Content

Refrigeration Oil Market Size and Forecast 2025 to 2034

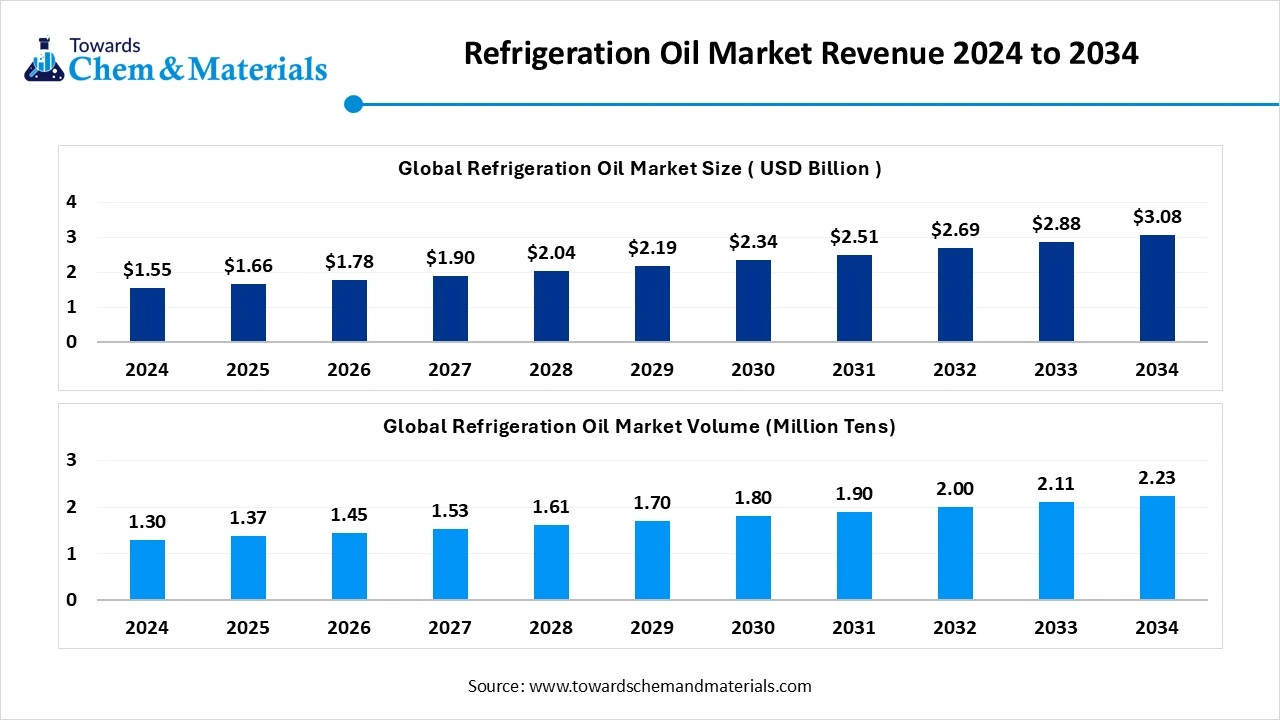

The global refrigeration oil market is expected to reach a volume of approximately 1.37 million tons in 2025, with a forecasted increase to 2.23 million tons by 2034, growing at a CAGR of 5.55% from 2025 to 2034.

The refrigeration oil market size is calculated at USD 1.55 billion in 2024, grew to USD 1.66 billion in 2025, and is projected to reach around USD 3.08 billion by 2034. The market is expanding at a CAGR of 7.11% between 2025 and 2034. The growth is driven by the expanding food and beverage industry and the growing healthcare and pharmaceutical industry, which drives the growth of the market.

Key Takeaways

- By region, Asia Pacific dominated the market in 2024. The North America region held approximately 36% share in the market in 2024. Rising disposable income influences the growth of the market in the region.

- By region, North America is expected to have significant growth in the market in the forecast period. The growth of e-commerce-driven food delivery and pharmaceutical cold storage drives the growth of the market.

- By product type, the mineral oil segment dominated the market in 2024. The mineral oil segment held approximately 38% share in the market in 2024. It offers superior lubrication, high thermal stability, and compatibility with eco-friendly refrigerants.

- By product type, the polyol ester oil segment is expected to grow significantly in the market during the forecast period. Cost-effectiveness and ease of availability influence the demand for the market.

- By application, the commercial refrigeration segment dominated the market in 2024. The commercial refrigeration segment held approximately 30% share in the market in 2024. The increasing demand for fresh and frozen foods drives the growth of the market.

