Content

What is the Copper Wire Market Size and Volume?

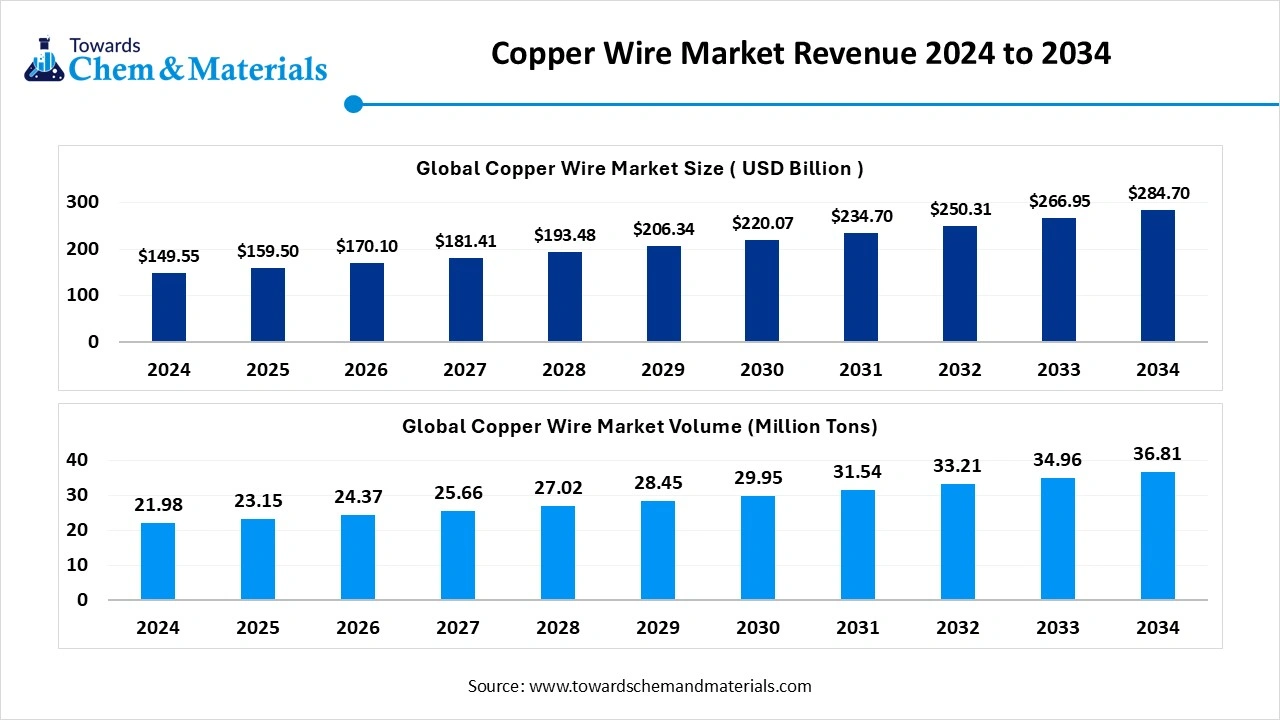

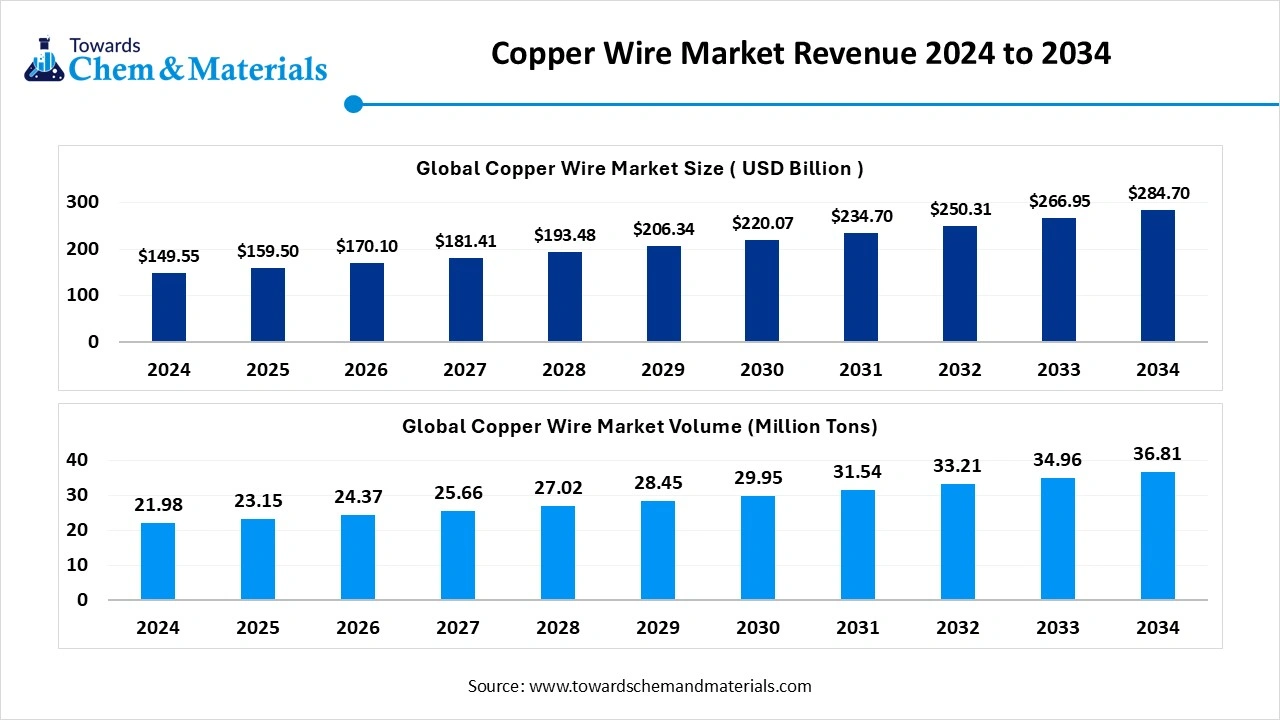

The global copper wire market size is calculated at USD 159.50 billion in 2025 and is expected to surpass around USD 284.70 billion by 2034, growing at a compound annual growth rate (CAGR) of 6.65% over the forecast period 2025 to 2034. The Asia Pacific dominated the copper wire market with a market share of 71% in 2024.

The global copper wire Market is expected to reach a volume of approximately 23.15 million tons in 2025, with a forecasted increase to 36.81 million tons by 2034, growing at a CAGR of 5.29% from 2025 to 2034.

Key Takeaways

- By region, Asia Pacific dominated the copper wire market share 71% in 2024, owing to the sudden expansion of industries such as power, construction, and electronics in the current period.

- By region, North America is expected to grow at a notable rate in the future, owing to heavy investment in clean energy projects.

- By type, the insulated copper wire segment emerged as the top-performing segment in 2024 due to its unique properties like flexibility, prevention of electrical shock, and safety in the current period.

- By type, the XLPE insulated segment is likely to experience notable growth during the expected period, akin to its ability to handle high voltages and temperatures.

- By form, the stranded copper wire segment led the market in 2024, owing to its flexibility and easier bending.

- By form, the fine strand segment is expected to grow significantly over the forecast period because it fits into small, complex spaces and handles high-performance tasks.

- By grade, the electrolytic tough pitch copper segment accounted for the highest of the copper wire market in 2024, akin to its excellent electrical conductivity and cost-effectiveness.

- By grade, the oxygen-free copper segment is projected to experience the quickest growth in the market over the forecast years, owing to its highest purity and conductivity

- By voltage range, the low range segment captured the biggest portion of the market in 2024, because it is easy to install, affordable, and safe to use in indoor environments

- By voltage range, the medium voltage segment is anticipated to expand at the highest rate in the coming years. They can handle higher voltages than household wires and are perfect for underground and long-distance power transmission

- By application, the power and energy segment led the market in 2024 because copper wire is ideal for the transformers and power generators.

