Content

What is the Current Biaxially Oriented Polypropylene (BOPP) Market Size and Volume?

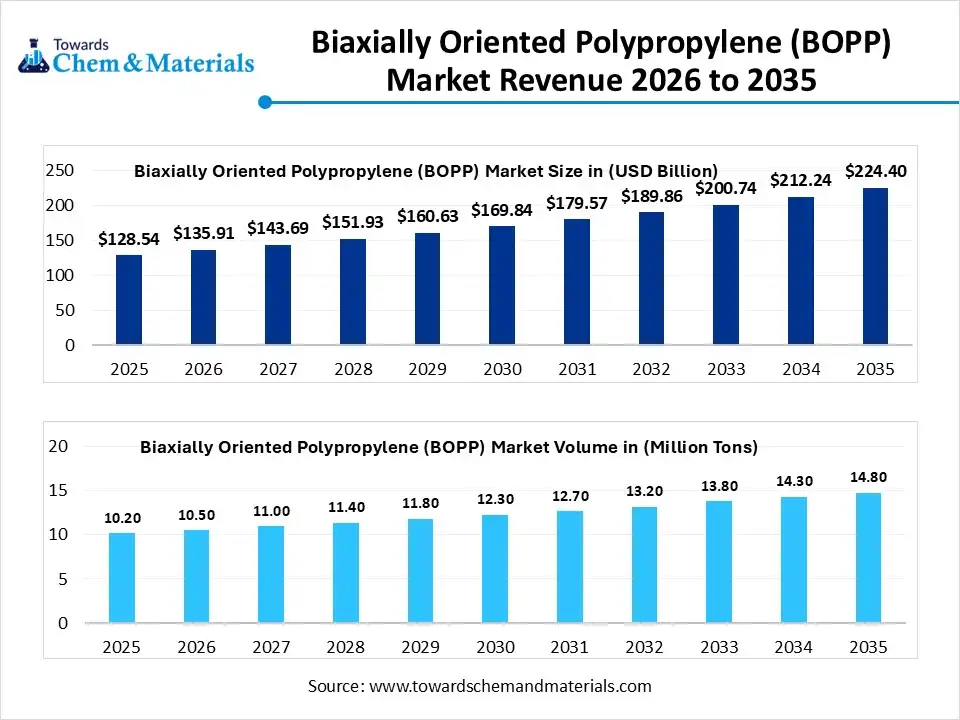

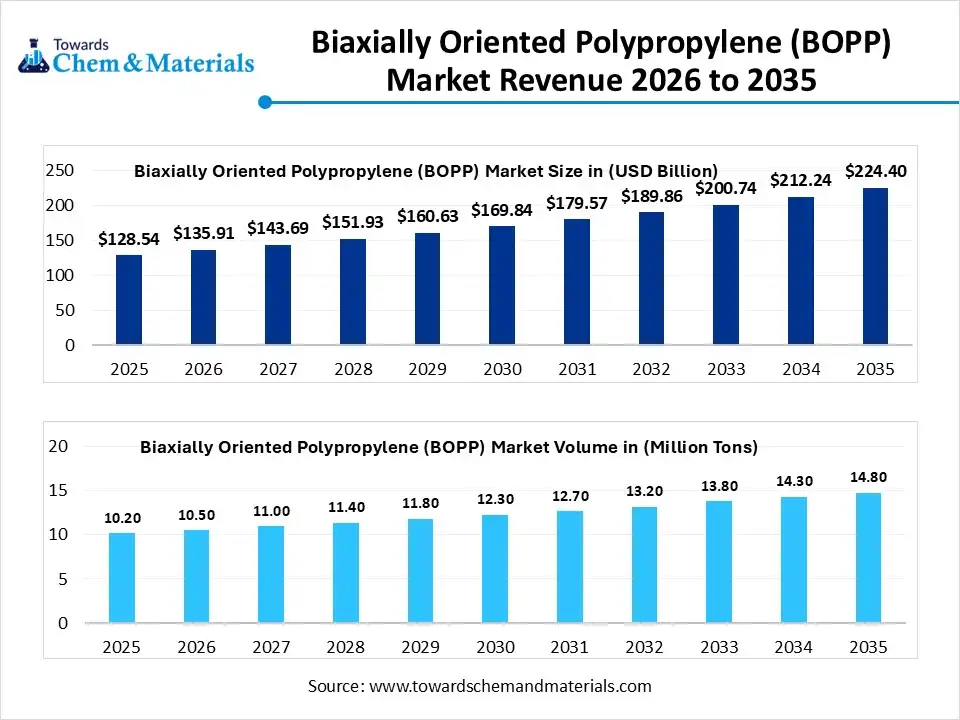

The global biaxially oriented polypropylene (BOPP) market size was estimated at USD 128.54 billion in 2025 and is expected to increase from USD 135.91 billion in 2026 to USD 224.40 billion by 2035, growing at a CAGR of 5.73% from 2026 to 2035. In terms of volume, the market is projected to grow from 10.2 million tons in 2025 to 14.8 million tons by 2035. growing at a CAGR of 3.87% from 2026 to 2035. Asia Pacific dominated the biaxially oriented polypropylene (BOPP) market with the largest volume share of 46% in 2025.The market is growing due to rising demand for flexible packaging, improved barrier properties, and increasing applications in food, labeling, and industrial sectors.

