Content

Diesel Exhaust Fluid Market Size and Growth 2025 to 2034

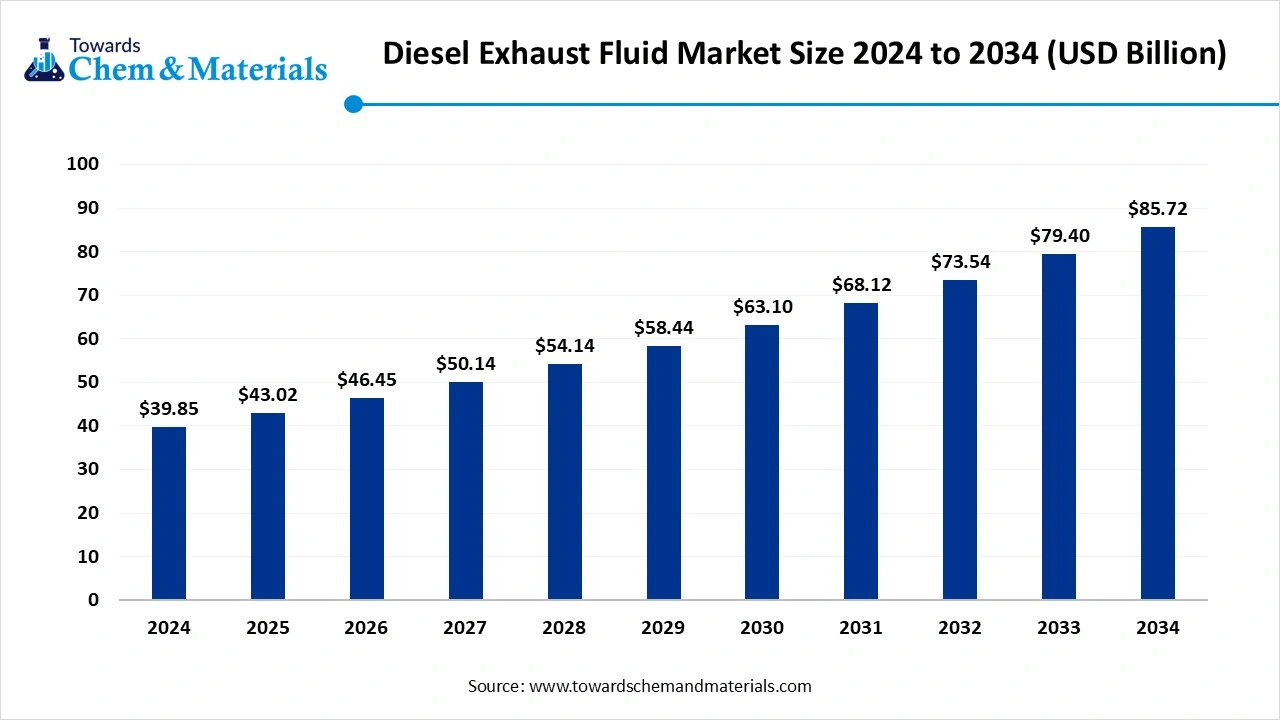

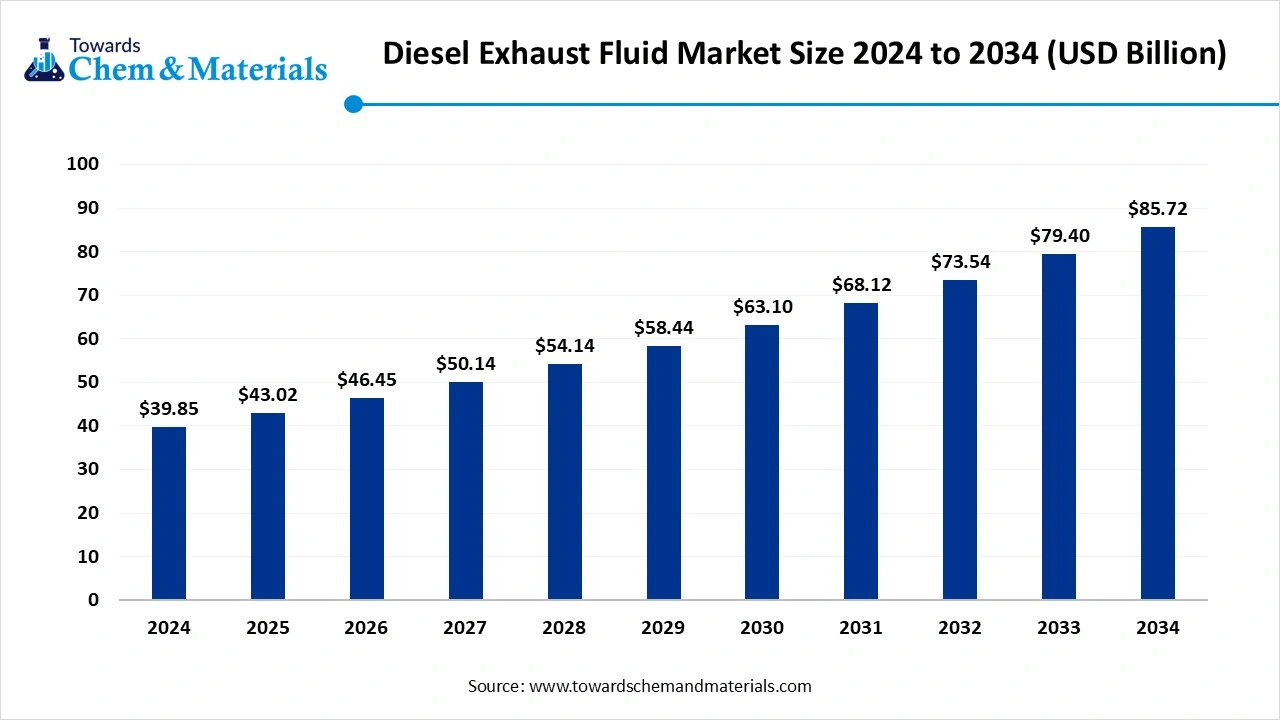

The global diesel exhaust fluid-market size was valued at USD 39.85 billion in 2024, grew to USD 43.02 billion in 2025, and is expected to hit around USD 85.72 billion by 2034, growing at a compound annual growth rate (CAGR) of 7.96% over the forecast period from 2025 to 2034. The increasing vehicle fleet, expansion of DEF dispensing infrastructure, and growing production of heavy-duty trucks drive the market growth.

