Content

Aluminum Foil Market Size and Growth 2025 to 2034

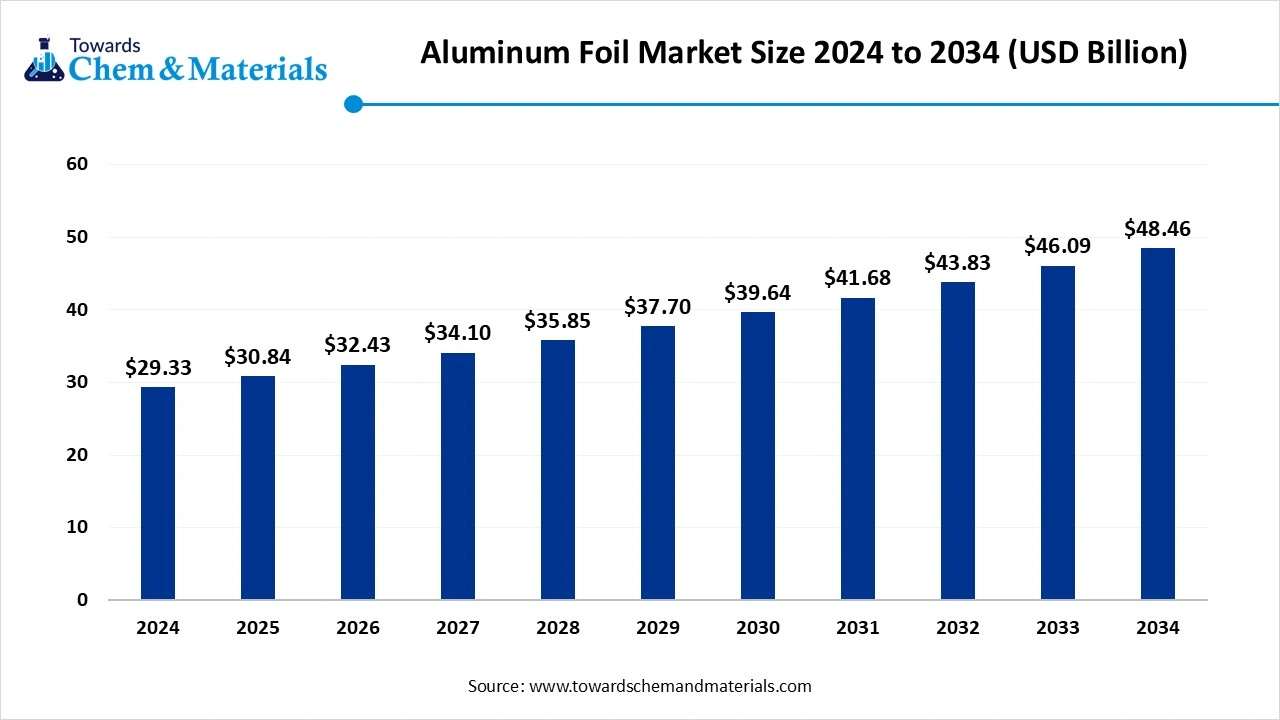

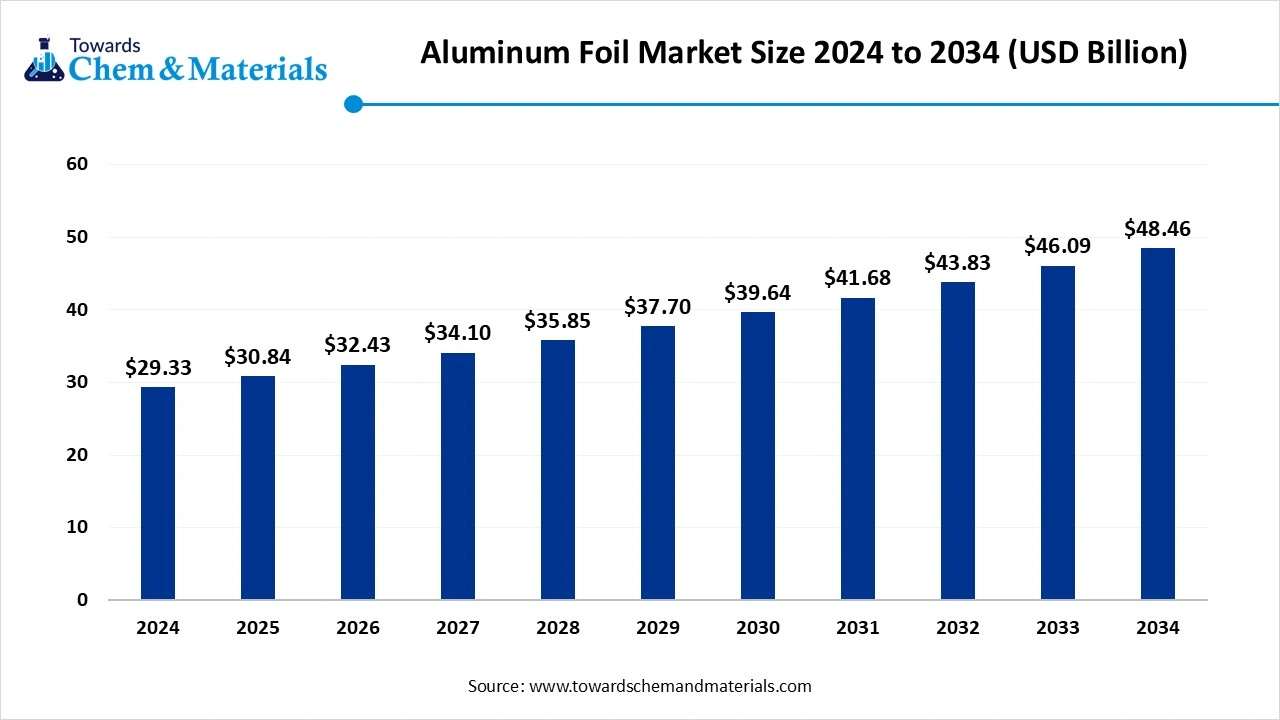

The global aluminum foil market size was reached at USD 29.33 billion in 2024 and is expected to be worth around USD 48.46 billion by 2034, growing at a compound annual growth rate (CAGR) of 5.15% over the forecast period 2025 to 2034. The growth of the market is driven by the growing demand from various sectors, including pharmaceutical, packaging, and construction, which supports the growth of the market.

