Content

Biorefinery Market Size and Growth 2025 to 2034

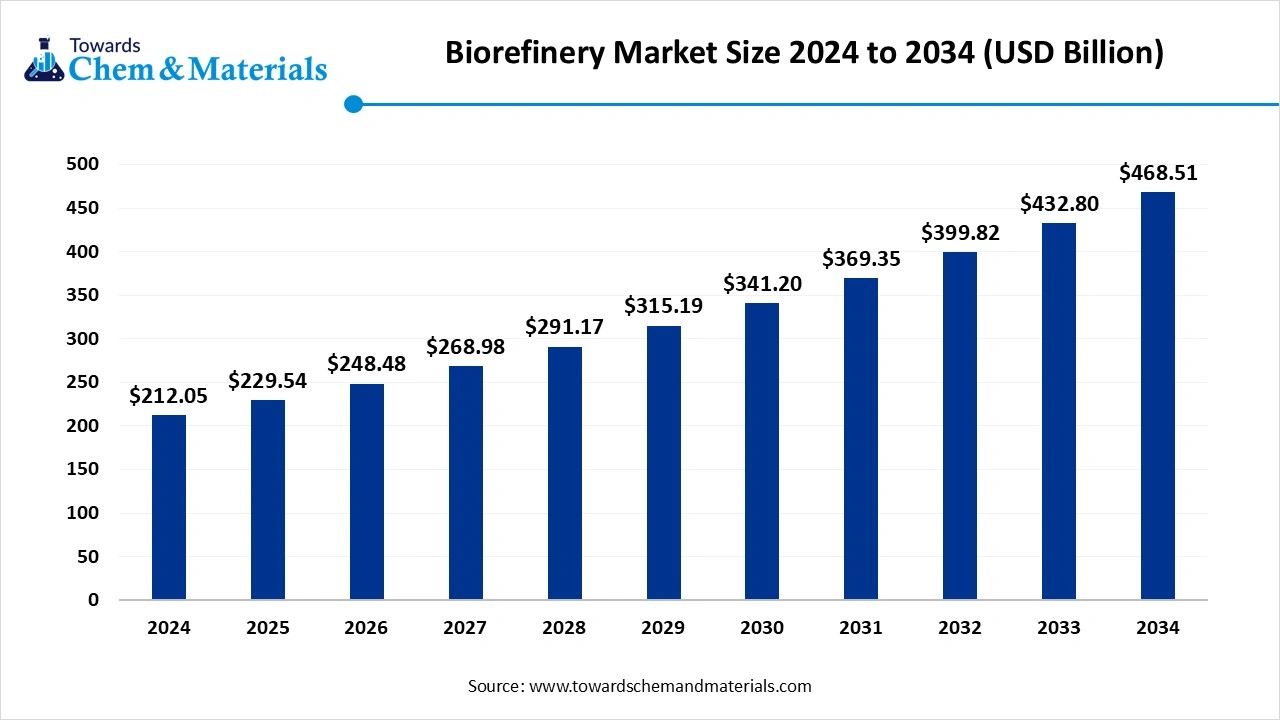

The biorefinery market was exhibited at USD 212.05 billion in 2024 and is projected to hit around USD 468.51 billion by 2034, growing at a CAGR of 8.25% during the forecast period 2025 to 2034. Growing environmental awareness is the key factor driving market growth. Also, supportive government policies coupled with the increasing demand for renewable energy can fuel market growth further.

