Content

Aluminum Trihydrate (ATH) Market Volume and Share 2034

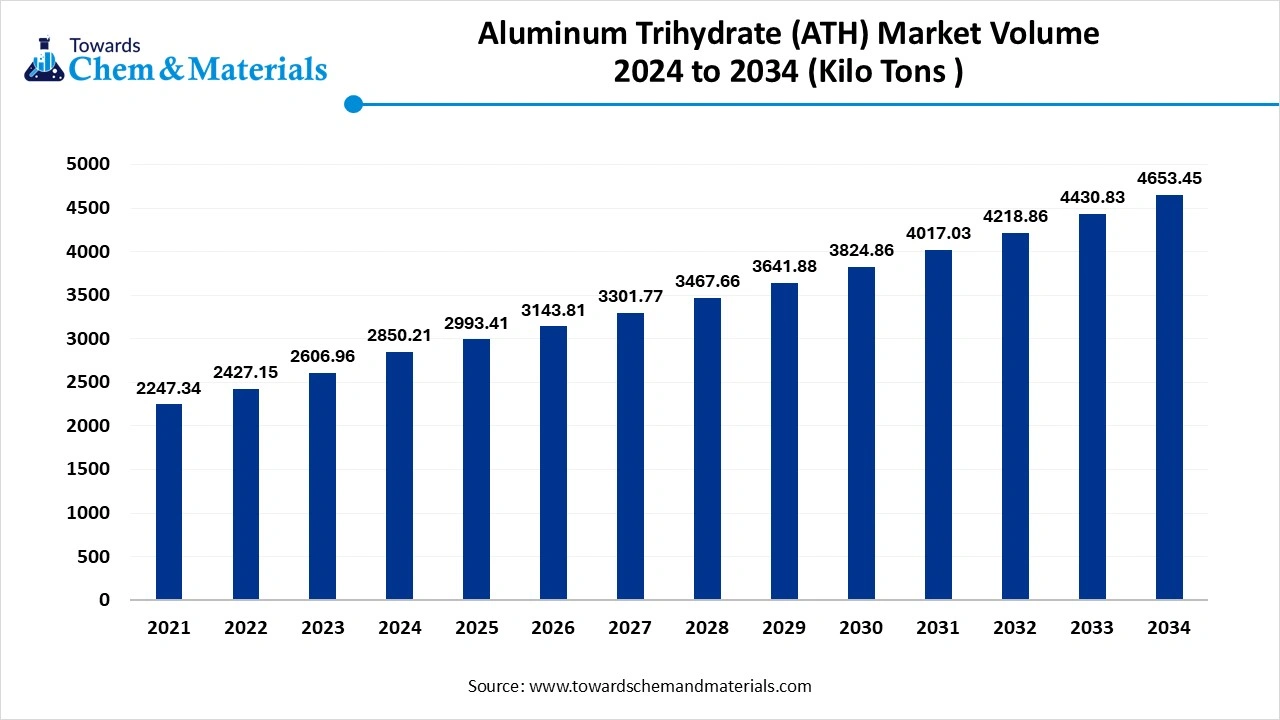

The global aluminum trihydrate (ATH) market volume was reached at 2850.21 kilo tons in 2024 and is expected to be worth around 4653.45 kilo tons by 2034, growing at a compound annual growth rate (CAGR) of 5.02% over the forecast period 2025 to 2034. The increased global safety standards and heavy demand for fire-resistant materials have accelerated the industry's growth in recent years.

Key Takeaways

- By region, Asia Pacific dominated the market in 2024 with 58.09% of the industry share, akin to the presence of heavy industrial spaces in the current period.

- By region, North America is expected to grow at a notable rate in the future, owing to a sudden increase in the safety regulations for the construction and electronics sectors in the region.

- By grade type, the fine grade segment led market in 2024 with 36% market share, due to its ability to blend well with other materials and offer smooth surface finishes.

- By grade type, the precipitated ATH segment is expected to grow at the fastest rate in the market during the forecast period, due to the increased need for better purity, improved performance, and controlled particle size in the current period.

