Content

U.S. Polypropylene Market Size and Top Companies Analysis, 2034

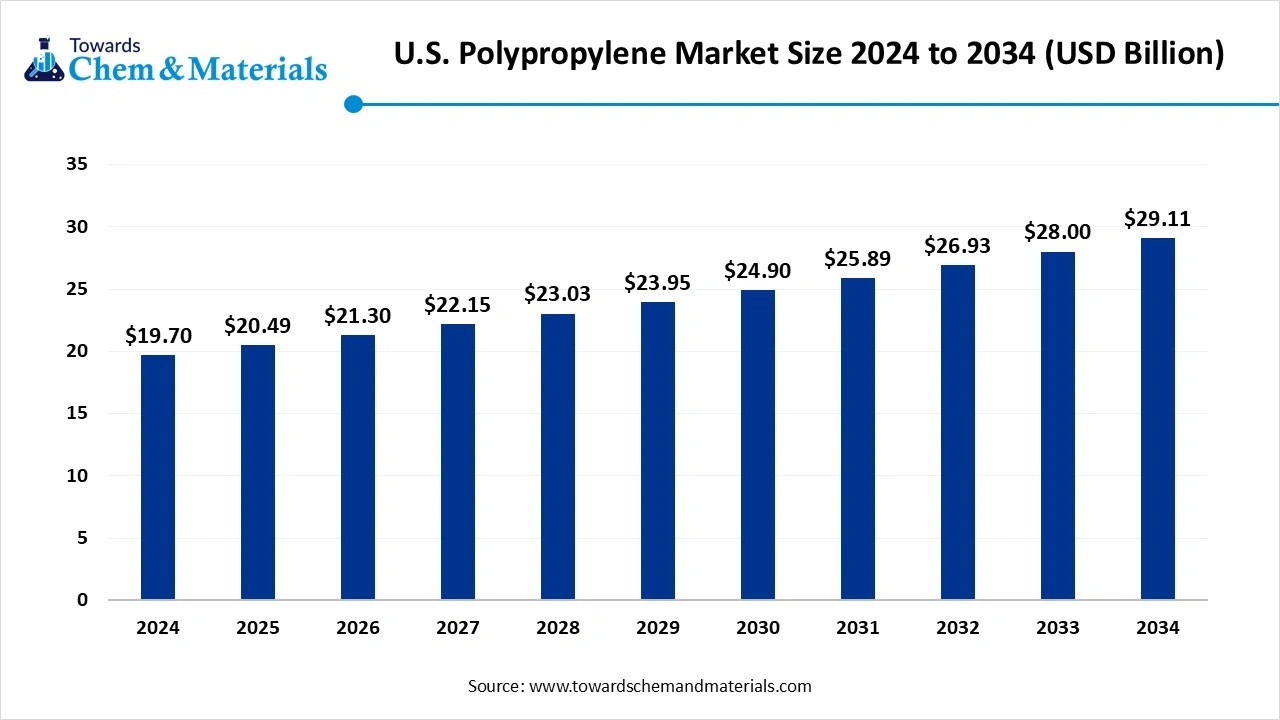

The U.S. polypropylene market size was valued at USD 19.70 billion in 2024, grew to USD 20.49 billion in 2025 and is expected to hit around USD 29.11 billion by 2034, growing at a compound annual growth rate (CAGR) of 3.98% over the forecast period from 2025 to 2034. Growing adoption of sustainable plastics across various industries is the key factor driving market growth. Also, increasing demand for fuel efficiency in the expanding automotive sector, coupled with innovations in recycling technologies, can fuel market growth.

Key Takeaways

- By polymer type, the homopolymer segment dominated the market with a 65% share in 2024. The dominance of the segment can be attributed to the increasing product demand from the packaging, automotive, and consumer goods industries.

- By polymer type, the copolymer segment is expected to grow at the fastest CAGR over the forecast period. The growth of the segment can be credited to the growing use of random copolymers for their lightweight properties in various sectors.

- By application, the extrusion segment held a 36% market share in 2024. The dominance of the segment can be linked to the growing polypropylene demand from the automotive industry for lightweight components.

- By application, the injection molding segment is expected to grow at the significant CAGR over the study period. The growth of the segment can be driven by growing demand for lightweight materials to enhance fuel efficiency.

- By end-use industry, the packaging segment dominated the market with a 45% share in 2024. The dominance of the segment is owed to its moisture resistance, high clarity, cost-efficiency, and compatibility with different packaging formats.

- By end-use industry, the electrical & electronics segment is expected to grow at the fastest CAGR during the projected period. The growth of the segment is due to the material's exceptional electrical insulation properties.

