Content

What is the Current GNSS in Agricultural Market Size and Share?

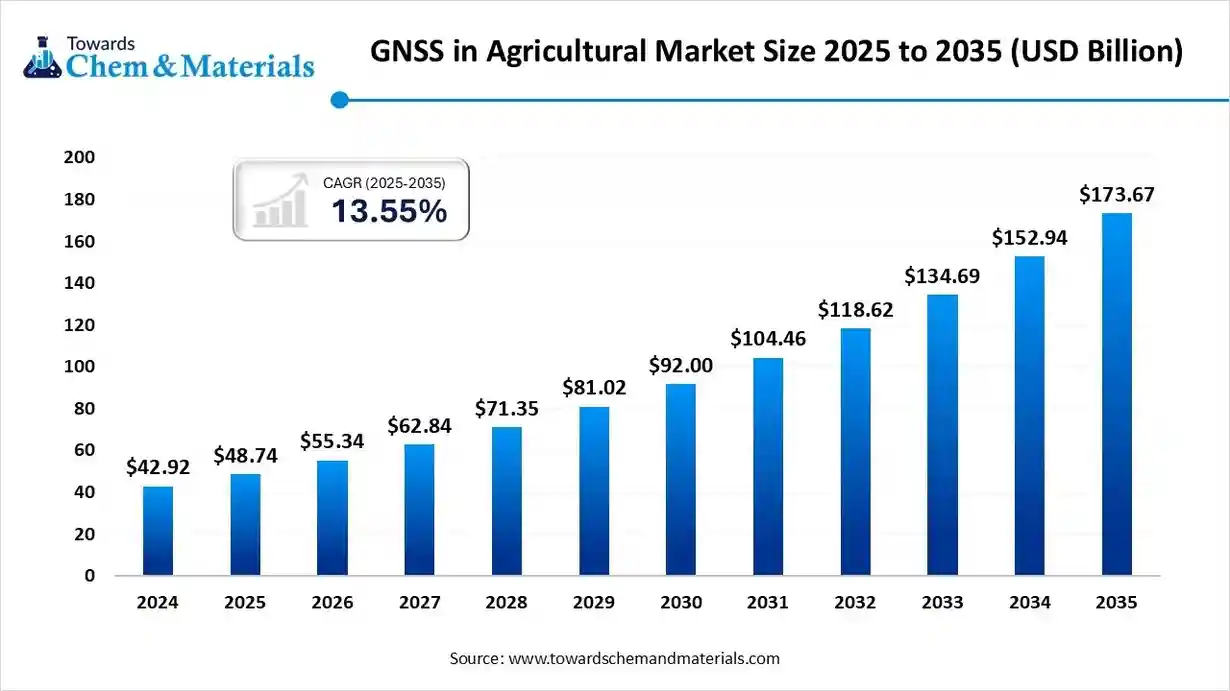

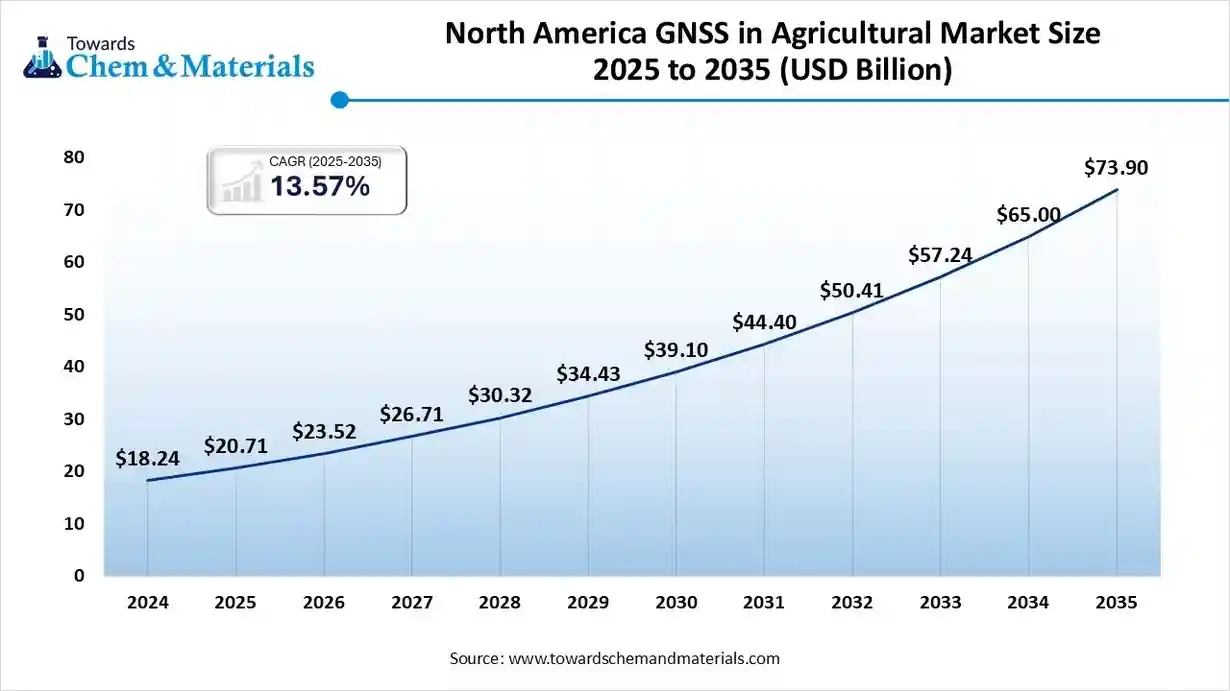

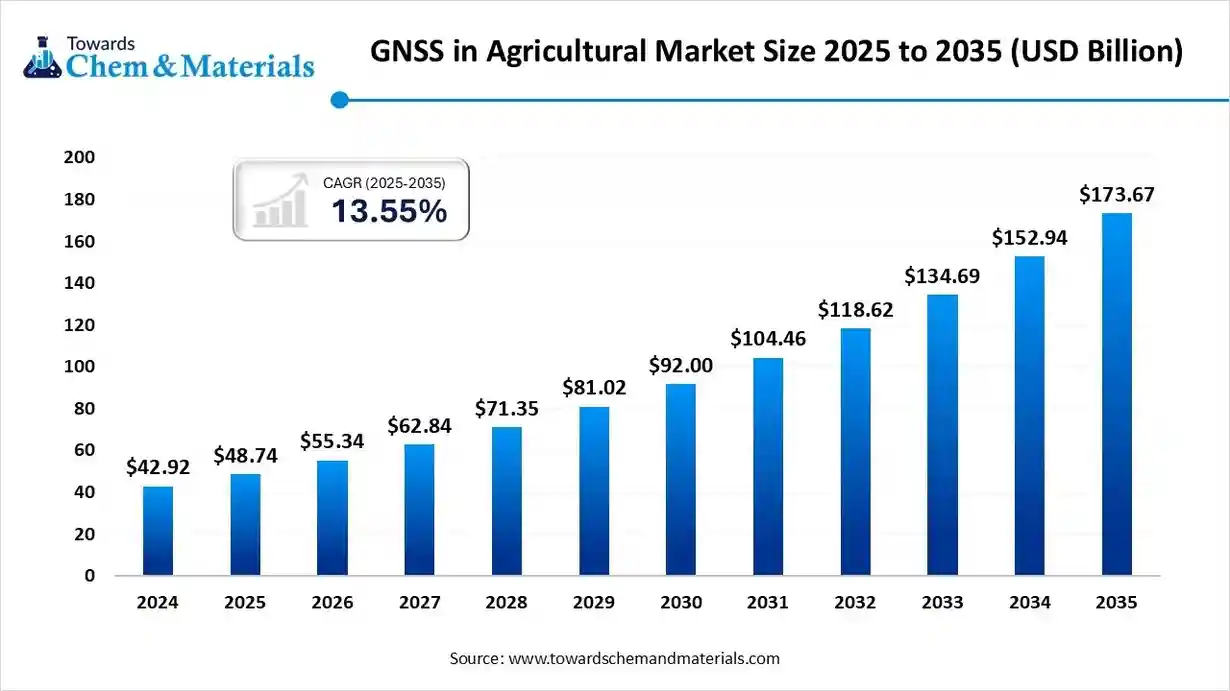

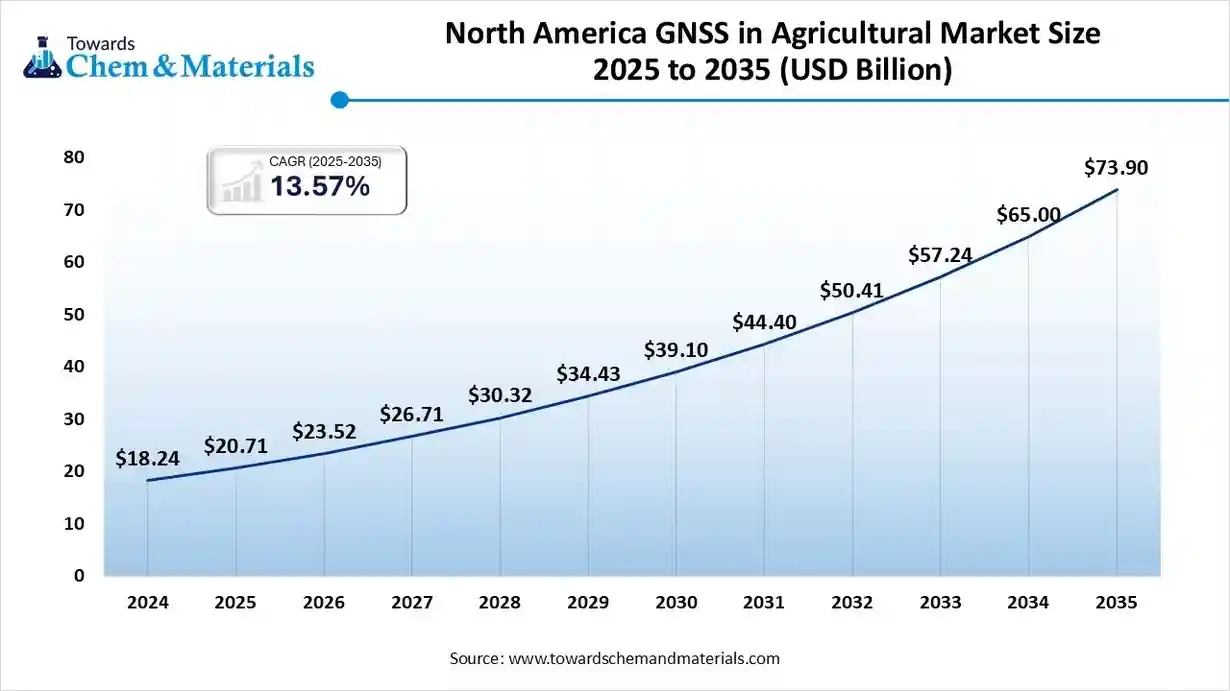

The global GNSS in Agricultural market size is calculated at USD 48.74 billion in 2025 and is predicted to increase from USD 55.34 billion in 2026 and is projected to reach around USD 173.67 billion by 2035, The market is expanding at a CAGR of 13.55% between 2025 and 2035. North America dominated the GNSS in agricultural market with a market share of 42.50% the global market in 2024.The growing adoption of precision agriculture and focus on enhancing operational efficiency drive the market growth.

Key Takeaways

- By region, North America held a 42.5% share of the GNSS in agricultural market in 2024.

- By region, Asia Pacific is growing at a 11.5% CAGR in the market during the forecast period.

- By component, the receivers segment held a 43.4% share in the GNSS in agricultural industry in 2024.

- By component, the correction services segment is expected to grow at a 10.0% CAGR in the market during the forecast period.

- By positioning/accuracy technique, the DGPS/SBAS segment held a 41.1% share in the market in 2024.

- By positioning/accuracy technique, the RTK segment is expected to grow at a 9.8% CAGR in the market during the forecast period.

- By application, the auto-guidance & steering segment held a 36.5% share in the GNSS in agricultural market in 2024.

- By application, the drone/ UAV navigation and variable-rate application segment is expected to grow at a 10.1% CAGR in the market during the forecast period.

- By deployment/offering type, the hardware segment held a 57.5% share in the market in 2024.

- By deployment/offering type, the services & integrated solutions segment is expected to grow at a 10.6% CAGR in the market during the forecast period.

- By satellite system, the multi-GNSS segment held a 53.4% share in the GNSS in agricultural market in 2024.