Key Takeaways

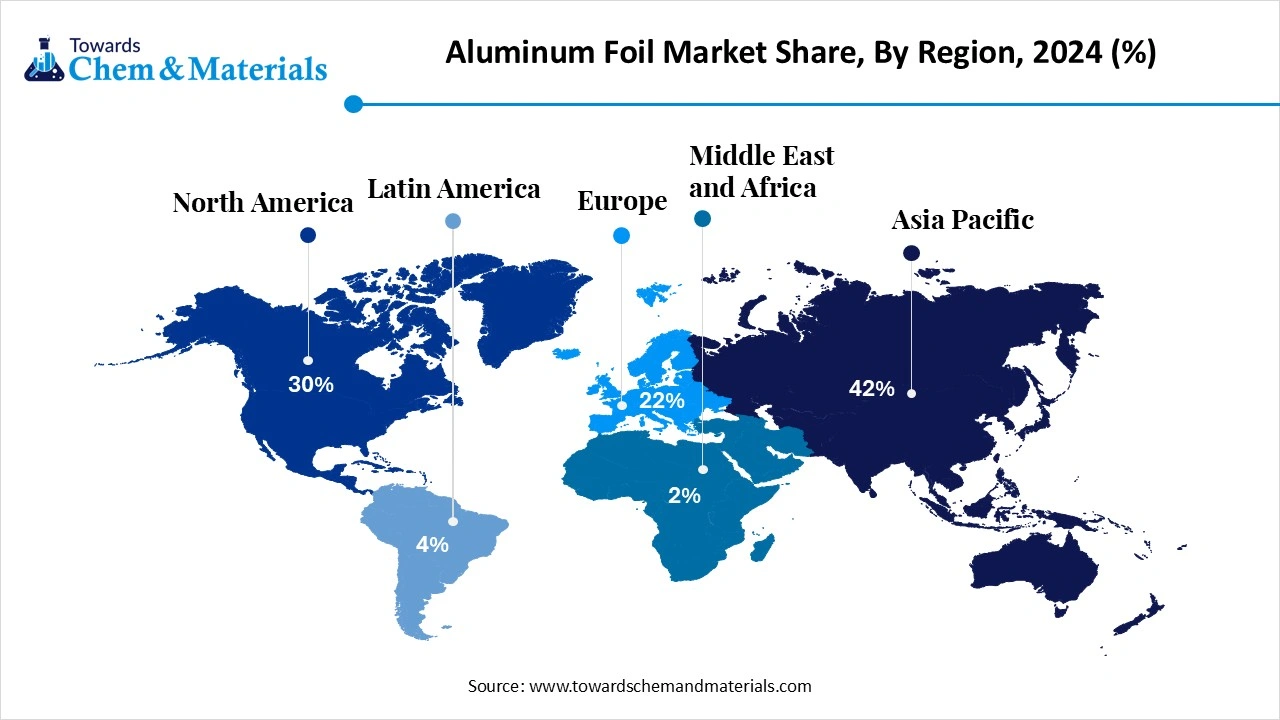

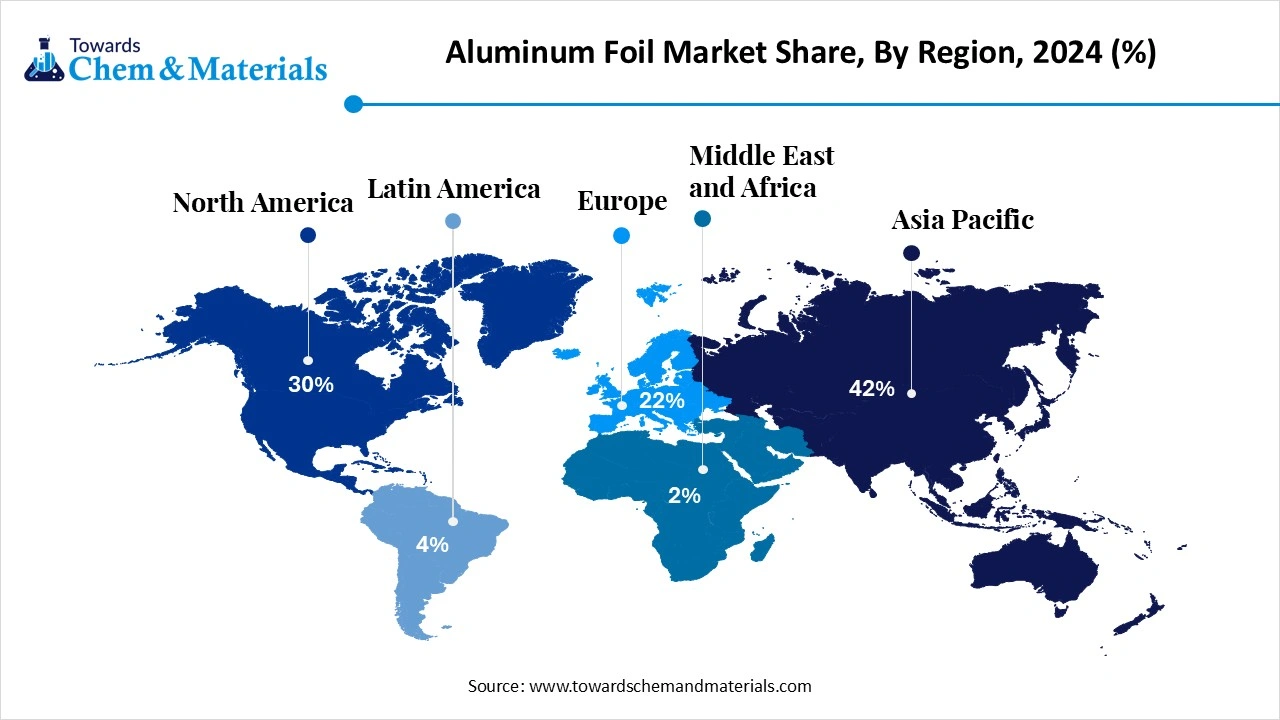

- By region, Asia Pacific dominated the market in 2024. The Asia-Pacific region held a 42% share in the market in 2024. The growth is driven by the increased demand from the packaging industry.

