Content

U.S. Polyolefin Compounds Market Size, Share | CAGR of 5.30%.

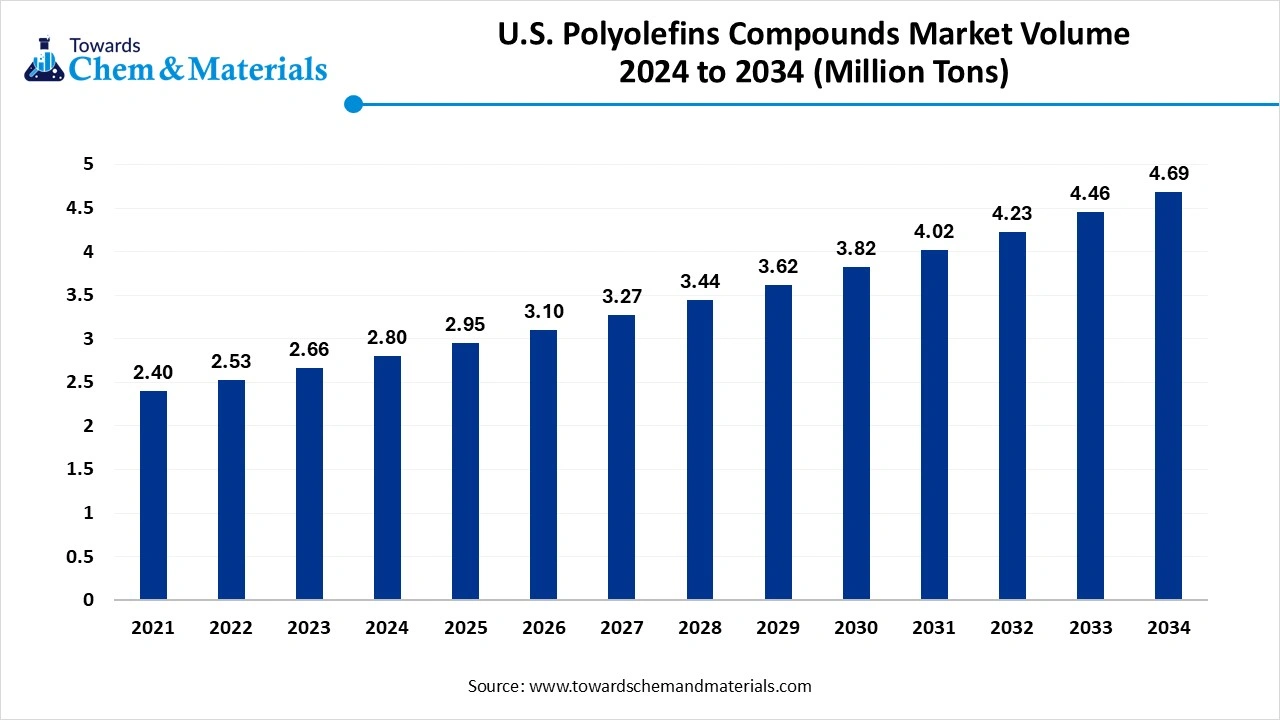

The U.S. polyolefin compounds market volume was reached at 2.80 million tons in 2024 and is expected to be worth around 4.69 million tons by 2034, growing at a compound annual growth rate (CAGR) of 5.30% over the forecast period 2025 to 2034. Growing demand for durable and lightweight materials is the key factor driving market growth. Also, ongoing innovations in compounding processes and R&D coupled with the increasing focus on the circular economy can fuel market growth further.

Key Takeaways

- By resin type, the polypropylene (PP) segment dominated the U.S. polyolefin compounds market with 55% market share in 2024. The dominance of the segment can be attributed to the ongoing expansion of the lightweight consumer goods industry.

- By resin type, the polyethylene (PE) segment is expected to grow at the fastest CAGR over the forecast period. The growth of the segment can be credited to the increasing demand for polyethylene in flexible packaging solutions.

- By filler type, the talc segment held a 34% market share in 2024. The dominance of the segment can be linked to the ongoing innovations in talc processing along with the emphasis on circular economy and sustainability.

- By filler type, the glass fibers segment is expected to grow at the fastest CAGR over the forecast period. The growth of the segment can be driven by increasing demand for glass fiber from the automotive industry.

- By application, the automotive segment led the market by holding 40% market share in 2024. The dominance of the segment is owed to the rising demand for lightweight materials in vehicle production.

