Content

Bio-based Surfactants Market Volume and Forecast 2025 to 2034

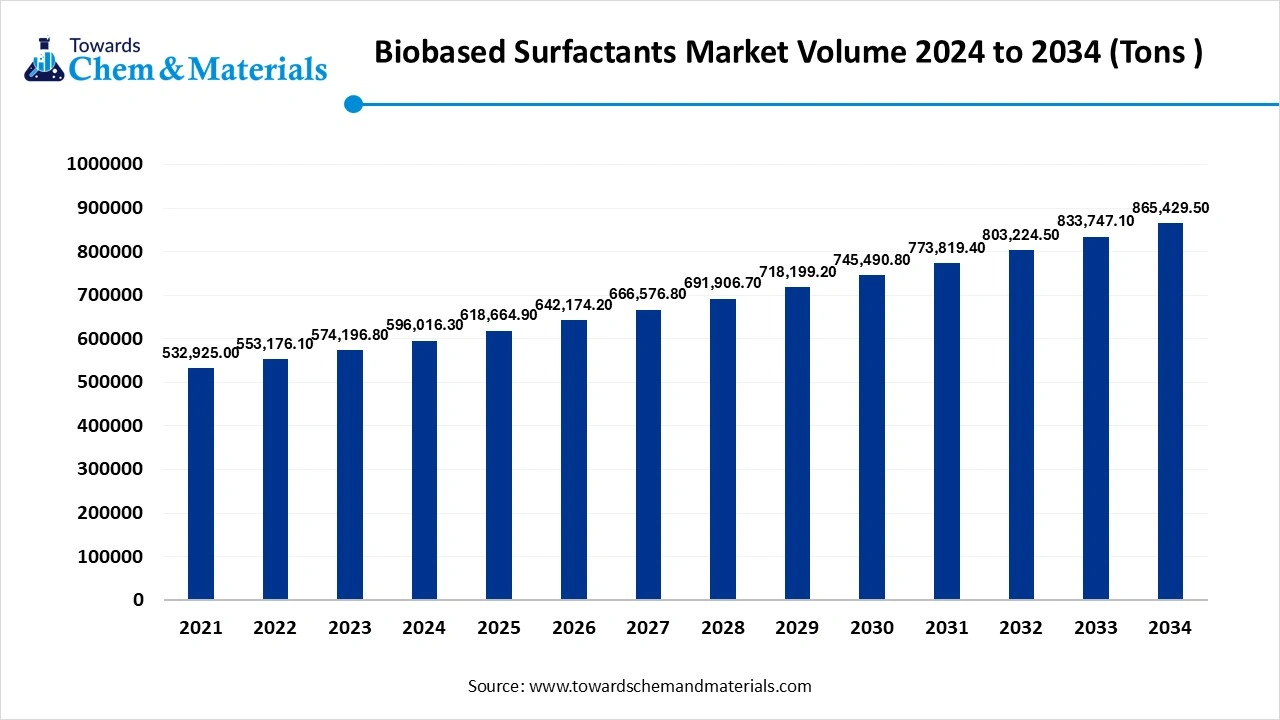

The bio-based surfactants market volume was 5,96,016.3 tons in 2024 and is forecasted to reach around 5,96,016.3 tons by 2034, accelerating at a CAGR of 3.80% from 2025 to 2034. The stricter environmental regulations and growing demand for sustainable products drive the market growth.

