Content

What is the Current Aluminum Casting Market Size and Share?

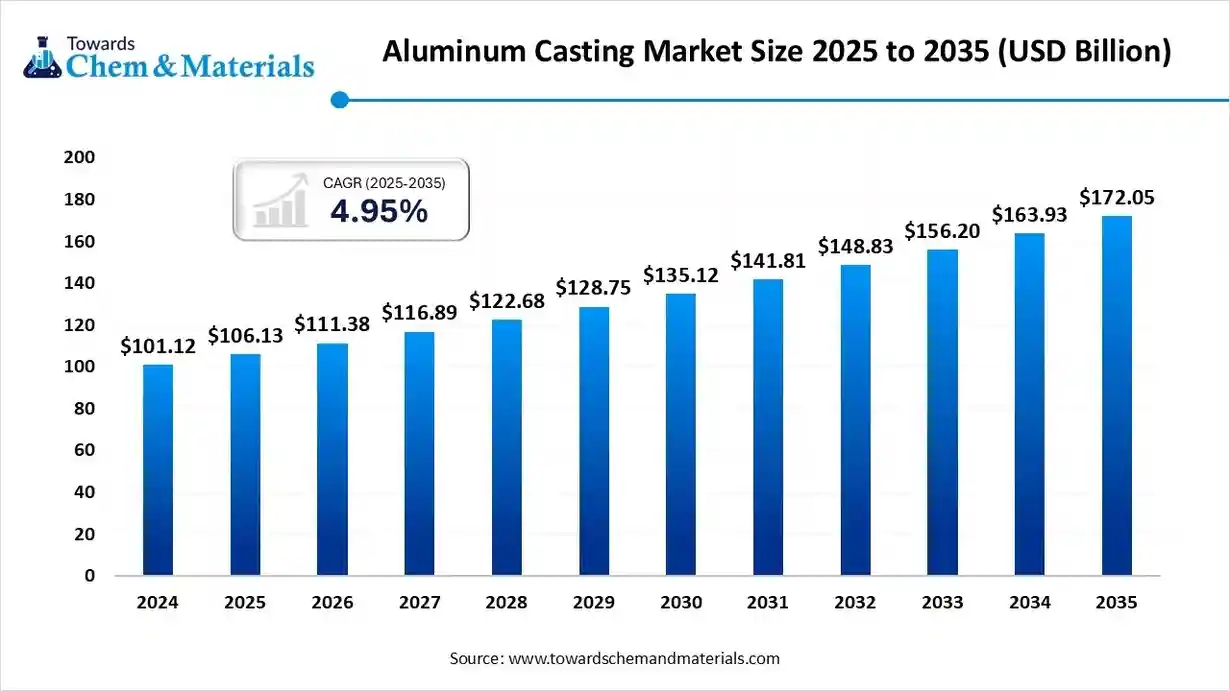

The global aluminum casting market size is calculated at USD 106.13 billion in 2025 and is predicted to increase from USD 111.38 billion in 2026 and is projected to reach around USD 172.05 billion by 2035, The market is expanding at a CAGR of 4.95% between 2025 and 2035. Asia Pacific dominated the aluminum casting market with a market share of 49% the global market in 2024. Growth in the aerospace and defence, construction, and industrial machinery sectors drives the market.

Key Takeaways

- By region, Asia Pacific dominated the market, accounting for 49% in 2024.

- By region, North America is expected to experience significant growth in the aluminum casting market over the forecast period.

- By process, the die casting segment dominated the market with a 55% share in 2024.

- By process, the investment casting segment is expected to grow significantly in the market during the forecast period.

- By end-use industry, the automotive segment dominated the market, accounting for 49% in 2024.

- By end-use industry, the aerospace segment is expected to grow at the highest CAGR in the forecast period.

- By alloy type, the aluminum-silicon (Al-Si) segment accounted for 43% of the market in 2024.

- By alloy type, the aluminum-zinc (Al-Zn) alloys segment is expected to grow in the forecast period.

