Content

Corrugated Plastic Sheets Market Size and Growth 2025 to 2034

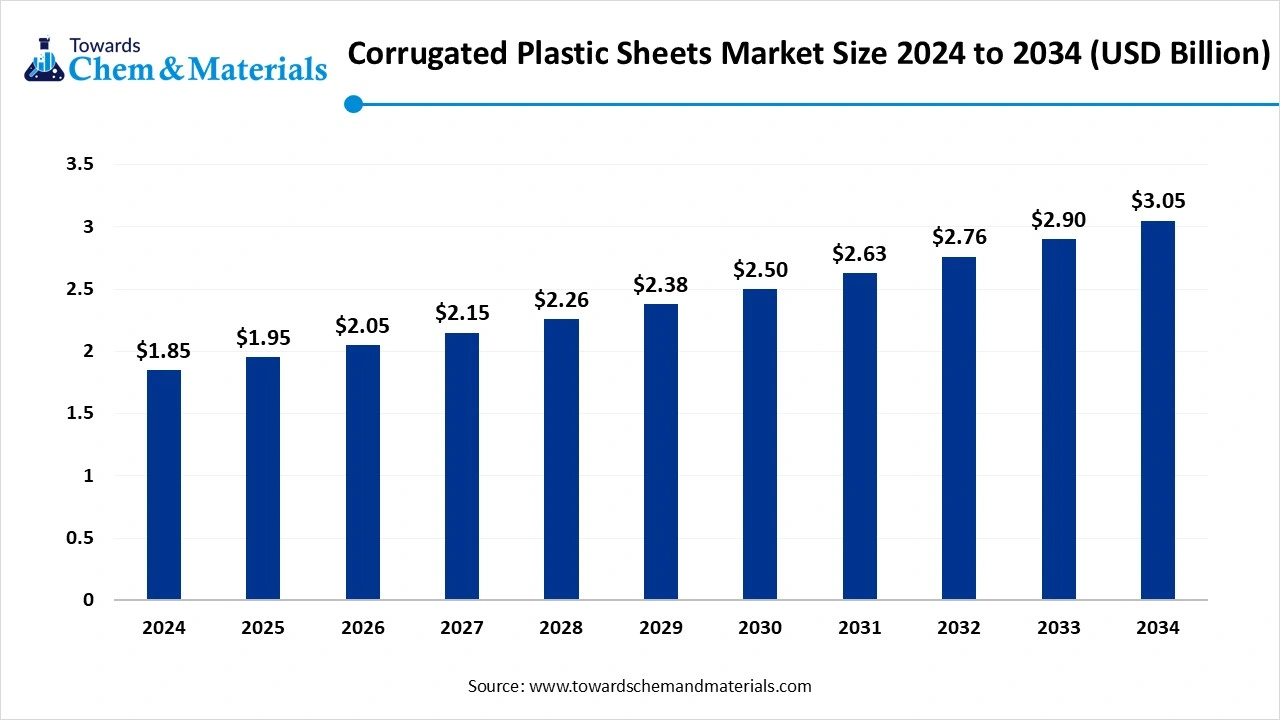

The global corrugated plastic sheets market size was valued at USD 1.85 billion in 2024, grew to USD 1.95 billion in 2025, and is expected to hit around USD 3.05 billion by 2034, growing at a compound annual growth rate (CAGR) of 5.14% over the forecast period from 2025 to 2034. The growth of the market is driven by the growing demand from the construction and automotive industries, which fuels the growth of the market.