- By application, the flame-retardant segment emerged as the top-performing segment in 2024 with 42% market share, due to its act as a smoke suppressant in the current period.

- By application, the pharmaceutical and personal care segment expects the fastest growth in the market in the coming years, due to the need for tablets, creams, and cosmetic powders in recent years.

- By end-use industry, the building and construction segment led the market in 2024 with 34% market share, because ATH is widely used in fireproof wallboards, flooring, sealants, and coatings.

- By end-use industry, the electrical and electronics segment is expected to capture the biggest portion of the market in the coming years, because fire safety is becoming increasingly critical in electronic devices and cables.

- By production process, the Bayer process segment led the market in 2024 with 61% industry share, because it is the most efficient and widely used method for producing ATH from bauxite.

- By production process, the hydrothermal process segment is expected to grow at the fastest rate in the market during the forecast period, because it produces high-purity ATH with better control over particle shape and size.

- By form type, the powder segment led the market in 2024 with 78% industry share, because it is the most common and versatile form of aluminum trihydrate.

- By form type, the slurry segment is expected to capture the biggest portion of the market in the coming years, because it is easier to pump and handle during automated manufacturing processes.

- By distribution channel, the direct sales segment led the market in 2024 with 67% industry share, because industrial users prefer to purchase ATH in bulk directly from producers.

- By distribution channel, the online segment is expected to grow at the fastest rate in the market during the forecast period, because more buyers are shifting to digital platforms for convenience, price comparison, and faster procurement.

Market Overview

Aluminum Trihydrate: The Versatile Flame Defender for Modern Industry

Aluminum Trihydrate (ATH), also known as Aluminum Hydroxide (Al(OH)₃), is a white, non-abrasive, and chemically inert inorganic compound. It is primarily used as a flame retardant, smoke suppressant, and filler in various industrial applications, including plastics, rubber, paper, adhesives, and paints. It also finds application in water treatment, pharmaceuticals, and ceramics due to its amphoteric properties and thermal decomposition characteristics.

Which Factor is Driving the Aluminum Trihydrate (ATH) market?

The increased need for flame retardants globally has spearheaded the industry's growth in recent years. Moreover, the increasing safety regulations for the building and construction sector globally have heavily contributed to industry growth in recent years. Also, several automakers have seen increasing their ATH in recent years, which is likely to drive the growth of the market in the upcoming years.

Market Trends

- The sudden increase in demand for the halogen-based flame retardant has contributed to the growth of the market in recent years. Also, the global government pushes for an environmentally friendly environment, supporting these flame retardants as per the observation.

- Several major companies are integrating nanotechnology in the production of ATH, which is expected to accelerate industry growth in the upcoming years.

Report Scope

| Report Attribute | Details |

| Market Volume in 2025 | 2993.41 Kilo Tons |

| Expected Volume by 2034 | 4653.45 Kilo Tons |

| Growth Rate from 2025 to 2034 | CAGR 5.02% |

| Base Year of Estimation | 2024 |

| Forecast Period | 2025 - 2034 |

| Dominant Region | Asia Pacific |

| Segment Covered | By Grade, By Application, By End-Use Industry, By Production Process, By Form, By Distribution Channel, By Region |

| Key Companies Profiled | Huber Engineered Materials, Nabaltec AG , Aluminum Corporation of China Ltd (CHALCO), TOR Minerals , Sumitomo Chemical Co., Ltd. , Showa Denko K.K. , KC Corporation , MAL Magyar Aluminium, J.M. Huber Corporation , Hindalco Industries Limited , Almatis GmbH , LKAB Minerals AB , AluChem Inc. , Zibo Pengfeng New Material Technology Co., Ltd. , Albemarle Corporation, Sasol Ltd. , Nippon Light Metal Holdings , PT Indonesia Chemical Alumina , Taiwan Aluminium Chemical , Zibo Xinfumeng Chemicals Co., Ltd. |

Market Opportunity

Manufacturers Eye Long-Term Gains in the Electrical Industry with ATH

The manufacturers can supply the ATH to the electrical and electronics industry is expected to create lucrative opportunities for the manufacturers during the forecast period. Moreover, the manufacturer can supply ATH for the flame-retardant cables, switchgear, and connectors according to the current market survey. Also, manufacturers can build strategic partnerships with the electrical companies, which can provide long-term profit margins and consumer trust as per the future industry expansions.