Technological Advancements Are Expanding Market Growth

The U.S. polypropylene (PP) market refers to the production, distribution, and consumption of polypropylene resins within the United States. Polypropylene is a thermoplastic polymer widely used across various industries due to its lightweight, chemical resistance, durability, and versatility in processing methods like injection molding, extrusion, and blow molding.

Advancements in fiber grade and copolymer blends of polypropylene are creating extensive opportunities for the market in different sectors. PP's durability is crucial for insulation pipes and roofing materials, promoting infrastructure development.

What Are the Key Trends Influencing the U.S. Polypropylene Market?

- The ongoing integration of digital printing in polypropylene packaging is the latest trend in the market. This trend is especially popular in the food and cosmetics sectors, focusing on distinctive market differentiation. The technology enables instant incorporation and modification of QR codes.

- Manufacturers are increasingly adopting circular economy principles, which is another trend shaping a positive market trajectory. The circular economy emphasizes reusability, reuse paradigms, and recyclable materials, where polypropylene can fit due to its thermoplastic reprocessing abilities, leading to further market expansion.

- The automotive sector is rapidly using polypropylene due to its lightweight properties to help minimize emissions and enhance fuel efficiency, aligning with industry trends regarding sustainability. The growing adoption of electric vehicles has propelled the expansion of the automotive industry further. In EVs, polypropylene is generally used in interiors and battery housing.

Report Scope

| Report Attributes | Details |

| Market Size in 2025 | USD 20.49 Billion |

| Expected Size by 2034 | USD 29.11 Billion |

| Growth Rate from 2025 to 2034 | CAGR 3.98% |

| Base Year of Estimation | 2024 |

| Forecast Period | 2025 - 2034 |

| Segment Covered | Type, Application, End-Use Industry |

| Key Companies Profiled | ExxonMobil Chemical Company, LyondellBasell Industries Holdings B.V., Braskem America, Chevron Phillips Chemical Company, TotalEnergies SE, SABIC Innovative Plastics, Formosa Plastics Corporation, INEOS Olefins & Polymers USA, Reliance Industries Limited, LG Chem, Sumitomo Chemical Co., Ltd., Borealis AG, DuPont de Nemours, Inc., Trinseo S.A., Washington Penn Plastic Co., Inc., Kingfa Sci. & Tech. Co., Ltd., Mitsui Chemicals, Inc., Repsol S.A., SABIC, Mitsubishi Chemical Group Corporation |

Market Opportunity

Growing Demand for Medical-Grade Polypropylene

The surge in demand for medical-grade polypropylene provides wide growth opportunities for OEMs serving the medical sector. Its sterilization capability, chemical resistance, and non-toxic nature allow major market players in the medical device industry to depend on polypropylene for products like labware and pharmaceutical packaging. Furthermore, stringent hygiene standards and regulatory policies are boosting the adoption of high-grade compliant materials like medical-grade PP.

Market Challenge

Environmental Concerns and Regulations

A major challenge facing the market is the increasing regulatory pressures and environmental concerns associated with plastic disposal and use. As global awareness regarding environmental issues like climate change and plastic pollution increases, polypropylene confronts scrutiny over its environmental impact. Moreover, Polypropylene is non-biodegradable, as it stays in the environment for hundreds of years, which can contribute to plastic pollution.

Country Insight

U.S. Polypropylene Market Trends

The South region dominated the market with a 40% share in 2024. The dominance of the region can be attributed to the strong product demand from the packaging and automotive sectors, along with the increasing focus on sustainability initiatives. In addition, the region also benefits from expanding production hubs and infrastructural investments, especially with the Gulf Coast.

The west region is expected to grow at the fastest CAGR over the forecast period. The growth of the region can be credited to the rising consumer demand for sustainable plastics and innovations in eco-friendly manufacturing. Furthermore, stringent EPA guidelines on plastic waste and recycling, coupled with the focus on a circular economy and other incentives for recycled plastics, are expected to fuel regional growth soon.

Who are the Top Polyethylene Exporters and Suppliers in the USA in 2024?

| Exporter and Supplier | Export Value ($) |

| Dow Chemical Company | $11.5 billion |

| ExxonMobil Chemical | $9.7 billion |

| LyondellBasell | $8.4 billion |

| Chevron Phillips Chemical | $6.8 billion |

| Westlake Chemical | $870 million |

Segmental Insight

Polymer Type Insight

Which Polymer Type Segment Dominated the U.S. Polypropylene Market In 2024?

