Content

Asia Pacific Renewable Diesel Market Size | Companies Analysis 2034

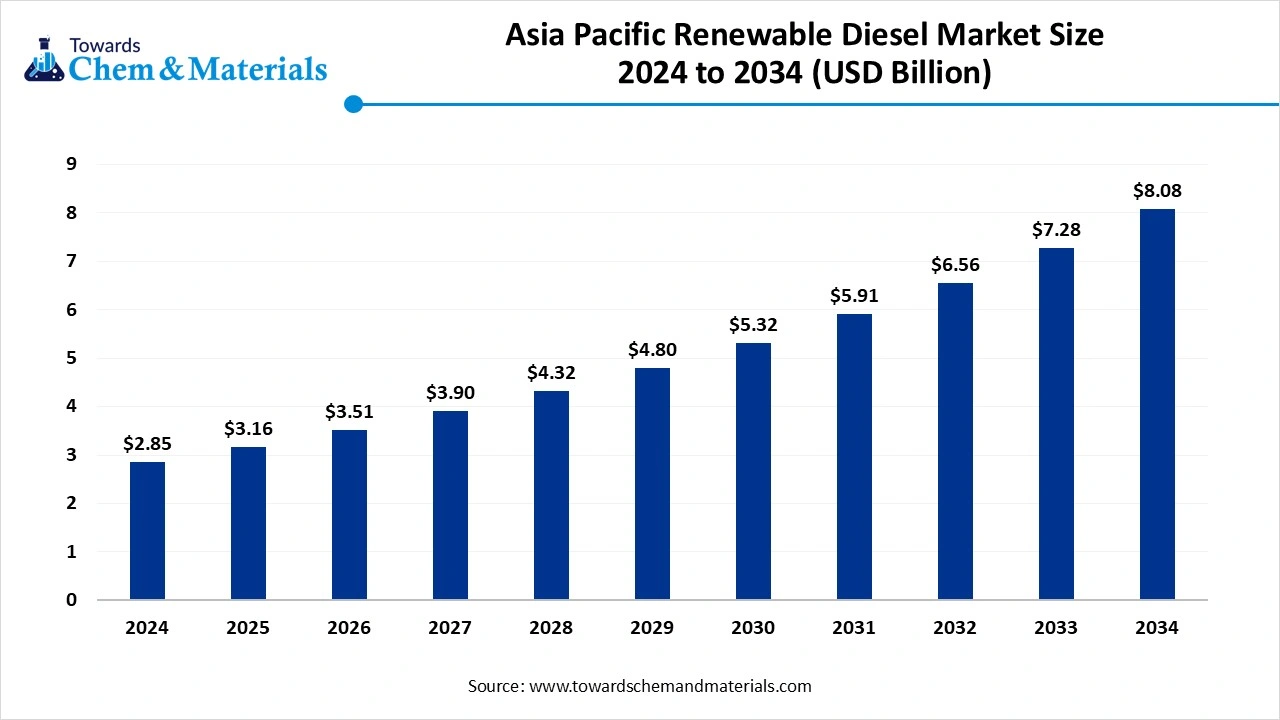

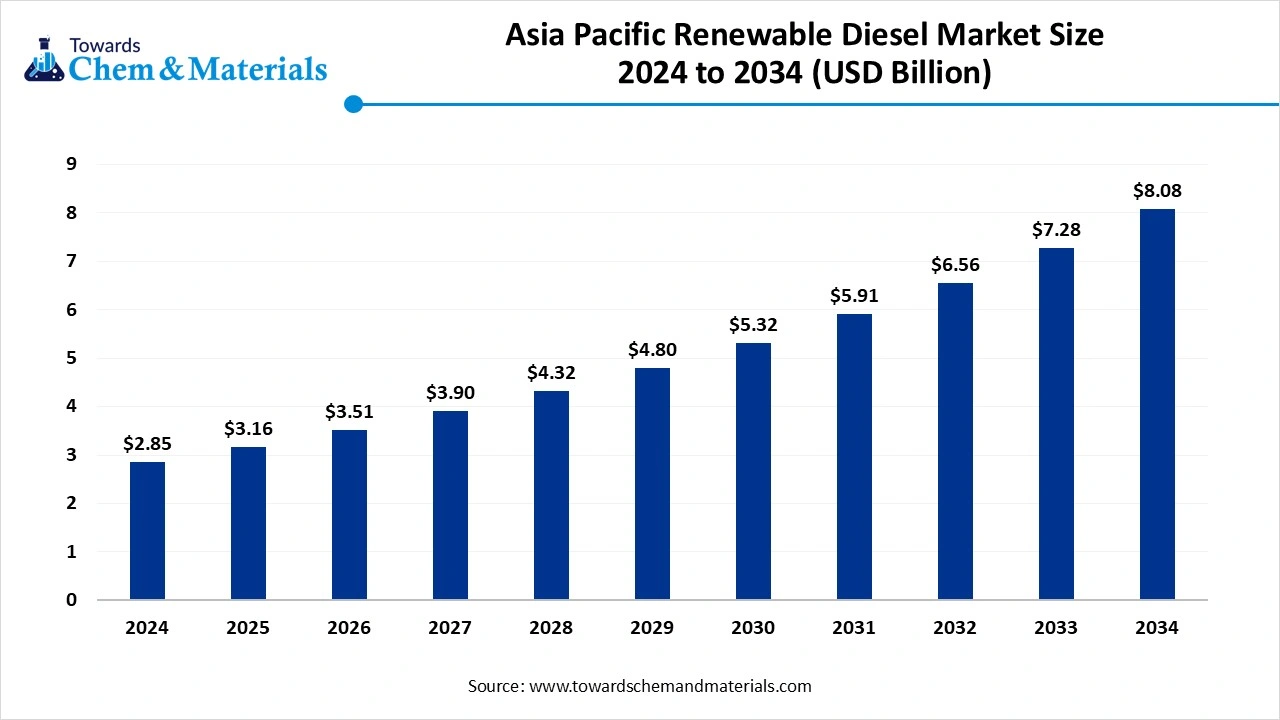

The Asia Pacific renewable diesel market size is calculated at USD 2.85 billion in 2024, grew to USD 3.16 billion in 2025, and is projected to reach around USD 8.08 billion by 2034. The market is expanding at a CAGR of 10.98% between 2025 and 2034. Growing demand for sustainable fuel alternatives is the key factor driving market growth. Also, stringent government support for decarbonization, coupled with the ongoing urbanisation in the region, can fuel market growth further.

Key Takeaways

- By type, the pure renewable diesel (HVO100) segment dominated the market with an approximate share of 55% over the forecast period.

- By type, the algae-derived renewable diesel segment is expected to grow at the fastest CAGR over the forecast period.

- By feedstock, the vegetable oils segment held an approximate market share of 38% in 2024.

- By feedstock, the algae segment is expected to grow at the fastest CAGR over the forecast period.

- By production technology, the hydrotreating segment dominated the market with a majority share in 2024.

- By production technology, the Fischer-Tropsch synthesis segment is expected to grow at the fastest CAGR during the forecast period.

- By application, the road transport fuel segment held an approximately share of 73% in 2024.

- By application, the sustainable aviation fuel (SAF) segment is expected to grow at the fastest CAGR during the study period.

- By end user, the oil refineries & blenders segment dominated the market with most of the share in 2024.

- By end user, the marine transport operators' segment is expected to grow at the fastest CAGR over the forecast period.

What is Renewable Diesel?

The growing demand for decarbonized transportation is the major factor driving market expansion. The market encompasses the production, distribution, and consumption of green diesel, also called hydrotreated vegetable oil (HVO), in the region. This fuel is created from renewable feedstocks such as animal fats and waste oils through hydro processing and is identical to traditional diesel, allowing its use in current infrastructure and engines without modifications.

Asia Pacific Renewable Diesel Market Outlook:

- Industry Growth Overview: Between 2025-2034, the market is expected to witness substantial growth due to heavy corporate and government investment in the development of new biorefineries, along with the increasing need for renewable diesel in industrial applications like construction and agricultural machinery.

