Content

What is the U.S. Aquaculture Market Size ?

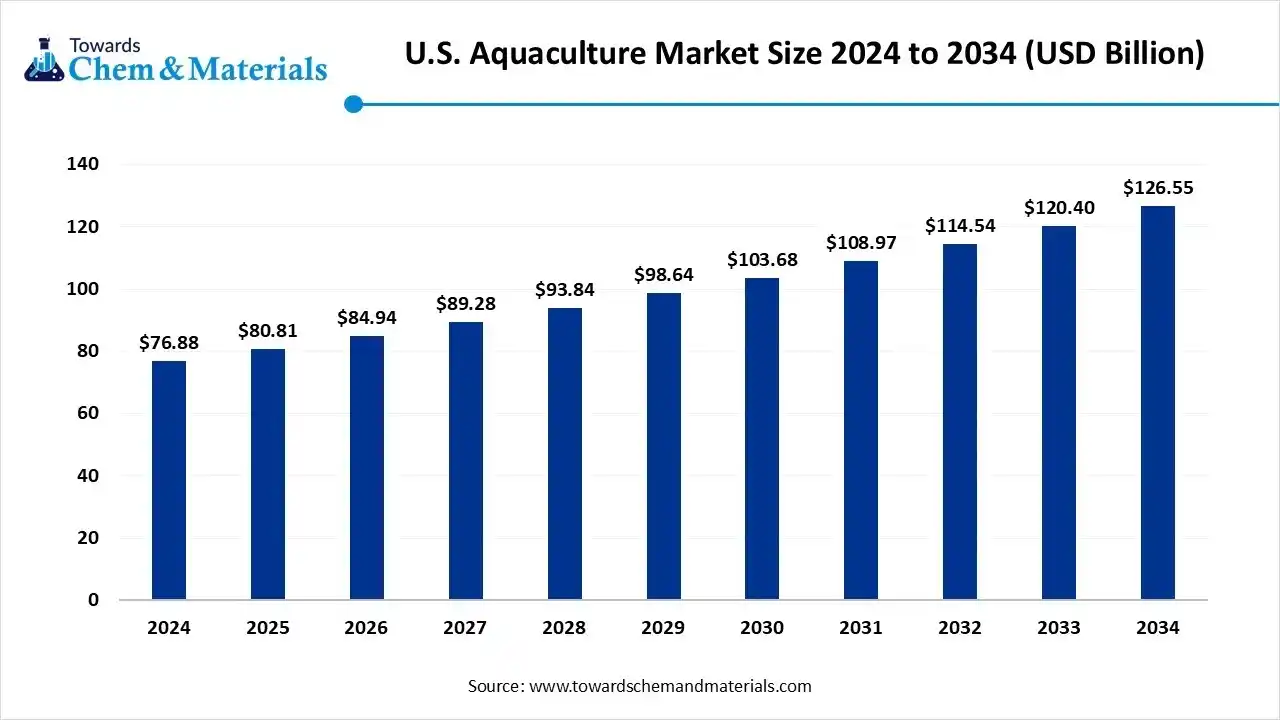

The U.S. aquaculture market size is calculated at USD 80.81 billion in 2025 and is predicted to increase from USD 84.94 billion in 2026 to approximately USD 126.55 billion by 2034, expanding at a CAGR of 5.11% from 2025 to 2034. the shift towards seafood and food security is forecasted to support the reshaping of supply and demand dynamics in the coming years.

Key Takeaways

- By species type, the finfish segment dominated the market with a 50% industry share in 2024.

- By species type, the shellfish segment is expected to grow at the fastest rate in the market during the forecast period.

- By farming method type, the recirculating aquaculture systems segment dominated the market with 45% industry share in 2024.

- By farming method type, the cage culture segment is expected to grow at the fastest rate in the market during the forecast period.

- By feed type, the commercial feed segment dominated the market with 60% industry share in 2024.

- By feed type, the natural feed segment is expected to grow at the fastest rate in the market during the forecast period.

- By application type, the human consumption segment dominated the market with a 65% industry share in 2024.

- By application type, the pharmaceutical & nutraceutical segment is expected to grow at the fastest rate in the market during the forecast period.

From Ocean to Table: The Growth of America’s Aquaculture Industry

The U.S. aquaculture market involves the farming of fish, shellfish, and other aquatic organisms under controlled conditions for human consumption, recreational use, or commercial purposes. The sector aims to meet growing seafood demand, ensure sustainable production, and support food security while reducing pressure on wild fish stocks.

