Content

What is the Current Cork Building Materials Market Size and Share?

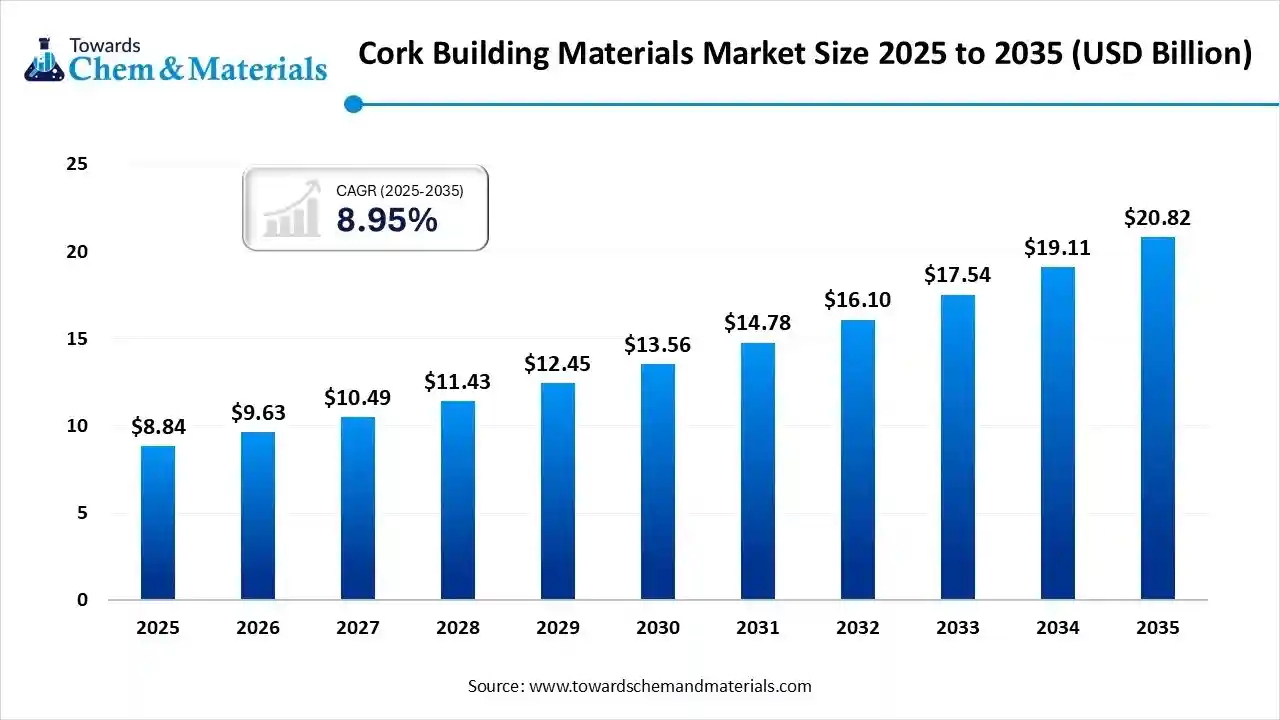

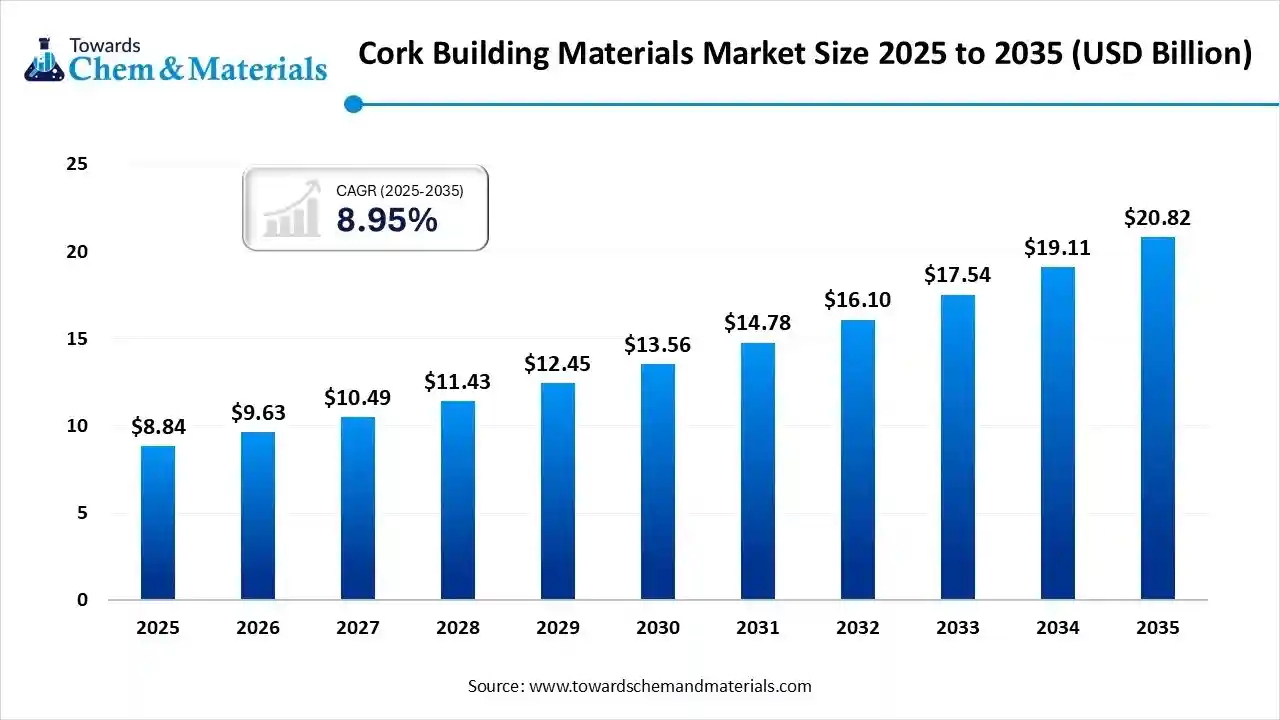

The global cork building materials market size is calculated at USD 8.84 billion in 2025 and is predicted to increase from USD 9.63 billion in 2026 and is projected to reach around USD 20.82 billion by 2035, The market is expanding at a CAGR of 8.95% between 2026 and 2035. Asia Pacific dominated the cork building materials market with a market share of 41.25% the global market in 2025. Growing consumer demand for energy efficiency and sustainable materials is the key factor driving market growth. Also, growing emphasis on green building certifications, coupled with the advancements and growth in construction activities, can fuel market growth further.

Key Takeaways

- Asia Pacific dominated the global cork building materials market with the largest revenue share of 41.25% in 2025.

- The China cork building materials market is projected to grow during the forecast period.

- By product, the cork flooring segment accounted for the largest revenue share of 43.61% in 2025.

- By product, the cork insulation materials segment is expected to grow at a significant CAGR of 9.79% over the forecast period

- By end-use, the residential segment dominated with the largest revenue share of 68.13% in 2025.

- By end-use, the non-residential segment is expected to grow at a significant CAGR of 9.75% over the forecast period.

What are Cork Building Materials?

The market is a global industry that emphasizes the manufacturing and sale of products made from cork for renovation and construction. These materials are preferred for their sustainable properties such as durability, thermal and acoustic insulation, and water resistance. The market includes products such as wall panels, flooring, and insulation boards used in both commercial and residential buildings.

