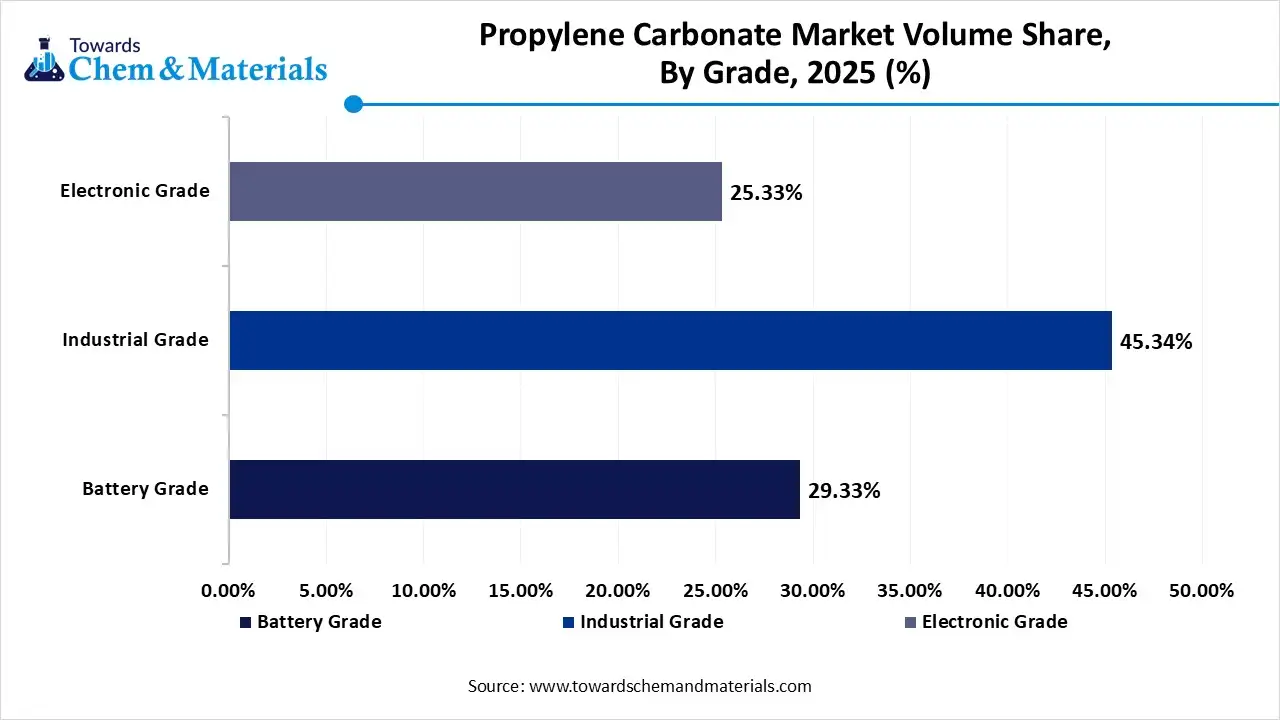

- By grade, the industrial grade segment dominated the market and accounted for the largest volume share of 45% in 2025.

- By grade, the battery grade segment is expected to grow at the fastest CAGR of 10.86% from 2026 to 2035 in terms of volume.

- By synthesis technology, the propylene oxide carbonation segment led the market with the largest revenue volume share of 92% in 2025.

- By application, the lithium-ion battery electrolyte segment dominated the market and accounted for the largest volume share of 54% in 2025.

- By end-use industry, the automotive & transportation segment led the market with the largest revenue volume share of 51% in 2025.

Propylene Carbonate Market Trends:

- Expanding Electric Vehicle Market:- The strong presence of manufacturers of EVs and the growing concerns of emission increases the adoption of electric vehicles, which requires PC for the creation of batteries.

- Surging Personal Care Products Use:- The increasing awareness about self-care and the transition towards the utilization of natural products increases demand for hair and skin care products.

- High Rate of Biodegradable Plastic Development:- The restriction on single-use plastics and increasing consumer awareness about the use of sustainable packaging create demand for biodegradable plastic.

