Content

Adiponitrile Market Size and Forecast 2025 to 2034

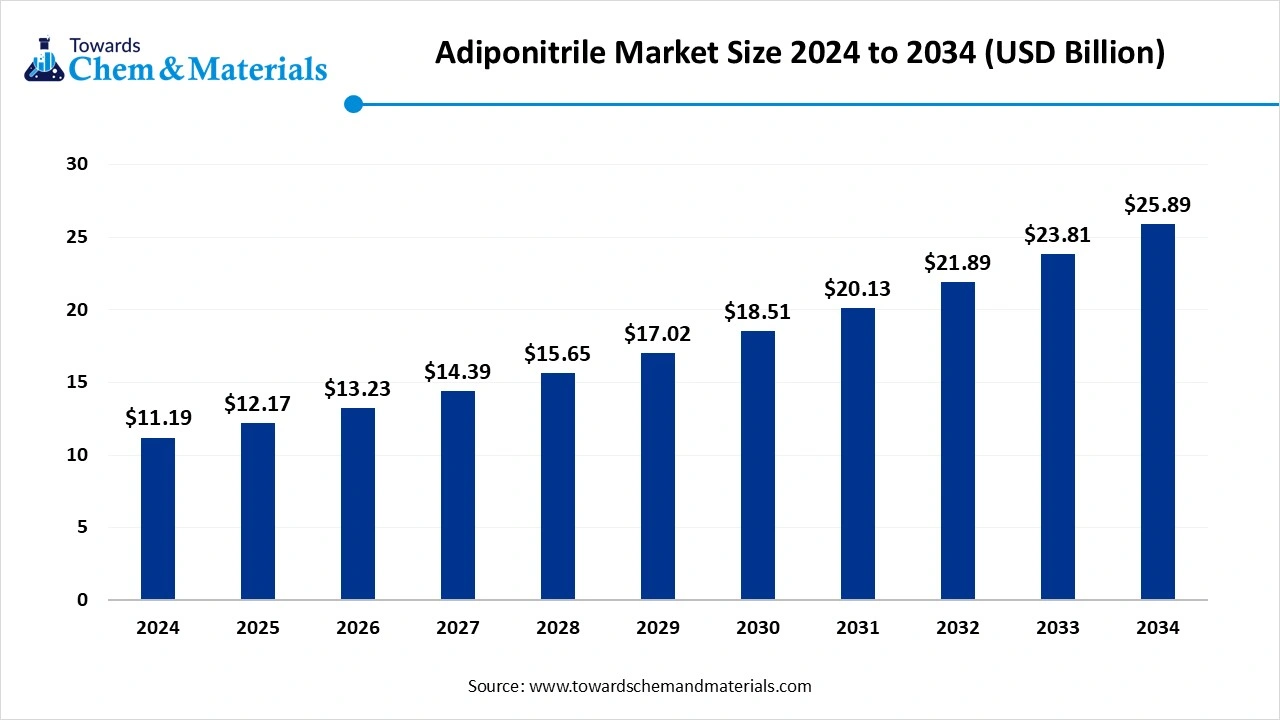

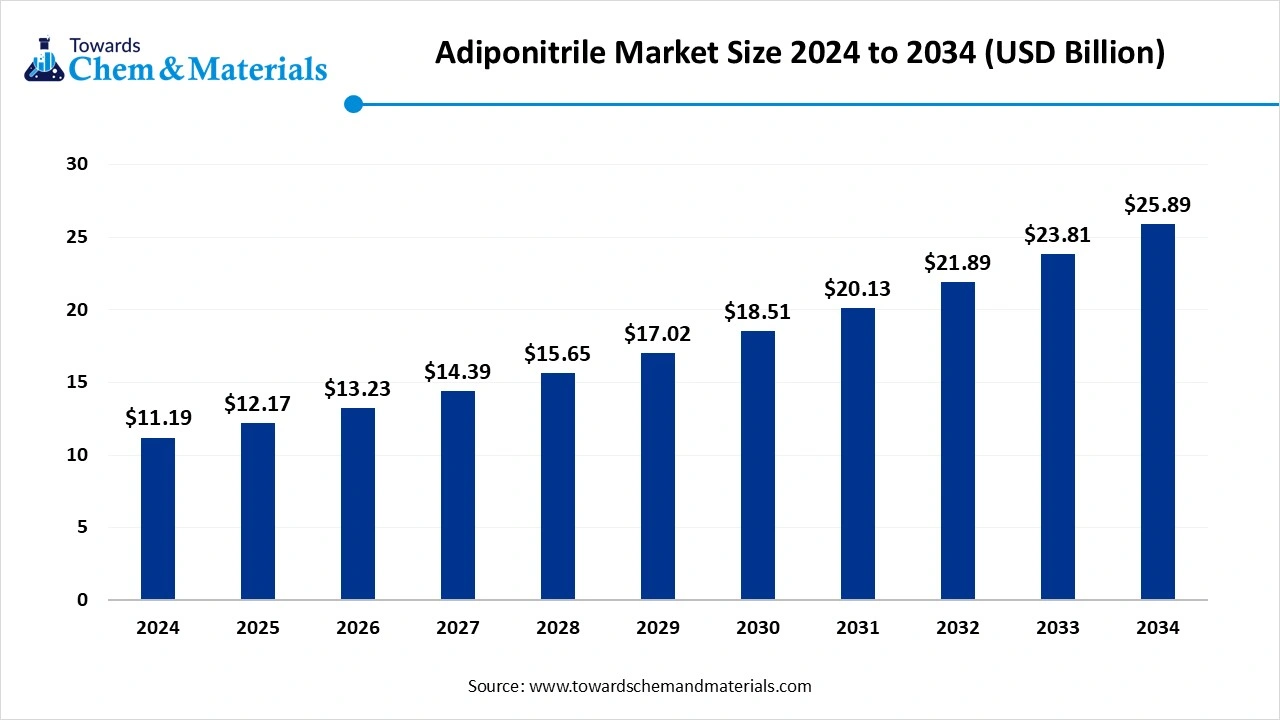

The global adiponitrile market size accounted for USD 13.23 billion in 2025 and is forecasted to hit around USD 25.89 billion by 2034, representing a CAGR of 8.75% from 2025 to 2034. The rise in electric vehicles, the growing demand across the electronics industry, and the development of bio-based adiponitrile drive the market growth.