- By application, the engine & powertrain components segment dominated the aluminum casting market, accounting for 38% in 2024.

- By application, the aerospace components segment is expected to grow in the forecast period.

- By casting material, the primary aluminum segment dominated the market with a share of 58% in 2024.

- By casting material, the recycled/secondary aluminum segment is expected to grow in the forecast period.

Market Overview

What Is the Significance of the Aluminum Casting Market?

The aluminum casting market refers to the manufacturing and supply of aluminum components produced by casting processes, including die casting, sand casting, and permanent mold casting. These methods involve pouring molten aluminum into a mold to form complex and lightweight parts with excellent mechanical properties, corrosion resistance, and thermal conductivity.

Aluminum castings are widely used across automotive, aerospace, industrial machinery, electronics, and construction industries due to their high strength-to-weight ratio, recyclability, and cost-effectiveness in mass production. Market growth is primarily driven by the global shift toward lightweighting in vehicles and aircraft, increasing use in electric vehicles (EVs), and rising investments in infrastructure and industry.

Aluminum Casting Market Outlook

- Industry Growth Overview: Between 2025 and 2030, the aluminum casting market is projected to expand steadily, driven by increasing demand from the automotive, aerospace, and construction sectors. Lightweighting trends, combined with the metal’s excellent strength-to-weight ratio and recyclability, are boosting its adoption in engine parts, structural components, and machinery.

- Sustainability Trends: Sustainability is shaping the market as manufacturers prioritise recycled aluminum and energy-efficient casting processes to reduce carbon emissions. Closed-loop recycling systems and the use of secondary aluminum are becoming standard industry practices. Companies are investing in cleaner melting furnaces, improved die lubricants, and digital process monitoring to enhance efficiency and minimise waste.

- Global Expansion & Innovation: Leading aluminum producers and foundries are expanding capacity and investing in technological advancements such as vacuum die casting, low-pressure casting, and additive-assisted mold design. Strategic partnerships between automakers and casting suppliers are driving innovation in lightweight and heat-resistant components.

Report Scope

| Report Attributes | Details |

| Market Size in 2026 | USD 111.38 Billion |

| Expected Size by 2035 | USD 172.05 Billion |

| Growth Rate from 2025 to 2035 | CAGR 4.95% |

| Base Year of Estimation | 2024 |

| Forecast Period | 2026 - 2035 |

| Leading Region | Asia Pacific |

| Fastest Growing Region | North America |

| Segment Covered | By Process, By End-Use Industry, By Alloy Type, By Application, By Casting Material, By Region |

| Key Companies Profiled | Ryobi Limited, Nemak S.A.B. de C.V., Dynacast International Inc., Endurance Technologies Ltd., Alcoa Corporation, Martinrea International Inc., Gibbs Die Casting Corp., Bharat Forge Ltd., Pace Industries LLC, Bühler AG, United Company RUSAL Plc |

Key Technological Shifts In The Aluminum Casting Market

Key technological shifts in the aluminum casting market include the integration of Industry 4.0 technologies, such as Artificial Intelligence and automation, to improve efficiency and precision; the use of advanced casting techniques, such as vacuum and high-pressure die casting; and the growing role of additive manufacturing and 3D printing for complex and customised designs. There is also a strong emphasis on sustainability, with increased use of recycled aluminum and the development of energy-efficient production methods.

Trade Analysis Of the Aluminum Casting Market: Import & Export Statistics

- According to Volza's India Export data, India exported 7,090 shipments of Aluminium Die Casting from Nov 2023 to Oct 2024 (TTM). These exports were made by 100 Indian Exporters to 276 Buyers, marking a 5% growth rate compared to the preceding 12 months.

- Most of the Aluminium Die Casting exports from India go to the United States, Germany, and Belgium.

