Content

Essential Oils Market Size, Share & Industry Analysis

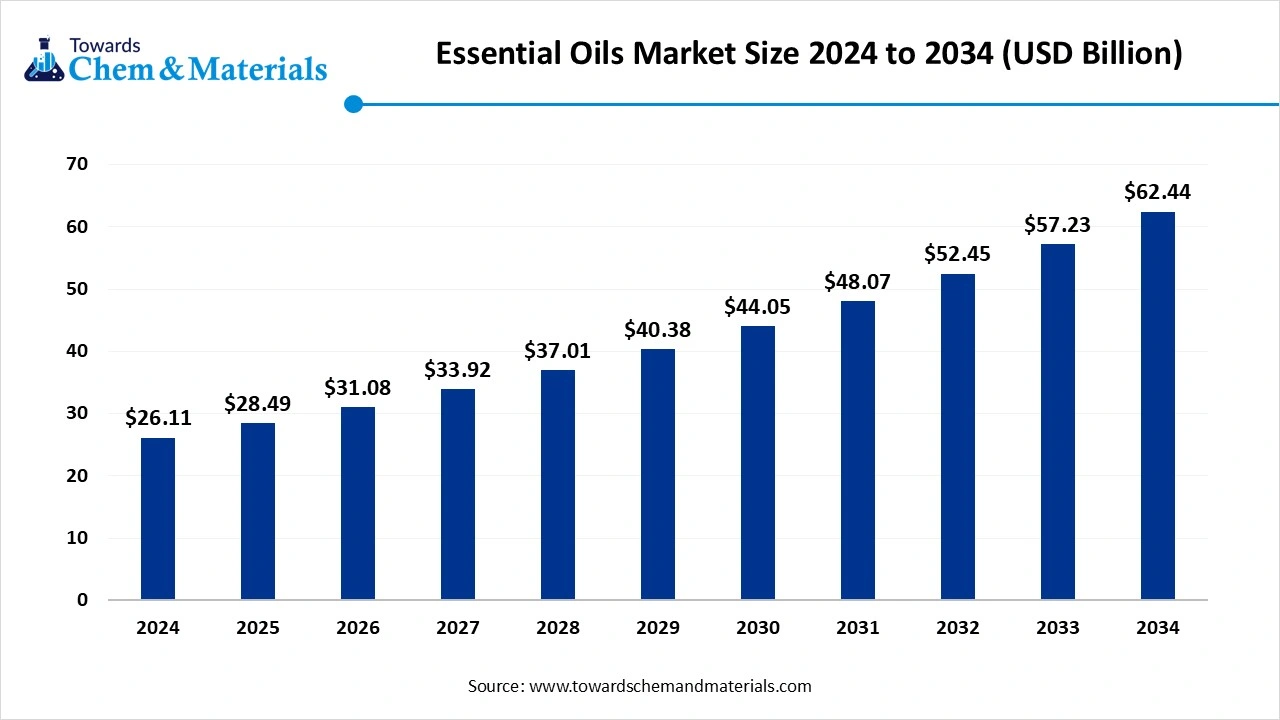

The global essential oils market size was valued at USD 26.11 billion in 2024, grew to USD 28.49 billion in 2025, and is expected to hit around USD 62.44 billion by 2034, growing at a compound annual growth rate (CAGR) of 9.11% over the forecast period from 2025 to 2034. The growing consumer preference for natural products is the key factor driving market growth. Also, growing awareness regarding the therapeutic benefits of essential oils, coupled with the advancements in extraction technologies, can fuel market growth further.