- Growing Pharmaceutical Manufacturing:- The increased development of stable formulations of drugs and heavy investment in the creation of generics requires PC for diverse pharmaceutical processes.

Report Scope

| Report Attribute | Details |

| Market Size Value in 2026 | USD 474.36 Million / 809.15 Kilo Tons |

| Revenue Forecast in 2035 | USD 782.56 Million / 1600.22 Kilo Tons |

| Growth Rate | CAGR 5.72% |

| Forecast Period | 2026 - 2035 |

| Base Year | 2025 |

| Units Considered | Value (Billion / Million), Volume (KiloTons) |

| Dominant Region | Asia Pacific |

| Segment Covered | By Grade, By Synthesis Technology, By Application, By End-Use Industry, By Region |

| Key companies profiled | BASF SE, Huntsman Corporation, LyondellBasell Industries N.V., Shida Shenghua Chemical Group Co., Ltd. Lotte Chemical Corporation Shandong Wells Chemicals Co., Ltd. Haike Chemical Group Liaoning Ganglong Chemical Co., Ltd. Shandong Depu Chemical Co., Ltd. Shandong Shuntong Chemical Co., Ltd. Mitsubishi Chemical Group Corporation Zibo Haihua Chemical Co., Ltd. Tokyo Chemical Industry Co., Ltd. (TCI) Empower Materials Panax Etec Co., Ltd. Ube Corporation Wanhua Chemical Group Co., Ltd. Kowa Company, Ltd. Mega Specialty Chemicals |

Key Technological Shifts in the Propylene Carbonate Market:

The propylene carbonate market is undergoing key technological shifts driven by the demand for safety, performance efficiency, and lower cost. The innovations like automation, digital monitoring systems, machine learning, IoT, and big data enhance sustainability and safety. The major technological innovation is the incorporation of AI supports sustainable production.

AI optimizes the route of sourcing feedstock and minimizes waste production. AI lowers the downtime of equipment failures and manufactures high-purity PC grades. AI easily manufactures a new formulation of PC and forecasts demand. Artificial Intelligence focuses on sustainable manufacturing processes and easily predicts defects in the product. Overall, AI is a smart manufacturing process and supports faster innovation in PC.

Trade Analysis of Propylene Carbonate Market: Import & Export Statistics

- China exported 924 shipments of propylene carbonate.

- The United States imported 1,116shipments of propylene carbonate.

- South Korea exported 236 shipments of propylene carbonate.

- India imported 324 shipments of propylene carbonate.

Propylene Carbonate Market Value Chain Analysis

- Feedstock Procurement : The feedstock procurement for propylene carbonate is carbon dioxide, urea, propylene oxide, and propylene glycol.

- Key Players:- Huntsman International LLC, Dow Inc., INEOS Group, BASF SE, Shell Plc, Mitsubishi Chemical Corporation

- Chemical Synthesis and Processing: The chemical synthesis and processing involve steps like cycloaddition of PO & CO2, urea alcoholysis, and transesterification.

- Key Players:- LyondellBasell Industries, Empower Materials, Shenzhen Capchem Technology Co., Ltd., BASF SE

- Quality Testing and Certification: Quality testing is the process of measuring attributes like appearance, refractive index, impurities, GC, water content, chemical identity, and density. The certifications like USP Standard, COA, Pharmacopeia Standards, and ISO 9001.

- Key Players:- Bureau Veritas, Sigma-Aldrich, Analytice, Actylis

Country-Level Overview of Propylene Carbonate

| Country | Regulations | Key Applications | Major Companies |

| China |

|

|

|

| United States |

|

|

|

| Germany |

|

|

|

| Saudi Arabia |

|

|

|

Segmental Insights

Grade Insights

Why the Industrial Grade Segment Dominates the Propylene Carbonate Market?

The industrial grade segment dominated the propylene carbonate market with approximately 45% share in 2025. The increased production of cleaning agents and the high manufacturing of Li-ion batteries increases demand for industrial grade. The growth in the utilization of plasticizers and the rise synthesis of specialty chemicals requires industrial grade. The expansion of gas separation processes and growing industrial expansion increases demand for industrial grade, driving the overall market growth.