- By application, the electrical & electronics segment is expected to grow at the fastest CAGR during the projected period. The growth of the segment is due to a surge in electrification trends and need for materials with better thermal management and insulation properties.

- By processing technique, the injection molding segment held a 48% market share in 2024. The growth of the segment can be credited to the technological innovations in the manufacturing process of injection molding and growing automation in the injection molding process.

- By processing technique, the extrusion segment is expected to grow at the fastest CAGR over the forecast period. The growth of the segment can be driven by growing demand for lightweight materials in the automotive sector.

Growing Demand for Recycled Materials is Expanding Market Growth

The U.S. Polyolefin Compounds Market refers to the domestic industry focused on the production, processing, and application of polyolefin-based compounds such as polypropylene (PP) and polyethylene (PE). These compounds are customized with additives, fillers, and reinforcements to enhance properties like durability, flexibility, chemical resistance, and thermal stability. The market caters to diverse end-use sectors including automotive, packaging, construction, electrical & electronics, and consumer goods.

This market is driven by demand for lightweight and high-performance materials, cost-efficiency, and recyclability. However, it also faces challenges related to environmental sustainability, regulatory pressures on plastic usage, and fluctuations in raw material prices derived from petrochemicals.

What Are the Key Trends Influencing the U.S. Polyolefin Compounds Market?

- Increasing emphasis on minimizing vehicle weight to enhance fuel economy to meet strict emission standards is the latest trend in the market. Polyolefin compounds are widely used to replace heavier metals in functional and structural parts due to their exceptional dimensional stability, mechanical properties, and resistance to chemicals.

- The rising demand for consumer goods products and growth in e-commerce logistics are major factors driving market growth. These materials offer high clarity, robust impact resistance, and excellent processability, which makes them convenient for both rigid containers and flexible films. Also, their ability to offer strong barrier properties supports longer shelf life.

- The surge in consumption of plastic in the country due to its low cost, versatility, and wide applications in various sectors such as automotive, packaging, and construction can impact market growth positively. Plastics are indispensable in production due to their lightweight nature, durability, and processability of polyolefins.

How Government is Supporting the U.S. Polyolefin Compounds Market?

The U.S. government is supporting the market through various initiatives emphasizing sustainability, infrastructure development, and the circular economy. Government regulations such as the U.S. Plastics Pact are promoting growing recycled content in packaging, which fuels the demand for recycled polyolefins. Moreover, the government support for R&D in recyclable and biodegradable polyolefin mixes further supports the advancements in sustainable materials.

Report Scope

| Report Attribute | Details |

| Market Volume in 2025 | 2.95 Million Tons |

| Expected Volume by 2034 | 4.69 Million Tons |

| Growth Rate from 2025 to 2034 | CAGR 5.30% |

| Base Year of Estimation | 2024 |

| Forecast Period | 2025 - 2034 |

| Segment Covered | By Resin Type, By Application, By Processing Technique, |

| Key Companies Profiled | LyondellBasell Industries, ExxonMobil Chemical, Dow Inc., Borealis AG, SABIC, INEOS Olefins & Polymers USA, Formosa Plastics Corporation U.S.A., Mitsui Plastics Inc., Celanese Corporation, RTP Company, Washington Penn Plastic Co., Asahi Kasei Plastics North America, Avient Corporation (formerly PolyOne), TotalEnergies Petrochemicals & Refining USA Ampacet Corporation |

Market Opportunity

Rising Demand for Bio-Based Polyolefin

Growing demand for bio-based polyolefin across many industries is the key factor creating lucrative opportunities in the market. Bio-based polyolefins, which are obtained from renewable resources, are increasingly gaining popularity due to their sustainability benefits and low-risk environment. Furthermore, the global market for sustainable materials is expected to grow substantially, boosted by new product launches, strategic initiatives, and production expansion.

- In April 2024, Clariant launched an innovative solution to minimize the environmental effect of plastics at Chinaplas. The new solution will enhance efficiency, safety, and increase circularity by reducing overall waste generated.(Source: www.clariant.com )

Market Challenges

Competition from Alternative Materials

The competition from other polymers, such as polyesters and polyamides, is a major factor hampering market growth. The development of recycled plastics and bioplastics creates a threat to the market value of virgin polyolefins. Furthermore, governments across the globe are implementing stringent environmental regulations associated with plastic production, use, and disposal. To fulfil these requirements can be challenging to some market players.

