Content

U.S. Froth Flotation Chemicals Market Size and Growth 2025 to 2034

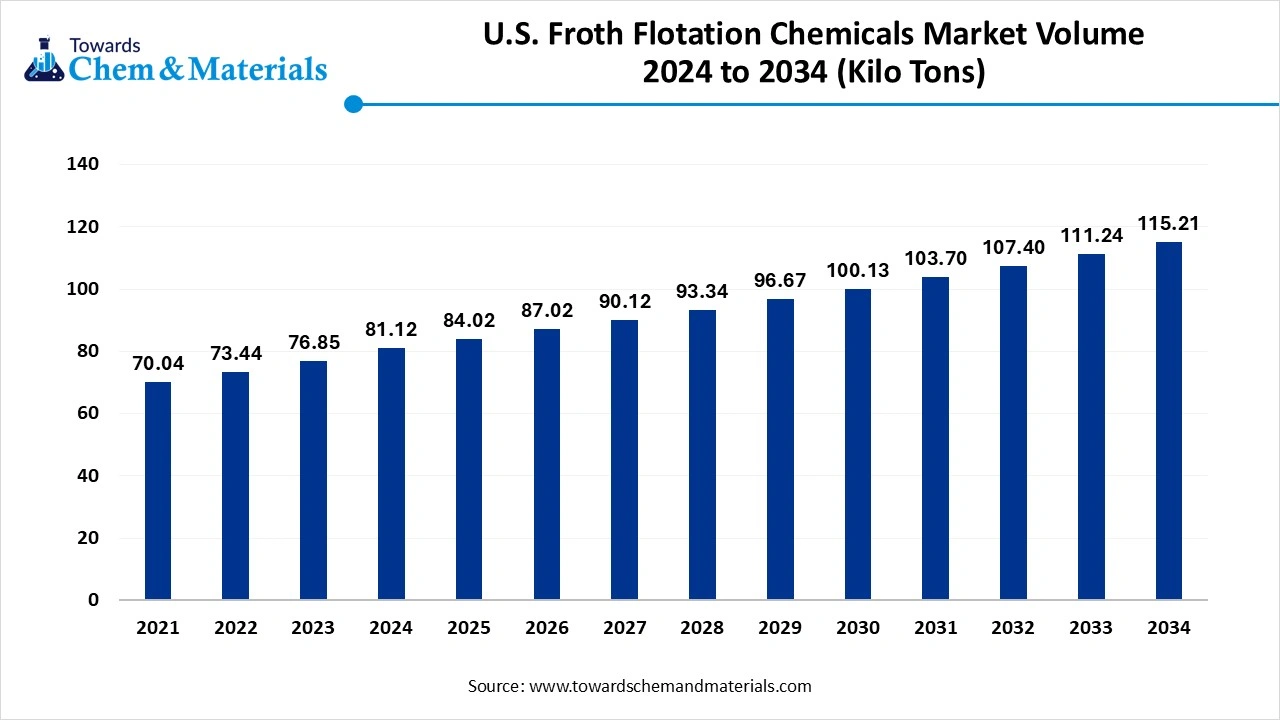

The U.S. froth flotation chemicals market volume was reached at 81.12 kilo tons in 2024 and is expected to be worth around 115.21 kilo tons by 2034, growing at a compound annual growth rate (CAGR) of 3.57% over the forecast period 2025 to 2034. The growing demand from various industries and sectors due to demand for technologically advanced materials and procedures drives the growth of the market.