Key Takeaways

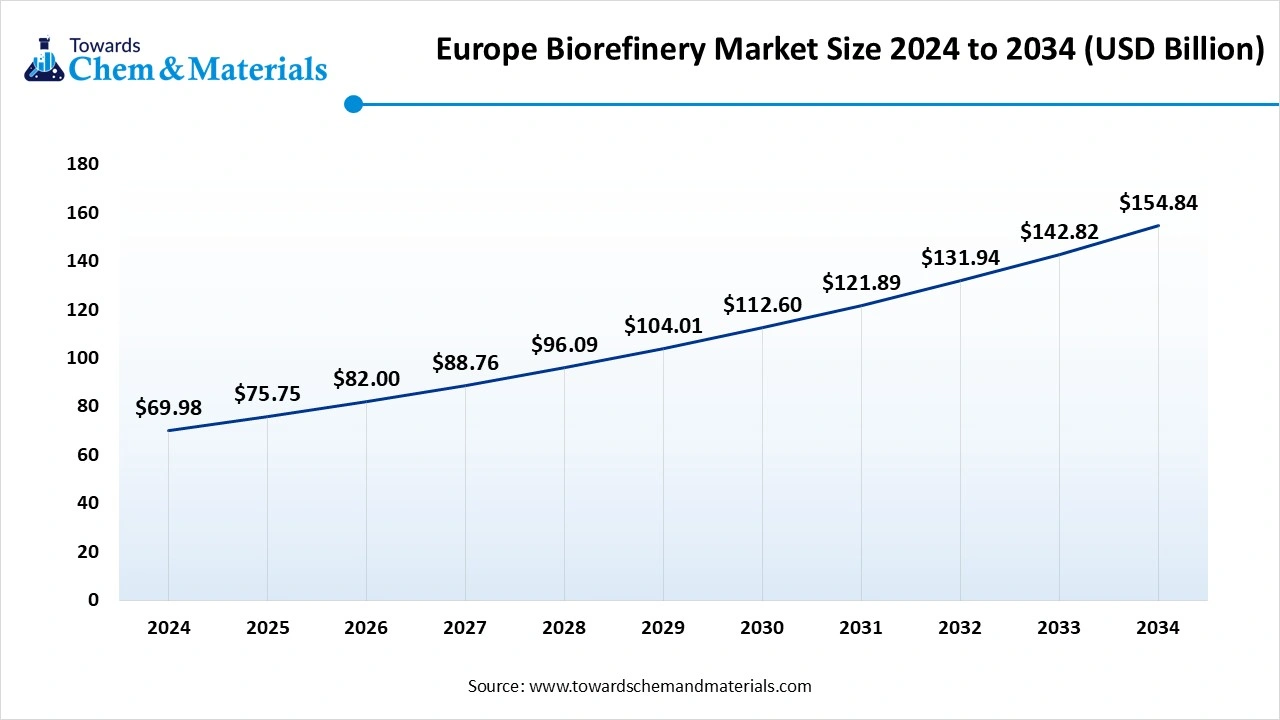

- The Europe biorefinery market size was estimated at USD 69.98 billion in 2024 and is expected to reach USD 154.84 billion by 2034, growing at a CAGR of 5.29%

