Content

Bio-Based Platform Chemicals Market Size and Share 2034

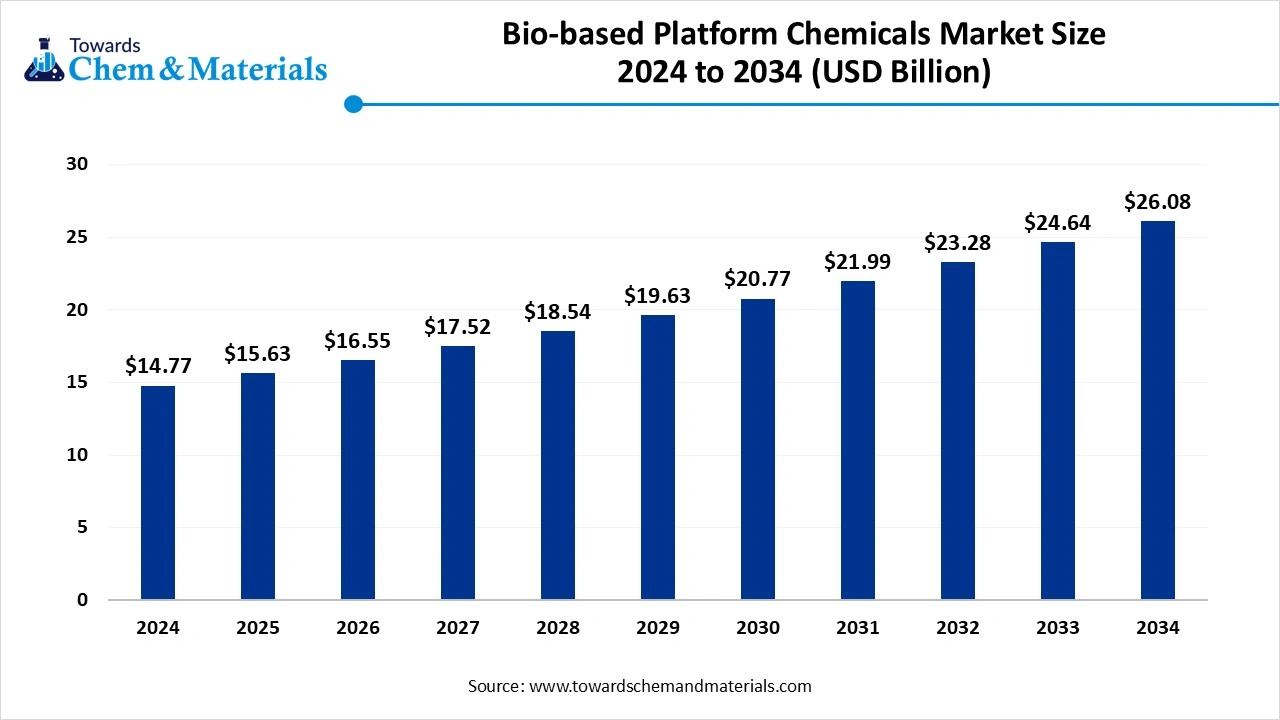

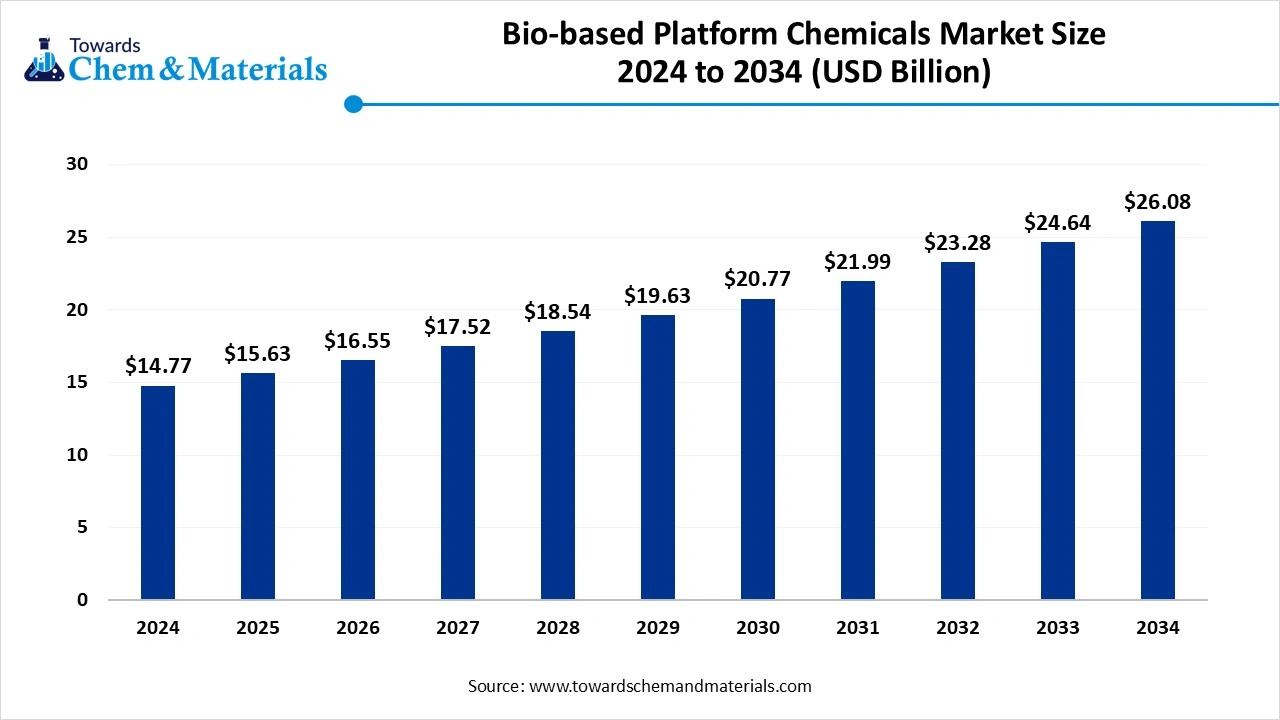

The global bio-based platform chemicals market size was reached at USD 29.33 billion in 2024 and is expected to be worth around USD 48.46 billion by 2034, growing at a compound annual growth rate (CAGR) of 5.15% over the forecast period 2025 to 2034. The sudden shift towards eco-friendly manufacturing has fueled industry potential in recent years.