- By application, the data center & telecom cooling segment is expected to grow in the forecast period. These facilities require highly reliable, efficient, and uninterrupted cooling.

- By compressor type, the reciprocating compressors segment dominated the market in 2024. The reciprocating compressors segment held approximately 30% share in the market in 2024. Reducing friction, minimizing wear, and ensuring longer operational life are the key factors driving growth.

- By compressor type, the scroll compressors segment is expected to grow in the forecast period. Their efficiency, compact design, and lower noise levels drive the growth and demand.

- By packaging, the drums segment dominated the market in 2024. The drums segment held approximately 40% share in the market in 2024. They offer cost efficiency for bulk users like food processing plants, cold storage warehouses, and large HVAC installations.

- By packaging, the IBC/totes segment is expected to grow in the forecast period. They reduce packaging waste and enable safer, more economical transportation.

Market Overview

Rising Demand For Durable Materials: Refrigeration Oil Market To Expand

Refrigeration oil is a specialized lubricant for air conditioning and refrigeration compressors, essential for reducing friction, preventing wear, sealing components, and dissipating heat. It must be chemically stable, have excellent low-temperature properties, and form a homogeneous bond with the specific refrigerant in the system. Using the correct type of refrigeration oil for a given refrigerant and compressor is crucial for maintaining the system's efficiency, reliability, and longevity.

What Are The Key Growth Drivers That Support The Growth Of the Refrigeration Oil Market?

The key growth drivers that support the growth of the market are the industrial demand, especially healthcare and food and beverage industry, due to its integrity and longevity, especially for storing vaccines and medications, which fuels the growth of the market, the technological advancements, and environmental factors like energy efficiency and sustainable systems to encourage the adoption of new advanced refrigeration oil. Innovation in synthetic oil, urbanization and infrastructure, growth in consumer appliances, and cold chain expansion are the key growth drivers that support the growth and expansion of the market.

Market Trends

- Shift to Synthetic Oils: Synthetic oils, such as Polyol Ester (POE), are gaining market share due to their superior thermal stability, extended service life, and excellent compatibility with new, environmentally friendly refrigerants.

- Dominance of the Air Conditioning Segment: The air conditioner segment is a major contributor to the overall demand for refrigeration oil, with continued growth expected in both residential and commercial applications.

- Regional Growth in Asia-Pacific: The Asia-Pacific region is a leading market, fueled by rapid industrial development, growing urbanization, and increasing demand for cold chain and air conditioning solutions.

- Focus on Cost-Effective and Functional Oils: There is a market focus on refrigeration oils that are not only effective but also cost-competitive while meeting regional environmental standards.

Report Scope

| Report Attributes | Details |

| Market Size in 2025 | USD 1.66 Billion |

| Expected Market Size by 2034 | USD 3.08 Billion |

| Growth Rate from 2025 to 2034 | CAGR 7.11% |

| Base Year of Estimation | 2024 |

| Forecast Period | 2025 - 2034 |

| High Impact Region | Asia Pacific |

| Segment Covered | By Product Type, By Application, By Compressor Type, By Packaging, By Region |

| Key Companies Profiled | Shell, ExxonMobil , Chevron , TotalEnergies , BP / Castrol , FUCHS Lubricants , Klüber Lubrication, Idemitsu Kosan , Petro-Canada (Suncor), ENEOS Corporation , Sinopec Lubricants , Indian Oil Corporation , Petronas Lubricants International , Gulf Oil Lubricants , Calumet Lubricants, Lukoil Lubricants , Repsol Lubricants, Valvoline , Motul , BASF Lubricants |

Market Opportunity

Growing Focus On Sustainability And Adoption Of Environmentally Friendly Materials

The growth opportunities for the market are the increasing adoption of environmentally friendly and sustainable refrigerants and a focus on low global warming potential solutions, which demand specialized oils for new and advanced systems, driving the growth. The demand for high-performance, energy-efficient cooling systems in residential, commercial, and industrial sectors is increasing, requiring oils that can enhance system efficiency and performance.

The growing global need for cold chain infrastructure in the food and beverage and pharmaceutical industries, to preserve temperature-sensitive products, is a significant driver for refrigeration oil demand. These factors create a great opportunity for growth and expansion of the market.