Market Highlights

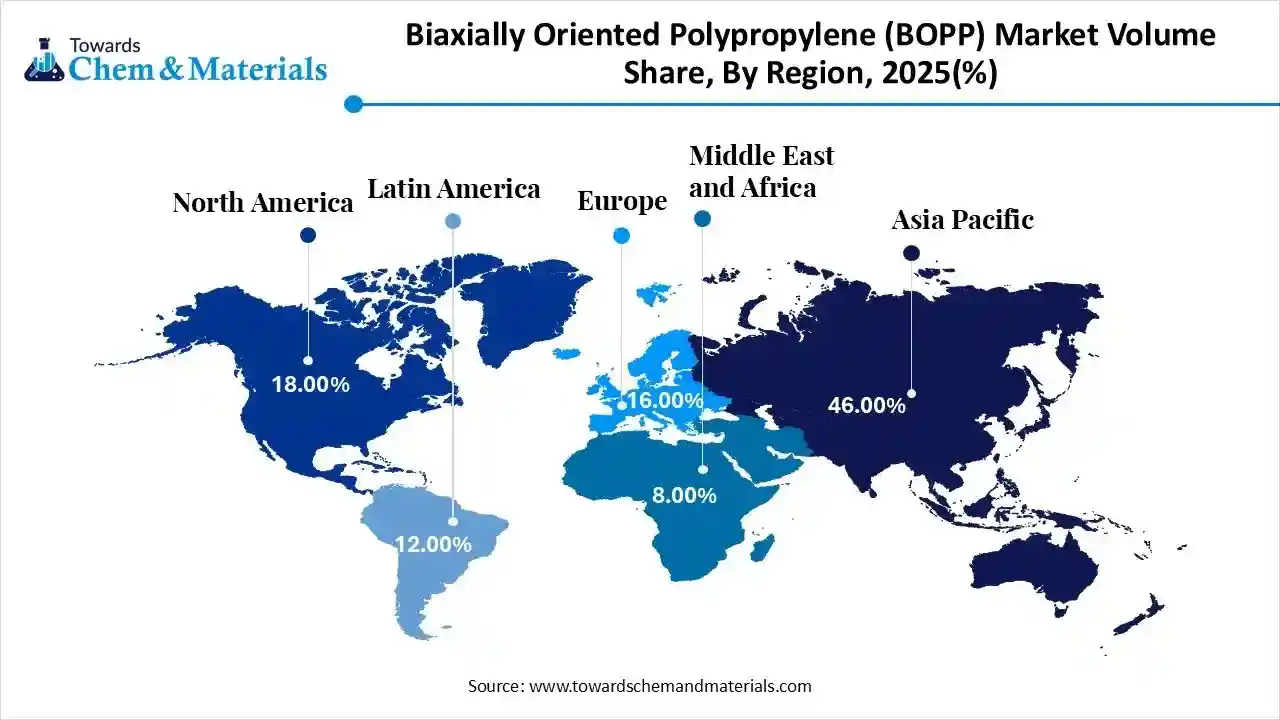

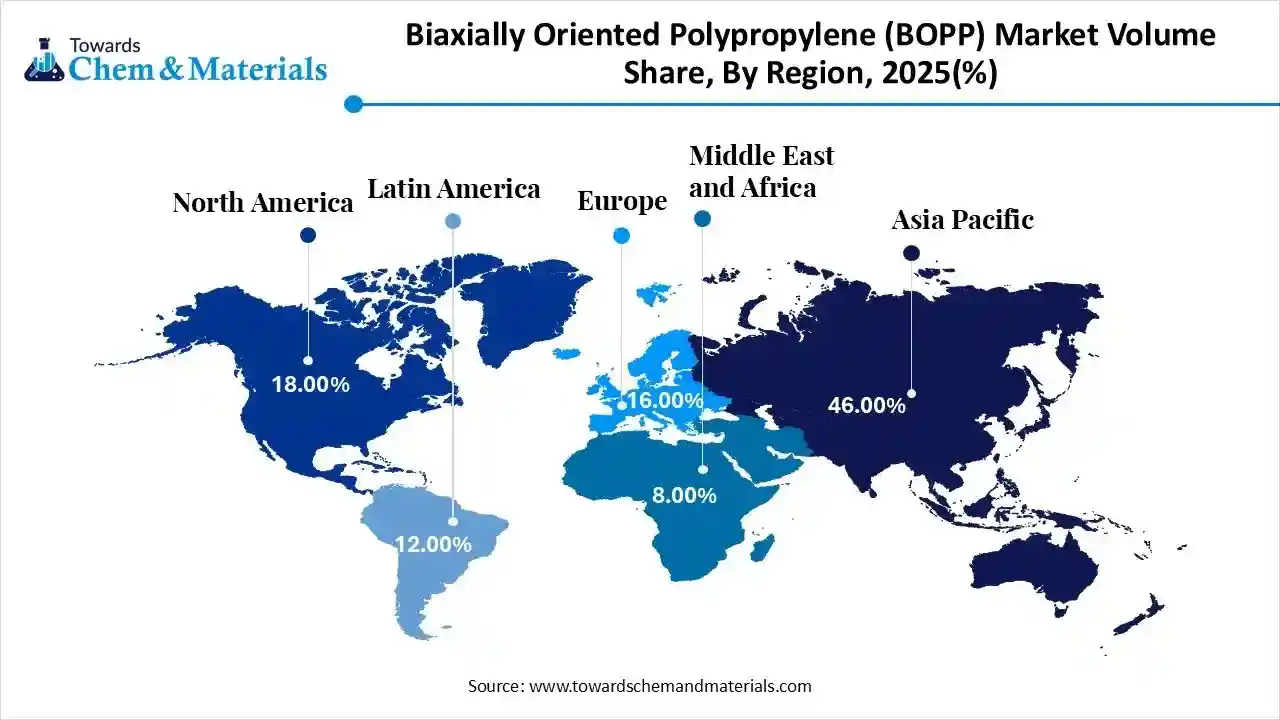

- The Asia Pacific dominated the global biaxially oriented polypropylene (BOPP) market with the largest volume share of 46.00% in 2025.

- The biaxially oriented polypropylene (BOPP) market in North America is expected to grow at a substantial CAGR of 4.39% from 2026 to 2035.

- The Europe biaxially oriented polypropylene (BOPP) market segment accounted for the major volume share of 16.00% in 2025.