Accelerating Ahead: The Catalyst Behind the Growth of GNSS in Agriculture

The GNSS in agricultural sector growth is driven by the growing need for enhancing crop yields, the trend of sustainable farming, the rise in adoption of smart agricultural practices, the increasing use of automated machinery, and a strong focus on resource optimization.

What is GNSS in Agriculture?

GNSS (global navigation satellite system) in agriculture is the use of satellite constellations with antennas, software, receivers, analytics, & correction services for various farm operations. GNSS helps identify problem areas in agriculture, accurately map fields, and create boundaries. GNSS is used for tasks such as farm monitoring, planting, and spraying.

GNSS in Agricultural Market Outlook:

- Industry Growth Overview: Between 2025 and 2034, the industry is expected to see accelerated growth in high-margin niches such as precision farming, development of autonomous agricultural robots, and sustainable farming. Growth is being reinforced by a focus on resource optimization and crop yield enhancement, particularly in Asia-Pacific, Europe, and North America.

- Global Expansion: Key players and primary companies are expanding geographically to align with technological innovations and precision farming, particularly in the Asia Pacific, North America, and Europe. Companies like Trimble Inc., Topcon Corporation, Deere & Company, and Hexagon AB are expanding globally.

- Major Investors: Capital firms and large agricultural machinery corporations are actively entering the space, drawn by high technological innovations and research & development. For instance, CNH Industrial acquired Hemisphere GNSS to develop automated farming technology and bolster GNSS technology.

Report Scope

| Report Attributes | Details |

| Market Size in 2026 | USD 55.34 Billion |

| Expected Size by 2035 | USD 173.67 Billion |

| Growth Rate from 2025 to 2035 | CAGR 13.55% |

| Base Year of Estimation | 2024 |

| Forecast Period | 2026 - 2035 |

| Leading Region | North America |

| Fastest Growing Region | Asia Pacific |

| Segment Covered | By Component, By Positioning/Accuracy Technique, By Application, By Deployment/ Offering Type, By Satellite System, By Region |

| Key Companies Profiled | Deere & Company, Trimble Inc., Topcon Positioning Systems, Hexagon/NovAtel, AGCO Corporation, CNH Industrial, Raven Industries, Ag Leader Technology, Hemisphere GNSS, Septentrio, u-blox, Leica Geosystems , TeeJet Technologies, Farmers Edge, DJI |

Key Technological Shifts in GNSS in Agricultural Market:

The GNSS in the agricultural industry is undergoing key technological transformations driven by demand for sustainability, higher crop yields, and optimized resource management. One of the most significant shifts is the integration of artificial intelligence, which enables predictive analytics and early disease detection. AI helps automate tasks and enables real-time obstacle detection. Artificial Intelligence provides recommendations for applications of pesticides, water, and fertilizers. AI applies the appropriate inputs and monitors crop health

- For instance, Trimble Agriculture integrated with AI-enabled data analytics platforms to perform agricultural tasks such as variable-rate application, field mapping, and soil sampling.

Trade Analysis of GNSS in Agricultural Sector: Import & Export Statistics

- The United States imported $4.16B of harvesting machinery in 2023.(Source: oec.world)

- Germany imported $2.56B of harvesting machinery in 2023.(Source: oec.world)

- China exported $3.35B of navigation equipment in 2023.(Source: oec.world)

- The United States $3.12B of navigation equipment in 2023.(Source: oec.world)

- Vietnam exported 5210 shipments of GNSS.(Source: www.volza.com)

- China exported 54268 shipments of receiver.(Source: www.volza.com)

- China exported 199241 shipments of antennas.(Source: www.volza.com)

GNSS in Agricultural Market Value Chain Analysis

- Feedstock Procurement : Feedstock procurement involves sourcing data inputs, software, hardware components, field maps, and satellite signals.

- Key Players: Trimble, CHC Navigation, NovAtel, Topcon, Harxon

- Quality Testing and Certification :The quality testing involves checking properties like precision, carrier-to-noise ratio, signal availability, positional accuracy, & cycle slip occurrence rates, and certifications like FCC, JRC, & FCC.

- Key Players: Bureau Veritas, TUV SUD, SGS SA, Intertek Group plc

- Regulatory Compliance and Safety Monitoring :Regulatory compliance involves environmental protection, agricultural laws, equipment standards, & data privacy and safety monitoring involves signal monitoring, IMUs, boundary control, & system redundancy.