Market Challenge

High Operational Costs Could Stall the ATH Market Expansion

The energy-intensive and high-cost production is expected to hamper industry growth in the coming years, as methods such as the Bayer method and others are seen under the heavy usage of energy, water, and chemicals. These factors can create growth barriers for the new entrants and mid-size businesses in the upcoming years, as per the recent industry observation.

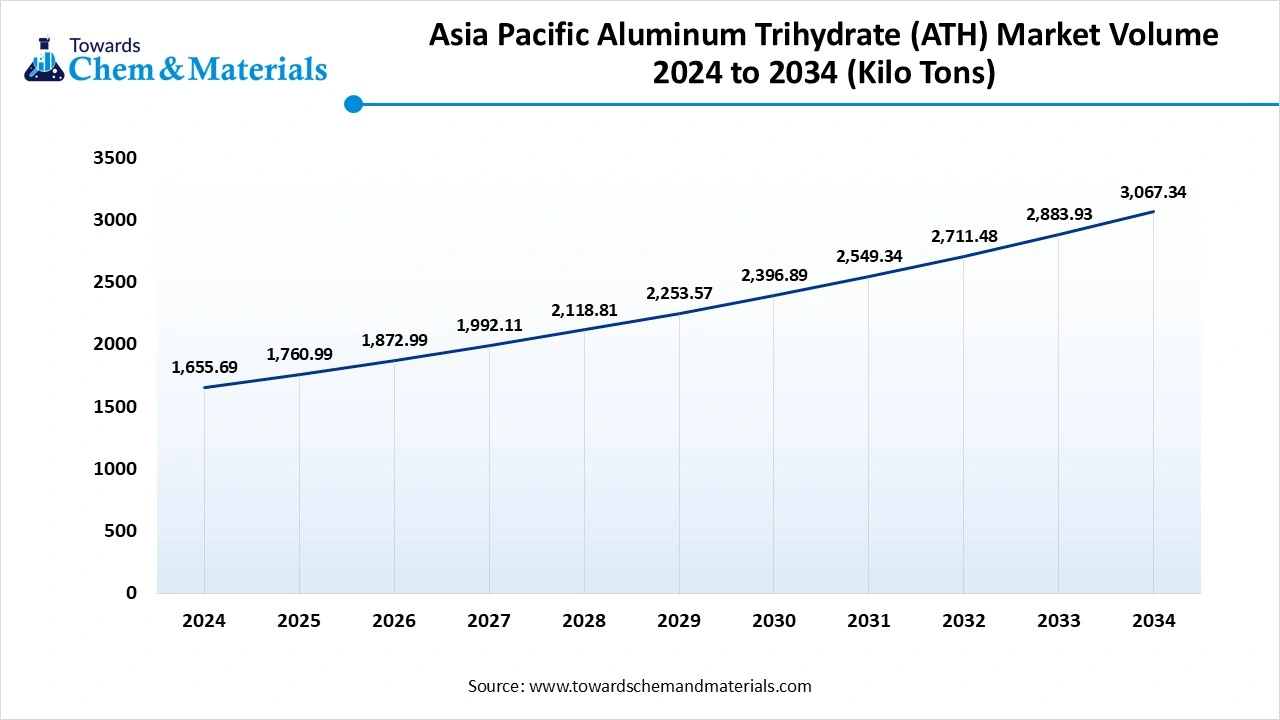

Regional Insights

The Asia Pacific aluminum trihydrate (ATH) market volume was estimated at 1655.69 tons in 2024 and is anticipated to reach 3,067.34 tons by 2034, growing at a CAGR of 6.36% from 2025 to 2034.

