Content

Europe Copper Market Size, Share, Trends and Forecasts 2034

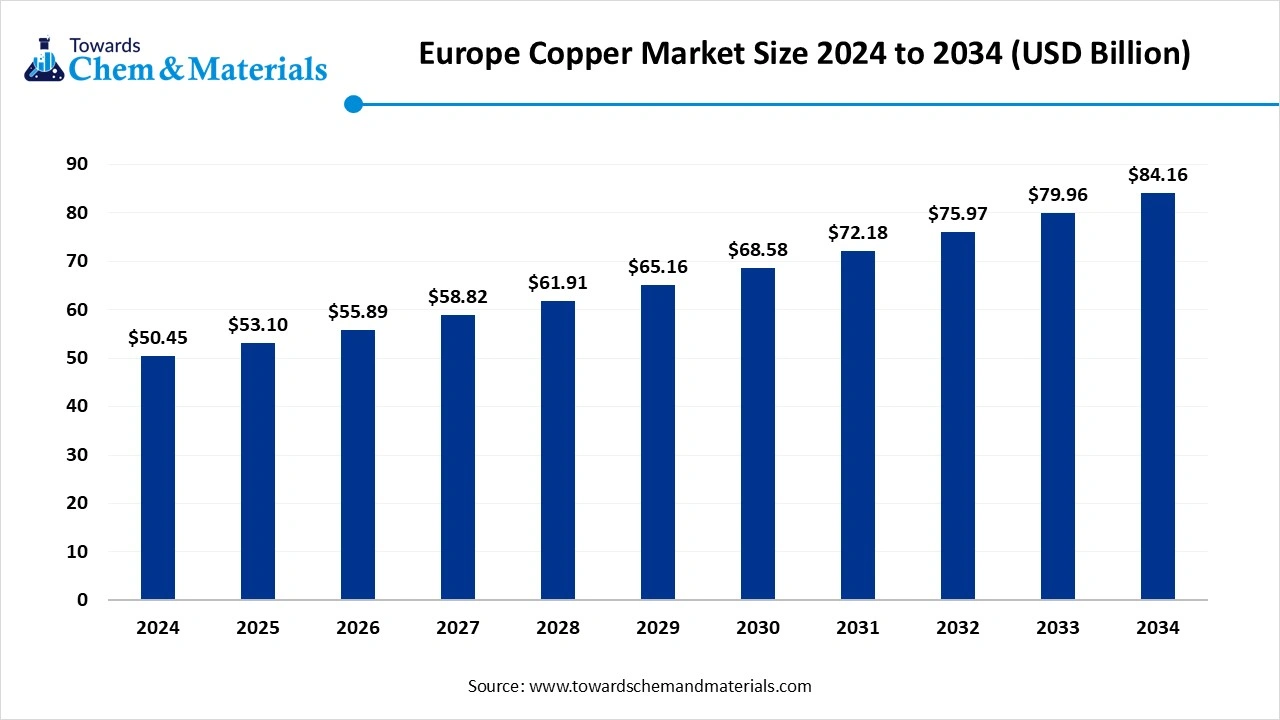

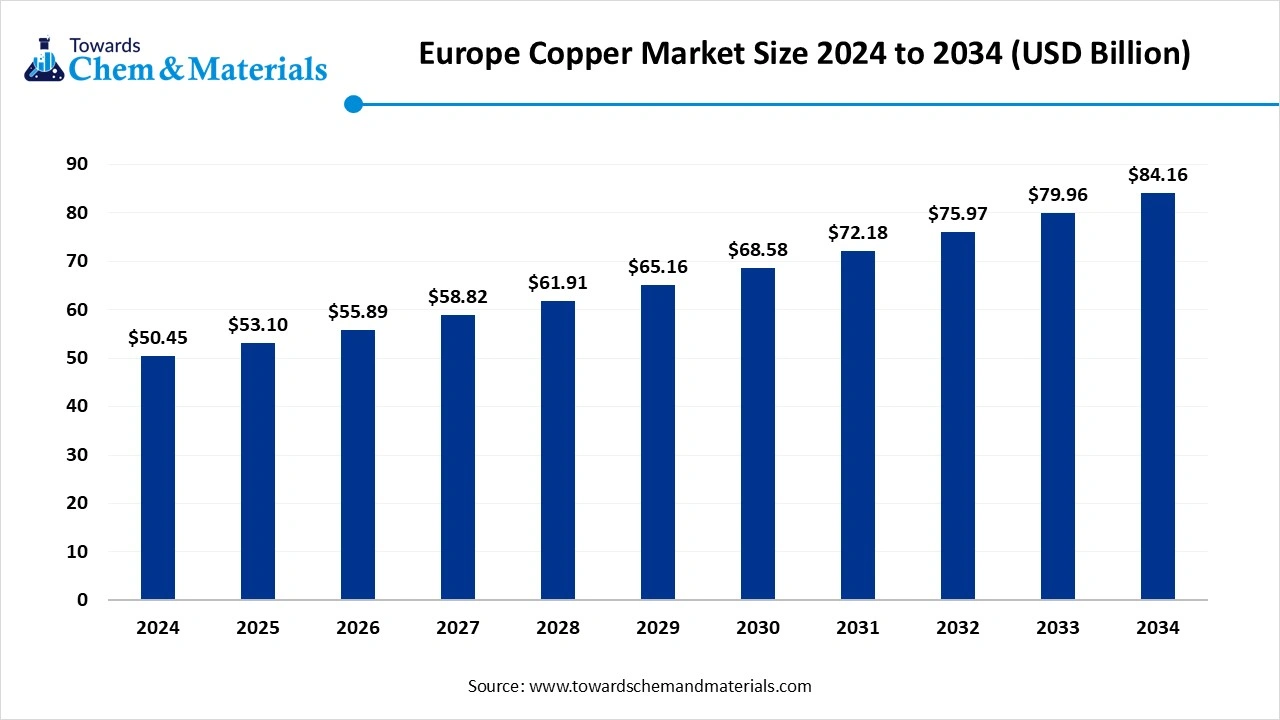

The Europe copper market size is calculated at USD 50.45 billion in 2024, grew to USD 53.1 billion in 2025, and is projected to reach around USD 84.16 billion by 2034. The market is expanding at a CAGR of 5.25 between 2025 and 2034. The growing emphasis on electrification and sustainability is the key factor driving market growth. Also, ongoing investments in infrastructure and electronics, coupled with the innovations in refining and extraction technologies, can fuel market growth further.

Key Takeaways

Key Takeaways

- By product type, the copper cathodes & blister segment dominated the market, with approximately 40% share in 2024.

- By product type, the copper foils & sheets segment is expected to grow at the fastest CAGR of approximately 12–14% over the forecast period.

- By grade, the electrolytic tough pitch (ETP) copper segment held approximately 50% market share in 2024.

- By grade, the oxygen-free copper segment is expected to grow at the highest CAGR of approximately 15% over the forecast period.

- By application, the electrical & electronics segment dominated the market with an approximate share of 45% during the forecast period.

- By application, the automotive & EV segment is expected to grow at the fastest CAGR of approximately 18-20% during the projected period.

- By end user, the electrical & electronics manufacturers segment held an approximate share of 40% over the forecast period.

- By end user, the renewable energy segment is expected to grow at the fastest CAGR of approximately 20% over the forecast period.

What is Copper?