- Key Players: USDA, EUSPA, FAO, ISRO

Overview of GNSS Systems Used for Modern Farming Practices

| System | Launched Year | Country | Applications | Operational Satellites |

| GPS | GPS | United States |

|

31 |

| BeiDou | 2020 | China |

|

45 |

| GLONASS | 1982 | Russia |

|

24 |

| Galileo | 2016 | European Union |

|

27 |

Segmental Insights

Component Insights

Why the Receivers Segment Dominates the GNSS in Agricultural Sector?

The receivers segment dominated the GNSS in agricultural sector with a 43.4% share in 2024. The growing number of agricultural tasks, such as spraying, planting, and fertilizing, require receivers to follow predefined routes. The focus on reducing fuel, seed, & fertilizer consumption and maintaining operational stability requires receivers. The availability of diverse types, such as integrated, handheld, & fixed, and the increasing adoption of precision farming are driving overall market growth.

The correction services segment is expected to grow at a 10.0% CAGR in the market during the forecast period. The focus on minimizing fuel consumption and optimizing the use of resources like pesticides, seeds, & fertilizers requires correction services. The growing need for improving input management and the rise in agricultural automation require correction services. The adoption of modern farming techniques and the production of higher crop yields require correction services, supporting the overall market growth.

The antennas segment is growing significantly in the market. The growing agricultural tasks, like harvesting, planting, spraying, and precision agriculture, require antennas. The development of autonomous drones, tractors, and harvesters requires antennas. The strong focus on yield monitoring, field mapping, and soil sampling is driving overall market growth by requiring antennas.

Positioning Insights

How did DGPS and SBAS Segment Hold the Largest Share in the GNSS in Agricultural Market?

- The DGPS and SBAS segment held the largest revenue share of 41.1% share in the GNSS in agricultural market in 2024. The growing precision agriculture operations, like variable rate application, yield monitoring, and soil sampling, increase demand for DGPS & SBAS. The need for cost-effectiveness and real-time corrections requires DGPS & SBAS. The focus on preventing overlaps and dependable operations in agriculture requires DGPS & SBAS, driving the overall market growth.

- The RTK segment is expected to grow at a 9.8% CAGR in the market during the forecast period. The growing tasks like tilling, planting, & spraying, and focus on autonomous operations require RTK. The strong focus on avoiding over-fertilization and improving crop health requires RTK. The increasing use of semi-autonomous & autonomous agricultural equipment, along with sustainable farming practices, requires RTK, supporting overall market growth.

- The PPP segment is growing rapidly in the market. The infrastructure-poor farmlands and increasing need for high-precision guidance technology require PPP. The stricter regulations for tasks such as variable-rate applications, automated steering, & precise planting require PPP. The increasing use of autonomous machinery and the monitoring of crop yields require PPP, supporting overall market growth.

Application Insights

Which Application Segment Dominated the GNSS in Agricultural Industry?

- The auto-guidance & steering segment dominated the GNSS in agricultural industry with a 36.5% share in 2024. The growing operations like spraying, seeding, & fertilizing, and focus on lowering mental & physical strain on the operator, require auto-guidance & steering. The growing demand to enhance farm productivity and optimize resource management requires automated guidance and steering. The increasing need to prevent soil compaction and ensure availability across various operations, field shapes, & sizes drives overall market growth.

- The drone/UAV navigation and variable-rate application segment is growing at a 10.1% CAGR in the market during the forecast period. The growing use of inputs such as pesticides, water, & fertilizers, and the focus on reducing human error, require drone or UAV navigation. The strong focus on improving resource management and data-driven decision-making requires drone/UAV navigation. The strong focus on addressing nutrient levels, soil composition, and the agricultural field's topography supports overall market growth.

- The field mapping and surveying segment is growing significantly in the market. The strong focus on topographical variations, field boundaries, and internal zones requires field mapping and surveying. The increasing need to optimize resources like fertilizers, water, seeds, & pesticides, and the rise in tasks such as mechanical weeding & precision planting, require field mapping and surveying that support overall market growth.

Deployment/Offering Type Insights

How did the Hardware Segment Hold the Largest Share in the GNSS in Agricultural Sector?