Country Insight

The growth of the polyolefin compounds market in the U.S. is attributed to the growing demand for cost-effective, lightweight, and recyclable packaging materials along with a rise in the need for fuel-efficient vehicles. Rapid innovations in compounding and polymer science technologies are propelling the development of high-performance polyolefin materials with improved properties. Furthermore, increasing demand for rigid and flexible packaging applications, especially in pharmaceuticals and food & beverage, is fuelling polyolefin consumption in the country.

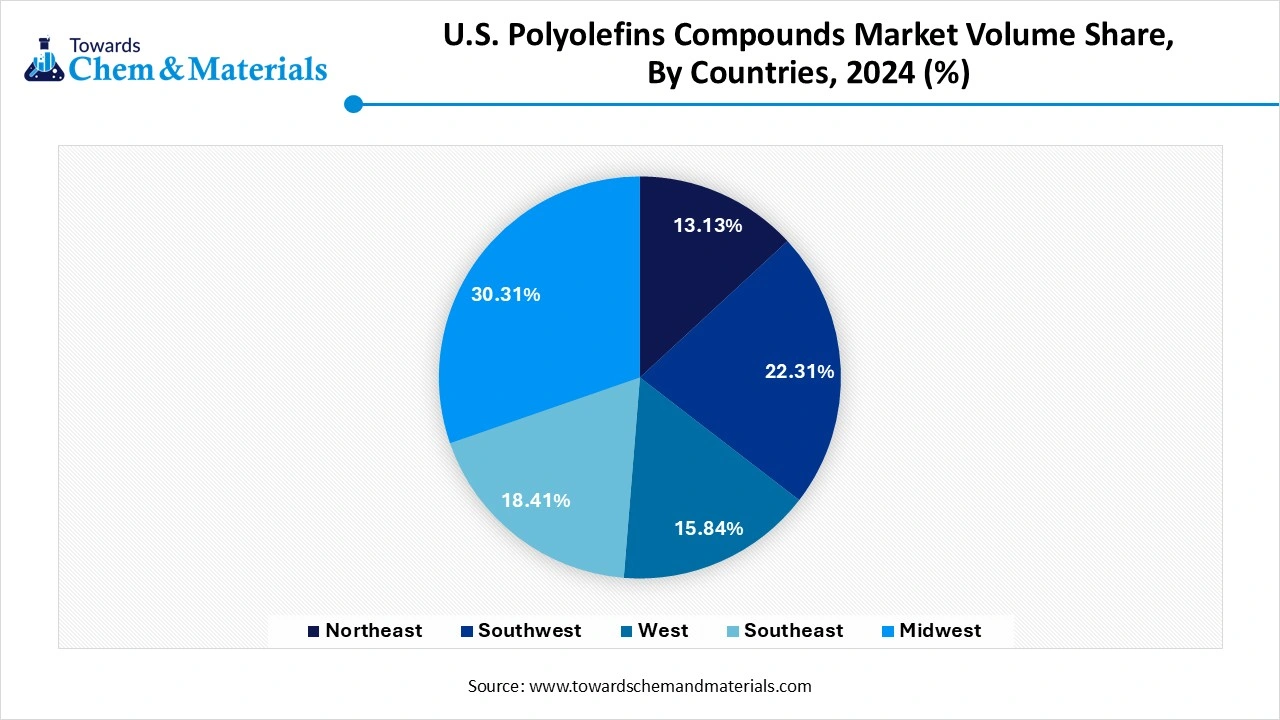

U.S. Polyolefin Compounds Market Volume Share, By Region, 2024-2034 (%)

| By Region | Volume Share, 2024 (%) | Market Volume Million Tons - 2024 | Volume Share, 2034 (%) | Market Volume Million Tons - 2034 | CAGR CAGR (2025 - 2034) |

| Northeast | 13.13% | 0.37 | 14.40% | 0.68 | 7.00% |

| Southwest | 22.31% | 0.62 | 20.31% | 0.95 | 4.81% |

| West | 15.84% | 0.44 | 16.57% | 0.78 | 6.44% |

| Southeast | 18.41% | 0.52 | 19.31% | 0.91 | 6.47% |

| Midwest | 30.31% | 0.85 | 29.41% | 1.38 | 5.55% |

| Total | 100% | 2.80 | 100% | 4.69 | 5.30% |

Who are the Top Polyethylene Exporters in the U.S.?