- Globally, the top three exporters of Aluminium Die Casting are India, China, and Malaysia. India leads the world in Aluminium Die Casting exports, with 21,716 shipments, followed by China with 4,780 shipments, and Malaysia in third place with 1,949 shipments.(Source: www.volza.com)

- According to Volza's Global Export data, the World exported 8,491 shipments of Aluminium Die Casting from Jun 2024 to May 2025 (TTM). These exports were made by 336 Exporters to 552 Buyers

- Most of the Aluminium Die Casting exports from the World go to the United States, Germany, and India.

- Globally, the top three exporters of Aluminium Die Casting are India, China, and Malaysia. India leads the world in Aluminium Die Casting exports, with 21,465 shipments, followed by China with 3,958 shipments, and Malaysia in third place with 1,668 shipments.(Source: www.volza.com)

Aluminum Casting Market Value Chain Analysis

- Chemical Synthesis and Processing : Aluminum casting is carried out using processes such as die casting, sand casting, and investment casting, in which molten aluminum alloys (such as Al-Si, Al-Mg, and Al-Zn) are poured into molds to form complex shapes with high dimensional accuracy.

- Key players: Alcoa Corporation, Ryobi Ltd., Nemak S.A.B. de C.V., Dynacast International Inc., Endurance Technologies Ltd.

- Quality Testing and Certification : Cast aluminum components undergo testing for tensile strength, porosity, hardness, and microstructural integrity, in accordance with standards such as ISO 9001, ASTM B26, and NADCA specifications for casting quality.

Key players: ASTM International, SGS, TÜV SÜD, Intertek. - Distribution to Industrial Users : Aluminum castings are distributed to automotive, aerospace, construction, and industrial machinery sectors through OEM supply chains and component distributors.

- Key players: Alcoa Corporation, Nemak S.A.B. de C.V., Endurance Technologies Ltd., Ryobi Ltd.

Aluminum Casting Regulatory Landscape: Global Regulations

| Country / Region | Regulatory Body(s) | Key Regulations / Standards (High Level) | Focus Areas | Notable Notes |

| United States | EPA; OSHA; DOT; ASTM International; state environmental agencies | - Federal environmental laws (Clean Air Act, Clean Water Act) and state air/effluent permits - OSHA worker-safety & hazard-communication rules (HCS/GHS) - DOT hazmat rules for transport of molten metal/chemicals - ASTM specifications & test methods for aluminum alloys and castings; industry-specific standards (automotive, aerospace) | - Emissions (particulates, metal fume, VOCs from coatings) - Worker protection (heat, silica, metal dust, fumes) - Material/specification compliance for end-use sectors | State/local air permit requirements (e.g., for foundry stacks, fume control) can add significant permitting steps. Aerospace/automotive customers require specific material and traceability standards (e.g., NADCAP/GMP/IATF, where relevant). |

| European Union | European Commission / ECHA; CEN/CENELEC; National environment & labour agencies | - REACH / CLP for chemical substances (alloys, fluxes, surface treatments) - Industrial Emissions and national transpositions (emissions & BAT for metal processing) - EN and ISO standards for casting, testing, and quality management (ISO 9001; sectoral standards) | - Chemical registration & restrictions (impurities, alloying elements) - Emissions & waste management (slag, spent flux) - Product conformity & supply-chain traceability | REACH obligations apply to alloys and additives; foundries often need to track SVHCs in materials. EU Emissions / BAT decisions influence foundry abatement technology (fume capture, filtration). |

| India | MoEFCC / CPCB / State Pollution Control Boards; BIS | - Environmental permits and effluent/air norms for foundries - BIS standards for metal products and testing procedures - Draft/ongoing chemical management rules impacting additives | - Zoning & pollution control for clusters (common effluent treatment) - Worker safety & chemical handling - Compliance for export customers (EU/US) | Foundry clusters often require the installation of common effluent or fume treatment units. BIS and buyer specifications drive quality testing. |

| Brazil / Latin America | IBAMA / National Standards bodies (ABNT) | - National environmental rules for emissions & effluent - ABNT standards for testing and product conformity | - Emissions control and hazardous waste management - Local content & certification for some public procurements | Regulatory stringency varies; exporters must meet end-customer (EU/US/Japan) specifications in addition to national rules. |

| Australia / New Zealand | Federal & State environment agencies; Standards Australia (AS/NZS) | - Environmental permitting; workplace safety laws; national standards for materials & testing | - Occupational safety and environmental compliance - Import compliance for materials and chemicals | Smaller market but strong alignment with international standards and a strong emphasis on workplace safety. |

Segmental Insights

Process Insights

Which Process Segment Dominated The Aluminum Casting Market In 2024?

