Content

Ethylene Propylene Diene Monomer Market Size and Growth 2025 to 2034

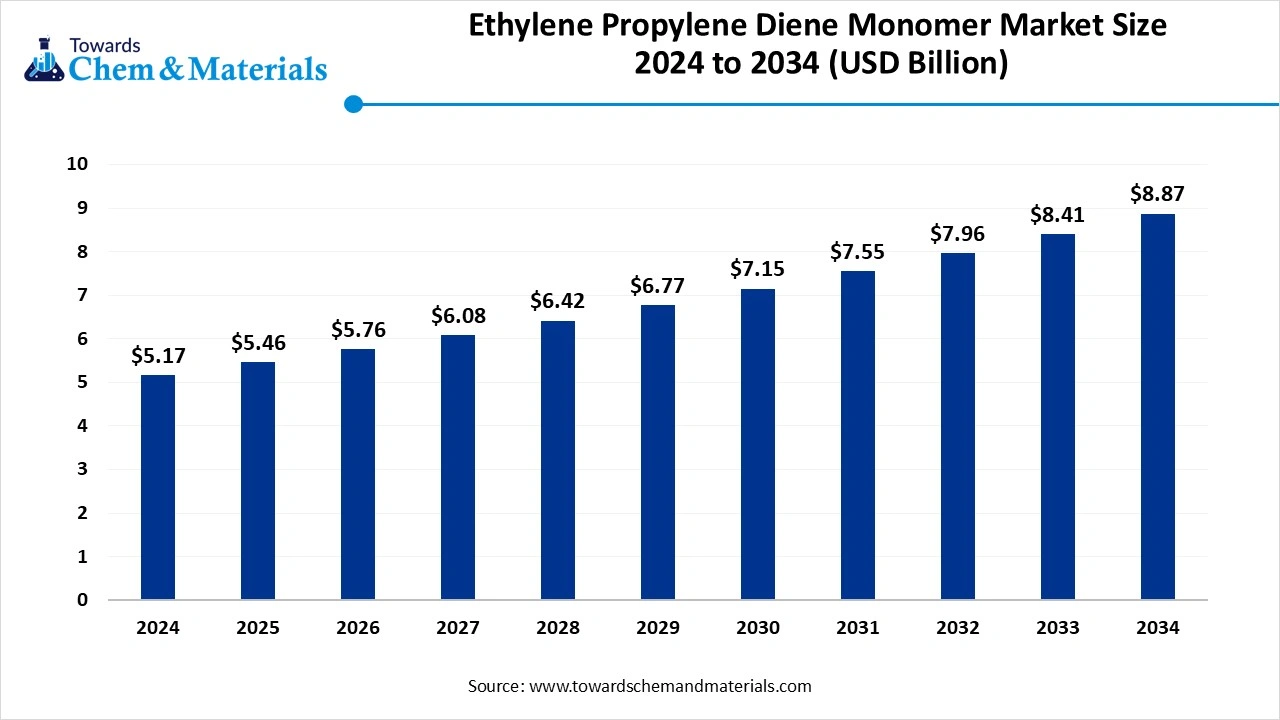

The global ethylene propylene diene monomer market size was estimated at USD 5.17 billion in 2024 and is predicted to increase from USD 5.46 billion in 2025 to approximately USD 8.87 billion by 2034, expanding at a CAGR of 5.55% from 2025 to 2034. The ongoing expansion of the automotive and construction industry has accelerated the market potential in recent years.

