Content

Butadiene Rubber Market Size, Price, Demand and Forecast, 2034

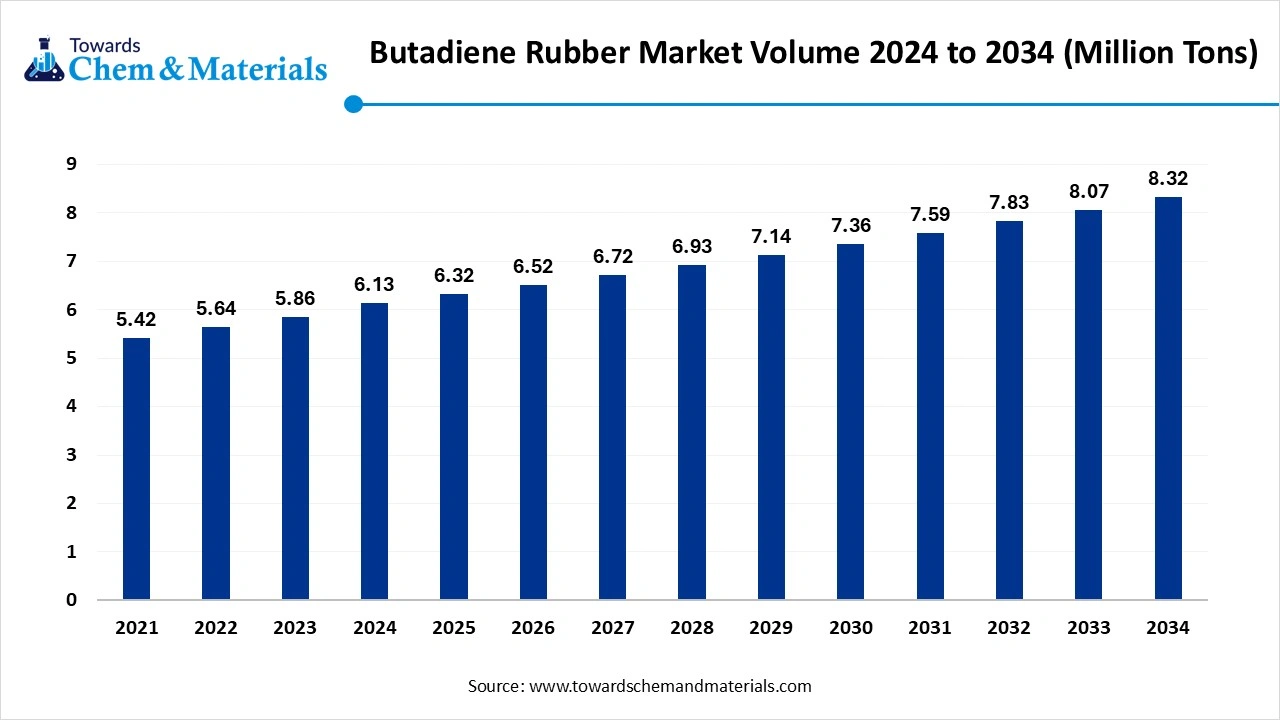

The global butadiene rubber market volume was reached at 6.13 million tons in 2024 and is expected to be worth around 8.32 million tons by 2034, growing at a compound annual growth rate (CAGR) of 3.10% over the forecast period 2025 to 2034. The increased expansion of the automotive sector has fueled industry potential in the current period.

