Content

Synthetic Graphite Market Size and Growth 2025 to 2034

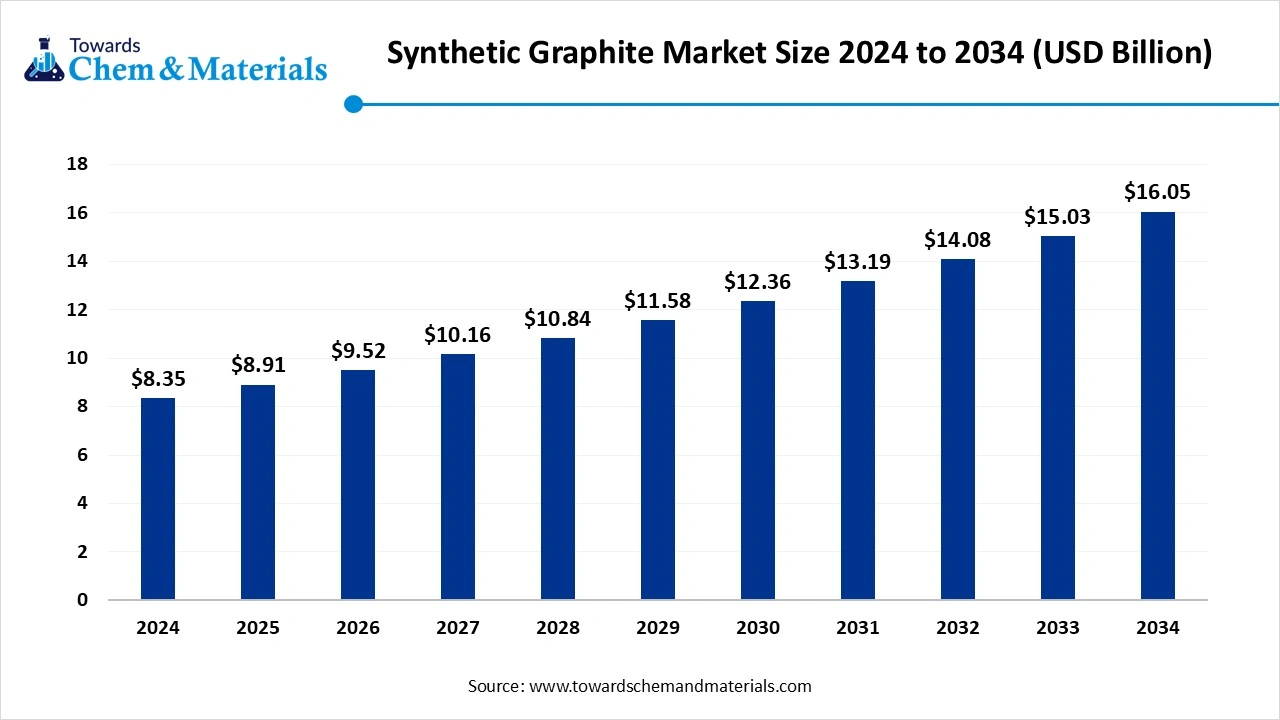

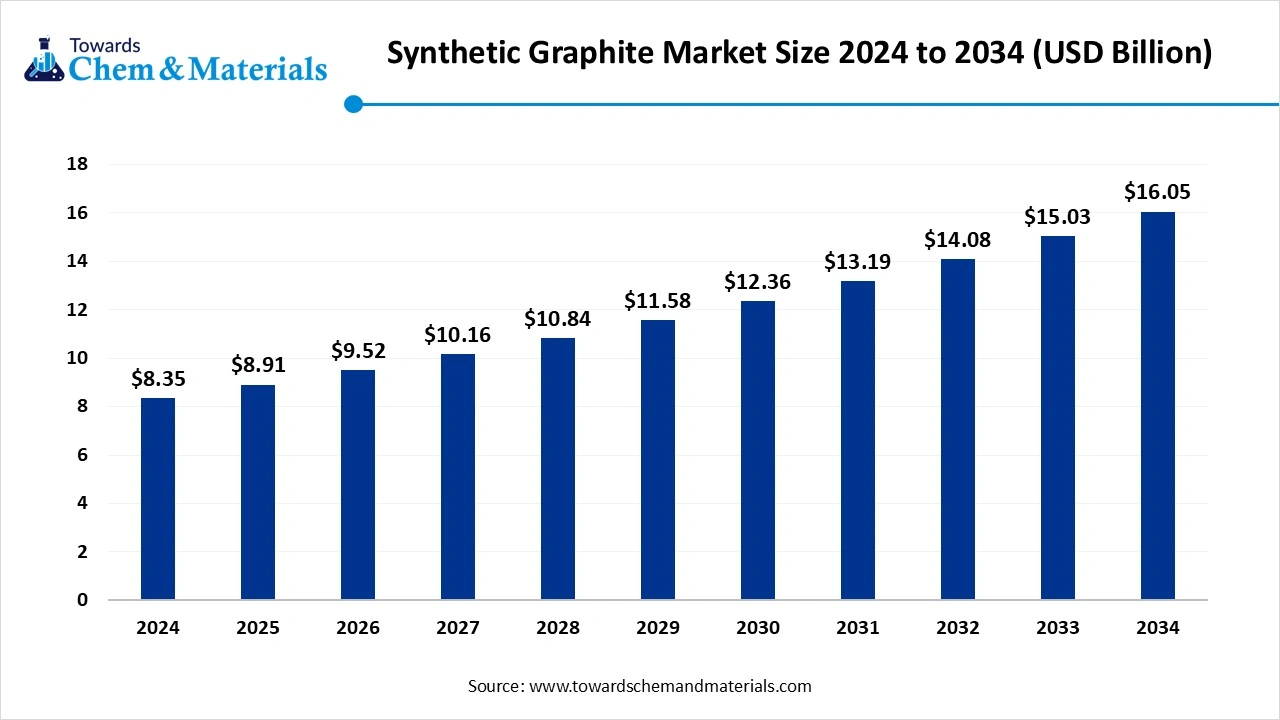

The synthetic graphite market was exhibited at USD 8.35 billion in 2024 and is projected to hit around USD 16.05 billion by 2034, growing at a CAGR of 6.75% during the forecast period 2025 to 2034. The growing adoption of EVs globally is the key factor driving market growth. Also, increasing demand for high-performance materials in various applications, coupled with the enhancements in natural graphite processing, can fuel market growth further.

Key Takeaways

- By region, Asia Pacific dominated the market in 2024, and the region is expected to sustain this position during the forecast period. The growth of the region can be attributed to the increasing demand from the aerospace and electric car sectors.

- By region, North America is expected to grow at a significant CAGR over the forecast period. The growth of the region can be credited to the ongoing advancements and technical enhancements that optimise the creation of high-performance innovative materials and batteries.

- By product type, the graphite electrode segment led the market while holding a 35-40% share in 2024. The dominance of the segment can be attributed to its crucial function in steel manufacturing and the surge in the energy storage industry.

- By product type, the battery anode material segment is expected to grow at the fastest CAGR over the forecast period. The growth of the segment can be credited to their high purity, capability to withstand high voltages, and excellent conductivity.

- By application, the EAF steel production segment dominated the market while holding a 35-40% share in 2024. The dominance of the segment can be linked to its key role in the electric arc furnace for manufacturing steel.

- By application, the lithium-ion Batteries segment is expected to grow at the fastest CAGR over the forecast period. The growth of the segment can be driven by the growing need for energy storage solutions coupled with the ongoing adoption of electric vehicles (EVs).

- By end user industry, the metallurgy segment led the market while holding a 35-40% share in 2024. The dominance of the segment is owed to the growing adoption of additive manufacturing and, cost-effectiveness of powder metallurgy processes.

- By end user industry, the automotive (EV sector) segment is expected to grow at the fastest CAGR during the projected period. The growth of the segment is due to the growing adoption of electric vehicles and innovations in battery technology.