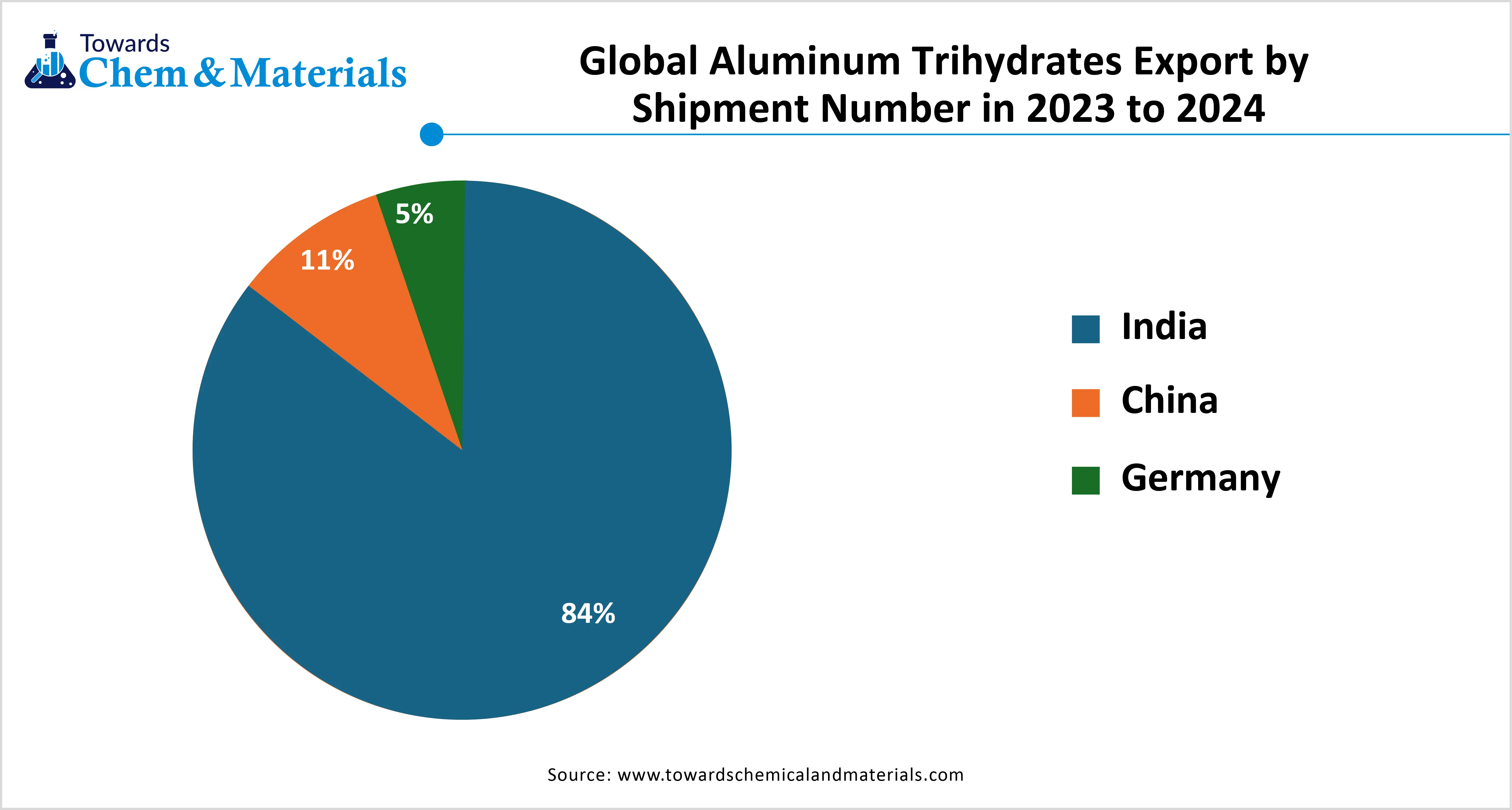

Asia Pacific dominated the market in 2024, akin to the presence of heavy industrial spaces in the current period. Sectors such as plastic, construction, and electronics were seen under the heavy requirement of the aluminum trihydrate in the region recently. Moreover, the regional countries such as China and India have been observed to use the ATH in applications like paints, flame retardants, and building materials in the past few years.

How is China’s Bauxite Abundance Powering Its ATH Supremacy?