Key Takeaways

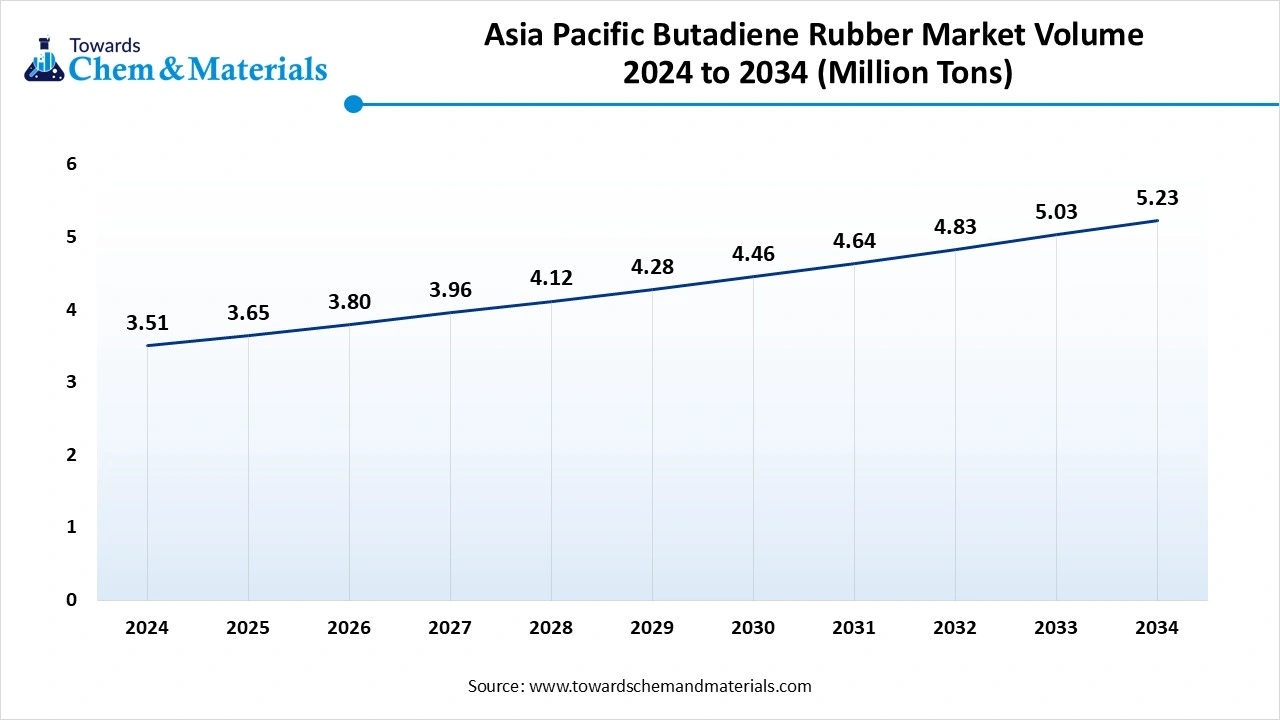

- The Asia Pacific butadiene rubber market Volume was estimated at USD 3.51 million tons in 2024 and is expected to reach USD 5.23 million tons by 2034, growing at a CAGR of 4.07% from 2025 to 2034.