The battery grade segment is the fastest-growing in the market during the forecast period. The increased production of next-generation batteries and the increasing use of grid storage require battery grade. The government’s focus on clean energy and the huge production of electrolyte components requires battery grade. The growing demand for high-purity purification technologies requires battery grade, supporting the overall market growth.

Propylene Carbonate Market Volume and Share, By Grade, 2025 (%)

| By Grade | Market Volume Share (%), 2025 | Market Volume (Kilo Tons)2025 | Market Volume (Kilo Tons)2035 | CAGR(%) 2026-2035 | Market Volume Share (%), 2035 |

| Battery Grade | 29.33% | 220.01 | 556.24 | 10.86% | 34.76% |

| Industrial Grade | 45.34% | 340.10 | 674.17 | 7.90% | 42.13% |

| Electronic Grade | 25.33% | 190.00 | 369.81 | 7.68% | 23.11% |

Synthesis Technology Insights

How did the Propylene Oxide Carbonation Segment hold the Largest Revenue Share in the Propylene Carbonate Market?

The propylene oxide carbonation segment held the largest revenue share of approximately 92% in the market in 2025. The growing demand for high-purity PC and the increasing use of green solvents increase the adoption of propylene oxide carbonation. The production of lithium-ion batteries and the high availability of raw materials increase demand for propylene oxide carbonation. The environmental friendliness, process efficiency, and high atom efficiency drive the overall market growth.

The phosgene-based synthesis segment is growing notably in the market during the forecast period. The strong focus on sustainability and the rise in manufacturing of low-VOC paints require phosgene-based synthesis. The cost-effectiveness, industrial efficiency, high reactivity, and industrial selectivity of phosgene-based synthesis support the overall market growth.

Application Insights

Which Application Dominated the Propylene Carbonate Market?

The lithium-ion battery electrolyte segment dominated the propylene carbonate market with approximately 54% share in 2025. The push towards electric vehicles and focus on enhancing the energy density of batteries requires PC. The increased use of electronic devices and the booming energy storage increases demand for PC. The production of next-generation electrolytes and the focus on enhancing the thermal stability of Li-ion batteries require PC, driving the overall growth of the market.

The solvent for paints & coatings segment is notably growing in the market during the forecast period. The stricter regulations on air quality and the growing development of construction projects require solvents. The expansion of the automotive sector and the growth in infrastructure project development require paints & coatings. The low toxicity, high stability, and excellent performance of the solvent support the overall market growth.

End-Use Industry Insights

Why did the Automotive and Transportation Segment hold the Largest Share in the Propylene Carbonate Market?

The automotive and transportation segment held the largest revenue share of approximately 51% in the market in 2025. The increased manufacturing of lightweight parts of vehicles and the expanding electrification of vehicles require PC. The increasing assembly of vehicles and the focus on enhancing the fuel efficiency of vehicles require PC. The increased production of bumpers and the need to enhance the safety of vehicles require PC, driving the overall market growth.

The paints, coatings, and inks segment is growing notably in the market during the forecast period. The growth in the refinishing of vehicles and the increased implementation of large-scale infrastructure projects require PC. The growing aerospace industry and rapid production of vehicles require PC. The increased development of waterborne coatings and the focus on the sustainable production of paints support the overall market growth.