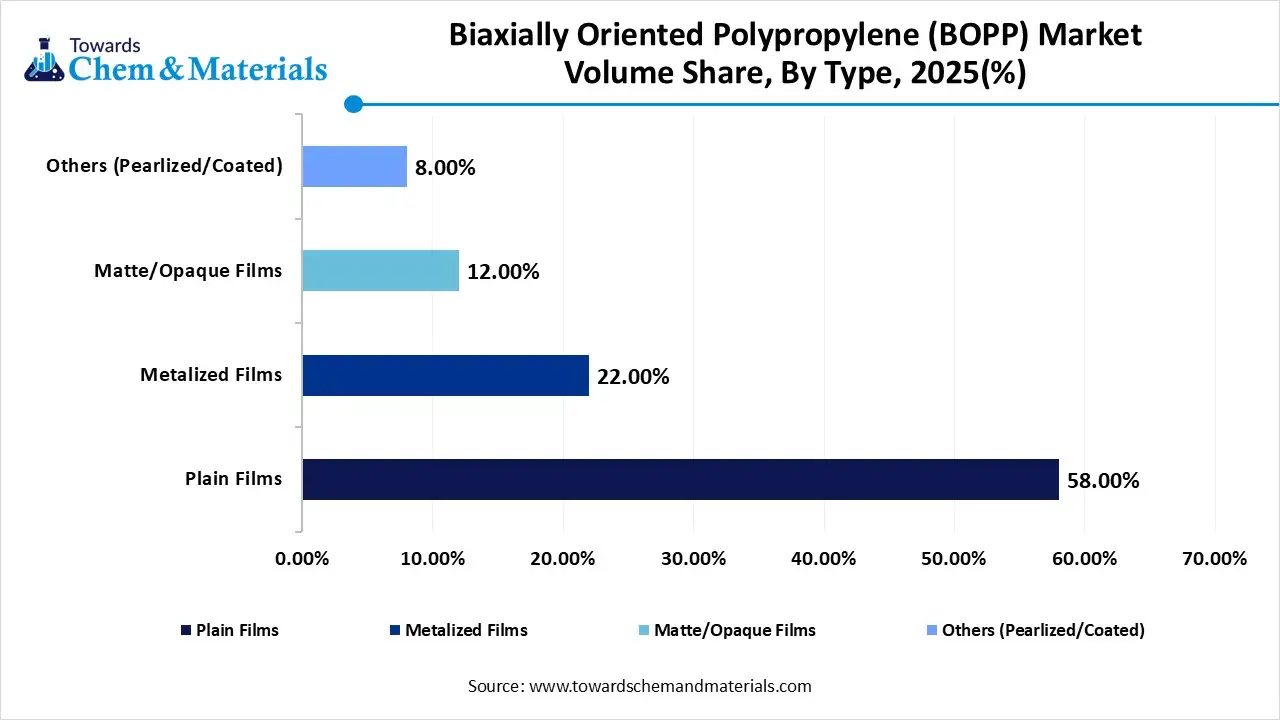

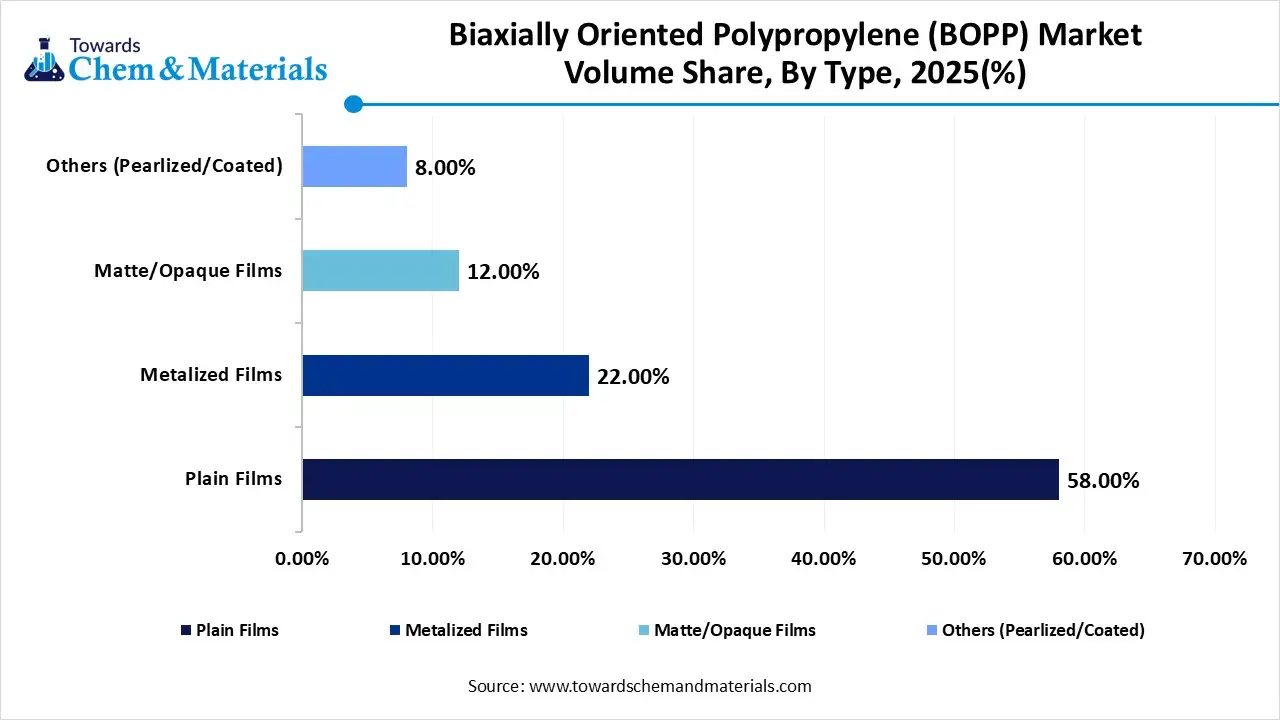

- By type, the plain films segment dominated the market and accounted for the largest volume share of 58% in 2025.

- By type, the metallized films segment is expected to grow at the fastest CAGR of 5.03% from 2026 to 2035 in terms of volume.

- By thickness, the 15–30-micron segment led the market with the largest revenue volume share of 64% in 2025.