- Sustainability Trends: It includes an emphasis on decarbonization and air quality, fuelled by government policies such as India's biofuel mandates and China's low-carbon fuel zones. Also, the growing focus on circular economy principles is promoting corporate net-zero goals, leading to further market growth.

- Global Expansion: Major players such as Neste are expanding through a feedstock diversification process. Government in the region is also focusing on minimizing greenhouse gas (GHG) emissions, creating an imperative for blended fuel programs.

Key Technological Shifts in the Asia Pacific Renewable Diesel Market:

Key technological shifts in the market are focusing on diversifying feedstocks, optimizing manufacturing methods, and integrating biorefineries to enhance sustainability and cost-effectiveness. These innovations are boosted by regional decarbonization goals, with a substantial move towards next-generation processes.

Companies such as Wilmar International, which is a major agribusiness firm in Singapore, are producing biodiesel with other products such as oleochemicals from its extensive agricultural feedstocks. Moreover, companies such as TMO Renewables in China are creating cutting-edge technology to use low-cost agricultural residues for the production of biofuel.

Trade Analysis of the Asia Pacific Renewable Diesel Market: Import & Export Statistics

- Indonesia: Significant domestic blending mandates, including a B35 mandate (35% biodiesel) in 2023 and planned B40 trials, reduce the amount available for export but solidify the country's position as a major producer.

- Japan: Japan aims for 10% SAF use by 2030, which could increase import demand for renewable diesel.

- Singapore: In 2024, Neste's Singapore plant was the source for most of Asia's SAF exports.

Value Chain Analysis of the Asia Pacific Renewable Diesel Market

- Feedstock Procurement : It involves sourcing and securing the organic materials, such as animal fats, vegetable oils, and another biomass, that are converted into renewable diesel.

- Chemical Synthesis and Processing : This stage involves the use of different advanced technologies and methods to convert raw materials (feedstocks) into renewable diesel.

- Packaging and Labelling : This stage involves the handling of logistical and informational aspects of renewable diesel, rather than its conventional retail packaging.

- Regulatory Compliance and Safety Monitoring : It refers to the safety protocols and legal frameworks that govern the manufacturing, distribution, and use of renewable diesel across the region.

Asia Pacific Renewable Diesel Market 's Regulatory Landscape: Global Regulations

| Country/Region | Key Regulations |

| China | China has national standards for B5 biodiesel blends and the pure biodiesel component. It provides tax and investment support for biodiesel production. |

| India | The country's primary policy aims to increase biofuel use, reduce import reliance, and cut emissions. The revised 2018 policy set an indicative target of 5% biodiesel blending by 2030, with a focus on non-edible oilseeds |

| Japan | Japan has also proposed a 10% SAF mandate by 2030, indicating a growing focus on decarbonizing aviation. |

Market Opportunity

Development of Advanced Biofuels

The ongoing development of cutting-edge biofuels and integrated biorefineries, which can create a range of renewable products, such as jet fuel, naphtha, and diesel, is a major factor creating lucrative opportunities in the market.

Furthermore, collaboration among feedstock suppliers, technology providers, and end-users is boosting advancements and propelling the commercialization of innovative renewable diesel technologies.

Market Challenge

Intense Market Competition

The demand for renewable diesel, especially in North America and Europe, has triggered competition for various feedstocks, which is a major factor hindering market growth. Moreover, renewable diesel production generally involves higher costs than manufacturing conventional petroleum diesel. This is a major hurdle to making it cost-effective in the APAC market.

Report Scope

| Report Attributes | Details |

| Market Size in 2025 | USD 3.16 Billion |

| Expected Size by 2034 | USD 8.08 Billion |

| Growth Rate from 2025 to 2034 | CAGR 10.98% |

| Base Year of Estimation | 2024 |

| Forecast Period | 2025 - 2034 |

| Segment Covered | By Type, By Feedstock, By Production Technology, By Application, By End-User |

| Key Companies Profiled | World Energy, Valero Energy Corporation, Diamond Green Diesel (DGD), Eni S.p.A., PBF Energy Inc., Gevo, Inc., Wilmar International, Musim Mas, IOI Group, Adani Wilmar, Sunshine Kaidi New Energy Group, GrainCorp, Cargill, Clariant, Sterling and Wilson |

Segmental Insights

Type Insight

How Much Share Did the Pure Renewable Diesel (HVO100) Segment Held in 2024?