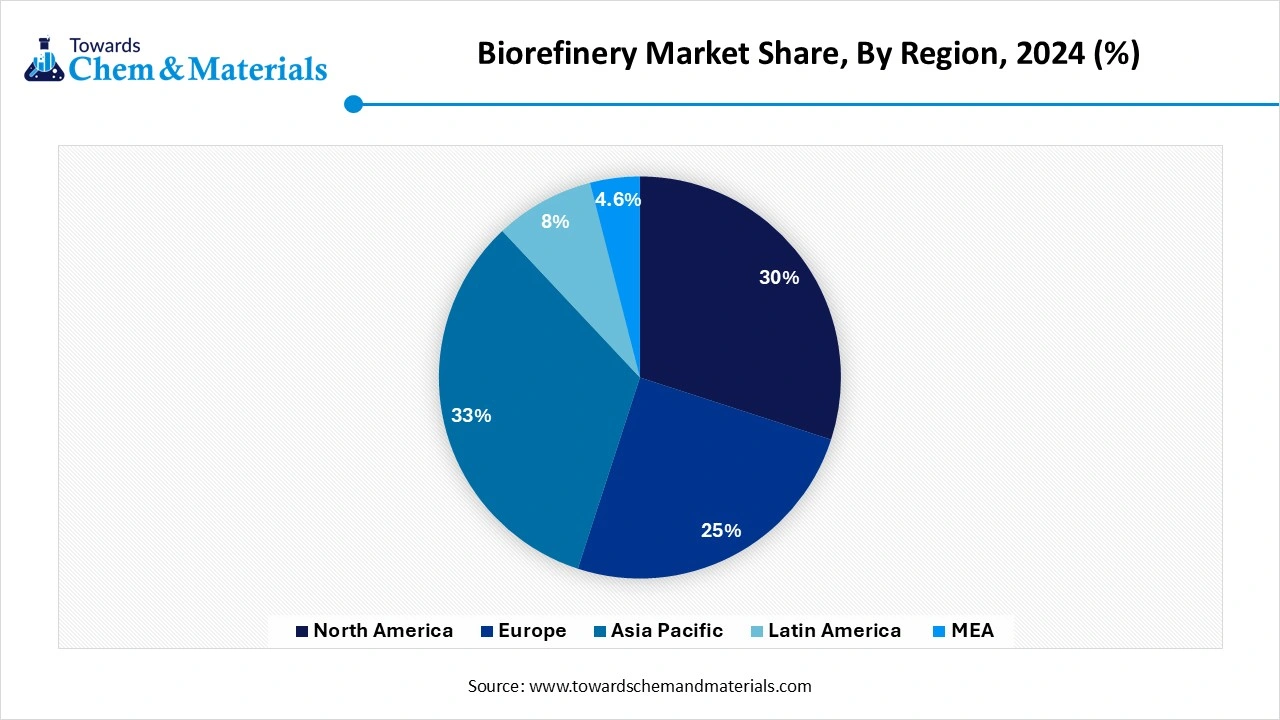

from 2025 to 2034. - By region, the Asia Pacific is expected to grow at the fastest CAGR over the forecast period. The growth of the region can be credited to the rapid urbanization, rising population, and industrialization in the emerging economies.

- By feedstock type, the lignocellulosic biomass segment held a 38%market share in 2024. The dominance of the segment can be attributed to the innovations in pretreatment technologies.

- By feedstock type, the aquatic biomass segment is expected to grow at the fastest CAGR over the forecast period. The growth of the segment can be credited to the innovations in photobioreactor technology.

- By technology, the biochemical conversion segment dominated the market with 44% market share in 2024. The dominance of the segment can be linked to the innovations in fermentation technology.

- By technology, the thermochemical segment is expected to grow at the fastest CAGR over the forecast period. The growth of the segment can be driven by the growing need for renewable energy sources.

- By product type, the bioethanol segment led the market by holding 32% market share in 2024. The dominance of the segment is owed to the rising government concerns, along with the innovations in bioethanol production technologies.

- By product type, the sustainable aviation fuel (SAF) segment is expected to grow at the fastest CAGR during the projected period. The growth of the segment can be driven by increasing environmental awareness.

- By end use industry, the transportation segment dominated the market with 46% market share in 2024. The dominance of the segment can be attributed to the rising awareness of climate change and innovations in biorefinery technologies.

- By end-use industry, the packaging segment is expected to grow at the fastest CAGR over the study period. The growth of the segment is due to advancements in biorefining technologies.

- By refinery type, the second-generation biorefineries segment held a 46% market share in 2024. The dominance of the segment can be linked to its ability to produce valuable biochemicals, along with the rising environmental concerns.

- By refinery type, the third-generation biorefineries segment is expected to grow at the fastest CAGR over the projected period. The growth of the segment can be credited to the growing global demand for renewable energy sources.

Advancements in Biorefining Technologies are Expanding Market Growth

A biorefinery is a type of unit that integrate biomass conversion processes and equipment to produce fuels, heat, power, chemicals, and materials from biomass. Like petroleum refineries, biorefineries convert biomass into a spectrum of marketable products and energy. The biorefinery market includes the technologies, processes, and value chains that enable this transformation from raw biomass into value-added products. Technological innovations in areas such as microbial optimization and enzyme engineering are improving the cost-effectiveness and efficiency of biorefining processes.

