Content

What is the Europe Industrial and Institutional Cleaning Chemicals Market Size ?

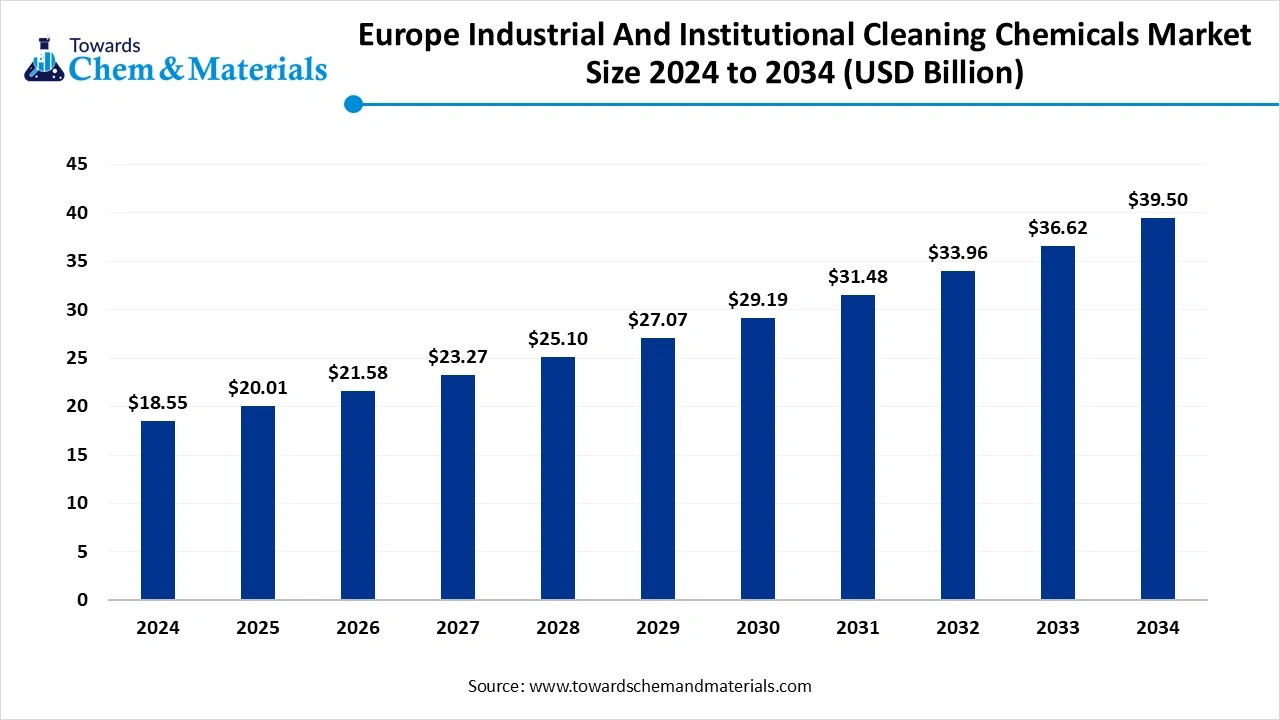

The Europe industrial and institutional cleaning chemicals market size accounted for USD 18.55 billion in 2024 and is predicted to increase from USD 20.01 billion in 2025 to approximately USD 39.50 billion by 2034, expanding at a CAGR of 7.85% from 2025 to 2034. A surge in hygiene awareness is the key factor driving market growth. Also, the growing popularity of sustainable and concentrated cleaning solutions, coupled with the innovations in technology, can fuel market growth further.

Key Takeaways

- By country, Germany dominated the market with the largest share in 2024.

- By country, Poland is expected to grow at the fastest CAGR over the forecast period.

- By country, France is expected to grow at a notable CAGR over the forecast period.

- By product type, the general-purpose cleaners' segment dominated the market with the largest share in 2024.

- By product type, the disinfectants and sanitizers segment is expected to grow at the fastest CAGR over the forecast period.

- By raw material, the surfactants segment dominated the market in 2024.

- By raw material, the antimicrobials segment is expected to grow at the fastest CAGR over the forecast period.

- By application, the healthcare segment dominated the market by holding the largest share in 2024.