Key Takeaways

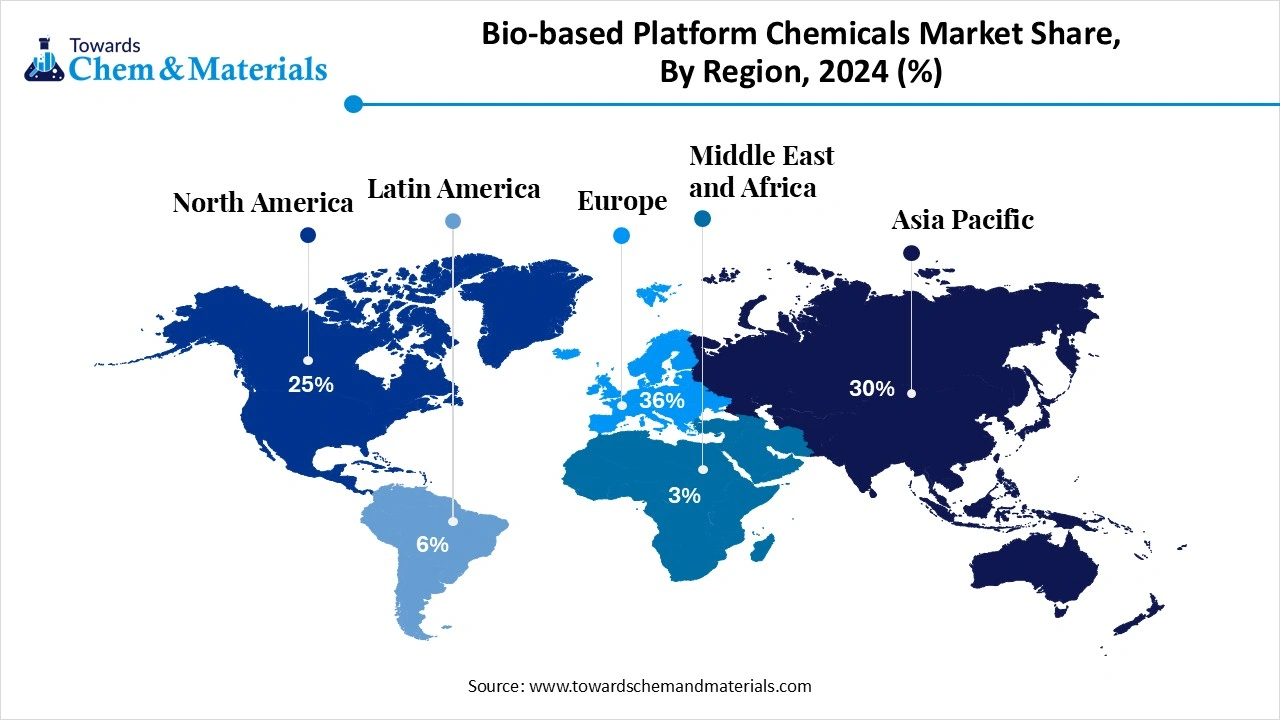

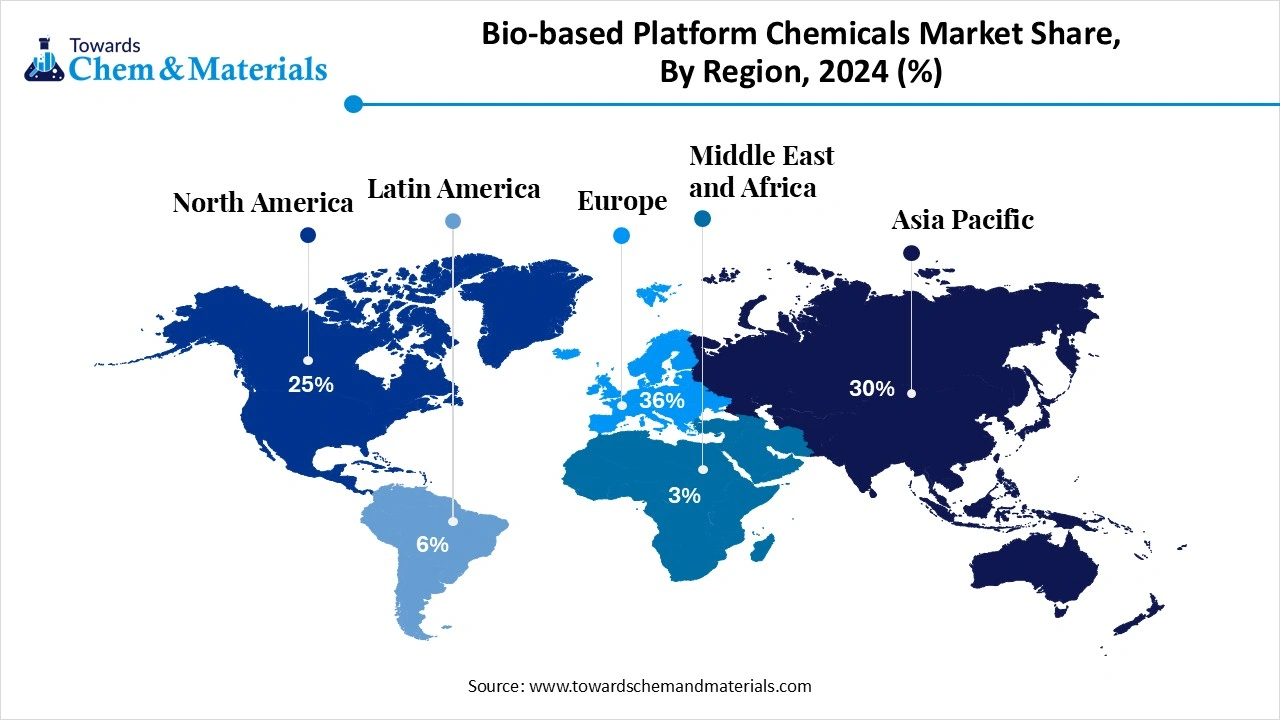

- By region, Europe dominated the bio-based platform chemicals market in 2024 with 36% of the industry share, akin to stricter sustainability standard implementations and initiatives to reduce reliance form fossil fuels.

- By region, Asia Pacific is expected to grow at a notable rate in the future, owing to the enlarged manufacturing base of various sectors and the shift towards eco-friendly manufacturing.

- By type, the bio-based succinic acid segment led the market in 2024 with 22% market share, due to its wide usage in the packaging sector.

- By type, the bio-based lactic acid segment is expected to grow at the fastest rate in the market during the forecast period, akin to it is considered a crucial element in the production of polylactic acid.

- By feedstock, the corn & sugarcane segment emerged as the top-performing segment in the market in 2024 with 46% industry share, because they are widely available, renewable, and cost-effective.

- By feedstock, lignocellulosic biomass is expected to lead the market in the coming years, because it uses non-food resources like agricultural waste, wood residues, and grasses.

- By processing technology, the fermentation segment led the market in 2024 with 55% market share because it is the most established and cost-effective way to produce bio-based chemicals from renewable feedstocks like sugarcane and corn.

- By processing technology, the catalytic conversion segment is expected to capture the biggest portion of the market in the coming years, because it is faster, more efficient, and allows precise control over chemical reactions.

- By end-use industry, the packaging segment led the bio-based platform chemicals market in 2024 with 30% market share, because of the high demand for sustainable and eco-friendly materials.