Key Takeaways

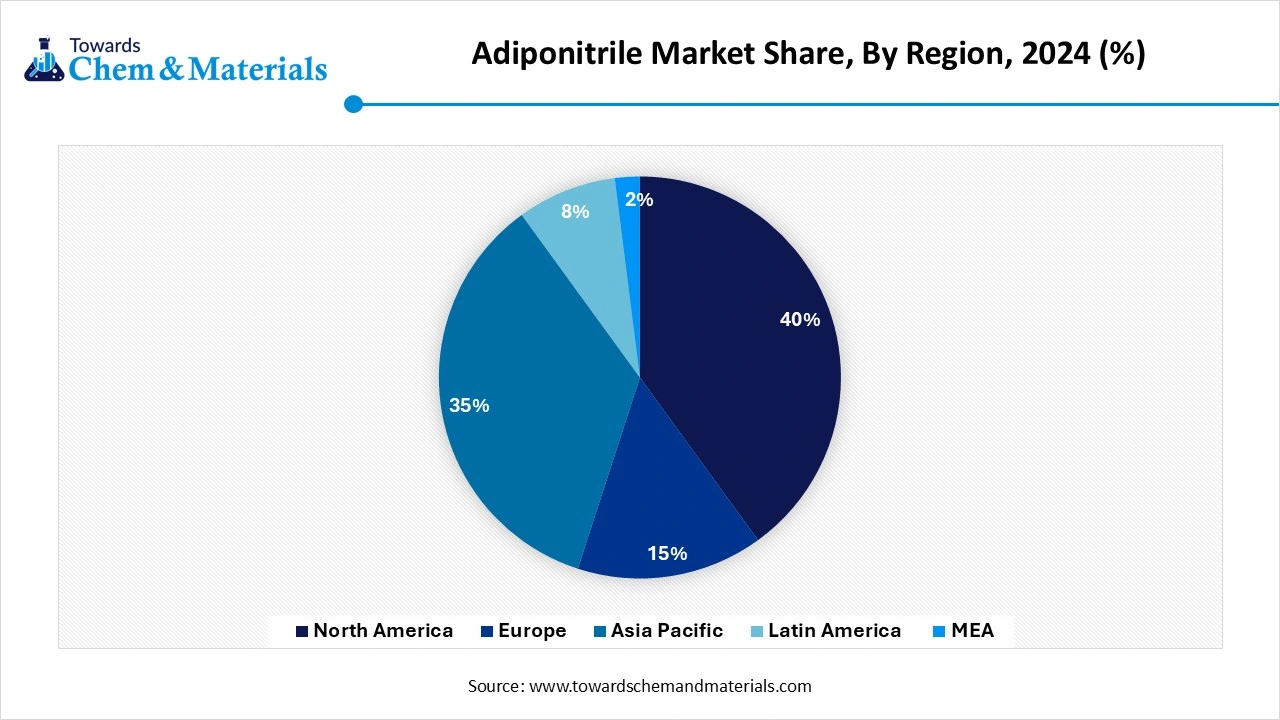

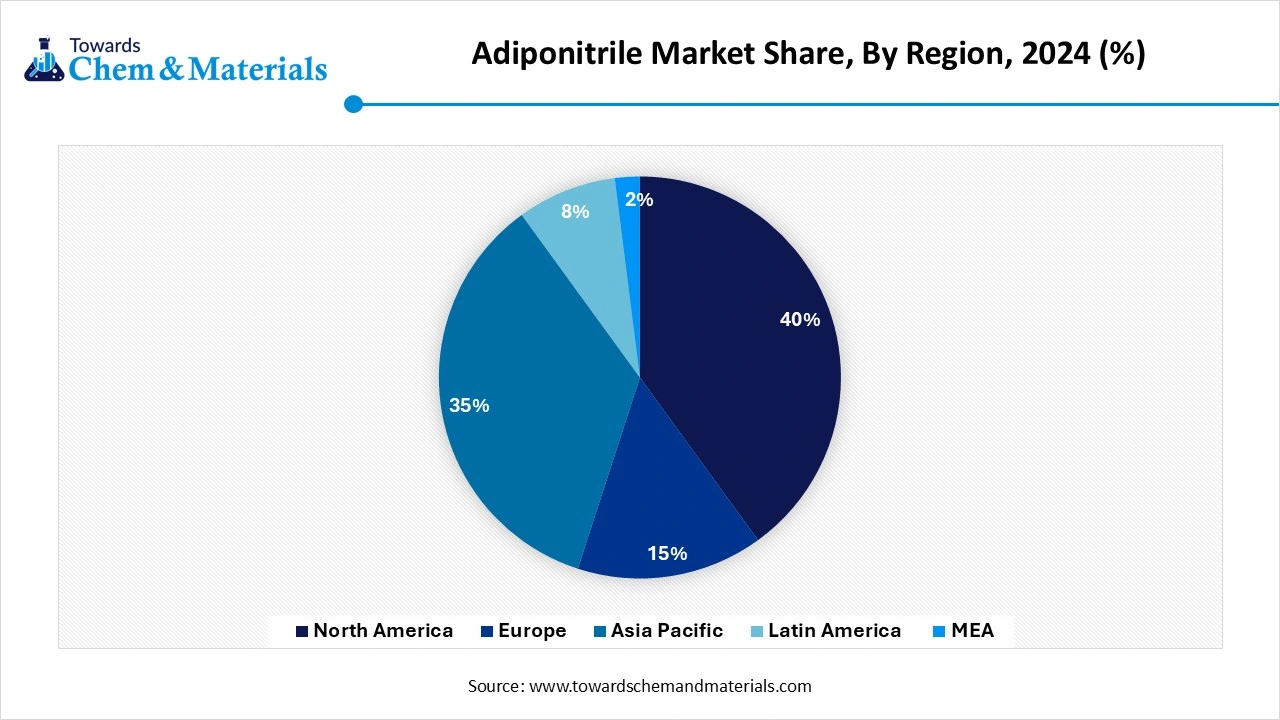

- The North America adiponitrile market held the largest Volume Share of 40% of the global market in 2024.

- By region, Asia Pacific is growing at the fastest CAGR in the market during the forecast period due to the presence of a strong manufacturing sector.

- By production process, the hydrocyanation of butadiene segment held a 75% share in the market in 2024 due to the integration with various chemical manufacturing processes.

- By production process, the electrochemical process segment is expected to grow at the fastest CAGR in the market during the forecast period due to the increasing focus on sustainability.

- By application, the hexamethylene diamine segment held a 60% share in the market in 2024 due to the growing production of textiles.

- By application, the nylon 6,6 fiber segment is expected to grow at the fastest CAGR in the market during the forecast period due to the increasing production of various automotive parts.

- By end-use industry, the automotive segment held a 45% share in the market in 2024 due to the rise in electric vehicles.

- By end use industry, the electrical & electronics segment is significantly growing in the market due to the growing production of electronic devices.