- By production process, the tenter process segment dominated the market and accounted for the largest volume share of 85% in 2025.

- By application, the wraps segment led the market with the largest revenue volume share of 35% in 2025.

- By end user industry, the food packaging segment dominated the market and accounted for the largest volume share of 48% in 2025.

Market Overview

Why is the Biaxially Oriented Polypropylene (BOPP) Market Expanding Rapidly?

The BOPP market is witnessing strong growth driven by its exceptional strength of clarity, and moisture barrier qualities, which make it perfect for flexible packaging. Adoption is also being accelerated by rising demand from industrial applications of food and beverage, and labeling.

The demand for long-lasting and aesthetically pleasing packaging solutions is also being driven by the rapid growth of e-commerce and urbanization. Furthermore, product performance and versatility are being improved by technological developments in coating and film production.

Market Key Trends

- Rising Demand in Food & Beverage Packaging: BOPP films are increasingly used for snacks, confectionery, and frozen foods due to their excellent barrier and clarity properties.

- Growth in Labeling Applications: BOPP films are preferred for self-adhesive and shrink labels because of durability, printability, and resistance to moisture.

- Technological Advancements in Coating & Metallization: Enhanced coating and metallized BOPP films improve barrier properties and extend the shelf life of packaged goods.

- E-commerce & Retail Packaging Expansion: The rise of online retail is driving demand for lightweight, tear-resistant, and visually appealing packaging solutions.

- Sustainability & Recyclable Packaging Focus: Manufacturers are increasingly offering recyclable and eco-friendly BOPP films to meet regulatory requirements and consumer demand.

Report Scope

| Report Attribute | Details |

| Market Size and Volume in 2026 | USD 135.91 Billion / 10.5 Million Tons |

| Revenue Forecast in 2035 | USD 224.40 Billion / 14.8 Million Tons |

| Growth Rate | CAGR 5.73% |

| Forecast Period | 2026 - 2035 |

| Base Year | 2025 |

| Units Considered | Value (Billion / Million), Volume (Million Tons) |

| Dominant Region | Asia Pacific |

| Segment Covered | By Type, By Thickness, By Production Process, By Application, By End-User Industry, By Region |

| Key companies profiled | Jindal Poly Films Ltd., Taghleef Industries, Cosmo First (formerly Cosmo Films), UFlex Limited, Oben Holding Group, CCL Industries (Innovia Films), Toray Industries, Inc., Mitsubishi Chemical Group, Inteplast Group, Poligal S.A., Sibur Holding, Polibak, Zhejiang Kinlead Innovative Materials, Ganesha Ecosphere (Bio-BOPP focus), Manucor S.p.A. |

Market Opportunities

- Expansion in the Food & Beverage Sector: Growing packaged food consumption and demand for extended shelf-life products present significant opportunities for BOPP film adoption.

- Emerging Markets Growth: Rapid urbanization, increasing disposable income, and retail expansion in the Asia-Pacific, Latin America, and MEA regions can drive strong market growth.

- Sustainable & Eco-Friendly Packaging Solutions: Rising consumer awareness and government regulations create opportunities for recyclable and biodegradable BOPP films.

- Technological Innovations: Development of metallized, coated, and high-barrier BOPP films enables new applications in premium and specialty packaging.

- E-commerce & Modern Retail Packaging: The surge in online shopping and retail packaging demands lightweight, durable, and visually appealing BOPP films, expanding market potential.

Value Chain Analysis

- Raw Material Sourcing: Polypropylene resin used in BOPP film manufacturing is sourced from large petrochemical producers with integrated refining and polymer operations. Stable raw material availability and price competitiveness are critical for consistent BOPP film production.

- Key Players: LyondellBasell, SABIC, ExxonMobil Chemical, Reliance Industries Limited

- Logistics and Distribution: Efficient logistics and distribution networks ensure smooth transportation of BOPP films from manufacturers to converters and end-use industries. Strong warehousing, cold-chain-free handling, and global shipping capabilities support timely delivery.

- Key Players: DHL Supply Chain, Maersk, Kuehne+Nagel, DB Schenker

- Recycling and Waste Management: Recycling and waste management focus on collecting, reprocessing, and reducing BOPP film waste through mono-material and circular economy initiatives. Increasing investment in recycling infrastructure supports sustainable packaging goals.

- Key Players: Veolia, SUEZ, Waste Management Inc., Indorama Ventures

Segmental Insights

By Type

What Made The Plain Films Segment Dominate The Biaxially Oriented Polypropylene (BOPP) Market?