- By application, the electric vehicle (EV) segment is expected to grow at the fastest rate in the market during the forecast period. Copper is needed for fast, safe power delivery and control

- By end user, the utilities segment emerged as the top consumer of the copper wire market in 2024, as utility companies are the biggest users of copper wire.

- By end user, the automotive OEM segment is likely to witness the most rapid growth in the market in the years ahead, as the automotive OEMs (Original Equipment Manufacturers) are rapidly adopting copper wire for electric vehicles.

Market Overview

The Backbone of Power and Precision: Copper Wire in Demand

The copper wire market refers to the global industry engaged in the production, distribution, and application of copper wire, an electrically conductive wire made primarily from refined copper. Copper wire is extensively used in power generation and transmission, telecommunications, electronics, automotive, building infrastructure, and industrial equipment, thanks to its excellent conductivity, ductility, and corrosion resistance. Also, by providing excellent advantages like flexibility, better conductivity, and durability, the copper wire has gained immense industry attention in recent years.

Which Factor is Driving the Growth of the Copper wire market?

The increased adoption of electric vehicles is spearheading the industry growth in the current period, as EV automakers are actively seen under the heavy usage of copper wire than traditional vehicles for vehicle batteries, motors, and charging systems. Moreover, the regional governments are actively playing a major role in the market expansion as a form of the implementation of green initiatives and providing attractive benefits of adopting the sustainability standards in the past few years. Also, copper's high conductivity and effectiveness are pushing its market potential in wide applications.

Market Trends

- The sudden establishment of renewable energy projects has driven the industry's growth in recent years. Moreover, the developers are increasingly demanding copper wire due to its flexibility and excellent conductivity.

- The sudden focus on recyclability and sustainability practices is contributing to the industry's growth in the current period. Moreover, having a 100% recycling quality made it the ideal material for industrial use in recent years.

Report Scope

| Report Attributes | Details |

| Market Size in 2025 | USD 159.50 Billion |

| Market Size by 2034 | USD 284.70 Billion |

| Growth rate from 2024 to 2025 | CAGR 6.65% |

| Base Year of Estimation | 2024 |

| Forecast Period | 2025 - 2034 |

| Dominant Region | Asia Pacific |

| Segment Covered | By Type, By Form, By Grade, By Voltage Range, By Application, By End User, By Region |

| Key Companies Profiled | Southwire Company, LLC, Prysmian Group , Nexans S.A. , LS Cable & System Ltd. , Sumitomo Electric Industries, Ltd. , Encore Wire Corporation , General Cable (a Prysmian brand), Rea Magnet Wire Company, Inc. , Belden Inc. , Furukawa Electric Co., Ltd. , KEI Industries Ltd. , Polycab India Ltd. ,RR Kabel , Finolex Cables Ltd., Leoni AG , Amphenol Corporation , LAPP Group , Saudi Cable Company , TPC Wire & Cable Corp. Gupta Power Infrastructure Ltd. |

Market Opportunity

Wire Producers Capitalize Sustainable Energy Momentum

The sudden expansion of the solar wind energy projects is expected to create a lucrative opportunity for the copper wire market in the coming years, as the copper wires are better conductive and flexible is actively encouraging the manufacturers to use them for the power storage and energy transmission in recent years. Also, wire producers are likely to offer innovative solutions for this sector, like specialized, high-efficacy, and weather-resistant wire solutions during the forecast period.

Market Challenge

Production Delays Loom Amid Rising Copper Costs

The price fluctuations of raw copper are anticipated to hinder the industry's growth in the upcoming years, as the supply of copper can face challenges like mining disruptions and global demand, which can slow down the global supply. Moreover, due to these issues, when the copper price increases, it can affect the profit margins and production delays from the small and mid-size producers in the coming years. However, advances in modern technology can play an ideal role in solving these problems, which is anticipated to drive the industry growth during the projected period, as per expectations.