- By distribution channel, the direct sales segment held a 70% share in the market in 2024 due to the increasing consumer focus on transparency.

- By distribution channel, the online sales segment is expected to grow at the fastest CAGR in the market during the forecast period due to the increasing consumer demand to shop from anywhere.

- By purity level, the 98%-99.5% (industrial grade) segment held a 65% share in the adiponitrile market in 2024 due to the increasing demand across the electronics industry.

- By purity level, the >99.5% (high purity grade) segment is expected to grow at the fastest CAGR in the market during the forecast period due to the increasing application in energy storage.

The Role of Adiponitrile in Synthetic Materials and Industries

Adiponitrile refers to an organic compound that is a viscous, dinitrile, and colorless liquid. The chemical formula of adiponitrile is (CH2)4(CN)2 and is manufactured through different methods like electrochemical process, nickel-catalyzed hydrocyanations, and many more. Adiponitrile, also called hexanedinitrile, and used in the production of various chemicals. The molecular weight is 108.14g/mol and is slightly soluble in water.

Adiponitrile is widely used to make pesticides, dyes, nylon, and drugs. The growing technological advancements in the production methods of adiponitrile help the market growth. The rise in electric vehicles increases demand for adiponitrile for the production of automotive components. The increasing focus on the development of bio-based adiponitrile helps the market growth. The growing demand across key industries like textiles, automotive, electronics, construction, and many more contributes to the growth of the market.

- Germany exported $1.94B of nylons in 2023.(Source: oec.world)

- South Korea exported $300M of acrylonitrile in 2023.(Source: oec.world)

- Chinese Taipei exported $294M of acrylonitrile in 2023.(Source:oec.world)

- South Korea exported 39,105 shipments of butadiene.(Source: www.volza.com)

- Vietnam exported 399,149 shipments of nylon.(Source:www.volza.com)

The Growing Textile Industry Drives Demand for Adiponitrile

The growing expansion of the textile industry in various regions increases demand for adiponitrile for the production of various textiles. The increasing production of specialized textiles, apparel, and industrial fabrics fuels demand for durable & strong nylon 6,6. The rising demand for high-quality textiles in various industries increases the adoption of adiponitrile. The increasing focus on fashion and the growing demand for performance-oriented textile products leads to higher demand for nylon 6, 6 derivatives of adiponitrile. The growing adoption of sustainable practices in the textile industry increases demand for adiponitrile. The increasing production of clothing, carpets, and sportswear is fueling demand for adiponitrile. The growing textile industry is a key driver for the growth of the adiponitrile market.

Market Trends

- Rise in Electric Vehicles: The rapid growth in the production and adoption of electric vehicles, fuel demand for adiponitrile for the production of lightweight materials like interiors, battery systems, and chassis to enhance the performance.

- Growing Adoption of Electronic Devices: The growing demand for electronic devices like laptops, wearable devices, smartphones, and computers increases the adoption of adiponitrile for insulating electrical components, battery housing, avoiding short circuits, and improving thermal stability.

- Increasing Focus on Sustainability: The growing focus on sustainability increases the development of the bio-based adiponitrile. They are produced from microbial fermentation and plant-based feedstock. The bio-based adiponitrile is environmentally friendly, sustainable, and lowers the carbon footprint.

Report Scope

| Report Attributes | Details |

| Market Size in 2025 | USD 13.23 Billion |

| Market Size by 2034 | USD 25.89 Billion |

| Growth rate from 2024 to 2025 | CAGR 8.75% |

| Base Year of Estimation | 2024 |

| Forecast Period | 2025 - 2034 |

| Dominant Region | North America |

| Segment Covered | By Production Process, By Application, By End-Use Industry, By Distribution Channel, By Purity Level, By Region |

| Key Companies Profiled | Invista (Koch Industries), Ascend Performance Materials, BASF SE, Lanxess AG, Shandong Runxing Chemical Co., Ltd., Asahi Kasei Corporation, LG Chem, UBE Corporation, Solvay S.A., Radici Group, Zhejiang Shenma Chemical Co., Ltd., Formosa Plastics Corporation, Jiangsu Eastern Shenghong Co., Ltd., Hengyi Petrochemical, Kuraray Co., Ltd., Toray Industries, Inc., Sumitomo Chemical Co., Ltd., INEOS Group, China Petroleum & Chemical Corporation (Sinopec), DuPont de Nemours, Inc. |