The plain films segment volume was valued at 5.9 million tons in 2025 and is projected to reach 8.4 million tons by 2035, expanding at a CAGR of 3.98% during the forecast period from 2025 to 2035. The plain films segment dominates the biaxially oriented polypropylene (BOPP) market, accounting for 58% of the total share because of their superior mechanical qualities, clarity, and adaptability. These films are highly favored for industrial food packaging and labeling applications because plain films are affordable and widely used in a variety of end-use industries. Manufacturers continue to concentrate on them.

The Metallized BOPP films segment volume was valued at 2.2 million tons in 2025 and is projected to reach 3.5 million tons by 2035, expanding at a CAGR of 5.03% during the forecast period from 2025 to 2035. The Metallized BOPP films segment is expected to experience the fastest growth with 22% in the market during the forecast period, driven by their superior appeal and improved barrier qualities. Snacks, candies, and other perishable items that need long shelf lives, and eye-catching designs are increasingly being packaged in these films.

Biaxially Oriented Polypropylene (BOPP) Market Volume and Share By Type, 2025-2035

| By Type | Market Volume Share (%), 2025 | Market Volume ( Million Tons)2025 | Market Volume (Million Tons)2035 | CAGR(%) 2026-2035 | Market Volume Share (%), 2035 |

| Plain Films | 58.00% | 5.9 | 8.4 | 3.98% | 56.39% |

| Metalized Films | 22.00% | 2.2 | 3.5 | 5.03% | 23.41% |

| Matte/Opaque Films | 12.00% | 1.2 | 1.9 | 4.83% | 12.55% |

| Others (Pearlized/Coated) | 8.00% | 0.8 | 1.1 | 3.79% | 7.65% |

By Thickness

What Made 15-30 Microns Segment Dominate The Biaxially Oriented Polypropylene (BOPP) Market?

The 15–30-micron segment dominates the biaxially oriented polypropylene (BOPP) market, accounting for 64% of the total share. For the majority of packaging and labeling applications, this range is the recommended option because it strikes a balance between strength, flexibility, and printability. Its dominant position is strengthened by its steady performance and broad industry adoption.

The segment below 15 microns segment is expected to experience the fastest growth with 18% in the market during the forecast period, as producers look for lightweight options to reduce costs and promote sustainability. These thinner films are becoming more popular in contemporary retail applications and e-commerce packaging, where minimizing material consumption is a top concern.

By Production Process

What Makes Tenter Process Segment Dominate The Biaxially Oriented Polypropylene (BOPP) Market?

Tenter process segment dominates the biaxially oriented polypropylene (BOPP) market, accounting for 85% of the total share, because of its capacity to create superior dimensionally stable films. Tentered BOPP films are ideal for a variety of packaging and labelling applications because of their consistent thickness and superior mechanical qualities.

The tubular (bubble) process segment is expected to experience the fastest growth with 15% in the market during the forecast period, because it facilitates flexible film applications and low-cost production, emerging markets, and rising demand for specialty and lightweight films are driving its increasing uptake.

By Application

Why Did Wraps Segment Dominate The Biaxially Oriented Polypropylene (BOPP) Market?

The wraps segment dominates the biaxially oriented polypropylene (BOPP) market, accounting for 35% of the total share, mostly driven by the specifications for food packaging. The clarity, strength, and barrier qualities of BOPP make wraps ideal for safeguarding packaged and perishable foods. Its dominant share is reinforced by fast-moving consumer goods brands in steady demand.

The labels segment is expected to experience the fastest growth with 15% in the market during the forecast period, driven by the growing demand for superior eye-catching long-lasting packaging labels. The growth is especially noticeable in FMCG, personal care, and beverage products. The market is expanding more quickly due to the growing demand for high-end and ornamental labeling solutions.

By End User Industry

What Made The Food Packaging Segment Dominate The Biaxially Oriented Polypropylene (BOPP) Market?

The food packaging segment dominates the biaxially oriented polypropylene (BOPP) market, accounting for 48% of the total share, reflecting the widespread use of BOPP films in protecting perishable goods and extending shelf life. The global rise in packaged food consumption is the driving force behind this dominance. The demand for packaged and ready-to-eat foods is still being driven by fast urbanization and shifting lifestyles.

The pharmaceuticals segment is expected to experience the fastest growth with 10% in the market during the forecast period, since BOPP films are utilized for labels, protective wraps, and blister packs, guaranteeing product safety and adherence to legal requirements. Growth in this market is being driven by the rise in pharmaceutical production and the emphasis on safe packaging.