Segmental Insights

Type Insights

How the Insulated Copper Wire Segment Dominated the Copper Wire Market in 2024?

The insulated copper wire segment held the largest share of the market in 2024, due to its unique properties like flexibility, prevention of electrical shock, and safety in the current period. As these insulated copper wires have been seen under heavy usage in applications such as homes, electronic spaces, and buildings in recent years. The need for safe wiring is pushing the growth of the segment in the current period.

The XLPE segment is seen to grow at a notable rate during the predicted timeframe, owing to its ability to handle high voltages and temperatures. Moreover, the power grid and industrial developers are increasingly demanding the XLPE segment for the durable and strong wiring needs, as per the recent observation, which is likely to play a major role in the segment's future market growth. Also, the long life and under stress performance are likely to drive the XLPE segment market potential in the coming years.

Form Insights

Why Stranded Copper Wire Segment Dominated the Copper Wire Market by Form Type?

The stranded copper wire segment held the largest share of the copper wire market in 2024, akin to its flexibility and the easier bending application. Also, the automakers and machine developers are actively seeking the stranded copper wire, which is reviving the industry growth in recent years, as per past years' observation. Moreover, individuals increasingly see heavy usage of the stranded wire in their daily applications, as per the survey.

The fine-stranded segment is expected to grow at a notable rate because it fits into small, complex spaces and handles high-performance tasks. As devices and vehicles become smarter and more compact, they need wire that's strong yet flexible. Fine strand wire is also better for reducing heat and supporting higher-speed electricity flow. It works well in wearable devices, drones, and smart gadgets, too. With more demand for advanced technology, fine strand copper wire is expected to see rapid growth and eventually lead the market in the coming years.

Grade Insights

Why Did the Electrolyte Tough Pitch Segment Dominate the Copper Wire Market in 2024?

The electrolyte tough pitch segment dominated the market with the largest share in 2024, owing to its excellent electrical conductivity and cost-effectiveness. It is the standard choice for most power cables, wiring systems, and electrical motors. ETP copper is easy to work with and widely available, making it the most popular grade. It is used in household wiring, transformers, and panel boards. This grade also has strong mechanical properties, so it performs well under everyday stress. Because it meets the needs of many industries without being too expensive, ETP copper wire has remained the most used type in the world.

The oxygen-free copper segment is expected to grow at the fastest rate in the market during the forecast period, akin to its highest purity and conductivity, making it perfect for high-tech electronics, audio systems, and electric vehicles. It is also corrosion-resistant and produces less electrical noise, which is important in sensitive equipment. As industries demand more precision and cleaner signal transfer, oxygen-free copper is gaining popularity. It's used in medical devices, aerospace electronics, and advanced charging systems. Though more expensive, its superior quality and performance make it the best choice for next-generation technologies.

Voltage Range Insights

Why is the Low Voltage Dominating the Copper Wire Market?

The low-voltage segment held the largest share of the market in 2024 because it is easy to install, affordable, and safe to use in indoor environments. These wires don't need heavy insulation or high durability, so they cost less and are more flexible. Because residential and commercial buildings make up a large part of global infrastructure, low-voltage applications dominate demand. Most common power and communication systems use low-voltage wires. As new homes, schools, and shops are built around the world, this segment continues to grow and lead the market today.

The medium voltage segment is observed to grow at the fastest rate during the forecast period. They can handle higher voltages than household wires and are perfect for underground and long-distance power transmission. With more investments in clean energy like wind and solar, medium-voltage wires are becoming essential. They are also used in factories and smart city infrastructure. These wires offer a good balance between performance and cost. As countries upgrade power systems and add new industrial zones, the medium-voltage segment will see higher demand and is expected to become the fastest-growing part of the market.

Application Insights

How Power and Energy Segment Dominated the Copper Wire Market Growth?

