Content

Liquid Crystal Polymers Market Size and Forecast 2025 to 2034

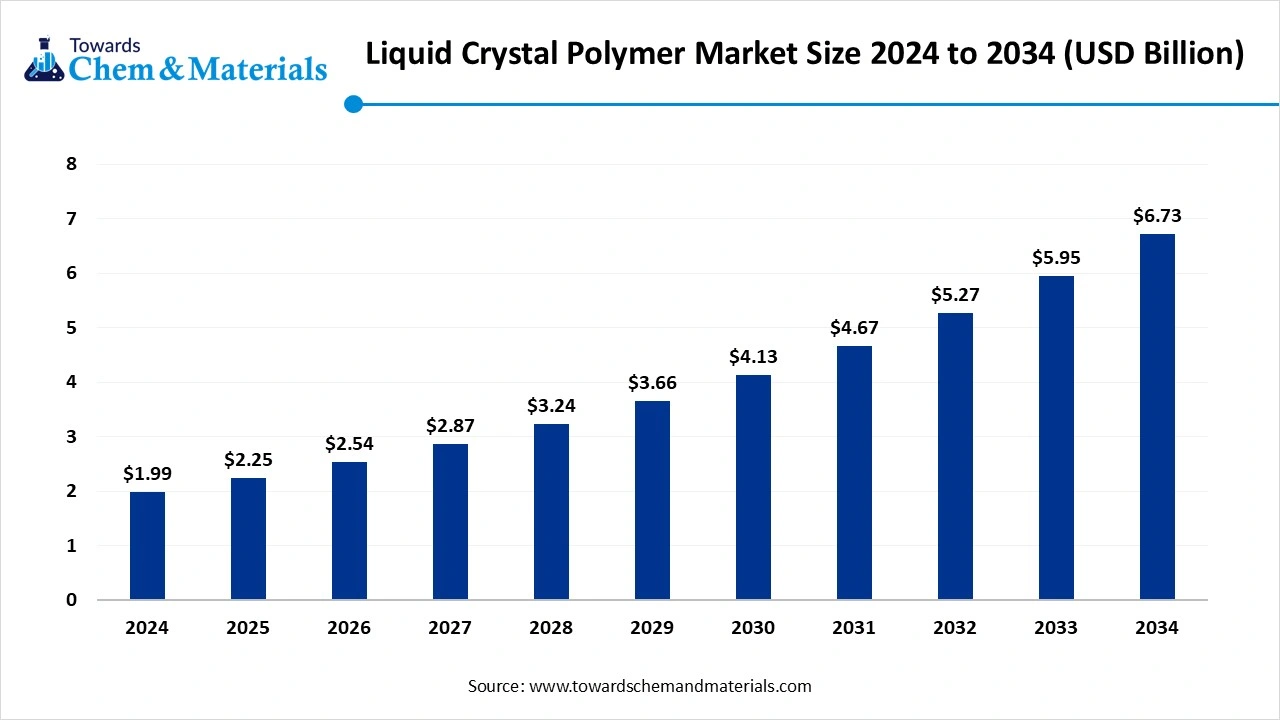

The global liquid crystal polymers market size was valued at USD 1.99 billion in 2024, grew to USD 2.25 billion in 2025, and is expected to hit around USD 6.73 billion by 2034, growing at a compound annual growth rate (CAGR) of 12.95% over the forecast period from 2025 to 2034. The growing global demand for high-performance electronics is the key factor driving market growth. Also, the ongoing shift towards smaller components, coupled with the excellent flow properties of LCPs, can fuel market growth further.

