Content

Copper Foil Market Volume and Share 2034

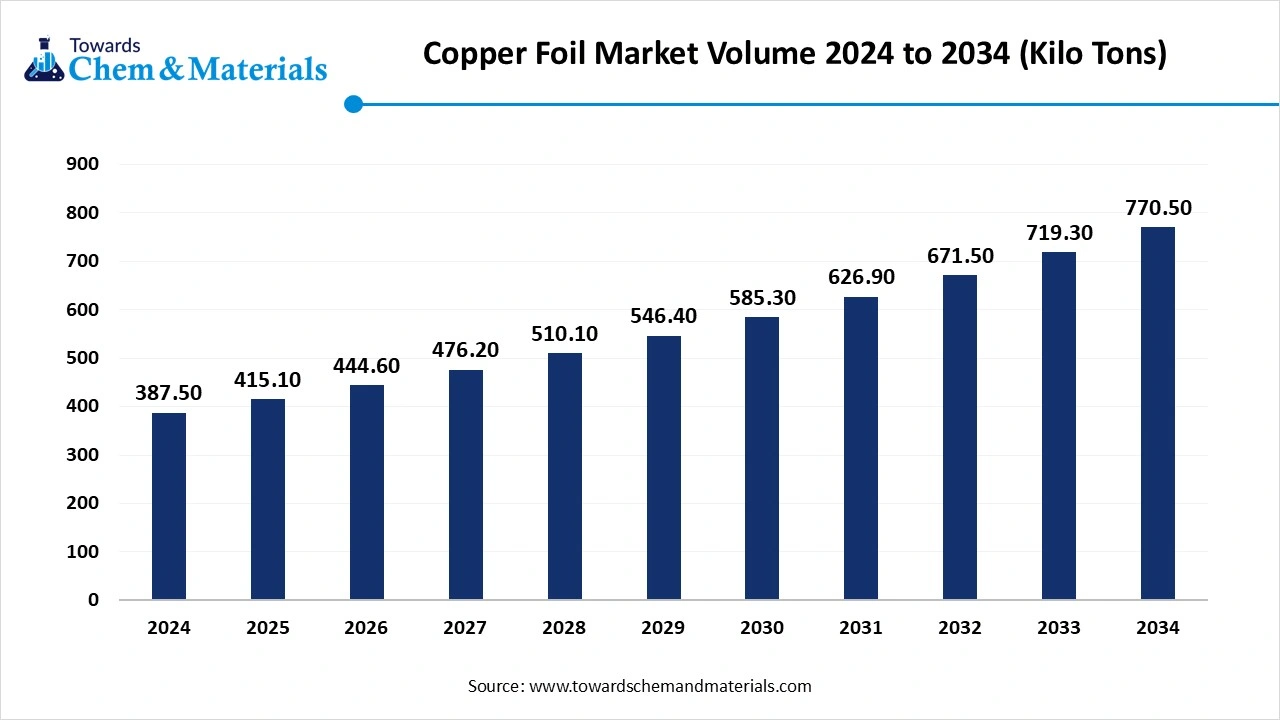

The global copper foil market volume is calculated at 387.50 kilo tons in 2024, grew to USD 415.07 kilo tons in 2025 and is predicted to hit around 770.50 kilo tons by 2034, expanding at healthy CAGR of 7.11% between 2025 and 2034. The increasing adoption of electric vehicles and the expansion of the electronics industry have accelerated market development in recent years.