The homopolymer segment dominated the market in 2024. The dominance of the segment can be attributed to the increasing product demand from the packaging, automotive, and consumer goods industries, especially for fuel-efficient and lightweight vehicles. Additionally, the exceptional moisture resistance of polypropylene homopolymers makes them a key choice for different packaging applications.

The copolymer segment is expected to grow at the fastest CAGR over the forecast period. The growth of the segment can be credited to the growing use of random copolymers for their lightweight properties in various sectors. Moreover, PP copolymer is important in healthcare, especially in medical devices and pharmaceuticals, because of its transparency, inert properties, purity, and autoclave compatibility.

Application Insight

Why Extrusion Segment Dominated The U.S. Polypropylene Market In 2024?

The extrusion segment held the largest market share in 2024. The dominance of the segment can be linked to the growing polypropylene demand from the automotive industry for lightweight components, along with the rising need for specialized polypropylene compounds and grades. Also, expansion of the construction sector in the U.S. propels demand for extruded polypropylene (XPP) foam, which serves as an efficient insulation material for buildings.

The injection molding segment is expected to grow at the fastest CAGR over the study period. The growth of the segment can be driven by growing demand for lightweight materials to enhance fuel efficiency, along with the growing adoption of customized and advanced products. The injection molding process enables the creation of complex designs, specific to diverse consumer preferences, driving segment growth soon.

End-Use Industry Insight

How Much Share Did the Packaging Segment Held in 2024?

The packaging segment dominated the market in 2024. The dominance of the segment is owing to its moisture resistance, high clarity, cost-efficiency, and compatibility with different packaging formats such as rigid containers, films, and corrugated packaging. Moreover, the ongoing innovations in sustainable packaging solutions like mono-material films and PP bottles are growing their applications further in the market.

The electrical & electronics segment is expected to grow at the fastest CAGR during the projected period. The growth of the segment is due to materials' exceptional electrical insulation properties and growing consumer demand for high-performance and advanced electronics appliances in the country. Furthermore, advancements in fiber-reinforced technology improve the material's range of applications in electronics.

U.S. Polypropylene Market Value Chain Analysis

- Feedstock Procurement: It mainly involves securing propylene monomer, the crucial raw material for polypropylene production. It is derived from crude oil and natural gas.

- Chemical Synthesis and Processing: This stage involves the whole chain of creating polypropylene (PP), from creating the raw materials to producing the final resin pellets, which are utilised to make products.

Packaging and Labelling: The market is increasingly focusing on offering sustainable, protective, and appealing packaging solutions for different products. - Regulatory Compliance and Safety Monitoring: This stage involves adhering to regulations set by agencies like the Environmental Protection Agency (EPA) and the Food and Drug Administration (FDA).

Recent Developments

- In May 2025, Dangote Petroleum Refinery and Petrochemicals stepped into a collaboration with Premier Product Marketing LLC, a U.S. based company, to export its polypropylene outside Africa and Nigeria.(Source: www.thecable.ng)

U.S. Polypropylene Market Top Companies

- ExxonMobil Chemical Company

- LyondellBasell Industries Holdings B.V.

- Braskem America

- Chevron Phillips Chemical Company

- TotalEnergies SE

- SABIC Innovative Plastics

- Formosa Plastics Corporation

- INEOS Olefins & Polymers USA

- Reliance Industries Limited

- LG Chem

- Sumitomo Chemical Co., Ltd.

- Borealis AG

- DuPont de Nemours, Inc.

- Trinseo S.A.

- Washington Penn Plastic Co., Inc.

- Kingfa Sci. & Tech. Co., Ltd.

- Mitsui Chemicals, Inc.

- Repsol S.A.

- SABIC

- Mitsubishi Chemical Group Corporation

Segments Covered

Type

- Homopolymer

- Copolymer

- Random Copolymer

- Block Copolymer

- Impact Copolymer

Application

- Injection Molding

- Blow Molding

- Extrusion

- Film & Sheet

- Fiber & Raffia

- Pipes & Fittings

- Profiles & Sheets

- Others

- Thermoforming

- Compression Molding

End-Use Industry

- Packaging

- Rigid Packaging

- Flexible Packaging

- Automotive

- Interior Components

- Exterior Components

- Under-the-Hood Components

- Medical

- Medical Devices

- Pharmaceutical Packaging

- Diagnostic Equipment

- Electrical & Electronics

- Insulation Materials

- Capacitors & Resistors

- Electrical Connectors

- Consumer Goods

- Household Items

- Personal Care Products

- Building & Construction

- Pipes & Fittings

- Insulation Materials

- Flooring & Roofing

- Agriculture

- Mulch Films

- Greenhouse Films

- Drip Irrigation Tubes

- Others

- Textiles

- Stationery

- Toys