Key Takeaways

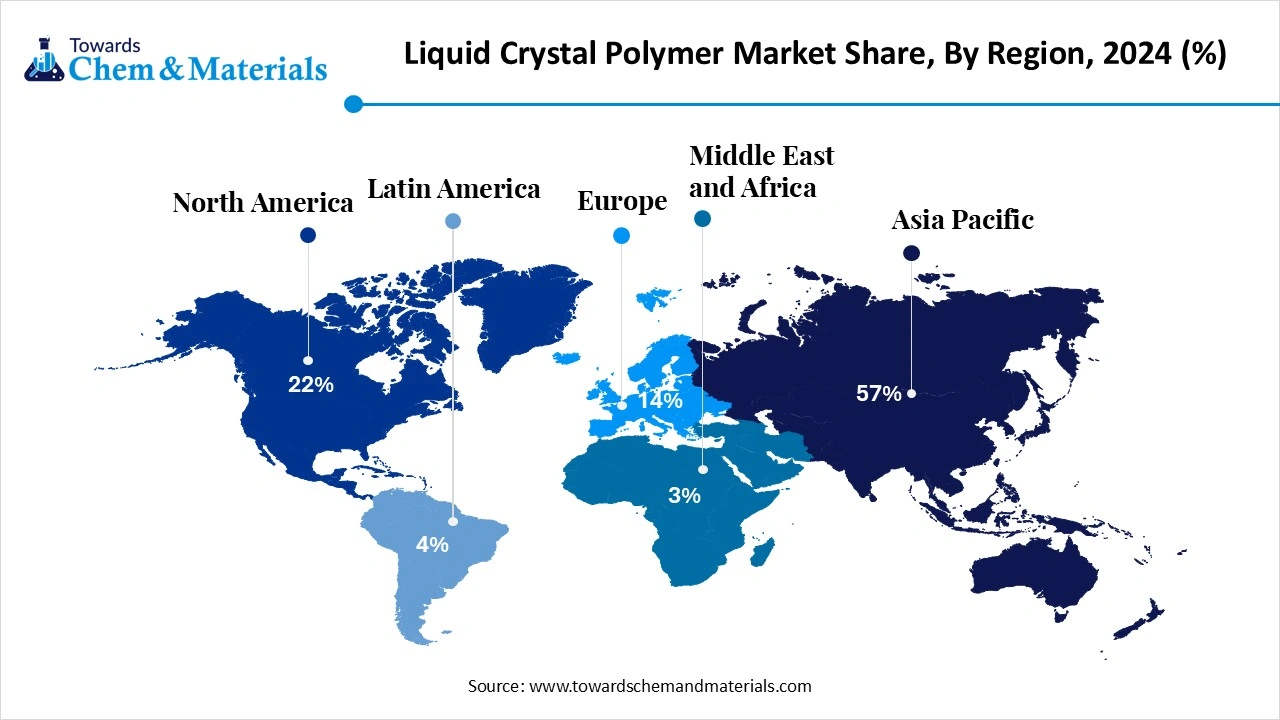

- By region, Asia Pacific dominated the market with approximately 57% share in 2024.

By region, North America is expected to grow at the fastest CAGR over the forecast period. - By product, the glass-fiber reinforced LCP segment dominated the market with approximately 48% share in 2024.

- By product, the carbon-fiber reinforced LCP segment is expected to grow at the fastest CAGR over the forecast period.

- By physical form, the pellets/granules segment held approximately 70% market share in 2024.

- By physical form, the films/laminates segment is expected to grow at the fastest CAGR over the forecast period.

- By processing method, the injection molding grades segment dominated the market by holding approximately 66% share in 2024.

- By processing method, the additive manufacturing/powder grades segment is expected to grow at the fastest CAGR over the projected period.

- By application, the electrical & electronics segment held a 38% market share in 2024.

- By application, the automotive & EV segment is expected to grow at the fastest CAGR during the study period.

- By performance, the high-temperature resistant grades segment held approximately 44% market share in 2024.

- By performance, the low-dielectric / low-loss grades segment is expected to grow at the fastest CAGR during the projected period.

- By distribution channel, the direct OEM supply segment dominated the market with approximately 56% share in 2024.

- By distribution channel, the distributor/compounder supply segment is expected to grow at the fastest CAGR over the forecast period.

What are Liquid Crystal Polymers?

The market is driven by increasing product demand in sectors such as automotive, electronics, and medical devices, due to the material's ability to replace conventional materials. The market encompasses the global manufacturing demand and the trade of LCPs, which enables them to form highly crystalline and ordered regions in their molten state. Key properties of LCPs include stiffness, high strength, inherent flame retardancy, and dimensional stability.

What Are the Key Trends Influencing the Liquid Crystal Polymers Market?

The growing LCP demand from the electronics and electrical industry is the latest trend in the market. LCPs are largely being utilized as replacements for metals in circuit boards and connectors used in laptops, smartphones, and consumer devices due to their better chemical and heat resistance.

The expanding sector for thermoplastic polymers is expected to provide crucial growth opportunities in the market. These are the key thermoplastics utilized for high-temperature applications across different sectors. Because of their properties, such as excellent chemical resistance, high-temperature resistance, and a higher weight-to-strength ratio.

