Content

Reusable Oil Absorbents Market Size and Growth 2025 to 2034

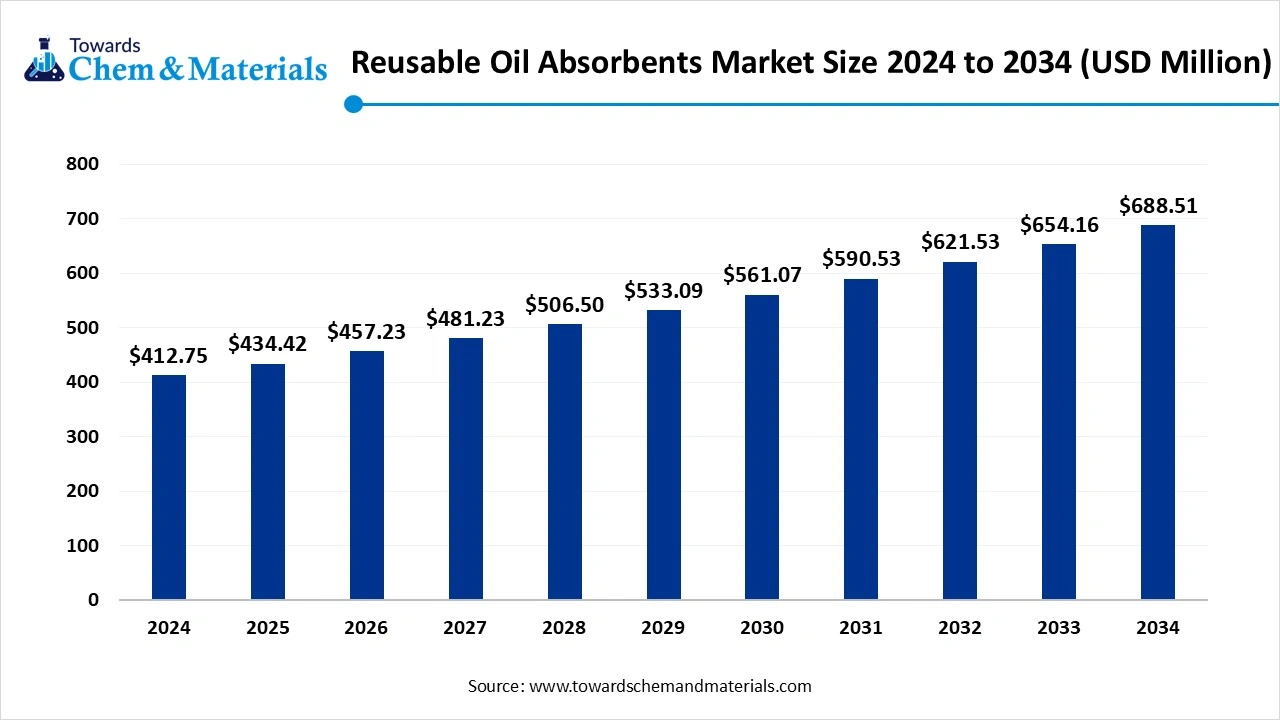

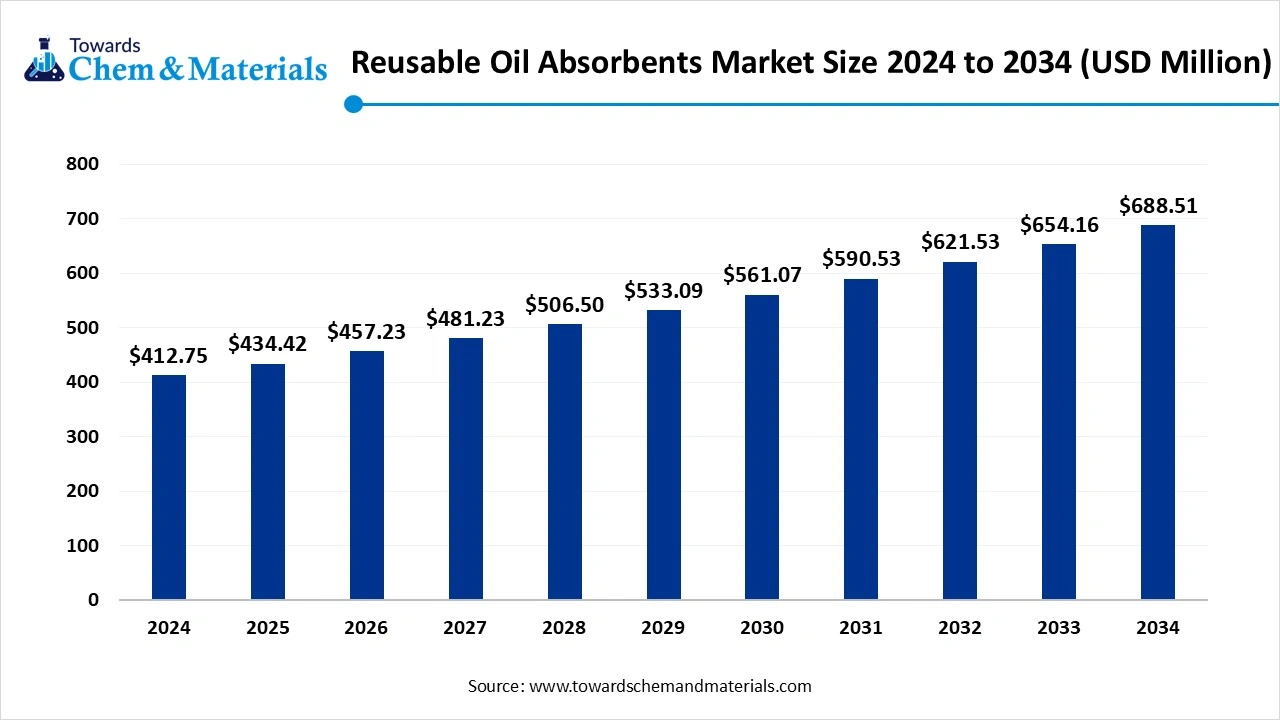

The global reusable oil absorbents market size was valued at USD 412.75 million in 2024. The market is projected to grow from USD 434.42 million in 2025 to USD 688.51 million by 2034, exhibiting a CAGR of 5.25% during the forecast period. The growing focus on sustainability and environmental regulations, and the growing demand from industries like oil and gas, chemicals, and automotives, increases the demand and helps in the growth of the market.