- The die casting segment dominated the aluminum casting market, accounting for 55% in 2024. Die casting is the most widely used aluminum casting process, offering superior dimensional accuracy, smooth surface finish, and high production efficiency. It is commonly used in the automotive sector to produce complex components such as engine blocks, housings, and transmission cases.

- The investment casting segment expects significant growth in the aluminum casting market during the forecast period. Investment casting delivers intricate detail and tight tolerances, making it suitable for critical aerospace, defence, and industrial applications. It enables manufacturers to produce lightweight yet durable parts ideal for high-performance environments.

- The sand casting segment has seen notable growth in the aluminum casting market. Sand casting remains the most flexible and cost-effective technique for large and low-volume parts. It is extensively utilised in heavy equipment, engine parts, and industrial machinery manufacturing.

End-Use Industry Insights

Why Did the Automotive Segment Dominate the Aluminum Casting Market in 2024?

- The automotive segment dominated the aluminum casting market, accounting for 49% in 2024. The automotive sector dominates the aluminum casting market due to demand for lightweight materials to improve vehicle efficiency. Components like cylinder heads, brackets, and wheels are major applications benefiting from aluminum’s strength-to-weight advantage.

- The aerospace segment is set to grow at the fastest CAGR in the aluminum casting market during the forecast period. Aerospace manufacturers employ aluminum castings for airframe structures, turbine blades, and landing gear assemblies. Their excellent mechanical properties and corrosion resistance enhance performance and reduce aircraft weight.

- The construction segment has seen notable growth in the aluminum casting market. In construction, aluminum casting is used for building facades, structural fittings, and electrical components. Its corrosion resistance and recyclability support sustainable infrastructure development.

Alloy Type Insights

Which Alloy Type Segment Dominated The Aluminum Casting Market In 2024?

- The aluminum-silicon (Al-Si) alloys segment dominated the aluminum casting market, accounting for 43% in 2024. These alloys are known for excellent fluidity, wear resistance, and low thermal expansion. They are widely used in automotive engine components and in industrial parts that require strength and machinability.

- The aluminum-zinc (Al-Zn) alloys segment is expected to see significant growth in the aluminum casting market during the forecast period. These alloys provide superior hardness, strength, and finishing characteristics. They find applications in aerospace components and in heavy-duty machinery that require high performance under pressure.

- The aluminum-magnesium (Al-Mg) alloys segment has seen notable growth in the aluminum casting market. Lightweight and corrosion-resistant, aluminum-magnesium alloys are preferred in transportation and aerospace applications. Their ductility makes them suitable for complex structural components.

Application Insights

How Did the Engine and Powertrain Components Segment Dominate the Aluminum Casting Market in 2024?

- The engine & powertrain components segment dominated the aluminum casting market, accounting for 38% in 2024. Aluminum casting plays a crucial role in the production of engine blocks, pistons, and gear housings. The lightweight nature of aluminum improves fuel efficiency and reduces emissions.

- The aerospace components segment expects significant growth in the aluminum casting market during the forecast period. Aluminum castings are used in the manufacture of airframe parts and turbine housings, ensuring strength, precision, and reliability. These components are key to improving aircraft performance and durability.

- The structural components segment has seen notable growth in the aluminum casting market. In both construction and automotive sectors, aluminum structural parts provide rigidity and long-term corrosion resistance. Their adaptability makes them suitable for a wide range of mechanical applications.

Casting Material Insights

Which Casting Material Segment Dominated The Aluminum Casting Market In 2024?