Regional Insights

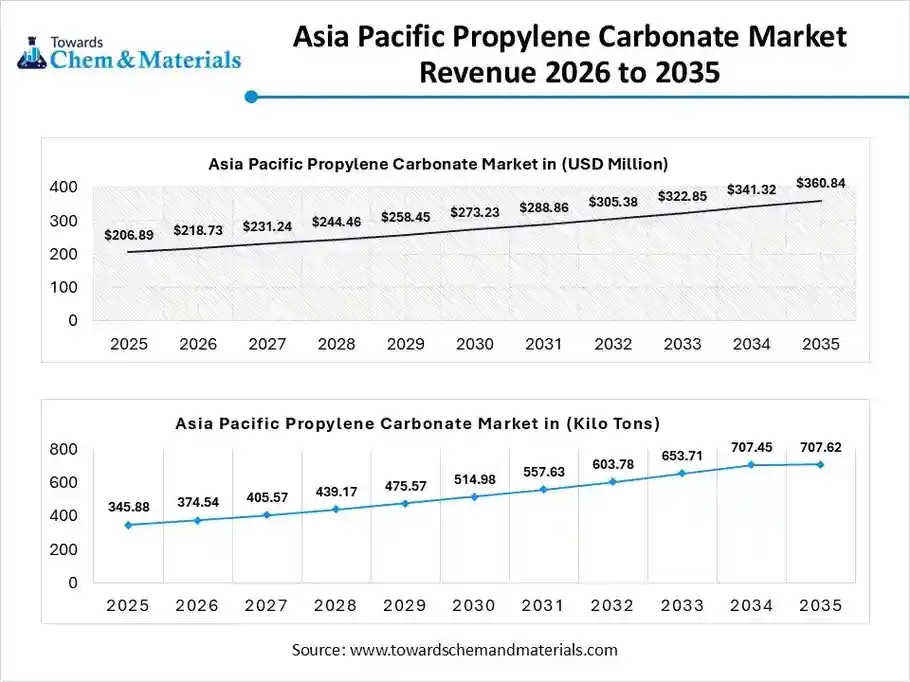

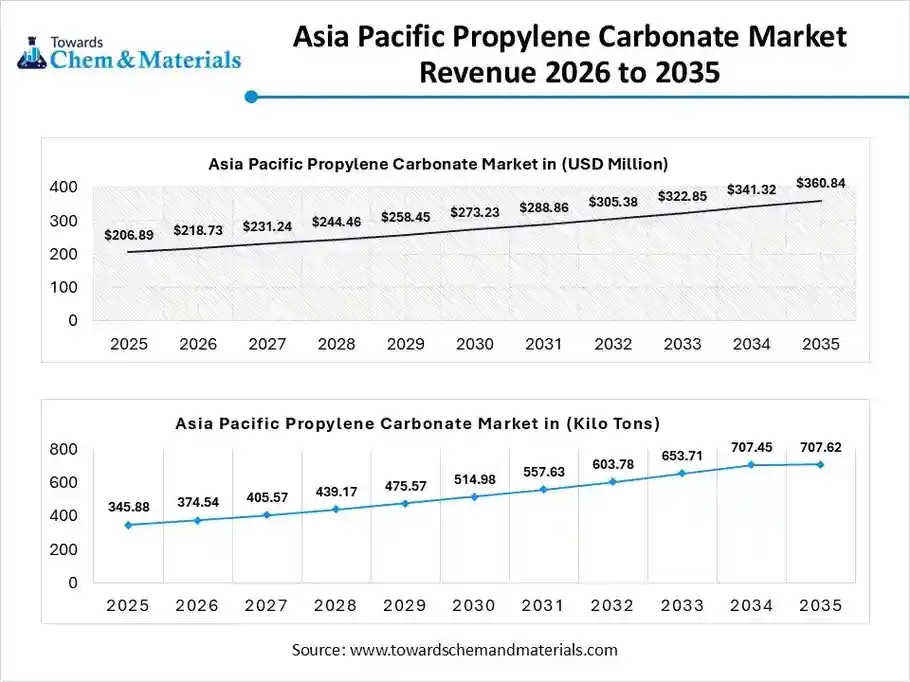

The Asia Pacific propylene carbonate market size was valued at USD 206.89 million in 2025 and is expected to be worth around USD 360.84 million by 2035, exhibiting at a compound annual growth rate (CAGR) of 5.74% over the forecast period from 2026 to 2035. The Asia Pacific propylene carbonate market volume was estimated at 345.88 kilo tons in 2025 and is projected to reach 707.62 kilo tons by 2035, growing at a CAGR of 8.28% from 2026 to 2035.

Asia Pacific dominated the market with approximately 46% share in 2025. The growth in the utilization of lithium-ion batteries and the huge development of infrastructure projects require propylene carbonate. The focus on clean energy adoption and the rise in production of electronics gadgets increases demand for propylene carbonate. The mature chemical manufacturing base and increased use of paints in construction projects require PC, driving the overall market growth.