- By application, the retail and office segment is expected to grow at the fastest CAGR over the forecast period.

- By end user, the commercial segment dominated the market in 2024.

- By end user, the industrial segment is expected to grow at the fastest CAGR over the forecast period.

What are Industrial and Institutional Cleaning Chemicals?

The increasing need for specialized cleaning solutions for industrial machinery is the major factor driving market growth. The market includes specialized cleaning agents for facilities such as hospitals, manufacturing plants, and offices. The market also encompasses products such as disinfectants, sanitizers, general-purpose cleaners, and floor care products, used to remove stains, dirt, and microorganisms.

Case Study: BASF SE Achieved New Milestones with Strategic Collaborations

- BASF SE is a major player in the market, with an emphasis on using sustainability and innovation to navigate a dynamic landscape characterised by raw material volatility, regulatory pressure, and demand for greener products.

- In 2024, BASF announced the expansion of its biomass-balanced EcoBalanced product line for cleaning products and detergents in Europe.

Europe Industrial and Institutional Cleaning Chemicals Market Outlook

- Industry Growth Overview: The expansion of restaurants, hotels, and commercial buildings, coupled with the growing spending on tourism, boosts the demand for cleaning chemicals. Advancements in chemical formulations, such as the development of concentrated solutions, can impact positive market growth soon.

- Sustainability Trends: Cutting-edge cleaning technologies, such as sustainable disinfectants and enzymatic cleaners, propel efficiency and minimize overall environmental impact, which aligns with industry standards and sustainability goals.

- Major Investors: Major investors in the market are Procter & Gamble, Henkel AG & Co. KGaA, BASF SE, 3M, and Clariant. These market players compete via advancements in sustainable solutions, product development, and compliance with strict hygiene and environmental regulations.

Report Scope

| Report Attributes | Details |

| Market Size in 2026 | USD 21.58 Billion |

| Expected Size by 2034 | USD 39.50 Billion |

| Growth Rate from 2025 to 2034 | CAGR 7.85% |

| Base Year of Estimation | 2024 |

| Forecast Period | 2025 - 2034 |

| Segment Covered | By Product Type, By Raw Material, By End-User, |

| Key Companies Profiled | CLARIANT, Solvay SA, Huntsman Corporation, Eastman Chemical Company, Lonza Group Limited, Croda International Plc., The Dow Chemical Company, Betco Corporation |

How State-of-the-Art Technologies are Revolutionising the European Industrial and Institutional Cleaning Chemicals Market?

- The advanced technologies are revolutionizing the market by enabling greater sustainability, efficiency, and data-driven insights. Mostly boosted by advanced hygiene awareness, stricter regulations, and the use of technologies such as bio-based chemicals, which are changing how businesses manage cleanliness.

Trade Analysis of Europe Industrial and Institutional Cleaning Chemicals Market: Import & Export Statistics:

- In 2024, EU chemical and related product exports rose by 7.0% while imports fell by 1.1%, resulting in a €40 billion increase in the trade surplus for this sector.(Source: ec.europa.eu)

- In 2023, Germany exported $4.75B of Cleaning Products, making it the largest exporter of Cleaning Products in the world. In 2023, the main destinations of Germany's Cleaning Products exports were: France ($474M), the Netherlands ($461M), Belgium ($281M), Austria ($271M), and the United Kingdom ($260M).(Source: oec.world)

Europe Industrial and Institutional Cleaning Chemicals Market Value

Chain Analysis :

- Feedstock Procurement: It refers to the sourcing of raw material used to produce cleaning products for commercial settings.

- Chemical Synthesis and Processing : It involves the production processes by which raw materials are turned into the finished chemical ingredients utilized in cleaning products.

- Packaging and Labelling : This stage involves safety requirements, strict regulations, and growing trends toward sustainability. These factors are necessary for ensuring the safe handling of hazardous products.

- Regulatory Compliance and Safety Monitoring : It refers to a dynamic and complex system of EU-wide and national regulations that govern the whole lifecycle of chemical products.