Key Takeaways

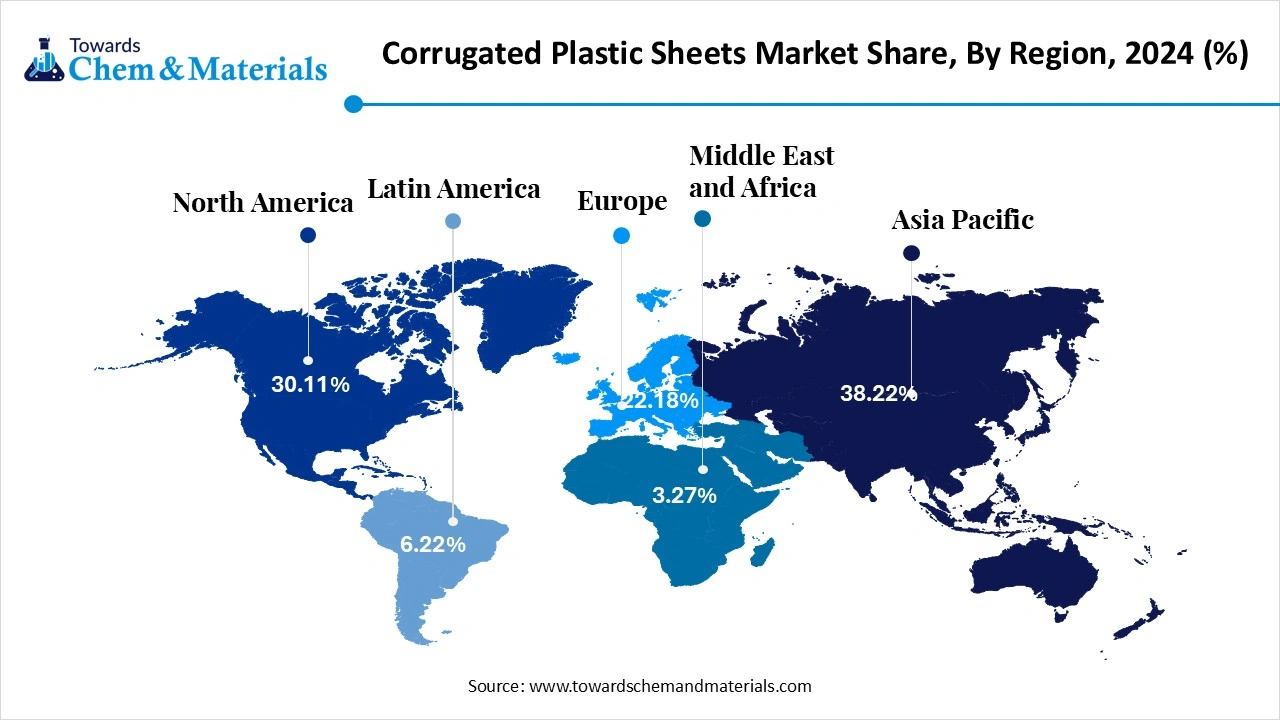

- By region, Asia Pacific dominated the market in 2024. The Asia Pacific region held approximately 38.22% share in the market in 2024. The growth of the market in the region is driven by rapid industrialization and urbanization.

- By region, Europe is expected to have significant growth in the market in the forecast period. The market is expected to experience growth, supported by ongoing investments in innovation.

- By materials type, the polypropylene (PP) segment dominated the market in 2024. The polypropylene (PP) segment held approximately 61.55% share in the market in 2024. They are widely used in packaging, signage, and agriculture, offering recyclability and cost efficiency

- By material type, the polyethylene (PE) segment is expected to grow significantly in the market during the forecast period. They find applications in heavy-duty packaging, construction, and protective barriers.

- By thickness, the 3 to 8 mm segment dominated the market in 2024. The 3 to 8 mm segment held approximately 51.90% share in the market in 2024. Their balance between strength and flexibility makes them highly adaptable.

- By thickness, the above 8 mm segment is expected to grow in the forecast period. Their higher rigidity and load-bearing capacity make them suitable for structural uses.

- By end use, the packaging segment dominated the market in 2024. The packaging segment held approximately 36.12% share in the market in 2024. These sheets are used for boxes, containers, and protective packaging in industries.

- By end use, the agriculture & allied products segment is expected to grow in the forecast period. Their weather resistance, reusability, and adaptability make them a preferred material.

Market Overview

Rising Demand For Durable Materials: Corrugated Plastic Sheets Market To Expand

The growth of the corrugated plastic sheets market is driven by the growing demand from various industries like construction and automotive due to its benefits, such as lightweight, moisture resistance, and ease of installation.

The nature of corrugated plastics also offers durability and weather resistance, which makes them a preferred choice by consumers, fueling the growth of the market. The growing demand from food and agriculture for greenhouse covering and plant protection, and benefits for packaging in the food and beverage industry, which drives the growth of the market.

Market Trends

- Government Regulations: Policies aimed at reducing plastic waste encourage the use of recyclable and reusable materials like corrugated plastic sheets.