India's Strong Engine Behind the Growth of Propylene Carbonate

India is rapidly growing in the market. The growing use of portable electronic gadgets and the rising development of construction projects require PC. The increased formulations of new drugs and the transition towards the use of electric vehicles require PC. The growing demand for biodegradable chemicals and the huge demand for personal care products require PC, supporting the overall market growth.

North America Propylene Carbonate Market Trends

The North America propylene carbonate market volume was estimated at 159.25 Kilo Tons in 2025 and is projected to reach 369.65 Kilo Tons by 2035, growing at a CAGR of 9.81% from 2026 to 2035. North America is growing at a notable rate in the market. The upsurge in the manufacturing of EV batteries and the increased reliance on natural cosmetics products require PC. The rise in refinishing of vehicles and the rapid expansion in the manufacturing of ESS require PC. The strong focus on the purification of natural gas and the intensification of the production of polyurethane foam requires PC, driving the overall growth of the market.

Role of Propylene Carbonate in the United States

The United States is a key contributor to the market. The heavy investment in the electrification of vehicles and the well-established chemical industrial base increases demand for PC. The increased use of automotive fluids and the expansion of gas processing require PC. The push towards grid energy storage and the government's backing for advanced battery technology require PC, supporting the overall market growth.

The United States exported 203 shipments of propylene carbonate.

Propylene Carbonate Market Volume and Share, By Region, 2025 (%)

| By Region | Market Volume Share (%), 2025 | Market Volume (Kilo Tons)2025 | Market Volume (Kilo Tons)2035 | CAGR(%) 2026-2035 | Market Volume Share (%), 2035 |

| North America | 21.23% | 159.25 | 369.65 | 9.81% | 23.10% |

| Europe | 20.11% | 150.85 | 357.49 | 10.06% | 22.34% |

| Asia Pacific | 46.11% | 345.88 | 707.62 | 8.28% | 44.22% |

| South America | 5.44% | 40.81 | 65.77 | 5.45% | 4.11% |

| Middle East & Africa | 7.11% | 53.33 | 99.69 | 7.20% | 6.23% |

Europe Propylene Carbonate Market Trends

The Europe propylene carbonate market volume was estimated at 150.85 Kilo Tons in 2025 and is projected to reach 357.49 Kilo Tons by 2035, growing at a CAGR of 10.06% from 2026 to 2035. Europe is experiencing the fastest growth in the market during the forecast period. The growing demand for electrolyte solvents and the development of renewable energy storage require PC. The expanding pharmaceutical base and well-developed automotive infrastructure created demand for PC. The growth in manufacturing activities and the increasing need for cleaning solutions require PC. The rise use of coatings drives the overall growth of the market.

France at the Centre of Propylene Carbonate Production

France is a major contributor to the market. The growing trend of clean beauty and the huge production of circuit boards increases demand for PC. The rapid expansion in the electrification of vehicles and the high utilization of sustainable plastic increase demand for PC. The heavy investment in clean energy resources and the increased production of Li-ion batteries require PC, supporting the overall market growth.

South America Propylene Carbonate Market Trends

The South America propylene carbonate market volume was estimated at 40.81 Kilo Tons in 2025 and is projected to reach 65.77 Kilo Tons by 2035, growing at a CAGR of 5.45% from 2026 to 2035. South America is growing substantially in the market. The growing domestic drug manufacturing and the strong presence of an agricultural base increase demand for PC. The growing manufacturing of electronic components and the growing consumer demand for beauty products require PC. The rise in the production of medicine and the growth in the development of vehicle parts require PC, driving the overall market growth.

Brazil Powering the Expansion of Propylene Carbonate

Brazil is significantly growing in the market. The expanding coating sector and the transition towards electric mobility require PC. The focus on the reduction of solid waste and expanding the electronics sector requires PC. The growth in the development of supercapacitors and the popularity of green chemistry increase the adoption of PC, supporting the overall market growth.