Key Takeaways

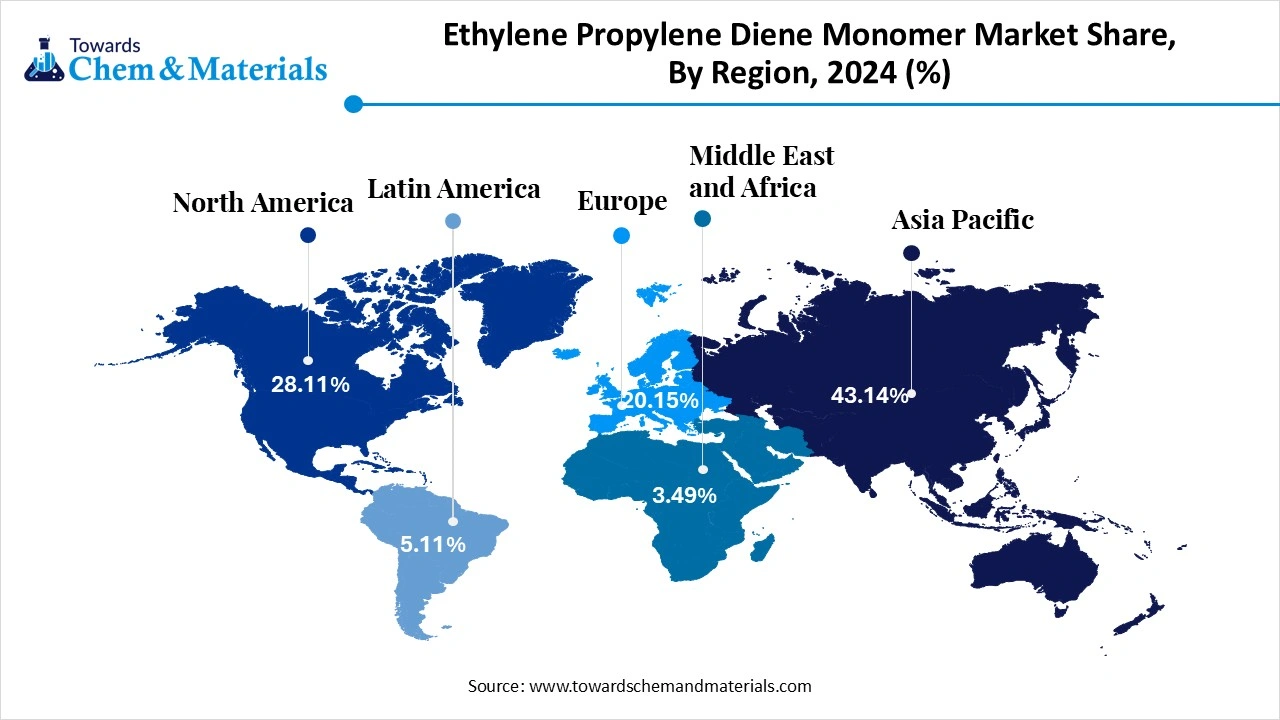

- Asia Pacific held the largest revenue share of the global ethylene propylene diene monomer industry and accounted for 43.14% in 2024, akin to ongoing expansion of the automotive industry and rapid infrastructure development in the current period.

- By region, North America is expected to grow at a notable rate in the future, owing to increasing focus on new innovations with the help of technological advancements in the region.

- By product type, the seals and O rings segment emerged as the top-performing segment share of 19.50% in 2024 due to increasing sealing applications in various industries and having better resistance to heat, chemicals, and any type of weather.

- By product type, the gasket segment is likely to experience notable growth during the expected period, akin to its superior properties like its ability to withstand extreme temperature, harsh chemicals, and pressure.

- By application, the automotive segment led the market share of 30.27% in 2024, as it is its use in weatherstripping, window and door seals, engine hoses, and vibration dampeners.

- By application, the lubricant additive segment is expected to grow significantly over the forecast period due to EPDM-based additives improving the performance of lubricants under high pressure and temperature.

Market Overview

Heat-Resistance and Long-Lasting: EPDM Powers Next-Gen Infrastructure

The ethylene propylene diene monomer market is expected to see steady growth owing to the increased widespread usage in industries such as the automotive, construction, and other industries. Moreover, having unique properties like greater resistance to heat, aging, and weather has further contributed to the demand in recent years. Several automakers are seen using these monomers in the car application, such as weather seals, insulation, roof membranes, and hoses, as per the recent industry observation. Also, the heavy need for long-lasting membranes and durable materials is severely driving the market growth in the current period. In developing countries, the market is gaining traction owing to the increasing demand for electric vehicles and construction development activities, as per the recent industry survey.

Which Factor is Driving the Growth of the EPDM?

The ongoing expansion of the automotive industry is spearheading the industry's growth in the current period. As the car owners are increasingly demanding better door seals, weather stripping, window seals, and under-hood parts for safety. In the making of these parts, the ethylene propylene diene monomer is playing the major role, as per the report observation. As the demand for vehicle production, specifically electric and hybrid vehicles, increases, the ethylene propylene diene monomer is expected to gain major industry potential in the coming years. Also, the EPDM is seen as increasing car performance and minimizing noise, which is contributing to the greater sales initiatives in recent years.

