Content

European Paints & Coatings Market - Size, Share & Industry Analysis

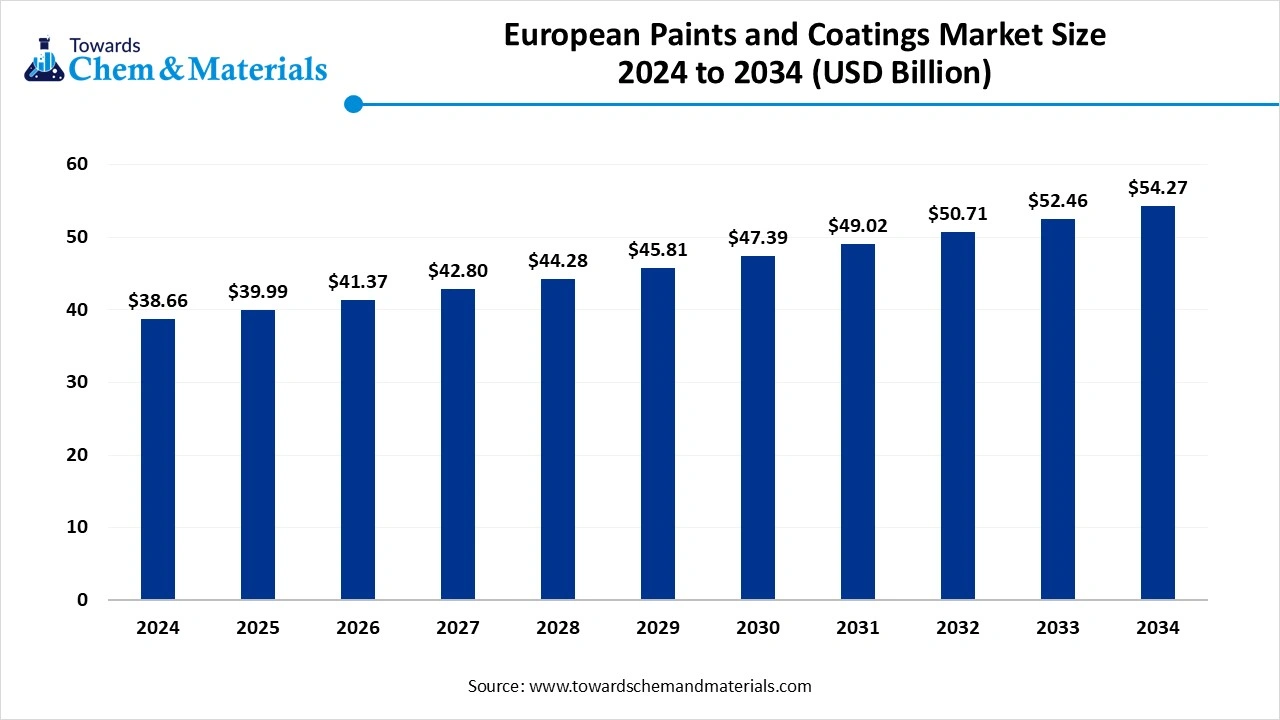

The European paints & coatings market size is calculated at USD 38.66 billion in 2024, grew to USD 39.99 billion in 2025, and is projected to reach around USD 54.27 billion by 2034. The market is expanding at a CAGR of 3.45% between 2025 and 2034. Growing product demand from the automotive and construction sectors is the key factor driving market growth. Also, advancements in smart and functional coatings, coupled with the rising preference for high-performance coatings, can fuel market growth further.

Key Takeaways

- By region, the Western Europe region dominated the market with a 45% share in 2024. The dominance of the region can be attributed to the growing demand for sustainable waterborne coatings.

- By region, the Eastern Europe region is expected to grow at the fastest CAGR over the forecast period. The growth of the region can be credited to the substantial rise in new vehicle production.

- By product type, the architectural & decorative segment dominated the market with a 45% share in 2024. The dominance of the segment can be attributed to the ongoing urbanization and infrastructure development.

- By product type, the industrial coatings segment is expected to grow at the fastest CAGR over the forecast period. The growth of the segment can be credited to the rapid surge in the electric vehicle and renewable energy sectors.

- By chemistry, the waterborne/acrylic emulsions segment held a 50% market share in 2024. The dominance of the segment can be linked to the growing demand for sustainable products due to stringent VOC regulations.