Europe Industrial and Institutional Cleaning Chemicals Market's Regulatory Landscape: Global Regulations

| Country/Region | Key Regulations/Investments |

| Germany | National authorities enforce compliance with EU regulations like REACH and CLP.Germany's emphasis on workplace safety leads to a high demand for high-performance cleaning solutions that comply with both EU and national best practices. |

| United Kingdom | After Brexit, UK importers who were formerly "downstream users" must now notify the UK Health and Safety Executive (HSE) of substances they import. |

| France | France passed a law banning Per- and polyfluoroalkyl substances (PFAS) in certain consumer goods from 2026, including some textiles. It also implements a "polluter pays" tax for PFAS contamination. |

Segmental Insights

Product Type Insights

How Much Share Did the General-Purpose Cleaners' Segment Held in 2024?

- The general-purpose cleaners' segment dominated the market with the largest share in 2024. The dominance of the segment can be attributed to its extensive application across various sectors for maintenance tasks and routine cleaning. Also, the versatility of these cleaners decreases the need for specialized products.

- The disinfectants and sanitizers segment is expected to grow at the fastest CAGR over the forecast period. The growth of the segment can be credited to the growing awareness regarding sanitation and hygiene, especially in hospitality, healthcare, and food service industries. There is also an increasing trend towards sustainable, innovative, and safer chemical blends.

- The growth of the sanitary cleaner's segment is due to increasing product demand from the healthcare sector, along with the rise in popularity of bio-based alternatives. Regulatory bodies are rapidly implementing stricter rules for sanitation and the use of cleaning chemicals.

- The degreasers are another subsegment of the market expanding because of rising demand for high-performance solvents to remove sticky oils and residues, along with the increasing need for effective cleaning in manufacturing and maintenance.

Raw Material Insights

Which Raw Material Type Segment Dominated the Europe Industrial and Institutional Cleaning Chemicals Market in 2024?

- The surfactants segment dominated the market in 2024. The dominance of the segment can be linked to its essential role in improving the cleaning effectiveness of various formulations. Moreover, the extensive applicability of surfactants in products such as degreasers, detergents, and disinfectants across various industries is impacting positive segment growth.

- The antimicrobials segment is expected to grow at the fastest CAGR over the forecast period. The growth of the segment can be credited to the growing focus on sanitation and hygiene in different sectors, along with the rising need for effective solutions to tackle the spread of infectious diseases caused by uncleanliness.

- The solvents are one of the major segments in the market, driven by the ongoing implementation of workplace safety initiatives and stringent hygiene standards in the region. Solvents are essential components in various specialized cleaning products for industries such as manufacturing, food service, and healthcare.

- The acids and alkalis segment's growth is mainly fuelled by the increasing need for specialized cleaners in facilities like senior care homes and a surge in hygiene standards in the food and healthcare sector. Market players are developing advanced alkaline and acid formulations to tackle specific cleaning challenges.

Application Insights

Which Application Type Segment Dominated the Europe Industrial and Institutional Cleaning Chemicals Market in 2024?

- The healthcare segment dominated the market by holding the largest share in 2024. The dominance of the segment is owed to the growing demand for infection prevention and stringent hygiene regulations. The healthcare industry has an increased focus on sanitation and hygiene to prevent infections, which fuels the demand for specialized cleaning chemicals.

- The retail and office segment is expected to grow at the fastest CAGR over the forecast period. The growth of the segment is due to the rising need for clean and sanitized work environments, along with the surge in consumer awareness of hygiene. Stringent health and safety regulations in the region are supporting the use of safer cleaning chemicals.

- The growth of the food and beverage processing segment is driven by growing consumer awareness of food safety and increasing demand for specialized sanitizers. Surfactants are necessary for removing oils, fats, and grease in food processing and are also high in demand for utilisation in sanitizing products.

- The hospitality segment is another major sub-segment in the market, whose growth is boosted by growing consumer demand for "green" practices with a strong emphasis on hygiene for brand reputation. Hospitality establishments are rapidly prioritizing biodegradable, non-toxic, and bio-based cleaning agents.

End-User Insights

How Much Share Did the Commercial Segment Held in 2024?

- The commercial segment dominated the market in 2024. The dominance of the segment can be attributed to the high demand for hygiene and cleaning solutions in sectors such as retail, offices, and hospitality. The commercial construction sector's growth is leading to a greater demand for cleaning and facility management services.