Key Takeaways

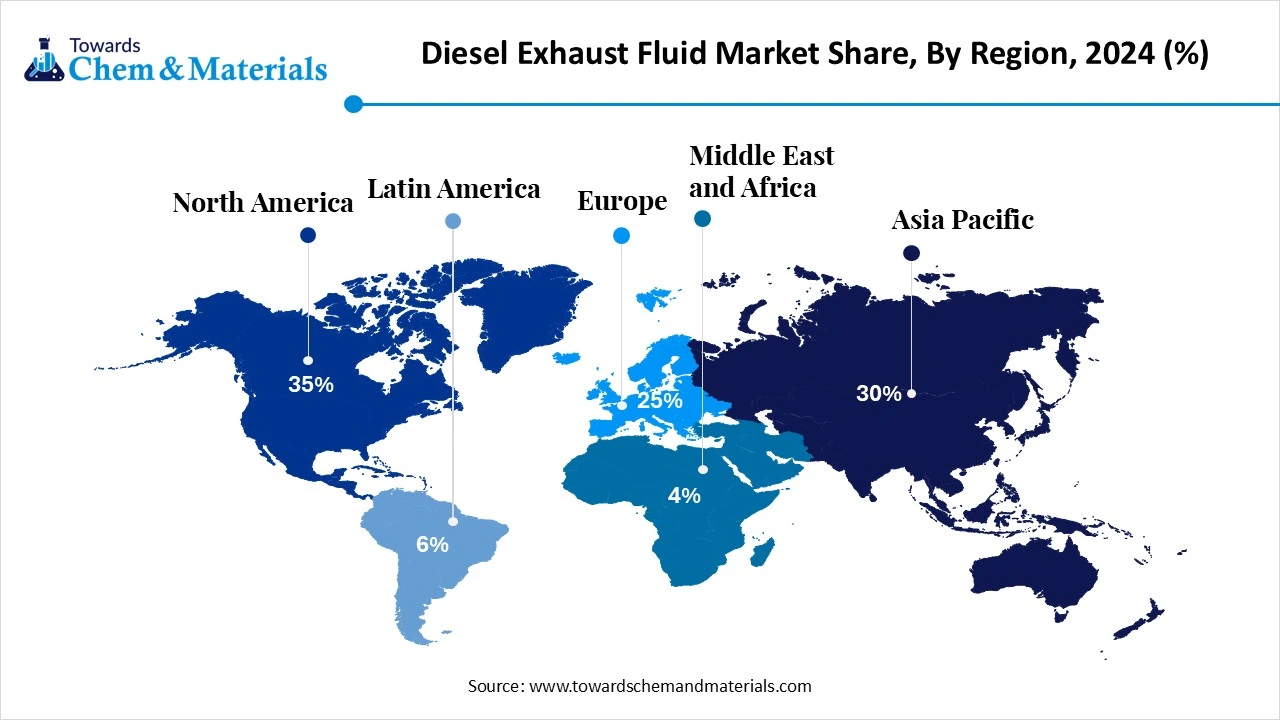

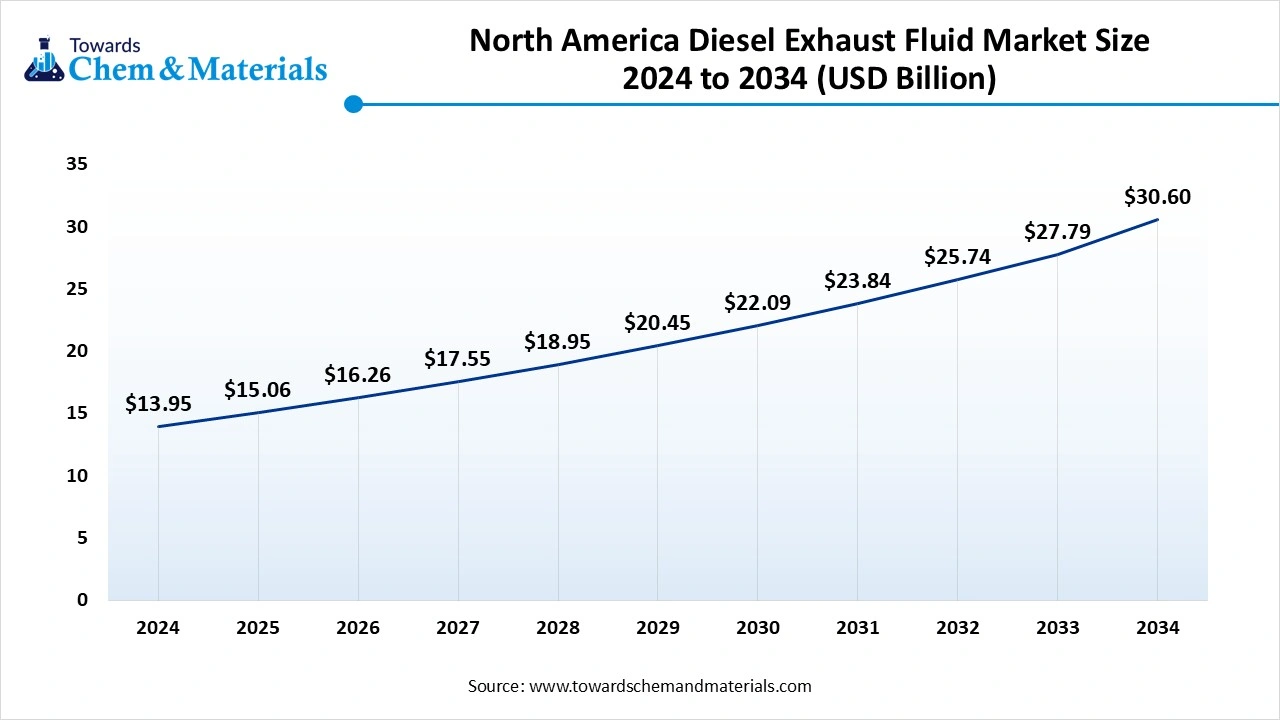

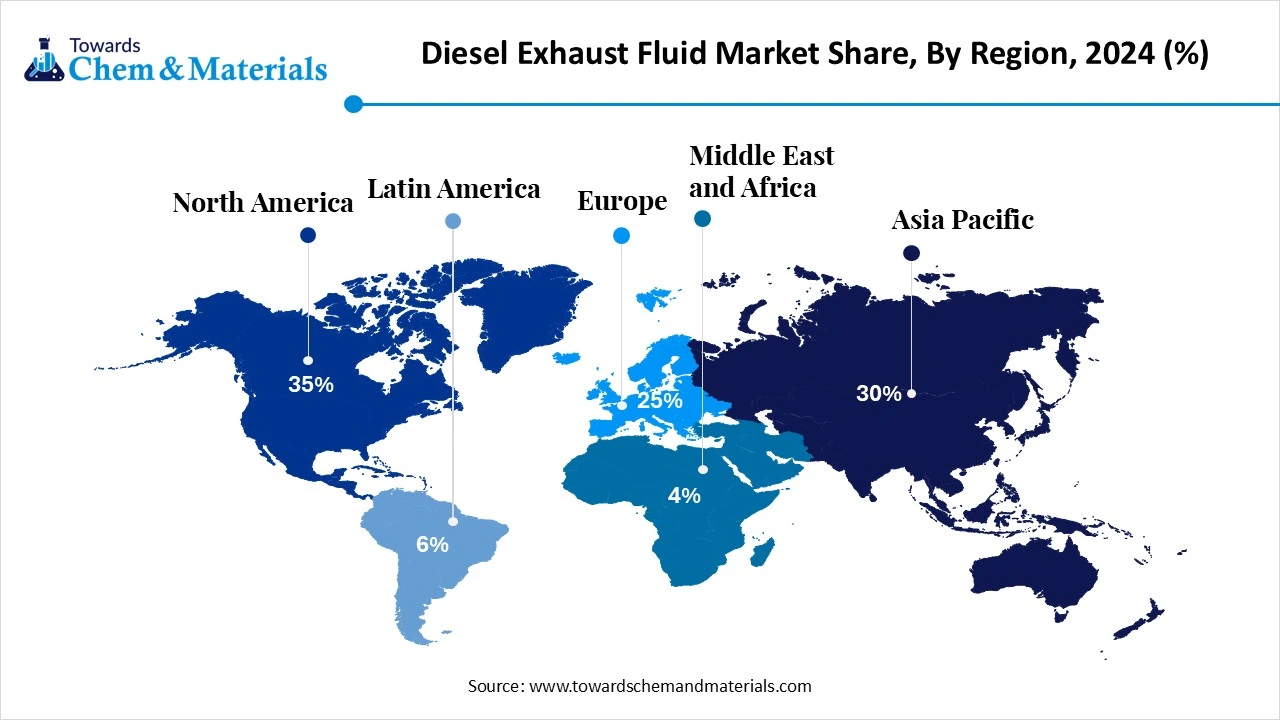

- By region, North America held approximately a 35% share in the diesel exhaust fluid market in 2024 due to the growing production of vehicles.

- By region, Asia Pacific is growing at the fastest CAGR in the market during the forecast period due to rapid industrialization.

- By product type, the packaged DEF segment held approximately a 50% share in the market in 2024 due to the ease of use.

- By product type, the bulk DEF segment is expected to grow at the fastest CAGR in the market during the forecast period due to the increasing production of large fleets.

- By vehicle type, the heavy commercial vehicles segment held approximately a 45% share in the market in 2024 due to the rise in e-commerce.

- By vehicle type, the off-road vehicles segment is expected to grow at the fastest CAGR in the market during the forecast period due to the increasing agricultural activities.

- By distribution channel, the OEM/dealerships segment held approximately a 40% share in the market in 2024 due to the availability of regular maintenance.