Key Takeaways

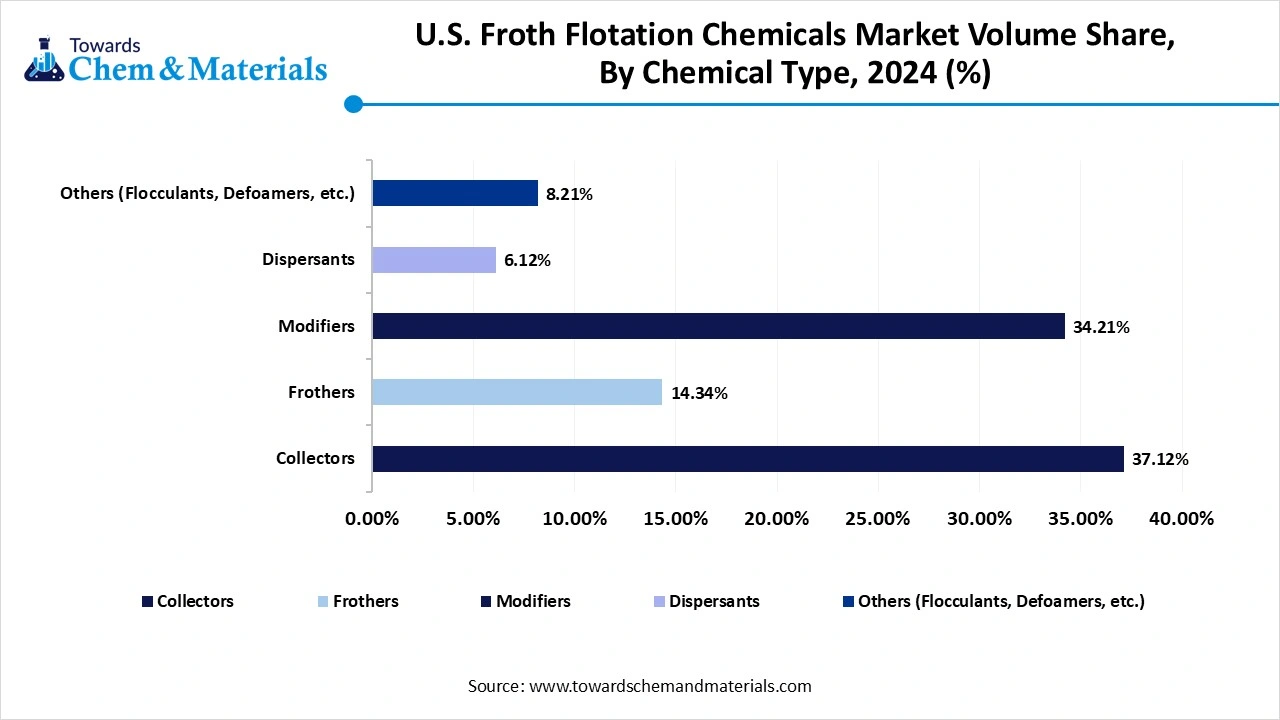

- By chemical type, the collectors segment dominated the market in 2024. The collectors segment held a 38% share in the market in 2024. These compounds effectively increase the hydrophobicity of the targeted minerals.

- By chemical type, the frothers (especially MIBC-based) segment is expected to grow significantly in the market during the forecast period. They are essential for creating stable foam with good performance in flotation processes.

- By ore type, the sulfide ores segment dominated the market in 2024. The sulfide ores segment held a 46% share in the market in 2024. Widely used in chemical processing, which fuels the growth.

- By ore type, the rare earth & oxide ores segment is expected to grow in the forecast period. The growing demand and processing propels the growth.

- By application, the mining (primary) segment dominated the market in 2024. The base metals (copper/zinc) segment held a 41% share in the market in 2024. The benefits offered drive the growth of the market.

- By application, the recycling & secondary recovery segment is expected to grow in the forecast period. The growing demand for recycling industry increases the growth.

- By end use, the mining & metallurgy segment dominated the market in 2024. The mining & metallurgy segment held a 72% share in the market in 2024. Demand for complex production technology influences the growth of the market.

- By end use, the water & waste management segment is expected to grow in the forecast period. The demand for improving the water quality treatment influences the growth.

Market Overview

Rising Demand for Durable Materials: U.S. Froth Flotation Chemicals Market to Expand

The U.S. Froth Flotation Chemicals Market refers to the industry involved in the production, distribution, and application of chemical reagents used in the froth flotation process—primarily in mineral processing. Froth flotation chemicals facilitate the separation of valuable minerals (such as copper, lead, zinc, gold, and rare earth elements) from their ores by promoting selective adhesion of particles to air bubbles in a flotation cell.

- The United States shipped out 361 Chemical Water Treatment shipments from October 2023 to September 2024 (TTM). These exports were handled by 108 U.S. exporters to 89 buyers, with the growth rate of 21% over the last year.(Source: www.volza.com)

What Are the Key Growth Drivers Responsible for The Growth of The U.S. Froth Flotation Chemicals Market?

This market growth is driven by the demand for base metals, industrial minerals, and strategic minerals for use in construction, electronics, automotive, and energy sectors (especially batteries). It is also shaped by technological advancements in mining operations, environmental regulations, and the increasing focus on mineral recycling and tailings reprocessing. These factors and demand increase the growth and expansion of the market.

Market Trends

- The froth flotation process plays a vital role in extracting minerals and metals and is increasingly used as industrialization and urbanization grow.

- A notable trend is the shift toward eco-friendly, biodegradable, and low-toxicity flotation chemicals, driven by stricter environmental laws and the push for sustainable mining.

- Advances in flotation technology, including automation and digitalization, present opportunities for improved performance and cost efficiency.

- Mining companies are also focusing more on water conservation due to water scarcity, leading to the development of water-saving chemicals and sophisticated water treatment methods.