- By region, the Middle East & Africa are expected to have significant growth in the market in the forecast period. The growth is driven by the growing disposable income, which supports growth.

- By product type, the wrapper foil (packaging) segment dominated the market in 2024. The wrapper foil (packaging) segment held a 35% share in the market in 2024. The properties offered fuel the growth of the market.

- By product type, the blister foil (pharma demand) segment is expected to grow significantly in the market during the forecast period. Its excellent barrier properties influence the growth.

- By thickness, the 0.007 mm – 0.09 mm (packaging grade) segment dominated the market in 2024. The 0.007 mm – 0.09 mm (packaging grade) segment held a 55% share in the market in 2024. Increasing demand for sustainable and recyclable materials drives growth.

- By thickness, the >0.2 mm (EV & specialty industrial) segment is expected to grow in the forecast period. The expanding EV production fuels the demand for the market.

- By application, the food & beverage packaging segment dominated the market in 2024. The food & beverage packaging segment held a 45% share in the market in 2024. The expanding use of packaged food fuels the growth.

- By application, the electronics & energy (EV batteries) segment is expected to grow in the forecast period. The growing benefits offered propel the growth.

- By end use, the food & beverage segment dominated the market in 2024. The food & beverage segment held a 47% share in the market in 2024. The rising demand for safety and sustainable packaging increases the growth.

- By end use, the pharmaceuticals & healthcare segment is expected to grow in the forecast period. The expanding pharmaceutical industries fuel the growth of the market.

- By distribution channel, the direct sales to the converters segment dominated the market in 2024. The high-strength segment held a 60% share in the market in 2024. The demand from large-scale industry fuels the growth.

- By distribution channel, the online B2B platforms segment is expected to grow in the forecast period. The convenience offered drives the growth of the market.

Market Overview

Rising Demand For Durable Materials: Aluminum Foil Market To Expand

The aluminum foil market covers the production, conversion, and distribution of aluminum foil, a thin-rolled sheet made primarily from aluminum ingots. It is widely used for packaging, insulation, and industrial applications due to its lightweight, high barrier properties (against moisture, light, and gases), recyclability, and flexibility. Aluminum foil is used in food & beverage packaging, pharmaceuticals, household products, construction insulation, electronics, and industrial applications. Demand is driven by rising consumption of packaged food, pharmaceuticals, ready-to-eat meals, sustainable & recyclable packaging solutions, and increasing applications in EV batteries and electronics.

What Are The Key Growth Drivers That Support The Growth Of the Aluminum Foil Market?

The growth of the market is driven by the growing demand from the food packaging industry due to increased consumption of packaged food, enhanced food preservation, convenience, and portion control fuel the growth. The growing focus on sustainability due to rising environmental concerns fuels the growth of the market. The reduced plastic usage focus due to the increasing adoption of aluminium foil as a more sustainable alternative fuels the growth of the market. The other drivers that support growth are cost effectiveness, economic growth, E-commerce and food delivery, and pharmaceutical packaging due to sterility protection and barrier properties supporting growth and expansion of the market.

Market Trends

- The increased demand for convenient packaging makes it a preferred choice, which is a growing trend fueling the growth.

- The innovation in products with effective solutions, including recyclable and spouted pouch options, is a growing trend supporting growth.

- The growing E-commerce due to the expanding industry boosts the demand for the market.

- The sustainability efforts and advancements in recycling techniques drive the growth of the aluminum foil market.

Report Scope

| Report Attributes | Details |

| Market Size in 2025 | USD 30.84 Billion |

| Expected Size by 2034 | USD 48.46 Billion |

| Growth Rate from 2025 to 2034 | CAGR 5.15% |

| Base Year of Estimation | 2024 |

| Forecast Period | 2025 - 2034 |

| Dominant Region | Asia Pacific |

| Segment Covered | By Product Type, By Thickness, By Application, By End-Use Industry, By Distribution Channel, By Region |

| Key Companies Profiled | ACM Carcano, Amcor, Assan Aluminyum, Ess Dee Aluminium, Eurofoil, Hindalco Industries Limited, Huawei Aluminium, Laminazione Sottile, Shanghai Metal Corporation, UACJ Foil Corporation, Xiamen Xiashun Aluminium Foil Co., Ltd, Zhejiang Junma Aluminum Industry |

Market Opportunity

What Are The Key Growth Opportunities That Support The Growth Of The Aluminum Foil Market?