Supportive government policies are the major factor driving the growth of the market in the region. The market encompasses the sourcing, manufacturing, distribution, and consumption of copper metal and its alloys. Copper is necessary for power transmission, electrical wiring, and the manufacturing of consumer goods and industrial equipment. The substantial surge in electric vehicle production directly influences the demand for copper in these vehicles.

Report Scope

| Report Attributes | Details |

| Market Size in 2025 | USD 53.1 Billion |

| Expected Size by 2034 | USD 84.16 Billion |

| Growth Rate from 2025 to 2034 | CAGR 5.25 |

| Base Year of Estimation | 2024 |

| Forecast Period | 2025 - 2034 |

| Segment Covered | By Product Type / Form, By Type / Grade, By Application / End-Use Industry, By End-User / Buyer |

| Key Companies Profiled | European Copper Institute (industry coordination & support), Boliden AB, Outokumpu Copper Products (Finland), Umicore Group, Metallo Group, MMC Norilsk Nickel (European operations), Global Copper Resources Europe, Hellenic Copper Mines (Greece), Kabelwerke Brugg AG (Copper wire & cables), Nexans (Copper cabling & solutions), Prysmian Group (Copper cables & systems), Recycled Copper Europe / Scrap processing companies |

Europe Copper Market Outlook

- Industry Growth Overview: Between 2025-2034, the market is anticipated to witness substantial growth due to growing urbanisation and rapid infrastructure investments across the region, along with the rising demand for smart computers, devices, and home appliances, which propels the demand for copper in circuit boards and electronic components.

- Sustainability Trends: The growing emphasis on the circular economy through various government initiatives for low-carbon copper production and stringent environmental regulations is increasing the adoption of sustainable mining practices like the Copper Mark assurance framework.