- By end-use industry, the automotive & transportation segment is expected to grow at the fastest rate in the market during the forecast period, because car makers are under pressure to reduce carbon emissions and use sustainable materials.

- By distribution channel, the direct sales to manufacturers segment led the market in 2024 with 62% market share because most bio-based platform chemicals are used in large quantities by big industries like packaging, automotive, and construction.

- By distribution channel, the online B2B segment is expected to capture the biggest portion of the market in the coming years, as digitalization changes the way industries buy and sell.

Market Overview

Driving the Green Revolution: The Rise of Bio-Based Platform Chemical

The bio-based platform chemicals market encompasses the production, formulation, and commercialization of chemicals derived from renewable biomass sources, including agricultural feedstocks, forestry residues, and industrial/municipal waste. These chemicals serve as intermediates or building blocks for the manufacture of biofuels, bioplastics, solvents, resins, personal care ingredients, and specialty chemicals. Bio-based platform chemicals include organic acids, alcohols, polyols, ketones, and hydrocarbons that are used in a wide range of industries, including packaging, automotive, textiles, pharmaceuticals, agriculture, and consumer goods.

What Factor is Driving the Bio-based Platform Chemicals Market?

The enlarged expansion of sustainable manufacturing globally is spearheading the industry growth in the current period. As several governments are actively replacing the traditional petrochemical-based products with eco-friendly ones, this has provided immense industry attention to bio-based plastic chemicals nowadays. Also, the global government push for sustainability is severely contributing to the industry's potential, as governments are providing attractive benefits like tax reduction and subsidies to manufacturers who implement the sustainability standards in their manufacturing.