- The industrial segment is expected to grow at the fastest CAGR over the forecast period. The growth of the segment can be credited to the increasing emphasis on workplace hygiene and safety, coupled with the rising regulatory compliance requirements. Advancements in cleaning processes are enhancing the efficiency of specialized cleaning formulations.

- The growth of the institutional segment is mainly propelled by the increasing need for green cleaning solutions, which are non-toxic and biodegradable. Also, regulatory requirements for food safety and hygiene fuel a high demand for effective cleaning chemicals in food processing plants and other food establishments.

Country Insights

How did Germany Thrived in the Europe Industrial and Institutional Cleaning Chemicals Market in 2024?

Germany dominated the market with the largest share in 2024. The dominance of the country can be attributed to the wide chemical production networks and cutting-edge manufacturing capabilities. Moreover, the German automotive sector is a major market for cleaning chemicals for new vehicle production and for car washing too, which can lead to market expansion in the country further.

Which is the Fastest Growing Country in the Region?

- Poland is expected to grow at the fastest CAGR over the forecast period. The growth of the country can be credited to the ongoing industrialization across various manufacturing sectors. Furthermore, the rapid shift towards bio-based cleaning chemicals is a major opportunity for market expansion in the country, fuelled by the development of more sustainable production practices.

- France is expected to grow at a notable CAGR over the forecast period. The growth of the country can be driven by a surge in awareness of hygiene, especially in the food and healthcare sectors, coupled with the increasing demand for sustainable cleaning solutions. Sophisticated medical infrastructure in France, with strict hygiene protocols, is propelling market growth in the country.

Recent Developments

- In October 2025, Sasol International Chemicals introduced bio-circular insect oil surfactant for the care chemical industry. Extracted from insect oil-based feedstocks, the product was convenient for use in home care, fabric, industrial, and institutional cleaning sectors.(Source : www.ofimagazine.com)

- In May 2024, Ecolab and HeiQ unveiled synbiotic cleaning products at Interclean. HeiQ's synbiotic cleaning technology was evaluated in various scientific studies, such as a study published in May 2023 in The Lancet by Charité University Hospital Berlin.(Source: www.prnewswire.com)

Top Europe Industrial and Institutional Cleaning Chemicals Market Companies

Procter & Gamble Co.

Corporate Information

- Name: Procter & Gamble Co. (commonly “P&G”)

- Headquarters: Cincinnati, Ohio, USA

- Founded: 1837 by William Procter and James Gamble in Cincinnati.

- Publicly traded: NYSE ticker “PG”.

- Scope: Global consumer goods company focused on daily-use products (baby, feminine & family care; beauty; grooming; fabric & home care; and health & wellness).

History and Background

- The company’s roots go back to 1837 when British candlemaker William Procter and Irish‐American soapmaker James Gamble formed a business partnership in Cincinnati after marrying sisters.

- Early growth & innovation: In the 1880s P&G introduced “Ivory” soap (a floating soap) which became a signature brand.

- Over the decades, P&G expanded through new product categories, acquisitions, and international markets.

Key Developments and Strategic Initiatives

- Portfolio focus: P&G has emphasized concentrating on its “daily‐use” categories where it can drive brand choice, performance and competitiveness.

- Digital & e-commerce growth: The company is pushing digital transformation, with e-commerce growth significantly outpacing average in recent years.

- Sustainability / circular economy: Targets include 100% recyclable or reusable packaging by 2030; significant investment into sustainable packaging, reduced water use, lower carbon etc.

Mergers & Acquisitions

- One of the most notable acquisitions: Gillette (2005) which brought major strength in grooming.

- More recent years: rather than large blockbuster acquisitions, the emphasis appears more on divestitures of underperforming/non-core assets and focusing on core brands.

Partnerships & Collaborations

- Collaboration with Basecamp Research: In 2024 P&G entered into a partnership to develop high‐performance cleaning enzymes for cold water conditions using AI platforms.

- Collaboration with Dow Chemical Company: March 2024: Joint development agreement to create technology for recycling hard-to-recycle plastic packaging (target: better polymer recovery and reuse) in partnership with Dow.

Product Launches / Innovations

- P&G emphasizes “superior performance” and innovation in its core brands (e.g., newer variants of Tide, Pampers, Gillette) as part of its growth strategy.

