July 2025

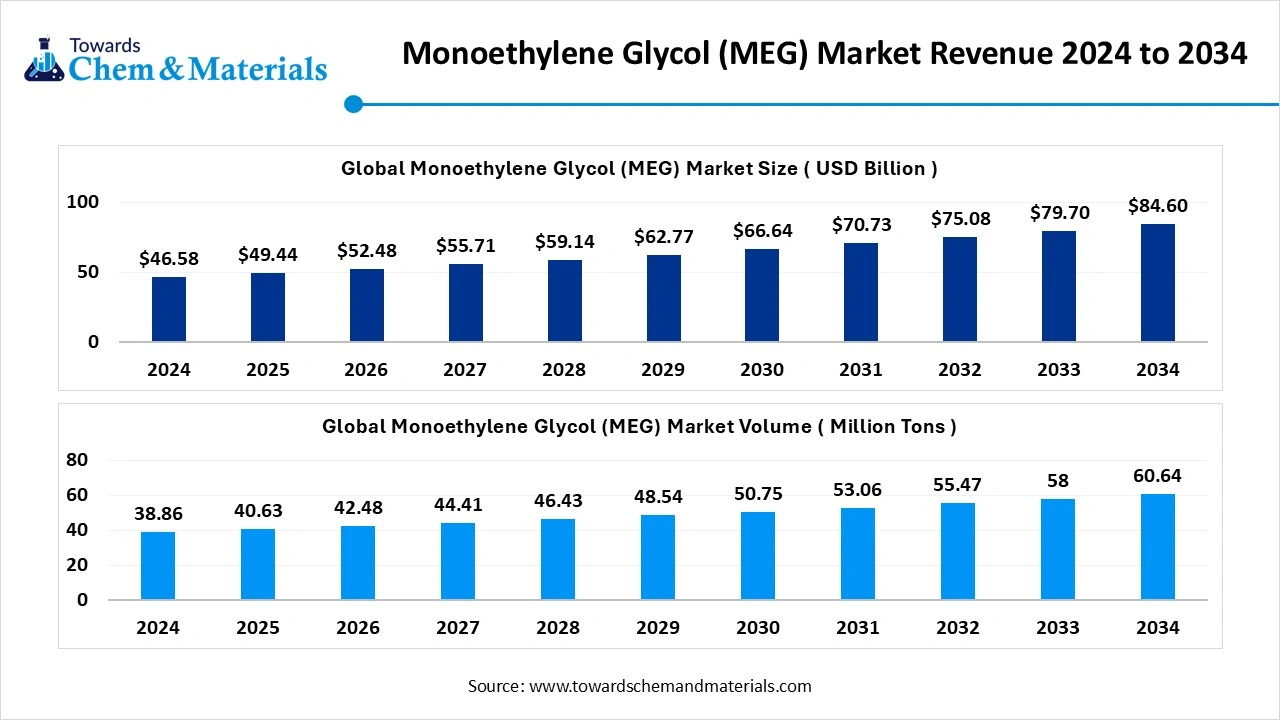

The global monoethylene glycol (MEG) Market volume is estimated at 40.63 million tons in 2025, and is expected to reach 60.64 million tons by 2034, at a CAGR of 4.55% during the forecast period 2025-2034.

The global monoethylene glycol (MEG) market size was reached at USD 46.58 billion in 2024 and is expected to be worth around USD 84.60 billion by 2034, growing at a compound annual growth rate (CAGR) of 6.15% over the forecast period 2025 to 2034. The increased need for PET packaging is supporting capital growth and economic activity in the sector.

The global monoethylene glycol (MEG) market refers to the production and consumption of MEG, a colorless, odorless, hygroscopic liquid primarily manufactured through the oxidation of ethylene to ethylene oxide, followed by hydrolysis.

MEG is a vital chemical intermediate widely used in the production of polyethylene terephthalate (PET) resins & films, polyester fibers, and antifreeze & coolants. Other applications include adhesives, inks, solvents, and chemical intermediates. Market growth is driven by the increasing demand for PET packaging in food & beverages, rising textile and apparel consumption (polyester fibers), and expanding automotive & industrial applications requiring antifreeze and coolants. The push for bio-based MEG and recycling initiatives also supports sustainable growth.