The sudden shift towards lignocellulose biomass as a better feedstock from the major companies than corn or sugarcane is driving industry growth in recent years.

Advanced technology integration, such as catalytic conversion and fermentation, is contributing to the industry's potential in the current period as the manufacturers are increasingly investing in R&D activities, according to the latest industry observation.

Market Opportunity

Reshaping Industries with Eco-Friendly Plastic Solution

The investment in the development of biobased plastic is expected to create lucrative opportunities for manufacturers in the predicted years. Furthermore, the manufacturer can also develop the biobased resins for the major sectors such as the packaging and automotive, which is likely to provide the long-term profit margins to the manufacturers in the coming years. Also, the global government push for sustainability is anticipated to contribute immensely to the industry's growth.

Market Challenge

Traditional Plastic Remains a Barrier to Sustainable Innovation

The higher production cost is anticipated to hinder the market growth in the coming years. Moreover, traditional habits like petroleum-based alternatives can also create growth barriers for the industry in the upcoming period. Moreover, feedstock, like corn or biomass, requires advanced processing, which can be expensive sometimes and likely to create hurdles for the new and mid-sized companies, where the budget is limited.

Regional Insights

Europe Bio-Based Platform Chemicals Market Trends

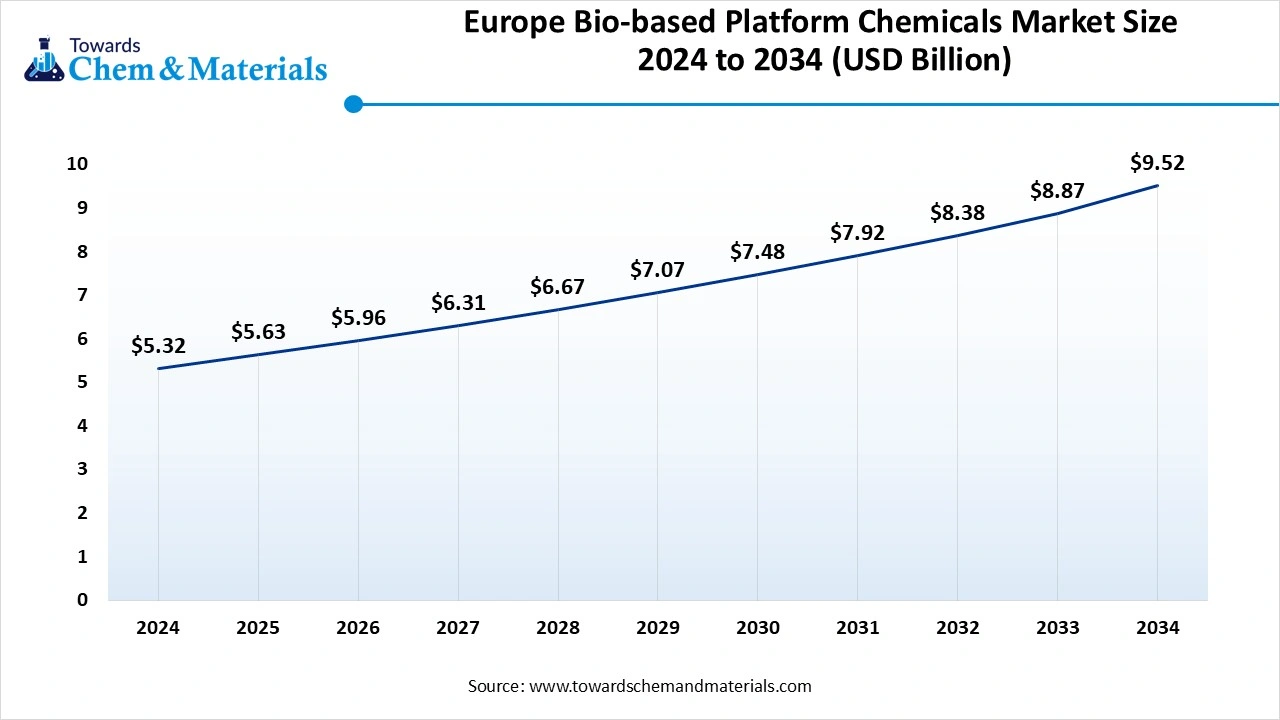

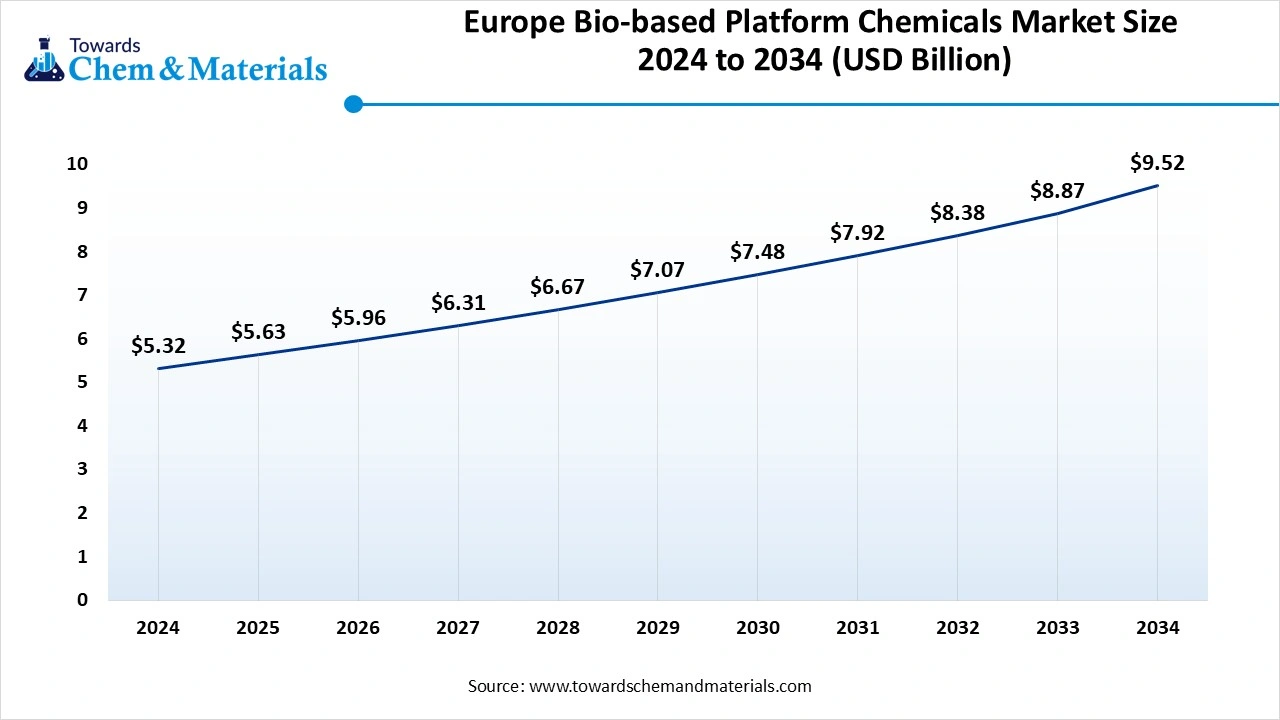

The Europe bio-based platform chemicals market size was estimated at USD 5.32 billion in 2024 and is anticipated to reach USD 9.52 billion by 2034, growing at a CAGR of 5.35% from 2025 to 2034.

Europe dominated the market in 2024, akin to the stricter sustainability standard implementations and initiatives to reduce reliance form fossil fuels. Moreover, the regional countries are actively putting investment into the R&D activities for green technology innovation, which has further supported the industry potential in recent years. Also, the region has the presence of major chemical manufacturing companies, which have contributed to the industry's growth for the past few years.