China maintained its dominance in the aluminum trihydrate (ATH) market, owing to the country being known as the largest heavy aluminum trihydrate producer globally, with the enlarged consumption. Moreover, the country is seen in a wide availability of bauxite and alumina, which is a key component of the aluminum trihydrate production is contributing to the growth market in the country. Also, the country is seen in heavy exports of aluminum trihydrate, which immensely drives the industry potential in the whole Asia Pacific region, as per the recent observations.

North America is expected to capture a major share of the market during the forecast period, owing to a sudden increase in the safety regulations for the construction and electronics sectors in the region. Moreover, the region has seen a heavy need for the non-halogenated flame retardants, where ATH plays a major role, and it is contributing immensely to the industry's growth in recent years.

Can ATH Propel the United States to the Forefront of Advanced Material Innovation?

The United States is expected to rise as a dominant country in the region in the coming years, owing to the country's use of the ATH in high-performance applications such as fire-resistant polymers, automotive electronics, and LED casing, as per the recent observation. Furthermore, the major brands are actively investing heavily in the R&D programs of the ATH to find out the cosmetic and pharmaceutical uses of ATH in the upcoming years.

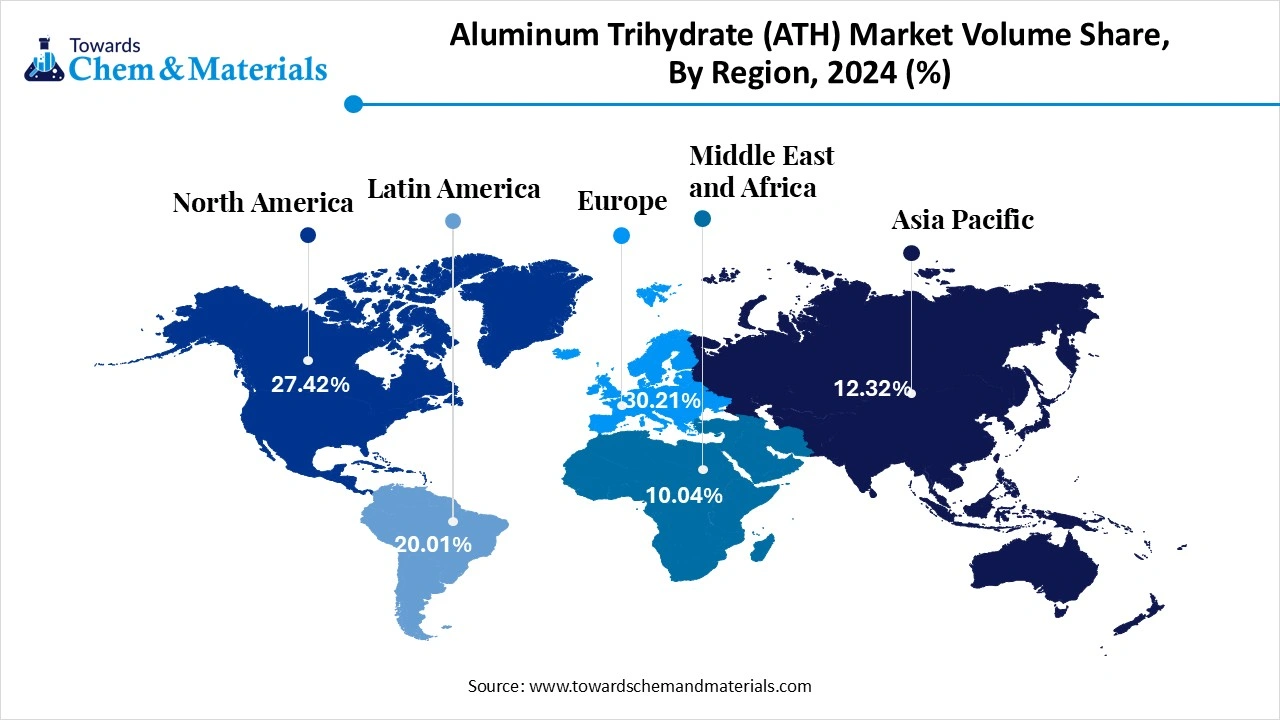

Aluminum Trihydrate (ATH) Market Volume Share, By Region, 2024-2034 (%)