Market Opportunity

The Booming Automotive Industry Unlocks Opportunity for Market

The growing production of vehicles in various regions increases the demand for adiponitrile for the production of various components. The increasing focus on the development of lightweight automotive parts, like under-the-hood applications, engine components, and air intake manifolds, is fueling demand for nylon 6,6. The growing focus on lowering emissions and improving the fuel efficiency of vehicles increases the adoption of adiponitrile. The nylon-6,6 derived from adiponitrile is widely used in fuel systems, interior components, engine compartments, and airbag fabrics. The rising focus on enhancing safety and strict environmental regulations for vehicles increases the demand for adiponitrile. The rise in electric vehicles increases demand for adiponitrile. The growing adoption of electric and hybrid vehicles is fueling demand for adiponitrile. The growing automotive industry creates an opportunity for the market.

Market Challenge

What is the Challenge for the Adiponitrile Market?

High Production Cost Shuts Down Adiponitrile Market Growth

Despite several benefits of adiponitrile in various sectors but the high production cost restricts the market growth. Factors like energy-intensive processes, complex manufacturing methods, and expensive raw materials increase the production cost. The high cost of raw materials like acrylonitrile and butadiene due to various factors like fluctuating crude oil prices, supply chain disruptions, and geopolitical factors affects the market growth. The energy-intensive chemical processes increase the production cost. The stringent environmental regulations to reduce environmental concerns and carbon emissions increase the cost. The complex production methods, like butadiene-based synthesis, and the requirement of specialized technology, fuel the production cost. High production cost hampers the growth of the market.

Regional Insights

How North America Dominated the Adiponitrile Market?