The power and energy segment led the market in 2024. Copper wire is ideal because it conducts electricity efficiently and lasts a long time. Power stations, transformers, and utility poles all rely on copper for stable operation. As the need for electricity grows globally, copper wiring remains essential in building and upgrading energy systems. Whether it's for fossil fuels or renewable energy sources, the demand for copper wire in the power sector remains high.

The electric vehicle (EV) segment is expected to grow at the fastest rate in the market during the forecast period. Copper is needed for fast, safe power delivery and control. As more countries push for cleaner transportation, EV production is rising fast. These vehicles need two to four times more copper than regular cars. Automakers also adding smart features and automation, which require even more wiring. With the global shift toward electric mobility, the EV segment will soon lead the copper wire market.

End User Insights

How the Utilities Segment Dominated the Copper Wire Market in 2024?

The utilities segment held the largest share of the market in 2024. Utility companies are the biggest users of copper wire because they build and maintain the power grid. They use copper in transmission lines, transformers, and substations to ensure a stable electricity supply. Utilities also invest in large-scale renewable energy projects, which require strong and durable wiring. Since most countries rely on national grids to deliver power, utility providers continue to be the top buyers.

The automotive OEM segment is seen to grow at a notable rate during the predicted timeframe. Automotive OEMs (Original Equipment Manufacturers) are rapidly adopting copper wire for electric vehicles, advanced safety systems, and in-car electronics. Modern cars have more electronics than ever-touchscreens, sensors, cameras, and charging ports. These need high-quality, flexible copper wiring. OEMs are also working on faster, lighter, and more energy-efficient vehicles, increasing the need for specialized copper wire. As EVs become more common, OEMs will invest heavily in copper to meet their production goals.