- By manufacturing process, the molded graphite segment held 30% synthetic graphite market share in 2024. The dominance of the segment can be attributed to the growing demand from the steel and electric vehicle (EV) battery market.

- By manufacturing process, the isostatically pressed graphite segment is expected to grow at the fastest CAGR during the study period. The growth of the segment can be credited to the growing demand from the solar PV, semiconductor, and EDM industries.

- By raw material, the needle coke segment led a 50 % market share in 2024 and is expected to grow at the fastest CAGR during the forecast period. The growth of the segment can be linked to the growth of renewable energy storage and innovations in battery technology.

Innovations in Battery Technology Expanding Market Growth

Synthetic Graphite is a high-purity carbon material artificially produced from carbon precursors (primarily petroleum coke and coal tar pitch) through high-temperature treatment (up to 3,000°C). It exhibits superior electrical conductivity, thermal stability, lubricity, and corrosion resistance. It is widely used in applications such as lithium-ion batteries, electrodes in electric arc furnaces, refractories, lubricants, and nuclear reactors. The growing need for high-purity synthetic graphite in various sectors such as refractories, electric vehicle (EV) batteries, and solar panels is expected to boost market growth shortly.

What Are the Key Trends Influencing the Synthetic Graphite Market?

- Increasing demand for refractories is the latest trend in the market, propelled by its unique set of properties needed in refractories. Hence, graphite as a significant mineral plays an important role in refractories by improving thermal conductivity and minimizing corrosion, which ultimately drives the performance of refractory materials.

- The exponential growth in EV adoption across the globe has raised the demand for lithium-ion batteries, where synthetic graphite is utilized as an anode material in battery manufacturing. Its properties, like high consistency and purity, make it more favourable than natural graphite in batteries.

- The growing adoption of graphite materials in steelmaking is another significant trend impacting market growth positively. Graphite electrodes are used to carry electricity within steel production facilities, a process that helps refine and purify and remove impurities. This material has a variety of benefits over conventional carbon electrodes.

Report Scope

| Report Attributes | Details |

| Market Size in 2025 | USD 8.91 Billion |

| Market Size by 2034 | USD 16.05 Billion |

| Growth rate from 2024 to 2025 | CAGR 6.75% |

| Base Year of Estimation | 2024 |

| Forecast Period | 2025 - 2034 |

| Dominant Region | Asia Pacific |

| Segment Covered | By Product Type, By Application, By End-Use Industry, By Manufacturing Process, By Raw Material, By Region |

| Key Profiled Companies | GrafTech International, Showa Denko K.K., Tokai Carbon Co., Ltd., HEG Ltd., Nippon Carbon Co., Ltd., SEC Carbon, Ltd., SGL Carbon SE, Mersen Group, Graphite India Limited, Fangda Carbon New Material Co., Ltd., Jilin Carbon Co., Ltd., Kaifeng Carbon Co., Ltd., Shida Carbon Group, Baotailong New Materials Co., Ltd., Sinosteel Corporation, Toyo Tanso Co., Ltd., Imerys Graphite & Carbon, AMG Graphite (Graphit Kropfmühl), Shanghai Carbon Co., Ltd., South Graphite Co., Ltd. |

Market Opportunity

Growing Demand from the Metallurgy Sector

In metallurgical applications, graphite is used in different forms, such as refractories, bricks, electrodes, crucibles, and monolithic. Etc. This increasing utilisation of synthetic graphite in this segment is expected to be propelled by the increased global production of crude aluminium and steel. Furthermore, in electric furnaces, synthetic graphite is utilized to produce ferroalloys, steel, and aluminium, creating future opportunities in the market.