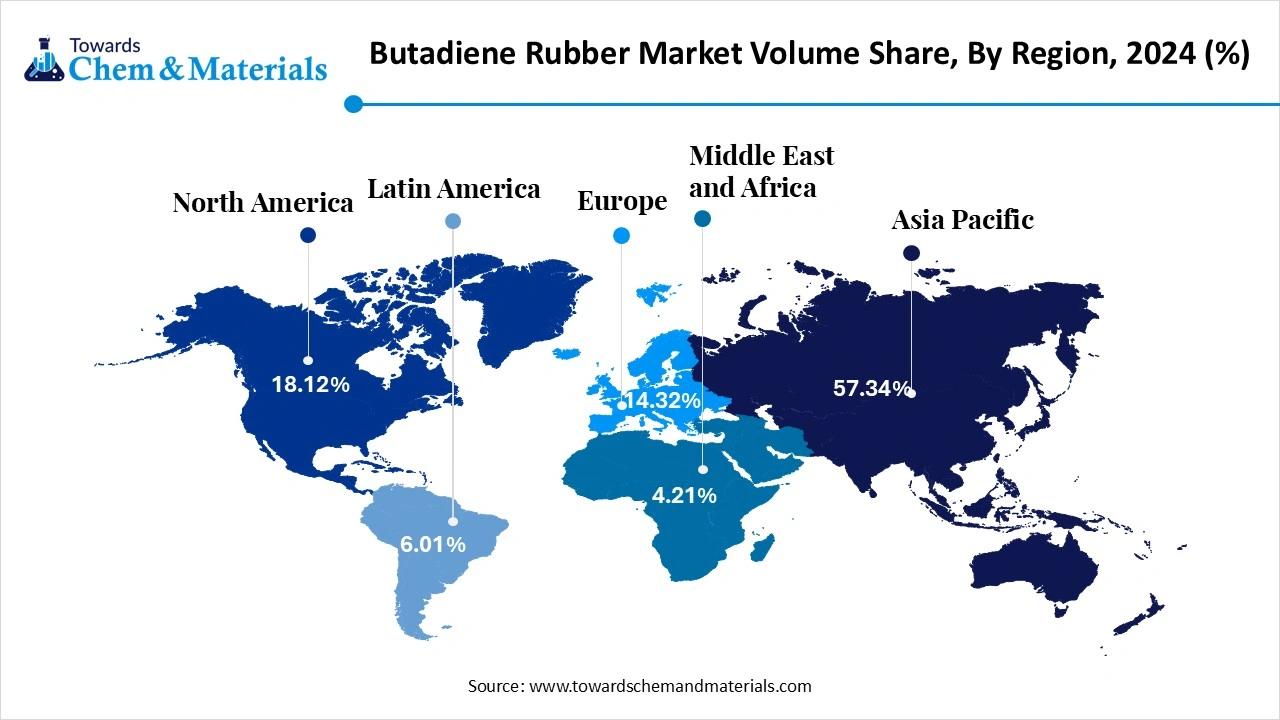

- The Asia Pacific butadiene rubber market held the largest Volume Share of 57.34% of the global market in 2024. owing to the presence of the large-scale automotive industry and the tire production industries.

- The North America butadiene rubber market is expected to register the fastest CAGR of 2.80% over the forecast period by 2025-2034 akin to a sudden shift towards high-performance tires with electric vehicle adoption

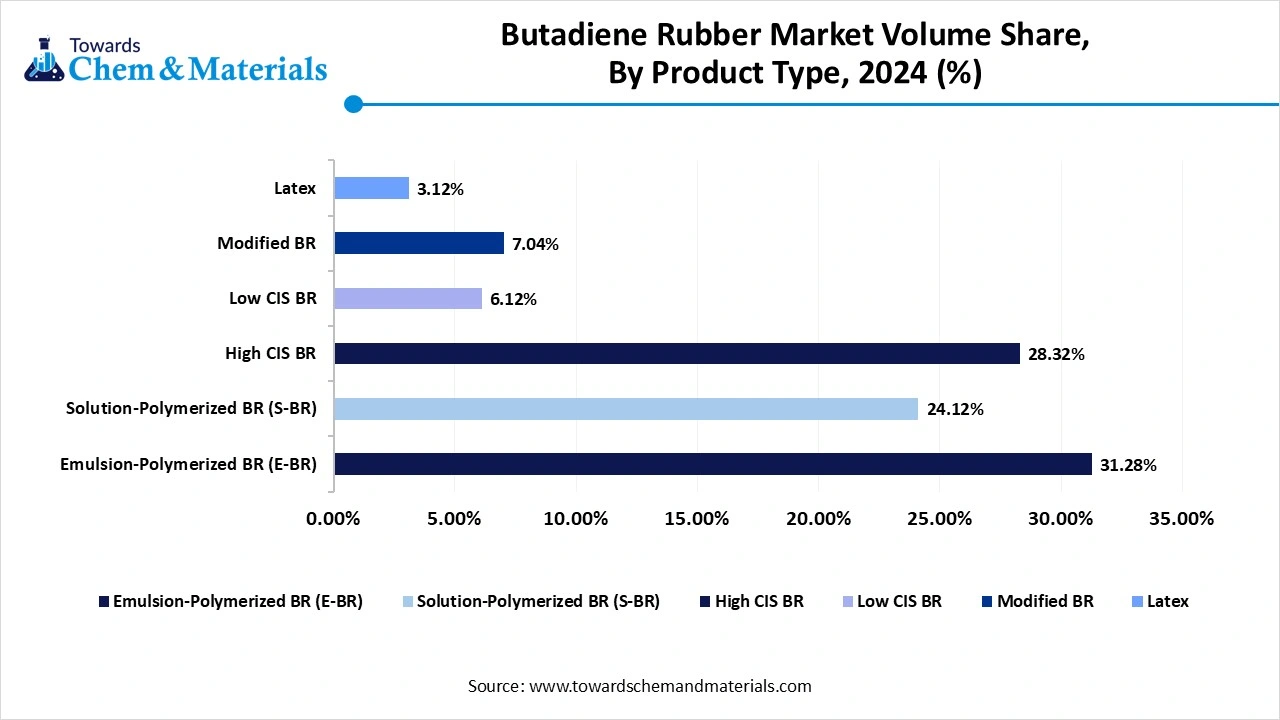

- By product type, the emulsion polymerized BR (E-BR) segment dominated the market with the largest Volume Share of 31.28% in 2024.due to having a low production cost with good abrasion resistance.

- By product type, the solution polymerized BR (S-BR) segment is projected to grow at the fastest CAGR of 6.07% over the forecast period by 2025-2034 due to the need for high-performance tires in recent years.