Market Trends

- The increasing adoption of electric vehicles is driving the market growth in recent years, as electric vehicle makers are increasingly using EPDM in their vehicle battery cooling systems, door seals, and other important parts in the past few years, as per industry observation.

- The ongoing implementation of the sustainability initiatives is driving industry growth as the EPDM manufacturers are seen in developing recyclable and eco-friendly rubber lines in recent years. Also, the use of technology advances supports the manufacturers and contributes to the market potential in today's industry environment.

- The expansion of construction and infrastructure development is leading the market growth in recent times. These EPDMs are used for applications such as roofing membranes, waterproof coatings, and window seals owing to their exceptional qualities, like UV-resistance, weatherproof nature.

Report Scope

| Report Attributes | Details |

| Market Size in 2025 | USD 5.46 Billion |

| Expected Size by 2034 | USD 8.87 Billion |

| Growth Rate from 2025 to 2034 | CAGR 5.55% |

| Base Year of Estimation | 2024 |

| Forecast Period | 2025 - 2034 |

| Dominant Region | Asia Pacific |

| Segment Covered | By Produtc, By Application, By Region |

| Key Companies Profiled | Dow, Exxon Mobil Corporation, Elevate (HOLCIM), ARLANXEO, Johns Manville, KUMHO POLYCHEM, Sumitomo Chemical Co., Ltd., Lion Elastomers, Mitsui Chemicals, Inc., PetroChina Company Limited, Rubber Engineering & Development Company (REDCO), SK Geo Centric Co., Ltd., Versalis (Eni S.p.A), West American Rubber Company, LLC |

Market Opportunity

Green Energy Push Positions EPDM as Strategic Material

The ongoing expansion of renewable energy is expected to create lucrative opportunities for ethylene propylene diene monomer market during the forecast period. In the solar energy sector, EPDM is increasingly used for the insulation, sealing, and weatherproofing of solar panels, as per recent observations. Moreover, having resistance to UV and greater durability, the EPDM is anticipated to gain industry attention as the ideal material for outdoor applications. Additionally, the increasing sustainability initiatives are expected to contribute to EPDM sales in the coming years, according to industry expectations.

Market Challenge

Profit-Driven Choices Lead to EPDM Market Restraints

The availability of alternative materials is expected to hinder ethylene propylene diene monomer market growth in the coming years. Alternatives such as the silicon rubbers, thermoplastic elastomers, and natural rubber have been increasingly seen as an alternative to EPDM in recent years. Moreover, the cost-effectiveness of these raw materials has further created industry growth barriers for the sale of EPDM in the past few years, as the manufacturers are increasingly demanding cost-effective