Copper Foil Market Key Takeaways

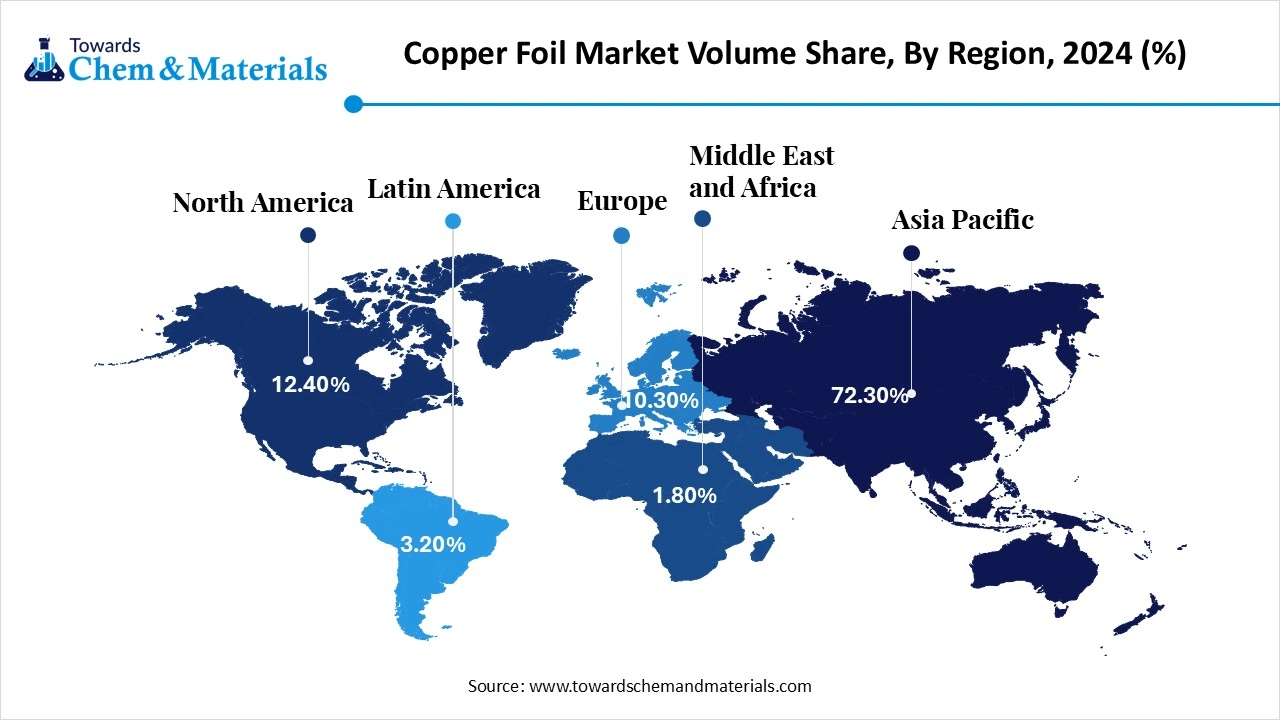

- The Asia Pacific copper foil industry dominated globally with a Volume share of 72.30% in 2024.

- The North America is anticipated to experience the fastest growth rate during the forecast period.

- The Europe has held Volume share of around 10.30% in 2024.

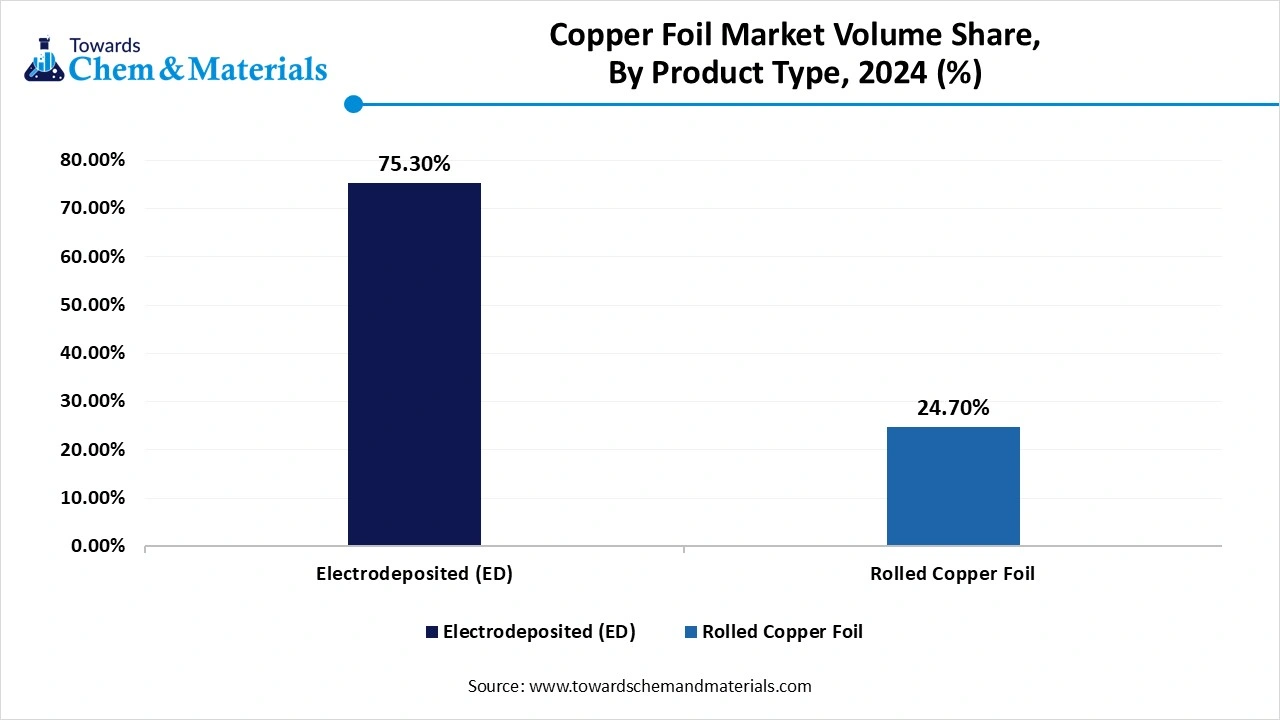

- By Product Type, the electrodeposited segment dominated the market, capturing a 75.30% Volume share in 2024