Market Challenge

Incompatibility And High Costs

The key challenges that hinder the growth of the market are the incompatibility with certain materials, along with the high cost of synthetic oils, and the raw material price volatility and supply chain disruption. The regulatory and environmental challenges, like transition to new refrigerants, recycling complexity, and incompatibility with certain materials, limit the use and adoption. Technical challenges include oil refrigerant compatibility and equipment modification, which are major limitations in the growth and

Regional Insights

How Did Asia Pacific Dominate The Refrigeration Oil Market In 2024?

Asia Pacific dominates the refrigeration oil market in 2024, driven by the expansion of commercial refrigeration, industrial cold storage, and a booming retail sector. Rising disposable incomes, growing demand for frozen and processed food, and a strong shift toward modern retail formats accelerate the need for advanced cooling systems.

The region is also experiencing rapid adoption of eco-friendly refrigerants, which supports demand for synthetic oils like polyol esters. In addition, the data center boom in countries such as China, Singapore, and Japan enhances market growth, making the Asia Pacific one of the fastest-growing regions for refrigeration oils.

India Has Seen Growth, Driven By The Expansion Of Cold Chain Infrastructure, Fueling Growth.

India represents a high-potential market within the Asia Pacific, driven by the expansion of cold chain infrastructure and government initiatives to reduce food wastage. Rising demand for dairy, seafood, and pharmaceuticals is fueling the installation of advanced refrigeration systems.

The rapid growth of organized retail and quick-commerce delivery platforms is also driving the need for efficient cooling solutions. Furthermore, the country’s growing data center industry and increased telecom penetration further boost demand for high-performance refrigeration oils, particularly synthetic formulations, as sustainability and energy efficiency become priority areas in India’s industrial development.

North America Is Expected To Experience Significant Growth In The Refrigeration Oil Market In the Forecast Period.

North America expects a significant share of the refrigeration oil market during the forecast period, due to its well-established cold chain logistics, food service industry, and strong data center infrastructure. The U.S. and Canada are at the forefront of adopting energy-efficient cooling systems aligned with regulatory standards on refrigerant usage. The growth of e-commerce-driven food delivery and pharmaceutical cold storage is expanding demand for advanced refrigeration oils.

Moreover, large-scale deployment of data centers and the increasing adoption of HVAC systems in commercial spaces further support regional market growth. Sustainability trends and retrofitting of older systems to eco-friendly oils are key drivers.

Segmental Insight

Product Type Insight

Which Mineral Oil Segment Dominates The Refrigeration Oil Market In 2024?

The mineral oil segment dominated the market in 2024. Mineral oil remains relevant in traditional refrigeration systems due to its cost-effectiveness and ease of availability. It is commonly paired with older refrigerants like CFCs and HCFCs, particularly in legacy equipment. While its use is declining with stricter environmental regulations, mineral oil still serves specific applications in developing markets and systems where retrofitting to synthetic alternatives has not yet been adopted.

The polyol ester (POE) oil segment expects significant growth in the refrigeration oil market during the forecast period. Polyol ester (POE) oil is widely used in modern refrigeration systems, especially with HFCs and natural refrigerants. It offers superior lubrication, high thermal stability, and compatibility with eco-friendly refrigerants. Its strong miscibility ensures efficient oil return and system performance. The shift toward low-GWP refrigerants and advanced cooling systems is driving demand for POE oil, making it a critical product in both commercial and industrial refrigeration applications.

Application Insight

How did the Commercial Refrigeration Segment Dominate the Refrigeration Oil Market in 2024?

The commercial refrigeration segment dominated the market in 2024. Commercial refrigeration represents a key application segment, covering supermarkets, cold storage, and food service industries. Refrigeration oils ensure efficient compressor operation, reduce wear, and enhance energy efficiency in these high-demand systems. With increasing demand for fresh and frozen foods, as well as stricter food safety standards, the segment is expanding. Transition to eco-friendly refrigerants is also influencing the choice of high-performance oils in this sector.

The data center & telecom cooling segment expects significant growth in the refrigeration oil market during the forecast period. The rapid expansion of data centers and telecom infrastructure has boosted demand for advanced cooling systems, directly increasing the use of refrigeration oils. These facilities require highly reliable, efficient, and uninterrupted cooling. Specialized oils compatible with next-generation refrigerants support energy efficiency and long-term compressor reliability. With digitalization and 5G rollouts driving data traffic, this segment is expected to see strong growth in refrigeration oil demand.

Compressor Type Insight

Which Compressor Type Segment Dominates The Refrigeration Oil Market In 2024?

