Content

What is the Current Aluminum Extrusion Market Size and share?

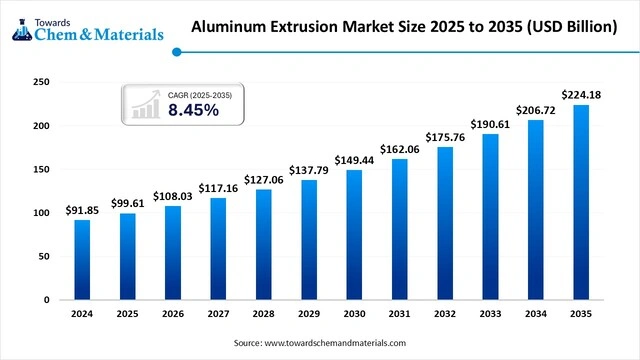

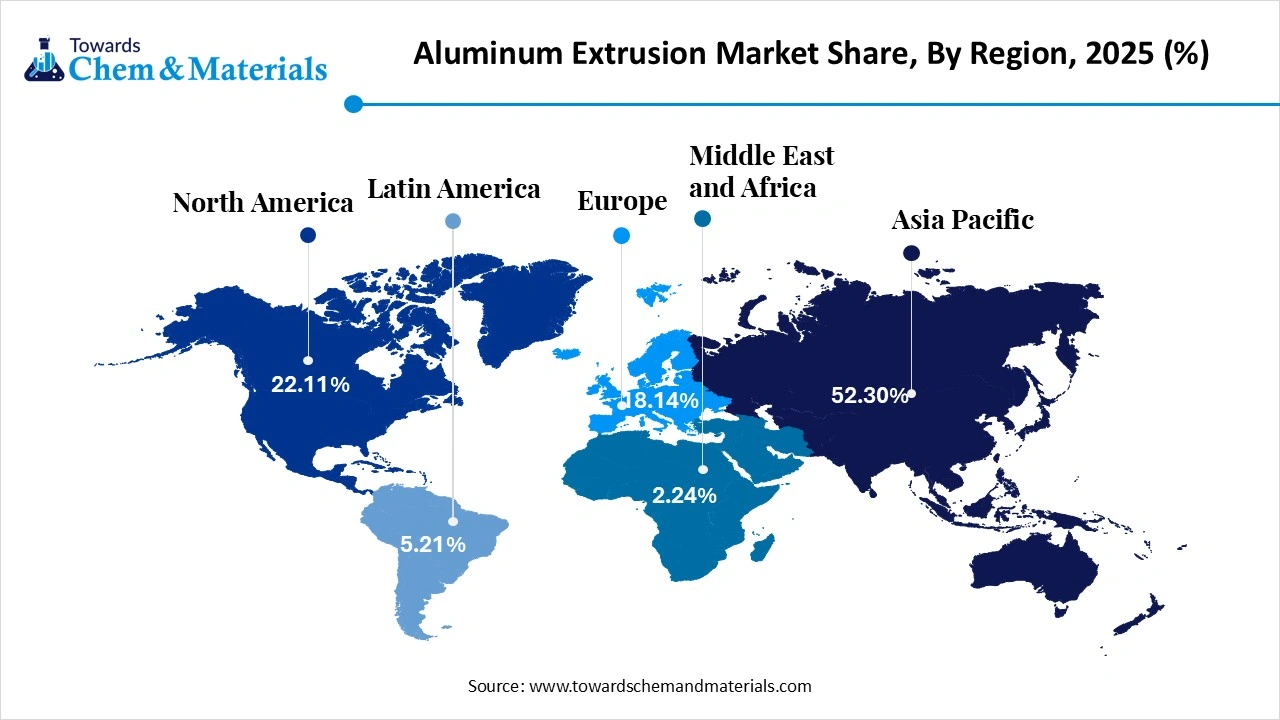

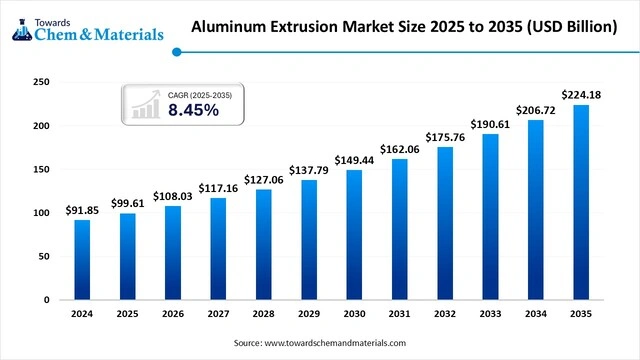

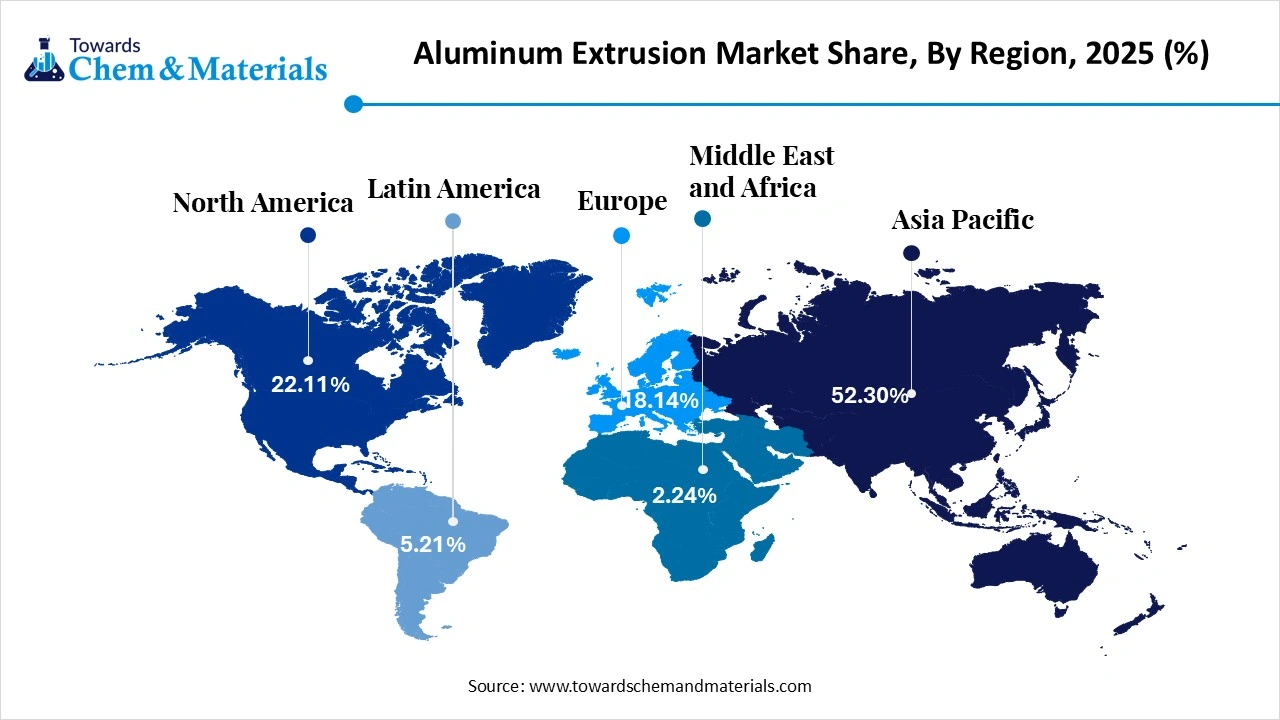

The global aluminum extrusion market size is calculated at USD 99.61 billion in 2025 and is expected to hit around USD 224.18 billion by 2035 from USD 108.03 billion in 2026, growing at a CAGR of 8.45% from 2025 to 2035. Asia Pacific dominated the aluminum extrusion market with the largest revenue share of 52.30% in 2025. The growing construction activities and increasing need for lightweight vehicle materials drive the market growth.

Key Takeaways

- The global aluminum extrusion market was valued at USD 99.61 billion in 2025.

- The is estimated to reach around USD 108.03 billion in 2026.

- The market is projected to grow to approximately USD 224.18 billion by 2035.

- This reflects a compound annual growth rate (CAGR) of about 8.45% during 2026-2035.

- Key aluminum extrusion top Company Alupco; Arconic Corp.; Bahrain Aluminum Extrusion Company; Constellium N.V.; Gulf Extrusions Co. LLC; Hindalco Industries Ltd.; Kaiser Aluminum; Norsk Hydro ASA; QALEX

- Asia Pacific dominated the aluminum extrusion market with a revenue share of 52.30% in 2025.

- By product type, the shapes segment led the market and accounted for 64.40% of the global revenue share in 2025.