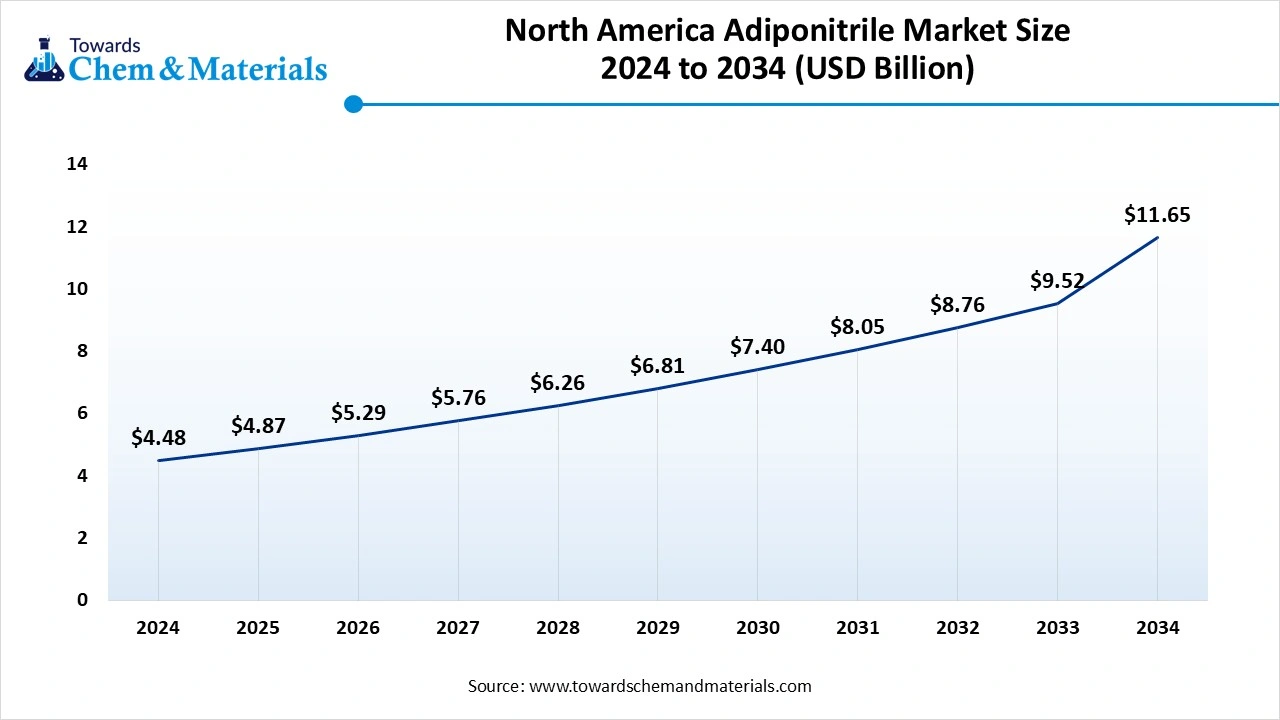

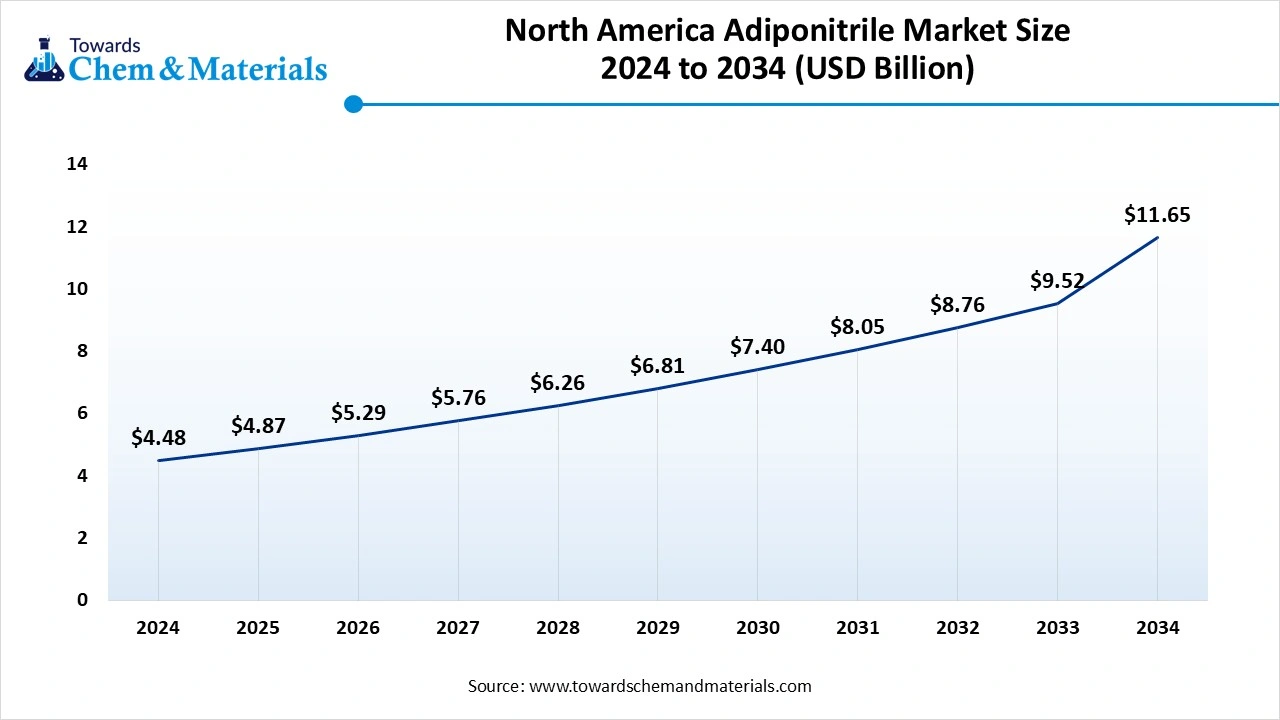

The North America adiponitrile market size accounted for USD 4.87 billion in 2025 and is forecasted to hit around USD 11.65 billion by 2034, representing a CAGR of 10.03% from 2025 to 2034. North America dominated the market in 2024.

The strong presence of chemical manufacturing infrastructure and a strong industrial base increases the production of adiponitrile. The growing electronic industry and the rise in the adoption of electric vehicles increase demand for nylon 6,6. The growing demand for nylon 6,6 in industries like textiles, automotive, and electronics helps the market growth. The strong manufacturing capabilities and increased industrialization in the region fuel demand for adiponitrile. The presence of key players like Ascend and Invista drives the overall growth of the market.

The United States Adiponitrile Market Trends

The United States is a major contributor to the market. The well-developed automotive industry in the region increases demand for adiponitrile. The increasing production of automotive parts, textiles, and carpets increases demand for nylon 6,6. The significant investment in the adiponitrile manufacturing facilities helps in the market growth. The growing production of electronic devices increases demand for adiponitrile. The rise in adoption of electric vehicles drives the overall growth of the market.

- The United States exported $1.88B of Polyamides: nylons in 2023.(Source: oec.world)

- The United States exported $392M of acrylonitrile in 2023.(Source:oec.world)

- The United States exported 26,329 shipments of nylon.(Source: volza.com)

Why is Asia Pacific the Fastest Growing in the Adiponitrile Market?