The global push for PET packaging is actively setting pace in market development. As the recyclable plastic and the shift towards lightweight materials have captured stakeholders' and major key players' interest in the industry. Also, the sudden growth of ready-to-drink health beverages has strongly shaped the growth narrative of the market in the current period. Furthermore, pharma packaging is likely to unlock value-rich channels of industry growth in the coming years.

| Report Attributes | Details |

| Market Size in 2025 | USD 49.44 Billion |

| Expected Market Size by 2034 | USD 84.60 Billion |

| Growth Rate from 2025 to 2034 | CAGR 6.15% |

| Base Year of Estimation | 2024 |

| Forecast Period | 2025 - 2034 |

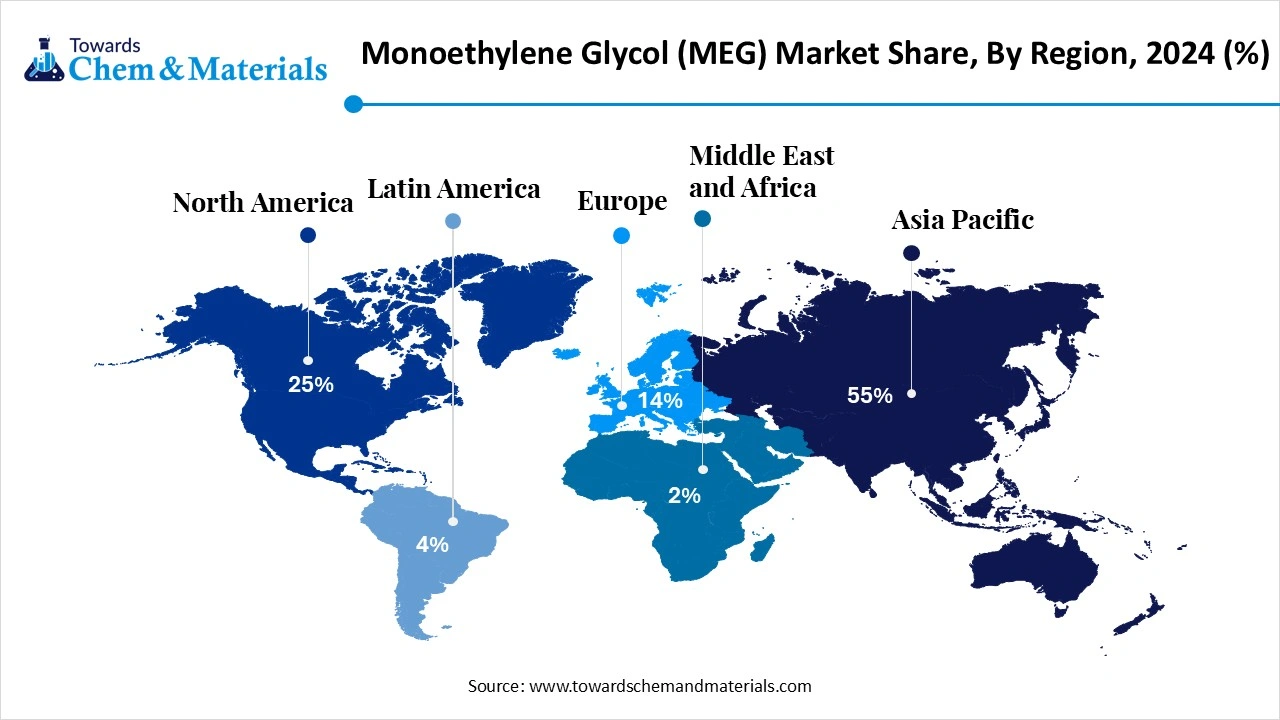

| High Impact Region | Asia Pacific |

| Segment Covered | By Application, By End-Use Industry, By Production Process, By Grade, By Distribution Channel, By Region |

| Key Companies Profiled | MEGlobal, Ishtar Company, LLC, Raha Group, India Glycols Ltd., Kimia Pars Co., LyondellBasell N.V., Arham Petrochem Pvt. Ltd., Indian Oil Corporation Ltd., Pon Pure Chemicals Group, Acuro Organics Ltd., SABIC, Euro Industrial Chemicals, Shell, UPM Biochemicals |

Textile Innovation Meets Chemical Excellence with High-Performance MEG

The fulfillment of the textile sector demand with high-performance MEG is set to trigger upward market trends and new profit margins during the forecast period. Moreover, by providing high-purity grades to fiber production, the MEG manufacturers are expected to garner widespread recognition across the sector in the upcoming years. Furthermore, the manufacturers can also gain benefits from the home furnishing industry, as per the recent survey.

The price volatility of the feedstock, such as ethylene and others, is expected to derail projected industry growth paths during the forecast period. As the MEG development is closely attached to crude oil, which is highly volatile in price due to factors such as geopolitical tensions and global trade wars, which are expected to create growth barriers for the market. Furthermore, these price fluctuations can increase product price, where the manufacturer is expected to face product delays and consumer rejections.

Asia Pacific Monoethylene Glycol (MEG) Market Trends.

Asia Pacific dominated the global monoethylene glycol (MEG) market in 2024, owing to the region being considered one of the leading manufacturing hubs of PET and polyester in the current period. Moreover, the regional countries like China, India, and Vietnam have seen an enhanced demand for MEG in the past few years. Also, the regional government is pushing export-oriented polyester production by releasing attractive benefits to the manufacturers in the region.