By Region

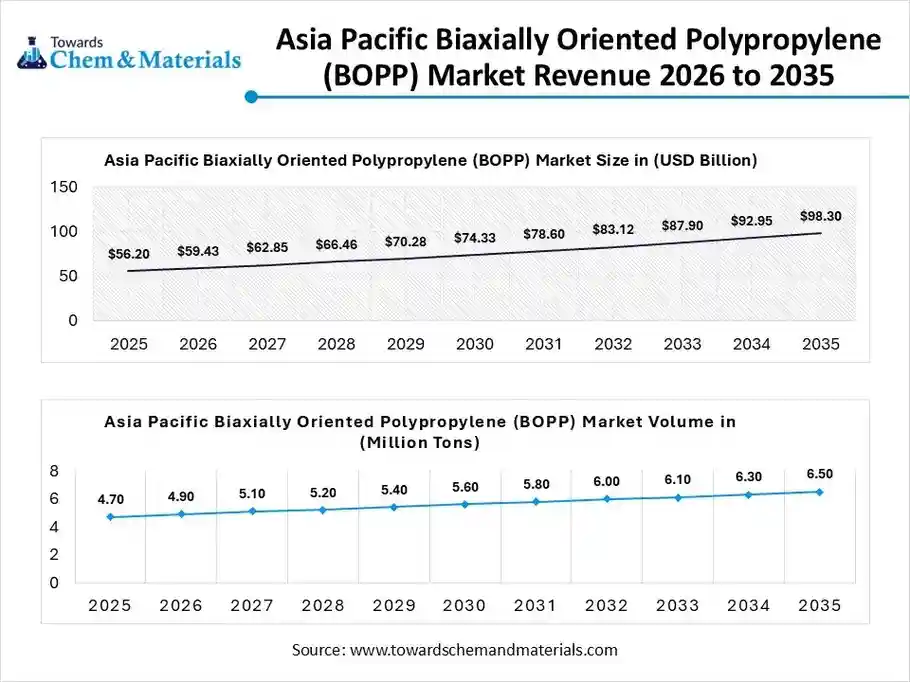

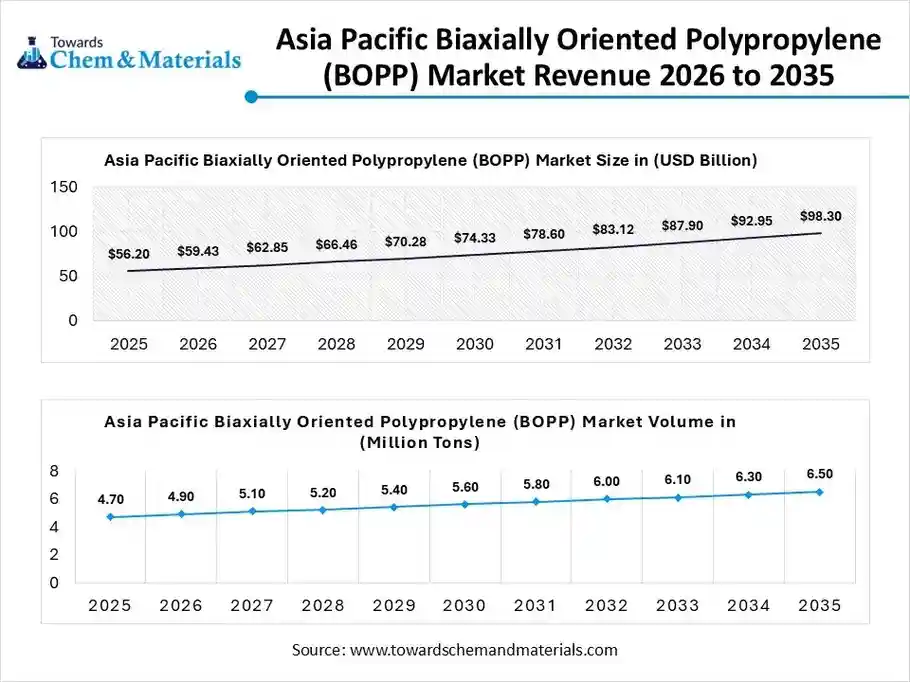

The Asia Pacific biaxially oriented polypropylene (BOPP) market size was valued at USD 56.20 billion in 2025 and is expected to be worth around USD 98.30 billion by 2035, exhibiting at a compound annual growth rate (CAGR) of 5.75% over the forecast period from 2026 to 2035.