- The hardware segment accounted for the largest revenue share of 57.5% in the GNSS in agricultural sector in 2024. The growing integration of hardware components into autonomous robots, tractors, and harvest sprayers helps market growth. The strong focus on real-time monitoring of agricultural activities requires hardware like cameras, yield monitors, & soil sensors. The growing operations, such as harvesting, planting, and tilling, and a focus on reducing manual labor requirements are driving overall market growth.

- The services & integrated solutions segment is growing at a 10.6% CAGR in the market during the forecast period. The growing VRA of pesticides, seeds, and fertilizers, and the need for enhancing accuracy, require services & integrated solutions. The strong focus on lowering the wastage of expensive inputs and increasing the use of autonomous machinery requires services & integrated solutions. User-friendly services and government support for digital infrastructure are driving market growth.

- The software segment is growing rapidly in the market. The need to optimize diverse resource use and enhance crop yields requires software. The growing use of automated machinery and the integration of GNSS with technologies such as IoT, drones, GIS, & sensors requires software. The digital agriculture trend and a strong focus on food security are driving software demand, supporting overall market growth.

Satellite System Insights

Why the Multi-GNSS Segment Dominates the GNSS in Agricultural Market?

- The multi-GNSS segment dominated the GNSS in agricultural market with a 53.4% share in 2024. The growing operations, such as automated steering & precision planting, and the focus on ensuring stable coverage, require multi-GNSS. The increased utilization of multiple independent systems and the focus on faster signal acquisition require multi-GNSS. The adoption of modern farming practices and the increasing use of autonomous farming technologies drive the overall market growth.

- The GPS-only segment is growing rapidly, with a 10.3% CAGR. The strong focus on reducing errors in agricultural applications such as harvesting, planting, and fertilizing requires a GPS-only solution. The lower cost and ease of use of GPS help drive market growth. The integration with various machinery and a strong focus on reducing operational delays require GPS-only, which supports overall market growth.

Regional Insights

The North America GNSS in agricultural market size was valued at USD 20.71 billion in 2025 and is expected to reach USD 73.90 billion by 2035, growing at a CAGR of 13.57% from 2025 to 2035.North America dominated the GNSS in agricultural market with a 42.5% share in 2024.

The presence of advanced agricultural infrastructures and the increasing adoption of precision farming require GNSS. The high investment in R&D and strong government support for digital farms help the market growth. The strong focus on reducing input use, such as herbicides & fertilizers, requires GNSS. The presence of modern agricultural technologies and well-established service provider and dealer networks drives overall market growth.

Advanced Agriculture: How GNSS Revolutionizes Farming in the United States

The United States is a major contributor to the GNSS in agricultural market. Large-scale farming activities and the growing manufacturing of agricultural equipment require GNSS. The focus on maximizing crop productivity and strong government support for precision & modern agriculture requires GNSS. Ongoing innovations, such as cloud-based correction services and large-scale farms, support overall market growth.

- The United States exported $5.01B of harvesting machinery in 2023.(Source: oec.world)

Asia Pacific GNSS in Agricultural Market Trends

Asia Pacific is experiencing the fastest growth with a 11.5% CAGR in the market during the forecast period. The strong focus on food security in countries like China & India and the rise in precision agriculture require GNSS. The shortage of agricultural workers and strong government support for smart farming require GNSS. The growing food demand and innovations in precision agriculture require GNSS. The presence of systems such as the Chinese BeiDou and Indian NAVIC systems drives overall market growth.

Satellite Agriculture: China’s High-Tech Agriculture Feeding Future

China is a key contributor to the GNSS in agricultural market. The growing modernization of agricultural practices and government investment in agricultural technology require GNSS. Applications such as smart irrigation, precision sowing, and automated guidance increasingly require GNSS. The agricultural labor shortage and the focus on ensuring food security require GNSS, thereby supporting overall market growth.

- China exported $3.19B of harvesting machinery in 2023.(Source: oec.world)

Europe GNSS in Agricultural Market Trends

Europe is growing at a notable rate in the GNSS in agricultural market. The adoption of the lean & green model and the focus on optimizing resources like pesticides, water, & fertilizers require GNSS. The presence of smart farming and precision farming technologies requires GNSS. The strong focus on addressing agricultural challenges and developing high-accuracy systems requires GNSS, thereby supporting overall market growth.