Key Takeaways

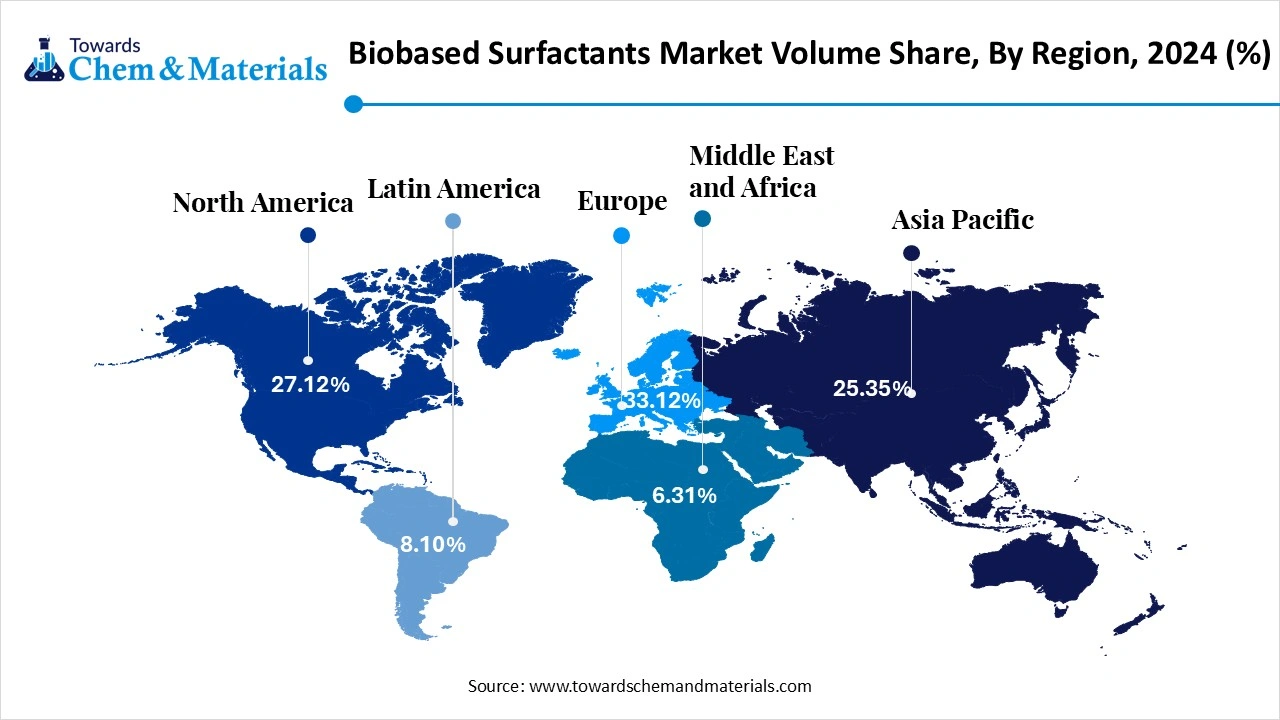

- By region, Europe held approximately a 33.12% share in the bio-based surfactants market in 2024 due to the focus on minimizing greenhouse gas emissions.

- By region, Asia Pacific is growing at the fastest CAGR in the market during the forecast period due to the abundant renewable feedstocks.

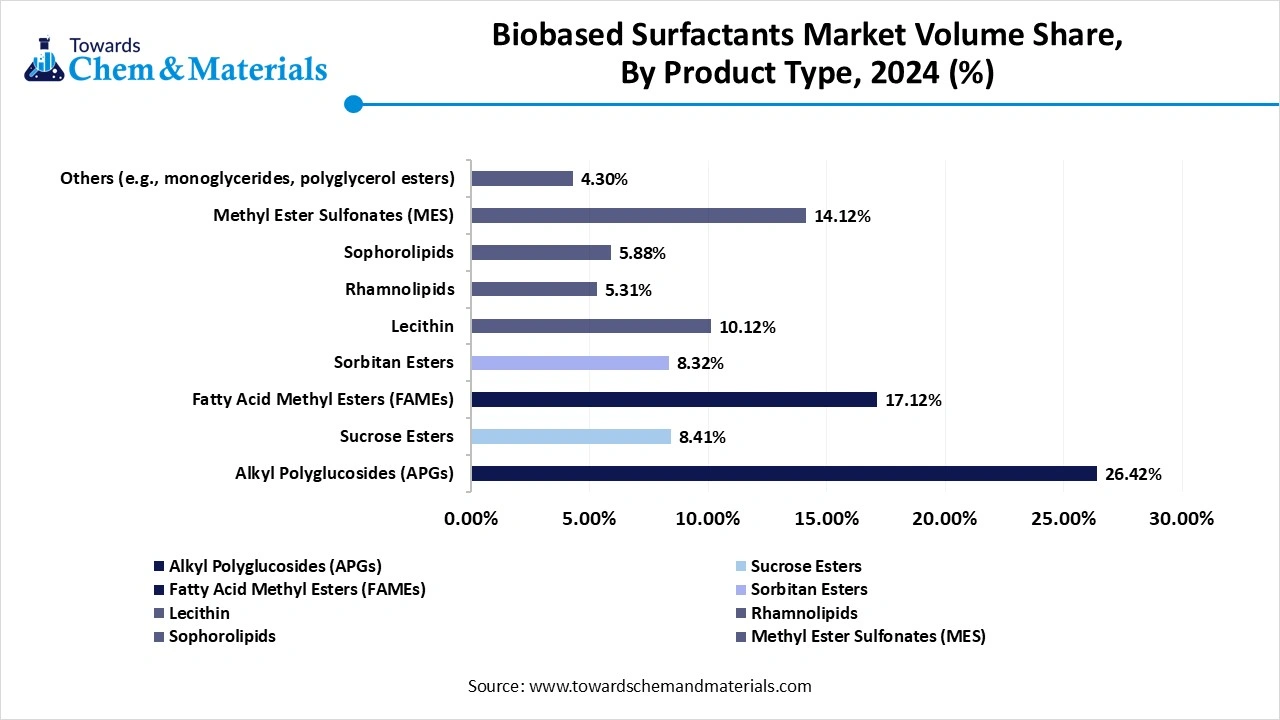

- By product type, the alkyl polyglucosides segment held approximately 32% share in the market in 2024 due to the excellent foaming ability.