The reciprocating compressors segment dominated the market in 2024. Reciprocating compressors are widely used in commercial refrigeration and industrial cooling, requiring oils that provide strong lubrication under high-pressure conditions. Refrigeration oils in this segment reduce friction, minimize wear, and ensure longer operational life. The adaptability of reciprocating compressors across multiple applications continues to support steady oil demand, particularly in food storage and cold chain logistics.

The scroll compressors segment expects significant growth in the market during the forecast period. Scroll compressors are gaining popularity in commercial and residential refrigeration due to their efficiency, compact design, and lower noise levels. Oils used in scroll compressors must maintain thermal stability and strong miscibility with modern refrigerants. Their increasing use in HVAC, supermarkets, and telecom cooling systems supports higher demand for synthetic refrigeration oils, particularly polyol ester formulations.

Packaging Insight

How Did Drums Segment Dominate The Refrigeration Oil Market In 2024?

The drums segment dominated the market in 2024. Drums are a traditional packaging format for refrigeration oils, widely used in large-scale operations and industrial applications. They offer cost efficiency for bulk users like food processing plants, cold storage warehouses, and large HVAC installations. Their widespread availability and ease of transport make them a preferred packaging choice where consistent supply and large-volume usage are required.

The IBC/totes segment expects significant growth in the refrigeration oil market during the forecast period. Intermediate bulk containers (IBCs) or totes are increasingly popular in industrial refrigeration oil supply due to their higher storage capacity and efficiency in handling. They reduce packaging waste and enable safer, more economical transportation. Ideal for large-scale data centers, logistics hubs, and industrial cooling facilities, IBCs support modern supply chain practices by providing flexibility and cost savings over multiple smaller containers.

Refrigeration Oil Market Value Chain Analysis

- Chemical Synthesis and Processing: The refrigeration oil is synthesised and processed through hydro finishing, acid treatment, urea dewaxing, and clay percolation.

- Key players: Fuchs, Gandhar Oil, Matrix Specialty Lubricants, and Kixx

- Quality Testing and Certification: The refrigeration oil requires ISO 8573-1 and AHRI certification.

- Key players: UL Solutions and Intertek

- Distribution to Industrial Users: The refrigeration oil is distributed to the Food & Beverage, Pharmaceutical, Automotive, Electronics Manufacturing, and Logistics sectors.

- Key players: FUCHS, Idemitsu Kosan, and PETRONAS.

Recent Developments

- In October 2024, RSC Bio Solutions launched FURERRA Compressor Oil, which is formulated with benefits like high performance, maintenance costs, and reduces downtime with superior thermal stability for performance in extreme environments.(Source: www.marinelink.com)

Refrigeration Oil Market Top Companies

- Shell

- ExxonMobil

- Chevron

- TotalEnergies

- BP / Castrol

- FUCHS Lubricants

- Klüber Lubrication

- Idemitsu Kosan

- Petro-Canada (Suncor)

- ENEOS Corporation

- Sinopec Lubricants

- Indian Oil Corporation

- Petronas Lubricants International

- Gulf Oil Lubricants

- Calumet Lubricants

- Lukoil Lubricants

- Repsol Lubricants

- Valvoline

- Motul

- BASF Lubricants

Segments Covered

By Product Type

- Mineral oil (naphthenic/paraffinic)

- Synthetic polyol ester (POE) oil

- Synthetic polyalphaolefin (PAO) oil

- Alkylbenzene (AB) oil

- Silicone-based oil

- Bio-based refrigeration oil

- Semi-synthetic / blends

By Application

- Commercial refrigeration (supermarkets, cold rooms, food retail)

- Residential HVAC & refrigeration (domestic refrigerators, split AC)

- Industrial process refrigeration (chemical, petrochemical, manufacturing)

- Cold chain & transport refrigeration (reefer trucks, marine containers)

- Automotive air conditioning (passenger & commercial vehicles)

- Marine & shipboard refrigeration

- Pharmaceutical & biotech refrigeration systems

- Data center & telecom cooling

By Compressor Type

- Reciprocating compressors

- Scroll compressors

- Screw compressors

- Rotary vane compressors

- Centrifugal compressors

By Packaging

- Bulk tank delivery

- Drums (≈200 L)

- Pails (20–60 L)

- Small packs (≤5 L service bottles)

- IBC/totes (1000 L)

By Region

- North America

- U.S.

- Canada

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Sweden

- Denmark

- Norway

- Asia Pacific

- China

- Japan

- India

- South Korea

- Thailand

- Latin America

- Brazil

- Mexico

- Argentina

- Middle East and Africa (MEA)

- South Africa

- UAE

- Saudi Arabia

- Kuwait