Key Takeaways

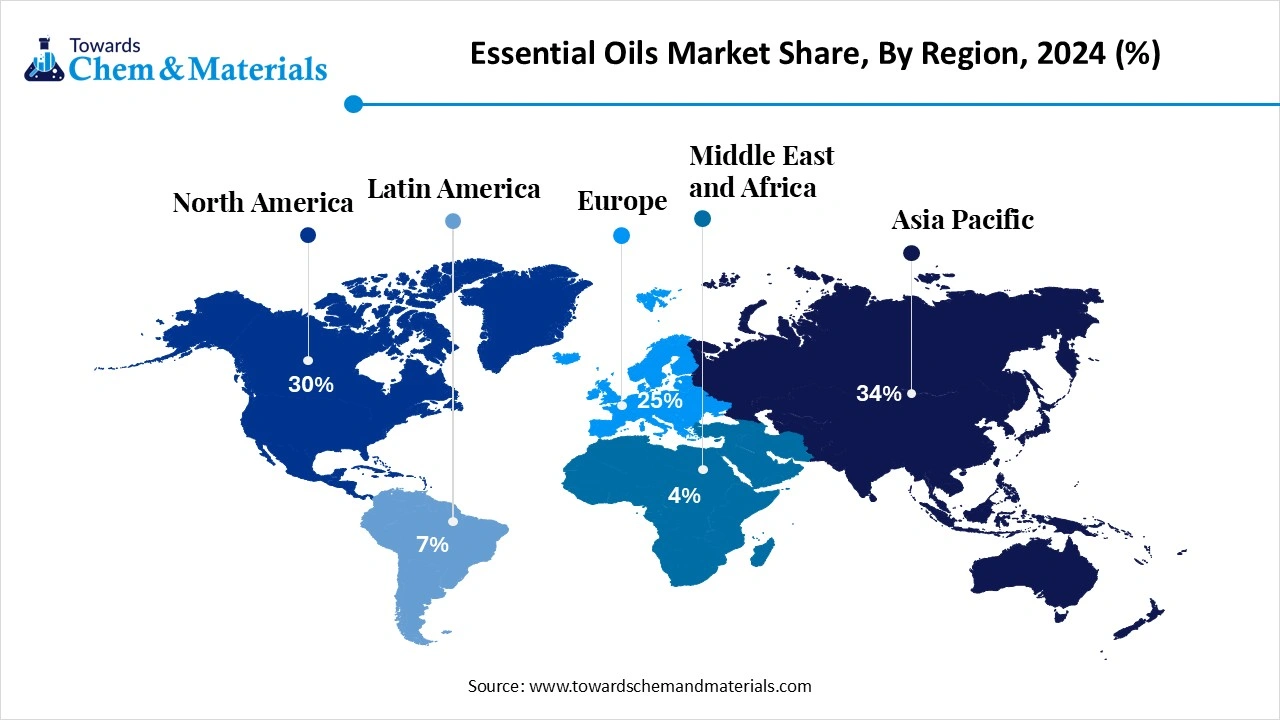

- By region, the Asia Pacific dominated the market with approximately 34% share in 2024. The dominance of the region can be attributed to the surge in health and wellness awareness, along with the supportive government policies in major countries.

- By region, Europe is expected to grow at the fastest CAGR over the forecast period. The growth of the region can be credited to the strong presence of various market players and the very easy availability of feedstock.

- By product type, the single oils segment dominated the market with approximately 70% share in 2024. The dominance of the segment can be attributed to the growing consumer demand for organic, natural, and chemical-free products.

- By product type, the blended oils segment is expected to grow at the fastest CAGR over the forecast period. The growth of the segment can be credited to the growing preference for convenient and ready-to-use solutions.

- By botanical source, the citrus oil segment held approximately 32% market share in 2024. The dominance of the segment can be linked to the growing consumer demand for natural ingredients in cosmetics, food, and aromatherapy.

- By botanical source, the floral oils segment is expected to grow at the fastest CAGR over the forecast period. The growth of the segment can be driven by the growing consumer demand for products with sophisticated and understandable ingredient lists.

- By extraction method, the steam distillation segment dominated the market by holding approximately 58% share in 2024. The dominance of the segment is owing to its effectiveness in separating volatile oils from plant material.

- By extraction method, the CO₂ supercritical extraction segment is expected to grow at the fastest CAGR over the forecast period. The growth of the segment is due to the increasing consumer awareness regarding the therapeutic benefits of essential oils.

- By end-use application, the personal care & cosmetics segment held approximately 30% market share in 2024. The dominance of the segment can be attributed to the growing consumer demand for organic, natural, and sustainable products.

- By end-use application, the pharmaceuticals & nutraceuticals segment is expected to grow at the fastest CAGR during the projected period. The growth of the segment can be credited to the surge in adoption of alternative medicine and aromatherapy.

- By form& packaging, the bulk packaging segment dominated the market by holding approximately 50% share in 2024. The dominance of the segment can be linked to the rising emphasis on ethical sourcing and sustainability.

- By form& packaging, the retail small bottles segment is expected to grow at the fastest CAGR during the study period. The growth of the segment can be driven by increasing product awareness through online channels.

- By distribution channel, the B2B direct sales segment dominated the market with approximately 42% share in 2024. The dominance of the segment is owed to the increasing emphasis on stress relief, mental well-being, and self-care.

- By distribution channel, the online marketplaces segment is expected to grow at the fastest CAGR over the study period. The growth of the segment is due to growing investment in online sales platforms by major market players.

Technological Advancements are Expanding Market Growth

Essential oils are concentrated, volatile plant extracts obtained from various botanical parts (flowers, leaves, bark, roots, seeds, resins, fruit peel) that capture the plant's aroma and active compounds; they are used across aromatherapy, perfumery, food & beverage, cosmetics, pharmaceuticals, and industrial applications. Advancements in extraction technologies make it more cost-effective and efficient to produce high-purity essential oils, growing their accessibility and availability.

What Are the Key Trends Influencing the Essential Oils Market?

- Increasing consumer demand for organic and natural products that are free from harmful substances is the latest trend in the market. This factor is fuelling the demand for essential oils in cosmetics, beverages, food, and personal care products. Also, these oils are being used in different industries for natural preservation and flavor enhancement.