Key Takeaways

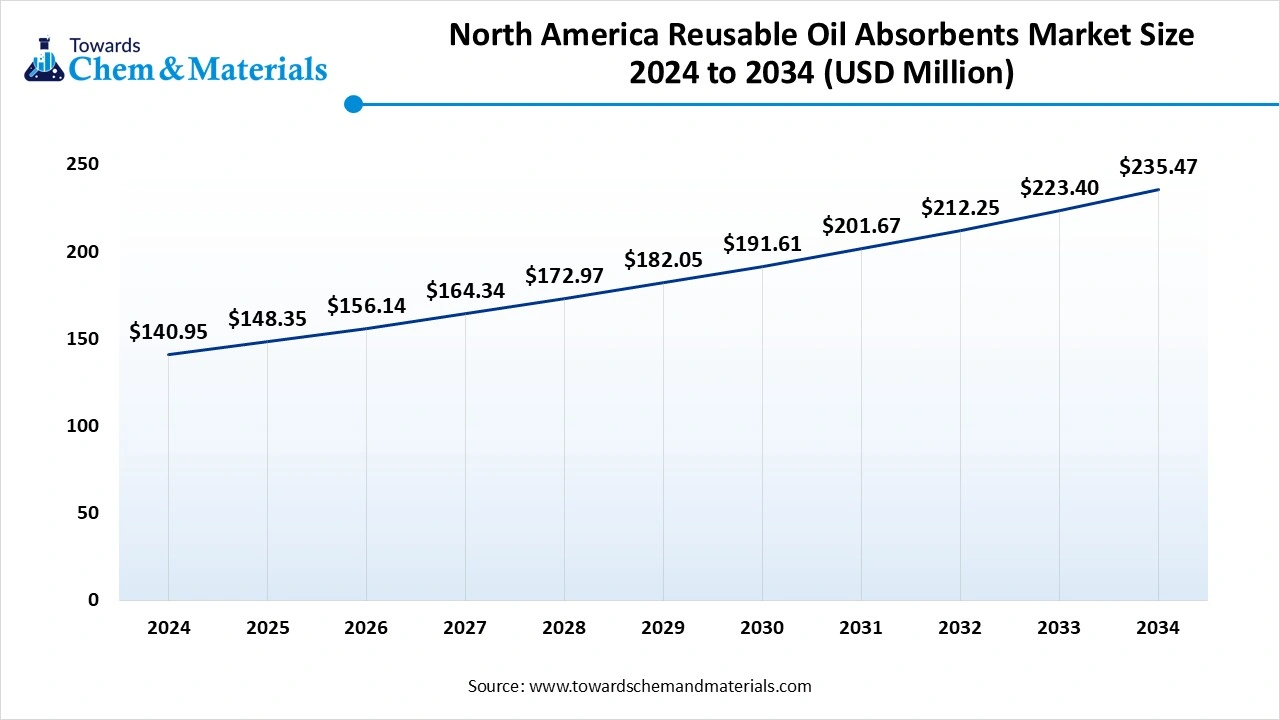

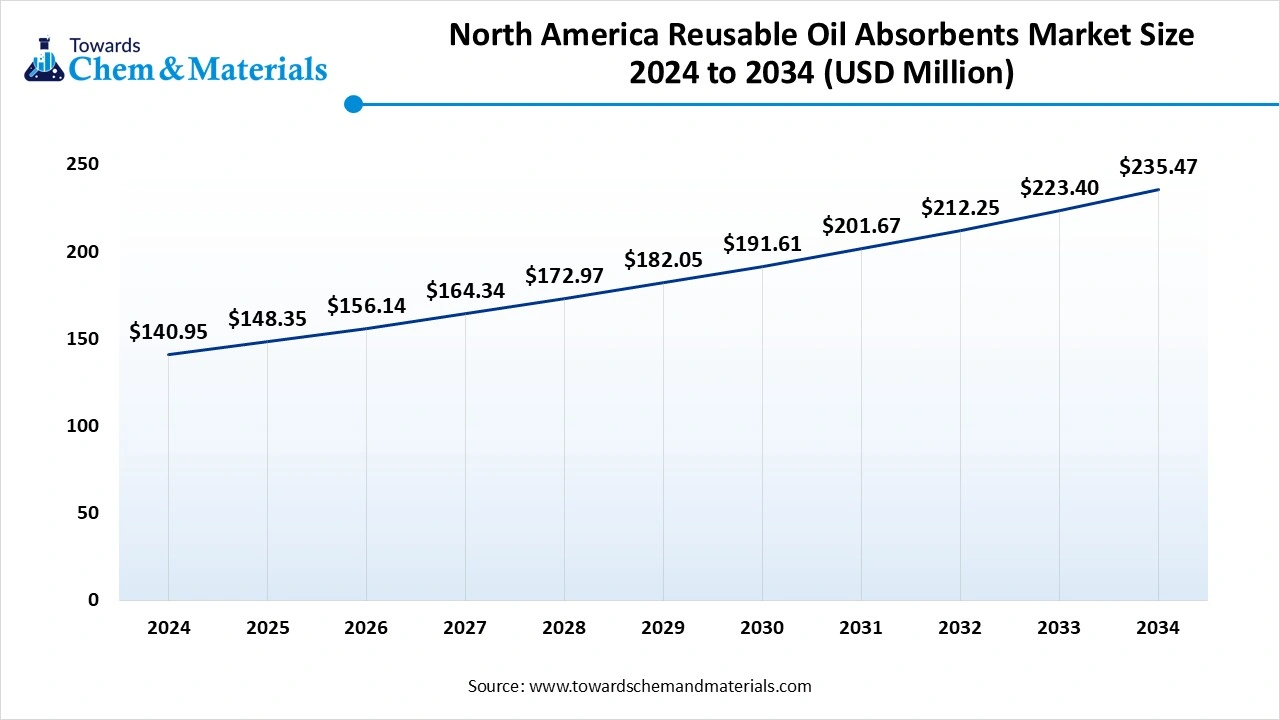

- The North America reusable oil absorbents market held the largest share of 34.15% of the global market in 2024.

- The Europe's reusable oil absorbents market is projected to grow at a CAGR of 5.25% during the forecast period.

- By material, the polypropylene segment accounted for the largest revenue market share, 45.41% in 2024 and is expected to continue to grow over the forecast period.