- By product type, the rhamnolipids segment is expected to grow at a significant CAGR in the market during the forecast period due to the growing demand in the agriculture industry.

- By origin, the plant oils segment held approximately a 48% share in the market in 2024 due to the growing demand across industrial processes.

- By origin, the microbial fermentation segment is expected to grow at the fastest CAGR in the market during the forecast period due to the increasing demand for cleaning products.

- By function, the emulsifiers segment held approximately 29% share in the market in 2024 due to the growing demand in food products.

- By function, the conditioning agents segment is expected to grow at the fastest CAGR in the market during the forecast period due to the increasing demand for sensitive skin products.

- By application, the household detergents segment held approximately a 35% share in the market in 2024 due to the growing demand for laundry products.

- By application, the personal care & cosmetics segment is expected to grow at the fastest CAGR in the market during the forecast period due to the growing expansion of the beauty & personal care industry.

- By end-use industry, the consumer goods segment held approximately a 38% share in the bio-based surfactants market in 2024 due to increasing demand for home care products.

- By end-use industry, the healthcare & pharmaceuticals segment is expected to grow at the fastest CAGR in the market during the forecast period due to the focus on improving drug delivery systems and vaccine formulation.

Bio-Based Surfactants: The Power Behind Clean Nature and Green Future

Bio-based surfactants are surface-active compounds derived from biomass, plant oils, and sugars. They are biodegradable and a sustainable alternative to traditional surfactants. They are less toxic and lower the carbon footprint. It is derived from neutral lipids & fatty acids and offers biocompatibility and biodegradability.

The common biosurfactants are trehalolipids, mannosylerythritol lipids, rhamnolipids, and sophorolipids. The increasing consumer awareness regarding synthetic surfactants increases demand for bio-based surfactants. The stricter environmental regulations for harmful chemicals increase the adoption of biobased surfactants. The growing demand across applications like home care, industrial cleaning, household detergents, cosmetics, personal care products, and agriculture contributes to the growth of the bio-based surfactants market.

- South Korea exported 138 shipments of alkyl polyglucoside. (Source: www.volza.com)

- Colombia exported 89 shipments of sucrose ester. (Source: www.volza.com )

- Vietnam exported 120,493 shipments of cleaning products.(Source: www.volza.com)

- The United States exported 110,655 shipments of cleaning products.(Source: www.volza.com)

- The European Union exported 42,793 shipments of surfactants.(Source: www.volza.com)