What Are the Key Trends Influencing the Biorefinery Market?

- Growing environmental awareness has boosted efforts to curb water, air, and soil pollution, which is the latest trend in the market nowadays. Many countries have grown awareness of their carbon footprints and have announced targets to minimize their carbon emissions soon. This factor boosted the investments in biorefineries.

- Advances in microbial optimization, enzyme engineering, and other advanced technologies are improving the cost-effectiveness and efficiency of biorefinery processes, impacting positive market growth soon. Also, Biorefineries are outgrowing their product portfolio to include biochemicals, biofuels, and bioplastics, tailored to different industries.

- Easy availability of biomass is the key market trend shaping a good market trajectory. Biomass, like animals, organic materials from plants and microorganisms, is accessible and abundant in nature. Biorefineries use this resource to produce biochemicals, biofuels, and biomaterials. This minimizes dependence on fossil fuels by supporting sustainable energy production.

Report Scope

| Report Attribute | Details |

| Market Size in 2025 | USD 229.54 Billion |

| Expected Size by 2034 | USD 468.51 Billion |

| Growth Rate from 2025 to 2034 | CAGR 8.25% |

| Base Year of Estimation | 2024 |

| Forecast Period | 2025 - 2034 |

| Dominant Region | Europe |

| Segment Covered | By Feedstock Type, By Technology Pathway, By Product Type, By End-use Industry, By Refinery Type, By Region |

| Key Companies Profiled | Neste Corporation, Abengoa Bioenergy, Clariant AG, POET LLC, TotalEnergies SE, ADM (Archer Daniels Midland Company), UPM-Kymmene Corporation, Renewable Energy Group (Chevron), Gevo Inc., BASF SE, Borregaard ASA, Beta Renewables (Biochemtex), Enerkem Inc., Valero Energy Corporation, Algenol Biotech LLC, Dong Energy (Ørsted), GranBio, St1 Nordic Oy, LanzaTech, Cargill Incorporated |

Market Opportunity

Investment in Green Energy

Private companies, governments, and research institutions are heavily investing in sustainable products and green energy technologies, creating lucrative opportunities in the market. Biorefineries align with these investments by reducing waste, supporting circular economies, and promoting the shift to cleaner energy sources. Furthermore, biorefineries provide a way to use renewable biomass to create chemicals, biofuels, and other products, tackling climate change problems.

- In December 2024, Samsung will get a contract for a biorefinery that will have the ability to generate hydrogenated vegetable oil and sustainable aviation fuel, tailored to the increasing demands of the global transportation and aviation sectors.(Source: biofuels-news.com)

Market Challenges

High Initial Capital Investment

Establishing a biorefinery needs a substantial initial investment in equipment, infrastructure, and technology, which is the major factor hampering market growth in the long run. Moreover, producing high-quality and consistent products from biomass can be challenging, necessitating strong quality and process assurance measures, hindering market expansion further.

Regional Insights

The Europe biorefinery market size was estimated at USD 69.98 billion in 2024 and is anticipated to reach USD 154.84 billion by 2034, growing at a CAGR of 5.29% from 2025 to 2034. Europe dominated the biorefinery market with a 33% share in 2024.

The dominance of the region can be attributed to the increasing demand for sustainable energy, rising environmental awareness, and supportive government initiatives. Additionally, the European Union has recently implemented policies such as the European Green Deal, which focuses on circular economies, waste reduction, and sustainable practices, boosting the growth of the market in the region.

Biorefinery Market in Germany

In Europe, Germany led the market owing to the increasing consumer awareness regarding carbon footprints and the desire for sustainable alternatives across many sectors such as pharmaceuticals, packaging, and transportation. Also, Germany has a robust agricultural sector that offers a readily available supply of biomass residues, which can be utilised as feedstock for biorefineries.