The key growth opportunities that support the growth of the market are the focus on innovation in the development of products to meet the market demands fuel the growth. The cost optimization, strategic partnerships, sustainable production, and expanding into emerging markets are the key opportunities that support and also fuel the growth and expansion of the market.

Market Challenge

What Are The Key Challenges That Hinder The Growth Of The Aluminum Foil Market?

The key challenge that hinders the growth of the market is the raw material price volatility, competition from alternatives, environmental concerns, recycling challenges, supply chain disruptions, and high production costs are the key challenges which hinders the growth and expansion of the market.

Regional Insights

How did Asia Pacific Dominate the Aluminum Foil Market in 2024?

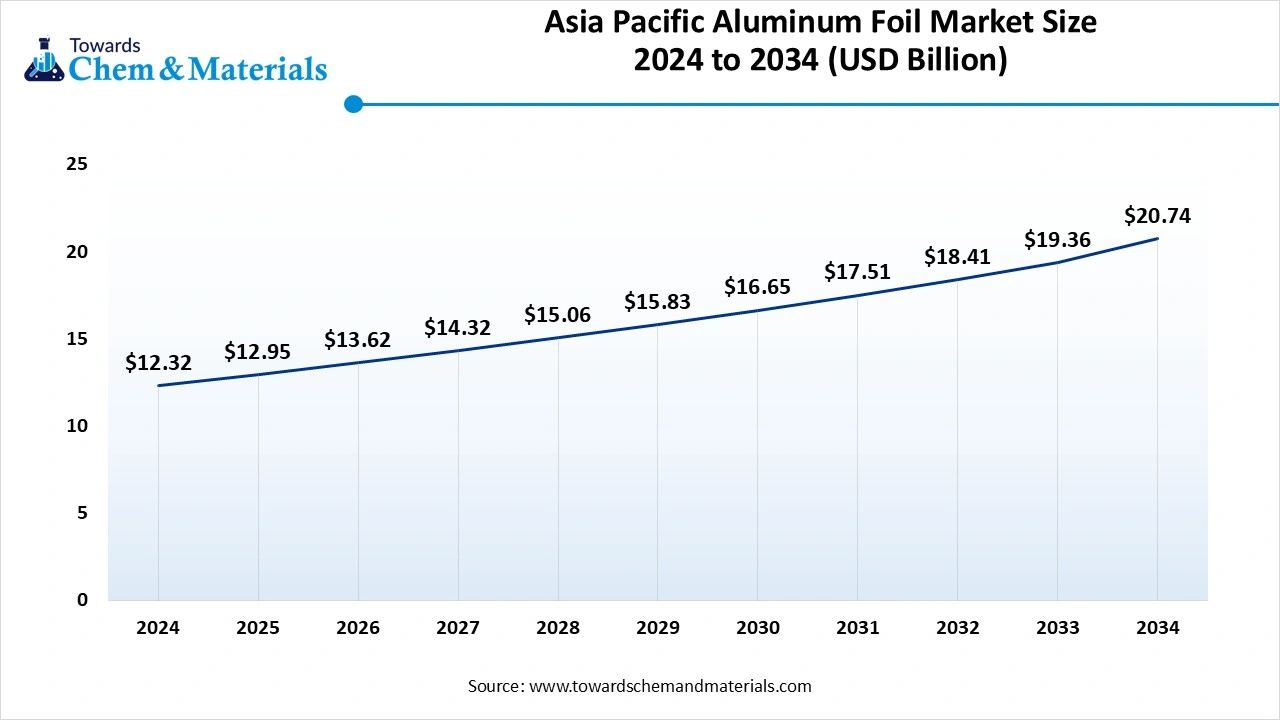

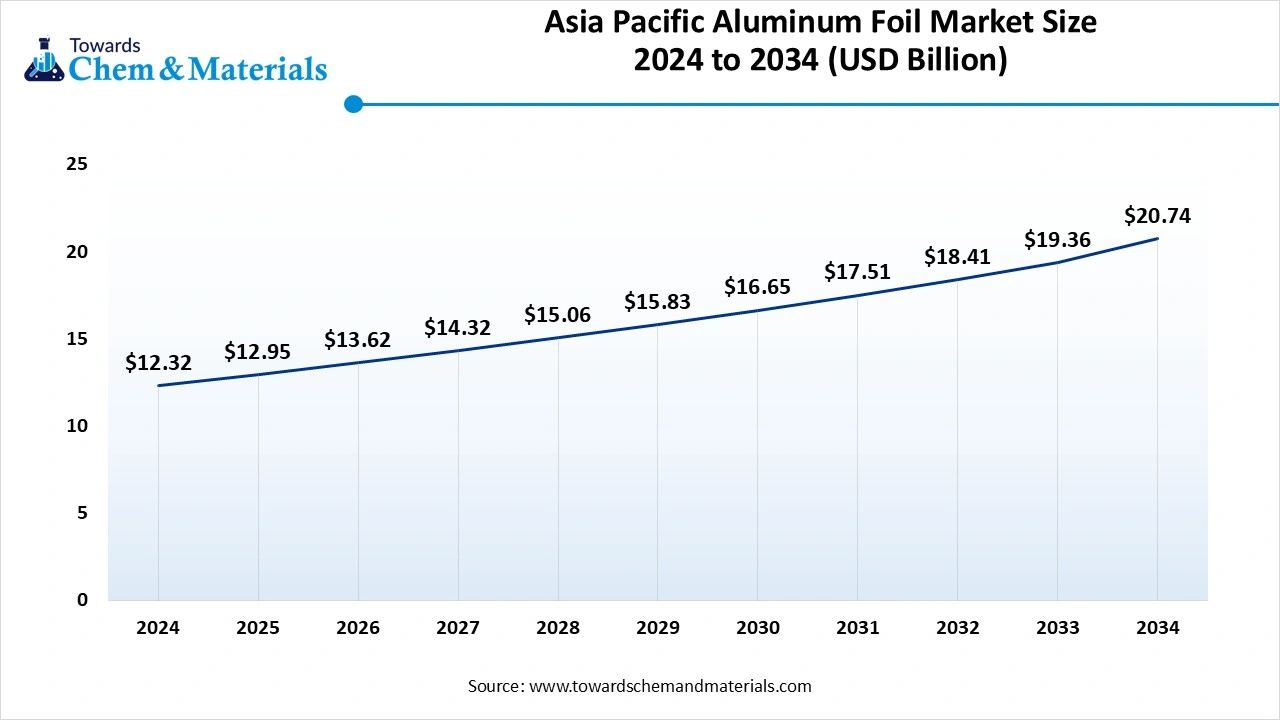

The Asia Pacific aluminum foil market size was estimated at USD 12.32 billion in 2024 and is anticipated to reach USD 20.74 billion by 2034, growing at a CAGR of 5.35% from 2025 to 2034. Asia Pacific dominated the aluminum foil market in 2024,

and the growth of the market is driven by the rapid urbanization and increasing demand for packaged foods from consumers, which increases the growth of the market. The growing demand from major industries like food and beverages, and the large and expanding pharmaceutical industry, is also a major contributor to the growth of the market in the region. The expanding automobile industry and use of EVs in the region increase the demand for Aluminum foil, which increases the rate of production, influencing the growth and expansion of the market.

China is Experiencing Growth Driven By the Increasing Focus on Sustainability

The growth of the market in China is driven by the growing focus of the government on sustainability due to growing environmental concerns, and rising adoption of advanced techniques, and a growing emphasis on sustainable practices are also contributing to the market growth of the country. The other key growth drivers that support the growth in China are the growing food and beverage industry, the pharmaceutical industry, and expanding e-commerce further support the growth and expansion of the market.