- By chemistry, the epoxy segment is expected to grow at the fastest CAGR over the forecast period. The growth of the segment can be driven by growing product demand from the construction, automotive, and industrial sectors.

- By technology, the waterborne segment dominated the market by holding a 55% share in 2024. The dominance of the segment is owed to the growing consumer awareness of volatile organic compounds (VOCs).

- By technology, the powder coating technology segment is expected to grow at the fastest CAGR over the forecast period. The growth of the segment is due to the technological advancements in coating technology.

- By end-use industry, the residential construction segment held a 48% market share in 2024. The dominance of the segment can be attributed to the growing demand for sustainable and decorative coatings.

- By end-use industry, the automotive OEM & aftermarket segment is expected to grow at the fastest CAGR during the projected period. The growth of the segment can be credited to the strict environmental regulations that prefer sustainable coatings.

- By formulation, the liquid segment dominated the market with 78% share in 2024. The dominance of the segment can be linked to the growing popularity of high-performance and premium coatings.

- By formulation, the powder segment is expected to grow at the fastest CAGR over the forecast period. The growth of the segment can be credited to the growing demand for durable, high-quality, and corrosion-resistant coatings for different industrial applications.

- By distribution channel, the DIY / retail segment held a 42% market share in 2024. The dominance of the segment is owed to the advancements in paint technology, providing improved durability and functionality.

- By distribution channel, the e-commerce segment is expected to grow at the fastest CAGR during the study period. The growth of the segment is due to the rising focus on environmental concerns, which leads to the demand for bio-based and water-based coatings.

Technological Advancements Are Expanding Market Growth

Paints & coatings are formulated products applied to surfaces to provide decoration, protection, and/or functional performance (e.g., corrosion resistance, fire retardance, aesthetics). Advancements in coatings technology, like the anti-microbial, self-cleaning, and smart coatings, are enhancing the performance and functionality, fulfilling consumer needs for more functional and durable products. Designers and consumers are also seeking advanced decorative paints with enhanced textures and colors.

What Are the Key Trends Influencing the European Paints & Coatings Market?

- Growing paint & coatings demand from the automotive and construction sectors is the latest trend in the market. In the construction industry, paints and coatings are needed for both aesthetic and protective purposes, meeting various commercial, residential, and industrial needs.

- The ongoing technological innovations to improve the quality of paints and coatings are further promoting market expansion. It involves the creation of novel formulations and materials that fulfil specific demands such as enhanced aesthetics, increased durability, and environmental sustainability. The growing availability of nano coatings is also reshaping the market dynamics.

- Strict environmental regulations have created a greater demand for the eco-friendly development of coating products. Paint manufacturers are introducing and advancing sustainable paint technology to fulfil the consumer demand. Also, the market players are focusing on minimizing volatile organic compounds (VOC) to include renewable materials and waste minimization.

Report Scope

| Report Attributes | Details |

| Market Size in 2025 | USD 39.99 Billion |

| Expected Size by 2034 | USD 54.27 Billion |

| Growth Rate from 2025 to 2034 | CAGR 3.45% |

| Base Year of Estimation | 2024 |

| Forecast Period | 2025 - 2034 |

| Segment Covered | Product Type, Chemistry / Resin Type, Technology / Process, End-Use Industry, Formulation & Physical Form, Distribution Channel, By Region |

| Key Companies Profiled | AkzoNobel, PPG Industries , Sherwin-Williams, Axalta Coating Systems , BASF (Coatings Solutions) , Hempel , Jotun , Kansai Paint , Nippon Paint , RPM International , Teknos , Tikkurila , Beckers Group , Sika , Cromology , Crown Paints , Titan (Titanlux) , Berger Paints, Helios Group, Henkel |

Market Opportunity

Growing Adoption of UV-Curable Coatings

The increasing adoption of UV-curable coatings across various industries is the major factor creating lucrative opportunities in the market. The benefits of UV-curable coatings, like mar and scratch resistance, contribute to their rise in popularity. Furthermore, many companies are investing rapidly in the manufacturing of multi-functional polyol intermediates, which are important ingredients in UV-curable coatings.

Challenges

Economic Slowdown and Inflation

Higher inflation and interest rates have reduced consumer spending and construction activities across Europe, which is the major factor hindering market growth, particularly in countries like Germany and France. Moreover, the market also faces a shortage of skilled labour, especially in Western Europe, which can hamper the proper and timely application of products.

