Content

AdBlue Oil Market Size and Growth 2025 to 2034

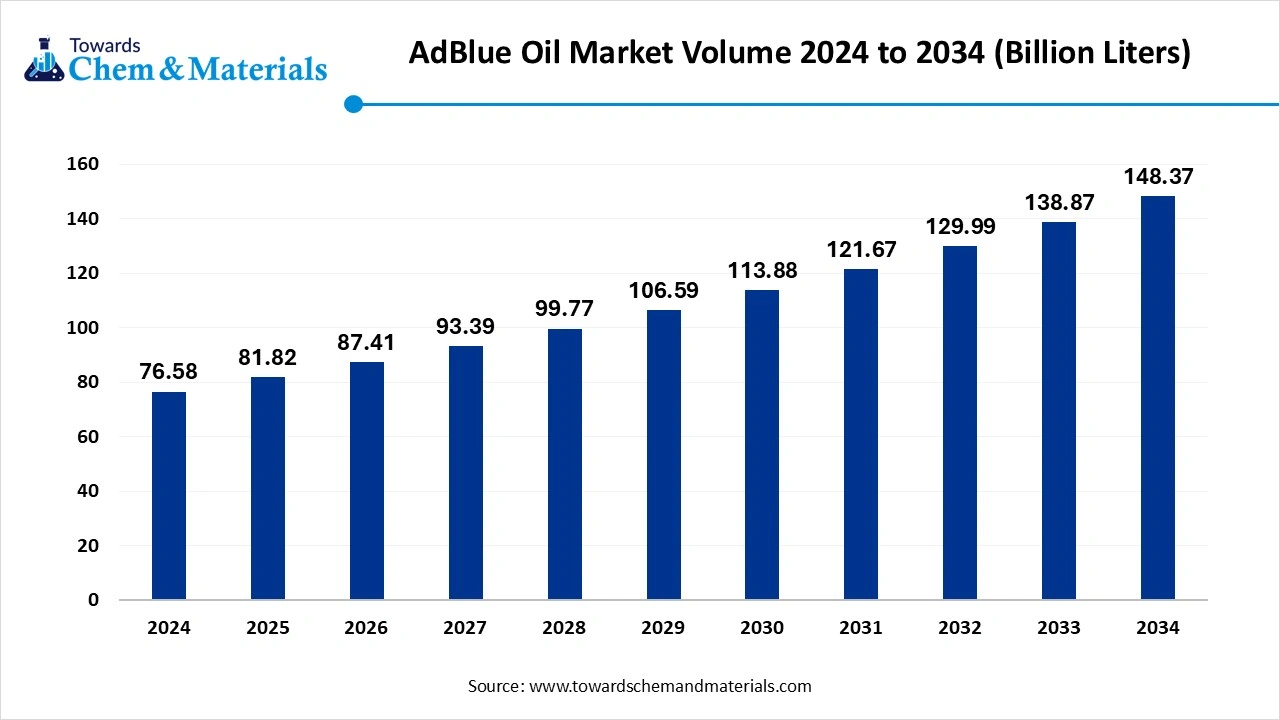

The global adblue oil market size was accounted for 76.58 billion liters in 2024 and is expected to be worth around USD 148.37 billion liters by 2034, growing at a compound annual growth rate (CAGR) of 6.84% during the forecast period 2025 to 2034. The implementation of sustainability initiatives by global governments is fueling market growth in the current period.