Cork Building Materials Market Trends:

- The demand for cork is growing due to its sustainable properties, such as being a renewable, low-carbon, and recyclable material, which aligns with green building certifications such as the EU and LEED green taxonomy.

- The advancements in cork processing techniques are improving the durability, quality, and performance of cork products, which makes them more viable for an extensive range of applications in construction and other sectors.

- Cork's unique cellular structure offers exceptional acoustic and thermal insulation, which makes it ideal for improving energy efficiency and indoor comfort in buildings. This is especially relevant with growing government initiatives.

- A growing consumer focus on health and wellness is the major market trend driving positive market growth.

- Consumers are rapidly seeking materials that contribute to a healthier indoor atmosphere. Hence, cork is a key choice for healthcare, residential, and educational facilities.

- The demand for cork in the insulation and flooring industry is on the rise, with consumers opting for more energy-efficient solutions, making it a favored choice for sustainable building materials.

Report Scope

| Report Attribute | Details |

| Market Size Value in 2026 | USD 9.63 Billion |

| Revenue Forecast in 2035 | USD 20.82 Billion |

| Growth Rate | CAGR 8.95% |

| Forecast Period | 2026 - 2035 |

| Base Year | 2025 |

| Dominant Region | Asia Pacific |

| Fastest Growing Region | North America |

| Segments covered | By Product, By End Use, By Region |

| Key companies profiled | Manton Cork, iCork Floor, Green Building Supply, Wicanders, Jelinek Cork Group, Capri Collections, Beach Bros Ltd, Amorim Cork Solutions S.A., ThermalCork Solutions |

How Cutting Edge Technologies are revolutionizing the Cork Building Materials Market?