- By product, the rolled segment is expected to grow at the fastest rate in the market during the forecast period of 2025 to 2034.

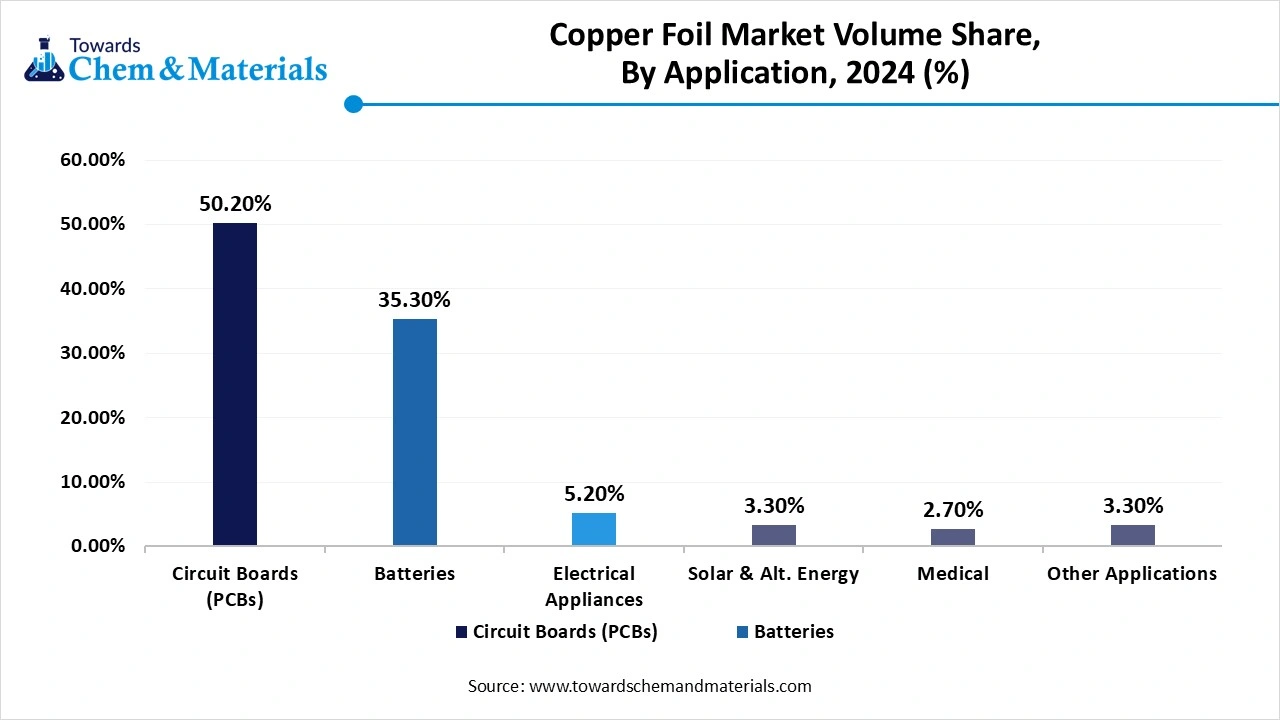

- By Application, the Circuit Boards (PCBs) segment dominated the market with the largest Volume share of 50.20% in 2024.

- By application, the batteries segment is set to experience the fastest rate of market growth from 2025 to 2034.

From Smartphones to Solar: Copper Foil Gains Momentum in Battery-Driven World

The copper foil market has witnessed rapid growth in earlier periods. The industry growth of copper foil is attributed to its unique properties, such as lightweight, excellent conductivity, and flexibility, in recent years. Moreover, the increasing demand for consumer electronics, energy storage, and telecommunications has gained major market share in the copper foil industry.

Also, the ongoing revolution of the electronic industry is expected to provide a wide consumer base for the copper foil manufacturers, as the copper foil has become an essential element in the making of printed circuit boards in the current period.