- Diversification of Applications: Corrugated plastic sheets are finding new applications in healthcare and the automotive sector due to their properties, such as reusability and resistance to harsh conditions.

- Material Enhancements: The development of specialized grades with enhanced properties, like UV resistance, is opening new opportunities in construction and agriculture.

- Technological Innovation: Advancements in manufacturing processes, such as automation and smart manufacturing, are improving production efficiency and product customization options.

- E-commerce Expansion: The booming e-commerce sector requires protective, durable, and reusable packaging, for which corrugated plastic sheets are ideal.

Report Scope

| Report Attributes | Details |

| Market Size in 2025 | USD 1.95 Billion |

| Expected Size by 2034 | USD 3.05 Billion |

| Growth Rate from 2025 to 2034 | CAGR 5.14% |

| Base Year of Estimation | 2024 |

| Forecast Period | 2025 - 2034 |

| Dominant Region | Asia Pacific |

| Segment Covered | By Material Type, By Thickness, By End Use, By Region |

| Key Companies Profiled | Coroplast , Primex Plastics Corporation , SABIC , Simona AG , Plaskolite, LLC , Corplex , Karton S.p.A. , Palram Industries Ltd., Mitsubishi Chemical Group, Inteplast Group , CoolSeal USA , Laird Plastics , Professional Plastics , Grimco , A&C Plastics , Falken Design Corporation, International Paper Company, Smurfit Kappa Group plc , Uline, Inc. , WestRock Company |

Market Opportunity

Growing Sectors Are The Key Opportunities That Support The Growth Of The Corrugated Plastic Sheets Market

The key growth opportunities that support the growth of the market are sustainability and recyclability due to growing environmental awareness and government regulations, which highlight the use of recyclable and reusable materials, which have advantages associated with them, driving the growth of the market.

The other key opportunities that support the growth are the expansion of the industries and the replacement of traditional materials. Corrugated plastic is replacing cardboard, wood, and metal in many applications due to its superior performance and durability, providing a significant market opportunity.

Market Challenge

Cost And Fluctuation In Profitability

The key challenge that hinders the growth of the market is the volatility of raw material prices, such as starch and adhesive, and also fluctuating oil prices, which affect the overall production and productivity of the material and product.

Other key challenges are the regulatory and sustainability challenges due to sustainable alternative demand, shift in consumer preferences, economic slowdown, and competition from other materials, which are restricting the growth and expansion of the market.