| Company | Export Quantity in 2023 |

| Dow Chemical Company | 6.9 million tons |

| ExxonMobil Chemical | 6.1 million tons |

| LyondellBasell Industries | 5.4 million tons |

| Chevron Phillips Chemical | 4.2 million tons |

Segmental Insight

Product Type Insights

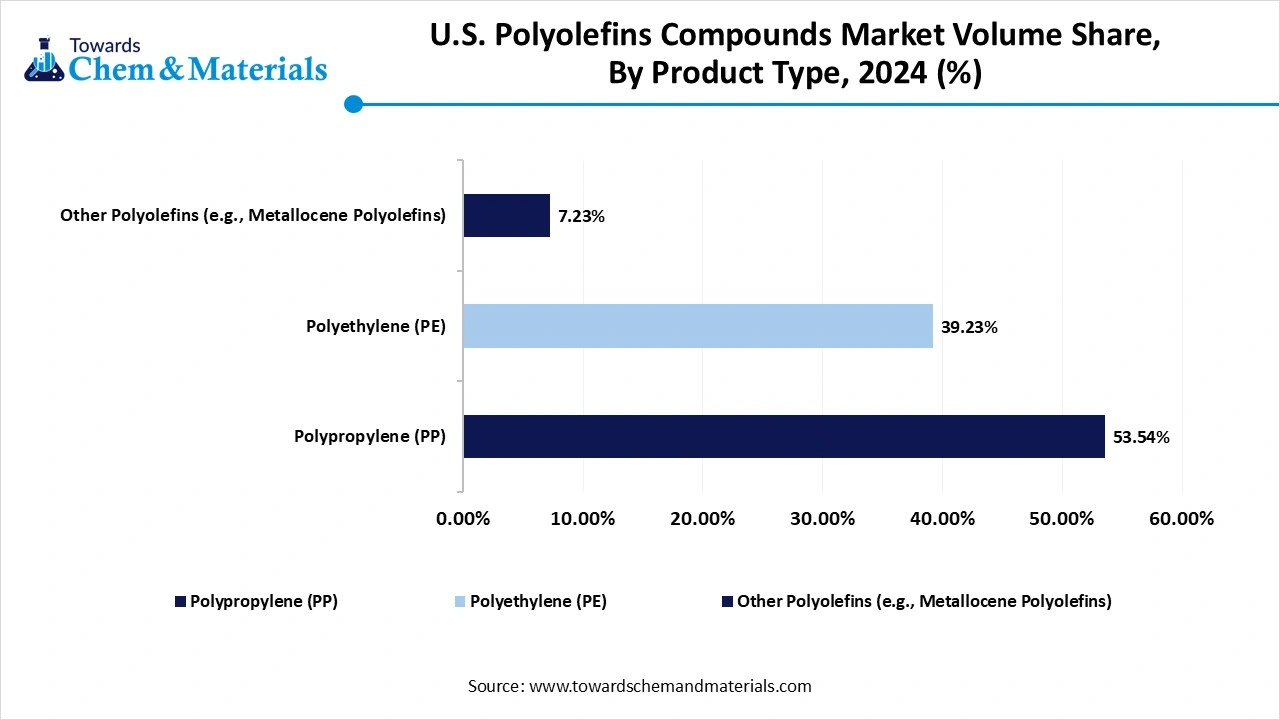

Which Product Type Segment Dominated the U.S. Polyolefin Compounds Market in 2024?

The polypropylene (PP) segment dominated the market with 55% market share in 2024. The dominance of the segment can be attributed to the ongoing expansion of the lightweight consumer goods industry and its properties, such as lightweight nature & chemical resistance. Additionally, PP provides a cost-effective solution to conventional methods, which makes it convenient for high-volume applications such as dashboards, bumpers, and door panels.

The polyethylene (PE) segment is expected to grow at the fastest CAGR over the forecast period. The growth of the segment can be credited to the increasing demand for polyethylene in flexible packaging solutions along with the advancements in copolymer blends. In this segment, the linear low-density polyethylene (LLDPE) segment is showing fastest growth due to developments in LLDPE technology and the strong availability of raw materials such as ethylene.

U.S. Polyolefin Compound Market Volume Share, By Product, 2024- 2034 (%)

| By Product Type | Volume Share, 2024 (%) | MarketVolume Million Tons - 2024 | MarketVolume Million Tons - 2034 | Volume Share, 2034 (%) | CAGR (2025 - 2034) |

| Polypropylene (PP) | 53.54% | 1.50 | 2.41 | 51.43% | 5.43% |

| Polyethylene (PE) | 39.23% | 1.10 | 1.88 | 40.13% | 6.17% |

| Other Polyolefins (e.g., Metallocene Polyolefins) | 7.23% | 0.20 | 0.40 | 8.44% | 7.74% |

| Total | 100.00% | 2.80 | 4.69 | 100.00% | 5.30% |

Filler Type Insights

Why Did the Talc Segment Dominated the U.S. Polyolefin Compounds Market in 2024?