The pure renewable diesel (HVO100) segment dominated the market with an approximate share of 55% over the forecast period. The dominance of the segment can be attributed to its compatibility with existing infrastructure and supportive corporate and government policies. Additionally, HVO100 can decrease the overall lifecycle CO₂ emissions by up to 90% in comparison to fossil diesel, based on the feedstock.

The algae-derived renewable diesel segment is expected to grow at the fastest CAGR over the forecast period. The growth of the segment can be credited to the technological advancements in diesel production, along with the supportive government policies. Innovations in genetic modification are optimizing the development of algae strains with faster growth rates, enhancing overall efficiency.

Feedstock Insight

Which Feedstock Type Segment Dominated the Asia Pacific Renewable Diesel Market in 2024?

The vegetable oils segment held an approximately market share of 38% in 2024. The dominance of the segment can be linked to the growing product demand from power and transportation sectors, coupled with the ongoing trends towards stringent sustainability certifications. Also, growing consumption of vegetable oils in the cosmetics and food sectors is impacting positive segment growth soon.

The algae segment is expected to grow at the fastest CAGR over the forecast period. The growth of the segment can be driven by growing consumer demand for sustainable fuels and rapid economic expansion and industrialization in developing Asia Pacific economies, such as India. Moreover, combining algae biofuel production with other high-grade products like animal feed and nutraceuticals helps to counter the high production costs of the fuel alone.

Production Technology Insight

Which hydrotreating Segment Dominated the Asia Pacific Renewable Diesel Market in 2024?

The hydrotreating segment dominated the market with a majority share in 2024. The dominance of the segment is owed to the growing product demand from the aviation sector for sustainable fuel and ongoing government support to reduce emissions. This process converts oils, fats, and greases (FOGs) into high-grade renewable diesel, which can smoothly substitute for traditional fossil diesel.

The Fischer-Tropsch synthesis segment is expected to grow at the fastest CAGR during the forecast period. The growth of the segment is due to growing product demand from hard-to-abate sectors such as aviation and the convenient properties of FT renewable diesel. Furthermore, studies have shown that FT diesel can substantially reduce carbon emissions throughout its lifecycle as compared to other fuels.

Application Insight

How Much Share Did the Road Transport Fuel Segment Held in 2024?

The road transport fuel segment held an approximate share of 73% in 2024. The dominance of the segment can be attributed to the ongoing innovations in biofuel production technologies, coupled with the government initiatives to minimize carbon emissions. Partnership between governments and the industry is essential for developing sustainable transportation solutions in the region.

The sustainable aviation fuel (SAF) segment is expected to grow at the fastest CAGR during the study period. The growth of the segment can be credited to the rapid innovations in SAF manufacturing technologies and feedstock availability. In addition, airlines are increasingly working towards carbon reduction targets, which leads them to adopt SAF as a sustainable alternative to conventional jet fuel.

End-User Insight

Which End-User Type Segment Dominated the Asia Pacific Renewable Diesel Market in 2024?

The oil refineries & blenders segment dominated the market with most of the share in 2024. The dominance of the segment can be linked to the increasing need for low-carbon fuels and financial incentives like tax credits and rewards for minimizing carbon intensity. Furthermore, oil refiners can launch renewable feedstocks such as animal fats or used cooking oil (UCO) into their existing hydrotreating units with much less investment.

The marine transport operators' segment is expected to grow at the fastest CAGR over the forecast period. The growth of the segment can be driven by increasing investments from major players to develop strong port infrastructure. Moreover, collaborative efforts between market players and providers of renewable diesel are driving the segment's expansion.

Regional Analysis

The East Asia region dominated the market with a majority share in 2024.