Germany’s Excellence in GNSS-Based Precision and Smart Agriculture

Germany is significantly growing in the market. The high adoption rate of precision agriculture and focus on addressing agricultural challenges require GNSS. The need to optimize resource use and increase agricultural mechanization requires GNSS. The strong focus on data-driven decision-making and the adoption of sustainable agriculture practices drive the market growth.

- Germany exported $5.74B of harvesting machinery in 2023.(Source: oec.world)

South America GNSS in Agricultural Market Trends

South America is growing significantly in the market. The ongoing modernization of the agricultural base and the strong focus on managing various resources require GNSS. The need for climate variability and for data-driven decision-making requires GNSS. The presence of large-scale plantations and the rise in adoption of precision agricultural practices require GNSS, driving the overall market growth.

Brazil GNSS in Agricultural Market Trends

Brazil is growing at a significant rate in the market. The presence of a vast agricultural sector and significant production of corn & soybeans requires GNSS. The adoption of precision agriculture practices and the increasing demand for food require GNSS. Strong government support for agricultural modernization and increased investment in GNSS-based solutions drive overall market growth.

Middle East & Africa GNSS in Agricultural Market Trends

The Middle East & Africa are growing in the GNSS in agricultural market. The growing population and high pressure to maximize crop output increase demand for GNSS. The expansion of precision agriculture and strong government support for agricultural technology requires GNSS. The growing adoption of precise land surveying and the expansion of software & hardware solutions require GNSS, driving the overall market growth.

GNSS in Agricultural Market Share, By Region, 2024 (%)

| Regional | Revenue Share |

| North America | 42.50% |

| Europe | 18.33% |

| Asia Pacific | 25.11% |

| Latin America | 8.14% |

| Middle East and Africa | 5.92% |

United Arab Emirates GNSS in Agricultural Market Trends

The United Arab Emirates is growing in the market. The growing government investment to enhance food security and shift towards precision farming requires GNSS. The strong focus on resource management and the presence of advanced agriculture technologies require GNSS. The growing use of autonomous farm machinery and focus on improving farm productivity require GNSS, supporting the overall market growth.

Recent Developments

- In July 2025, Punjab’s PAU launched a GNSS-based auto-steering system for precision farming. The system has a touchscreen control panel, multiple satellite constellations, and sensors. The system includes features such as customized turning patterns, auto-headland turns, and skip-row operations. The system consists of automatic and manual modes.(Source: www.global-agriculture.com )

- In July 2025, CHC Navigation launched an automated steering system, CHCNAV NX610, for precision agriculture. The system consists of an intuitive user interface and enhanced hardware. The system offers ±2.5 cm accuracy and supports DGPS, E-PPP, SPP, H-PPP, & RTK technology. It is useful in various farming tasks like seeding, tillage, land preparation, & spraying.(Source: www.chcnav.com )

- In May 2025, PTx Trimble launched the NAV-960 GNSS receiver for precision farming. The receiver consists of a rugged design, an upgraded GNSS engine, and enhanced sensors. The receivers withstand harsh conditions and perform complex tasks like tilling, planting, & spraying.(Source: raceautoindia.com )

Top Companies in the GNSS in Agricultural Market

- Deere & Company – Deere & Company is a leading U.S.-based manufacturer of agricultural, forestry, and construction equipment, integrating GNSS (Global Navigation Satellite System) technology into its precision agriculture solutions. The company’s advanced machinery, such as tractors, sprayers, and combines, utilizes GPS-guided automation systems for optimized field mapping, variable-rate application, and autonomous operations. Through its John Deere Operations Center™, the company enables farmers to make data-driven decisions for improved yield, efficiency, and resource management.

- Trimble Inc. – Trimble is a global technology company providing hardware, software, and data analytics solutions for precision agriculture. Its GNSS-enabled guidance and correction services enhance machine control, field mapping, and asset tracking. Trimble’s Ag Software Platform integrates GNSS data with farm management tools to optimize input use and maximize productivity, helping agricultural operators achieve higher accuracy in planting, spraying, and harvesting.

- Topcon Positioning Systems – Topcon develops GNSS-based positioning technologies and precision agriculture tools, including high-accuracy receivers, antennas, and real-time correction services. The company’s X-Family consoles and Horizon software support a wide range of agricultural applications, including autosteering, section control, and yield monitoring. Topcon’s focus on interoperable, scalable precision solutions positions it as a major provider of modern digital farming systems.