The talc segment held a 34% market share in 2024. The dominance of the segment can be linked to the ongoing innovations in talc processing along with the emphasis on circular economy and sustainability. Talc is relatively cheap as compared to other options, impacting the cost-effectiveness of talc-filled polyolefin compounds. Also, talc-filled polyolefins are utilized in various applications such as appliances, automotive interior, packaging films, and appliances.

The glass fibers segment is expected to grow at the fastest CAGR over the forecast period. The growth of the segment can be driven by increasing demand for glass fiber from the automotive industry as it offers a high-strength and lightweight solution to the sector. In addition, glass fibers are added into polyolefin matrices to improve their mechanical properties; hence, they can be used in automotive construction, components, and packaging, driving the segment's growth soon.

Application Insights

How Did the Automotive Segment Dominated the U.S. Polyolefin Compounds Market in 2024?

The automotive segment led the market by holding 40% market share in 2024. The dominance of the segment is owed to the rising demand for lightweight materials in vehicle production coupled with the increasing trend towards innovative lightweighting solutions. Furthermore, polyolefin compounds such as polyethylene and polypropylene blends provide a combination of lightweight properties and thermal stability.

The electrical & electronics segment is expected to grow at the fastest CAGR during the projected period. The growth of the segment is due to a surge in electrification trends and the need for materials with better thermal management and insulation properties. Innovations in compounding technologies such as recycled resins and bio-based additives are facilitating the development of individualized formulations for tailored applications in electronics and the electrical industry.

Processing Technique Insights

Which Processing Technique Segment Held the Largest U.S. Polyolefin Compounds Market Share in 2024?

The injection molding segment held a 48% market share in 2024. The growth of the segment can be credited to the technological innovations in the manufacturing process of injection molding and growing automation in the injection molding process, which minimizes labor costs and improves overall production capabilities. The injection molding process is compatible for mass production of polyolefin parts with high quality, which makes it a more cost-efficient method.

The extrusion segment is expected to grow at the fastest CAGR over the forecast period. The growth of the segment can be driven by growing demand for lightweight materials in the automotive sector, increasing adoption of polyolefins in construction, and the expansion of the packaging industry. Also, advancements in production processes, like metallocene catalysis, are enhancing the properties and performance of polyolefins.

Recent Developments

- In July 2024, LyondellBasell, a major leader in the chemical sector, announced the launch of its latest Schulamid ET100 product line, an innovative polyamide-based compound solution. Manufactured for interior of automotive structural solutions, like door window frames.(Source: www.lyondellbasell.com)

- In March 2024, Dow unveiled a cutting-edge polyolefin elastomer-based leather solution for the automotive industry. The POE alternative has better color stability with ultra-soft tactility, impelling designers with more flexibility on the choice of color, particularly light ones.(Source: www.prnewswire.com)

Top Companies List

- LyondellBasell Industries

- ExxonMobil Chemical

- Dow Inc.

- Borealis AG

- SABIC

- INEOS Olefins & Polymers USA

- Formosa Plastics Corporation U.S.A.

- Mitsui Plastics Inc.

- Celanese Corporation

- RTP Company

- Washington Penn Plastic Co.

- Asahi Kasei Plastics North America

- Avient Corporation (formerly PolyOne)

- TotalEnergies Petrochemicals & Refining USA

- Ampacet Corporation

Segments Covered

By Product Type

- Polypropylene (PP)

- Polyethylene (PE)

- High-Density Polyethylene (HDPE)

- Low-Density Polyethylene (LDPE)

- Linear Low-Density Polyethylene (LLDPE)

- Other Polyolefins (e.g., Metallocene Polyolefins)

By Filler/Reinforcement Type

- Talc

- Calcium Carbonate

- Glass Fibers

- Minerals & Natural Fibers

- Others

By Application

- Automotive

- Packaging

- Building & Construction

- Electrical & Electronics

- Household Appliances

- Agriculture

- Others

By Processing Technique

- Injection Molding

- Blow Molding

- Extrusion

- Thermoforming

- Others