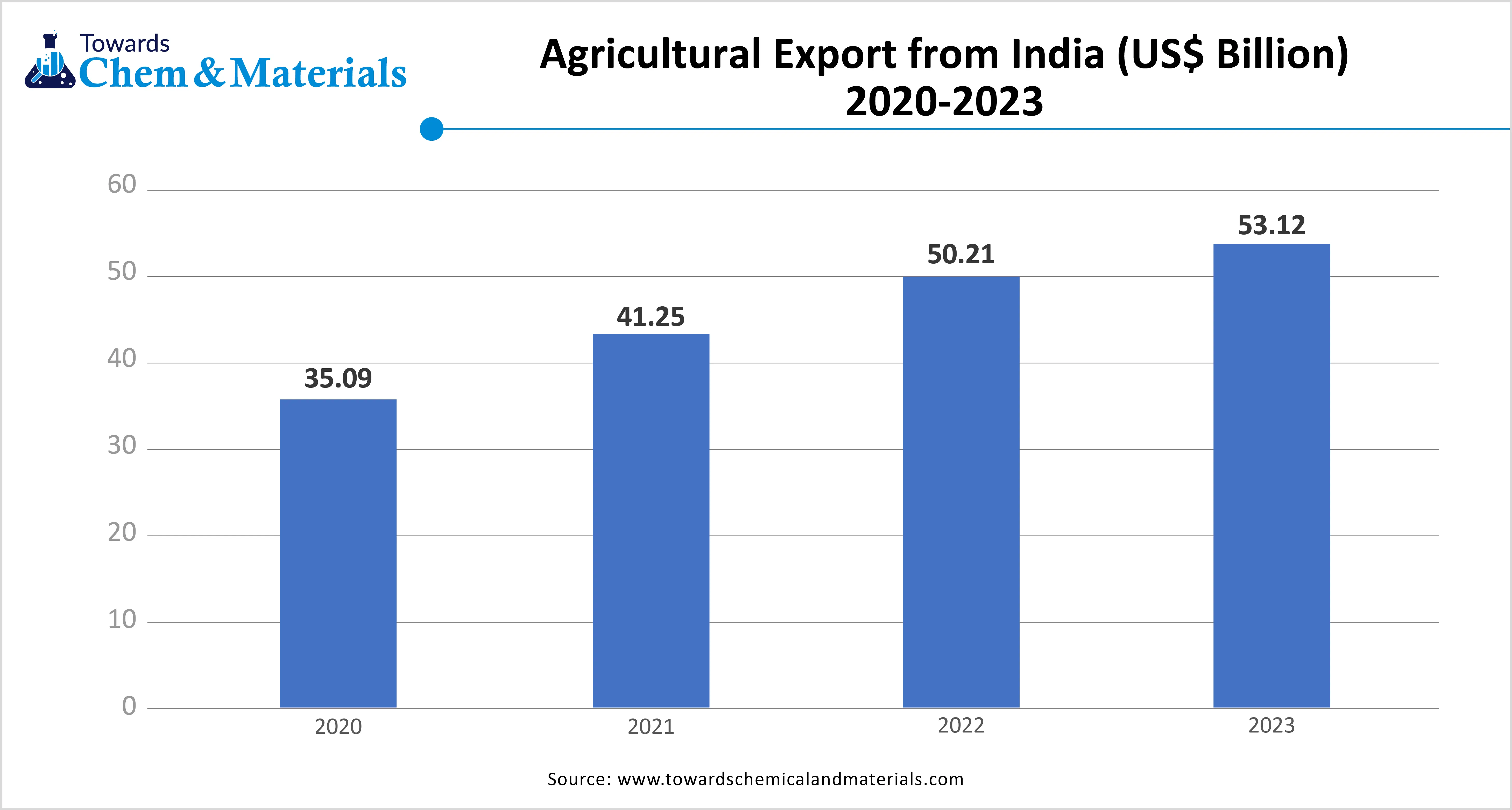

Growing Agriculture Sector Propels Bio-Based Surfactants Market Growth

The growing agriculture sector in various regions increases demand for bio-based surfactants due to the growing adoption of eco-friendly farming practices. The growing concerns like soil contamination and water pollution increase the demand for bio-based surfactants to reduce the environmental impacts. The increasing focus on sustainable agriculture practices fuels demand for bio-based surfactants. The stricter regulations regarding synthetic surfactants in the agriculture sector increase demand for bio-based surfactants. The increasing demand for fungicides, pesticides, and herbicides to enhance crop protection requires bio-based surfactants.

The focus on improving nutrient uptake and lowering agrochemical runoff increases demand for bio-based surfactants to minimize pollution risk. The increasing adoption of precision agriculture and advancements like digital tools & data analytics increases demand for bio-based surfactants. The increasing investment in the development of bio-based surfactants from key companies like Bayer, Syngenta Crop Protection, BASF, and Corteva helps market growth. The growing agriculture sector is a key driver for the growth of the bio-based surfactants market.

Market Trends

- Growing Focus on Sustainability: The increasing consumer focus on sustainability fuels demand for bio-based surfactant products. The focus on lowering the environmental footprint and increasing demand for natural ingredients fuels the adoption of bio-based surfactants.

- Expansion of Pharmaceutical Industry: The growing expansion of the pharmaceutical industry increases demand for bio-based surfactants. The focus on enhancing drug delivery, wound healing, and other pharmaceutical applications increases demand for bio-based surfactants due to their low toxicity and biocompatibility.

- Growing Demand for Cosmetics Products: The increasing demand for various cosmetics products and growing demand for sustainable products increases the adoption of bio-based surfactants. The increasing demand for moisturizers and anti-aging skin products requires bio-based surfactants.