- Growing adoption of essential oils in the aromatherapy and wellness sector is another major trend shaping positive market growth. Aromatherapy has recently gained significant acceptance as a complementary therapy in pain relief, stress management, and mental health. The wellness sector, which involves yoga centres, spas, and other practices, has combined essential oils into different treatments.

- Advancements in product applications represent a crucial growth opportunity for the market. With changing consumer preferences, market players are exploring various uses of essential oils beyond conventional aromatherapy. In the personal care and cosmetic sectors, these oils are being utilized to formulate serums and natural perfumes.

Report Scope

| Report Attributes | Details |

| Market Size in 2025 | USD 28.49 Billion |

| Expected Size by 2034 | USD 62.44 Billion |

| Growth Rate from 2025 to 2034 | CAGR 9.11% |

| Base Year of Estimation | 2024 |

| Forecast Period | 2025 - 2034 |

| Dominant Region | Asia Pacific |

| Segment Covered | By Product Type, By Botanical Source, By Extraction Method, By End-use Application, By Form & Packaging, By Distribution Channel, By Region |

| Key Companies Profiled | DSM-Firmenich, International Flavors & Fragrances (IFF) , Symrise , Robertet Group , MANE SAS , Takasago International Corporation , BASF SE , Sensient Technologies Corporation, T. Hasegawa Co., Ltd., Privi Speciality Chemicals Ltd. , Cargill, Incorporated , Biolandes SAS , doTERRA International LLC , Young Living Essential Oils, LC , Pranarôm International , Bell Flavors & Fragrances , Kato Flavors & Fragrances , Eden Botanicals, Inc. , Aromaaz International |

Market Opportunity

Growing Demand for Exotic Essential Oils

There is an increasing demand for exotic and premium essential oils, especially from emerging markets, which is the major factor creating lucrative opportunities in the market, as consumers globally are increasingly seeking high-quality and unique products. Furthermore, the surge in the e-commerce industry has made it convenient for consumers to access an extensive variety of essential oils from all over the world.

Market Challenge

Lack of Standardization

Concerns regarding contamination, adulteration, and mislabelling, coupled with the inadequate regulatory oversight in several regions, are creating challenges for ensuring product purity and quality. Moreover, the availability of much cheaper synthetic alternatives with persistent pricing and quality compared to natural essential oils may create competition, especially in cost-sensitive segments.