- In January 2025, General Motors signed an agreement for Norway's Vianode to offer the U.S. automaker synthetic graphite anode materials for its batteries. This graphite will be used for EV batteries made by the Ultium Cells joint venture.(Source: www.reuters.com)

Challenges

Competition from Natural Graphite

Natural graphite competes with synthetic graphite, particularly in cost-sensitive applications. Despite its superior properties, the decreased cost of natural graphite can make it more tempting, particularly in markets with less stringent performance criteria. Moreover, the production method for synthetic graphite is energy-intensive and includes significant capital investment, which results in high production costs, hampering market growth further.

Regional Insights

Asia Pacific dominated the synthetic graphite market in 2024, and the region is expected to sustain this position during the forecast period. The growth of the region can be attributed to the increasing demand from the aerospace and electric car sectors, especially in emerging economies such as China and India. Furthermore, the rapid industrialization in the region, along with the increased expenditure in battery and electric car production, is boosting market expansion soon.

Synthetic Graphite Market in China

In the Asia Pacific, China led the market owing to the growing need for lithium-ion batteries in energy storage systems and electric vehicles, along with the surging metallurgical and steel industries in the country. Also, the advancements in manufacturing processes, such as the development of high-purity graphite utilising optimized methods, are improving efficiency and expanding market growth.

North America is expected to grow at a significant CAGR over the forecast period. The growth of the region can be credited to the ongoing advancements and technical enhancements that optimise the creation of high-performance innovative materials and batteries. Additionally, government support for clean energy technologies, such as renewable energy storage, is creating a reliable environment for the market.

Who is the Top 5 Graphite-producing Countries in 2024?

| Country | Natural graphite production |

| China | 1.27 million metric tons |

| Madagascar | 89,000 metric tons |

| Mozambique | 75,000 metric tons |

| Brazil | 68,000 metric tons |

| India | 27,800 metric tons |

Segmental Insight

Product Type Insight

Which Product Type Segment Dominated the Synthetic Graphite Market in 2024?

The graphite electrode segment led the market while holding a 35-40% share in 2024. The dominance of the segment can be attributed to its crucial function in steel manufacturing and the surge in the energy storage industry. In addition, these electrodes are important for converting electrical energy to melt steel scrap in EAFs, with their unique properties, which make them important for the high-temperature process.

The battery anode material segment is expected to grow at the fastest CAGR over the forecast period. The growth of the segment can be credited to their high purity, capability to withstand high voltages, and excellent conductivity. Graphite, both synthetic and natural, is currently the most extensively used anode material because of its cost-effectiveness and stable performance, driving segment growth soon.

Application Insight

Why EAF Steel Production Segment Led the Synthetic Graphite Market in 2024?

The EAF steel production segment dominated the market while holding a 35-40% share in 2024. The dominance of the segment can be linked to its key role in electric arc furnaces to manufacture steel, which is further propelled by growing demand in the automotive, construction, and industrial industries. Also, surging consumer preference and awareness for sustainable products are boosting the demand for EAF steel shortly.

Lithium-ion Batteries segment is expected to grow at the fastest CAGR over the forecast period. The growth of the segment can be driven by the growing need for energy storage solutions coupled with the ongoing adoption of electric vehicles (EVs). Lithium-ion batteries play a significant role in storing energy created from renewable sources such as wind and solar.

End-Use Industry Insights

How Metallurgy Segment Held the Largest Synthetic Graphite Market Share in 2024?

The metallurgy segment led the market while holding a 35-40% share in 2024. The dominance of the segment is owed to the growing adoption of additive manufacturing, the cost-effectiveness of powder metallurgy processes, and the growing demand for lightweight components. Furthermore, the integration of powder metallurgy with additive manufacturing (AM) enables the production of complex geometries with less material waste.

The automotive (EV sector) segment is expected to grow at the fastest CAGR during the projected period. The growth of the segment is due to the growing adoption of electric vehicles and innovations in battery technology. Moreover, governments across the globe are rapidly implementing stringent emission regulations, impelling automakers to shift towards EVs.The surging popularity of EVs is boosting the demand for lithium-ion batteries.

Manufacturing Process Insights

Why Molded Graphite Segment Dominated the Synthetic Graphite Market in 2024?