Report Scope

| Report Attribute | Details |

| Market Volume in 2025 | 84.02 Kilo Tons |

| Expected Volume by 2034 | 115.21 Kilo Tons |

| Growth Rate from 2025 to 2034 | CAGR 3.57% |

| Base Year of Estimation | 2024 |

| Forecast Period | 2025 - 2034 |

| Segment Covered | By Chemical Type , By Ore Type , By Application , By End-Use Industry, By Region |

| Key Companies Profiled | Solvay S.A., Clariant AG, BASF Corporation , Arkema Group , Huntsman Corporation , Kemcore USA , Dow Inc. , Orica Limited , Cytec Industries Inc. (a Solvay brand) , ArrMaz (a part of Arkema) , Chevron Phillips Chemical Company , SNF Floerger , AkzoNobel Specialty Chemicals |

Market Opportunity

What Are the Primary Growth Opportunities Fueling the U.S. Froth Flotation Chemicals Market?

The main drivers of growth are the expanding mining industry. As accessible mineral deposits diminish, mining firms are increasingly dealing with more complex ores that require advanced flotation chemicals like frothers for effective extraction and purification. There is a rising focus on maximizing mineral recovery and refining flotation processes, boosting demand for high-performance, specialized chemicals creasting opportunity for the growth and expansion of the market.

Market Challenge

What Are the Main Obstacles Restricting the Growth of the U.S. Froth Flotation Chemicals Market?

The market faces multiple challenges, including environmental issues related to waste and pollution, the need for precise and efficient separation methods, and escalating costs of sophisticated flotation systems which limits the growth of the market. Furthermore, the introduction of alternative chemicals and the growing demand for sustainable mining practices are also impacting market growth and hindering the expansion of the market.

Segmental Insights

Chemical Type Insights

Which Chemical Segment Dominated the U.S. Froth Flotation Chemicals Market In 2024?

The collectors segment dominated the market in 2024. The collectors segment plays a pivotal role in the market. These surfactant-based reagents, such as xanthates, dithiophosphates, and amines, selectively attach to mineral particles, increasing hydrophobicity and enhancing separation efficiency in mining and industrial mineral processing. Representing nearly 39% of the U.S. chemical mix, collectors are favored for their ability to boost recovery rates and ore grades. As demand for tailored formulations grows, collectors continue to drive innovation and market expansion.

The frothers (especially MIBC-based) segment expects significant growth in the market during the forecast period. The frothers segment, particularly MIBC-based (methyl isobutyl carbinol) frothers, holds a crucial position in the market. Frothers play a key role in stabilizing air bubbles and creating a suitable froth layer, ensuring effective separation of hydrophobic particles. MIBC-based frothers are widely preferred for their low toxicity, good selectivity, and ability to produce stable, fine bubbles. Their effectiveness across various mineral types drives consistent demand, supporting market growth and enhancing flotation process efficiency.

U.S. Froth Flotation Chemicals Market Volume Share, By Chemical, 2024- 2034 (%)

| By Chemical Type | Volume Share, 2024 (%) | Market Volume Kilo Tons - 2024 | Market Volume Kilo Tons - 2034 | Volume Share, 2034 (%) | CAGR (2025 - 2034) |

| Collectors | 37.12% | 30.11 | 40.59 | 35.23% | 3.37% |

| Frothers | 14.34% | 11.63 | 15.22 | 13.21% | 3.03% |

| Modifiers | 34.21% | 27.75 | 43.00 | 37.32% | 4.99% |

| Dispersants | 6.12% | 4.96 | 8.31 | 7.21% | 5.89% |

| Others (Flocculants, Defoamers, etc.) | 8.21% | 6.66 | 8.10 | 7.03% | 2.20% |

| Total | 100% | 81.12 | 115.21 | 100% | 3.57% |

Ore Type Insights

How Did Sulfide Ores Segment dominate the U.S. Froth Flotation Chemicals Market In 2024?

The sulfide ores segment dominated the market in 2024. The sulfide ores segment is a major driver in the market, as froth flotation is the most effective method for separating valuable metals like copper, zinc, lead, and nickel from sulfide minerals. The use of specialized reagents such as collectors, frothers, and modifiers enhances the selectivity and efficiency of the flotation process. The continued demand for base and precious metals supports the strong use of flotation chemicals in sulfide ore processing, fueling market growth.

The rare earth & oxide ores segment expects significant growth in the U.S. froth flotation chemicals market during the forecast period. The rare earth and oxide ores segment is gaining traction in the market due to the rising demand for rare earth elements used in high-tech, renewable energy, and defense applications. These ores require customized flotation reagents to effectively separate fine and complex oxide minerals. The need for high-purity separation, especially in rare earth processing, is driving innovation in collector and modifier formulations, supporting increased adoption of froth flotation chemicals in this specialized segment.