Regional Insight

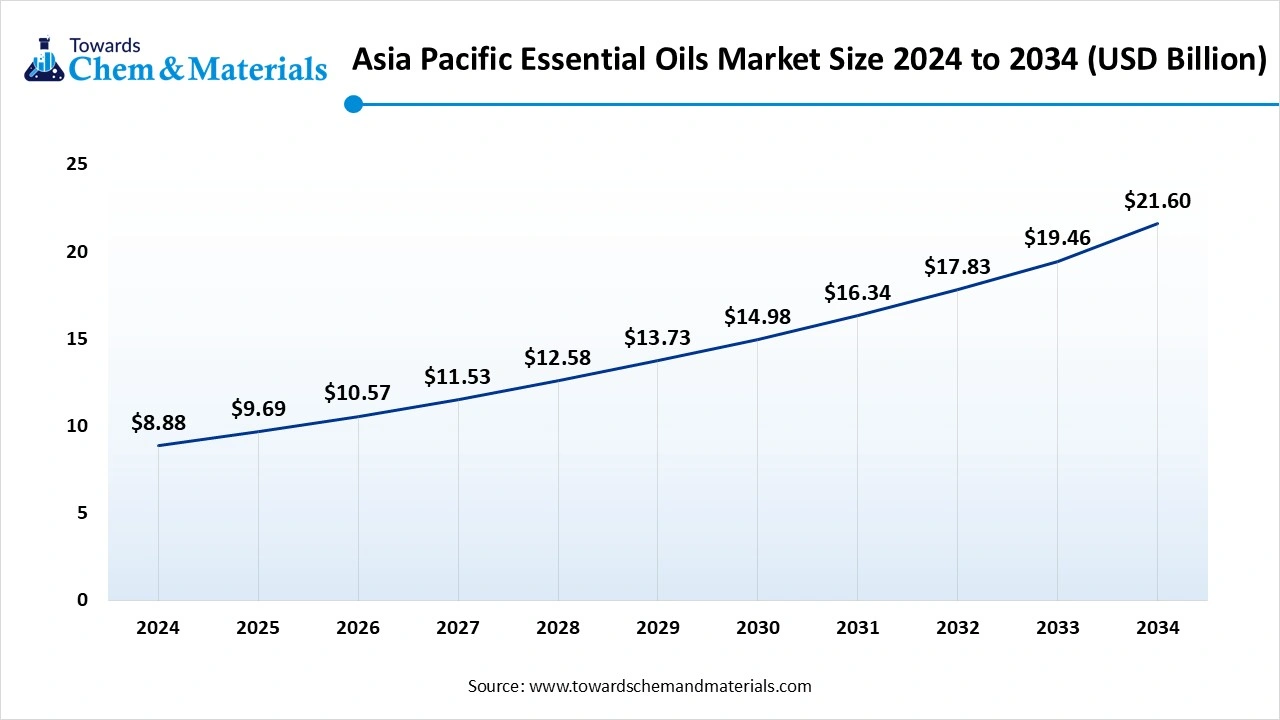

Asia Pacific Essential Oils Market Size, Industry Report 2034

The Asia Pacific essential oils market size was estimated at USD 8.88 billion in 2024 and is anticipated to reach USD 21.60 billion by 2034, growing at a CAGR of 9.30% from 2025 to 2034. Asia Pacific dominated the market with a 34% share in 2024.

The dominance of the region can be attributed to the surge in health and wellness awareness, along with the supportive government policies in major countries such as China and India. In addition, the region has abundant plant species offering an extensive range of essential oils and natural ingredients specific to the demand for unique products.

Europe Essential Oils Market Trends

Europe is expected to grow at the fastest CAGR over the forecast period. The growth of the region can be credited to the strong presence of various market players and the very easy availability of feedstock. Furthermore, consumers in Europe are rapidly seeking more organic and natural solutions for their overall health and well-being, fuelling the demand for essential oils in different sectors.

Segmental Insight

Product Type Insight

Which Product Type Segment Dominated the Essential Oils Market in 2024?

The single oils segment dominated the market in 2024. The dominance of the segment can be attributed to the growing consumer demand for organic, natural, and chemical-free products, especially for wellness, personal care, and aromatherapy applications. Additionally, the growing interest in conventional health practices such as Ayurveda increases the need for single essential oils such as sandalwood.

The blended oils segment is expected to grow at the fastest CAGR over the forecast period. The growth of the segment can be credited to the growing preference for convenient and ready-to-use solutions, along with the product developments in the wellness industry. Also, blended oils are rapidly being used in products for cosmetics, aromatherapy, personal care, and home care.

Botanical Source Insight

How Much Share Did the Citrus Oil Segment Held in 2024?

The citrus oil segment held a largest market share in 2024. The dominance of the segment can be linked to the growing consumer demand for natural ingredients in cosmetics, food, and aromatherapy, due to their mood-boosting and antimicrobial properties. Furthermore, the push for clean beauty and natural products free from synthetics boosts the use of citrus oils in haircare, skincare, and makeup products.

The floral oils segment is expected to grow at the fastest CAGR over the forecast period. The growth of the segment can be driven by the growing consumer demand for products with sophisticated and understandable ingredient lists, generally referred to as "clean labels". These oils are seen as wholesome and natural alternatives to artificial fragrances and additives in many consumer goods.

Extraction Method Insight

Why Steam Distillation Segment Dominated the Essential Oils Market in 2024?

The steam distillation segment dominated the market in 2024. The dominance of the segment is owing to its effectiveness in separating volatile oils from plant material and its use in manufacturing high-grade oils. Furthermore, this method is comparably cost-effective and economical, with low investment requirements for operation and setup as compared to more developed techniques such as CO2 extraction.

The CO₂ supercritical extraction segment is expected to grow at the fastest CAGR over the forecast period. The growth of the segment is due to the increasing consumer awareness regarding the therapeutic benefits of essential oils for stress relief, mental well-being, and health supplements. Cutting-edge extraction techniques, such as supercritical CO₂, can substantially minimize the overall extraction time and increase yield.

End-Use Application Insight

Which End-use Application Segment Held a Largest Essential Oils Market Share in 2024?

The personal care & cosmetics segment held a largest market share in 2024. The dominance of the segment can be attributed to the growing consumer demand for organic, natural, and sustainable products, coupled with the surge in applications of essential oils in hair care, skin care, and perfumes. Moreover, certain essential oils are increasingly incorporated into age management and anti-aging products because of their rejuvenating properties.

The pharmaceuticals & nutraceuticals segment is expected to grow at the fastest CAGR during the projected period. The growth of the segment can be credited to the surge in adoption of alternative medicine and aromatherapy, along with the pursuit of clean-label and wellness trends. Essential oils are being used in dietary supplements and pharmaceutical products to improve health benefits.

Form & Packaging Insight

How Much Share Did the Bulk Packaging Segment Held in 2024?

The bulk packaging segment dominated the market by holding a largest share in 2024. The dominance of the segment can be linked to the rising emphasis on ethical sourcing and sustainability, and the demand for consistent quality control, utilizing cutting-edge testing methods such as GC/MS. Major players in the market are focusing on industry consolidation, which can drive the demand for bulk ingredients.