The molded graphite segment held 30% market share in 2024. The dominance of the segment can be attributed to the growing demand from the steel and electric vehicle (EV) battery market. Other factors, such as innovations in production methods and uses in renewable and aerospace energy sectors, are also contributing to the market expansion further. Molded graphite is used in electrodes, refractories, and other high-temperature industrial processes.

The isostatically pressed graphite segment is expected to grow at the fastest CAGR during the study period. The growth of the segment can be credited to the growing demand from solar PV, semiconductor, and EDM industries, along with rising use in electric vehicle manufacturing and nuclear power plants. Innovations in production processes such as chemical vapor deposition (CVD) are expanding segment growth soon.

Raw Material Insights

Which Raw Material Segment Led the Synthetic Graphite Market in 2024?

The needle coke segment led a 50 % market share in 2024 and is expected to grow at the fastest CAGR during the forecast period. The growth of the segment can be linked to the growth of renewable energy storage and innovations in battery technology, especially for lithium-ion batteries. Additionally, needle coke is an essential component in the manufacturing of synthetic graphite, which is a crucial material for these battery anodes.

Recent Developments

- In March 2025, Vianode launches a recycled graphite product, which has generated significant excitement across battery technology circles. This makes an advanced shift towards sustainable battery production. The product has become integral to discussions on climate impact.(Source: discoveryalert.com.au)

- In June 2024, Battery materials and technology company NOVONIX signed an agreement for synthetic graphite material. Under this offtake agreement, NOVONIX will provide approximately 32,000 tonnes of synthetic graphite material to PowerCo.(Source:investingnews.com)

Companies List

- GrafTech International

- Showa Denko K.K.

- Tokai Carbon Co., Ltd.

- HEG Ltd.

- Nippon Carbon Co., Ltd.

- SEC Carbon, Ltd.

- SGL Carbon SE

- Mersen Group

- Graphite India Limited

- Fangda Carbon New Material Co., Ltd.

- Jilin Carbon Co., Ltd.

- Kaifeng Carbon Co., Ltd.

- Shida Carbon Group

- Baotailong New Materials Co., Ltd.

- Sinosteel Corporation

- Toyo Tanso Co., Ltd.

- Imerys Graphite & Carbon

- AMG Graphite (Graphit Kropfmühl)

- Shanghai Carbon Co., Ltd.

- South Graphite Co., Ltd.

Segments Covered

By Product Type

- Graphite Electrodes (Largest; ~35–40%)

- Carbon Fibers

- Specialty Graphite

- Isotropic Graphite

- Extruded Graphite

- Molded Graphite

- Graphite Blocks

- Graphite Powder

- Graphite Granules

- Graphite Anode Material for Batteries (Fastest Growing; >20% CAGR)

- Other Forms (e.g., synthetic diamond precursors, rods, etc.)

By Application

- Electric Arc Furnace (EAF) Steel Production (Largest; ~30–35%)

- Lithium-ion Batteries (Fastest Growing; >25% CAGR)

- Foundry & Casting

- Refractories

- Friction Products (Brake Linings, Clutches)

- Lubricants

- Nuclear Reactors

- Aerospace and Defense

- Semiconductors

- Other Industrial Applications

By End-Use Industry

- Metallurgy (Steel & Iron) (Largest)

- Automotive (EV & ICE)

- Energy & Power (Batteries, Fuel Cells) (Fastest Growing)

- Electronics & Semiconductors

- Aerospace

- Chemicals

- Nuclear

- Others

By Manufacturing Process

- Extrusion Processed Graphite

- Molded Graphite

- Isostatically Pressed Graphite

- Vibrational Molding

- Continuous Process Graphite

By Raw Material

- Needle Coke (Largest and Critical for High-grade Electrodes & Anodes)

- Petroleum Coke

- Coal Tar Pitch

- Other Carbon Materials

By Region

- Asia-Pacific (Largest Market; ~45% Share)

- North America

- Europe

- Latin America

- Middle East & Africa