U.S. Aquaculture Market Outlook:

- Industry Growth Overview: Between 2025 and 2034, the local want fresh seafood and companies want a steady supply, the aquaculture industry has gained major prominence in the region United States. Also, the ongoing investment toward small coastal farms and indoor systems has raised awareness among venture and corporate backers in recent years.

- Sustainability Trends: the major aquaculture brands are actively seen adopting the modern farming practices that save water with lower waste generation in recent years. Also, several feed makers are testing the insect protein to avoid dependence on wild fish, which is anticipated to increase return on investment for manufacturers.

- Global Expansion: the aquaculture brands of the United States have seen under the export of seaweed ingredients, premium shellfish, and branded smoke products across the globe. Moreover, the foreign partners are also showing interest in the investment in the United States' aquaculture while creating strategic collaborations.

Report Scope

| Report Attributes | Details |

| Market Size in 2026 | USD 84.94 Billion |

| Expected Size by 2034 | USD 126.55 Billion |

| Growth Rate from 2025 to 2034 | CAGR 19.55% |

| Base Year of Estimation | 2024 |

| Forecast Period | 2025 - 2034 |

| Segment Covered | By Species, By Farming Method, By Feed Type, By Application |

| Key Companies Profiled | Atlantic Sapphire, Cargill Aqua Nutrition , Greensea Systems , Hendrix Genetics , Clearwater Seafoods , Tassal Group , Skretting USA , Blue Ridge Aquaculture , Ocean Spray Aquaculture , Zeigler Bros., Inc. |

From Nets to Networks: The Digital Transformation of Aquaculture

The technology has played a major role in the transformation of the aquaculture industry in the United States. The modern farmers are actively observed in the adoption of smart feeders, indoor recirculating systems, and other advanced products like water sensors and others. Furthermore, the increasing shift towards microbiome management has been widely discussed in technological forums and white papers in recent years.

Trade Analysis of the U.S. Aquaculture Market:

- Import, Export, Consumption, and Production Statistics : The United States aquaculture export touched $4.9 billion in 2024, as per the published report.(Source : www.ers.usda.gov)

- The sales of aquaculture products in the United States are approximately worth $1.964 billion in 2024.(Source: www.ers.usda.gov)

Value Chain Analysis of the U.S. Aquaculture Market:

- Distribution to Industrial Users : For the U.S. aquaculture market, industrial users primarily acquire products through wholesalers, large-scale distributors, direct sales from large producers, and specialized ingredient suppliers

- Chemical Synthesis and Processing : In the market, chemical synthesis and processing involve a broad array of specialized products and techniques used to ensure biosecurity, manage water quality, enhance nutrition, and control disease.

- Regulatory Compliance and Safety Monitoring : Federal and state agencies work together to regulate the market, with a focus on safety, environmental protection, and animal health.

U.S. Aquaculture Market Regulatory Landscape: Global Regulations

| Country / Region | Regulatory Body | Key Regulations | Focus Areas | Notable Notes |

| United States | Food and Drug Administration (FDA) | Food, Drug, and Cosmetic Act (FFDCA) | Food Safety | The agency governs the safety of food, drugs, and feed additives used in aquaculture. |

Segmental Insights

Species Insights

How did the Finfish Segment Dominate the U.S. Aquaculture Market in 2024?

The finfish segment dominated the market with 50% of industry share in 2024 due to it being considered the most farmed and traditional seafood. Moreover, species such as the catfish, trout, and salmon have gained greater local demand while establishing the farming system in the United States in recent years. Also, the farmers have gained advantages of the advanced hatchery technology and strong cold water farming infrastructure in the past few years.

The shellfish segment is expected to grow at a notable rate owing to it includes in the eco-friendly aquaculture initiatives. Moreover, having a high protein index, the shellfish have gained a sophisticated consumer base in recent years. Also, several farmers are shifting towards shellfish farming, aiming to improve water quality and meet the increasing food requirements in the region nowadays.

Farming Method Insights

Why does the Recirculating Aquaculture Systems Segment Dominate the U.S. Aquaculture Market by Farming Method?

The recirculating aquaculture systems segment dominated the market with 45% industry share in 2024. By allowing farming in controlled indoor environments, the recirculating aquaculture system has gained major industry attention in the past few years. Moreover, the factors like minimal water use and high biosecurity are driving the growth of the segment in the current period as aqua farmers are seeking to small areas with greater income farming initiatives in the region.