The retail small bottles segment is expected to grow at the fastest CAGR during the study period. The growth of the segment can be driven by increasing product awareness through online channels and the ongoing advancement in new product formulations for home goods and personal care. Furthermore, the use of small glass bottles offers protection from light and maintains oil quality.

Distribution Channel Insight

Which Distribution Channel Segment Dominated the Essential Oils Market in 2024?

The B2B direct sales segment dominated the market in 2024. The dominance of the segment is owed to the increasing emphasis on stress relief, mental well-being, and self-care, coupled with the supporting government initiatives promoting ethical sourcing. Moreover, the growing e-commerce industry offers extensive consumer reach and accessibility, enabling businesses to sell essential oils.

The online marketplaces segment is expected to grow at the fastest CAGR over the study period. The growth of the segment is due to growing investment in online sales platforms by major market players and growing focus on physical and mental well-being. Furthermore, online marketplaces give consumers easy access to an extensive variety of essential oils, enabling them to do other activities.

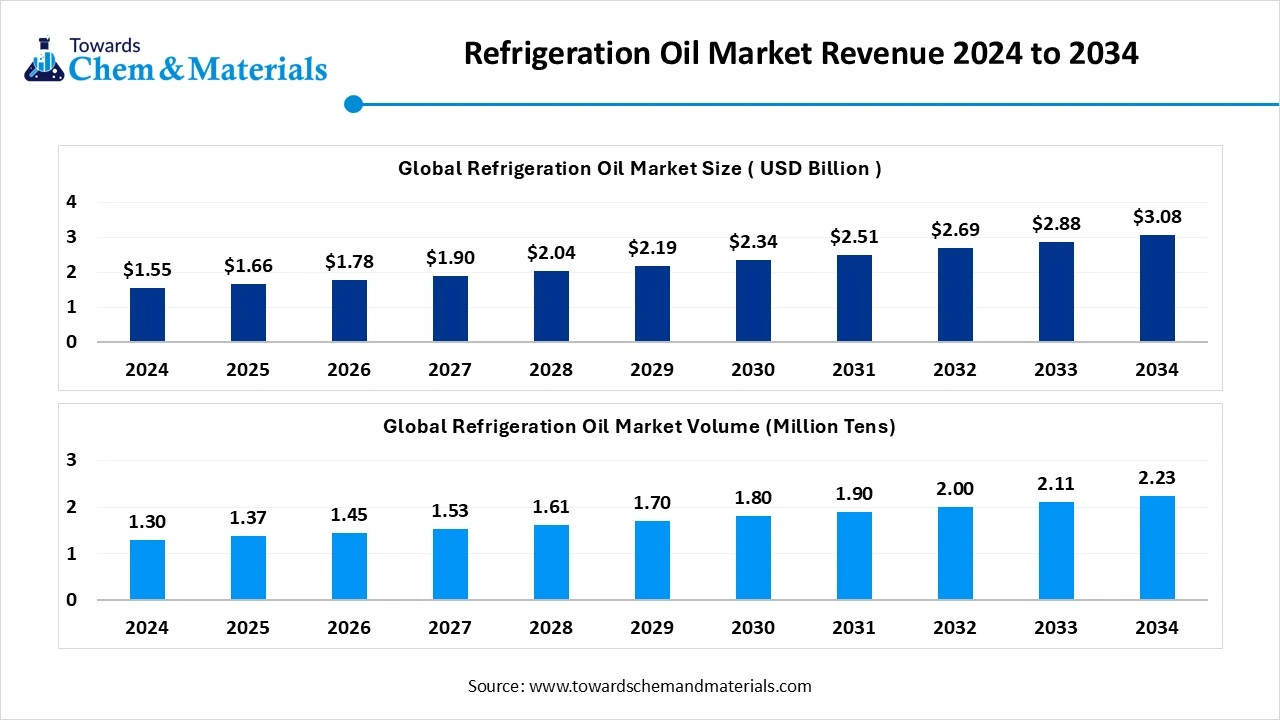

Future of Refrigeration Oil Market

The global refrigeration oil market is expected to reach a volume of approximately 1.37 million tons in 2025, with a forecasted increase to 2.23 million tons by 2034, growing at a CAGR of 5.55% from 2025 to 2034.

The refrigeration oil market size is calculated at USD 1.55 billion in 2024, grew to USD 1.66 billion in 2025, and is projected to reach around USD 3.08 billion by 2034. The market is expanding at a CAGR of 7.11% between 2025 and 2034. The growth is driven by the expanding food and beverage industry and the growing healthcare and pharmaceutical industry, which drives the growth of the market.

Refrigeration oil is a specialized lubricant for air conditioning and refrigeration compressors, essential for reducing friction, preventing wear, sealing components, and dissipating heat. It must be chemically stable, have excellent low-temperature properties, and form a homogeneous bond with the specific refrigerant in the system. Using the correct type of refrigeration oil for a given refrigerant and compressor is crucial for maintaining the system's efficiency, reliability, and longevity.