Key Takeaways

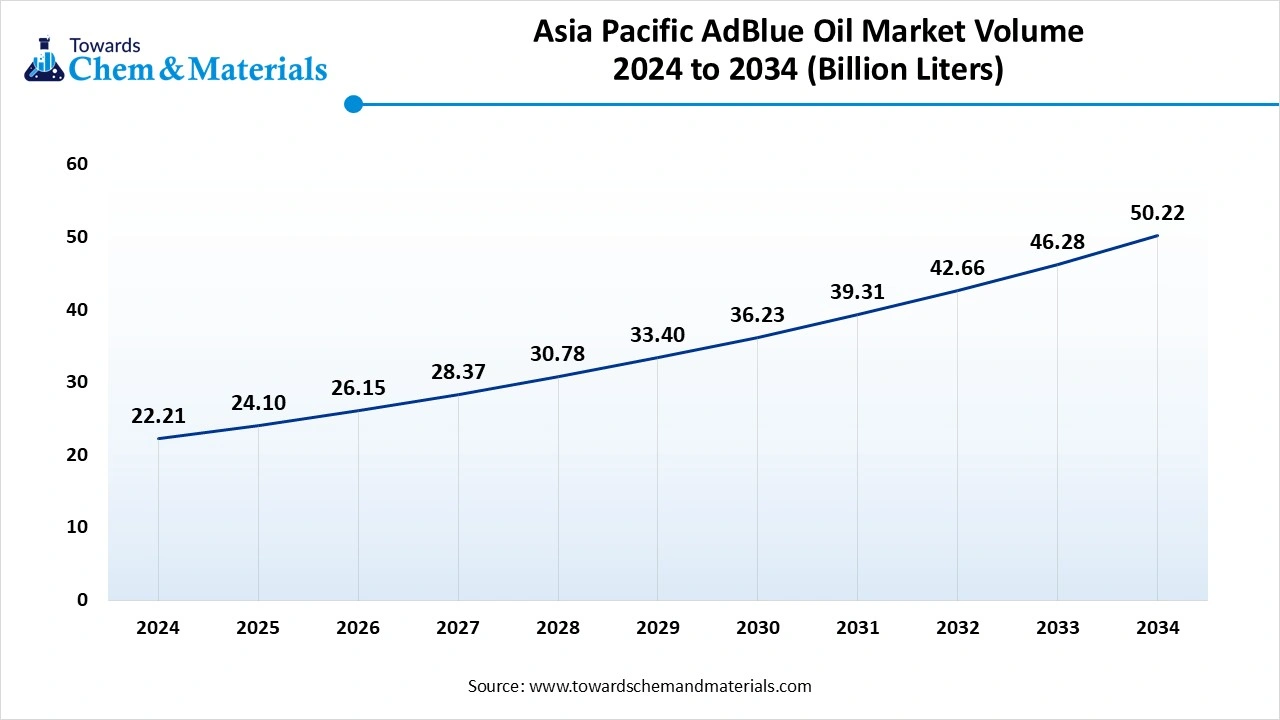

- The Asia-Pacific AdBlue oil market Volume was valued at 22.21 Volume Billion Liters in 2024 and is expected to be worth around 50.22 volume billion liters by 2034, growing at a compound annual growth rate (CAGR) of 8.50% over the forecast period 2025 to 2034.