Report Scope

| Report Attribute | Details |

| Market Volume in 2025 | 6,18,664.9 Tons |

| Expected Volume by 2034 | 8,65,429.5 Tons |

| Growth Rate from 2025 to 2034 | CAGR 3.80% |

| Base Year of Estimation | 2024 |

| Forecast Period | 2025 - 2034 |

| Dominant Region | Europe |

| Segment Covered | By Product Type, By Origin, By Function, By Application, By End-Use Industry, By Region |

| Key Companies Profiled | BASF SE, Clariant AG, Croda International Plc, Evonik Industries AG, Solvay S.A., Stepan Company, Dow Inc., Kao Corporation, AkzoNobel N.V., Galaxy Surfactants Ltd., Nouryon (formerly AkzoNobel Specialty Chemicals), Innospec Inc., Sasol Limited, Aarti Surfactants, Jeneil Biosurfactant Co. LLC, SEPPIC (Air Liquide), Givaudan Active Beauty, Sun Products Corporation, Allied Carbon Solutions Co., Ltd., TAIKOO Green Energy Technology Co., Ltd. |

Market Opportunity

Expansion of the Personal Care Industry Unlocks Market Opportunity

The growing demand for various personal care products and the expansion of the personal care industry increase demand for bio-based surfactants. The growing disposable incomes and increasing focus on personal care & grooming fuel demand for various products. The growing consumer shift towards sustainable products increases demand for bio-based surfactants for personal care products like lotions, shampoos, and soaps to remove impurities, dirt, & oil from hair & skin. The focus on reducing the toxicity of personal care items and enhancing skin compatibility increases demand for bio-based surfactants.

The growing production of gentle cleansing products fuels the adoption of bio-based surfactants. These surfactants offer emulsifying, cleansing, and foaming properties. The increasing demand for products like shampoos, cleansers, and shower gels fuels the adoption of bio-based surfactants. The growing expansion of the personal care industry creates an opportunity for the bio-based surfactants market.

Market Challenge

High Production Cost Restrains Growth of Bio-Based Surfactants Market

Despite several benefits of the bio-based surfactants in various industries, the high production cost restricts the market growth. Factors like need for specialized equipment, complex fermentation processes, skilled labor, and high cost of raw materials are responsible for high production costs. The complex processes like microbial fermentation and downstream processing increase the costs. The fluctuations in the cost of raw materials like sugars, refined oils, and other agricultural products affect the market growth. The need for specialized equipment like bioreactors and fermentation facilities requires a high initial cost. The need for skilled labor in the downstream & fermentation processing leads to higher costs. The high production cost hampers the growth of the market.

Regional Insights

How Europe Dominated the Bio-Based Surfactants Market?

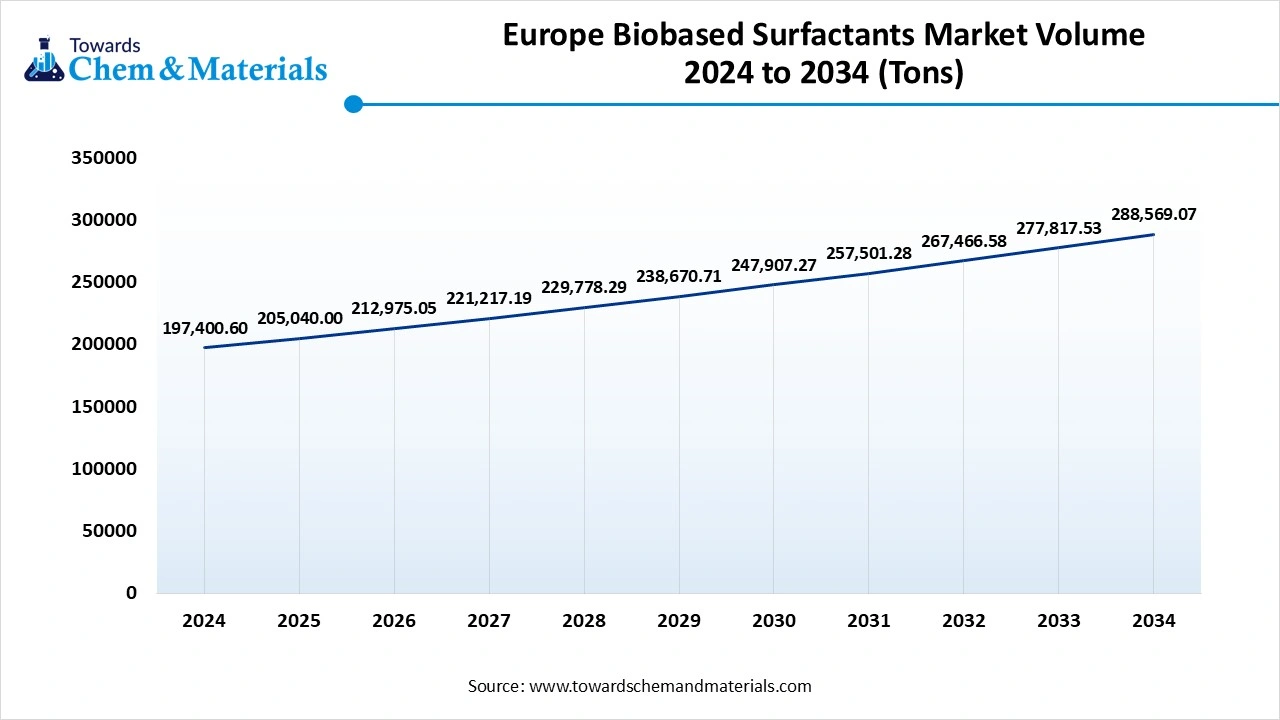

The Europe bio-based surfactants market volume was estimated at 1,97,400.6 tons in 2024 and is anticipated to reach 2,77,802.9 tons by 2034, growing at a CAGR of 3.87% from 2025 to 2034.