The Market in The Middle East And Africa is Experiencing Growth Driven by the Rising Disposable Income

The Middle East and Africa are experiencing significant growth in the market in the forecast period. The growth is driven by the growing demand for sustainable packaging, the expanding food and beverage industry, rising disposable incomes, versatility, preservation, and infrastructure development plans in the region, which further fuel the growth of the market.

Segmental Insights

Product Type Insights

Which Product Type Segment Dominated the Aluminum Foil Market in 2024?

The wrapper foil (packaging) segment dominated the market in 2024. Wrapper foil dominates aluminum foil usage due to its extensive role in flexible packaging, providing lightweight, durable, and barrier properties against moisture, oxygen, and contaminants. Widely used for confectionery, dairy, and ready-to-eat food, wrapper foil ensures longer shelf life and product safety. Increasing demand for sustainable and recyclable packaging materials is driving growth, with manufacturers focusing on thinner gauge foils to reduce material usage while maintaining performance.

The blister foil (pharma demand) segment expects significant growth in the aluminum foil market during the forecast period. Blister foil plays a crucial role in pharmaceutical packaging, ensuring product safety, extended shelf life, and tamper resistance for tablets and capsules. Its excellent barrier properties against light, oxygen, and moisture make it indispensable for regulated healthcare markets. Rising demand for safe and convenient medication packaging, coupled with growing pharmaceutical consumption, particularly in emerging economies, continues to drive blister foil demand, while recyclability initiatives are reshaping material innovation.

Thickness Insights

How Did The 0.0007mm-0.09mm (Packaging Grade) Segment Dominate The Aluminum Foil Market In 2024?

The 0.007 mm – 0.09 mm (packaging grade) segment dominated the market in 2024. Packaging-grade aluminum foil in the thickness range of 0.007mm–0.09mm is widely utilized in food, beverage, and household applications. Its flexibility, high barrier performance, and lightweight structure make it the preferred choice for wrapping, lamination, and container applications. The segment benefits from rising consumption of convenience foods, dairy products, and e-commerce-driven packaged goods. Innovation in ultra-thin foils and recyclable laminates further enhances the market outlook.

The >0.2 mm (EV & specialty industrial) segment expects significant growth in the market during the forecast period. Foils with thickness greater than 0.2mm are increasingly utilized in specialty industrial applications such as insulation, aerospace, and particularly in EV battery components. This segment is witnessing strong growth as electric mobility accelerates, with aluminum foils serving as current collectors and thermal management materials. High strength, conductivity, and corrosion resistance make this thickness range vital for advanced industrial solutions, positioning it as a critical growth area within the market.

Application Insights

Which Application Segment Dominated The Aluminum Foil Market In 2024?

The food & beverage packaging segment dominated the market in 2024. Food and beverage packaging represents the largest application for aluminum foil, owing to its protective properties, lightweight structure, and recyclability. Widely used in ready meals, snacks, confectionery, and dairy, foil ensures product preservation and convenience. The segment is driven by growing demand for packaged food, urbanization, and sustainability preferences, with innovations in foil laminates and eco-friendly coatings strengthening its role in the global packaging ecosystem.

The electronics & energy (EV batteries) segment expects significant growth in the aluminum foil market during the forecast period. Aluminum foil is emerging as a vital material in electronics and energy applications, particularly EV batteries and capacitors. It functions as a current collector in lithium-ion cells, ensuring high conductivity, thermal stability, and lightweight performance. With the rapid adoption of electric vehicles and renewable energy storage solutions, demand in this segment is accelerating. Manufacturers are focusing on high-purity foils and advanced processing technologies to meet stringent performance requirements.

End-Use Industry Insights

How Did The Food And Beverage Segment Dominate The Aluminum Foil Market In 2024?

The food and beverage segment dominated the market in 2024. The food and beverage industry remains the largest consumer of aluminum foil, leveraging its barrier properties for packaging perishable goods. From confectionery and bakery to dairy and beverages, foil extends product shelf life and ensures safety. Rising demand for convenience foods, frozen meals, and sustainable packaging is fueling growth. Recycling initiatives and lightweight packaging trends further enhance aluminum foil’s appeal in this sector.