- By distribution channel, the online/direct-to-fleet sales segment is expected to grow at the fastest CAGR in the market during the forecast period due to the competitive pricing.

- By end user, the logistics & transportation companies segment held approximately a 50% share in the market in 2024 due to the rise in online shopping.

- By end user, the construction & mining companies segment is expected to grow at the fastest CAGR in the market during the forecast period due to the growing infrastructure development.

What is Diesel Exhaust Fluid?

Diesel exhaust fluid (DEF) is an aqueous urea solution used in a selective catalytic reduction system. It is made up of urea & deionized water and is an odorless, toxic, & colorless fluid. DEF is widely used in diesel engines in vehicles like commercial vehicles, buses, off-road equipment, & trucks. DEF offers benefits like improving air quality, lowering emissions of NOx, enhancing engine performance, reducing maintenance costs, increasing fuel efficiency, and extending engine lifespan.

Factors like growing production of diesel-based vehicles, increasing expansion of DEF dispensing infrastructure, rising fleet modernization, rise in off-road applications, and growing awareness about environmental issues contribute to the growth of the diesel exhaust fluid market.

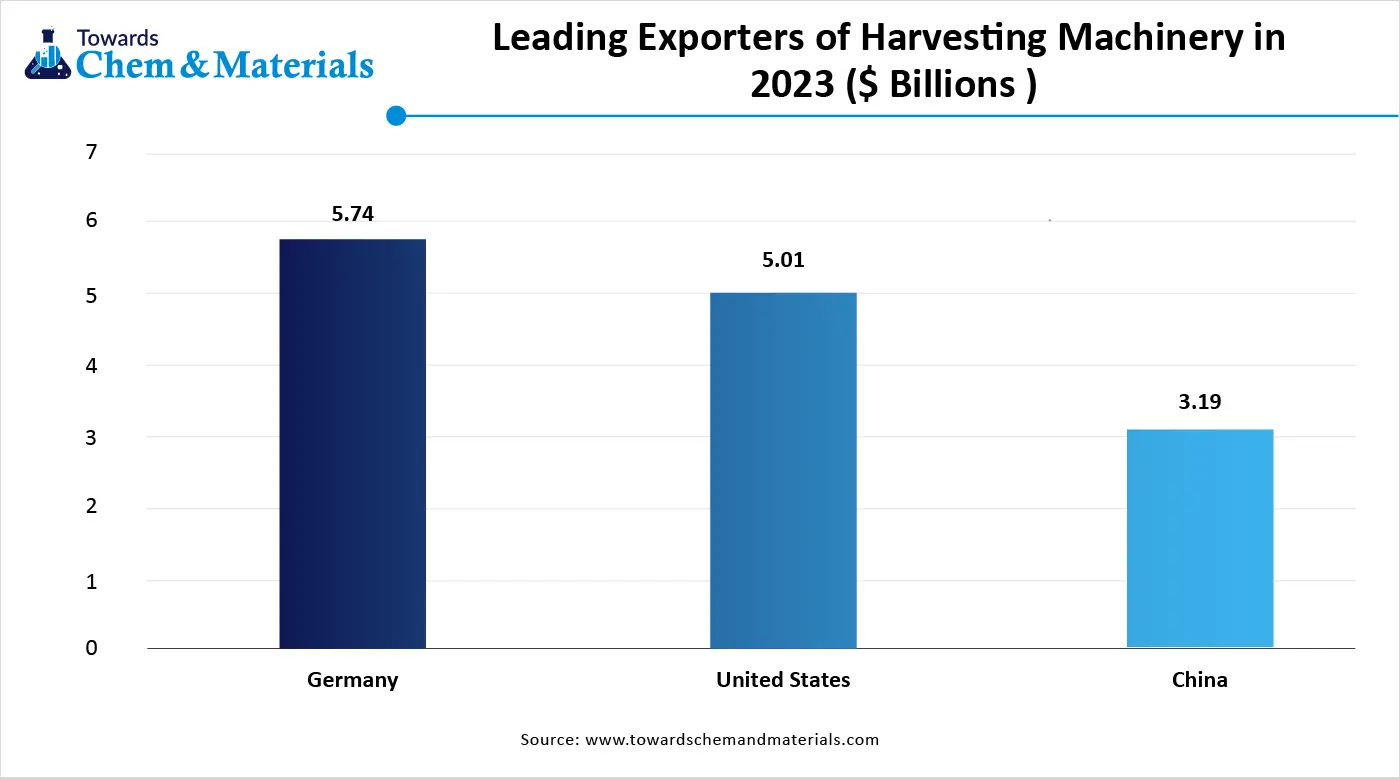

Who are the Leading Exporters of Diesel Exhaust Fluid?

| Company Name | Constituent % |

| Old World Automotive | 46% |

| Dorian Drake International Inc | 11% |

| GUANGDONG HANGPIN JINGGONGKEJI CO | 11% |

Growing Automotive Industry Surges Demand for DEF

The growing automotive industry in various regions and the increasing production of vehicles increase demand for DEF. The rising manufacturing of commercial vehicles like buses & trucks increases the adoption of DEF. The increasing adoption of light-duty vehicles like SUVs, camper vans, passenger cars, and pickup vehicles increases demand for DEF. The stricter emission regulations and increasing modernization of vehicle fleets increase the adoption of DEF. The strong focus on reducing pollution and increasing integration of SCR technology with vehicles increases demand for DEF.