Asia Pacific is expected to grow at the fastest CAGR over the forecast period. The growth of the region can be credited to the rapid urbanization, rising population, and industrialization in emerging economies such as China and India. Furthermore, biofuel production is rising in China, India, and Thailand due to several major factors. These nations also possess large arable land and favourable climates for cultivating feedstock crops such as corn, sugarcane, and palm oil, which are crucial for biofuel production.

Biorefinery Market in China

In the Asia Pacific, China dominated the market by holding the largest market share, due to ongoing technological advancements, increasing awareness of environmental sustainability, and the country's commitment to carbon neutrality. China also has a huge agricultural sector and generates substantial amounts of agricultural residues, offering handy feedstock for biorefineries.

What are the Sales of Top 5 Chemical Firms for 2023?

| Company | Chemical Sales |

| BASF | $74.5 billion |

| Sinopec | $58.1 billion |

| Dow | $44.6 billion |

| LG Chem | $42.3 billion |

| PetroChina | $40.9 billion |

Segmental Insight

Feedstock Type Insight

Which Feedstock Type Segment Dominated the Biorefinery Market in 2024?

The lignocellulosic biomass segment held a 38%market share in 2024. The dominance of the segment can be attributed to the innovations in pretreatment technologies for smooth biomass conversion, along with the supportive government regulations. In addition, the segment uses materials such as forestry waste and agricultural residues to produce biochemicals, biofuels, and biomaterials.

The aquatic biomass segment is expected to grow at the fastest CAGR over the forecast period. The growth of the segment can be credited to the innovations in photobioreactor technology and increasing utilisation of algae-based biofuels. Research and development efforts focused on promoting growing, harvesting, and extraction processes are important for minimizing the overall cost of algae-based products.

Technology Insight

Why Biochemical Conversion Segment Dominated the Biorefinery Market in 2024?

The biochemical conversion segment dominated the market with a 44% market share in 2024. The dominance of the segment can be linked to the innovations in fermentation technology, coupled with the increasing emphasis on sustainable practices. Moreover, the fermentation segment held the largest market share in 2024. The research is continuously enhancing the robustness and efficiency of microorganisms used in fermentation, which leads to better product quality and higher yields.

The thermochemical segment is expected to grow at the fastest CAGR over the forecast period. The growth of the segment can be driven by the growing need for renewable energy sources and its potential to convert different biomass types into valuable bioproducts. In the thermochemical segment, the hydrothermal liquefaction segment is anticipated to grow at the fastest CAGR due to rising government support for R&D in renewable energy technologies, such as HTL and biorefining, which are supporting market expansion soon.

Product Type Insight

How Did the Bioethanol Segment Held the Largest Biorefinery Market Share in 2024?

The bioethanol segment led the market by holding 32% market share in 2024. The dominance of the segment is owed to the rising government concerns, along with the innovations in bioethanol production technologies. The biofuels segment held the largest market share in 2024, due to the ongoing push for cleaner fuels and the need to minimize carbon emissions. Biofuels provide a way to decrease greenhouse gas emissions in the transportation industry, especially when mixed with gasoline.

The sustainable aviation fuel (SAF) segment is expected to grow at the fastest CAGR during the projected period. The growth of the segment can be driven by increasing environmental awareness and substantial investment, and collaboration between major players. Furthermore, airlines are setting ambitious goals, such as net-zero emissions targets, making SAF a crucial tool to achieve these goals.

End-Use Industry Insight

Why Did the Transportation Segment Dominated the Biorefinery Market in 2024?

The transportation segment dominated the market with a 46% market share in 2024. The dominance of the segment can be attributed to the rising awareness of climate change, innovations in biorefinery technologies, and the stringent environmental regulations. Also, consumers are increasingly opting for sustainable products such as eco-friendly transportation options, further boosting the demand for this segment in the market.

The packaging segment is expected to grow at the fastest CAGR over the study period. The growth of the segment is due to advancements in biorefining technologies, which have made it more cost-effective and efficient to produce bio-based plastics and other materials for packaging use. The integration of biorefineries with other sectors like the paper and pulp industry is also impacting overall segment growth positively in the near future.

