Content

What is the U.S. nickel market size ?

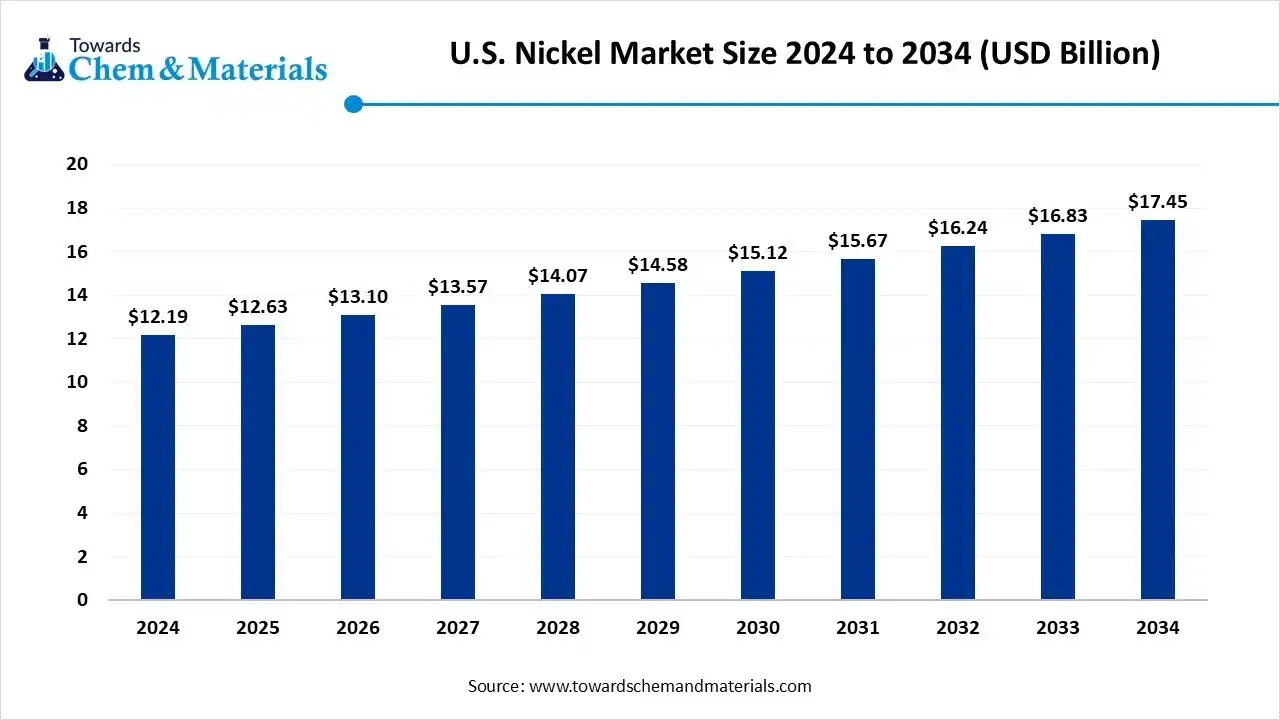

The U.S. nickel market size was valued at USD 12.19 billion in 2024 and is expected to hit around USD 17.45 billion by 2034, growing at a compound annual growth rate (CAGR) of 3.65% over the forecast period from 2025 to 2034. The market's growth is driven by increasing domestic demand from various industries, particularly the steel and electric vehicle sectors, which in turn drive market expansion.

Key Takeaways

- By product type, the refined nickel segment dominated the market with a share

- By product type, the nickel sulfate segment is expected to grow significantly in the market during the forecast period.

- By application, the stainless-steel segment dominated the market with a share of 50% in 2024.

- By application, the batteries segment is expected to grow in the forecast period.

- By form, the nickel briquettes segment dominated the market with a share of 45% in 2024.

- By form, the nickel sulfate solution segment is expected to grow in the forecast period.

- By end user, the stainless-steel manufacturers segment dominated the market with a share of 50% in 2024.

- By end user, the battery manufacturers segment is expected to grow in the forecast period.

Market Overview

What Is The Significance Of The U.S. Nickel Market?