- The primary Aluminum segment dominated the aluminum casting market, accounting for 58% in 2024. Primary aluminum casting utilises virgin aluminum to produce premium-grade products that require purity, consistency, and structural reliability, primarily in aerospace and electronics.

- The recycled/secondary aluminum segment expects significant growth in the aluminum casting market during the forecast period. Recycled/secondary aluminum plays a crucial role in sustainable manufacturing, offering lower energy consumption and reduced carbon footprint. It is widely used in the automotive and construction sectors for mass-market components, aligning with circular-economy principles and cost-efficiency goals.

Regional Analysis

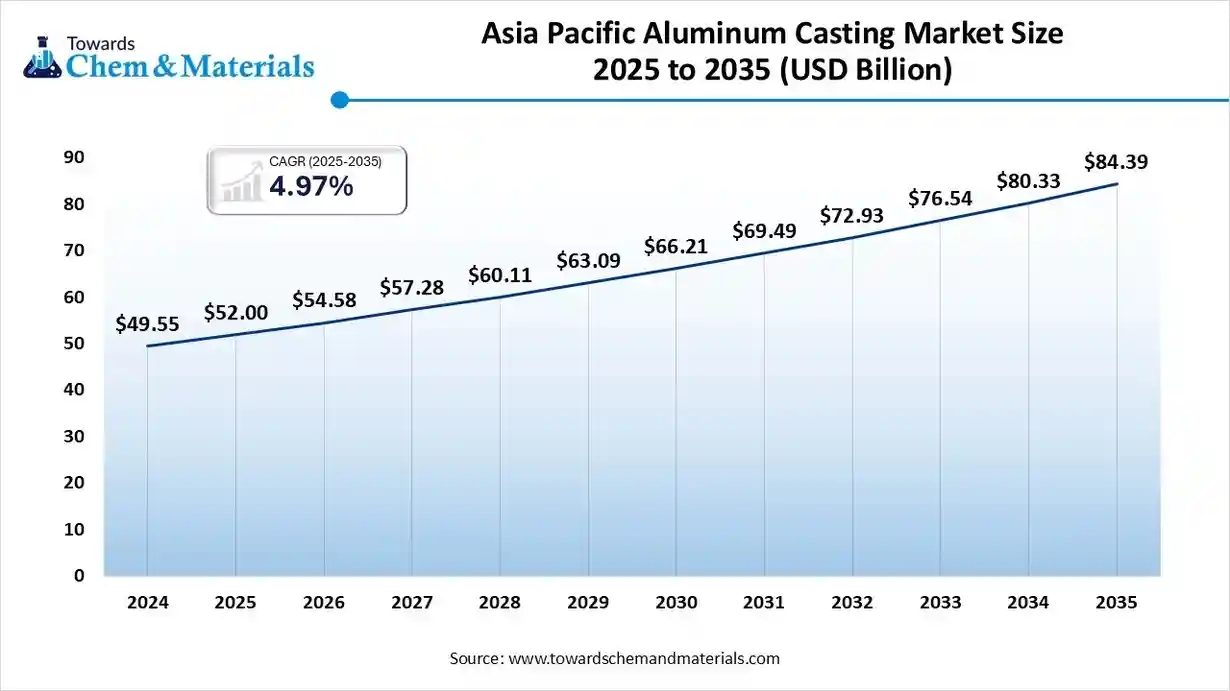

The Asia Pacific aluminum casting market size was valued at USD 52.00 billion in 2025 and is expected to reach USD 84.39 billion by 2035, growing at a CAGR of 4.97% from 2025 to 2035. Asia Pacific dominates the Aluminum casting market, accounting for 49% in 2024.

The Asia Pacific region dominates the global aluminum casting market, driven by rapid industrialisation, strong automotive production, and infrastructure investments. Demand for lightweight vehicles and electric mobility drives growth. Technological advancements in die-casting and recycling further enhance regional competitiveness, supported by government initiatives promoting sustainable materials.