Europe dominated the market in 2024. The stricter environmental regulations in the region increase demand for bio-based surfactants. The focus on reducing waste and minimizing greenhouse gas emissions fuels the adoption of bio-based surfactants. The focus on cleaning products and natural beauty increases demand for bio-based surfactants. The well-established networks of biotechnology firms, universities, and research organizations help the market growth. The growing demand across industries like industrial applications, personal care, & household cleaning, and the presence of key players like BASF SE & Evonik Industries drive the market growth.

Germany Bio-Based Surfactants Market Trends

Germany is a key contributor to the bio-based surfactants market. The stricter environmental regulations and focus on lowering chemical emissions increase the adoption of bio-based surfactants. The strong government support for the adoption of bio-based surfactants helps the market growth. The strong manufacturing base and well-established chemical industry increase demand for bio-based surfactants. The diverse industrial base in sectors like home care, textiles, personal care, and automotive supports the market growth.

- Germany exported 83 shipments of sucrose ester. (Source: www.volza.com)

Which Region is the Fastest-Growing in the Bio-Based Surfactants Market?

Asia Pacific is experiencing the fastest growth in the market during the forecast period. The rapid urbanization and growing demand for household cleaning and personal care products increases demand for bio-based surfactants. The increasing environmental impact of traditional surfactants and the focus on greener alternatives help the market growth.

The availability of abundant renewable feedstocks like sugar, palm oil, and coconut oil increases the production of bio-based surfactants. The rapid growth in industrial cleaning and textiles fuels demand for bio-based surfactants. The rapid industrial growth in construction, manufacturing, and automotive increases demand for bio-based surfactants, supporting the overall growth of the market.

China Bio-Based Surfactants Market Trends

China is a major contributor to the market. The focus on sustainable development and green manufacturing increases demand for the market. The increasing demand for household cleaning and personal care products fuels the adoption of bio-based surfactants. The strong manufacturing base in sectors like construction, electronics, and automotive increases the adoption of bio-based surfactants. The strong government support for sustainability and focus on eco-friendliness drive the overall growth of the market.

- China exported 1,846 shipments of alkyl polyglucoside. (Source: www.volza.com )

- China exported 281 shipments of sucrose ester. (Source: www.volza.com )

- China exported 16,548 shipments of household cleaning products. (Source: www.volza.com )

- China exported 51,295 shipments of surfactants.(Source: www.volza.com )

Bio-based Surfactants Market Volume Share, By Region, 2024-2034 (%)

| By Region | Volume Share, 2024 (%) | Market Volume Tons - 2024 | Volume Share, 2034 (%) | Market Volume Tons - 2034 | CAGR (2025 - 2034) |

| North America | 27.12% | 1,61,639.6 | 26.10% | 2,25,877.1 | 3.79% |

| Europe | 33.12% | 1,97,400.6 | 32.10% | 2,77,802.9 | 3.87% |

| Asia Pacific | 25.35% | 1,51,090.1 | 26.26% | 2,27,261.8 | 4.64% |

| Latin America | 8.10% | 48,277.3 | 8.44% | 73,042.2 | 4.71% |

| Middle East & Africa | 6.31% | 37,608.6 | 7.10% | 61,445.5 | 5.61% |

| Total | 100% | 5,96,016.3 | 100% | 8,65,429.5 | 3.80% |

Segmental Insights

Product Type Insights

Why did Alkyl Polyglucosides Segment Dominate the Bio-Based Surfactants Market?

The alkyl polyglucosides (APGs) segment dominated the bio-based surfactants market in 2024. The growing demand for sustainable and eco-friendly products increases demand for APGs. The stricter environmental regulations help the market growth. APGs are non-toxic, biodegradable, and derived from glucose. APGs offer good wetting and enhance foaming ability. APGs are suitable for sensitive skin and stabilize emulsions. The growing applications in industries like household cleaning, agriculture, personal care, and industrial processes drive the market growth.