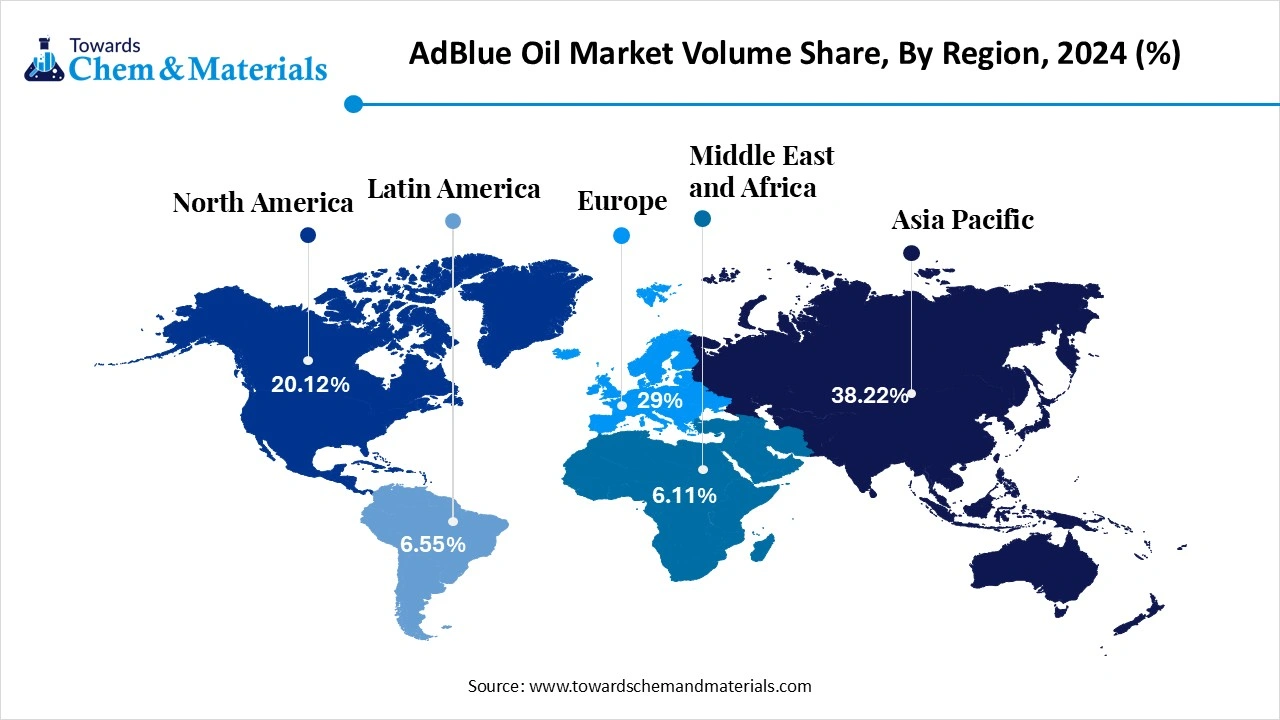

- The Asia Pacific dominated the AdBlue Oil market with the largest Volume share of over 38.22% of the global Volume in 2024.

- The Europe has held Volume share of around 29% in 2024.

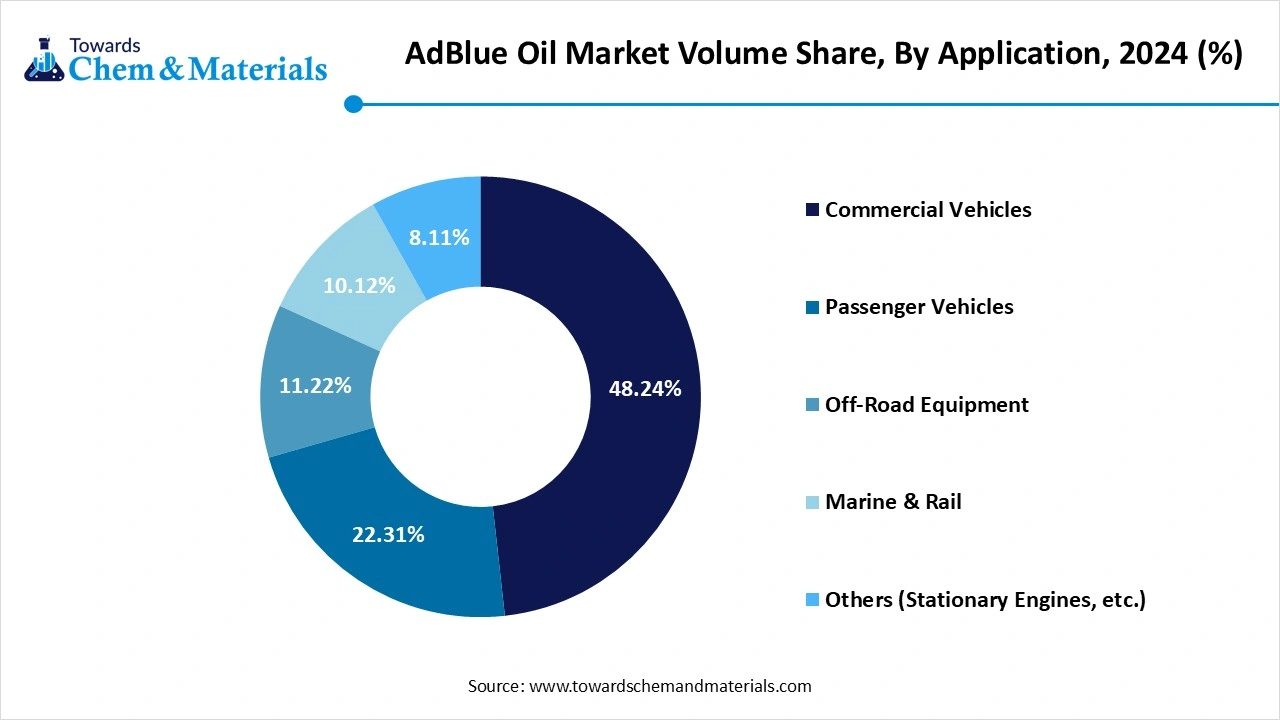

- By application, the railway trains segment dominated the market with the largest Volume share of 48.24% in 2024, akin to the rising need for emission control in high-power diesel engines.