Furthermore, copper has exceptional recyclability, which is likely to create lucrative growth opportunities for foil producers during the projected periodAccording to a report published by Volza in 2025, China maintained its dominance with a huge number of copper foil export shipments, which were 113,734. Also, South Korea stands in the second position at copper foil exports with 59,548 shipments. Other countries also have greater shipment numbers, according to the infographic.

The increasing demand for lithium-ion batteries from heavy industries is driving market growth in the current period. Lithium batteries have become crucial in the development of laptops, smartphones, and electric vehicles nowadays. Moreover, the global shift towards sustainability, lithium-ion batteries are rapidly gaining a consumer base in the current market situation.

Several governments are imposing bans and rules and regulations on traditional fuel-based vehicles, while encouraging customers to buy EVs by providing benefits like tax reduction and subsidies. Also, the rising need for energy storage for solar and wind is heavily contributing to the lithium-ion battery sales in recent years, as the lithium-ion batteries allow energy storage for a longer period.

Copper Foil Market Trends

- The expansion of renewable energy applications is spearheading the copper foil market growth in the current industry scenario, as the solar and wind energy needs electrical components such as copper foil and others. Also, these foils are observed to be heavily used in solar inverters and power storage systems.

- The sudden surge in the adoption of electric vehicles is significantly driving the sector growth in the current period as the manufacturers are seen in heavy usage of copper foil in these vehicles for the battery application to improvising strength, flexibility, and electrical conductivity.

- The ongoing technological advancements in copper foil production are contributing to the copper foil market growth in recent years. As per the industry observation, several copper foil producers are using modern and advanced manufacturing techniques to capture substantial market share in the current days. Also, the automation and AI-based production facilities can play a major role in the growth of the industry while reducing downtime and labor costs.

Copper Foil Market Report Scope

| Report Attributes | Details |

| Market Volume in 2025 | 415.07 Kilo Tons |

| Expected Volume in 2034 | 770.50 Kilo Tons |

| Growth Rate | CAGR of 7.11% from 2025 to 2034 |

| Base Year of Estimation | 2024 |

| Forecast Period | 2025-2034 |

| Dominant Region | Asia Pacific |

| Segment Covered | By Product, By Application, By Region |

| Key Companies Profiled | Chang Chun Group,Circuit Foils,Doosan Corporation Electro-Materials,Furukawa Electric Co., Ltd.,Lingbao,Lotte Energy Materials Consumption,LS Mtron,Nippon Denkai, Ltd.,SKC,UACJ Foil Corporation |

From Ground Control to Space Missions: Copper Foil Emerges as Key Enabler

The expansion of the aerospace and defense sector is expected to create lucrative opportunities for the copper foil manufacturers. The copper foil is seen in use in applications such as control systems, communication systems, and navigation equipment in these sectors in the current period.

Also, the manufacturers can create a customized foil that meets the stringent standards of these industries and is likely to gain a major industry share in the coming years. Also, special programs like space exploration missions and others are expected to further expand the demand for copper foil in the future.

Rising Cost and Trade Shocks: The Hidden Hurdles for Copper Foil Producers

The unstable price of raw materials is expected to hamper the industry's growth during the forecast period, as the copper price is consistently observed to fluctuate. These fluctuations are generally due to geopolitical tension, such as recently America increased tariff rates on China imports called the Trump tariff, and sometimes can be due to supply chain disruptions. Moreover, the new entrants, smaller manufacturers, are likely to face these cost barriers during the projected period, as per the observations.

Copper Foil Market Regional Insights

Asia Pacific

Asia Pacific dominated the copper foil market in 2024. The increasing adoption of electric vehicles and the heavy need for electronics have provided a large consumer base for the copper foil manufacturer in recent years.

Moreover, the presence of heavy manufacturing industries has contributed to these ongoing market demands in the past period. Also, countries like South Korea, Japan, China, and India are considered as the enlarged EV and electronics production hubs with the heavy copper foil consumption in the current period.

From Gigafactories to Global Markets: How China is Dominating the Copper Foil Game

China maintained its dominance in the Asia Pacific region for the past period, akin to the enlarged production capacity with heavy domestic need for copper foils. Moreover, China has an advanced EV market, which is apparently pushing the copper foil demand every day, as manufacturers are seen in heavy usage of copper foil in lithium-ion batteries these days.

Also, the strong export capacities are increasing, providing a global consumer base to China’s copper foil manufacturers in the current period. Furthermore, the government of China has seen in heavy promotion of self-sufficient initiatives, which is contributing to the growth of the copper foil market as copper foil manufacturers are receiving benefits like tax reduction and attractive subsidies in recent years.

North America

North America is expected to grow at the fastest pace in the coming period. The upcoming advancement in battery technology will lead to the copper foil industry in the region for the upcoming years, as the major brands are seen as making heavy investments in the development and adoption of modern technology.