- Enzyme and cold water laundry innovation: As above, via Basecamp Research partnership, to enable effective cleaning at lower temperatures (energy & carbon saving) – an innovation in “fabric & home care” category.

Key Technology Focus Areas

- Artificial Intelligence & Data Analytics: P&G is embedding AI across R&D (product development), supply chain, marketing and consumer insight.

- Enzyme & Biotechnology for cleaning: Development of biologically-derived high-performance cleaning enzymes (for cold water, sustainability).

- Advanced packaging & circular-economy materials: Development of recyclable/new materials, partnerships for hard-to-recycle plastics, focus on circular supply chains.

R&D Organisation & Investment

- P&G describes its innovation model as combining the heart of a start-up with the resources of a global corporation.

- The “Connect + Develop” open innovation framework: started decades ago and recently updated to increase external collaboration value.

- Investment: For example, the company allocated around US$1.1 billion toward its ICT (information & communication technology) budget in 2024 as per independent analysis.

SWOT Analysis

Strengths

- Global scale and strong portfolio of iconic consumer brands (Tide, Pampers, Gillette, etc.).

Deep innovation capabilities and R&D infrastructure, strong track record of new product launches.

Strong financial position, ability to return capital to shareholders and invest in growth.

Solid supply chain and global reach.

Sustainability credentials and partnerships allow differentiation (e.g., circular packaging).

Weaknesses

- Heavy reliance on mature, slow-growth categories; growth rates modest (organic sales growth around ~2 %).

- Exposure to cost pressures (raw materials, tariffs, supply chain disruptions) and margin sensitivity.

- Complexity and size of organization may reduce agility relative to smaller, more nimble competitors.

- Some markets (e.g., China) show softness; premiumisation may limit broad consumer uptake.

Opportunities

- Growth via premiumisation of core brands (higher-value variants) and emerging markets.

- Digital commerce expansion, direct‐to‐consumer channels, personalised offerings.

- Sustainability and circular economy initiatives to drive differentiation and cost savings.

Leveraging AI and biotechnology for next-generation product innovation (cleaning enzymes, etc.).

Threats

- Macroeconomic uncertainty: inflation, cost increases (raw materials, energy), tariffs/trade tensions.

- Consumer spending slows down, especially in developed markets; shift to value/discount brands.

- Competitive pressure from private label, niche brands, alternative offerings (especially in categories like personal care).

- Regulatory and sustainability risks: packaging regulations, plastic waste regulation, supply chain disruptions.

- Currency/foreign exchange risk and regional market volatility.

Recent News & Strategic Updates

- P&G announced that it will cut approximately 7,000 non-manufacturing jobs (about 15% of its non-manufacturing workforce) over the next two years as part of a major restructuring program to boost productivity and streamline operations.

- Leadership change: The company revealed that Jon Moeller will transition to executive chairman and Shailesh Jeurikar (current COO) will become CEO effective January 1, 2026.

- CLARIANT: Clariant is a specialty chemical company active in the Industrial and Institutional (I&I) cleaning market through its Care Chemicals business segment. It supplies innovative and sustainable chemical ingredients for a range of I&I cleaning applications.

- Solvay SA: Provides specialty surfactants, polymers and biocides for hard-surface cleaning and industrial hygiene applications in Europe (e.g., Mirapol® Surf, Rhodoclean®) which address low-foam, high-efficiency and sustainable cleaning requirements.

- Huntsman Corporation

- Eastman Chemical Company

- Lonza Group Limited

- Croda International Plc.

- The Dow Chemical Company

- Betco Corporation

Segments Covered in the Report

By Product Type

- General Purpose Cleaners

- Sanitary Cleaners

- Disinfectants and Sanitizers

- Degreasers

- Dishwashing Chemicals

- Laundry Care Products

- Others

By Raw Material

- Surfactants

- Solvents

- Chelating Agents

- Acids and Alkalis

- Antimicrobials

- Others

By Application

- Healthcare

- Food and Beverage Processing

- Hospitality

- Manufacturing

- Retail and Offices

- Educational Institutions

- Others

By End-User

- Commercial

- Industrial

- Institutional