How Are German Bio-Refineries Powering Industry Growth?

Germany maintained its dominance in the market, owing to a stronger industrial base and an advanced green material supply. Moreover, chemical manufacturers are actively seen under the heavy investment for the bio refineries, which is contributing to the industry growth in recent years. Furthermore, the stronger automotive industry has been actively providing a sophisticated consumer base in recent years, as a sudden shift towards lightweight vehicles and a cut in carbon emissions.

Asia Pacific Bio-based Platform Chemicals Market Trends

Asia Pacific is expected to capture a major share of the market, owing to the enlarged manufacturing base of various sectors and the shift towards eco-friendly manufacturing. Furthermore, the government's push for domestic manufacturing is likely to support industry potential in the upcoming years. Moreover, the regional countries such as India, China, and Japan are actively seen investing in green material manufacturing, which is anticipated to drive further industry growth during the projected period, as per the latest industry survey.

Segmental Insights

Type Insights

How did the Bio-based Succinic Acid Segment Dominate the Bio-based Platform Chemicals Market in 2024?

The bio-based succinic acid segment held the largest share of the market in 2024, due to its wide usage in the packaging sector. Moreover, the sectors such as textiles, construction, and automotive parts have significantly contributed to the segment growth in recent years. Furthermore, by offering the unique advantages such as cost efficiency and lower carbon emissions, succinic acid has gained major industry share in the past few years.

The bio-based lactic acid segment is expected to grow at a notable rate during the predicted timeframe, akin to it is considered a crucial element in the production of polylactic acid. Furthermore, polylactic acid is widely consumed in several industries such as packaging, food, and 3D printing in the current period. As these industries are likely to build a greater future for the lactic acid in the upcoming years, as per industry expectations.

Feedstock Insights

Why does the Corn & Sugarcane Segment Dominate the Bio-based Platform Chemicals Market by the Feedstock?

The corn & sugarcane segment held the largest share of the market in 2024, because they are widely available, renewable, and cost-effective. They have high sugar content, which makes them ideal for fermentation processes used in producing succinic acid, lactic acid, and other bio-based chemicals. The developing countries, such as Brazil, India, and the United States, have an enlarged supply of these crops, ensuring steady raw material availability.

The lignocellulosic biomass segment is expected to grow at a notable rate because it uses non-food resources like agricultural waste, wood residues, and grasses. Unlike corn and sugarcane, it does not compete with food production, making it more sustainable. Governments and industries are focusing on this feedstock to reduce pressure on farmland and ensure long-term availability.

Processing /Technology Insights

How did the Fermentation Segment Dominate the Bio-based Platform Chemicals Market in 2024?

The fermentation segment dominated the market with the largest share in 2024 because it is the most established and cost-effective way to produce bio-based chemicals from renewable feedstocks like sugarcane and corn. It uses natural microorganisms to convert sugars into valuable chemicals such as succinic acid, lactic acid, and ethanol. This process is eco-friendly, scalable, and has been used for decades in industries like food and beverages.

The catalytic conversion segment is expected to grow at a significant rate because it is faster, more efficient, and allows precise control over chemical reactions. This process can directly convert biomass into platform chemicals without depending heavily on fermentation. It also reduces processing time and can handle a wider variety of feedstocks, including lignocellulosic biomass. As technology advances, catalytic conversion is expected to become more cost-competitive.

End Use Industry Insights

How did the Packaging Segment Dominate the Bio-based Platform Chemicals Market in 2024?

The packaging segment held the largest share of the market in 2024 because of the high demand for sustainable and eco-friendly materials. With e-commerce, food delivery, and consumer goods growing worldwide, industries needed biodegradable plastics and bio-based films to reduce plastic waste. Governments banning single-use plastics pushed companies to adopt bio-based solutions, increasing demand in packaging.