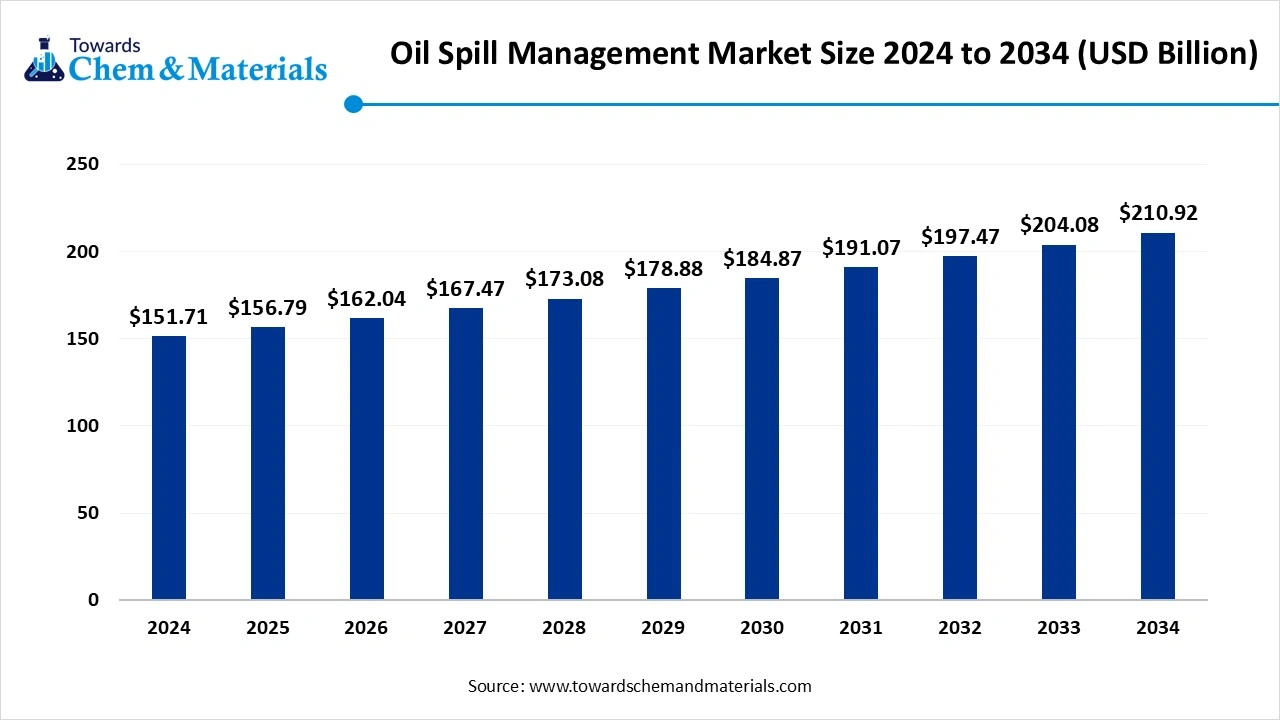

Future of Oil Spill Management Market size

The global oil spill management market size was reached at USD 151.71 billion in 2024 and is estimated to surpass around USD 210.92 billion by 2034, growing at a compound annual growth rate (CAGR) of 3.35% during the forecast period 2025 to 2034. The growing number of oil spill incidents, rising environmental awareness, and stricter government regulations drive the market's growth.

The growth in oil transportation, production, and processing increases the risks of spills, which increases demand for effective oil spill management technologies. The aging infrastructure & pipelines and growing spill incidents in the maritime & offshore sectors increase demand for effective management solutions. The growing oil spill incidents create risks for water bodies, marine life, and the ecosystem, which increases demand for advancements or innovations in technologies to protect the environment.