Packaging and Beverages Sectors Unlock New Opportunities for China’s Meg Industry

China maintained its dominance in the global monoethylene glycol (MEG) market, owing to the enlarged polyester manufacturing industry. Moreover, the country has seen a heavy demand for MEG. Also, the government is actively looking for local production facilities to fulfill the enlarged need for MEG in China nowadays. Furthermore, the sectors such as the packaging and beverage industry are likely to create lucrative opportunities for the industrial manufacturer in China per the recent industry survey.

Middle East Monoethylene Glycol (MEG) Market Trends

The Middle East is expected to capture a major share of the global monoethylene glycol (MEG) market, akin to the enhanced availability of raw material and heavy petrochemical investment. Moreover, the regional countries like Saudi Arabia and Qatar have been closely linked with MEG production due to their natural gas and crude oil reserves. Furthermore, this reserve is likely to attract world MEG manufacturers in the upcoming years, as per the recent regional survey.

How did the Polyester Fibers Segment Dominate the Global Monoethylene Glycol (MEG) Market in 2024?

The polyester fibers segment held the largest share of the market in 2024, due to its being known for a crucial element of the apparel and textile industry. Moreover, factors such as the sudden rise in fast fashion and low-cost clothing, and the polyester fiber have gained major industry attention in the past few years. Furthermore, the high versatility and durability the polyester have made it the trending subject among institutional investors.

The PET resins and films segment is expected to grow at a notable rate during the predicted timeframe, akin to the global push for sustainable packaging. Moreover, the MEG is considered the major element in the production of PET products such as bottles, containers, and others. Furthermore, trends like the growing popularity of ready-to-eat products, soft drinks, and bottled water are contributing to the growth of the segment in recent years, as per the observation.

Why does the Textiles and Apparel Segment Dominate the Global Monoethylene Glycol (MEG) Market by End Use?

The textiles and apparel segment held the largest share of the market in 2024, because polyester-based fabrics are the most widely used materials for clothing, furnishings, and exports. MEG demand is heavily tied to polyester fibers, and countries like China, India, and Bangladesh rely on it for their global garment exports. The affordability and versatility of polyester drive massive use in fast fashion, sportswear, and home textiles.

The packaging segment is expected to grow at a notable rate due to the rising use of PET bottles, containers, and films for beverages, food, and pharmaceuticals. Consumer lifestyles are shifting toward convenience, driving demand for lightweight, durable, and recyclable packaging. PET packaging made from MEG meets these needs while supporting sustainability through recycling initiatives.

How did the Conventional Petrochemical-Based MEG Segment Dominate the Global Monoethylene Glycol (MEG) Market in 2024?

The conventional petrochemical-based MEG segment dominated the market with the largest share in 2024 because it is produced at a large scale, cost-efficiently, using established processes like ethylene oxide hydration. For decades, petrochemical feedstocks have been abundant and relatively cheap, especially in regions like the Middle East and North America.

These mature technologies allow stable supply chains and global trade flows, making petrochemical-based MEG the industry standard. The bio-based MEG segment is expected to grow at a significant rate as sustainability becomes central to the chemical and packaging industries. Produced from renewable sources like sugarcane or corn, bio-MEG reduces carbon emissions and dependency on fossil fuels. Leading beverage and packaging companies are already shifting toward bio-based PET bottles, which require bio-MEG as a raw material.

How did the Fiber Grade Segment Dominate the Global Monoethylene Glycol (MEG) Market in 2024?

The fiber grade MEG segment held the largest share of the market in 2024 because polyester fiber production accounts for the largest share of MEG consumption globally. Most of the MEG produced is converted into polyester fibers for clothing, furnishings, and textiles. The demand for affordable and durable fabrics in emerging markets like Asia ensures consistent fiber-grade MEG consumption.

The antifreeze-grade MEG segment is expected to grow at a notable rate during the predicted timeframe due to rising demand from automotive, industrial, and aviation sectors. This grade is used in coolants and de-icing solutions, which are becoming critical as vehicles shift to electric and hybrid models that require advanced cooling systems.

Why does the Direct Sales Segment Dominate the Global Monoethylene Glycol (MEG) Market by Distribution Type?

The direct sales segment dominated the market with the largest share in 2024. because large buyers like textile mills, PET resin producers, and chemical manufacturers prefer long-term contracts directly with MEG producers. This ensures a steady supply, better pricing, and technical support for bulk requirements. Direct supply also allows producers to build strategic partnerships with global customers, especially in Asia's textile hubs and PET packaging clusters.

The distributors segment is expected to grow at a significant rate because small and medium-scale industries are increasing their MEG usage in packaging, automotive, and specialty applications. These companies cannot commit to bulk contracts directly with producers, making distributors essential for flexible supply. Distributors also offer value-added services like inventory management, credit facilities, and localized delivery, which help smaller firms remain competitive.

By Application

By End-Use Industry

By Production Process

By Grade

By Distribution Channel

By Region

July 2025

July 2025

July 2025

July 2025