Asia Pacific is experiencing the fastest growth in the market during the forecast period. The strong presence of a robust manufacturing sector and growing industrialization in the region increases demand for adiponitrile. The strong government support for the domestic production of adiponitrile helps in the market growth. The growing consumer demand for electronics, textiles, and automotive parts increases demand for adiponitrile. The increasing demand for electronic devices in countries like South Korea, China, India, and Japan increases the demand for adiponitrile. The rising adoption of electric vehicles and the strong presence of the automotive industry drive the overall growth of the market.

China Adiponitrile Market Trends

China is a key contributor to the adiponitrile market. The growing adoption of electric vehicles and the strong presence of the automotive industry increase demand for adiponitrile. The rising industrial expansion in the region helps in the market growth. The strong government support for the chemical industry fuels demand for adiponitrile. The increasing focus on sustainable manufacturing practices increases the production of bio-based adiponitrile. The growing textile production supports the overall growth of the market.

- China exported $1.46B of Polyamides: nylons in 2023.(Source:oec.world)

- China exported 13,249 shipments of butadiene.(Source: www.volza.com)

- China exported 119,033 shipments of nylon.(Source: www.volza.com)

Segmental Insights

Production Process Insights

Why did the Hydrocyanation of Butadiene Segment Dominate the Adiponitrile Market?

The hydrocyanation of butadiene segment dominated the market in 2024. The growing production of high-yield adiponitrile increases the demand use of hydrocyanation in the butadiene production process. Hydrocyanation of butadiene offers high conversion rates and is easily scalable. It is an affordable way to produce adiponitrile, and it integrates with downstream & upstream chemical manufacturing systems. This process uses hydrogen cyanide and offers consistent production output. The strong investment of companies like Ascend Performance Materials and Invista in the hydrocyanation of the butadiene process drives the market growth.

The electrochemical process segment is the fastest growing in the market during the forecast period. The government regulations for the adoption of sustainable practices increase demand for electrochemical processes. This process reduces emissions and lowers the consumption of energy. Electrochemical processes minimize waste and produce higher yields of adiponitrile. The growing demand for nylon 6,6 in various industries increases the adoption of the electrochemical process. The electrochemical process uses bio-based feedstock and is scaled up to meet increasing demand. The increasing production of lithium-ion batteries supports the overall growth of the market.

Application Insights

How Hexamethylene Diamine Segment Held the Largest Share in the Adiponitrile Market?

The hexamethylene diamine (HMDA) segment held the largest revenue share in the market in 2024. The increasing production of high-performance and lightweight automotive components increases demand for HMDA for lowering emissions and enhancing fuel efficiency. The growing demand for nylon fibers in textiles increases the adoption of HMDA, helping the market growth. HDMA has excellent heat resistance, strength, and durability. HDMA is widely used as a crosslinking agent in coatings & adhesives, water treatment chemicals, and as a curing agent in epoxy resins. The growing expansion of industries like textiles and automotive drives the overall growth of the market.

The nylon 6,6 fiber segment is experiencing the fastest growth in the market during the forecast period. The growing production of various automotive parts like electrical systems, engine components, and fuel lines increases demand for nylon 6,6 fiber. The increasing consumer demand for comfortable and durable fabrics like swimwear & sportswear increases demand for nylon 6,6 fiber, helping the market growth. Nylon 6,6 has high abrasion strength, tensile strength, and heat resistance. It has dimensional stability and a high melting point. It consists of a compact molecular structure and is widely used in various applications. The growing electrical and electronic industry drives the overall growth of the market.

End-Use Industry Insights

Which End-Use Industry Segment Dominated the Adiponitrile Market?

The automotive segment dominated the adiponitrile market in 2024. The growing focus on enhancing fuel efficiency and reducing the weight of vehicles increases demand for adiponitrile. The increasing production of various automotive components like fuel system components, interior trims, engine parts, and airbags increases demand for nylon 6,6 derivative of adiponitrile, helping the market growth. The stringent safety regulations for automotive manufacturing increase the adoption of adiponitrile. The rise in electric vehicles and growing automotive production support the overall growth of the market.

The electrical & electronics segment is the fastest growing in the market during the forecast period. The growing demand for various consumer electronics like smartphones, laptops, wearable devices, and many more increases the demand for adiponitrile. The increasing demand for electrical components and insulation materials for various applications fuels demand for adiponitrile, helping the market growth. The rising consumer investment in semiconductor advancements and smart technology increases the adoption of adiponitrile. The increasing trend for miniaturization of electronic devices drives the market growth.