The U.S. nickel market is vital as a major consumer, especially for electric vehicle (EV) batteries and as a centre for stainless steel manufacturing, fueling both local and global demand. Despite heavy reliance on imports, the U.S. is increasingly investing in domestic supply chains and recycling efforts to facilitate its energy transition and strengthen strategic capabilities. The U.S. plays a key role in driving nickel demand, driven by the booming EV sector. Nickel is essential for high-energy lithium-ion batteries, with companies like Tesla and General Motors heavily investing in securing supply chains to support their expanding EV production.

U.S. Nickel Market Outlook:

- Industry Growth Overview: Between 2025 and 2034, the U.S. nickel market is expected to grow steadily, supported by rising demand from stainless steel production, electric vehicle (EV) batteries, and renewable energy storage applications. The ongoing transition toward electrification and grid-scale energy systems is strengthening domestic nickel consumption.

- Sustainability Trends: Sustainability is driving major shifts in nickel sourcing and production. Increasing emphasis is being placed on responsible mining, traceability, and low-carbon refining methods. Companies are exploring the recycling of nickel from end-of-life batteries and industrial scrap to strengthen circular supply chains.

- Domestic Expansion & Investments: Significant investments are underway to boost domestic nickel supply and processing. Several U.S. based mining and materials companies are advancing projects in Minnesota and Michigan to produce battery-grade nickel for EV and energy storage industries. Strategic collaborations between automakers and miners are emerging to secure long-term supply chains.

Key Technological Shifts In The U.S. Nickel Market:

Key technological shifts in the U.S. nickel market include the surge in demand from EV batteries, advancements in battery chemistry and recycling, and the integration of digital solutions like AI and automation in production and supply chains. Traditional stainless steel production remains the dominant application, but innovation is focused on high-performance applications like aerospace and the sustainable sourcing and processing of nickel for batteries.

The adoption of artificial intelligence, machine learning, and automation is transforming operations across the nickel market, from mining to manufacturing and supply chain management.

Report Scope

| Report Attributes | Details |

| Market Size in 2026 | USD 13.10 Billion |

| Expected Size by 2034 | USD 17.45 Billion |

| Growth Rate from 2025 to 2034 | CAGR 3.65% |

| Base Year of Estimation | 2024 |

| Forecast Period | 2025 - 2034 |

| Segment Covered | By Product Type, By Application, By Form, By End User |

| Key Companies Profiled | Norilsk Nickel, Jinchuan Group International , BHP Group , Sumitomo Metal Mining Co., Ltd. , Anglo American PLC , Eramet SA , Royal Nickel Corporation , MMC Norilsk Nickel , China Nickel Corporation , Minmetals Group , Falcon Metals , Huayou Cobalt Co., Ltd. |

Trade Analysis Of the U.S. Nickel Market: Import & Export Statistics

- In 2023, the U.S. exported $113 million in nickel powders and flakes, mainly to Germany and Canada.(Source: wits.worldbank.org)

- In 2024, the United States exported nickel articles, ranking 48th out of 97 products in terms of total export value. The primary destinations for these U.S. exports are China, Mexico, the United Kingdom, France, and Canada.(Source : oec.world)

U.S. Nickel Market Value Chain Analysis

- Chemical Synthesis and Processing : Nickel is extracted from sulfide and laterite ores through processes such as smelting, refining, electrolysis, and hydrometallurgical leaching to produce high-purity nickel metal and alloys.

- Key players : Vale S.A., Glencore plc, Sibanye-Stillwater Ltd., Nornickel, Umicore

- Quality Testing and Certification : Nickel and its alloys undergo testing for purity, composition, hardness, and corrosion resistance under ASTM and ISO standards, including ASTM B39 and ISO 9001.

- Key players: ASTM International, SGS, Intertek, UL Solutions

- Distribution to Industrial Users : Nickel is supplied to stainless steel, aerospace, automotive, and battery manufacturing industries for use in alloys, coatings, and energy storage systems.

- Key players: ATI Inc., Carpenter Technology Corporation, Alcoa Corporation, Tesla Inc.