Regional Insights

Asia Pacific Corrugated Plastic Sheets Market Size, Industry Report 2034

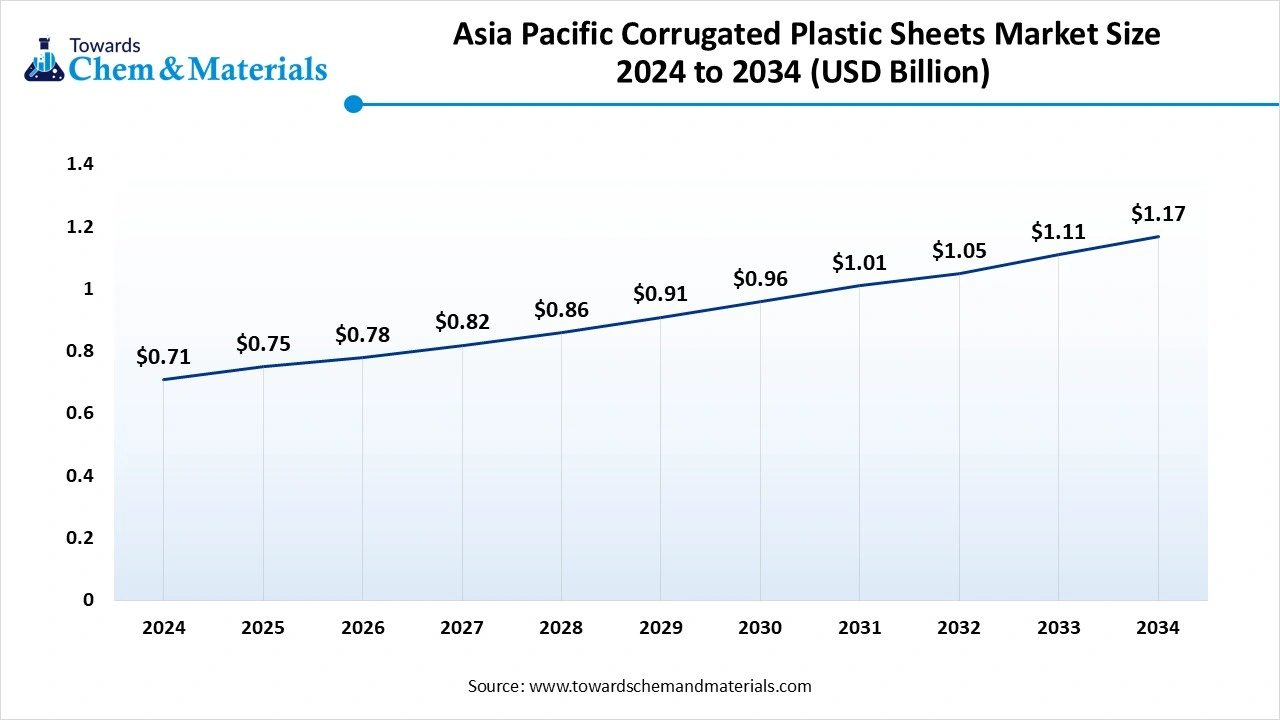

The Asia Pacific corrugated plastic sheets market size was valued at USD 0.71 billion in 2024 and is expected to surpass around USD 1.17 billion by 2034, expanding at a compound annual growth rate (CAGR) of 5.12% over the forecast period from 2025 to 2034.

Asia Pacific dominated the corrugated plastic sheets market in 2024. The growth of the market in the region is driven by the rapid industrialization and urbanization, which leads to an increasing demand for materials in construction and packaging, which in turn fuels the growth of the market. The sustainability initiatives amid rising environmental concerns, material innovation and customization, and technological advancements, which improve material properties and enhance cost effectiveness, further drive the growth of the market.

The region is leading in the consumption and production of corrugated plastic sheets, benefiting from both established industrial bases and growing economies, which boost the growth and expansion of the market in the region.

China Has Seen Growth Due To Expanding Key Players In The Country.

China is experiencing growth in the market, which is driven by the growing manufacturing hubs like Suzhou and Qingdao in Jiangsu and Shandong provinces, respectively, which are important manufacturing centers that drive the growth of the market in the country.

Green Packaging Initiatives and Five-Year Plans promoting green development support the large-scale adoption of recyclable corrugated plastic solutions, fostering the growth of the market. The demand for lightweight, durable, and recyclable packaging materials from various industries further drives the growth and expansion of the market in the country.

Europe Is Experiencing Growth, Which Is Driven By The Country's Increasing Industrial Sector.

Europe is expected to experience significant growth in the corrugated plastic sheets market in the forecast period. The market is expected to experience growth, supported by ongoing investments in innovation, strategic partnerships, and the growing emphasis on customer-centric, eco-friendly solutions.

Other major drivers in the market are the growing industries that require and demand corrugated plastic sheets in automotive and construction due to their properties like certainty and durability, which further fuel the growth and expansion of the market in Europe.

Segmental Insights

Material Type Insights

Which Material Type Segment Dominated The Corrugated Plastic Sheets Market In 2024?

The polypropylene (PP) segment dominated the market in 2024. Polypropylene corrugated sheets dominate the market due to their lightweight, durability, and chemical resistance. They are widely used in packaging, signage, and agriculture, offering recyclability and cost efficiency. Their moisture resistance makes them suitable for outdoor applications, while their ease of fabrication supports diverse industrial uses. Growing demand for reusable and sustainable packaging solutions continues to drive polypropylene’s adoption across multiple end-use sectors.

The polyethylene (PE) segment expects significant growth in the market during the forecast period. Polyethylene corrugated sheets also known for its resistance, strength, and flexibility. They find applications in heavy-duty packaging, construction, and protective barriers. Their superior resistance to harsh environmental conditions and UV exposure makes them ideal for long-term outdoor applications. Increasing demand from the agriculture and building industries supports growth, as polyethylene sheets provide durability and cost-effective alternatives to traditional materials.

Thickness Insights

How did 3 to 8 mm Segment Dominate the Corrugated Plastic Sheets Market in 2024?