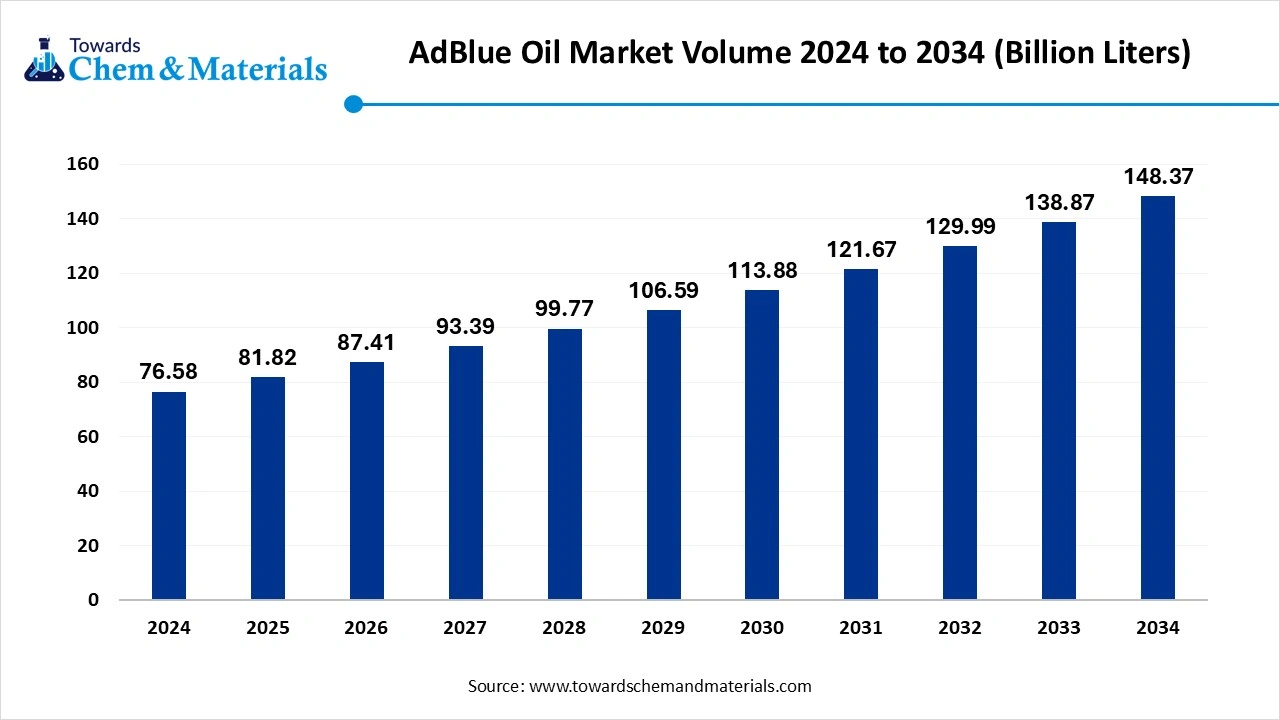

Future of AdBlue Oil Market

The global adblue oil market volume was accounted for 76.58 billion liters in 2024 and is expected to be worth around USD 148.37 billion liters by 2034, growing at a compound annual growth rate (CAGR) of 6.84% during the forecast period 2025 to 2034. The implementation of sustainability initiatives by global governments is fueling market growth in the current period.

The AdBlue oil market is undergoing a rapid phase of growth akin to the increasing regulatory push for reduced vehicular emissions across global markets. As governments implemented stricter environmental regulations, the demand for selective catalytic reduction (SCR) technology and, by extension, AdBlue, has witnessed consistent growth in recent years. This urea-based diesel exhaust fluid plays a critical role in lowering nitrogen oxide emissions, specifically in heavy-duty vehicles and off-road machinery. Also, the market is gaining momentum across transportation, agriculture, and construction sectors, where diesel engine usage remains high.