The pharmaceuticals & healthcare segment expects significant growth in the aluminum foil market during the forecast period. Pharmaceutical and healthcare applications rely heavily on aluminum foil for packaging medicines, surgical instruments, and medical devices. Blister foils and strip packs are critical for protecting medicines from light, oxygen, and contamination, ensuring regulatory compliance. With rising global demand for pharmaceuticals, especially in aging populations and emerging markets, this segment is experiencing steady growth. Innovations in child-resistant and recyclable foils are shaping the future of this end use.

Distribution Channel Insights

Which Distribution Channel Segment Dominated The Aluminum Foil Market In 2024?

The direct sales to converters segment dominated the aluminum foil market in 2024. Direct sales to converters form a significant distribution channel, where large-scale buyers procure aluminum foil for lamination, printing, and customized packaging applications. This channel ensures cost efficiency, stable supply, and customization, making it a preferred route for food, pharma, and industrial sectors. Growing collaborations between foil producers and packaging converters are enhancing supply chain integration and ensuring quality consistency for diverse applications.

The online B2B platforms segment expects significant growth in the market during the forecast period. Online B2B platforms are gaining traction as a modern distribution channel for aluminum foil, particularly among small and medium buyers. These platforms provide ease of procurement, price transparency, and access to a wide range of foil grades. Increasing digitalization of the packaging supply chain and the need for flexible sourcing options are driving adoption. The channel supports cost-effective transactions and strengthens market accessibility across geographies.

Aluminum Foil Market Value Chain Analysis

Chemical Synthesis and Processing

The Aluminum foil is extracted and processed through a process called the Bayer process, smelting, and rolling.

- Key players: Al Bayader International (UAE), Hotpack Global (UAE), and HFA Packaging Solutions (Egypt)

Quality Testing and Certification

The Aluminum foil requires BIS ISI certification, which is offered by the Ministry of Commerce and Industry.

- Key players: Aluminium Stewardship Initiative (ASI)

Distribution to Industrial Users

The transparent plastics are distributed to the food and beverage, pharmaceutical, and manufacturing industries.

- Key players: Hindalco Industries, Ess Dee Aluminium Ltd, and Albraco

Recent Developments

- In March 2025, Cosmo Specialty Chemicals a leading company announced the launch of the product COSEAL-601 heat seal coating solution. The launch aims to offer consumers the best-in-class sealing, which offers high and superior resistance to water and oil.(Source: www.manufacturingtodayindia.com)

Aluminum Foil Market Top Companies

- ACM Carcano

- Amcor

- Assan Aluminyum

- Ess Dee Aluminium

- Eurofoil

- Hindalco Industries Limited

- Huawei Aluminium

- Laminazione Sottile

- Shanghai Metal Corporation

- UACJ Foil Corporation

- Xiamen Xiashun Aluminium Foil Co., Ltd

- Zhejiang Junma Aluminum Industry

Segments Covered

By Product Type

- Wrapper Foil

- Container Foil

- Blister Foil

- Foil Rolls (household, catering)

- Industrial Foil (HVAC, insulation, batteries)

By Thickness

- 0.007 mm – 0.09 mm (Packaging & Household)

- 0.09 mm – 0.2 mm (Containers & Industrial)

- 0.2 mm (Specialty Applications)

By Application

- Food & Beverage Packaging (dairy, bakery, confectionery, ready meals)

- Pharmaceuticals (blister packs, strip packs)

- Household Use (kitchen foil, wrapping)

- Industrial (HVAC insulation, construction, electronics, batteries)

- Tobacco Packaging

- Others (cosmetics, personal care, specialty uses)

By End-Use Industry

- Food & Beverage

- Pharmaceuticals & Healthcare

- Household & Consumer Goods

- Construction & Building Materials

- Electronics & Energy (EV batteries, capacitors)

- Tobacco Industry

By Distribution Channel

- Direct Sales to Converters & Manufacturers

- Packaging Distributors

- Retail (household foil rolls)

- Online B2B Platforms

By Region

- North America

- U.S.

- Canada

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Sweden

- Denmark

- Norway

- Asia Pacific

- China

- Japan

- India

- South Korea

- Thailand

- Latin America

- Brazil

- Mexico

- Argentina

- Middle East and Africa (MEA)

- South Africa

- UAE

- Saudi Arabia

- Kuwait