Regional Insight

European Paints & Coatings Market Trends

The Western Europe region dominated the market with a 45% share in 2024. The dominance of the region can be attributed to the growing demand for sustainable waterborne coatings, along with the rapid investments in sustainable infrastructure such as renewable energy. In addition, consumers in Western Europe are rapidly seeking high-quality and premium architectural paints for home decoration, leading to regional growth soon.

The Eastern Europe region is expected to grow at the fastest CAGR over the forecast period. The growth of the region can be credited to the substantial rise in new vehicle production and the expanding automotive sector. Furthermore, companies and consumers in the region are focusing more on sustainable products, which leads to the adoption of eco-friendly solutions and other bio-based binders.

Segmental Insight

Product Type Insight

Which Product Type Segment Dominated the European Paints & Coatings Market in 2024?

The architectural & decorative segment dominated the market with a 45% share in 2024. The dominance of the segment can be attributed to the ongoing urbanization and infrastructure development, followed by the investments in infrastructure projects. Additionally, growing disposable incomes and a shift towards aesthetic improvements boost he demand for high-end and premium decorative paints.

The industrial coatings segment is expected to grow at the fastest CAGR over the forecast period. The growth of the segment can be credited to the rapid surge in the electric vehicle and renewable energy sectors. Also, major companies are heavily investing in technologies such as UV-curable coatings for faster drying times, improving overall product durability and performance across various applications.

Chemistry Insight

Why Waterborne/Acrylic Emulsions Segment dominated the European Paints & Coatings Market in 2024?

The waterborne/acrylic emulsions segment held a 50% market share in 2024. The dominance of the segment can be linked to the growing demand for sustainable products due to stringent VOC regulations, such as the EU's REACH. Waterborne coatings are preferred as they emit substantially lower VOCs, which leads to convenient indoor environments and compliance with environmental regulations.

The epoxy segment is expected to grow at the fastest CAGR over the forecast period. The growth of the segment can be driven by growing product demand from construction, automotive, and industrial sectors due to its high corrosion resistance, durability, and chemical resistance properties. Furthermore, Epoxy resins are used for both decorative and protective purposes, such as chemical-resistant and durable industrial flooring.

Technology Insight

How Much Share Did the Waterborne Segment Held in 2024?

The waterborne segment dominated the market by holding a 55% share in 2024. The dominance of the segment is owed to the growing consumer awareness of volatile organic compounds (VOCs) and the increasing shift towards sustainable building practices. Moreover, this coating provides a cost-effective solution for maintaining and protecting surfaces, particularly as companies focus on improving the sustainability of their products.

The powder coating technology segment is expected to grow at the fastest CAGR over the forecast period. The growth of the segment is due to the technological advancements in coating technology, which lead to more effective applications and energy-efficient curing processes. Also, powder coatings are inherently VOC-free, which aligns with strict regulations which contributes to the overall segment expansion.

End-Use Industry Insight

Which End Use Industry Segment Dominated the Market in 2024?

The residential construction segment held a 48% market share in 2024. The dominance of the segment can be attributed to the growing demand for sustainable and decorative coatings, coupled with the increasing disposable incomes across the region. The region's focus on renovation wave strategy and energy-efficient buildings is growing the demand for high-performance residential coatings further in the market.

The automotive OEM & aftermarket segment is expected to grow at the fastest CAGR during the projected period. The growth of the segment can be credited to the strict environmental regulations preferring sustainable coatings and the growing adoption of electric vehicles (EVs) in the region. Furthermore, consumers in Europe desire high-quality and visually appealing finishes for their vehicles.

Formulation Insight

Which Formulation Type Segment Dominated the Market in 2024?

The liquid segment dominated the market with a 78% share in 2024. The dominance of the segment can be linked to the growing popularity of high-performance and premium coatings, along with the growing focus on energy-efficient infrastructure. Advancements in liquid coating technologies, like bio-based and UV-curable coatings, improve durability, performance, and overall environmental compliance.

The powder segment is expected to grow at the fastest CAGR over the forecast period. The growth of the segment can be credited to the growing demand for durable, high-quality, and corrosion-resistant coatings for different industrial applications. Powder coatings are extensively used across applications such as industrial equipment, pipes, and heavy machinery for their protective and functional properties.

Distribution Channel Insight

How Much Share Did the DIY / Retail Segment Held in 2024?