- By alloy type, the 6000 series segment accounted for the largest revenue share of 42.30% in 2025.

- By alloy type strength, the soft alloys segment dominated with the largest revenue share of 68.50% in 2025.

- By end-use industry, the construction segment accounted for the largest market revenue share of 48.50% in 2025.

- By process type, the hot extrusion segment accounted for the largest share of 70.30% in 2025.

Forces Powering Aluminum Extrusion Industry Growth

The aluminum extrusion market is growing, driven by the rise in electric vehicles, the expansion of renewable energy resources, the increased manufacturing of machinery, the development of energy-efficient construction projects, and innovations in extrusion processes. These factors are increasing demand for lightweight, durable, and easily formed aluminum components used across automotive frames, solar panel structures, industrial equipment, and modern building systems.

Electric vehicle manufacturers rely heavily on extruded aluminum for battery housings, structural reinforcements, and lightweight body parts that improve efficiency and performance. Renewable energy projects, including solar and wind installations, also use aluminum extrusions for mounting systems, support frames, and electrical infrastructure. At the same time, construction companies continue to adopt aluminum for efficient window systems, curtain walls, and thermally efficient building materials.

What is Aluminum Extrusion?

The aluminum extrusion process is a multi-step process used to create diverse aluminum products and profiles. It involves heating aluminum billets and forcing them through a shaped die to form continuous lengths of material with uniform cross sections. This method allows manufacturers to achieve high precision and tailor products to specific design and performance requirements.

The process develops hollow, solid, and semi-hollow aluminum products. These different profile types support a wide range of structural and functional applications, from lightweight frameworks to heat-dissipating components. Their versatility makes extrusion suitable for both simple and highly complex shapes.

Aluminum extrusion is widely used in applications like automotive, furniture, construction, electronics, and aerospace. Industries choose extruded aluminum for its strength, corrosion resistance, and low weight, making it ideal for vehicles, building systems, machinery, and high-performance equipment. As demand grows across these sectors, extrusion remains an essential part of modern manufacturing.

Current Trends in Aluminum Extrusion ?

- Industry Growth Overview: Between 2025 and 2034, the aluminum extrusion industry is expected to experience accelerated growth, particularly in high-margin sectors such as construction, electronics and automotive. The increasing adoption of electric vehicles is expanding demand for lightweight structural components, battery housings and thermal management solutions made from extruded aluminum. The shift toward sustainable building materials in residential and commercial projects across the Asia Pacific, Europe and North America is also strengthening demand. Continuous improvements in extrusion technology and alloy development are enabling manufacturers to supply high-precision profiles for advanced engineering applications.

- Sustainability Trends: Sustainability is reshaping the aluminum extrusion landscape as industries prioritise energy-efficient materials, low-carbon manufacturing and circular economy practices. There is a growing demand for extruded products made using closed-loop recycling systems, which help reduce emissions and conserve resources. Manufacturers are also increasing the use of renewable energy sources to power extrusion facilities. For instance, Jindal Aluminum Limited has integrated solar and wind power to support its production operations. Further improvements in billet preheating efficiency, furnace optimization and scrap recovery are helping companies minimize environmental impact and enhance overall operational performance.

- Global Expansion: Global expansion is driven by strategic acquisitions, capacity increases and new production facilities across North America, Europe and Asia Pacific. Major producers are strengthening their international presence to serve growing demand from automotive, building and industrial machinery sectors. Partnerships with regional distributors and downstream processors are helping companies tailor extrusions to local standards and industry-specific applications. For example, Norks Hydro ASA recently opened a new aluminum recycling plant in Michigan, United States, to support the North American market with high-recycled-content extrusions and improved supply-chain resilience.

- Major Investors: Major investors in the aluminum extrusion market include leading global producers such as Hindalco Industries Limited, Alcoa Corporation, Norks Hydro ASA, and Castellum N.V. These companies are investing in modern extrusion presses, upgraded die technologies, automation, and high-speed finishing lines to improve precision and output. Investors are also focusing on technologies that enhance scrap utilization, increase recycled content and support the production of specialty extrusions for electric vehicles, renewable energy systems and aerospace components. Strategic capital is being directed toward regional expansions and sustainability-focused process improvements.