U.S. Nickel Regulatory Landscape: Global Regulations

| Country / Region | Regulatory Body | Key Regulations / Frameworks | Focus Areas | Notable Notes |

| United States | U.S. Environmental Protection Agency (EPA) | - Clean Air Act (CAA) - Clean Water Act (CWA) - Resource Conservation and Recovery Act (RCRA) - Toxic Substances Control Act (TSCA) |

- Air and water emissions from smelting/refining - Waste treatment and disposal standards - Chemical safety and risk evaluation |

The EPA regulates emissions of nickel compounds as hazardous air pollutants. Industrial discharges of nickel are closely monitored under the National Pollutant Discharge Elimination System (NPDES). |

| U.S. Department of Energy (DOE) | - Battery Materials Supply Chain Policy (2022) - Bipartisan Infrastructure Law (2021) - Inflation Reduction Act (IRA, 2022) |

- Support for domestic nickel refining and recycling - EV battery material supply chain resilience - Funding for critical mineral projects |

The DOE funds battery-grade nickel refining and recycling infrastructure. The IRA offers tax incentives for locally sourced nickel used in EV batteries. | |

| U.S. Occupational Safety and Health Administration (OSHA) | - 29 CFR 1910.1000 (Air Contaminants Standard) - Hazard Communication Standard (HCS) |

- Worker exposure limits to nickel dust/fumes - Hazard labelling and communication |

OSHA classifies nickel compounds as potential carcinogens. Industrial facilities must adhere to strict permissible exposure limits (PEL) for nickel in workplaces. | |

| U.S. International Trade Commission (USITC) and the U.S. Department of Commerce (DOC) |

- Section 232 of the Trade Expansion Act - Anti-dumping and Countervailing Duty Laws |

- Tariffs and trade barriers on imported nickel and alloys - Domestic supply chain protection |

The U.S. monitors nickel imports from Indonesia, Russia, and China for potential dumping. Trade policy alignment with the EU and Canada supports sustainable sourcing of nickel. | |

| U.S. Securities and Exchange Commission (SEC) | - Dodd–Frank Act Section 1502 (Conflict Minerals Rule) | - Supply chain transparency and reporting - Sourcing traceability of minerals (nickel included when linked to high-risk zones) |

Although not a traditional “conflict mineral,” nickel is increasingly scrutinised under responsible sourcing frameworks, particularly for EV and electronics manufacturers. |

Segmental Insights

Product Type Insights

Which Product Type Segment Dominated The U.S. Nickel Market In 2024?

The refined nickel segment dominated the market with a share of 20% in 2024. Refined nickel dominates the U.S. market due to its extensive use in stainless steel and high-performance alloys. The metal’s high purity and corrosion resistance make it essential in industrial manufacturing, aerospace, and defence applications. Growing demand from the stainless steel and automotive sectors continues to drive domestic consumption and sustain stable pricing trends.

The nickel sulfate segment expects significant growth in the U.S. nickel market during the forecast period. Nickel sulfate demand in the U.S. is increasing rapidly, mainly due to its critical role in lithium-ion battery cathodes for electric vehicles. Major battery manufacturers are expanding production capacities, supporting supply chain localisation. Investment in refining technologies and recycling infrastructure is also enhancing domestic nickel sulfate availability for clean energy applications.

Application Insights

How Did the Stainless Steel Segment Dominated The U.S. Nickel Market In 2024?

The stainless-steel segment dominated the market with a share of 50% in 2024. Stainless steel remains the largest application segment for nickel in the US, accounting for significant consumption in construction, automotive, and industrial machinery. Nickel improves the alloy’s strength, corrosion resistance, and formability. Infrastructure modernisation initiatives and the revival of manufacturing activity are expected to bolster stainless steel production, sustaining nickel demand.

The batteries segment expects significant growth in the U.S. nickel market during the forecast period. Nickel’s application in battery manufacturing, particularly for EVs and energy storage systems, is growing rapidly. The metal enhances battery energy density and longevity. U.S. investments in gigafactories and renewable energy storage are accelerating demand for nickel-based chemistries, especially in NMC (Nickel-Manganese-Cobalt) battery production, positioning nickel as a critical energy transition material.

Form Insights

Which Form Segment Dominated The U.S. Nickel Market In 2024?