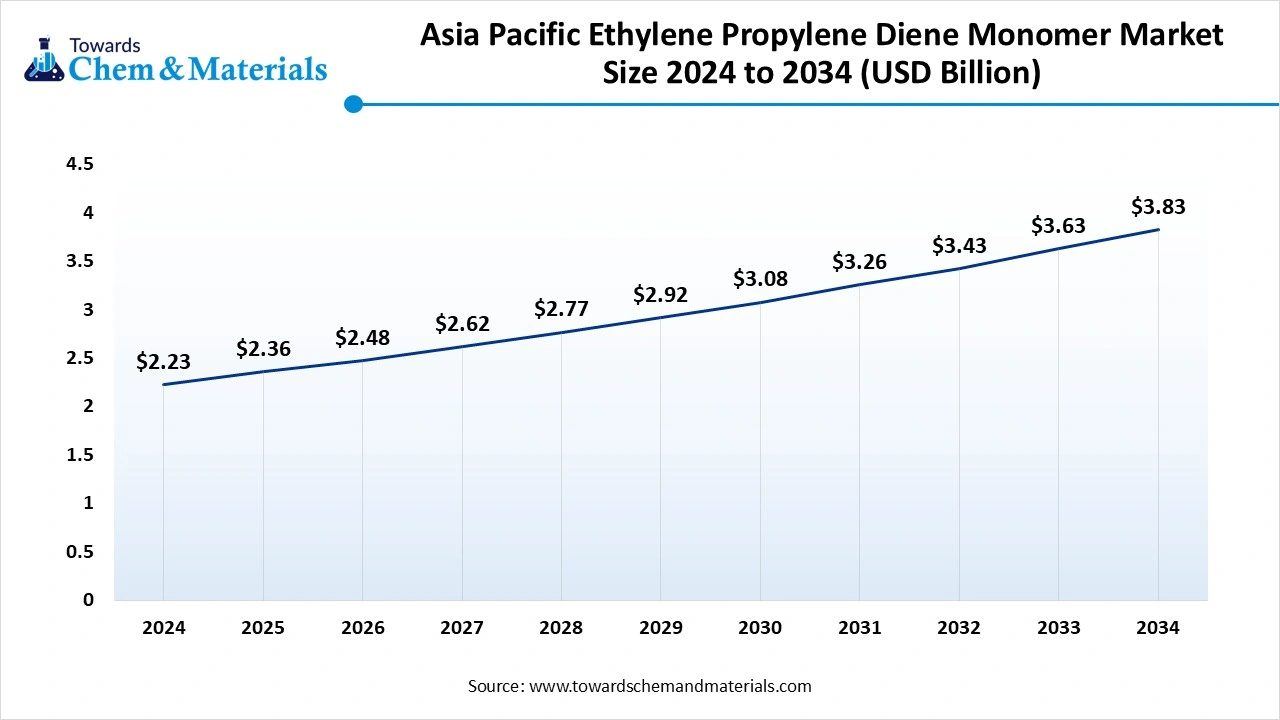

Regional Insights

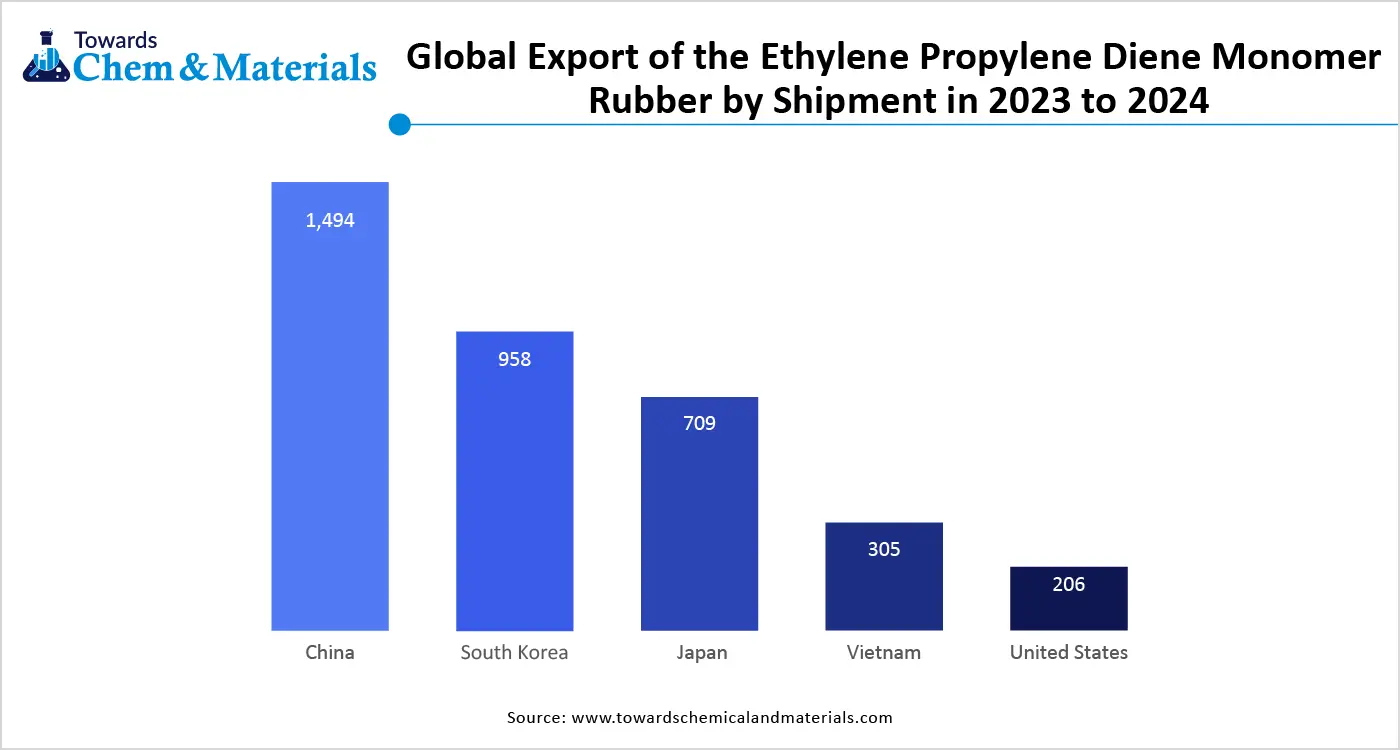

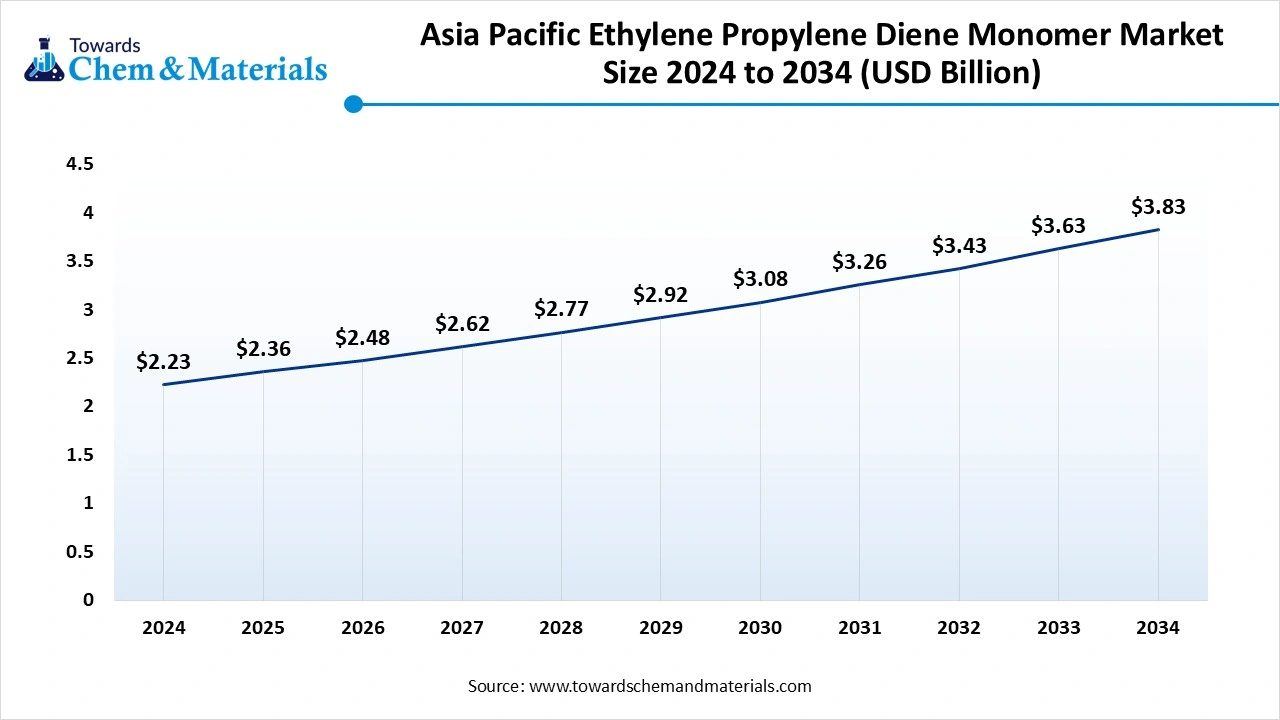

The Asia Pacific ethylene propylene diene monomer market is expected to increase from USD 2.36 billion in 2025 to USD 3.83 billion by 2034, growing at a CAGR of 5.56% throughout the forecast period from 2025 to 2034. Asia Pacific dominated the ethylene propylene diene monomer market in 2024. Asia Pacific accounted for the sophisticated revenue in the current sector, akin to the ongoing expansion of the automotive industry and rapid infrastructure development in the current period. The regional countries, such as Japan, India, China, and South Korea, have heavy manufacturing bases for various works like car parts, roofing, and others, where EPDM plays an ideal role. Moreover, having attractive benefits such as low labour cost, availability of raw materials, and sudden infrastructure development is contributing to the regional growth in recent years. Also, this can lead to the EPDM industry's growth in the coming years, as per the recent market environment observation.