The increasing production of tractors and trucks increases demand for DEF. The growth in diesel vehicles and the popularity of diesel engines increases the adoption of DEF. The growing automotive industry is a key driver for the growth of the diesel exhaust fluid market.

Market Trends

- Growing Construction Activities: The growing development of infrastructure projects and increasing construction activities increase demand for heavy-duty equipment & heavy machinery that requires DEF.

- Growth in E-Commerce: The growth in last-mile delivery services and the rise in e-commerce increases the adoption of light commercial vehicles, heavy commercial vehicles, and trucks that require DEF.

- Increasing Environmental Awareness: The increasing pollution and stringent emission standards in regions like the Asia Pacific, Europe, and others increase demand for DEF to lower pollution.

Report Scope

| Report Attributes | Details |

| Market Size in 2025 | USD 43.02 Billion |

| Expected Size by 2034 | USD 85.72 Billion |

| Growth Rate from 2025 to 2034 | CAGR 7.96% |

| Base Year of Estimation | 2024 |

| Forecast Period | 2025 - 2034 |

| Dominat Region | North America |

| Segment Covered | By Product Type, By Vehicle Type, By Distribution Channel, By End User, By Region |

| Key Companies Profiled | Total Energies, Shell, BASF SE, Sinopec, Cummins Filtration, CF Industries Holdings, Inc., Dyno Nobel, Agrium Inc., Honeywell International Inc., Faurecia SE |

Market Opportunity

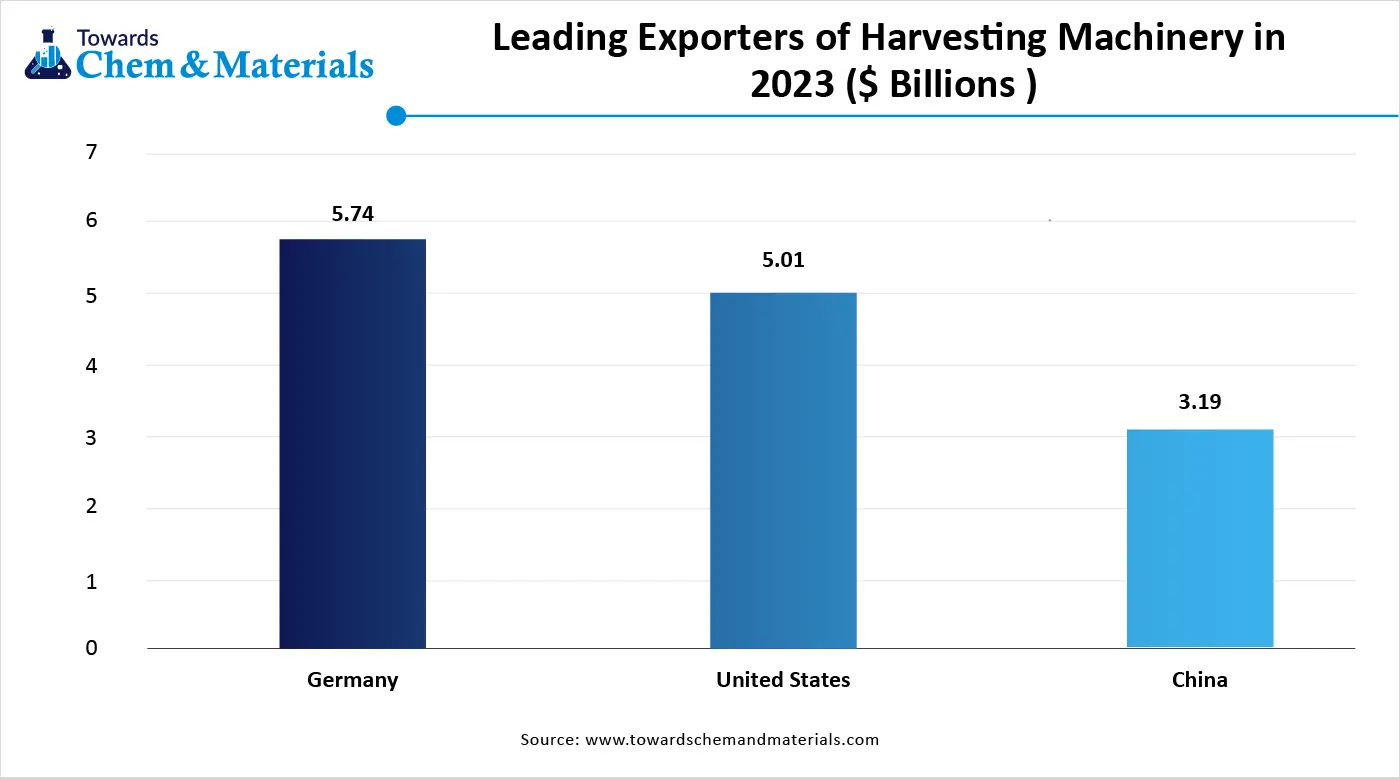

Growing Agriculture Activities Unlocks DEF Market Opportunity

The growth in the agriculture sector and the increasing production of various agricultural products increase the adoption of DEF. The growing manufacturing of modern agricultural machinery and the focus on lowering air pollution increase the adoption of DEF. The increasing demand for heavy-duty equipment, tractors, and combines in various agricultural activities increases demand for DEF. The strong focus on sustainable farming practices and increasing utilization of modern machinery in agricultural activities increases demand for DEF.