| By Region | Volume Share, 2024 (%) | Market Volume Kilo Tons - 2024 | Volume Share, 2034 (%) | Market Volume Kilo Tons - 2034 | CAGR (2025 - 2034) |

| North America | 14.32% | 408.15 | 16.54% | 573.31 | 3.85% |

| Europe | 18.34% | 522.73 | 61.99% | 769.68 | 4.39% |

| Asia Pacific | 58.09% | 1655.69 | 5.10% | 2884.67 | 6.36% |

| Latin America | 5.04% | 143.65 | 4.05% | 237.33 | 5.74% |

| Middle East & Africa | 4.21% | 119.99 | 100.00% | 188.46 | 5.14% |

| Total | 100% | 2850.21 | 4653.45 | 4653.45 | 5.02% |

Segmental Insights

Grade Type Insights

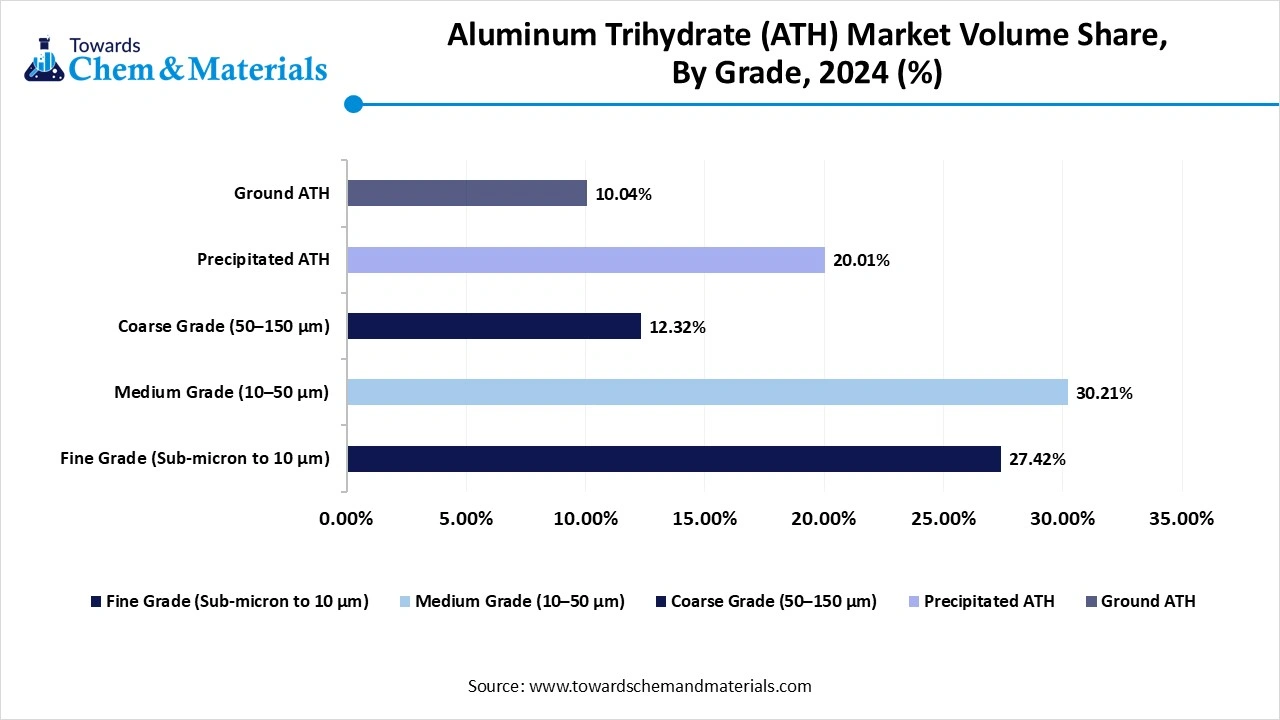

How did the Fine Grade Segment Dominate the Aluminum Trihydrate (ATH) Market in 2024?