The increasing need for connectors with high pin density is expected to fuel the demand for LCP further. Also, the growing demand for high-performance and lightweight materials from the automotive sector to produce fuel-efficient vehicles is expected to present new opportunities in the market soon.

Report Scope

| Report Attributes | Details |

| Market Size in 2025 | USD 2.25 Billion |

| Expected Size by 2034 | USD 6.73 Billion |

| Growth Rate from 2025 to 2034 | CAGR 12.95% |

| Base Year of Estimation | 2024 |

| Forecast Period | 2025 - 2034 |

| Dominant Region | Asia Pacific |

| Segment Covered | By Product Type, By Physical Form, By Processing Method, By Application (detailed, non-overlapping), By Performance / Grade, By Distribution Channel, By Region |

| Key Companies Profiled | Solvay, Celanese Corporation, Sumitomo Chemical Company, TORAY INDUSTRIES, INC., UENO FINE CHEMICALS INDUSTRY, LTD., RTP Company,Zeus Company Inc., Chang Chung Group, Polyplastics Co., Daken Chem |

Market Opportunity

Emergence of 5G and Advanced Technologies

The emergence of 5G networks with other advanced technologies creates a major opportunity in the market for the usage of LCP in high-frequency substrates and antenna membranes. Furthermore, the shift towards smaller electronics components creates demand for materials such as LCPs that can be used as an injection mold.

Market Challenge

Limited processability

LCPs have a much narrower processing window and need precise control over shear rates and temperature during molding, which can be challenging to maintain. Moreover, this tedious processing might limit some market players from using LCPs, especially those lacking the required specialized equipment and technical expertise, hindering market growth further.

Regional Insight

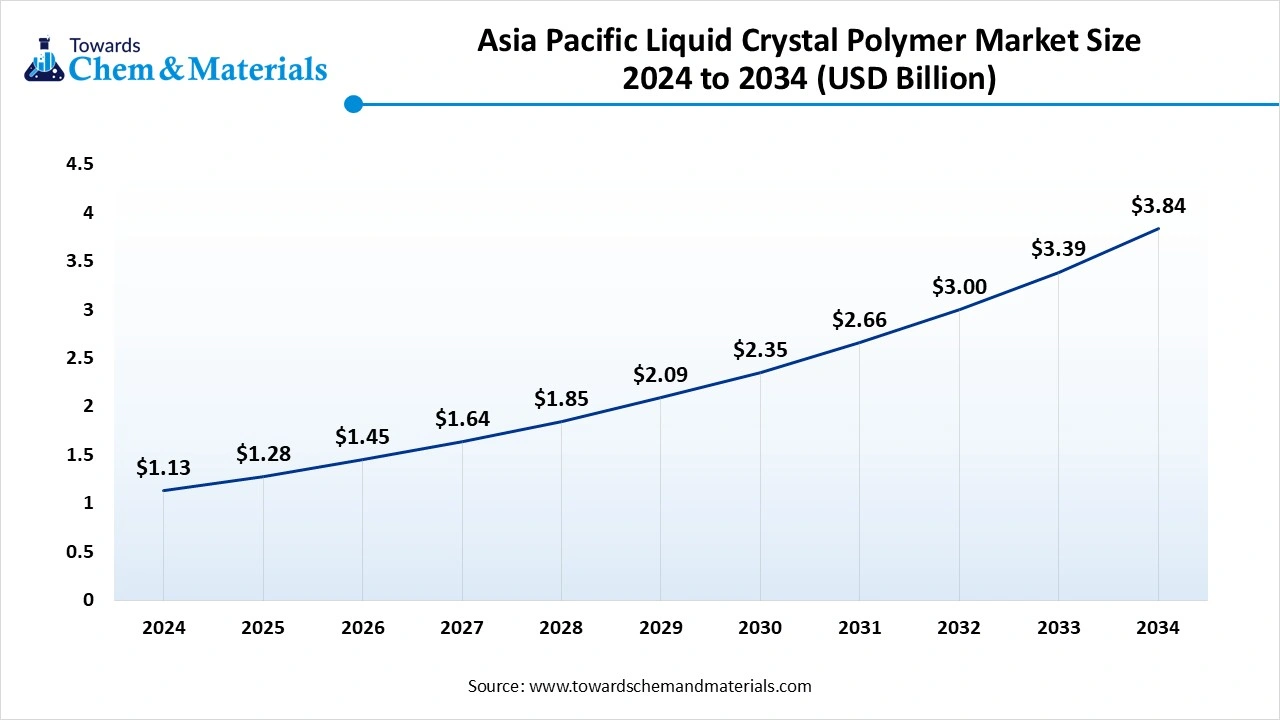

Asia Pacific Liquid Crystal Polymers Market Size, Industry Report 2034

The liquid crystal polymers market size was estimated at USD 1.13 billion in 2024 and is projected to reach USD 3.84 billion by 2034, growing at a CAGR of 13.01% from 2025 to 2034. Asia Pacific dominated the market with approximately 57% share in 2024.