- By application, the Commercial vehicles are anticipated to register the fastest CAGR of 6.70% over the forecast period, owing to governments globally enforcing stricter emission regulations for heavy-duty transport.

AdBlue Surge : Regulation, Innovation, and Global Demand Drive Market

The AdBlue oil market is undergoing a rapid phase of growth akin to the increasing regulatory push for reduced vehicular emissions across global markets. As governments implemented stricter environmental regulations, the demand for selective catalytic reduction (SCR) technology and, by extension, AdBlue, has witnessed consistent growth in recent years. This urea-based diesel exhaust fluid plays a critical role in lowering nitrogen oxide emissions, specifically in heavy-duty vehicles and off-road machinery. Also, the market is gaining momentum across transportation, agriculture, and construction sectors, where diesel engine usage remains high.

Manufacturers are rapidly increasing their production capacities and distribution networks to meet rising regional demands, particularly in regions such as Europe, North America, and Asia-Pacific. Furthermore, digital tracking and quality monitoring technologies are increasingly being integrated into the supply chain, ensuring efficiency and product integrity. With emission standards becoming stronger, AdBlue has become central to achieving sustainable mobility goals, making it a key focus area for automotive and fuel supply chains.

The increasing application of emission control regulations, particularly those aimed at curbing nitrogen oxide emissions from diesel engines, is driving the AdBlue oil market in the current period. As international standards such as Euro 6 and others take effect, vehicle manufacturers are increasingly adopting SCR technology, which requires a consistent supply of AdBlue in recent years. This regulation-driven transformation is encouraging operators and fuel distributors to invest in AdBlue infrastructure and storage facilities, contributing to industry growth in the current period. Also, the commercial vehicle sector, from logistics to public transportation, is accelerating the adoption of emission-reducing systems to comply with sustainability mandates. Furthermore, the regulatory landscape is not only increasing demand but also compelling innovation in fluid formulation, packaging, and delivery systems in recent years.

AdBlue Oil Market Trends

- The expansion of dispensing infrastructure at fuel stations and logistics is driving the growth of the AdBlue oil market in the current period. With commercial operations growing increasingly, specifically in urban logistics and long trucking, the need for on-site and easily accessible AdBlue refilling stations has become critical in recent years. Moreover, fuel retailers and service providers are now integrating AdBlue pumps alongside diesel dispensers, sorting out operational logistics for transport companies.

- Strategic collaborations between AdBlue manufacturers and automotive OEMs are spearheading the industry's potential. As emission regulations become stronger globally, vehicle manufacturers are prioritizing partnerships with reliable AdBlue suppliers to ensure fluid compatibility, consistent quality, and seamless integration with SCR systems. This trend is changing product quality standards and boosting brand differentiation for both suppliers and automotive brands.

- The introduction of digital monitoring and smart dispensing systems is contributing to the industry's growth in the current period. Also, fleet operators and industrial users are seen adopting telemetry-based solutions to track AdBlue levels, consumption patterns, and refill needs in real time. These innovations are enhancing operational planning, reducing wastage, and ensuring uninterrupted compliance with emission regulations in the current period. Moreover, smart dispensers, equipped with IoT sensors and cloud connectivity, which allows for remote diagnostics, temperature control, and inventory alerts.

- Sustainability is an emerging trend in the AdBlue market, driving interest in bio-based and environmentally low-impact urea alternatives. Moreover, traditional AdBlue is derived from synthetic urea, which involves a carbon-intensive production process. Moreover, manufacturers are exploring formulations using urea produced from renewable storage or lower-emission chemical processes in the current period.