Middle East & Africa Propylene Carbonate Market Trends

The Middle East & Africa propylene carbonate market volume was estimated at 53.33 Kilo Tons in 2025 and is projected to reach 99.69 Kilo Tons by 2035, growing at a CAGR of 7.20% from 2026 to 2035. The Middle East & Africa are growing in the market. The heavy investment in green technologies and the push towards renewable energy increases demand for PC. The growth in the cosmetics manufacturing and the expansion of vehicle manufacturing require PC. The booming utilization of hair products and the development of high-performance EVs boost demand for PC, driving the overall growth of the market.

Saudi Arabia’s Rise in Propylene Carbonate Innovation

Saudi Arabia is growing significantly in the market. The heavy investment in electronics manufacturing and the expansion of construction activities increase demand for PC. The upsurge in renewable energy storage and the increased production of semiconductors require PC. The growing use of paints and the manufacturing of battery electrolytes require PC, supporting the overall growth of the market.

Recent Developments

- In April 2025, Anhui Putan New Materials Technology launched the world’s largest CO2-based polycarbonate polylol production line in China. The annual production capacity of the facility is 300000 tons and focuses on lowering carbon emissions.(Source: www.chemanalyst.com )

- In December 2024, Jiangsu Sailboat Petrochemical began commercial production of high-purity carbonates by using technology licensed from Asahi Kasei in China. The facility’s annual production capacity of dimethyl carbonate & ethylene carbonate is 70000 tons and 38000 tons, respectively. (Source: www.businesswire.com )

Market Top Companies

- BASF SE:- The company is the leading manufacturer of chemicals and produces propylene carbonate to serve diverse industries like coatings, textiles, electronics, and agrochemicals.

- Huntsman Corporation:- The North America-based company produces propylene carbonate to support key applications like electronics, adhesives, semiconductors, energy, industrial manufacturing, and coatings.

- LyondellBasell Industries N.V.:- The company manufactures high-purity propylene carbonate to be used as a foundry binder catalyst, solvent, and viscosity in diverse industrial applications.

- Shida Shenghua Chemical Group Co., Ltd.:- The China-based company supplies propylene carbonate to develop lithium batteries for industries like battery and EVs.

- Lotte Chemical Corporation:- The South Korea-based chemical manufacturing company produces high-purity

- PC for electric vehicles.

- Shandong Wells Chemicals Co., Ltd.

- Haike Chemical Group

- Liaoning Ganglong Chemical Co., Ltd.

- Shandong Depu Chemical Co., Ltd.

- Shandong Shuntong Chemical Co., Ltd.

- Mitsubishi Chemical Group Corporation

- Zibo Haihua Chemical Co., Ltd.

- Tokyo Chemical Industry Co., Ltd. (TCI)

- Empower Materials

- Panax Etec Co., Ltd.

- Ube Corporation

- Wanhua Chemical Group Co., Ltd.

- Kowa Company, Ltd.

- Mega Specialty Chemicals

Segments Covered

By Grade

- Battery Grade (Ultra-High Purity >99.99%)

- Industrial Grade (Purity 99.5% - 99.9%)

- Electronic Grade

By Synthesis Technology

- Propylene Oxide Carbonation (CO2 Insertion)

- Phosgene-based Synthesis

- Transesterification

By Application

- Lithium-Ion Battery Electrolyte

- Solvent for Paints and Coatings

- Cleaning and Degreasing Agent

- Foundry Core Binder

- Plasticizer and Polymer Modifier

- Chemical Intermediate (Synthesis of Polycarbonates/Carbamates)

- Personal Care and Cosmetics (Solvent/Viscosity Modifier)

- Gas Treatment (CO2 and H2S Removal)

- Textile and Fabric Treatment

By End-Use Industry

- Automotive and Transportation (EV Batteries)

- Electronics and Electricals

- Paints, Coatings, and Inks

- Personal Care and Healthcare

- Oil and Gas (Refining)

- Agriculture (Pesticide Formulations)

- Industrial Manufacturing

By Region

- North America

- U.S.

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Asia Pacific

- China

- India

- Japan

- South Korea

- Latin America

- Brazil

- Argentina

- Middle East & Africa

- Saudi Arabia

- South Africa