China Has Seen Growth In The Market, Driven By The Growing Demand

China is the largest aluminum casting producer globally, with strong integration across mining, refining, and manufacturing. The country’s dominance stems from its massive automotive production base, cost-effective labour, and supportive industrial policies. Growth in electric vehicles and renewable energy equipment significantly boosts aluminum casting demand.

North America Has Seen Growth In The Market Driven By The Innovative Approach

North America is expected to experience significant market growth in the forecast period. North America exhibits strong aluminum casting demand, driven by automotive innovation and aerospace development. Increased adoption of lightweight materials and advances in automation enhance regional production efficiency. The market benefits from high recycling rates and regulatory support for sustainable manufacturing.

The US Market Is Driven By The Growing Manufacturing Hub

The U.S. is the leading market within North America, driven by robust automotive and aerospace manufacturing. Technological advancements in precision die-casting and a focus on EV manufacturing continue to propel the market. Investment in sustainable foundries also contributes to long-term industry resilience.

What Are the Market Trends in the European Aluminum Casting Market?

Europe remains a major hub for advanced aluminum casting technologies. The region’s stringent emission regulations and commitment to circular economy practices encourage the use of lightweight, recyclable materials. Automotive electrification and aerospace innovation continue to drive growth.

Germany's Market Growth Is Driven By The Strong Research And Development In The Country

Germany leads Europe’s aluminum casting market, supported by strong automotive OEMs and engineering firms. Its focus on high-precision, low-emission casting techniques aligns with sustainability and performance goals. Continuous R&D in lightweight metal design keeps Germany at the forefront of global casting innovation.

South America Aluminum Casting Market Growth Analysis

The South American market is gradually expanding, driven by the recovery of automotive production and public infrastructure projects. The abundance of natural resources supports local aluminum production.

Brazil's Market Has Seen Growth In The Aluminum Casting Due To Growing Sectors

Brazil’s aluminum casting industry benefits from bauxite availability and renewable hydropower. Growth in the automotive and construction sectors, along with government incentives for industrial modernisation, strengthens domestic demand and export potential.

Aluminum Casting Market Share, By Region, 2024 (%)

| Regional | Revenue Share |

| North America | 27% |

| Europe | 14% |

| Asia Pacific | 49% |

| Latin America | 6% |

| Middle East and Africa | 4% |

Middle East & Africa Have Seen Growth in the Aluminum Casting Market, Driven by

Increased Investments : MEA’s aluminum casting market is developing due to increased investment in downstream industries and energy infrastructure. The availability of inexpensive energy supports competitive manufacturing.

GCC Countries' Aluminum Casting Market Growth Trends

GCC nations, particularly the UAE and Saudi Arabia, are enhancing their aluminum value chain by establishing downstream casting and processing units. Industrial diversification programs under Vision 2030 and infrastructure development continue to fuel aluminum casting applications in transport and construction.

Recent Developments

- In February 2025, Obeikan Glass launched commercial operations at its new aluminum casting foundry in Al-Madina Al-Monawara Industrial City, Saudi Arabia. The facility, a subsidiary where Obeikan Glass holds a 60% stake, began commercial operations(Source: www.foundry-planet.com)

- In October 2025, Golden Aluminum launched its NEXCAST line in Fort Lupton, Colorado, introducing a continuous casting system for high-alloy strip casting. The technology converts molten aluminum directly into coils, reducing steps and lowering the carbon footprint compared to traditional methods.(Source: www.alcircle.com)

Top players in the Aluminum Casting Market & Their Offerings:

- Ryobi Limited – Ryobi Limited is a leading Japanese manufacturer of high-pressure aluminum die-cast components, primarily serving the automotive, construction, and electronics sectors. The company specializes in lightweight structural parts, such as engine blocks, transmission cases, and chassis components, and focuses on energy efficiency, precision, and recyclability in production.

- Nemak S.A.B. de C.V. – Nemak, based in Mexico, is a global leader in aluminum casting and structural component manufacturing for the automotive industry. The company produces engine heads, blocks, and electric vehicle (EV) components, emphasizing lightweighting, sustainability, and advanced die-casting technologies for improved vehicle efficiency.