Report Scope

| Report Attribute | Details |

| Market Volume in 2025 | 81.82 Billion Liters |

| Expected Volume by 2034 | 148.37 Billion Liters |

| Growth Rate from 2025 to 2034 | 6.84 % |

| Base Year of Estimation | 2024 |

| Forecast Period | 2025 - 2034 |

| Dominant Region | North America |

| Segment Covered | By Type, By Application, By Region |

| Key Companies Profiled | BASF SE, Bosch Limited, Brenntag S.p.A., CF Industries Holdings, Inc., CrossChem Limited, Graco Inc., Komatsu, Mitsui Chemical, Inc., Nandan Petrochem Ltd., Nissan Chemical Company, S.C. OMV PETROM S.A., Shell plc, STOCKMEIER Group, TotalEnergies, Yara |

Market Opportunity

Next Gen Dispensing and Fleet Growth Fuel AdBlue Opportunities

The rapid growth of commercial and logistics fleets across global markets is expected to create lucrative opportunities for AdBlue oil market during the forecast period. As emission regulations become stronger, specifically in developing countries, fleet operators are under pressure to adopt SCR (Selective Catalytic Reduction) technologies that depend upon AdBlue. This shift can open significant growth doors for manufacturers to increase production capacities, establish supply partnerships, and enhance distribution networks in the future, as per the observation.

The increasing integration of IoT-enabled dispensing and monitoring systems is anticipated to create lucrative opportunities for manufacturers in the coming years. As the market increases, industries are moving toward digital tracking of AdBlue usage to improve operational efficiency, reduce wastage, and meet regulatory compliance. Also, the ability to offer real-time tracking, automated refill alerts, and remote diagnostics creates differentiation, allowing manufacturers to gain major attention in the coming years.

Market Challenge

Strong Sensitivity Creates Challenges for AdBlue Reliability

The material’s sensitivity to temperature and contamination affects its shelf-life and performance is likely Unlike traditional fuels or fluids, AdBlue requires strict storage conditions to maintain urea concentration and prevent degradation. Moreover, variations in temperature or exposure to sunlight can lead to crystallization or ammonia loss, reducing its effectiveness in SCR systems, which can create growth barriers for the AdBlue oil market in the coming years.

Regional Insights

North America Leads With Regulation-Driven AdBlue Adoption, North America dominated the AdBlue oil market in 2024, akin to stringent emission regulations, particularly in countries such United States, where EPA standards have driven widespread adoption of selective catalytic reduction (SCR) systems in the current period. The well-established commercial transportation network, along with high diesel vehicle penetration, supports consistent AdBlue demand, which is the primary driver in the country nowadays. Also, the region gained advantage from a robust distribution infrastructure and early regulatory enforcement, pushing fleet operators and vehicle manufacturers to follow emission control technologies in the current period. These factors, combined with growing

The Asia-Pacific AdBlue oil market volume was valued at 22.21 volume billion liters in 2024 and is expected to be worth around 50.22 volume billion liters by 2034, growing at a compound annual growth rate (CAGR) of 8.50% over the forecast period 2025 to 2034.

Asia Pacific Accelerates: Emerging Economies Drive AdBlue Demand, Asia Pacific is expected to grow at a significant pace in the coming period, akin to rising vehicle production, expanding transportation networks, and accelerating environmental regulations in countries such as China and India in the current period. Also, governments are actively pushing for cleaner diesel technologies, promoting SCR system adoption in the commercial sector, which has severely contributed to the demand for AdBlue oil in recent years. The growing industrialization and surge in diesel-powered vehicles in emerging economies contribute to increased AdBlue consumption. Furthermore, as domestic manufacturing capacities rise, regional suppliers are increasing production to meet demand.

Green Mandates and Market Stability: Europe’s AdBlue Advantage, Europe expects notable growth in the market in future, akin to early adoption of sustainability policies and a mature regulatory framework. The region’s focus on decarbonization and strict Euro emission standards has long driven SCR implementation in both commercial and passenger vehicles in the region. However, supply chain challenges such as high energy costs and regional production disruptions have occasionally impacted availability and pricing in Europe. Despite this, the strong policy backing and consumer attention on green mobility have sustained consistent demand in recent years. Europe’s adoption of alternative fuels and electrification introduces uncertainty, but AdBlue remains important for existing diesel fleets in the current period.