The nickel briquettes segment dominated the market with a share of 45% in 2024. Nickel briquettes are a preferred form for alloying and electroplating industries in the U.S., valued for ease of handling, purity, and compatibility with automated feed systems. These are extensively used in stainless steel and superalloy production. Stable supply from key producers and recycling operations supports domestic consumption and industrial processing efficiency.

The nickel sulfate solutions segment expects significant growth in the market during the forecast period. Nickel sulfate solutions are primarily consumed in the battery industry for cathode material production. Their high solubility and compatibility with chemical processing make them ideal for EV battery manufacturing. With growing domestic cathode production capacity and recycling of spent batteries, nickel sulfate solutions are gaining importance in sustainable supply chain development.

End User Insights

How Did Stainless Steel Manufacturers Segment Dominated The U.S. Nickel Market In 2024?

The stainless-steel manufacturers segment dominated the market with a share of 50% in 2024. Stainless steel manufacturers represent a major end-user segment for nickel in the U.S., utilising it as a vital alloying element. The industry’s shift toward high-performance and corrosion-resistant grades continues to fuel steady nickel demand. Expanding infrastructure projects and industrial equipment production further strengthen the segment’s market position.

The battery manufacturers segment expects significant growth in the market during the forecast period. Battery manufacturers are emerging as a rapidly growing end-user segment, driven by the surge in EV adoption and renewable energy storage initiatives. Nickel is essential for developing high-energy-density cathodes in lithium-ion batteries. Government incentives for domestic EV production and sustainable supply chain goals are boosting nickel consumption among U.S. battery producers.

Recent Developments

- In October 2025, Appian Capital Advisory and the International Finance Corporation (IFC) launched a $1 billion fund aimed at investing in responsible critical mineral mining projects within emerging markets. The fund's initial focus includes Atlantic Nickel's Santa Rita mine in Brazil, targeting projects vital for the global energy transition.(Source : mining.com.au)

- In April 2025, the American Floral Endowment (AFE) announced its "Wholesale Nickel Program" in March 2025 as a funding initiative for floriculture sustainability. This program encourages wholesale florists to voluntarily contribute a small fee per box of flowers to support Sustainabloom, AFE's sustainability research and education program, providing free resources to help the floral industry adopt more sustainable practices.(Source: www.greenhousemag.com)

Top players in the U.S. Nickel Market & Their Offerings:

- Vale S.A.: One of the world’s largest nickel producers, Vale supplies refined nickel, nickel sulfate, and other nickel-based products to U.S. manufacturers in the stainless steel, battery, and aerospace industries.

- Glencore plc: Operates nickel mining, refining, and trading operations supplying the U.S. market with Class 1 nickel and intermediates for energy storage, alloys, and chemical applications.

- Sibanye Stillwater Limited: Engages in nickel mining and refining within the U.S., producing nickel as a byproduct of platinum group metal (PGM) operations, serving industrial and EV battery applications.

- Sherritt International Corporation: Supplies high-purity nickel briquettes and powders for use in stainless steel, catalysts, and battery materials through its integrated mining and refining operations.

- Nornickel: A major global nickel producer supplying refined nickel and nickel salts to the U.S. chemical, alloy, and battery industries through distribution partnerships.

Other Top Players Are

- Norilsk Nickel

- Jinchuan Group International

- BHP Group

- Sumitomo Metal Mining Co., Ltd.

- Anglo American PLC

- Eramet SA

- Royal Nickel Corporation

- MMC Norilsk Nickel

- China Nickel Corporation

- Minmetals Group

- Falcon Metals

- Huayou Cobalt Co., Ltd.

Segments Covered:

By Product Type

- Nickel Sulfate

- Nickel Pig Iron

- Nickel Matte

- Nickel Powder

- Refined Nickel

By Application

- Stainless Steel

- Batteries (Lithium-Ion, EV)

- Superalloys

- Electroplating

By Form

- Nickel Sulfate Solution

- Nickel Powder

- Nickel Briquettes

By End User

- Stainless Steel Manufacturers

- Battery Manufacturers

- Aerospace & Automotive

- Electroplating & Chemicals