- Dynacast International Inc. – Dynacast manufactures precision die-cast components using aluminum, zinc, and magnesium alloys. Its multi-slide die-casting process enables the production of high-volume, complex parts for automotive, industrial, and electronics applications, with a focus on tight tolerances and efficient production.

- Endurance Technologies Ltd. – Endurance Technologies, based in India, specializes in aluminum die-cast and machining components for two- and four-wheeler OEMs. Its product range includes engine covers, crankcases, and transmission housings, integrating high-pressure die-casting with in-house finishing and testing capabilities.

- Alcoa Corporation – Alcoa is a global pioneer in aluminum production and casting technologies, offering foundry alloys, billet casting, and precision cast components for industrial, aerospace, and automotive applications. The company focuses on sustainability and closed-loop recycling, driving advancements in low-carbon aluminum casting.

- Martinrea International Inc. – Martinrea produces lightweight aluminum components through advanced casting and extrusion processes. The company’s aluminum offerings target vehicle body structures, powertrains, and chassis systems, helping OEMs achieve emission-reduction and performance goals.

- Gibbs Die Casting Corp. – Gibbs Die Casting specializes in high-pressure and squeeze aluminum die-casting for automotive and industrial applications. The company integrates design, machining, and finishing services, focusing on structural integrity, dimensional accuracy, and cost efficiency.

- Bharat Forge Ltd. – Bharat Forge, an Indian multinational, operates in forging and aluminum casting for the automotive, defense, and energy sectors. The company is expanding into lightweight aluminum cast components to support EV and hybrid vehicle platforms, emphasizing innovation and sustainability.

- Pace Industries LLC – Pace Industries is one of North America’s largest die-casting manufacturers, producing custom aluminum, magnesium, and zinc castings for automotive, lighting, and consumer applications. The company offers value-added solutions, including design, machining, and assembly for high-precision parts.

- Bühler AG – Bühler is a global technology leader providing die-casting machinery and process automation systems for aluminum foundries. Its Carat and Ecoline series enable energy-efficient, high-speed casting with enhanced metal flow control, supporting major automotive and industrial suppliers.

- United Company RUSAL Plc – RUSAL is one of the world’s largest aluminum producers, offering primary and secondary aluminum casting products, including alloys, slabs, and billets. The company supplies automotive and aerospace sectors with low-carbon aluminum produced using hydropower and advanced recycling processes.

Segments Covered:

By Process

- Die Casting

- High-Pressure Die Casting (HPDC)

- Low-Pressure Die Casting (LPDC)

- Sand Casting

- Permanent Mold Casting

- Investment Casting

- Gravity Die Casting

- Others (Vacuum Die Casting, Centrifugal Casting, etc.)

By End-Use Industry

- Automotive

- Powertrain Components (Engine Blocks, Cylinder Heads)

- Wheels, Housings, Brackets

- EV Components (Battery Housings, Motor Housings)

- Aerospace

- Industrial Machinery

- Construction

- Electrical & Electronics

- Marine & Defense

- Others (Consumer Goods, Energy Sector)

By Alloy Type

- Aluminum-Silicon (Al-Si) Alloys

- Aluminum-Copper (Al-Cu) Alloys

- Aluminum-Magnesium (Al-Mg) Alloys

- Aluminum-Zinc (Al-Zn) Alloys

- Others (Customised High-Performance Alloys)

By Application

- Engine & Powertrain Components

- Structural Components

- Body & Chassis Parts

- Electrical & Electronic Enclosures

- Aerospace Components

- Industrial and Machinery Components

- Decorative & Architectural Parts

By Casting Material

- Primary Aluminum

- Recycled / Secondary Aluminum

By Region

- North America

- U.S.

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Asia Pacific

- China

- India

- Japan

- South Korea

- Latin America

- Brazil

- Argentina

- Middle East & Africa

- Saudi Arabia

- South Africa