The growing focus on minimizing NOx emissions and the development of new agricultural engines increase demand for DEF. The increasing utilization of combine harvesters in modern farming practices increases demand for DEF. The growing agricultural activities create an opportunity for the growth of the diesel exhaust fluid.

Market Challenge

High Production Cost Shuts Down Market Expansion

With several benefits of the diesel exhaust fluid in various applications, the high production cost restricts the market growth. Factors like volatility in raw material prices, high quality standards, the need for specialized equipment, and complex manufacturing processes are responsible for the high production cost. The fluctuating prices of key raw materials like natural gas, which are used in the production of urea, directly affect the market.

The need for high-purity ingredients and focus on contamination sensitivity increases the cost. The intensive manufacturing process, like precision mixing, and the need for a temperature-controlled environment increase the cost. The high production cost hampers the growth of the diesel exhaust fluid market.

Regional Insights

North America Diesel Exhaust Fluid Market Size, Industry Report 2034

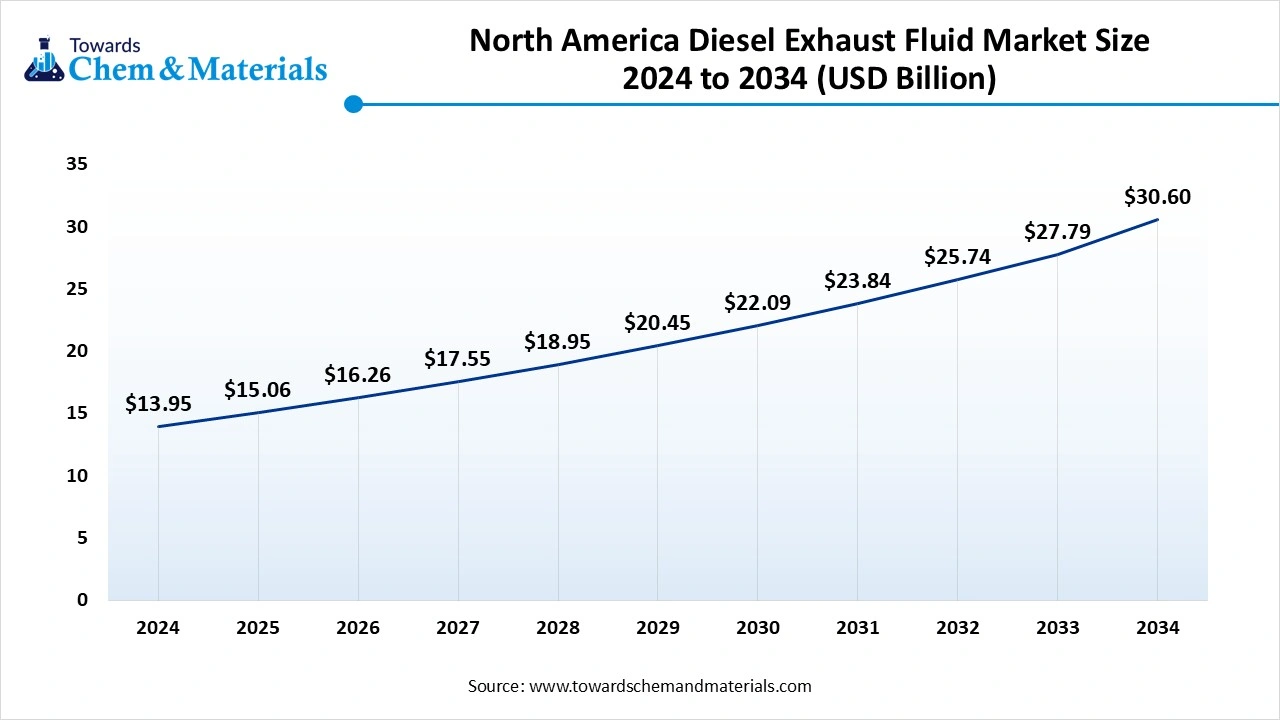

The North America diesel exhaust fluid market size was estimated at USD 13.95 billion in 2024 and is anticipated to reach USD 30.60 billion by 2034, growing at a CAGR of 8.17% from 2025 to 2034. North America dominated the market in 2024.

The growing adoption of SCR systems and stricter emission regulations increases the adoption of DEF. The increasing production of vehicles and the presence of a large fleet of diesel vehicles increase demand for DEF. The growing infrastructure development and construction activities increase demand for DEF. The increasing manufacturing of commercial vehicles and the growing need for off-road equipment increase the adoption of DEF. The strong presence of manufacturers like Peterbilt and Freightliner drives the market growth.

United States Diesel Exhaust Fluid Market Trends

The United States is a major contributor to the market. The increasing production of diesel vehicles and the strong presence of commercial trucking systems increase demand for DEF. The stringent emission regulations and growing construction activities increase demand for DEF. The increasing demand for construction equipment and well-established infrastructure for DEF distribution support the overall growth of the market.

- From September 2023 to August 2024, the United States exported 96 shipments of diesel exhaust.(Source: www.volza.com)

Asia Pacific Diesel Exhaust Fluid Market Trends

Asia Pacific is experiencing the fastest growth in the market during the forecast period. The growing industrialization and stringent emission standards in countries like India, South Korea, China, and Japan increase demand for diesel exhaust fluid. The rising expansion of diesel vehicle fleets and growing development of infrastructure increases demand for DEF. The growing agricultural sectors and increasing construction activities increase the adoption of DEF. The growing vehicle pollution and a well-established chemical manufacturing base increase demand for DEF, supporting the overall growth of the market.