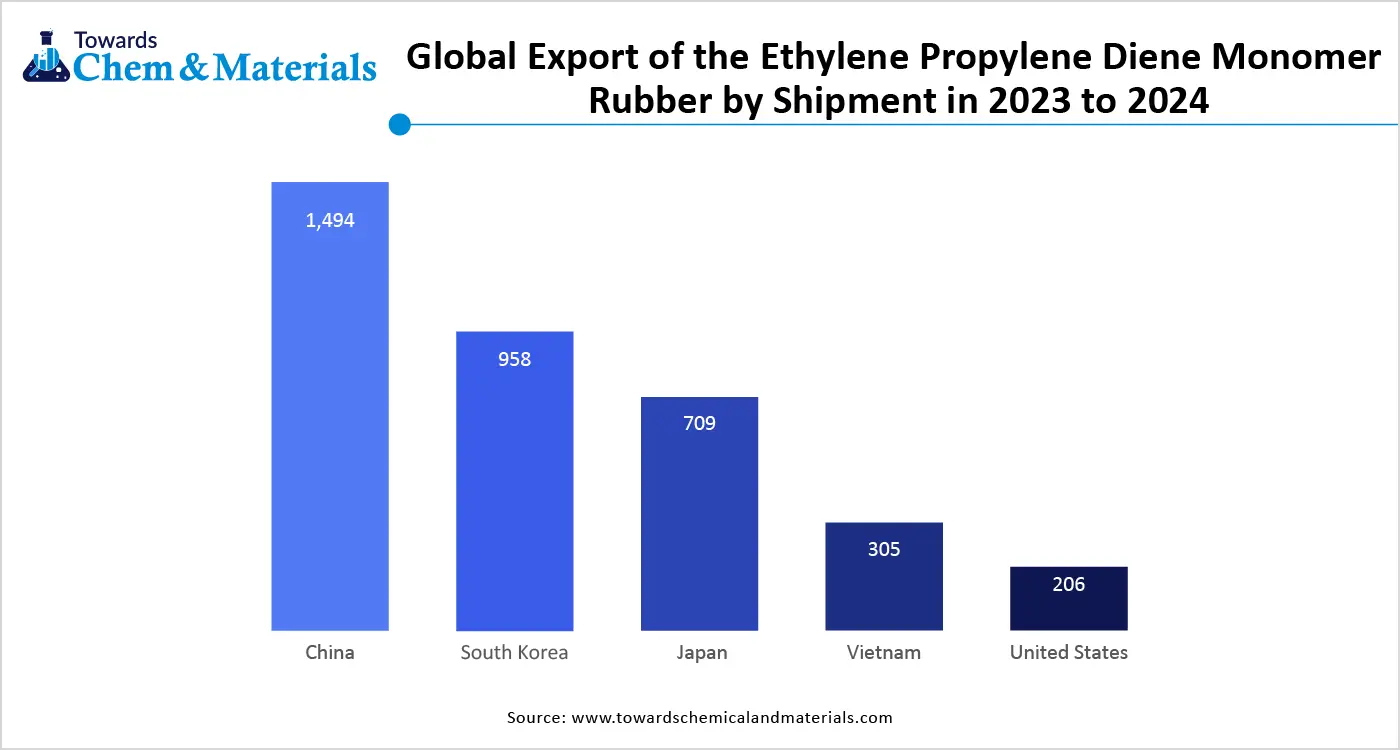

Is China’s EV Growth Fueling a New Wave of EPDM Demand?

China maintained its dominance in the ethylene propylene diene monomer market owing to having greater domestic production and consumption, according to recent observations. Also, China’s automakers are seen as heavily using EPDM in car parts such as sealing systems, engine parts, and hoses, which is leading the EPDM sales in the country nowadays. Moreover, the increasing adoption of advanced vehicles and EVs is contributing to the EPDM industry's growth in recent years, as per the recent country survey.

North America is expected to capture a significant share of the market during the forecast period, owing to increasing focus on new innovations with the help of technological advancements in the region. The individuals are increasingly demanding energy-efficient building structures and electric vehicles in recent years, which is expected to increase the usage of EPDM in the coming years. Also, the initiatives of advanced manufacturing further enhance the EPDM industry growth as per the market observation for the forecast period.

Can the American Tech-Driven Rubber Industry Lead Global Growth?

The United States is expected to rise as a dominant country in the North American region in the coming years, owing to the presence of a large-scale industrial base. Also, the United States is considered a technologically advanced region in the world. Moreover, the manufacturers are investing in research and development activities to produce the advanced EPDM, which is expected to increase industry growth during the forecast period. Also, the implementation of eco-friendly regulations is anticipated to drive industry growth as manufacturers are increasingly launching recyclable and high-quality rubber lineups as per the country’s recent observation.