The Asia Pacific biaxially oriented polypropylene (BOPP) market volume was estimated at 4.7 million tons in 2025 and is projected to reach 6.5 million tons by 2035, growing at a CAGR of 3.83% from 2026 to 2035. Asia Pacific dominates the biaxially oriented polypropylene (BOPP) market, accounting for 46% of the total share, driven by strong growth in the FMCG and retail sectors, rapid industrialization, and high consumption of packaged foods. The area gains growing demand for flexible packaging, economic production, and large-scale manufacturing capabilities. To increase shelf life and aesthetic appeal, nations in the region are also implementing cutting-edge packaging technologies. Sustained market growth is further supported by robust export activity.

India Biaxially Oriented Polypropylene (BOPP) Market Trends

India is a key growth engine within the Asia Pacific because of the growing demand for packaged foods and pharmaceuticals, rising urbanization, and rising disposable income. BOPP films are being used more often in wraps and labels as organized retail and e-commerce grow. Investment in packaging materials is also being encouraged by government support for domestic manufacturing and food processing. Long-term demand is also supported by the move to recyclable and lightweight packaging.

Latin America Biaxially Oriented Polypropylene (BOPP) Market Trends

The Latin America biaxially oriented polypropylene (BOPP) market volume was estimated at 1.2 million tons in 2025 and is projected to reach 1.9 million tons by 2035, growing at a CAGR of 5.25% from 2026 to 2035.South America fastest growing with 10% market share, supported by growing retail infrastructure and an increase in packaged food consumption. The demand for premium and eye-catching packaging is driven by the growing presence of multinational FMCG brands. Additionally, the region is seeing a slow modernization of packaging standards. Adoption is further accelerated by growing awareness of adaptable and affordable packaging options.

Brazil Biaxially Oriented Polypropylene (BOPP) Market Trends

Brazil leads the South American BOPP market due to its sizable consumer base and robust food and beverage industry. BOPP films are becoming more and more popular in the nation for labeling snacks and confectionery. Supply capabilities are being strengthened by investments in innovative packaging and regional films production. Furthermore, BOPP film producers continue to have new opportunities due to the expansion of exports and contemporary retail formats.

Biaxially Oriented Polypropylene (BOPP) Market Volume and Share, By Region, 2025-2035

| By Region | Market Volume Share (%), 2025 | Market Volume ( Million Tons)2025 | Market Volume (Million Tons)2035 | CAGR(%) 2026-2035 | Market Volume Share (%), 2035 |

| North America | 18.00% | 1.8 | 2.7 | 4.39% | 18.12% |

| Europe | 16.00% | 1.6 | 2.5 | 4.88% | 16.81% |

| Asia Pacific | 46.00% | 4.7 | 6.5 | 3.83% | 44.12% |

| Latin America | 12.00% | 1.2 | 1.9 | 5.25% | 13.01% |

| Middle East & Africa | 8.00% | 0.8 | 1.2 | 4.22% | 7.94% |

Recent Developments

- In September 2025, to meet increasing demand for high-quality labels, new data highlighted how BOPP's treated surfaces strengthen adhesion, positioning it as a preferred option for food and beverage packaging where visual clarity and protection are essential.(Source: www.poly-source.com)

- In December 2025, The BOPP market size was expected to reach $31.27 billion in 2025, a strong growth trajectory from 2024, driven by advancements in technology and a shift towards sustainable packaging.(Source: www.einpresswire.com)

Top Companies

- Jindal Poly Films Ltd.

- Taghleef Industries

- Cosmo First (formerly Cosmo Films)

- UFlex Limited

- Oben Holding Group

- CCL Industries (Innovia Films)

- Toray Industries, Inc.

- Mitsubishi Chemical Group

- Inteplast Group

- Poligal S.A.

- Sibur Holding

- Polibak

- Zhejiang Kinlead Innovative Materials

- Ganesha Ecosphere (Bio-BOPP focus)

- Manucor S.p.A.

Segments Covered in the Report

By Type

- Plain Films

- Metalized Films

- Matte/Opaque Films

- Others (Pearlized/Coated)

By Thickness

- 15–30 Microns

- Below 15 Microns

- 30–45 Microns

- Above 45 Microns

By Production Process

- Tenter Process

- Tubular (Bubble) Process

By Application

- Wraps

- Bags & Pouches

- Tapes

- Labels

By End-User Industry

- Food Packaging

- Tobacco Packaging

- Consumer Goods & Personal Care

- Industrial & Electrical

- Pharmaceuticals

By Region

- North America

- Europe

- Asia Pacific

- South America

- Middle East & Africa