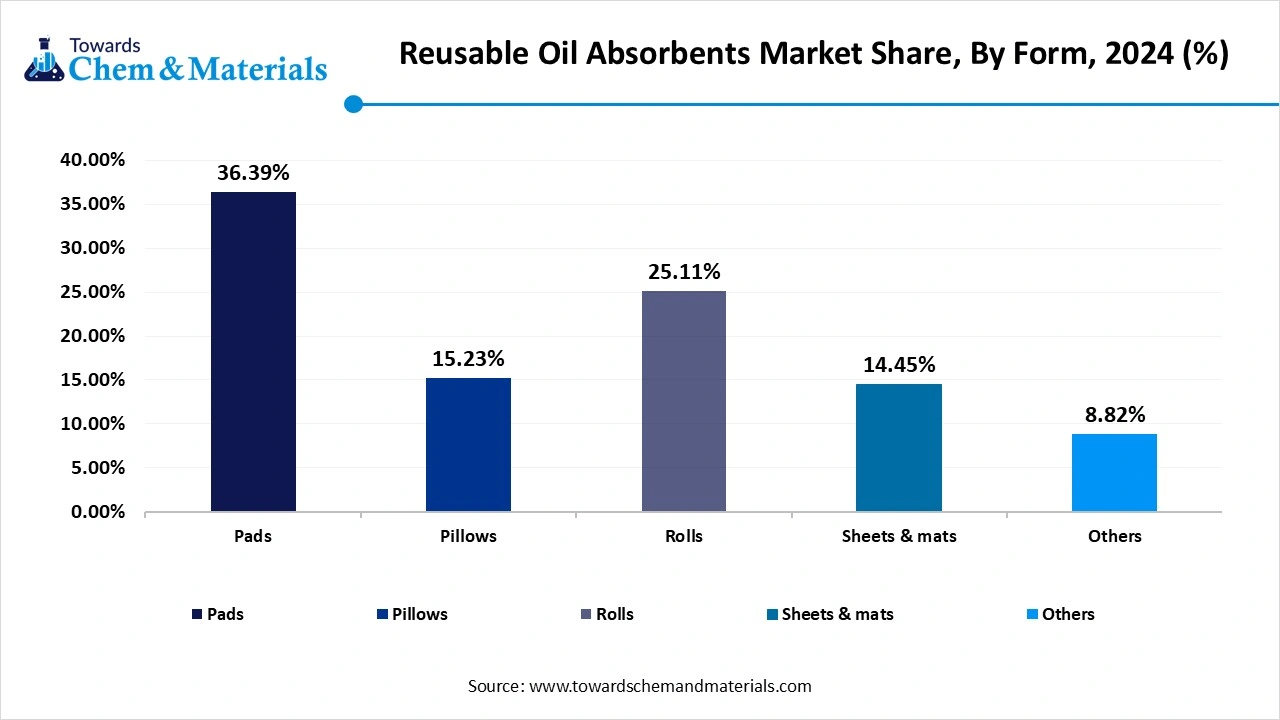

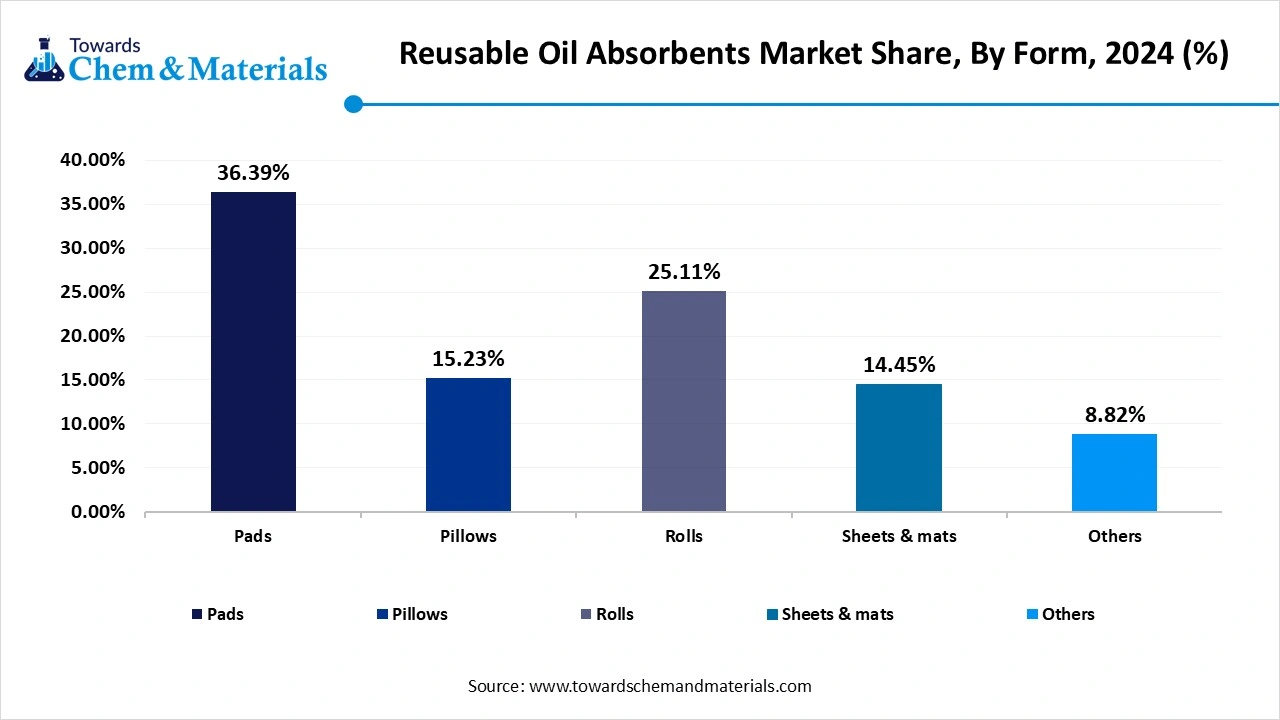

- By form, the Pads segment accounted for the largest revenue market share of 36.39% in 2024 and is expected to continue to grow over the forecast period.

- By end use, the oil & gas segment accounted for the largest revenue market share of 31.25% in 2024. The demand from industry for leaks and spills from equipment and containers drives the growth.