Advanced technologies are transforming the market by enabling the production of innovative composite materials, enhancing production efficiency, and boosting the integration with smart building systems. Also, researchers are developing new mixtures, like lightweight polymer mortars and cork-infused concrete with cork granules, which will impact positive market growth soon.

Trade Analysis of Cork Building Materials Market: Import & Export Statistics:

- In 2025, the United States exported $26.3M of Cork & cork articles, being the 94th most exported product in the United States.

- In 2025, the main destinations of the United States' Cork & cork articles exports were: Mexico ($8.94M), Canada ($8.33M), Portugal ($3.78M), South Korea ($920k), and Ecuador ($421k).

- In 2025, the United States imported $283M of Cork & cork articles, being the 92nd most imported product in the United States.

- In 2025, the main origins of the United States' Cork & cork articles imports were: Portugal ($209M), Spain ($30.8M), China ($17.7M), Italy ($7.51M), and France ($5.38M).

- From October 2023 to September 2025, India exported 701 shipments of cork sheets to 178 buyers, representing a 3% growth from the previous 12-month period. The exports were handled by 71 Indian companies.(Source: www.volza.com)

- In 2025, India imported $12.15 million worth of cork and cork products, based on data from the United Nations COMTRADE international trade database.(Source: tradingeconomics.com)

Cork Building Materials Market Value Chain Analysis

- Feedstock Procurement :It is the strategic process of sourcing the raw material, which is the bark of the cork oak tree from sustainably managed forests, especially in the Mediterranean region. This process is essential for ensuring a sound supply chain.

- Major Players: Corticeira Amorim S.G.P.S, Corksribas

- Chemical Synthesis and Processing : It refers to the industrial application of chemistry and production techniques to modify natural cork or develop synthetic materials that feature cork's properties, primarily for use in construction products.

- Major Players: Sika AG, Saint-Gobain, BASF

- Packaging and Labelling : This stage covers the types, materials, functions, and regulatory standards related to how cork products are packaged and identified for distribution and sale, along with the market trends related to how these products are packaged and labeled.

- Major Players: Amorim Cork Solutions S.A., Ecore International

- Regulatory Compliance and Safety Monitoring : It involves adhering to stringent national and international standards associated with product health, performance, and environmental impact to ensure market access and consumer safety.

- Major Players: Granorte, Jelinek Cork Group.

Cork Building Materials Market 's Regulatory Landscape: Global Regulations

| Country/Region | Key Regulations |

| European Union (EU) | The EU has a harmonized regulatory framework through the Construction Products Regulation (CPR), which requires CE marking for cork products covered by a harmonized European standard. |

| United States | Regulations are often set and overseen by agencies like the Environmental Protection Agency (EPA) for health and environmental standards. |

| Asia Pacific (e.g., India, China, Japan, South Korea) | The regulatory landscape often involves a mix of national codes (e.g., India's National Building Code and Energy Conservation Building Code (ECBC)) and norms from rating programs like LEED-India. |

Segment Insights

Product Insights

How Much Share Did the Cork Flooring Segment Held in 2025?

By product, the cork flooring segment accounted for the largest revenue share of 43.61% in 2025. the dominance of the segment can be attributed to the natural insulation and acoustic benefits of cork, along with the technological innovations that increase its water resistance and durability. The availability of an extensive range of designs and finishes has improved its appeal in various spaces.

The cork insulation materials segment is expected to grow at a significant CAGR of 9.79% over the forecast period. The growth of the segment can be credited to the government incentives and increasing energy costs. The cork offers excellent acoustic and thermal insulation, reducing the need for heating and cooling.

The growth of the cork wall panels & tiles segment can be fuelled by growing consumer awareness of sustainable options and ongoing technological innovations in design and production. Cork's natural benefits, such as exceptional moisture resistance and durability, make it a desirable choice among consumers.

The other segment held a significant market share in 2025. Premium product offerings and customization solutions are allowing market players to differentiate their products for more unique, high-end materials. R&D is driving breakthroughs in manufacturing, like improved waterproofing and wear-resistant coatings.

End Use Insight

Which End Use Segment Dominated the Cork Building Materials Market in 2025?

The esidential segment dominated with the largest revenue share of 68.13% in 2025. The dominance of the segment can be linked to the growing consumer awareness of indoor wellness and sustainable living. Homeowners are rapidly choosing wall panels, cork flooring, and insulation products for their natural warmth and quality.