Regional Insights

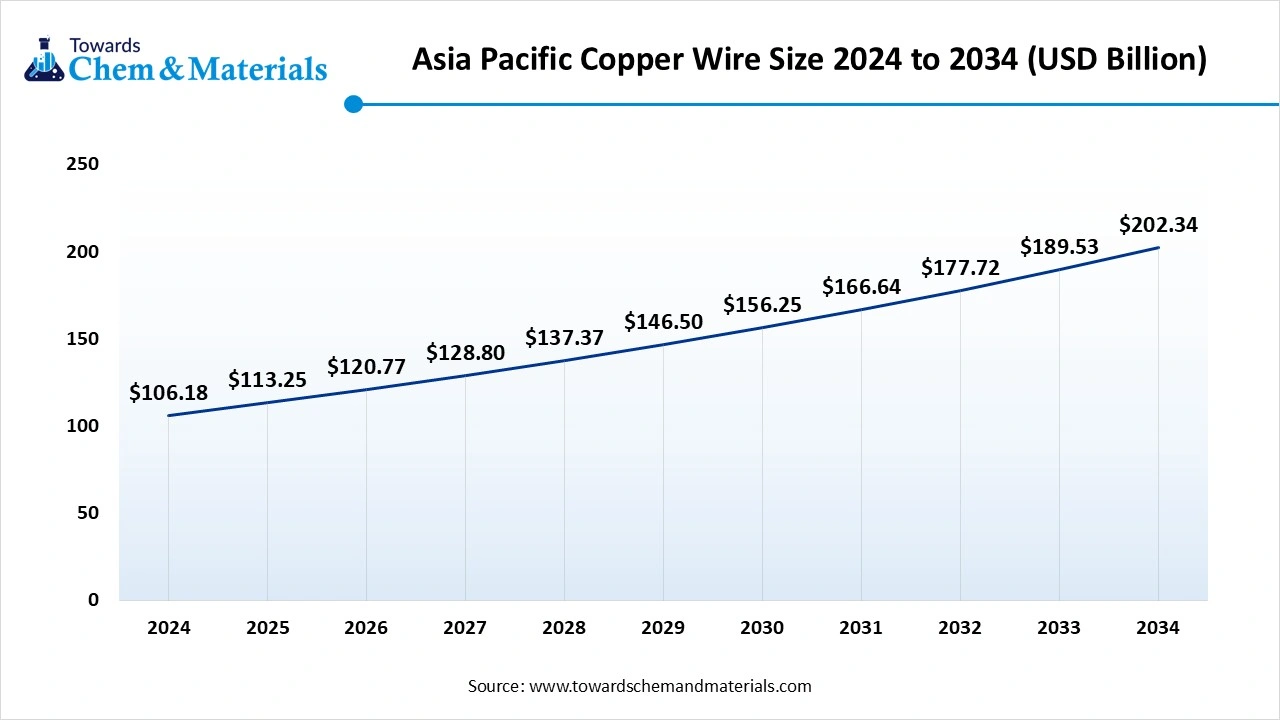

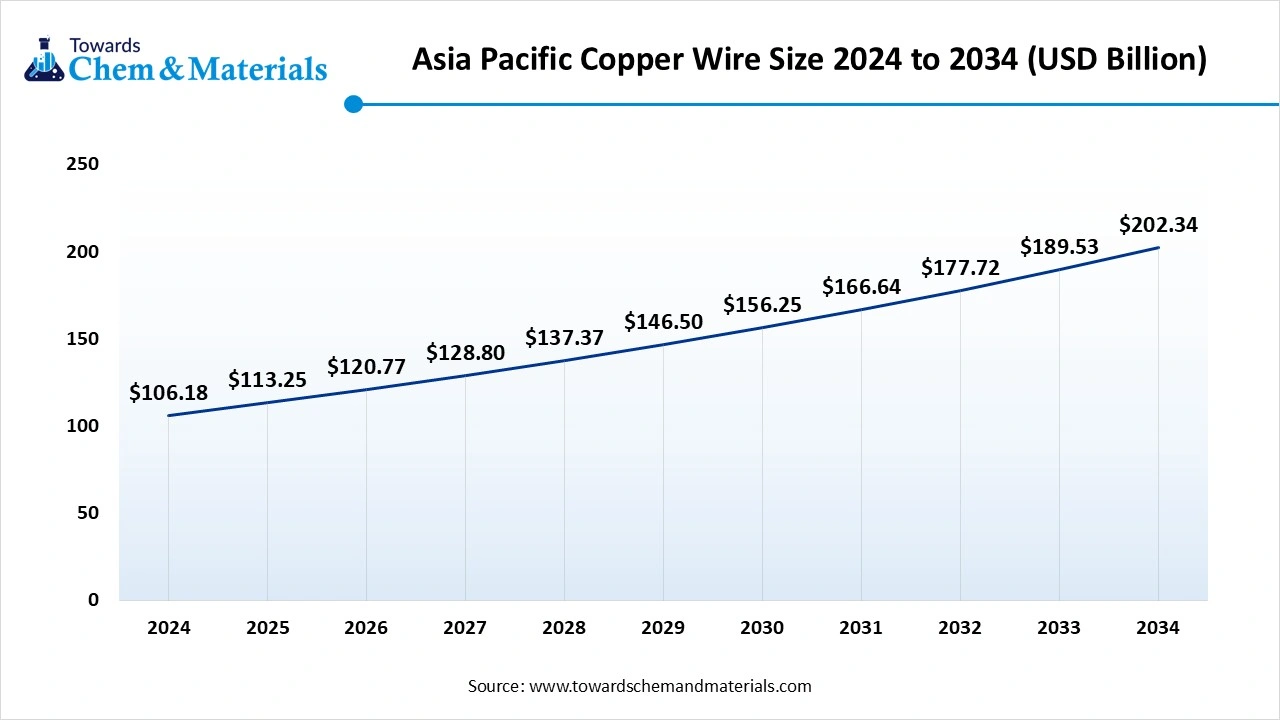

The Asia Pacific copper wire market size is calculated at USD 113.25 billion in 2025 and is predicted to increase from USD 120.77 billion in 2026 to approximately USD 202.34 billion by 2034, expanding at a CAGR of 6.66% from 2025 to 2034.