The automotive & transportation segment is expected to grow at a notable rate during the predicted timeframe, because carmakers are under pressure to reduce carbon emissions and use sustainable materials. Bio-based platform chemicals can be used to produce lightweight plastics, lubricants, coatings, and composites for vehicles. These materials help reduce fuel consumption and improve efficiency.

Distribution Channel Insights

How did the Direct Sales To Manufacturers Segment Dominate the Bio-based Platform Chemicals Market in 2024?

The direct sales to manufacturers segment held the largest share of the market in 2024, dominated because most bio-based platform chemicals are used in large quantities by big industries like packaging, automotive, and construction. Direct sales help ensure long-term supply agreements, lower costs, and customized solutions. Manufacturers prefer direct deals to maintain quality, pricing, and consistent delivery.

The online B2B platforms segment is expected to grow at a significant rate as digitalization changes the way industries buy and sell. Online platforms make it easier for small and medium businesses to access bio-based chemicals, compare prices, and find global suppliers. They reduce transaction time and expand market reach for manufacturers. With the rise of e-commerce and digital trade, companies are adopting online platforms for bulk purchases.

Value Chain Analysis

Waste Management and Recycling

The waste management of bio-based platform chemicals lies in different methods, like mechanical recycling, chemical recycling, and energy recovery.

- Key Players: IFP Energies Novelles and other research institutes.

Chemical Synthesis and Processing

The chemical synthesis of the biobased platform chemicals is distributed into various methods, such as fermentation, enzyme reaction, and chemical transformation.

- Key Players: BASF, DOW Inc., Avantium, and CJ CheilJedang Corp

Regulatory Compliance and Safety Monitoring

Biobased platform chemical processes require sophisticated regulatory compliance and safety monitoring, including a comprehensive compliance program, regulatory experts, and data management.

- Key Players: Cargill/NatureWorks LLC, VTT Technical Research Centre, Quentic, and ChemADVISOR

Recent Developments

- In June 2025, HH Chemical introduced its latest bio-based material brand. The newly launched brand is called BIODEX, as per the company's claim.(Source: www.chemanalyst.com)

Bio-based Platform Chemicals Market Top Companies

- Braskem

- GFBiochemicals Ltd

- Reverdia

- GC Innovation America

- Cargill, Incorporated

- Mitsubishi Chemical Corporation

- AVA Biochem AG

- LyondellBasell Industries NV

- Royal DSM NV

- BASF SE

- BioAmber Inc.

- Qingdao Kehai Biochemistry Co., Ltd

- Itaconix PLC

- Braskem

Segment Covered

By Product Type

- Bio-based Succinic Acid

- Bio-based Lactic Acid

- Bio-based Acrylic Acid

- Bio-based Acetic Acid

- Bio-based Propanediol (1,3-PDO)

- Bio-based Butanediol (BDO)

- Bio-based Isoprene

- Bio-based Fumaric Acid

- Bio-based Glycerol & Derivatives

- Others (levulinic acid, itaconic acid, etc.)

By Feedstock

- Corn & Sugarcane (starch & sugar crops)

- Lignocellulosic Biomass (wood, crop residues)

- Algae

- Waste Streams (food waste, municipal solid waste, industrial residues)

By Process/Technology

- Fermentation

- Enzymatic Conversion

- Catalytic Conversion

- Gasification & Syngas Routes

- Hybrid/Integrated Biorefinery

By End-Use Industry

- Packaging

- Automotive & Transportation

- Textile & Apparel

- Agriculture & Animal Feed

- Healthcare & Pharmaceuticals

- Consumer Goods & Personal Care

- Chemicals & Materials Manufacturing

By Distribution Channel

- Direct Sales to Manufacturers

- Chemical Distributors

- Online B2B Platforms

By Region

- North America

- U.S.

- Mexico

- Canada

- Europe

- Germany

- UK

- France

- Italy

- Asia Pacific

- China

- India

- Japan

- South Korea

- Central & South America

- Brazil

- Argentina

- Middle East & Africa

- Saudi Arabia

- UAE