China Diesel Exhaust Fluid Market Trends

China is a key contributor to the market. The growing production of agricultural machinery, trucks, and buses increases demand for DEF. The increasing need for commercial vehicles and high investment in DEF production increases demand for DEF. The strong focus on sustainability and stricter emission regulations increases the adoption of DEF. The increasing production of diesel fleet and the rising development of large-scale construction projects increase the adoption of DEF, driving the overall growth of the market.

- China exported 1381 shipments of diesel exhaust.(Source: www.volza.com)

Segmental Insights

Product Type Insights

Why did the Packaged DEF Segment Dominate the Diesel Exhaust Fluid Market?

The packaged DEF segment dominated the market in 2024. The ease of use and strong focus on portability increase demand for packaged DEF. The focus on maintaining product integrity and the need to reduce the risk of spills increase the adoption of packaged DEF. The growing rate of small fleet operators and the growth in DEF pumps increase the adoption of packaged DEF. The increasing availability of packaged DEF in retail stores, auto part stores, and gas stations drives the market growth.

The bulk DEF segment is the fastest-growing in the market during the forecast period. The growing production of large fleets and the increasing expansion of SCR technology increase demand for bulk DEF. The increasing number of diesel vehicle fleets and the presence of large commercial hubs increase the adoption of bulk DEF. The growth in the transportation sector and increasing environmental awareness increase the adoption of bulk DEF. The cost-effectiveness and expansion of SCR technology increase demand for bulk DEF, supporting the overall growth of the market.

Vehicle Type Insights

Which Vehicle Type Held the Largest Share in the Diesel Exhaust Fluid Market?

The heavy commercial vehicles segment held the largest revenue share in the market in 2024. The rapid growth in the logistics sector and increasing production of buses & trucks increases demand for DEF. The increasing demand for bulldozers & excavators in construction activities increases the adoption of DEF. The growing development of infrastructure projects and increasing construction activities increases demand for heavy commercial vehicles. The growth in the e-commerce sector and growing emissions in heavy commercial vehicles increase the adoption of DEF, driving the overall market growth.

The off-road vehicles segment is experiencing the fastest growth in the market during the forecast period. The growing agricultural activities and the rise in development of construction projects increase demand for off-road vehicles. The growing demand for forklifts, tractors, and cranes in various industrial activities increases the adoption of DEF. The growth in sectors like mining & logging increases demand for off-road vehicles. The growing demand for off-road vehicles like trucks, all-terrain vehicles, and others increases the adoption of DEF, supporting the overall market growth.

Distribution Channel Insights

What made OEM or Dealerships Segment Dominate the Diesel Exhaust Fluid Market?

The OEM or dealerships segment dominated the market in 2024. The stringent emission standards and focus on preventing potential damage to vehicles increase demand for OEMs. The growing demand for high-quality DEF and trusted dealership recommendations increases demand for OEM. The need for consistent experience and focus on regular maintenance increases demand for dealerships. The strong presence of the service centre and the availability of integration of SCR systems in OEM/dealerships drives the overall growth of the market.

The online or direct-to-fleet sales segment is the fastest-growing in the market during the forecast period. The strong focus on minimizing vehicle downtime and streamlining delivery increases demand for direct-to-fleet sales. The cost-effectiveness and availability of better inventory management increase the adoption of direct-to-fleet sales. Direct access to DEF and the competitive pricing of DEF increase the adoption of online sales, supporting the overall market growth.

End User Insights

How Logistics & Transportation Companies Segment Held the Largest Share in the Diesel Exhaust Fluid Market?

The logistics & transportation companies segment held the largest revenue share in the market in 2024. The growing demand for passenger vehicles and the increasing need for heavy-duty trucks increase the demand for DEF. The growing adoption of logistics vehicles like construction equipment, heavy-duty trucks, and buses increases demand for DEF. The growth in online shopping and increasing demand for public transportation increases the adoption of DEF, driving the overall growth of the market.

The construction & mining companies segment is experiencing the fastest growth in the market during the forecast period. The rapid urbanization and growing infrastructure development increase demand for DEF for construction equipment. The increasing mining activities and growth in commercial & residential construction activities increase the adoption of DEF. The growing development of public spaces, roadways, & building and expansion of the mining sector increases demand for DEF, supporting the overall growth of the market.

Diesel Exhaust Fluid Market Value Chain Analysis

- Feedstock Procurement: The feedstock procurement for diesel exhaust fluid includes 32.5% Urea with 67.5% deionized water.

- Chemical Synthesis and Processing: The chemical synthesis & processing involve steps like urea synthesis, deionization, and blending, including dissolution & concentration.

- Quality Testing and Certification: The quality testing involves testing of purity, urea concentration, visual inspection, refractive index, & contamination, and certification includes BIS, ISO 22241, and API DEF Certification Mark.

Recent Developments

- In March 2025, HPCL and Tata Motors launched Genuine DEF to enhance the performance of commercial vehicles. The DEF solution extends the longevity of vehicles and boosts the efficiency of the drivetrain. It lowers harmful emissions and supports cleaner transportation solutions.(Source: www.tatamotors.com)

- In June 2025, Rislone launched super-concentrated DEF treatment. The treatment supports agricultural operations, commercial vehicles, and governmental fleets. It is available in a 33-ounce bottle, and it improves the selective catalytic reduction system. It prevents crystallization in the pump, sender, injector, tank, mixer, heater, and lines.(Source: www.aftermarketnews.com)

Diesel Exhaust Fluid Market Top Companies

- Total Energies

- Shell

- BASF SE

- Sinopec

- Cummins Filtration

- CF Industries Holdings, Inc.