Market Overview

Built to Last: Butadiene Rubber in High Performance Products

Butadiene rubber (BR) is a synthetic rubber primarily derived from the polymerization of 1,3-butadiene. It is valued for its high resistance to wear, low-temperature flexibility, and excellent resilience. It is commonly used in the manufacturing of tires, footwear, adhesives, automotive parts, and industrial goods. The BR market is driven by demand from the automotive, industrial, and consumer goods sectors, often in the form of emulsion (E-SBR) or solution (S-SBR) products.

Which Factor Is Driving the Butadiene Rubber Market?

The increasing need for tires for the automotive sector is spearheading the industry's growth in the current period. Moreover, by providing excellent flexibility, durability, and wear resistance, the butadiene rubber has emerged as the ideal raw material in the production of tires in the past few years. As the industry trend, such as the adoption of the EV vehicle, and others actively participating in the industry potential in the current phase of the market.

Market Trends

- The sudden shift towards eco-friendly rubber production is driving the market potential in recent years, as the global governments are seen as supporting the manufacturers who are applying sustainability initiatives in their manufacturing.

- The increased need for high-performance tires is contributing to the market growth in recent years. Moreover, several automakers are actively looking for a reliable and high-performance tire option for their vehicle.

Report Scope

| Report Attribute | Details |

| Market Volume in 2025 | 6.32 Million Tons |

| Expected Volume by 2034 | 8.32 Million Tons |

| Growth Rate from 2025 to 2034 | CAGR 3.10% |

| Base Year of Estimation | 2024 |

| Forecast Period | 2025 - 2034 |

| Dominant Region | Asia Pacific |

| Segment Covered | By Product Type, By Application, By End-Use Industry, By Distribution Channel, By Processing Technology, By Region |

| Key Companies Profiled | Lanxess AG, JSR Corporation, Sibur Holding , LG Chem, Trinseo, Sinopec , Goodyear Tire & Rubber Company, Kumho Petrochemical , Nizhnekamskneftekhim (NKNK) , Versalis (ENI) , ZEON Corporation , Reliance Industries Limited (RIL) , ExxonMobil Chemical , TSRC Corporation , Braskem , PetroChina Company Limited , Arlanxeo , Lotte Chemical Corporation , Haldia Petrochemicals , Dynasol Elastomers |

Market Opportunity

Recycled Rubber Creates Green Pathways for Industry Expansion

The development of the recycled rubber blend is expected to create lucrative opportunities for the manufacturers in the coming years, as the manufacturers can combine the recycled rubber blends with the new butadiene rubber, which offers cost-effectiveness and eco-friendly labeling at the same time. Also, the manufacturers can expand their businesses in the developing regions where sectors such as the automotive and rubber products are under rapid expansion.

Market Challenge

Rising Petrochemical Instability Threatens Butadiene Rubber Manufacturing Growth

The high price fluctuation of the raw material is anticipated to hinder the industry's growth in the coming years. Moreover, raw materials such as crude oil and naphtha have experienced various price fluctuations in previous years, which is likely to create growth barriers for the market in the coming years. Also, factors such as geopolitical tensions and supply chain issues are projected to hinder the industry's potential.

Regional Insights

Asia Pacific

The Asia Pacific butadiene rubber market Volume was estimated at USD 3.51 million tons in 2024 and is anticipated to reach USD 5.23 million tons by 2034, growing at a CAGR of 4.07% from 2025 to 2034.

Asia Pacific dominated the market in 2024, akin to the presence of the large-scale automotive industry and the tire production industries. Furthermore, the regional advantages, such as the low-cost manufacturing and skilled workforce, are actively attracting major global manufacturing companies to the region in recent years. Furthermore, the regional countries such as China, India, and Japan are seen under the heavy demand for synthetic materials to produce hoses, tires, and belts in the current period.

How Has China Secured Its Lead in the Global Butadiene Rubber Industry?

China maintained its dominance in the butadiene rubber market, owing to its massive tire production units. Moreover, the country is considered the world's largest synthetic rubber producer, with heavy consumption at the same time. The manufacturers in China are gaining significant advantages from their domestic consumption of synthetic rubber in recent years. Furthermore, the manufacturers have been actively seen in investing in advanced polymer technologies in the past few years.