Market Overview

Rising Demand for Durable Materials: Reusable Oil Absorbents Market to Expand

Reusable oil absorbents are materials that soak up oil and other petroleum-based liquids, allowing them to be cleaned and reused instead of being thrown away after one use. This makes them a more sustainable and often cost-effective choice compared to disposable oil absorbents. Reusable oil absorbents come in various forms, including pads, mats, booms, and socks, and are typically made from durable, absorbent materials like polypropylene, natural fibers, or recycled materials. They're designed to absorb oil and other non-water-based liquids while repelling or floating on water. Examples include SorbIt from ITU AbsorbTech and Greensorb, a granular absorbent. The benefits include reduced waste, cost savings, sustainability, and lower labor costs. After absorbing spills, these materials can be cleaned (often through washing or other methods) and reused. Some companies even offer services to collect, clean, and redistribute reusable absorbents.

What Are the Key Growth Drivers Responsible for the Growth of the Reusable Oil Absorbents Market?

The reusable oil absorbents market has seen steady growth, the growth is driven by the growing and stringent environmental regulations and awareness due to ecological impact, government regulations and policies, and strict rules regarding oil and chemicals, and a shift towards sustainable and effective management solutions also drives the growth of the market. Driving ecological factors like cost-effectiveness and reduced landfill waste align with sustainability, and environmental regulation fuels the growth of the market. Technological advancement, like innovation in material by using bio-based materials to improve its efficiency, and innovation and improvement in absorption capacity and reusability by making them effective and attractive, also boosts the growth of the market. These factors and rapid industrial and sustainable practices fuel the growth and expansion of the market.

Market Trends

- Technological advances like innovation in biodegradable and sustainable absorbent materials and development procedures aligning with the growth of environmental concerns drive the growth.

- Integration of digital monitoring to improve the efficiency of tracking real-time spills and to manage the spill response boosts the growth of the market.

- Increase in industrial activity is a growing trend in the market, which demands sustainable oil absorbent materials and effective spill control solutions, which fuels the growth.

- Stringent regulations and environmental sustainability are the growing trend in the market, responsible for the growth and expansion of the market.

Report Scope

| Report Attributes | Details |

| Market Size in 2025 | USD 434.42 Million |

| Expected Size by 2034 | USD 688.51 Million |

| Growth Rate from 2025 to 2034 | CAGR 5.25% |

| Base Year of Estimation | 2024 |

| Forecast Period | 2025 - 2034 |

| Dominant Region | North America |

| Segment Covered | By Material, By Form, By Region |

| Key Companies Profiled | ITU AbsorbTech, Inc, Sorbent Green LLC, Closed Loop Recycling, Park Industries, New Pig Corporation, 3M, SpillTech Environmental Incorporated, Darcy Spillcare Manufacturing, Oil-Dri Corporation of America Fentex Ltd., U.S. Sorbents, Inc., Progressive Planet Inc, Absorb Environmental Solutions, Chemtex, Inc., Brady Corporation, Ecospill Ltd. |

Market Opportunity

What Are the Key Growth Opportunities Responsible for The Growth of The Reusable Oil Absorbents Market?

With the strict environmental regulations and increasing environmental awareness for the management of pollution amid rising environmental concerns, the use and adoption of sustainable materials and products in various sectors like chemical, petrochemicals, and food processing fuels the growth of the market. The reusable oil absorbents are a good and better sustainable option to the traditional disposable, which aligns with the need and demand of the growing eco-conscious consumers and regulatory demand for waste management, which fuels the growth of the market and also supports the expansion of the market, boosting the demand.

Market Challenge

The Limited Awareness and Performance Issues Are a Challenge That Hinders the Growth of The Reusable Oil Absorbents Market

The market has some challenges which hinder the growth of the market, like limited awareness among users about long-term cost saving and environmental benefits offered, but due to a lack of awareness, leads to limited and low adoption rate, which leads to hindrance in the growth of the market. Another challenge is the inconsistency of product performance, which affects the overall adoption due to factors like saturation and loss of floating capacity, which also affects the standardization, which limits the growth of the market.