Refinery Type Insight

Which Refinery Type Segment Dominated the Biorefinery Market in 2024?

The second-generation biorefineries segment held a 46% market share in 2024. The dominance of the segment can be linked to its ability to produce valuable biochemicals, along with the rising environmental concerns. Second-generation biorefineries use lignocellulosic biomass as a feedstock, which is more convenient and sustainable than food-based feedstocks used in first-generation biorefineries.

The third-generation biorefineries segment is expected to grow at the fastest CAGR over the projected period. The growth of the segment can be credited to the growing global demand for renewable energy sources, coupled with the advancements in technology. Moreover, third-generation biorefineries use microalgae, which can grow in different environments and fix CO2, making them a reliable feedstock for biofuel production.

Recent Developments

- In October 2024, Barracuda Technologies Pvt. Ltd. introduced its Maiden modular bio-refinery project in India, marking a substantial milestone in circular and sustainable materials manufacturing. This bio-refinery uses proprietary biomass fractionation techniques to transform agricultural waste into valuable materials.(Source: www.businesswire.com)

- In September 2024, Lygos announced an MOU agreement with biotechnology and fermentation leader CJ BIO to manufacture and deliver commercial volumes of sustainable and high-performing products in the market.(Sources : www.indianchemicalnews.com)

Top Companies List

- Neste Corporation

- Abengoa Bioenergy

- Clariant AG

- POET LLC

- TotalEnergies SE

- ADM (Archer Daniels Midland Company)

- UPM-Kymmene Corporation

- Renewable Energy Group (Chevron)

- Gevo Inc.

- BASF SE

- Borregaard ASA

- Beta Renewables (Biochemtex)

- Enerkem Inc.

- Valero Energy Corporation

- Algenol Biotech LLC

- Dong Energy (Ørsted)

- GranBio

- St1 Nordic Oy

- LanzaTech

- Cargill Incorporated

Segments Covered

By Feedstock Type

- Lignocellulosic Biomass

- Wood

- Straw

- Corn stover

- Bagasse

- Sugar & Starch Crops

- Sugarcane

- Corn

- Wheat

- Oil Crops

- Soybean

- Rapeseed

- Palm

- Algae

- Organic Waste

- MSW

- Industrial Waste

- Food Waste

- Aquatic Biomass

- Seaweed

- Microalgae

By Technology Pathway

- Thermochemical Conversion

- Pyrolysis

- Gasification

- Hydrothermal Liquefaction

- Biochemical Conversion

- Fermentation

- Anaerobic Digestion

- Enzymatic Hydrolysis

- Mechanical/Physical Extraction

- Pressing

- Drying

- Milling

By Product Type

- Biofuels

- Bioethanol

- Biodiesel

- Biogas

- Sustainable Aviation Fuel (SAF)

- Bio-oil

- Biochemicals

- Platform Chemicals

- Succinic Acid

- Lactic Acid

- Others (Furfural, etc.)

- Specialty Chemicals

- Surfactants

- Solvents

- Biopolymers

- Biomaterials

- Bioplastics

- Bio-composites

- Natural Fibers

- Power & Heat

- Bioelectricity

- District Heating

By End-use Industry

- Transportation (Road, Aviation, Marine)

- Chemical Industry

- Power Generation

- Agriculture

- Packaging

- Textiles

- Pharmaceuticals & Personal Care

- Construction & Building Materials

By Refinery Type

- First-Generation Biorefineries (food-based)

- Second-Generation Biorefineries (non-food biomass)

- Third-Generation Biorefineries (algae and aquatic sources)

- Integrated Biorefineries (multi-feedstock, multi-product)

By Region

- North America

- U.S.

- Canada

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Sweden

- Denmark

- Norway

- Asia Pacific

- China

- Japan

- India

- South Korea

- Thailand

- Latin America

- Brazil

- Mexico

- Argentina

- Middle East and Africa (MEA)

- South Africa

- UAE

- Saudi Arabia

- Kuwait