The dominance of the region can be attributed to the robust decarbonization goals in developing countries such as China and Japan, along with the development of synthetic diesel fuels from renewable sources. In addition, innovations in renewable diesel production, like the Fischer-Tropsch synthesis, are enhancing the efficiency and cost-effectiveness of biofuel creation.

China Asia Pacific Renewable Diesel Market Trends

In the Asia Pacific, China dominated the market owing to the growing availability of waste-based feedstocks and ambitious climate goals. Also, China has expanded its imports of bio-based diesel fuels, such as palm oil biodiesel from Southeast Asia, to meet the demand of domestic feedstock supply, driving the country's growth soon.

The Southeast Asia region is expected to grow at the fastest CAGR over the forecast period. The growth of the region can be credited to the robust availability of agricultural feedstocks such as palm oil in the region, coupled with the increasing government support through biofuel mandates. Furthermore, the region has great potential to develop more advanced biofuels from waste products.

India Asia Pacific Renewable Diesel Market Trends

In East Asia, India is expected to witness the fastest growth over the forecast period due to growing demand to reduce dependence on fossil fuels to fulfil decarbonization goals. Mandates for biofuel blending, carbon pricing, and low-carbon fuel standards (LCFS) are also encouraging the adoption of renewable diesel in the country.

Country-level Investments & Funding Trends for the Asia Pacific Renewable Diesel Market:

- India: India is rapidly expanding its renewable energy capacity, aiming to increase ethanol blending to 20% by 2025-26.

- Indonesia: Strong government policies, such as the B40 blending mandate (40% biodiesel), are a key driver for investment. The program is supported by palm oil export levies.

- Singapore: Singapore is forming partnerships to expand the use of renewable diesel, with collaborations like the one between Neste and DB Schenker for low-emission logistics.

Recent Development

- In April 2025, Neste and DB Schenker collaborated to boost low-emission transportation in the Asia Pacific. The partnerships align with companies' net-zero policies and emphasize offering scalable, immediate-impact solutions.(Source: esgnews.com)

Top Vendors in the Asia Pacific Renewable Diesel Market & Their Offerings:

- Neste Corporation: Neste Corporation's involvement in the market is focused on providing sustainable and circular solutions to replace fossil-based raw materials.

- TotalEnergies: TotalEnergies has a significant presence in the market, driven by its strategic industrial assets, a focus on petrochemical growth, and a commitment to circular polymers.

- Marathon Petroleum Corporation: MPC is one of the largest petroleum refining, marketing, and midstream companies in the U.S. and operates the nation's largest refining system.

Other Players

- World Energy

- Valero Energy Corporation

- Diamond Green Diesel (DGD)

- Eni S.p.A.

- PBF Energy Inc.

- Gevo, Inc.

- Wilmar International

- Musim Mas

- IOI Group

- Adani Wilmar

- Sunshine Kaidi New Energy Group

- GrainCorp

- Cargill

- Clariant

- Sterling and Wilson

Segment Covered

By Type

- Pure Renewable Diesel (HVO100)

- Renewable Diesel Blends

- Co-processed Renewable Diesel

- Algae-derived Renewable Diesel

- Synthetic Fuels from Biomass

By Feedstock

- Vegetable Oils

- Soybean Oil

- Palm Oil

- Canola Oil

- Others

- Animal Fats and Residues

- Tallow

- Poultry Fat

- Yellow Grease

- Others

- Used Cooking Oil (UCO)

- Algae

- Tall Oil and Waste Residues

- Municipal Solid Waste (MSW)

By Production Technology

- Hydrotreating

- Pyrolysis

- Fischer-Tropsch Synthesis

- Other Advanced Conversion Processes

By Application

- Road Transport Fuel

- Heavy-Duty Vehicles

- Light-Duty Vehicles

- Aviation (Sustainable Aviation Fuel)

- Marine Fuel (Commercial Shipping & Fishing Vessels)

- Industrial Power Generation (Backup & Off-Grid)

- Grid Power Generation

By End-User

- Oil Refineries & Blenders

- Commercial Fleet Operators

- Airlines & Aviation Authorities

- Marine Transport Operators

- Industrial Power Users