Regional Insights

How Did North America Dominate the Reusable Oil Absorbents Market In 2024?

The North America reusable oil absorbents market is expected to increase from USD 148.35 million in 2025 to USD 235.47 million by 2034, growing at a CAGR of 5.27% throughout the forecast period from 2025 to 2034. North America dominated the reusable oil absorbents market in 2024. The region has seen steady growth driven by stringent environmental regulations due to growing environmental concerns and a shift towards sustainability, which increases the demand for the market. The growing oil and gas industrial sector and other manufacturing units are increasing demand for absorbents for maintaining spills, attracting consumers, and increasing adoption, which fuels the growth of the market in the region and contributes to the expansion.

The Advanced Industrial Infrastructure in The US Contributes to The Growth of The Market.

The US has seen a steady growth, and the growth is driven by the various factors like stringent environmental regulation, rising focus on sustainability, industrial expansion, advanced industrial infrastructure, technological advancements, and cost efficiency these factors fuel the growth of the market in the country ad also supports the expansion of the market.

- The United States shipped out 619 Oil Absorbent shipments. These exports were handled by 54 United States exporters to 13 buyers(Source: volza)

Globally China, Japan United States are the top three exporters of Oil Absorbent. China is the global leader in Oil Absorbent exports with 7,849 shipments, followed closely by Japan with 5,823 shipments, and the United States in third place with 3,864 shipments.(Source: volza)

The Sustainability Goals Drive the Growth of The Reusable Oil Absorbents Market in Europe

Europe is expected to have a significant growth in the market in the forecast period. The growing and expanding industrial sector and sustainability goals, and widespread use of these materials in the automotive, aerospace, and industrial sectors boost the growth of the market and support the expansion of the market in the region.

The Cost Efficiency and Industrial Growth Drive the Growth of The Market in the UK.

The UK has seen a steady growth in the reusable oil absorbents market, the growth is driven by the growing industrial sector like chemicals, automotive, and manufacturing sectors, which fuels the growth in the country. The long-term cost-saving properties offered by the reusable absorbents offered as compared to single-use options, in industries to manage the spills and leaks further drive the growth of the market and boost the expansion in the country.

- The World shipped out 344 Oil Absorbent Pads shipments. These exports were handled by 59 world exporters to 55 buyers(Source: volza)

Segmental Insights

Material Insights

Which Material Segment Dominated the Reusable Oil Absorbents Market In 2024?

The polypropylene segment dominated the reusable oil absorbents market in 2024. The polypropylene is used as an oil absorbent due to its effectiveness because of its properties, like hydrophobic nature, which is crucial for cleaning up spilled oil, and oleophilic nature which make it suitable for absorbing petroleum based products and other chemicals, high absorbency which make it efficient for large spills, versatility, durability and low density properties make it a crucial and promising materials for absorbing oil spills offering flexibility which boosts the growth of the market. The varying applications, like oil spill cleanup, industrial spills, and water filtration, make it an ideal choice for the industries for cleanup, which drives the growth and supports the expansion of the market.

The natural fibers segment expects significant growth in the reusable oil absorbents market during the forecast period. Natural fibers like cotton, straw, kenaf, and coconut coir are very effective oil absorbents. This is due to their porous structure and ability to attract and hold oil molecules, the biodegradability and sustainability offered by the material fuel the growth and demand for the product. Natural fibers work through a capillary mechanism and surface tension, which traps the oil in fibers, and the hydrophobic nature of materials further boosts the growth. The advantages associated with the use of natural fibers for oil absorption, like biodegradability, which helps reduce environmental impact, sustainability, which helps in aligning with the growing trend over environmental degradation, and cost-effectiveness of natural fibers over traditional synthetic alternatives make it an ideal choice for large scale processes and operations, these factors drive the growth and expansion of the market.

Form Insights

How Did Pads Segment Dominate the Reusable Oil Absorbents Market In 2024?