Segmental Insights

Product Type Insights

How Seals and O-Rings Segment Dominated the Ethylene Propylene Diene Monomer Market in 2024?

The seals and O-rings segment held the largest share of the market in 2024, due to increasing sealing applications in various industries and having better resistance to heat, chemicals, and any type of weather. Moreover, the seals and O-rings are increasingly seen in applications such as pipelines, engines, and water systems to prevent leaks and ensure long-term durability, as per the observation. Also, in the earlier period, the increasing need for the maintenance of heavy machinery in various industries has actively contributed to the segment's growth in recent years.

The gasket segment is seen to grow at a notable rate during the predicted timeframe, owing to its superior properties like its ability to withstand extreme temperature, harsh chemicals, and pressure, which is slightly advanced than the seals and O-rings as per the recent observation. Moreover, these qualities make the gasket an ideal option for sealing and insulation in the automotive and heavy industry sectors. Also, the ongoing push for energy-efficient and emission reduction initiatives is anticipated to drive the segment growth as the gasket is considered the preferred material in the major sealing application, and the process of the replacement of old parts over the past few years.

Application Insights

What Made the Automotive Segment the Dominant Segment in 2024?

The automotive segment held the dominant share of the ethylene propylene diene monomer market in 2024, akin to its use in weatherstripping, window and door seals, engine hoses, and vibration dampeners. EPDM's heat, ozone, and weather resistance make it ideal for vehicles that need long-lasting and reliable rubber parts. As vehicle production increased globally, especially in developing countries, the demand for EPDM also rose. Automakers prefer EPDM because it helps improve comfort by reducing noise and sealing out moisture and dust. Its cost-effectiveness and durability made it a preferred choice, allowing the automotive segment to dominate the EPDM market over the past several years.

The lubricant additive segment is seen to grow at a notable rate during the predicted timeframe, owing to EPDM-based additives improving the performance of lubricants under high pressure and temperature. These additives enhance oil stability, reduce friction, and extend equipment life. As industries and vehicles become more advanced, they require high-performance lubricants for engines, gearboxes, and heavy machinery. The growing demand for synthetic and long-lasting lubricants in automotive, marine, and industrial applications will drive this segment forward. EPDM's chemical resistance and compatibility with oil formulations make it suitable for modern lubricant technologies, positioning this segment for strong future growth in the EPDM market

Recent Developments

- In July 2024, DOW introduced its NORDEL™ REN Ethylene Propylene Diene Terpolymers (EPDM), its eco-friendly version of the DOW’s EPDM, as reported by the company. Moreover, this product is specifically designed for the infrastructure, automotive, and consumer applications, as the company claims.(Source: corporate.dow)

- In September 2023, CDI products unveiled their latest aerospace sealing systems. This product lineup includes the T-Seals, OptiSealR, Pisto Rings, and the Static Face, which is produced from materials such as EPM and others, as per the report published by the company.(Source: cdiproducts)

Top Companies list

- Dow

- Exxon Mobil Corporation

- Elevate (HOLCIM)

- ARLANXEO

- Johns Manville

- KUMHO POLYCHEM

- Sumitomo Chemical Co., Ltd.

- Lion Elastomers

- Mitsui Chemicals, Inc.

- PetroChina Company Limited

- Rubber Engineering & Development Company (REDCO)

- SK Geo Centric Co., Ltd.

- Versalis (Eni S.p.A)

- West American Rubber Company, LLC

Segment Covered

By Product

- Hoses

- Hydraulic & Pressure Washer Hoses

- Industrial Hoses

- Others

- Seals & O-Rings

- Shaft Seal

- Molded Packing & Seals

- Motor Vehicle Body Seal

- Others

- Gaskets

- Metallic

- Semi-metallic

- Non-metallic

- Rubber Compounds

- Car Bumpers

- Fender Extensions

- Rub Strips

- Others

- Roofing Membranes

- Connectors and insulators

- Weather Stripping

- Others

By Application

- Building & Construction

- Electrical & Electronics

- Lubricant Additive

- Plastic Modifications

- Automotive

- Tires & Tubes

- Others

By Region

- North America

- U.S.

- Mexico

- Canada

- Europe

- Germany

- UK

- France

- Italy

- Asia Pacific

- China

- India

- Japan

- South Korea

- Central & South America

- Brazil

- Argentina

- Middle East & Africa

- Saudi Arabia

- UAE