Application Insights

Which Application Segment Dominates the U.S. Froth Flotation Chemicals Market In 2024?

The mining (primary) segment dominated the market in 2024. The mining uses froth flotation for specific chemicals to separate valuable minerals from waste rock. They are crucial and widely used for separating various sulfide minerals and non-sulfide minerals, which increases the demand for the market. The base metals (copper, zinc, lead) segment held the largest market share. The growth of the market is driven by the growing benefits offered, like high efficiency, cost-effectiveness, and wide applicability, which increase the growth of the market and support expansion.

The recycling & secondary recovery segment expects significant growth in the market during the forecast period. The growth of the market is driven by the growing application in paper, lithium-ion battery, e-waste, plastic recycling, and wastewater treatment to improve the quality of the treated water which increases the demand for the market. the key benefits offered like resource conservation, environmental protection, economic viability and energy efficiency also fuels the growth and expansion of the market.

End-Use Industry Insights

How Did Mining and Metallurgy Segment Dominate the U.S. Froth Flotation Chemicals Market In 2024?

The mining & metallurgy segment dominated the market in 2024. The mining and metallurgy segment is the primary end user in the market, driven by the need for efficient separation and recovery of valuable minerals from ores. Froth flotation chemicals such as collectors, frothers, and modifiers play a crucial role in enhancing mineral selectivity, grade, and recovery rates. With increasing demand for base metals, precious metals, and industrial minerals, mining and metallurgical operations continue to rely heavily on flotation processes, fueling consistent market demand.

The water & waste management segment expects significant growth in the U.S. froth flotation chemicals market during the forecast period.

The waste and wastewater management segment is an emerging end-use area in the market, driven by growing environmental regulations and the need for sustainable treatment solutions. Froth flotation is increasingly used to remove oils, suspended solids, and contaminants from industrial wastewater. Chemicals such as collectors and frothers aid in separating impurities effectively. As industries seek efficient and eco-friendly methods for water recycling and sludge treatment, this segment is expected to witness steady growth and adoption.

Recent Developments

- In February 2024, Orica's acquisition of Cyanco, the U.S.-based leader in sodium cyanide production for gold mining across the US, Canada, Mexico, Latin America, and Africa, is set to enhance its Mining Chemicals segment. This move will establish a seamless global manufacturing and distribution network.(Source: www.orica.com)

- In February 2024, Syensqo, formerly part of Solvay, introduced its Transfoamer frother line. These frothers feature a groundbreaking technology that adjusts froth strength according to pH levels, enabling more efficient copper recovery, particularly from challenging ores. This innovation is especially important as rising copper demand, driven by electrification and energy transition, makes resource extraction increasingly critical.(Source: im-mining.com)

Top Companies List

- Solvay S.A.

- Clariant AG

- BASF Corporation

- Arkema Group

- Huntsman Corporation

- Kemcore USA

- Dow Inc.

- Orica Limited

- Cytec Industries Inc. (a Solvay brand)

- ArrMaz (a part of Arkema)

- Chevron Phillips Chemical Company

- SNF Floerger

- AkzoNobel Specialty Chemicals

Segments Covered

By Chemical Type

- Collectors

- Xanthates

- Dithiophosphates

- Dithiocarbamates

- Sulfhydryl Compounds

- Frothers

- Alcohol-based

- Glycols (e.g., MIBC – Methyl Isobutyl Carbinol)

- Modifiers

- Activators (e.g., copper sulfate)

- Depressants (e.g., sodium cyanide, organic agents)

- pH Regulators (e.g., lime, sulfuric acid)

- Dispersants

- Others (Flocculants, Defoamers, etc.)

By Ore Type

- Sulfide Ores

- Non-Sulfide Ores

- Rare Earth and Oxide Ores

- Industrial Minerals (e.g., phosphate, potash, fluorite)

By Application

- Mining (Primary)

- Base Metals (Copper, Zinc, Lead)

- Precious Metals (Gold, Silver, PGMs)

- Rare Earth Elements

- Wastewater Treatment

- Recycling & Secondary Metal Recovery

By End-Use Industry

- Mining & Metallurgy

- Chemical Processing

- Water & Waste Management

- Others (Battery Materials, Ceramics, etc.)

By Region

- North America

- U.S.

- Canada

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Sweden

- Denmark

- Norway

- Asia Pacific

- China

- Japan

- India

- South Korea

- Thailand

- Latin America

- Brazil

- Mexico

- Argentina

- Middle East and Africa (MEA)

- South Africa

- UAE

- Saudi Arabia

- Kuwait