The dominance of the region can be attributed to the surge in adoption of consumer electronics along with the expanding middle class in developing economies such as China and India. In addition, the region's established cost-competitive production capabilities and the strong presence of a skilled workforce can boost regional growth further.

North America Liquid Crystal Polymers Market Trends

North America is expected to grow at the fastest CAGR over the forecast period. The growth of the region can be credited to the growing demand for miniaturized electronic components in electronics and electrical sectors, coupled with the ongoing adoption of advanced technologies such as ADAS and 5G. Furthermore, continuous R&D activities lead to the advanced LCP formulations with specialised properties.

Segmental Insight

Product Type Insight

Which Product Type Segment Dominated the Liquid Crystal Polymers Market in 2024?

The glass-fiber reinforced LCP segment dominated the market with approximately 48% share in 2024. The dominance of the segment can be attributed to the increasing demand for lightweight and high-performance materials in sectors such as automotive and electronics. GFLCPs are also increasingly being used in medical devices due to their stability, biocompatibility, and capability to withstand sterilization processes.

The carbon-fiber reinforced LCP segment is expected to grow at the fastest CAGR over the forecast period. The growth of the segment can be credited to the rising demand for miniaturization of electronic components, along with the need for enhanced fuel efficiency and decreased emissions through lighter parts in vehicles. Additionally, CFR-LCPs give exceptional thermal stability, chemical resistance, and high stiffness, which makes them suitable for various applications.

Physical Form Insight

How Much Share Did the Pellets/Granules Segment Held in 2024?

The pellets/granules segment held approximately 70% market share in 2024. The dominance of the segment can be linked to the technological innovations in 3D printing and the growing adoption of autonomous vehicles. Also, LCPs are used in precision devices like HF network switches, IC sockets, and custom electrical connectors where high performance is needed.

The films/laminates segment is expected to grow at the fastest CAGR over the forecast period. The growth of the segment can be driven by growing product demand in medical and aerospace applications, along with the favourable government policies in developing countries. Furthermore, LCP films offer higher dimensional stability and strength, which makes them convenient for various components in aerospace.

Processing Method Insight

Why Injection Molding Grades Segment Dominated the Liquid Crystal Polymers Market in 2024?

The injection molding grades segment dominated the market by holding approximately 66% share in 2024. The dominance of the segment is owed to the growing use of innovative materials for the manufacturing of pressure injection molding. The growing use of microinjection molding, enabled by LCPs' flow properties, optimises the manufacturing of intricate parts of various devices.

The additive manufacturing/powder grades segment is expected to grow at the fastest CAGR over the projected period. The growth of the segment is due to the rapid emergence of cutting-edge technologies and the need for high-performance materials in different sectors. Moreover, additive manufacturing with LCPs provides benefits such as the ability to create more complex geometries.

Applications Insight

Which Application Segment Dominated the Liquid Crystal Polymers Market in 2024?

The electrical & electronics segment held approximately 38% market share in 2024. The dominance of the segment can be attributed to the growing demand for high-performance electronic devices such as laptops and smartphones, coupled with the automotive sector's shift towards electric vehicles (EVs). Also, LCPs are rapidly being utilized in semiconductor production due to their high temperature resistance.

The automotive & EV segment is expected to grow at the fastest CAGR during the study period. The growth of the segment can be credited to the rapid innovations in 3D printing and automation in automotive production, and the surge in advanced production technologies. In addition, LCPs are used in many automotive applications such as ignition systems and high-performance lamp sockets.

Performance Insight

How Much Share Did the High-Temperature Resistant Grades Segment Held in 2024?

The high-temperature resistant grades segment held approximately 44% market share in 2024. The dominance of the segment can be linked to the increasing demand for EVs, which requires high-performance and lightweight materials for components such as sensors, connectors, and inverters. LCPs' inherent properties, like the high chemical resistance and heat tolerance, make them suitable for various demanding applications.