Distribution Channel Insights

Why Direct Sales Segment Held the Largest Share of the Adiponitrile Market?

The direct sales segment held the largest revenue share in the adiponitrile market in 2024. The increasing focus on quality and transparency of the product increases demand for direct sales. The growing consumer demand for personalised interaction with distributors increases the adoption of direct sales. The focus on customized product recommendations and demand for authentic experiences drives the market growth.

The online sales segment is experiencing the fastest growth in the market during the forecast period. The growing consumer preference for convenient shopping, such as shopping from anywhere, price comparison, and home delivery, helps the market growth. The increasing focus on digitalization fuels demand for online sales. The shifting younger consumer preference for online shopping supports the overall growth of the market.

Purity Level Insights

How 98%-99.5% Segment Dominated the Adiponitrile Market?

The 98%-99.5% (industrial grade) segment dominated the adiponitrile market in 2024. The growing nylon 6,6 production increases demand for 98%-99.5% purity adiponitrile. The increasing demand across industrial applications and the electronics industry helps the market growth. The growing textile industry, like the production of carpets and apparel, increases demand for 98%-99.5% purity adiponitrile, driving the overall growth of the market.

The 99.5% (high purity grade) segment is the fastest-growing in the market during the forecast period. The growing production of lithium-ion batteries increases demand for 99.5% purity. The increasing demand from the electronics industry is fueling demand for 99.5 % purity adiponitrile to ensure regulations compliance, product quality, and safety. The growing electric vehicle expansion and increasing energy storage demand support the overall growth of the market.

Recent Developments

- In March 2025, Lululemon and ZymoChem collaborated to expand bio-based nylon. The company used nylon in the Wunder & Align train leggings and focuses on a sustainable materials transition. (Source:www.fashiondive.com)

- In July 2023, Solvay launched sustainable nylon 6,6 from 100% recycled content. The nylon 6,6 is applied to textiles, automotive, and small appliances. The sustainable product saves energy and reduces waste. The sustainable plant is present in Brazil and reduces carbon dioxide emissions by 95%.(Source:www.indianchemicalnews.com)

- In November 2024, Invista and its joint venture Butachimie launched a new type of adiponitrile technology in France. The new technology lowers energy consumption, enhances process stability, increases output, and minimizes the emission of greenhouse gases.(Source:en.sinowinfiber.com)

Top Companies List

- Invista (Koch Industries)

- Ascend Performance Materials

- BASF SE

- Lanxess AG

- Shandong Runxing Chemical Co., Ltd.

- Asahi Kasei Corporation

- LG Chem

- UBE Corporation

- Solvay S.A.

- Radici Group

- Zhejiang Shenma Chemical Co., Ltd.

- Formosa Plastics Corporation

- Jiangsu Eastern Shenghong Co., Ltd.

- Hengyi Petrochemical

- Kuraray Co., Ltd.

- Toray Industries, Inc.

- Sumitomo Chemical Co., Ltd.

- INEOS Group

- China Petroleum & Chemical Corporation (Sinopec)

- DuPont de Nemours, Inc.

Segments Covered

By Production Process

- Hydrocyanation Of Butadiene (Mainstream Process)

- Electrochemical Process

- Ammonoxidation Process

By Application

- Hexamethylene Diamine (Hmda)

- Nylon 6,6 Resin

- Nylon 6,6 Fiber

- Lubricants & Corrosion Inhibitors

- Coatings & Adhesives

- Elastomers

- Others (Additives, Intermediates, Etc.)

By End-Use Industry

- Automotive

- Electrical & Electronics

- Textiles & Fibers

- Industrial Machinery

- Consumer Goods

- Packaging

- Aerospace & Defense

- Construction

- Others (Medical, Oil & Gas)

By Distribution Channel

- Direct Sales

- Distributors / Traders

- Online Sales

By Purity Level

- <98% (Technical Grade)

- 98%–99.5% (Industrial Grade)

- 99.5% (High Purity Grade / Specialty Grade)

By Region

- North America

- U.S.

- Canada

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Sweden

- Denmark

- Norway

- Asia Pacific

- China

- Japan

- India

- South Korea

- Thailand

- Latin America

- Brazil

- Mexico

- Argentina

- Middle East & Africa

- South Africa

- UAE

- Saudi Arabia

- Kuwait