The rhamnolipids segment is the fastest growing in the market during the forecast period. The applications like cosmetics, even oil remediation, personal care, and agriculture increase the adoption of rhamnolipids. They reduce surface tension and have low toxicity. They are biodegradable and reduce interfacial tension. The increasing consumer preference for eco-friendly products and stricter environmental regulations increases demand for rhamnolipids, supporting the overall growth of the market.

Bio-based Surfactants Market Volume Share, By Product, 2024-2034 (%)

| By Product Type | Volume Share, 2024 (%) | Market Volume Tons - 2024 | Volume Share, 2034 (%) | Market Volume Tons - 2034 | CAGR (2025 - 2034) |

| Alkyl Polyglucosides (APGs) | 26.42% | 1,57,467.5 | 25.06% | 2,16,876.6 | 3.62% |

| Sucrose Esters | 8.41% | 50,125.0 | 9.44% | 81,696.5 | 5.58% |

| Fatty Acid Methyl Esters (FAMEs) | 17.12% | 1,02,038.0 | 16.10% | 1,39,334.1 | 3.52% |

| Sorbitan Esters | 8.32% | 49,588.6 | 9.01% | 77,975.2 | 5.16% |

| Lecithin | 10.12% | 60,316.9 | 9.87% | 85,417.9 | 3.94% |

| Rhamnolipids | 5.31% | 31,648.5 | 5.87% | 50,800.7 | 5.40% |

| Sophorolipids | 5.88% | 35,045.8 | 6.40% | 55,387.5 | 5.22% |

| Methyl Ester Sulfonates (MES) | 14.12% | 84,157.5 | 13.12% | 1,13,544.3 | 3.38% |

| Others (e.g., monoglycerides, polyglycerol esters) | 4.30% | 25,628.7 | 5.13% | 44,396.5 | 6.30% |

| Total | 100% | 5,96,016.3 | 100% | 8,65,429.5 | 3.80% |

Origin Insights

How Plant Oils Segment Held the Largest Share in the Bio-Based Surfactants Market?

The plant oils segment held the largest revenue share in the bio-based surfactants market in 2024. The growing consumer demand for sustainable products increases demand for plant oils. The increasing cultivation of crops like palm, sunflower, soybean, coconut, and rapeseed increases the production of plant oils. The focus on lowering the risk of bioaccumulation and pollution fuels demand for plant oils, helping the market growth. Plant oils are a biodegradable and sustainable option for long-term use. The growing demand across sectors like cosmetics, industrial processes, detergents, and agriculture drives the market growth.

The microbial fermentation segment is experiencing the fastest growth in the market during the forecast period. The various functionalities like detergency, emulsification, and foaming increase the adoption of microbial fermentation. The growing demand for cleaning products like household cleaning, laundry detergents, and dish soaps increases the adoption of microbial fermentation. Microbial surfactants are less toxic and can be derived from renewable sources like agricultural waste. The growing demand across industries like cosmetics, agriculture, detergents, oil recovery, and pharmaceuticals supports the overall market growth.

Function Insights

What Made Emulsifiers Segment Dominate the Bio-Based Surfactants Market?

The emulsifiers segment dominated the bio-based surfactants market in 2024. The increasing demand for the creation of personal care products with desired consistencies & textures increases the adoption of emulsifiers. The shift towards clean-label products and minimally processed ingredients increases demand for emulsifiers. The growing demand for emulsifiers in food products like ice cream, salad dressing, and bread helps the market growth. The growing production of cleaning products and detergents increases demand for emulsifiers. The increasing demand for emulsifiers in makeup, skincare, and haircare products drives the overall growth of the market.

The conditioning agents segment is the fastest growing in the market during the forecast period. The growing production of grooming, hair care, and skincare products increases demand for conditioning agents to enhance overall performance and product texture. The growing demand for detergents and fabric softeners increases the demand for conditioning agents. The focus on anti-static effects, enhancing foam quality, and improving fragrance retention increases demand for conditioning agents. The increasing production of hypoallergenic & sensitive skin products fuels demand for conditioning agents, supporting the overall growth of the market.

Application Insights

How did the Household Detergent Segment Hold the Largest Share in the Bio-Based Surfactants Market?

The household detergents segment held the largest revenue share in the bio-based surfactants market in 2024. The increasing demand for sustainable household detergents increases the demand for bio-based surfactants. The growing penetration of washing machines fuels the adoption of bio-based surfactants, helping the market growth. The higher demand for household detergents like surface cleaners, laundry detergents, and dishwashing liquids drives the market growth.

