December 2025

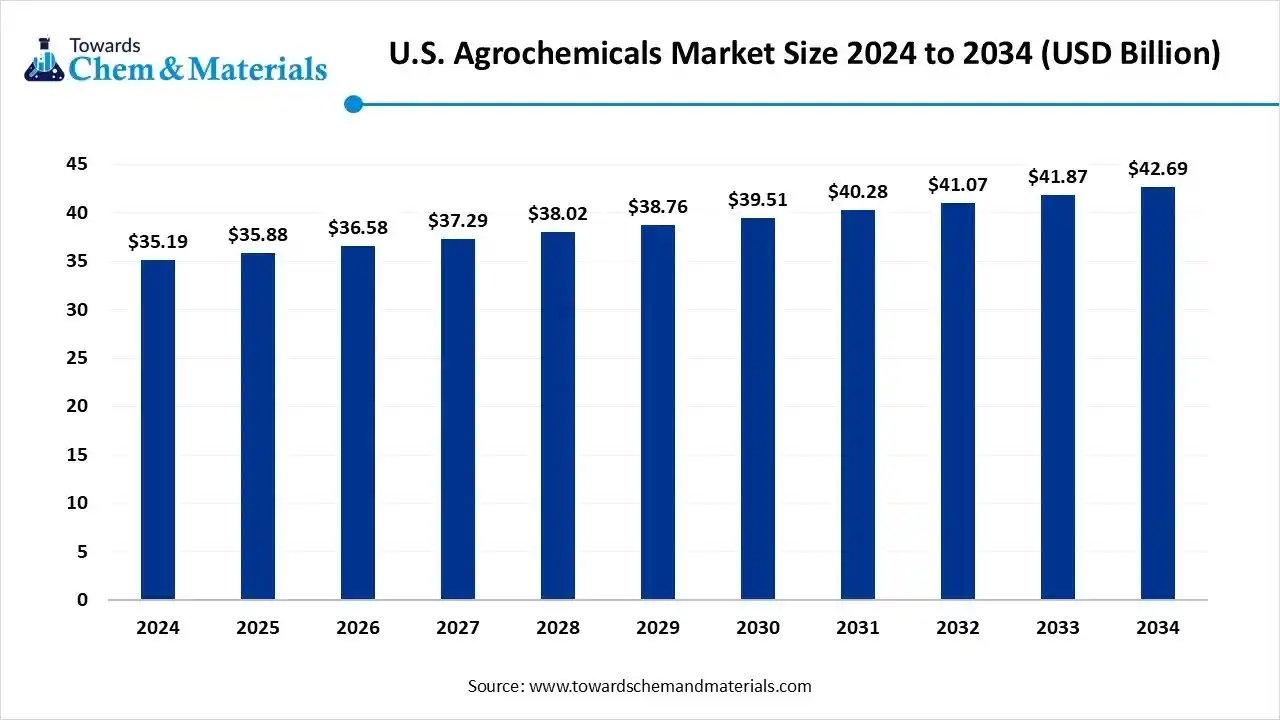

The U.S. agrochemicals market size was valued at USD 35.19 billion in 2024 and is expected to hit around USD 42.69 billion by 2034, growing at a compound annual growth rate (CAGR) of 1.95% over the forecast period from 2025 to 2034. Growing demand for specialized and cost-effective products is the key factor driving market growth. Also, the expansion of the food and beverage industry, coupled with the ongoing technological advancements like precision farming, can fuel market growth further.

Rising research and development into bio-based pesticides with other biopesicides is the major factor driving market growth. The U.S. agrochemicals market comprises chemical products used in agriculture to protect crops, enhance growth, and increase yield. This includes pesticides, herbicides, fungicides, fertilizers, and plant growth regulators that improve crop productivity and protect against pests, diseases, and environmental stressors.

| Report Attributes | Details |

| Market Size in 2026 | USD 36.58 Billion |

| Expected Size by 2034 | USD 42.69 Billion |

| Growth Rate from 2025 to 2034 | CAGR 1.95% |

| Base Year of Estimation | 2024 |

| Forecast Period | 2025 - 2034 |

| Segment Covered | By Product, By Crop Type, By Formulation, By Application, By End User |

| Key Companies Profiled | Corteva Agriscience, Syngenta AG, FMC Corporation, ADAMA Agricultural Solutions, Nutrien Ltd., UPL Limited, Valent U.S.A. LLC, Sumitomo Chemical Co., Ltd., Dow AgroSciences, Cheminova A/S, Nufarm Limited, Sipcam Agro USA, Arysta LifeScience |

The key technological shifts are revolutionizing how crops are protected and cultivated. The market is moving towards more precise and sustainable methods by combining digital farming tools, using advanced material science, and harnessing the power of biological products. These advancements are further boosted by a need for stringent environmental regulations and higher agricultural productivity.

| Country/Region | Key Regulations/Investments |

| California | The state's Department of Pesticide Regulation (DPR) conducts a thorough, independent data review, and applicants must submit data beyond what is required by the EPA. |

| New York | Under the "Birds and Bees Protection Act," New York is phasing out certain neonicotinoid pesticides for use on outdoor ornamental plants and turf. |

| Illinois | Illinois Department of Agriculture (IDOA): The primary authority for enforcing state regulations concerning pesticides and fertilizers used for agricultural production. |

How Much Share Did the herbicides Segment Held in 2024?