AdBlue Oil Market Volume Share, By Region, 2024-2034 (%)

| By Region | Volume Share, 2024 (%) | Volume Billion Liters - 2024 | Volume Share, 2034 (%) | Volume Billion Liters - 2034 | CAGR (2025 - 2034) |

| North America | 20.12% | 15.41 | 18.34% | 27.21 | 5.85% |

| Europe | 29.00% | 22.21 | 33.21% | 49.27 | 8.30% |

| Asia Pacific | 38.22% | 29.27 | 33.85% | 50.22 | 5.55% |

| Latin America | 6.55% | 5.02 | 7.50% | 11.13 | 8.29% |

| Middle East & Africa | 6.11% | 4.68 | 7.10% | 10.53 | 8.45% |

| Total | 100% | 76.58 | 100% | 148.37 | 6.84% |

Application Insights

The railway trains segment dominated the market with the largest share in 2024, akin to the rising need for emission control in high-power diesel engines. Rail operators are seen adopting selective catalytic reduction (SCR) systems to meet stringent NOx emission standards while maintaining fuel efficiency. As long-distance trains and passenger trains depend heavily on diesel locomotion, consistent AdBlue usage becomes integral. Moreover, regulatory frameworks in Europe and Asia have accelerated compliance-driven demand, making railways a key application area.

The commercial vehicle segment is expected to experience notable market growth in the future, owing to governments globally enforcing stricter emission regulations for heavy-duty transport. Fleets across logistics, construction, and municipal services increasingly integrate SCR technologies to align with evolving environmental standards in the current period. Moreover, the growing dependence on diesel-based movement, specifically in developing markets, fuels consistent AdBlue demand. Furthermore, fleet operators prioritize efficiency and regulatory compliance, leading to higher consumption patterns. With infrastructure expansion and e-commerce growth boosting road vehicle volumes, which is expected to drive the growth of the market during the upcoming years.

AdBlue Oil Market Volume Share, By Application, 2024- 2034 (%)

| By Application | Volume Share, 2024 (%) | Volume Billion Liters - 2024 | Volume Share, 2034 (%) | Volume Billion Liters 2034 | CAGR (2025 - 2034) |

| Commercial Vehicles | 48.24% | 36.94 | 47.64% | 70.68 | 6.70% |

| Passenger Vehicles | 22.31% | 17.08 | 20.03% | 29.72 | 5.69% |

| Off-Road Equipment | 11.22% | 8.59 | 13.11% | 19.45 | 8.51% |

| Marine & Rail | 10.12% | 7.75 | 9.22% | 13.68 | 5.85% |

| Others (Stationary Engines, etc.) | 8.11% | 6.21 | 10.00% | 14.84 | 9.10% |

| Total | 100% | 76.58 | 100% | 148.37 | 6.84% |

AdBlue Oil Market Recent Developments

- In December 2024, LIQUI MOLY introduced their latest additive for AdBlue recently. Moreover, this AdBlue supports nitrogen oxide levels in diesel engines as per the company claim. (Source : liquimoly.com)

- In February 2024, BPCL unveiled its mobile MAK AdBlue dispenser in Kolkata, India, recently. The main motive of the launch is to access eco-friendly fuel access. (Source : energy.economictimes.indiatimes)

- In April 2024, BASF introduced its latest product, called AdBlueR ZeroPCF. The company’s motive behind the launch is to reduce its carbon footprint. (Source: fuelsandlubes)

Top Companies list

- BASF SE

- Bosch Limited

- Brenntag S.p.A.

- CF Industries Holdings, Inc.

- CrossChem Limited

- Graco Inc.

- Komatsu

- Mitsui Chemical, Inc.

- Nandan Petrochem Ltd.

- Nissan Chemical Company

- S.C. OMV PETROM S.A.

- Shell plc

- STOCKMEIER Group

- TotalEnergies

- Yara

Segment Covered in the Report

By Application

- Commercial Vehicles

- Passenger Cars

- Railway Trains

- Others

By Region

- North America

- U.S.

- Canada

- Mexico

- Europe

- UK

- Germany

- France

- Italy

- Spain

- Sweden

- Denmark

- Norway

- Asia Pacific

- Japan

- China

- India

- Australia

- South Korea

- Thailand

- Latin America

- Brazil

- Argentina

- The Middle East and Africa

- South Africa

- Saudi Arabia

- UAE

- Kuwait