Moreover, the rapid expansion of the aerospace and consumer electronics industry is further contributing to the growth of the copper foil market in the region. Also, the flexibility and excellent conductivity of copper foil are likely to gain major market attraction in the defense and aerospace industry during the projected period.

Copper Foil in the United States Set for Growth as Nation Bets on Green Energy and Electronics the United States is expected to play a crucial role in the development of the copper foil market during the forecast period, akin to a sudden shift toward electrical vehicle adoption and clean energy production in the country.

Also, manufacturers of copper foil in the United States are involved in the development of customized copper foil for industries like telecom and others that need high-purity copper foil. Moreover, the increasingly heavy investments for reducing dependency on foreign countries for semiconductors and other electronics will help the copper foil industry to gain momentum in the coming years.

Copper Foil Market Segmental Insights

Product Insights

The rolled segment held the dominating share of the copper foil market in 2024. Having properties such as high purity, high performance, and superior mechanical properties is severely contributing to the segment growth in the current period. Moreover, the increasing demand for lithium-ion batteries, high-frequency circuit boards, and other electronics has gained substantial market share in the segment growth in recent years, as the rolled copper foil becomes an essential element in the making of these products. Furthermore, the better heat and corrosion properties of rolled copper foil have provided vast popularity in sectors such as industrial machinery, automotive, and aerospace in recent years.

On the other hand, the electrodeposited segment is expected to experience significant market growth in the future. The wide industrial applications are projected to drive segment growth during the forecast period, as the electrodeposit copper foil has efficiency, cost-effectiveness, and precision, which is required in these industries.

The increasing need for the printed circuit board is likely to provide a wide consumer base to the electrodeposited copper foil, as electrodeposited copper foil has become a critical element in the making of printed circuit boards in recent years, as per observation. Also, technological advancements are likely to contribute to this ongoing demand.

Application Insights

The circuit boards segment dominated the market with the largest share in 2024. The rapid expansion of the electronics industry has majorly contributed to the growth of the circuit board segment in recent years. As the copper foil is used as a conductive layer in these boards, which ensures smooth flow of electricity, the board connects to the various electronic components, which make it an irreplaceable element and provide major market attraction in the coming years. Moreover, the increasing demand for consumer electronics is leading to segment growth in the current industry scenario.

The batteries segment is expected to grow at the fastest rate in the market during the forecast period. The increasing use of lithium-ion batteries and the need for energy storage systems are likely to lead to segment growth in the coming years. Also, the favorable government policies for the usage of these materials, like batteries and others, will gain major market attraction in the future. Moreover, the battery manufacturers are seen in heavy technology integration in their batteries for improving performance is likely to gain major market share during the projected period as per industry observations.

Copper Foil Market Recent Developments

JINCHUAN GROUP CO., LTD

- Product Launch: In 2024, the Jinchuan group introduced their latest copper foil, which is double-sided lithium battery copper foil. Also, their foil has 4.5 um to 8 um maximum thickness according to their consumer needs. Also, the foil has properties such as good wettability and stable performance, as per the company's claim.

Hindalco Industries

Plant Establishment: In 2024, Hindalco is planning to establish a new plant in India. The plant aims to produce aluminum, copper, and specialty foil products for EV batteries in the coming years. Also, the company is likely to collaborate with technology giants for manufacturing in India, as per the company's claim.

Londian Wason

- Production Facility Launch: In 2024, the company signed an agreement with the Asas Panorama Sdn Bhd to expand the high foil development project. Also, the company is planning to make copper files, which are mostly used in EV batteries, as per the company's claim.

Key Players in the Copper Foil Market

- Chang Chun Group

- Circuit Foils

- Doosan Corporation Electro-Materials

- Furukawa Electric Co., Ltd.

- Lingbao

- Lotte Energy Materials Consumption

- LS Mtron

- Nippon Denkai, Ltd.

- SKC

- UACJ Foil Corporation

Segment Covered in the Report

By Product

- Electrodeposited

- Rolled

By Application

- Circuit Boards

- Batteries

- Electrical Appliances

- Solar & Alternative Energy

- Medical

- Other Applications

By Region

- North America

- U.S.

- Canada

- Mexico

- Europe

- UK

- Germany

- France

- Italy

- Spain

- Sweden

- Denmark

- Norway

- Asia Pacific

- Japan

- China

- India

- Australia

- South Korea

- Thailand

- Latin America

- Brazil

- Argentina

- The Middle East and Africa

- South Africa

- Saudi Arabia

- UAE

- Kuwait