Asia Pacific dominated the market in 2024, akin to the sudden expansion of industries such as power, construction, and electronics in the current period. Moreover, the regional countries such as Japan, China, and India are seen under a heavy use of copper wiring for applications like factories and constructions. Also, the region has advantages like a huge and advanced manufacturing base with the wide availability of raw materials, which is actively leading the industry in the region, as per the recent observation.

Can China Sustain Its Lead in Copper-Dependent Sectors?

China maintained its dominance in the copper wire market, owing to the ongoing establishment of infrastructure projects. Moreover, the country is seeing a heavy demand for copper wire nowadays, akin to the huge base of the electric vehicle manufacturing and power stations in the current period. Moreover, the government is increasingly pushing industrial growth by implementing sustainability standards in the country.

North America expects significant growth in the market during the forecast period, owing to the heavy investments in clean energy initiatives. Moreover, the region has the latest technological advantage, which can play a major role in future industry development, as per the current industry observation. Also, several manufacturers in the region are increasingly investing in R&D activities to boost their manufacturing productivity and cost-effective solutions in the region.

How Are Data Centers Fueling Copper Cable Growth in the United States?

The United States is expected to rise as a dominant country in the North American region in the coming years, owing to the presence of heavy data centers and renewable energy plants, which is having the dependency on copper wire cables. Moreover, the country has access to the latest technology, which is likely to provide substantial advantages to the copper wire manufacturer in the coming years.

Recent Developments

- In October 2024, Remee Wire & Cable launched its latest stranded copper ground wires. Moreover, these newly launched wires are specifically designed for outdoor use for wind farms and solar arrays, as per the company's claim.(Source: www.globenewswire.com)

- In March 2025, Conticon increased the copper rod production recently. This sudden boost in copper production is mainly associated with the development of the wire cable industry, as per the report published by the company recently.(Source: www.sms-group.com)

Top Companies list

- Southwire Company, LLC

- Prysmian Group

- Nexans S.A.

- LS Cable & System Ltd.

- Sumitomo Electric Industries, Ltd.

- Encore Wire Corporation

- General Cable (a Prysmian brand)

- Rea Magnet Wire Company, Inc.

- Belden Inc.

- Furukawa Electric Co., Ltd.

- KEI Industries Ltd.

- Polycab India Ltd.

- RR Kabel

- Finolex Cables Ltd.

- Leoni AG

- Amphenol Corporation

- LAPP Group

- Saudi Cable Company

- TPC Wire & Cable Corp.

- Gupta Power Infrastructure Ltd.

Segment covered

By Type

- Bare Copper Wire

- Insulated Copper Wire

- PVC Insulated

- XLPE Insulated

- Teflon Insulated

- Rubber Insulated

By Form

- Solid Copper Wire

- Stranded Copper Wire

- Fine Strand

- Coarse Strand

By Grade

- Oxygen-Free Copper (OFC)

- Electrolytic Tough Pitch Copper (ETP)

- Deoxidized High Phosphorus Copper (DHP)

By Voltage Range

- Low Voltage (≤1kV)

- Medium Voltage (1kV–35kV)

- High Voltage (>35kV)

By Application

- Power & Energy

- Power Transmission & Distribution

- Substations

- Switchgears

- Building & Construction

- Residential Wiring

- Commercial Wiring

- Industrial Facilities

- Telecommunication

- Cable TV

- Internet Infrastructure

- Telephone Lines

- Automotive

- Electric Vehicles (EVs)

- ICE Vehicles

- Electronics

- Consumer Electronics

- Circuit Boards

- Industrial Machinery & Equipment

By End User

- Utilities

- Industrial

- Commercial

- Residential

- Automotive OEMs

- Telecom Providers

- Consumer Electronics Manufacturers

By Region

- North America

- U.S.

- Mexico

- Canada

- Europe

- Germany

- UK

- France

- Italy

- Asia Pacific

- China

- India

- Japan

- South Korea

- Central & South America

- Brazil

- Argentina

- Middle East & Africa

- Saudi Arabia

- UAE