- Global Expansion: Major players such as Aurubis and KGHM are expanding their market presence through various strategic investments in smelting, recycling, and mining technologies. This growth is further boosted by high demand for copper in renewable energy infrastructure, electric vehicles and data centers.

Key Technological Shifts in the Europe Copper Market:

The market is undergoing several major technological shifts, mainly driven by the transition to a digital and climate-neutral economy. These shifts are more focused on circular economy innovations, electrification, and the digitalization of the entire copper value chain.

Companies such as Swedish-based Boliden and German-based Aurubis are leading the adoption of these advancements. These companies are investing heavily in innovative recycling facilities that can process complex copper-bearing scrap with other materials.

Trade Analysis of the Europe Copper Market: Import & Export Statistics

- Germany: Germany is also a leading importer of copper ores and concentrates in Europe, with imports valued at $2.47 billion in 2024.

- Spain: Spain is another significant importer of copper ores and concentrates, with imports valued at $2.58 billion in 2024.

- Bulgaria: This country imported copper ores and concentrates worth $2.54 billion in 2024.Bulgaria: This country imported copper ores and concentrates worth $2.54 billion in 2024.

Value Chain Analysis of the Europe Copper Market

- Feedstock Procurement : It refers to the process of sourcing the raw materials required to produce refined copper.

- Chemical Synthesis and Processing : This stage includes the use of copper as a raw material in chemical production and in creating specialized chemical products.

- Packaging and Labelling : The EU has a strong emphasis on regulating packaging and labeling, especially with the new regulations, which aim to harmonize rules across member states.

- Regulatory Compliance and Safety Monitoring : The market operates under a strong regulatory framework, and standards focus on environmental protection and safety.

Europe Copper Market's Regulatory Landscape: Global Regulations

| Country/Region | Key Regulations |

| European Union | Copper is recognized as a "strategic raw material" due to its role in fulfilling the EU's 2050 climate neutrality objective. The EU aims to meet at least 25% of domestic copper demand from recycled material. |

| Germany | Manufacturers are compelled to increase investments in advanced recycling technologies to meet EU targets, potentially exceeding 50% recycled content by 2030. |

| Italy | Italy imported 229 shipments of copper between September 2023 and August 2024, with imports largely sourced from Turkey, the United States, and India. |

Market Opportunity

Growth Of 5G Infrastructure in the Region

The ongoing expansion of the 5G infrastructure in the region creates substantial market opportunities during the forecast period, due to growing demand for high-conductivity and high-performance materials to support more rapid data transmission. Furthermore, copper's better electrical conductivity makes it crucial for components like antennas, coaxial cables, and connectors used in 5G networks.

Market Challenge

Supply Chain Pressures

The rapidly surging imports of copper scrap from the EU by major economies such as China are adding supply chain pressure in the region, which is a major factor hindering market expansion. Moreover, the price of copper is more prone to volatility, which further poses a substantial challenge for the oxygen-free copper market.

Segmental Insights

Product Type Insight

Which Product Type Segment Dominated the Europe Copper Market in 2024?

The copper cathodes & blister segment dominated the market with approximately 40% share in 2024. The dominance of the segment can be attributed to the ongoing copper demand from key end-user industries such as electronics and construction, along with the rapid adoption of circular economy principles. Copper is also necessary for creating, storing, and transmitting renewable energy.

The copper foils & sheets segment is expected to grow at the fastest CAGR of approximately 12–14% over the forecast period. The growth of the segment can be credited to the growing demand for high-tech electronics, particularly PCBs for consumer devices, and the expanding EV sector. Additionally, copper foils are necessary for the manufacturing of solar panels and other components.

Grade Insight

How Much Share Did the Electrolytic Tough Pitch (ETP) Copper Segment Held in 2024?

The electrolytic tough pitch (ETP) copper segment held approximately 50% market share in 2024. The dominance of the segment can be linked to the increasing demand for copper in major sectors, including power generation, transmission, and transportation, boosted by growing infrastructure projects. Also, ETP copper is crucial for busbars in electrical distribution with its exceptional electrical and thermal conductivity.

The oxygen-free copper segment is expected to grow at the highest CAGR of approximately 15% over the forecast period. The growth of the segment can be linked to the strong regulatory support for green technology and growing product demand from the electronics and electrical sectors. Furthermore, ongoing R&D efforts in OFC production processes have facilitated the enhanced purity levels and performance.

Application Insight

Which Application Segment Dominated the Europe Copper Market in 2024?