Butadiene Rubber Market Volume Share, By Region, 2024 (%)

| By Region | Volume Share, 2024 (%) | Market Volume Million Tons - 2024 | Market Volume Million Tons - 2034 | Volume Share, 2034 (%) | CAGR (2025 - 2034) |

| North America | 18.12% | 1.11 | 1.42 | 17.12% | 2.80% |

| Europe | 14.32% | 0.88 | 1.03 | 12.34% | 1.76% |

| Asia Pacific | 57.34% | 3.51 | 5.23 | 60.51% | 4.07% |

| Latin America | 6.01% | 0.37 | 0.54 | 6.53% | 4.41% |

| Middle East & Africa | 4.21% | 0.26 | 0.29 | 3.50% | 1.35% |

| Total | 100% | 6.13 | 8.32 | 100% | 3.10% |

North America

North America is expected to capture a major share of the market during the forecast period, owing to a sudden shift towards high-performance tires with electric vehicle adoption. Moreover, the region has seen under the heavy need for advanced rubber tires such as the S-BR and others as per the recent regional survey. Furthermore, the region is also observed in putting investment in sustainability, where manufacturers are actively looking for recycled material in recent years.

What Role Does R&D Play in Shaping the Future of the United States Rubber Production?

The United States is expected to rise as a dominant country in the region in the coming years, owing to increasing demand from sectors such as aerospace, automotive, and industrial. Moreover, the manufacturers are increasingly investing in advanced R&D activities for the development of high-performance rubber in recent years. Furthermore, the government has increasingly supported the local manufacturing initiatives in the past few years.

Segmental insights

Product Type Insights

How did the Emulsion Polymerized BR (E-BR) Segment Dominate the Butadiene Rubber Market in 2024?

The emulsion polymerized BR (E-BR) segment held the largest share of the market in 2024, due to having a low production cost with good abrasion resistance. Moreover, its easy production and wide application suitability have provided immense industry attention in recent years. Furthermore, having the cost effectiveness, several industries where the extreme performance is not proprietary are actively demanding the emulsion polymerized BR in recent years.

Butadiene Rubber Market Volume Share, By Product Type, 2024 (%)

| By Product Type | Volume Share, 2024 (%) | Market Volume Million Tons - 2024 | Volume Share, 2034 (%) | Market Volume Million Tons - 2034 | CAGR (2025 - 2034) |

| Emulsion-Polymerized BR (E-BR) | 31.28% | 1.92 | 25.31% | 2.11 | 1.05% |

| Solution-Polymerized BR (S-BR) | 24.12% | 1.48 | 30.21% | 2.51 | 6.07% |

| High CIS BR | 28.32% | 1.74 | 28.01% | 2.33 | 3.33% |

| Low CIS BR | 6.12% | 0.38 | 5.45% | 0.45 | 2.13% |

| Modified BR | 7.04% | 0.43 | 8.01% | 0.67 | 4.95% |

| Latex | 3.12% | 0.19 | 3.01% | 0.25 | 3.04% |

| Total | 100% | 6.13 | 100% | 8.32 | 3.10% |

The solution polymerized BR (S-BR) segment is expected to grow at a notable rate during the predicted timeframe due to the need for high-performance tires in recent years. By offering better rolling resistance and fuel efficiency, the major manufacturers are actively seen in the heavy adoption of the solution polymerized segment. Furthermore, the EV sector has provided immense attention to the solution polymerized segment in the past few years.

Application Type

Why does the Tires and Tire Products Segment Dominate the Butadiene Rubber Market by Application Type?

The tires and tire products segment held the largest share of the butadiene rubber market in 2024, owing to butadiene rubber is considered a crucial element in the production. Moreover, the increased expansion of the automotive industry is expected to create significant industry opportunities in the coming years, as per recent observations.

The footwear segment is expected to grow at a notable rate, owing to the increased need for comfort, convenience, durability, and luxury requirements in the footwear industry. Moreover, by providing flexibility and better cushioning, the butadiene rubber emerged as the ideal material in the footwear industry in the past few years.

End Use Industry insighst

Why Did the Automotive Segment Dominate the Butadiene Rubber Market in 2024?

The automotive segment dominated the market with the largest share in 2024 as it is the primary user of butadiene rubber in tires, hoses, belts, and seals. Rubber's flexibility, strength, and resistance to wear and heat make it essential for various vehicle components. As more vehicles hit the roads, especially in Asia Pacific, demand for automotive-grade rubber remains high. The replacement tire market also supports steady consumption.