The fine grade segment held the largest share of the market in 2024, due to its ability to blend well with other materials and offer smooth surface finishes. Moreover, the fine grades are seen in using flame retardants, plastic fillers, and coatings, considered the ideal solution for these applications. Moreover, having higher thermal stability, the fine grade has gained immense industry attention in recent years.

The precipitated ATH segment is expected to grow at a notable rate during the predicted timeframe due to the increased need for better purity, improved performance, and controlled particle size in the current period. By providing consistency and application suitability, the precipitated ATH has created demand from sectors such as high-end polymers, pharmaceuticals, and flame retardants in recent years.

Aluminum Trihydrate (ATH) Market Volume Share, By Grade Type, 2024-2034 (%)

| By Grade | Volume Share, 2024 (%) | Market Volume Kilo Tons - 2024 | Volume Share, 2034 (%) | Market Volume Kilo Tons - 2034 | CAGR (2025 - 2034) |

| Fine Grade (Sub-micron to 10 µm) | 27.42% | 781.53 | 31.15% | 1449.55 | 7.11% |

| Medium Grade (10–50 µm) | 30.21% | 861.05 | 29.32% | 1364.39 | 5.25% |

| Coarse Grade (50–150 µm) | 12.32% | 351.15 | 10.54% | 490.47 | 3.78% |

| Precipitated ATH | 20.01% | 570.33 | 21.45% | 998.17 | 6.42% |

| Ground ATH | 10.04% | 286.16 | 7.54% | 350.87 | 2.29% |

| Total | 100% | 2850.21 | 100% | 4653.45 | 5.02% |

Application Type Insights

Why does the Flame Retardant Segment Dominate the Aluminum Trihydrate (ATH) Market in 2024?

The flame-retardant segment held the largest share of the aluminum trihydrate (ATH) market in 2024, due to its act as a smoke suppressant in the current period. Moreover, with the increased safety rules and regulations of the building and construction industry, fire retardants have gained immense industry share in recent years. Furthermore, the reduce the fire risk in plastic, rubber, and cables, the ATH is considered a crucial material in the production of fire retardants in recent years.

The pharmaceutical and personal care segment is expected to grow at a notable rate during the forecast period, due to the need for tablets, creams, and cosmetic powders in recent years. The ATH is increasingly used as a filler in these pharmaceutical and cosmetic-grade products, as per the observation. As more products are released, the ATH can gain immense industry share in the upcoming years, as per the observation.

End Use Insights

Why Did the Building and Construction Segment Dominate the Aluminum Trihydrate (ATH) Market in 2024?

The building and construction segment dominated the market with the largest share in 2024, because ATH is widely used in fireproof wallboards, flooring, sealants, and coatings. It improves the fire resistance of materials and meets safety regulations in residential, commercial, and industrial buildings. As cities expand and infrastructure projects increase, especially in Asia, demand for ATH has soared. Construction companies prefer ATH-based materials because they are affordable, durable, and environmentally friendly.

The electrical and electronics segment is expected to grow at a notable rate during the forecast period, because fire safety is becoming increasingly critical in electronic devices and cables. ATH is used in wire insulation, circuit boards, and connectors to prevent fire-related failures. With the rapid growth of consumer electronics, EVs, and smart homes, demand for fire-safe components is rising.

Production Process Insights

Why Did The Bayer Process Segment Dominated The Aluminum Trihydrate (ATH) Market in 2024?

The Bayer process segment held the largest share of the aluminum trihydrate (ATH) market in 2024, because it is the most efficient and widely used method for producing ATH from bauxite. It provides high yields, consistent quality, and lower costs, making it ideal for large-scale production. Most industries rely on Bayer-produced ATH for flame retardants, plastics, and coatings due to its reliability and availability.

The hydrothermal process segment is expected to grow at a notable rate during the forecast period, because it produces high-purity ATH with better control over particle shape and size. This method is ideal for specialized applications in pharmaceuticals, electronics, and personal care where quality and consistency are critical. As industries demand more advanced and customized ATH grades, the hydrothermal process offers flexibility that other methods lack. Although it's more expensive, technological improvements are making it more efficient. Manufacturers focusing on premium and high-performance products are expected to adopt this method more widely in the future.