The cage culture segment is expected to grow at a notable rate because it offers lower costs, easier scalability, and high production potential in open water areas. Advancements in durable cages, offshore farming, and feeding systems make this method more efficient and sustainable than before. As coastal regions explore ocean farming, cage culture allows large-scale fish production with less land and infrastructure. It also supports species diversification, including high-value fish like cobia and sea bass.

Feed Type Insights

How did the Commercial Feed Segment Dominate the U.S. Aquaculture Market in 2024?

The commercial feed segment dominated the market with 60% of industry share in 2024 because it provides balanced nutrition, faster growth, and consistent product quality. Farmers rely on scientifically formulated pellets that include proteins, vitamins, and minerals for specific fish species. Commercial feeds save time, ensure uniform size, and help improve disease resistance. United States feed producers also focus on reducing waste and improving feed conversion rates.

The natural feed segment is expected to grow at a notable rate because consumers increasingly prefer organic and chemical-free seafood. Farmers are turning to eco-friendly feeding methods using algae, insects, and plant-based proteins. These natural feeds improve fish health and reduce pollution from uneaten pellets. As awareness about sustainable seafood rises, certification programs for "naturally fed fish" will become more popular in the United States market.

Application Insights

Why does the Human Consumption Segment Dominate the U.S. Aquaculture Market by Application Type?

The human consumption segment dominated the market with a 65% industry share in 2024 because seafood is a staple part of the American diet. People are eating more fish for its high protein and heart-healthy benefits. Restaurants, supermarkets, and meal delivery services all depend on a steady supply of farmed fish and shellfish. The push for locally grown, fresh, and traceable seafood also supports domestic aquaculture.

The pharmaceuticals and nutraceuticals segment is expected to grow at a notable rate as people look for natural health supplements from marine sources. Fish oils, collagen, and shellfish extracts are now used in medicines, beauty products, and dietary supplements. These products have high profit margins and growing demand in health-conscious markets.

Recent Development

- In September 2025, Innovasea established a collaboration with the Andrew J Young Foundation. The main motive of the collaboration is to launch RAS facilities in the United States region, as per the published report.(Source: www.seafoodsource.com)

Top U.S. Aquaculture Market companies

Mowi ASA

Corporate Information

- Headquarters: Sandviksboder 77 AB, 5035 Bergen, Norway.

- Year Founded: 1964 (original company)

- Ownership Type: Public company

History and Background

- The company traces its roots back to 1964 when a small pioneering fish-farming operation started near Bergen in Norway.

- Over the decades, multiple mergers and acquisitions reshaped the business: for example the merging of Pan Fish ASA, Marine Harvest N.V. and Fjord Seafood around 2006-2007 created a large salmon-farming group.

- In December 2018 the company changed its name from Marine Harvest ASA to Mowi ASA, with the new ticker “MOWI” becoming effective 2 January 2019.

Key Developments and Strategic Initiatives

Mergers & Acquisitions

- In January 2025 Mowi announced it would increase its ownership of Nova Sea AS (Norway) from 49% to 95% by acquiring Vigner Olaisen’s 46% stake for ~NOK 7.4 billion (~EUR 625 m).

- In October 2025 Mowi’s acquisition of Nova Sea received full regulatory approval (EU Commission + Norwegian competition authority).

Partnerships & Collaborations

- Mowi collaborated with X (company) (Alphabet’s moonshot / innovation engine) via its “Tidal” ocean tech unit, to deploy an underwater sensing and software analysis platform for salmon farming (tracking fish behaviour, lice counts, feeding optimisation).

- Mowi extended/renewed a global framework agreement with Innovasea to become the preferred supplier of environmental monitoring systems and software across all Mowi sites, as part of its “Smart Farming / 4.0” initiative.

Product Launches / Innovations

- In the U.S. food-service market Mowi launched the MOWI Signature program (May 2025) a line of premium Atlantic salmon tailored for foodservice operators/chefs, with fixed-price programs, ready-to-prep fillets, pre-cut portions sourced from Norway/Scotland.

- In retail/consumer markets, Mowi launched new items such as “Fjord Salmon Burgers” (frozen ready-to-cook) in May 2025 and expanded its pre-packed fresh portion range (pre-seasoned, flavoured butter pucks, etc).

Key Technology Focus Areas

Smart Farming & Digitalization

- Mowi has launched its “Mowi 4.0 Smart Farming” initiative: implementation of remote operations centres, real-time monitoring of biomass, automatic feeding, advanced sensors in seawater pens.