The DIY / retail segment held a 42% market share in 2024. The dominance of the segment is owed to the advancements in paint technology, providing improved durability and functionality, coupled with the stringent environmental regulations promoting low-VOC and water-based products. Furthermore, there is an increasing consumer interest in home decoration in the region, which leads to premium architectural paints.

The e-commerce segment is expected to grow at the fastest CAGR during the study period. The growth of the segment is due to the rising focus on environmental concerns, which leads to the demand for bio-based and water-based coatings. Also, online platforms give an extensive range of paints and coatings, from basic to premium products for the automotive and industrial sectors.

European Paints & Coatings Market -Value Chain Analysis

- Feedstock Procurement: It is the process of acquiring raw materials like pigments, solvents, resins, and additives, which are necessary for manufacturing paint and coating products.

- Chemical Synthesis and Processing: It involves the entire process of manufacturing the chemical components utilized in paint and coatings, which are then formulated into a finished product.

- Packaging and Labelling : This stage is influenced by changing regulations and a strong push for sustainability. Key factors are voluntary ecolabels, mandatory hazard communications, and rules regarding packaging waste.

- Regulatory Compliance and Safety Monitoring: This is a crucial stage governed by a strong framework of EU regulations that aims at safeguarding human health and the environment.

Recent Developments

- In April 2025, Ecoat, a Grasse-based company of eco-friendly binders in paint, secured €21 million to change the future of the paint industry. Fueled by eco-design and green chemistry, the company combines performance, sustainability, and life cycle analysis into its innovation.(Source: www.eu-startups.com)

Companies List

- AkzoNobel

- PPG Industries

- Sherwin-Williams

- Axalta Coating Systems

- BASF (Coatings Solutions)

- Hempel

- Jotun

- Kansai Paint

- Nippon Paint

- RPM International

- Teknos

- Tikkurila

- Beckers Group

- Sika

- Cromology

- Crown Paints

- Titan (Titanlux)

- Berger Paints

- Helios Group

- Henkel

Segments Covered

Product Type

- Architectural & Decorative Coatings

- Interior Wall Paints

- Exterior Wall Paints

- Decorative Wood Coatings

- Decorative Metal Coatings

- Decorative Varnishes & Stains

- Industrial Coatings

- Protective & Corrosion-Resistant Coatings

- Powder Coatings

- Coil Coatings

- Can & Packaging Coatings

- Industrial Wood Coatings

- Industrial Metal Coatings

- Automotive Coatings

- OEM Automotive Coatings

- Refinish / Aftermarket Automotive Coatings

- Automotive Electrocoat (E-coat)

- Marine Coatings

- Marine Hull Coatings

- Offshore / Heavy-Industry Protective Coatings

- Aerospace Coatings

- Specialty / Functional Coatings

- Anti-microbial / Hygiene Coatings

- Fire-retardant / Intumescent Coatings

- Anti-graffiti Coatings

- Optical / Electronic Coatings

Chemistry / Resin Type

- Waterborne / Acrylic Emulsions

- Solvent-borne Alkyds

- Epoxy (solvent-borne and waterborne)

- Polyurethane / Polyaspartic

- Polyester

- Vinyl / PVC-based

- Silicone & Silane Modified

- Radiation-cured (UV/EB)

- Powder coating chemistries

Technology / Process

- Waterborne Technology

- Solvent-borne Technology

- Powder Coating Technology

- High-solids Liquid Systems

- Radiation-cured Systems

- Electrodeposition (E-coat)

- Two-component (2K) Systems

- Single-component (1K) Systems

End-Use Industry

- Residential Construction

- Commercial / Non-residential Construction

- Infrastructure & Civil (bridges, pipelines, rail)

- Automotive OEM & Aftermarket

- Industrial Manufacturing (machinery, equipment)

- Packaging (metal cans, paperboard)

- Marine & Offshore

- Wood & Furniture Manufacturing

- Aerospace & Defense

- Electronics & Electrical

Formulation & Physical Form

- Liquid

- Concentrates / Tinting Systems

- Powder

- Paste / Thick body

- Aerosol / Spray-can

Distribution Channel

- DIY / Retail

- Professional B2B / Contractors

- Direct OEM Sales

- E-commerce / Online Retail

- Specialist Distributors

By Region

- Western Europe

- Northern Europe

- Southern Europe

- Central Europe

- Eastern Europe

- Mediterranean & Balkans