The low-dielectric / low-loss grades segment is expected to grow at the fastest CAGR during the projected period. The growth of the segment can be driven by the growing adoption of high-frequency and high-performance materials in the automotive and electronics sectors. Furthermore, low-loss LCP grades give a unique combination of high stiffness and heat resistance.

Distribution Channel Insight

Why Direct OEM Supply Segment Dominated the Liquid Crystal Polymers Market in 2024?

The direct OEM supply segment dominated the market with approximately 56% share in 2024. The dominance of the segment is owing to the rising need for miniaturized electronic components and supportive government policies in developing countries. Also, LCPs are used in components like electrical connectors, combustion systems, and insulation components, leading to further segment growth.

The distributor/compounder supply segment is expected to grow at the fastest CAGR over the forecast period. The growth of the segment is due to the ongoing R&D initiatives and advancements in LCP processing technologies. Moreover, increasing environmental consciousness is fuelling the demand for long-lasting and durable LCP-based products.

Liquid Crystal Polymers Market Value Chain Analysis

- Feedstock Procurement: It is the process of sourcing the raw materials required to synthesize LCPs. These raw materials can be extracted from various sources, such as fossil resources.

- Chemical Synthesis and Processing: This stage describes the manufacturing of Liquid Crystal Polymers (LCPs) from raw materials and their conversion into usable forms for downstream applications.

- Packaging and Labelling : It is a growing area in the market, fuelled by chemical resistance and LCP's excellent barrier properties with dimensional stability.

- Regulatory Compliance and Safety Monitoring : It refers to the adherence to rules, laws, and safety procedures established by numerous governing bodies. It also helps to mitigate the risk associated with the lifecycle of LCPs.

Recent Developments

- In June 2025, Sumitomo Chemical established a mass manufacturing technology for liquid crystal polymer (LCP) by utilizing a monomer obtained from biomass materials. The company will further boost the development of a mass manufacturing system for bio-based LCP using this technology.(Source: www.sumitomo-chem.co.jp )

Liquid Crystal Polymers Market Top Companies

- Solvay

- Celanese Corporation

- Sumitomo Chemical Company

- TORAY INDUSTRIES, INC.

- UENO FINE CHEMICALS INDUSTRY, LTD.

- RTP Company

- Zeus Company Inc.

- Chang Chung Group

- Polyplastics Co.

- Daken Chem

Segments Covered

By Product Type

- Neat / Unfilled LCP

- Glass-fiber Reinforced LCP

- Carbon-fiber Reinforced LCP

- Mineral-filled LCP

- Flame-retardant LCP

- High-purity / Medical-grade LCP

- Conductive / ESD-modified LCP

By Physical Form

- Pellets / Granules

- Films / Laminates

- Powders

- Sheets / Plates

- Masterbatch Concentrates

By Processing Method

- Injection Molding Grades

- Extrusion Grades

- Compression Molding Grades

- Additive Manufacturing / Powder Grades

By Application (detailed, non-overlapping)

- Electrical & Electronics

- Connectors

- IC / Semiconductor Packaging

- Flexible Printed Circuit (FPC) Substrates

- RF & Microwave Modules / Antennas

- LED Component Housings

- Sensor Housings

- Automotive & EV

- Wiring Harness Connectors

- Sensor Casings

- Under-the-hood Components

- EV Battery Insulation / Components

- Infotainment System Components

- Medical Devices

- Diagnostic & Monitoring Device Housings

- Connectors & Interconnects

- Surgical Instrument Components

- Aerospace & Defense

- Avionics Connectors

- RF & Communication Modules

- Lightweight Structural Housings

By Performance / Grade

- High-temperature Resistant Grades

- High-flow Grades (thin-wall precision)

- Low-dielectric / Low-loss Grades

- Chemical-resistant Grades

- Biobased / Sustainable Grades

By Distribution Channel

- Direct OEM Supply

- Distributor / Compounder Supply

By Region

- North America

- U.S.

- Canada

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Sweden

- Denmark

- Norway

- Asia Pacific

- China

- Japan

- India

- South Korea

- Thailand

- Latin America

- Brazil

- Mexico

- Argentina

- Middle East and Africa (MEA)

- South Africa

- UAE

- Saudi Arabia

- Kuwait