Future of Reusable Oil Absorbents Market Size

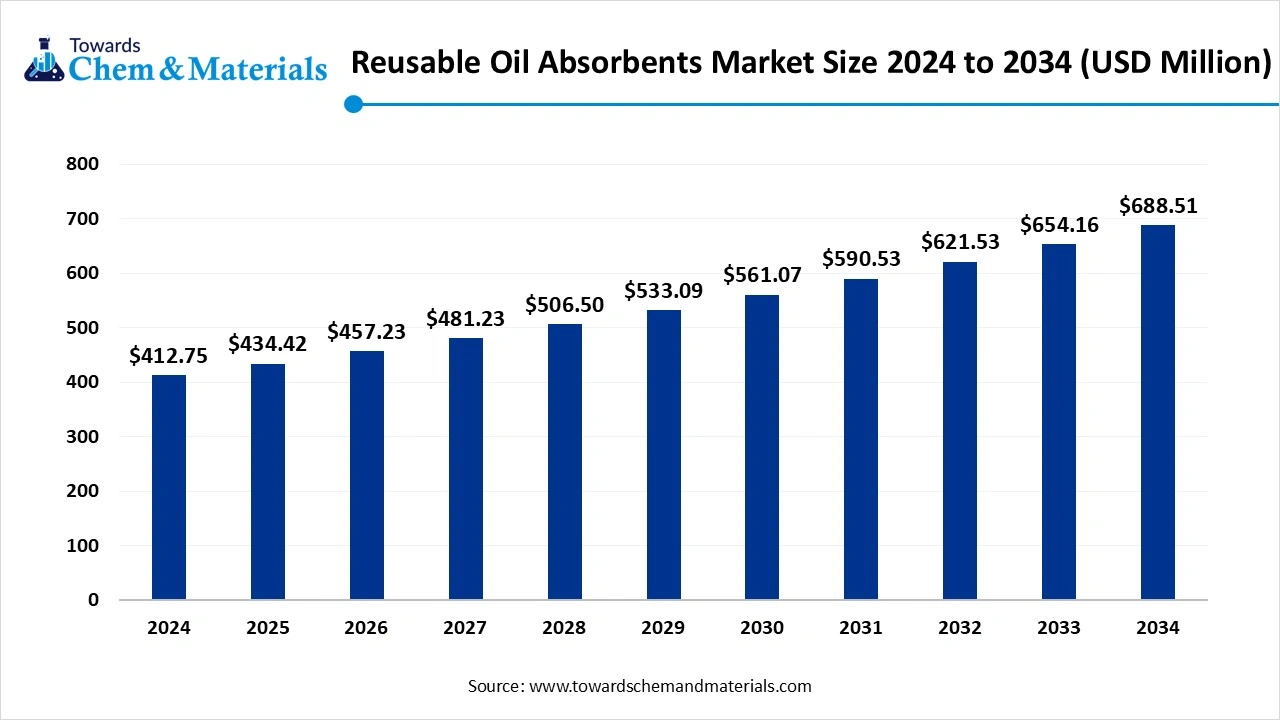

The global reusable oil absorbents market size was valued at USD 412.75 million in 2024. The market is projected to grow from USD 434.42 million in 2025 to USD 688.51 million by 2034, exhibiting a CAGR of 5.25% during the forecast period. The growing focus on sustainability and environmental regulations, and the growing demand from industries like oil and gas, chemicals, and automotives, increases the demand and helps in the growth of the market.

Reusable oil absorbents are materials that soak up oil and other petroleum-based liquids, allowing them to be cleaned and reused instead of being thrown away after one use. This makes them a more sustainable and often cost-effective choice compared to disposable oil absorbents. Reusable oil absorbents come in various forms, including pads, mats, booms, and socks, and are typically made from durable, absorbent materials like polypropylene, natural fibers, or recycled materials. They're designed to absorb oil and other non-water-based liquids while repelling or floating on water. Examples include SorbIt from ITU AbsorbTech and Greensorb, a granular absorbent.

Essential Oils Market Value Chain Analysis

- Feedstock Procurement: It is the essential technique of sourcing the raw plant materials, such as leaves, flowers, and roots, from which essential oils are extracted.

- Chemical Synthesis and Processing: It is a crucial stage in the market as it provides several benefits over plant-based and traditional extraction, such as scalability and greater consistency.

- Packaging and Labelling: It involves the use of specialized materials to safeguard the oils from degradation and to design a product to appeal to certain consumer trends, such as sustainability and personalization.

- Regulatory Compliance and Safety Monitoring: This stage is crucial to ensure consumer safety, product quality, and market access. Various regulatory standards govern essential oils depending on their intended use.

Recent Developments

- In May 2025, Egypt announced a new collaboration with India to introduce a special training programme focusing on boosting the production of medicinal and aromatic oils, an expanding sector both locally and globally.(Source: tvbrics.com)

Essential Oils Market Top Companies

- DSM-Firmenich

- International Flavors & Fragrances (IFF)

- Symrise

- Robertet Group

- MANE SAS

- Takasago International Corporation

- BASF SE

- Sensient Technologies Corporation

- T. Hasegawa Co., Ltd.

- Privi Speciality Chemicals Ltd.

- Cargill, Incorporated

- Biolandes SAS

- doTERRA International LLC

- Young Living Essential Oils, LC

- Pranarôm International

- Bell Flavors & Fragrances

- Kato Flavors & Fragrances

- Eden Botanicals, Inc.

- Aromaaz International

Segments Covered

By Product Type

- Single (mono) essential oils

- Blended essential oils

By Botanical Source

- Citrus oils

- Floral oils

- Herbal/leafy oils

- Woody oils

- Spice oils

- Root & rhizome oils

- Resin & gum oils

- Seed & kernel oils

- Other unique botanicals

By Extraction Method

- Steam distillation

- Cold pressing / expression

- Solvent extraction (absolutes)

- CO₂ supercritical extraction

- Enfleurage / maceration

By End-use Application

- Aromatherapy & wellness

- Personal care & cosmetics

- Fragrance & perfumery

- Food & beverages

- Pharmaceuticals & nutraceuticals

- Household & cleaning products

- Industrial & technical uses

By Form & Packaging

- Bulk packaging (drums, IBC, tanks)

- Retail small bottles (≤100 ml)

- Retail medium bottles (101–500 ml)

- Encapsulated / microencapsulated

By Distribution Channel

- B2B direct sales (manufacturers → formulators/brands)

- Distributors & wholesalers

- Online marketplaces / e-commerce

- Specialty retail stores

By Region

- North America

- U.S.

- Canada

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Sweden

- Denmark

- Norway

- Asia Pacific

- China

- Japan

- India

- South Korea

- Thailand

- Latin America

- Brazil

- Mexico

- Argentina

- Middle East and Africa (MEA)

- South Africa

- UAE

- Saudi Arabia

- Kuwait