The non-residential segment is expected to grow at a significant CAGR of 9.75% over the forecast period. the growth of the segment can be driven by growing awareness of cork's superior durability and insulation properties for commercial buildings. The inherent benefits of cork are leading to its growing use in non-residential construction.

Regional Insights

The Asia Pacific cork building materials market size was valued at USD 3.65 billion in 2025 and is expected to surpass around USD 8.60 billion by 2035, expanding at a compound annual growth rate (CAGR) of 8.97% over the forecast period from 2026 to 2035.

The Asia Pacific dominated the market in 2025. The dominance of the region can be attributed to the growing awareness regarding sustainable construction practices, along with the rapid urbanization in emerging economies such as China and India. Also, there is a rising regional demand for sustainable building materials as an alternative to synthetic products, leading to regional expansion soon.

China Cork Building Materials Market Trends

In the Asia Pacific, China dominated the market owing to government support for sustainable development, such as carbon reduction goals and green building policies. Also, advancements in manufacturing have enhanced the durability and performance of cork products, making them more competitive.

North America Cork Building Materials Market Trends

North America is expected to grow at the fastest CAGR over the forecast period. The growth of the region can be credited to the surge in demand for sustainable and energy-efficient construction, boosted by green building certifications like LEED. Moreover, consumers in the region are increasingly preferring health-conscious materials for their businesses and homes.

U.S. Cork Building Materials Market Trends

In North America, the U.S. led the market due to growing regulations in the country, which are optimizing the adoption of energy-efficient building practices, further fuelling demand for materials like cork insulation. Architects and builders are also extensively using cork for its unique textural and visual qualities.

Europe Cork Building Materials Market Trends

Europe is expected to grow at a notable CAGR over the forecast period. The growth of the region can be driven by increasing preference for natural aesthetics in exterior and interior design, which cork offers through products such as flooring and wall coverings. Furthermore, Portugal is the world's largest manufacturer of cork, which offers an efficient and reliable supply chain for manufacturers in the region.

Germany Cork Building Materials Market Trends

The growth of the market in Germany can be fuelled by the country's emphasis on energy-efficient building practices and the rise in consumer awareness about sustainable construction practices. Especially, premium cork flooring and wall panels are gaining popularity for their modern design.

Latin America Cork Building Materials Market Trends

The Latin America region held a significant market share in 2025. Governments in the region are increasingly implementing policies that support energy-efficient construction practices, which propels the demand for materials such as cork that give good thermal insulation. There is an increasing need to renovate existing buildings to meet new market requirements.

Brazil Cork Building Materials Market Trends

The growth of the market in Brazil can be linked to the growing awareness of cork as a renewable resource that can replace less eco-friendly alternatives. In addition, increasing emphasis on sustainable housing and government policies are supporting natural materials to minimize carbon emissions in the country.

Recent Developments

- In July 2025, Heidelberg Materials and Seabound launch an innovative onboard carbon capture project in collaboration with Hartmann Group and InterMaritime Group. This solution is equipped with the UBC Cork, a 5,700 gross tonnage (GT) cement-carrying ship.(Source: www.agg-net.com)

- In June 2025, Elliott Group introduced its UK fit-out division amid a hotel redevelopment surge. The contractor said this move will allow it to scale current operations by establishing a dedicated team and structure across various sectors such as healthcare, offices, and hospitality.(Source: www.constructionnews.co.uk)

Cork Building Materials Market Companies

- Manton Cork: Manton Cork is a supplier of premium cork sheets and rolls for the building and materials market, which is experiencing growth due to sustainability trends. The company provides 100% natural cork for a wide range of uses.

- iCork Floor: Cork Floor is a US-based retailer specializing in cork flooring and wall tiles, emphasizing sustainability, comfort, and ease of installation. In the broader building materials market, iCork Floor is part of a growing global trend towards eco-friendly materials.

Other Companies in the Market

- Green Building Supply

- Wicanders

- Jelinek Cork Group

- Capri Collections

- Beach Bros Ltd

- Amorim Cork Solutions S.A.

- ThermalCork Solutions

Segments Covered in the Rep

By Product

- Cork Flooring

- Cork Wall Panels & Tiles

- Cork Insulation Materials

- Others

By End Use

- Non-residential

- Residential

By Region

- North America

- U.S.

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Asia Pacific

- China

- India

- Japan

- South Korea

- Latin America

- Brazil

- Argentina

- Middle East & Africa

- Saudi Arabia

- South Africa