The personal care & cosmetics segment expects the fastest growth in the market during the forecast period. The growing demand for sustainable, natural, and organic personal care & cosmetics products increases demand for bio-based surfactants. The rising demand for lotions, shampoos, and soaps fuels the adoption of bio-based surfactants. The growing expansion of the personal care & beauty industry and the development of cosmetic formulations support the overall market growth.

End-Use Industry Insights

Which End-Use Industry Dominated the Bio-Based Surfactants Market?

The consumer goods segment dominated the bio-based surfactants market in 2024. The growing demand for home care products like all-purpose cleaners, dishwashing liquids, and laundry detergents increases demand for bio-based surfactants. The increasing production of cosmetic products, shampoos, and body washes fuels the adoption of bio-based surfactants, helping the market growth. The growing demand across home and personal care drives the overall growth of the market.

The healthcare & pharmaceuticals segment is the fastest growing in the market during the forecast period. The focus on enhancing the drug delivery system increases demand for bio-based surfactants. The development of various vaccine formulations increases demand for bio-based surfactants to improve effectiveness and stability. The focus on wound healing and the solubilization of poorly soluble drugs fuels demand for bio-based surfactants. The growing expansion of the healthcare & pharmaceuticals industry supports the market growth.

Recent Developments

- In September 2024, Evonik launched biosurfactants TEGO Wet 580 Terra and TEGO Wet 570 Terra for inks, paints & coatings. The biosurfactants are manufactured through the fermentation process and derived from 100% natural resources. These biosurfactants reduce grinding time, provide good filler wetting & pigment, and improve substrate wetting.(Source: www.evonik.com)

- In May 2025, Novvi and Pilot Chemical launched biobased surfactants technology, CalCare AOS biobased in North America. The biobased surfactants are available for personal care, household, institutional, and industrial purposes.(Sources: www.alchempro.com)

- In October 2024, AmphiStar launched waste-based biosurfactants AmphiClean & Amphicare. It is derived from organic biowaste and produced using microbial fermentation. The biosurfactants Amphicare are used in cosmetic products like skincare products, shampoos, & makeup removers, and AmphiClean is used in detergents, multi-surface cleaners, & dishwashing products. (Source: www.ofimagazine.com )

Top Companies List

- BASF SE

- Clariant AG

- Croda International Plc

- Evonik Industries AG

- Solvay S.A.

- Stepan Company

- Dow Inc.

- Kao Corporation

- AkzoNobel N.V.

- Galaxy Surfactants Ltd.

- Nouryon (formerly AkzoNobel Specialty Chemicals)

- Innospec Inc.

- Sasol Limited

- Aarti Surfactants

- Jeneil Biosurfactant Co. LLC

- SEPPIC (Air Liquide)

- Givaudan Active Beauty

- Sun Products Corporation

- Allied Carbon Solutions Co., Ltd.

- TAIKOO Green Energy Technology Co., Ltd.

Segments Covered

By Product Type

- Alkyl Polyglucosides (APGs)

- Sucrose Esters

- Fatty Acid Methyl Esters (FAMEs)

- Sorbitan Esters

- Lecithin

- Rhamnolipids

- Sophorolipids

- Methyl Ester Sulfonates (MES)

- Others (e.g., monoglycerides, polyglycerol esters)

By Origin

- Plant Oils (e.g., palm, coconut, castor)

- Sugars/Starches (e.g., corn, sugarcane)

- Animal-derived Sources

- Microbial Fermentation (e.g., biosurfactants via microbes)

By Function

- Emulsifiers

- Foaming Agents

- Dispersants

- Wetting Agents

- Detergents

- Conditioning Agents

By Application

- Personal Care & Cosmetics

- Shampoos

- Facial Cleansers

- Body Washes

- Household Detergents

- Dishwashing Liquids

- Laundry Detergents

- Industrial & Institutional Cleaning

- Surface Cleaners

- Sanitizers

- Agriculture

- Pesticide Formulations

- Soil Conditioners

- Oilfield Chemicals

- Enhanced Oil Recovery

- Drilling Fluids

- Food Processing

- Emulsifiers

- Cleaners

- Textiles & Leather

- Paints & Coatings

- Others (Pulp & Paper, Mining, Construction)

By End-Use Industry

- Consumer Goods

- Industrial Manufacturing

- Agriculture

- Oil & Gas

- Food & Beverage

- Healthcare & Pharmaceuticals

- Textile & Leather

- Pulp & Paper

By Region

- North America

- U.S.

- Canada

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Sweden

- Denmark

- Norway

- Asia Pacific

- China

- Japan

- India

- South Korea

- Thailand

- Latin America

- Brazil

- Mexico

- Argentina

- Middle East & Africa

- South Africa

- UAE

- Saudi Arabia

- Kuwait