- Dyno Nobel

- Agrium Inc.

- Honeywell International Inc.

- Faurecia SE

Segments Covered

By Product Type

- Packaged DEF

- Bottled / Packaged (1–20 L)

- Drums & Totes (200–1000 L)

- Bulk DEF

- Tanker Transport

- On-Site Bulk Storage

By Vehicle Type

- Light Commercial Vehicles (LCVs)

- Medium Commercial Vehicles (MCVs)

- Heavy Commercial Vehicles (HCVs)

- Buses & Coaches

- Off-Road Vehicles (Construction, Mining, Agriculture)

By Distribution Channel

- OEM / Dealerships

- Retail / Aftermarket

- Bulk / Industrial Distribution

- Online / Direct-to-Fleet Sales

By End User

- Logistics & Transportation Companies

- Public Transport Authorities

- Construction & Mining Companies

- Agriculture & Farming Enterprises

- Industrial & Power Generation Companies

By Region

- North America

- U.S.

- Canada

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Sweden

- Denmark

- Norway

- Asia Pacific

- China

- Japan

- India

- South Korea

- Thailand

- Latin America

- Brazil

- Mexico

- Argentina

- Middle East & Africa

- South Africa

- UAE

- Saudi Arabia

- Kuwait

List of Figures

- Figure 1. Global Diesel Exhaust Fluid Market Size (USD 39.85 Billion with CAGR 7.96%), 2024–2034

- Figure 2. Global Diesel Exhaust Fluid Market Share by Region, 2024 (North America 35%, Europe 25%, Asia Pacific 20%, Latin America 10%, Middle East & Africa 10%)

- Figure 3. Global Diesel Exhaust Fluid Market Share by Product Type, 2024 (Packaged DEF 50% – Bottled/Packaged 20%, Drums & Totes 30%; Bulk DEF 50% – Tanker Transport 30%, On-Site Bulk Storage 20%)

- Figure 4. Global Diesel Exhaust Fluid Market Share by Vehicle Type, 2024 (Heavy Commercial Vehicles 45%, Medium Commercial Vehicles 20%, Light Commercial Vehicles 15%, Off-Road Vehicles 20%)

- Figure 5. Global Diesel Exhaust Fluid Market Share by Distribution Channel, 2024 (OEM/Dealerships 40%, Retail/Aftermarket 30%, Bulk/Industrial Distribution 15%, Online/Direct-to-Fleet Sales 15%)

- Figure 6. Global Diesel Exhaust Fluid Market Share by End User, 2024 (Logistics & Transportation Companies 50%, Public Transport Authorities 20%, Construction & Mining Companies 15%, Agriculture & Farming Enterprises 10%, Industrial & Power Generation Companies 5%)

- Figure 7. Regional Market Forecast: North America DEF Market Size (USD Billion), 2024–2034

- Figure 8. Regional Market Forecast: Asia Pacific DEF Market Size (USD Billion), 2024–2034

- Figure 9. Regional Market Forecast: Europe DEF Market Size (USD Billion), 2024–2034

- Figure 10. Competitive Landscape – Export Market Share of DEF, 2024 (Old World Automotive 46%, Dorian Drake International Inc 11%, Guangdong Hangpin Jinggongkeji Co 11%, Others 32%)

List of Tables

- Table 1. Global Diesel Exhaust Fluid Market Size, 2024–2034 (USD 39.85 Billion with CAGR 7.96%)

- Table 2. Global Diesel Exhaust Fluid Market Share by Region, 2024 (North America 35%, Europe 25%, Asia Pacific 20%, Latin America 10%, Middle East & Africa 10%)

- Table 3. Global Diesel Exhaust Fluid Market Share by Product Type, 2024 (Packaged DEF 50% – Bottled/Packaged 20%, Drums & Totes 30%; Bulk DEF 50% – Tanker Transport 30%, On-Site Bulk Storage 20%)

- Table 4. Global Diesel Exhaust Fluid Market Share by Vehicle Type, 2024 (Heavy Commercial Vehicles 45%, Medium Commercial Vehicles 20%, Light Commercial Vehicles 15%, Off-Road Vehicles 20%)

- Table 5. Global Diesel Exhaust Fluid Market Share by Distribution Channel, 2024 (OEM/Dealerships 40%, Retail/Aftermarket 30%, Bulk/Industrial Distribution 15%, Online/Direct-to-Fleet Sales 15%)

- Table 6. Global Diesel Exhaust Fluid Market Share by End User, 2024 (Logistics & Transportation Companies 50%, Public Transport Authorities 20%, Construction & Mining Companies 15%, Agriculture & Farming Enterprises 10%, Industrial & Power Generation Companies 5%)

- Table 7. Regional Market Insights – North America Diesel Exhaust Fluid Market Size Forecast, 2024–2034 (USD Billion)

- Table 8. Regional Market Insights – Asia Pacific Diesel Exhaust Fluid Market Size Forecast, 2024–2034 (USD Billion)

- Table 9. Regional Market Insights – Europe Diesel Exhaust Fluid Market Size Forecast, 2024–2034 (USD Billion)

- Table 10. Competitive Landscape – Export Market Share of DEF, 2024 (Old World Automotive 46%, Dorian Drake International Inc 11%, Guangdong Hangpin Jinggongkeji Co 11%, Others 32%)