The herbicides segment dominated the market with a 45% share in 2024. The dominance of the segment can be attributed to the increasing use of herbicide-resistant crops and the extensive prevalence of weeds. In addition, advancements such as precision spraying technology help to minimize herbicide usage while keeping effectiveness.

Companies are rapidly developing smart, customized, and sustainable solutions to enhance crop productivity.

The insecticides segment held a 25% market share and is expected to grow at the fastest CAGR of 7.5%over the forecast period. The growth of the segment can be credited to the growing demand for crop protection to boost yields, along with the cultivation of crops such as fruits and vegetables. High investment in R&D is leading to the creation of advanced and more sustainable insecticide formulations.

Which Crop Type Segment Dominated the U.S. Agrochemicals Market in 2024?

The cereals & grains segment held a 40% market share in 2024. The dominance of the segment can be credited to the growing need for food due to population growth and ongoing government support to produce grain to ensure food security. Furthermore, cereals and grains are rapidly being used for non-food purposes such as animal feed and biofuel, further fuelling demand for their large-scale production.

The fruits & vegetables segment held a 25% market share and is expected to grow at the fastest CAGR of 8.0% over the forecast period. The growth of the segment can be driven by growing consumer demand for healthy and fresh produce, which leads to the need for higher-quality yields. Moreover, advanced farming technologies are propelling productivity and efficiency in fruit and vegetable cultivation, leading to further positive segment growth.

Which Formulation Type Segment Dominated the U.S. Agrochemicals Market in 2024?

The liquid formulations segment dominated the market by holding a 50% market share in 2024. The dominance of the segment is owed to the growing demand for easy-to-apply products coupled with the advancements in precision farming. Also, these formulations generally have better penetration into plant tissues with better bioavailability, which leads to more effective results.

The dry formulations segment held a 30% market share and is expected to grow at the fastest CAGR of 8.0 % during the forecast period. The growth of the segment is due to the growing adoption of IPM systems, which depend on strategic and targeted applications. Dry formulations such as granules have a low drift hazard, which reduces exposures to non-target areas and organisms. This makes them convenient for various applications.

How Much Share Did the Crop Protection Segment Held in 2024?

The crop protection segment held a 55% market share in 2024. The dominance of the segment can be attributed to the surge in pest and disease pressure exacerbated by climate change and increasing adoption of precision agriculture methods. The use of technologies such as sensors, drones, and Artificial Intelligence enables the more effective and targeted application of agrochemicals, which minimizes overall chemical use while enhancing crop protection.

The soil treatment & fertility segment held a 30% market share and is expected to grow at the fastest CAGR of 8.0% during the projected period. The growth of the segment can be credited to the growing demand for increased agricultural productivity and technological innovations in precision agriculture. Increasing consumer awareness regarding organic and sustainably produced food is fuelling the adoption of bio-based soil treatments soon.

Which End User Segment Dominated the U.S. Agrochemicals Market in 2024?

The commercial farmers segment dominated the market by holding a 50% share in 2024. The dominance of the segment can be linked to the growing demand for higher crop yields because of shrinking arable land and population growth. Furthermore, partnerships among companies are boosting advancements in creating more efficient and sustainable agrochemical formulations.

The government/research institutes segment, which held a 25% market share, is expected to grow at the fastest CAGR of 7.5% during the study period. The growth of the segment can be driven by the ongoing shift toward bio-based products, along with the rise in concerns regarding environmental pollution and climate change. Moreover, research is more focused on biopesticides, which are obtained from natural materials, to fulfil the need for eco-friendly solutions.

Midwest U.S. Agrochemicals Market Trends

The Midwest region dominated the market with a 40% share in 2024. The dominance of the region can be attributed to the rapid adoption of technologies such as GPS, data analytics, and AI, which enable more targeted and precise application of agrochemicals. In addition, this region is crucial for the production and trade of grains and oilseeds, impacting positive market growth.

South U.S. Agrochemicals Market Trends

The South region held 25% market share and is expected to grow at 8.0% CAGR during the forecast period. The growth of the region can be credited to the increasing emphasis on sustainable and biological products, coupled with the surge in research and development in the southern states. Furthermore, Government initiatives and regulations are facilitating the development of more sustainable and safer agrochemicals.

By Product

By Crop Type

By Formulation

By Application

By End User

December 2025

December 2025

December 2025

December 2025