The 3 to 8 mm segment dominated the market in 2024. Corrugated plastic sheets in the 3 to 8 mm range are extensively used in lightweight packaging, point-of-purchase displays, and protective layering. Their balance between strength and flexibility makes them highly adaptable for transportation and storage applications. The segment is favored for short to medium-term uses where ease of handling and cost efficiency are critical, particularly in packaging and promotional sectors.

The above 8 mm segment expects significant growth in the market during the forecast period. Sheets above 8 mm in thickness are primarily used in heavy-duty applications, including construction, agriculture, and industrial packaging. Their higher rigidity and load-bearing capacity make them suitable for structural uses and reusable packaging solutions. The segment is gaining traction as industries seek durable, long-lasting materials that can withstand rough handling and environmental stress while offering sustainability benefits over conventional alternatives.

End Use Insights

Which End Use Segment Dominated The Corrugated Plastic Sheets Market In 2024?

The packaging segment dominated the market in 2024. Packaging represents a leading end-use segment for corrugated plastic sheets, driven by their lightweight, reusable, and recyclable nature. These sheets are used for boxes, containers, and protective packaging in industries ranging from e-commerce to automotive. Their moisture resistance and durability offer advantages over cardboard, making them increasingly popular in supply chains emphasizing sustainability and product protection.

The agriculture & allied products segment expects significant growth in the corrugated plastic sheets market during the forecast period. In agriculture, corrugated plastic sheets are applied in nursery trays, fencing, greenhouse panels, and crop protection. Their weather resistance, reusability, and adaptability make them a preferred material for farm and horticulture applications. The segment is expanding as modern farming practices adopt cost-effective, durable solutions that support higher efficiency and longer lifecycle use compared to traditional wood or cardboard alternatives.

Corrugated Plastic Sheets Market Value Chain Analysis

- Chemical Synthesis and Processing: The corrugated plastic sheets are synthesised and processed through steps including melting, extrusion, corrugation, cooling, and finishing.

- Key players: Coroplast, Polyflute, and Plastply.

- Quality Testing and Certification: The corrugated plastic sheets require IS 1254, IS 459, and ISO 9001 certification.

- Key players: Bureau of Indian Standards

- Distribution to Industrial Users: The corrugated plastic sheets are distributed to the packaging, logistics, advertising, and construction industries.

- Key players: Trideo Packaging, R K Packaging, and Swastik Corrupack Industries, Plastic Corrugated Sheet Manufacturers India.

Recent Developments

- In February 2025, Advanced Plastics Group (APG) announced the launch of a new product line and product development services with new designs in plastics, electronics, and hardware, with enhanced 3D printing, along with a chain of suppliers.(Source: interplasinsights.com)

- In February 2025, Kite Packaging, a leading UK supplier of packaging solutions, expanded its offering with eco-friendly anti-slip pallet sheets. These are designed to reduce damage, enhance load stability, and increase handling efficiency across logistics, warehouse, and distribution operations.(Source: grocerytrader.co.uk)

Corrugated Plastic Sheets Market Top Companies

- Coroplast

- Primex Plastics Corporation

- SABIC

- Simona AG

- Plaskolite, LLC

- Corplex

- Karton S.p.A.

- Palram Industries Ltd.

- Mitsubishi Chemical Group

- Inteplast Group

- CoolSeal USA

- Laird Plastics

- Professional Plastics

- Grimco

- A&C Plastics

- Falken Design Corporation

- International Paper Company

- Smurfit Kappa Group plc

- Uline, Inc.

- WestRock Company

Segments Covered

By Material Type

- Polypropylene (PP)

- Polyethylene (PE)

- Others (e.g., PVC, PS)

By Thickness

- Less than 3 mm

- 3 to 8 mm

- Above 8 mm

By End Use

- Packaging

- Logistics & Transportation

- Building & Construction

- Agriculture & Allied Products

- Others (e.g., Signage, Furniture)

By Region

- North America

- U.S.

- Canada

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Sweden

- Denmark

- Norway

- Asia Pacific

- China

- Japan

- India

- South Korea

- Thailand

- Latin America

- Brazil

- Mexico

- Argentina

- Middle East and Africa (MEA)

- South Africa

- UAE

- Saudi Arabia

- Kuwait