- Their MOWInsight data platform integrates multiple data streams (farm, feed, processing) enabling data-driven decisions across the value chain.

Notable Technological Collaborations & Deployments

- Collaboration with X (company) (Alphabet’s “moonshot” division) via its “Tidal” project: sensors, cameras, machine-learning for growth, lice counting, fish behaviour monitoring.

- Renewed global framework with Innovasea for environmental monitoring systems across Mowi farms.

R&D Organisation & Investment

- Mowi maintains a dedicated Global R&D & Technical Department of ~17 full-time experts covering marine biology, fish health, nutrition, data science, engineering, veterinary medicine supporting innovation across the entire value chain.

- R&D expenditure in 2023 was €35.3 million, essentially flat vs 2022 (~€35.0m).

Mowi ASA SWOT Analysis

Strengths

- Global Leadership in Salmon Farming

- One of the largest salmon producers worldwide with operations in Norway, Scotland, Canada, Chile, and the U.S.

- Vertically integrated across the value chain (hatcheries → farming → processing → distribution).

- Technological and R&D Capabilities

-

- Strong focus on Smart Farming (Mowi 4.0), digitalisation, sensors, AI-based monitoring.

- Advanced R&D in genetics, fish health, and sustainable feed.

Weaknesses

- High Operational Costs

-

- Vertical integration and global operations increase fixed costs.

- High capital expenditure for R&D, post-smolt facilities, and technological upgrades.

- Exposure to Biological Risks

-

- Disease outbreaks (e.g., sea lice, ISA) can impact production.

- Dependence on Atlantic salmon species limits diversification.

Opportunities

- Expansion in the U.S. and Asia-Pacific Markets

- Growing seafood demand, especially premium salmon in foodservice and retail.

- Technological Innovation & Smart Farming

- Digital monitoring, RAS systems, AI, and precision farming can improve efficiency and reduce environmental impact.

Threats

- Environmental and Climate Risks

- Ocean warming, algal blooms, and extreme weather events threaten fish farms.

- Rising water temperatures may affect salmon growth and health.

- Competition

- Other major players like Cooke Aquaculture, Atlantic Sapphire, and Benchmark and Holdings increase competitive pressure.

Recent News & Strategic Updates

- Record Financial Performance in 2024 :Mowi concluded 2024 with record-high operating revenues of €5.62 billion and a harvest volume of 502,000 tonnes of salmon. The fourth quarter alone saw revenues of €1.50 billion and an operational profit of €226 million, marking a significant achievement for the company.

- Acquisition of Nova Sea Approved : On October 21, 2025, Mowi received final approval from both the EU Commission and the Norwegian competition authority to acquire a controlling 95% stake in Nova Sea AS. This move is expected to increase Mowi's global harvest to 597,000 tonnes in 2025, with 161,000 tonnes coming from Northern Norway, a prime region for Atlantic salmon farming.

- Strategic Review of Feed Division :In March 2025, Mowi initiated a strategic review of its integrated Feed division, which generated €1.12 billion in operating revenues in 2024. The review will assess all available options, including a potential sale, to streamline operations and optimize capital allocation.

Top Vendors in the U.S. Aquaculture Market & Their Offerings:

- Cooke Aquaculture Inc: A vertically integrated, family-owned Canadian multinational that is a global leader in salmon farming and has diverse seafood operations.

- Benchmark Holdings PLC: A UK-based aquaculture biotechnology company that provides technical services.

- American Aquafarms: An American-based company that plans to build a large-scale, closed-pen salmon farm in coastal Maine.

- Regal Springs Tilapia: The world's largest producer of responsibly farmed premium tilapia, known for its sustainable practices and vertically integrated operations.

Other Key Players

- Atlantic Sapphire

- Cargill Aqua Nutrition

- Greensea Systems

- Hendrix Genetics

- Clearwater Seafoods

- Tassal Group

- Skretting USA

- Blue Ridge Aquaculture

- Ocean Spray Aquaculture

- Zeigler Bros., Inc.

Segments Covered in the Report

By Species

- Finfish

-

- Salmon

- Trout

- Catfish

-

- Shellfish

-

- Shrimp

- Oysters

- Mussels

-

- Crustaceans

-

- Lobster

- Crabs

-

By Farming Method

- Recirculating Aquaculture Systems (RAS)

- Cage Culture

- Pond Culture

- Flow-Through Systems

By Feed Type

- Commercial Feed

- Natural Feed

By Application

- Human Consumption

- Pharmaceuticals & Nutraceuticals

- Ornamental & Recreational