- Hexagon/NovAtel – NovAtel, part of Hexagon, offers GNSS antennas, receivers, and positioning components used in precision agriculture and autonomous machinery. Its products deliver centimeter-level accuracy and signal reliability, supporting applications like automated steering, mapping, and variable-rate application. NovAtel’s TerraStar Correction Services ensure global coverage and high-precision performance for farm operations under diverse environmental conditions.

- AGCO Corporation – AGCO designs and manufactures smart farming technologies and agricultural machinery integrated with GNSS for precision navigation and control. Its brands, including Fendt, Massey Ferguson, and Valtra, feature autonomous and guided vehicle technologies that enhance planting precision, reduce overlaps, and lower input costs. AGCO’s Fuse® Smart Farming Platform connects equipment data through GNSS to enable real-time field optimization and predictive analytics.

- CNH Industrial – CNH Industrial, through brands like Case IH and New Holland Agriculture, integrates GNSS into automated guidance and precision control systems. Its PLM Intelligence™ suite supports data synchronization across machinery and digital tools, improving efficiency and reducing operator workload.

- Raven Industries – Raven Industries provides GPS and GNSS-based precision agriculture systems, specializing in autonomous technology, field computers, and application control systems. Its Slingshot® platform enables real-time connectivity, mapping, and data management across fleets and fields.

- Ag Leader Technology – Ag Leader develops precision farming hardware and software powered by GNSS, offering solutions for guidance, mapping, variable-rate control, and yield monitoring. Its InCommand displays and SteerCommand systems enable accurate steering and data collection across different farm equipment brands.

- Hemisphere GNSS – Hemisphere GNSS designs positioning and navigation systems for agriculture, including GNSS receivers, antennas, and correction services. The company’s Atlas® GNSS Global Correction Service provides highly accurate satellite-based positioning essential for large-scale agricultural operations.

- Septentrio – Septentrio develops high-precision GNSS receivers and correction technologies that enable autonomous agricultural applications. Its solutions are optimized for machine guidance, land leveling, and precision spraying, offering superior performance in signal-challenging environments.

- u-blox – u-blox supplies GNSS chips and modules for agricultural automation and asset tracking. Its high-precision multi-band receivers enhance navigation accuracy in compact systems, supporting IoT-enabled farming and vehicle telematics.

- Leica Geosystems – Leica Geosystems, part of Hexagon, offers positioning and guidance systems that use GNSS for field mapping, machine automation, and variable-rate application. The company’s technology is recognized for its robust accuracy, connectivity, and integration with large-scale agricultural machinery.

- TeeJet Technologies – TeeJet Technologies specializes in GNSS-based field mapping, guidance, and spray control systems. Its Matrix 900 and Aeros consoles provide precision navigation and section control capabilities to optimize chemical and fertilizer usage in crop management.

- Farmers Edge – Farmers Edge leverages GNSS data and digital agriculture tools to deliver precision field analytics, crop modeling, and variable-rate prescriptions. Its FarmCommand® platform integrates satellite imagery and weather data to enhance decision-making for farm operations.

- DJI – DJI applies drone and GNSS technology to agricultural spraying, surveying, and field analysis. Its Agras drone series integrates real-time GNSS positioning for automated flight paths, precision input delivery, and large-scale field coverage.

Segments Covered

By Component

- Receivers

- Antennas

- GNSS Chips/Modules

- Correction Services (RTK/PPP/DGPS/SBAS)

- Software & Platforms

- Integrated Systems (Autosteer)

By Positioning/Accuracy Technique

- SBAS

- DGPS

- RTK

- PPP

- RTK+PPP Hybrids

By Application

- Auto-Guidance & Steering

- Field Mapping & Surveying

- Variable-Rate Application (VRA)

- Yield Monitoring

- Drone/UAV Navigation

- Asset/Livestock Tracking

- Telematics & Fleet Management

By Deployment/ Offering Type

- Hardware

- Software

- Services

- Integrated Solutions

By Satellite System

- GPS-Only

- Multi-GNSS (GPS + GLONASS + Galileo + BeiDou)

- Regional Augmentations

By Region

- North America

- U.S.

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Asia Pacific

- China

- India

- Japan

- South Korea

- Latin America

- Brazil

- Argentina

- Middle East & Africa

- Saudi Arabia

- South Africa