The pads segment dominated the reusable oil absorbents market in 2024. The growth of the market is driven by its versatility and easy-to-use pattern for oil absorption. Its versatility for the absorption of spilled oil drives the growth of the market. They are crucial and a key choice by many sectors due to their lightweightness, ease of use, quick absorption, reusability, making it more efficient and also helping reduce the cost of the cleanup and also of operations, which influences more consumers to use and also fuels the growth of the market. The alignment of the use of pads with environmental and sustainability policies further boosts the growth and expansion of the market.

The pillows segment expects significant growth in the market during the forecast period. They are used for the absorption of large amounts of hazardous and non-hazardous liquids and spilled oil, and in places with low depth and limited access, and from the water surfaces, where it is difficult, which fuels the growth of the market. They are extensively used in industrial settings, workshops, and many other places, especially in industrial machinery and containers for preventing spills or leakages, which makes it a preferred choice, and this boosts the market growth along with the expansion of the market.

End Use Insights

Which End-Use Segment Dominated the Reusable Oil Absorbents Market In 2024?

The oil and gas segment dominated the reusable oil absorbents market in 2024. The growth of the market is driven by the growing need of the industrial sector to manage the spills and leaks from machinery and equipment in the oil and gas industry, which also contributes to environmental protection and helps in reducing the cost of the product, thus fueling the growth of the market. They are highly used due to their applications in spill response, water treatment, leak control, shoreline and port protection, waste reduction, which attracts the consumers in large number and increases the adoption, which helps in the growth of the market. They are a preferred choice by many key players due to their benefits like environmental responsibility, cost saving, efficiency, durability, and compliance, which help boost the growth and expansion of the market.

The marine segment expects significant growth in the market during the forecast period. They are used extensively for the cleaning up of the oil spills over water and used materials like polypropylene, which are hydrophobic and repel water and float, which makes them ideal for marine use, which drives the growth of the market. Their benefits, like environmental protection, recyclability, ease of use, and versatility, make them ideal for use and help boost the growth and expansion of the market.

Recent Developments

- In May 2025, saw a Wisconsin-based environmental services company, specializing in the manufacturing industry, bought out an Upstate service provider. ITU AbsorbTech Inc., which offers, launderable, and reusable oil absorbents under the SorbIts brand, acquired Industrial Absorbent Solutions, a Lancaster-based service provider.(Source: gsabusiness)

- In May 2025, a new company, Electroscope, from the Hartness Development project on Greenville’s eastside. The company aims to bring some peace to the nearby neighbors while groundskeepers and landscapers are working. According to Hartness, ElectroScapes is a full-service, all-electric landscaping company serving the Upstate.(Source: gsabusiness.com)

Top Companies List

- ITU AbsorbTech, Inc

- Sorbent Green LLC

- Closed Loop Recycling

- Park Industries

- New Pig Corporation

- 3M

- SpillTech Environmental Incorporated

- Darcy Spillcare Manufacturing

- Oil-Dri Corporation of America

- Fentex Ltd.

- U.S. Sorbents, Inc.

- Progressive Planet Inc

- Absorb Environmental Solutions

- Chemtex, Inc.

- Brady Corporation

- Ecospill Ltd.

Segments Covered

By Material

- Polyester

- Polypropylene

- Natural Fibers

- Composites

- Others

By Form

- Pads

- Pillows

- Rolls

- Sheets & mats

- Others

By End use

- Oil & gas

- Chemical

- Food processing

- Healthcare

- Manufacturing

- Marine

- Others

By Region

- North America

- U.S.

- Canada

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Sweden

- Denmark

- Norway

- Asia Pacific

- China

- Japan

- India

- South Korea

- Thailand

- Latin America

- Brazil

- Mexico

- Argentina

- Middle East and Africa (MEA)

- South Africa

- UAE

- Saudi Arabia

- Kuwait