The industrial segments are expected to grow at a notable rate. Because butadiene rubber is increasingly used in machinery parts, belts, gaskets, and seals. As manufacturing sectors modernize and expand-especially in robotics, automation, and heavy equipment-durable synthetic rubber becomes more essential. Industries are looking for heat, abrasion, and oil-resistant materials for reliable operations, and butadiene rubber meets these needs.

Distribution Channel Insights

Why Did the Direct Sales Segment Dominate the Butadiene Rubber Market in 2024?

The direct sales segment held the largest share of the market in 2024 because most large manufacturers and bulk buyers prefer direct transactions for better pricing, reliability, and supply control. Industries such as tire, automotive, and footwear manufacturing require consistent volumes and quality, which are directly dealt with by producers. Long-term contracts, customization, and technical support are easier to manage through direct sales.

The E-commerce platform segment is expected to grow at a notable rate during the predicted timeframe due to growing digitalization and preference for quick, transparent purchases. Small and medium enterprises (SMEs), which are rising in number, prefer flexible purchasing through online platforms that offer easy comparisons, bulk discounts, and global sourcing. These platforms provide access to a variety of grades, prices, and suppliers, especially for buyers in remote or developing regions.

Process Technology Insights

How does the Solution Polymerization Segment Maintain Dominance in the Processing Type?

The solution polymerization segment held the largest share of the market in 2024 due to the high-quality rubber it produces, especially for advanced applications like high-performance tires. This method allows for better control over molecular weight and branching, resulting in consistent and high-performance material. It also enables the creation of specialized rubber grades with improved durability, fuel efficiency, and weather resistance.

The thermomechanical blending segment is expected to grow at the fastest rate during the forecast period due to its efficiency and eco-friendliness. This process blends rubber with fillers and additives mechanically under heat, reducing the need for solvents and water. It's energy-saving and environmentally safer. The method also supports recycling and upcycling of rubber waste, aligning with sustainability goals.

Recent Developments

- In February 2025, Yokohama Rubber and Zeon established a strategic collaboration. The main motive of the collaboration is to produce plant-based butadiene as per the report published by the company(Source : tyre-trends.com)

- In November 2024, Bridgestone received federal funding to produce synthetic rubber. Moreover, the company’s motive for the future is to convert ethanol into butadiene, as per the report published by the company recently(Source: www.chemanalyst.com)

Top Companies List

- Lanxess AG

- JSR Corporation

- Sibur Holding

- LG Chem

- Trinseo

- Sinopec

- Goodyear Tire & Rubber Company

- Kumho Petrochemical

- Nizhnekamskneftekhim (NKNK)

- Versalis (ENI)

- ZEON Corporation

- Reliance Industries Limited (RIL)

- ExxonMobil Chemical

- TSRC Corporation

- Braskem

- PetroChina Company Limited

- Arlanxeo

- Lotte Chemical Corporation

- Haldia Petrochemicals

- Dynasol Elastomers

Segment Covered

By Product Type (Volume, Kilotons; Revenue, USD Million, 2021 - 2034)

- Emulsion-Polymerized BR (E-BR)

- Solution-Polymerized BR (S-BR)

- High Cis BR

- Low Cis BR

- Modified BR

- Latex

By Application (Volume, Kilotons; Revenue, USD Million, 2021 - 2034)

- Tires & Tire Products

- Passenger Car Tires

- Truck/Bus Tires

- Two-Wheeler Tires

- Footwear

- Adhesives & Sealants

- Polymer Modification

- Impact Modifiers

- Plastics Blending (e.g., HIPS, ABS)

- Industrial Rubber Goods

- Wires & Cables

- Others

- Sporting Goods

- Conveyor Belts

By End-Use Industry (Volume, Kilotons; Revenue, USD Million, 2021 - 2034)

- Automotive

- Construction

- Electronics & Electrical

- Consumer Goods

- Industrial Manufacturing

- Aerospace

- Others

By Distribution Channel (Volume, Kilotons; Revenue, USD Million, 2021 - 2034)

- Direct Sales (OEMs)

- Distributors/Dealers

- E-Commerce Platforms

By Processing Technology (Volume, Kilotons; Revenue, USD Million, 2021 - 2034)

- Solution Polymerization

- Emulsion Polymerization

- Thermomechanical Blending

By Region

- North America

- U.S.

- Mexico

- Canada

- Europe

- Germany

- UK

- France

- Italy

- Asia Pacific

- China

- India

- Japan

- South Korea

- Central & South America

- Brazil

- Argentina

- Middle East & Africa

- Saudi Arabia

- UAE