Form Type Insights

Why Did The Powder Segment Held The Largest Aluminum Trihydrate (ATH) Market share in 2024?

The powder segment dominated the market with the largest share in 2024 because it is the most common and versatile form of aluminum trihydrate. It's easy to mix with other materials like plastics, paints, and coatings, and is widely used in flame retardants and construction products. Powdered ATH is cost-effective and readily available, making it suitable for mass production in different industries.

The slurry segment is expected to grow at a significant rate during the forecast period, because it is easier to pump and handle during automated manufacturing processes. Slurries provide better dispersion of ATH in coatings, adhesives, and sealants. This reduces dust during production and improves workplace safety. Slurry form is especially useful in industries aiming to adopt cleaner and faster processing techniques.

Distribution Channel Insights

Why Did The Direct Sales Segment Dominated The Aluminum Trihydrate (ATH) Market in 2024?

The direct sales segment held the largest share of the aluminum trihydrate (ATH) market in 2024, because industrial users prefer to purchase ATH in bulk directly from producers. This helps them get lower prices, a steady supply, and customized solutions for their specific applications. Large manufacturers, especially in flame retardants and construction, rely on long-term contracts and direct relationships with ATH suppliers.

The online channels segment is expected to grow at a notable rate because more buyers are shifting to digital platforms for convenience, price comparison, and faster procurement. Small and mid-size buyers prefer online platforms to access a wider variety of ATH grades and packaging sizes.

Recent Developments

- In May 2025, Huber Advanced Materials expands its company portfolio by acquiring R.J. Marshall’s fire retardants. Also, the assets include the antimony-free flame retardant, alumina trihydrate, and the molybdate-based smoke suppressants, as per the report published by the company recently.(Source: www.chemanalyst.com)

- In January 2024, Closed Loop invested in the latest technology for aluminum scrap. This technology can make manufacturing precursors and energy from any type of aluminum scrap, as per the company's claim.(Source : resource-recycling.com )

Top Companies List

- Huber Engineered Materials

- Nabaltec AG

- Aluminum Corporation of China Ltd (CHALCO)

- TOR Minerals

- Sumitomo Chemical Co., Ltd.

- Showa Denko K.K.

- KC Corporation

- MAL Magyar Aluminium

- J.M. Huber Corporation

- Hindalco Industries Limited

- Almatis GmbH

- LKAB Minerals AB

- AluChem Inc.

- Zibo Pengfeng New Material Technology Co., Ltd.

- Albemarle Corporation

- Sasol Ltd.

- Nippon Light Metal Holdings

- PT Indonesia Chemical Alumina

- Taiwan Aluminium Chemical

- Zibo Xinfumeng Chemicals Co., Ltd.

Segment Covered

By Grade

- Fine Grade (Sub-micron to 10 µm)

- Medium Grade (10–50 µm)

- Coarse Grade (50–150 µm)

- Precipitated ATH

- Ground ATH

By Application

- Flame Retardant

- Thermoplastics (PE, PP, PVC)

- Thermosets (Epoxy, Polyesters)

- Rubber

- Filler

- Adhesives & Sealants

- Paints & Coatings

- Paper

- Ceramics

- Water Treatment Chemicals

- Pharmaceuticals & Personal Care

- Antacids

- Toothpaste

- Glass & Ceramics

- Others

- Wire & Cable Insulation

- Artificial Marble

By End-Use Industry

- Building & Construction

- Electrical & Electronics

- Automotive

- Packaging

- Healthcare & Personal Care

- Water Treatment

- Textiles

- Others (Industrial Manufacturing, Energy, etc.)

By Production Process

- Bayer Process

- Precipitation from Sodium Aluminate

- Other Hydrothermal Processes

By Form

- Powder

- Gel

- Slurry

By Distribution Channel

- Direct Sales (B2B)

- Distributors & Traders

- Online Channels

By Region

- North America

- U.S.

- Mexico

- Canada

- Europe

- Germany

- UK

- France

- Italy

- Asia Pacific

- China

- India

- Japan

- South Korea

- Central & South America

- Brazil

- Argentina

- Middle East & Africa

- Saudi Arabia

- UAE