The electrical & electronics segment dominated the market with an approximate share of 45% in 2024. The dominance of the segment is owed to the extensive adoption of electric vehicles (EVs) and the growth of renewable energy sources, fuelled by the EU's Green Deal. In addition, the development of the latest, high-efficiency electronic devices for consumer electronics is driving the use of specialized copper.

The automotive & EV segment is expected to grow at the fastest CAGR of approximately 18-20% during the projected period. The growth of the segment is due to the region's ongoing transition towards sustainable technologies and electric mobility. R&D is focusing on creating more durable and efficient copper alloys and foil for electrical systems and batteries.

End-User Insight

How Much Share Did the Electrical & Electronics Manufacturers Segment Held in 2024?

The electrical & electronics manufacturers segment held an approximate share of 40% over the forecast period. The dominance of the segment can be attributed to the growing need for energy-efficient equipment coupled with the shift towards electric mobility. Furthermore, the demand for superior thermal and electric conductivity in devices such as laptops, smartphones, and other appliances fuels the consumption of high-purity copper.

The renewable energy segment is expected to grow at the fastest CAGR of approximately 20% over the forecast period. The growth of the segment can be credited to the extensive investment in green infrastructure, along with the ambitious decarbonization policies. Copper's electrical conductivity enhances the overall energy efficiency of renewable power systems.

Country Insights

The Western Europe dominated the market with an approximate share of 50% in 2024. The growth of the segment can be attributed to the region's increasing emphasis on decarbonization and electrification, along with the growth of the electric vehicle (EV) sector. In addition, advancements in copper-based alloys are improving material performance, such as strength and corrosion resistance, for various other applications.

The Eastern Europe is expected to grow at the fastest CAGR of approximately 14% during the projected period. The growth of the region can be credited to the increasing infrastructure development, coupled with the ongoing investments in advancing aging public infrastructure, like telecommunications and power grids. Furthermore, the region's focus on circular economy principles can fuel market growth soon.

Country-level Investments & Funding Trends for the Europe Copper Market:

- Germany: Companies like Aurubis AG, the largest copper recycler and manufacturer in Europe, have major operations in Germany.

- Spain: Major refining and recycling operations are in Huelva, run by Atlantic Copper.

- France: France's copper market is expected to see increased investments, fueled by a focus on renewable energy and infrastructure projects.

Recent Development

- In April 2025, the London Metal Exchange announced plans for a "green premium" on sustainably mined materials. This exchange, the world's biggest marketplace for metals, said the company. The sustainable mined metals include copper, nickel, aluminium, and zinc.(Source: www.ft.com)

Top Vendors in Europe Copper Market & Their Offerings:

- Aurubis AG: Aurubis AG is Europe's leading integrated copper producer and one of the world's largest copper recyclers, processing complex metal concentrates and scrap.

- KME Group: KME Group is a leading European manufacturer of copper and copper alloy semi-finished products, holding a central role in the global copper processing industry.

- Wieland-Werke AG: Wieland-Werke AG is a global market leader for semi-finished products and system solutions made of copper and copper alloys and holds a top position within the European market.

Other Players

- European Copper Institute (industry coordination & support)

- Boliden AB

- Outokumpu Copper Products (Finland)

- Umicore Group

- Metallo Group

- MMC Norilsk Nickel (European operations)

- Global Copper Resources Europe

- Hellenic Copper Mines (Greece)

- Kabelwerke Brugg AG (Copper wire & cables)

- Nexans (Copper cabling & solutions)

- Prysmian Group (Copper cables & systems)

- Recycled Copper Europe / Scrap processing companies

Segment Covered

By Product Type / Form

- Cathodes & Blister Copper

- Refined Copper Wire & Rods

- Copper Bars & Profiles

- Copper Foils & Sheets

- Copper Tubes & Pipes

- Scrap Copper

By Type / Grade

- Electrolytic Tough Pitch (ETP) Copper

- Oxygen-Free Copper (OFC)

- High Conductivity Copper

- Alloyed Copper (Brass, Bronze, Other Alloys)

By Application / End-Use Industry

- Electrical & Electronics (wiring, cables, motors)

- Construction & Building (pipes, roofing, plumbing)

- Automotive & Transportation (wiring harnesses, connectors, EV motors)

- Industrial Machinery & Equipment

- Renewable Energy (solar, wind, EV charging infrastructure)

- Consumer Goods & Appliances

- Others (coins, art, specialty applications)

By End-User / Buyer

- Electrical & Electronics Manufacturers

- Construction Companies

- Automotive OEMs

- Industrial Equipment Manufacturers

- Renewable Energy Developers

- Scrap & Recycling Companies