- Startup Ecosystem: The startup ecosystem in aluminum extrusion is gaining momentum as new companies enter the market with innovative design solutions, simulation-based extrusion modelling and custom prototyping services. Startups are leveraging lightweight design tools, rapid die development and digital manufacturing platforms to offer customized and small-batch extrusions for niche applications. Some new entrants are also working on advanced thermal management profiles, recycled-aluminum product lines and integrated downstream fabrication capabilities. Their agility and focus on technology-driven solutions are supporting faster innovation and complementing the capabilities of large established producers.

Market Report Scope

| Report Attribute | Details |

| The market size value in 2026 | USD 108.03 billion |

| The revenue forecast in 2035 | USD 224.18 billion |

| Growth rate | CAGR of 8.45% from 2026 to 2035 |

| Forecast period | 2026 - 2035 |

| Base Year | 2025 |

| Dominant Region | Asia Pacific |

| Fastest Growing Region | North America |

| Quantitative units | Volume in kilotons; revenue in USD million/billion, and CAGR from 2025 to 2035 |

| Segments covered | Product Type, Alloy Type, Alloy Type Strength, End-use Industry, Process Type, By Region |

| Key companies profiled | Alupco; Arconic Corp.; Bahrain Aluminum Extrusion Company; Constellium N.V.; Gulf Extrusions Co. LLC; Hindalco Industries Ltd.; Kaiser Aluminum; Norsk Hydro ASA; QALEX |

Key Technological Shifts in the Aluminum Extrusion Market:

The aluminum extrusion market is undergoing key technological advancements driven by the demand for efficient production, a smaller environmental footprint, and high-quality products. These improvements help manufacturers reduce energy consumption, increase throughput, and produce more consistent extruded profiles for various industrial applications. As industries push for greater sustainability and operational efficiency, extrusion facilities are adopting smarter and more automated systems.

One of the most significant transformations is the use of smart extrusion systems, which enable in-line quality control and optimize production schedules. These systems allow real-time monitoring of extrusion performance and help identify quality issues early in the process. By integrating digital tools and automated controls, manufacturers can improve precision while reducing downtime.

The smart extrusion system manages billet handling and reduces manual labor. Automated billet loading, positioning, and feeding help streamline operations and minimize human error, improving safety and overall production consistency. These improvements support higher output and more stable extrusion cycles.

- For instance, the Banco Aluminum Limited uses advanced processes for manufacturing, surface treatment, die design, and fabrication.

Trade Analysis of the Aluminum Extrusion Market: Import & Export Statistics

Vietnam exported 36722 shipments of aluminum extrusion. The high export volume reflects Vietnam’s strong position as a competitive manufacturing base for aluminum products, supported by rising industrial capacity and access to regional trade networks. The country continues to expand its extrusion capabilities to meet demand from the global automotive, construction, and electronics industries.(Source: https://www.volza.com)

The United Arab Emirates exported 374 shipments of aluminum extrusion products. These exports demonstrate the UAE’s growing role in the aluminum sector, supported by advanced smelters and industrial parks. The country’s strategic location helps facilitate trade across the Middle East, Europe, and Asia (Source: https://www.volza.com)

Vietnam exported 2827 shipments of aluminum extrusion profiles. This steady flow of extrusion profile shipments highlights the country’s increasing specialization in customized aluminum products. These profiles are widely used in machinery, furniture, construction frameworks, and industrial equipment. (Source: https://www.volza.com)

China exported 13956 shipments of aluminum rods. The country’s large output reflects its massive aluminum production infrastructure and strong global supply chains. Aluminum rods are essential for manufacturing, electrical applications, and mechanical components, supporting high export demand. China exported 2462 shipments of aluminum pipes. These products serve diverse industrial uses including HVAC systems, automotive components, and fluid-handling equipment. China’s exports reflect its ability to supply large volumes with consistent quality. These tubes are widely used in transportation, aerospace, construction, and general engineering applications. (Source: https://www.volza.com)

Vietnam exported 34155 shipments of aluminum bars. The significant number of shipments illustrates Vietnam’s growing capacity to produce semi-finished aluminum products. Aluminum bars are used in forging, machining, and structural applications across multiple industries. (Source: https://www.volza.com)

Aluminum Extrusion Market Value Chain Analysis

1. Feedstock Procurement

Feedstock procurement involves sourcing raw materials such as aluminum logs or aluminum billets. These inputs form the backbone of the extrusion process, as the quality and purity of the billets directly influence the strength, finish, and consistency of the final extruded profiles. Reliable procurement ensures steady production flow and helps manufacturers meet high-volume industrial requirements.

- Key Players: Hindalco Industries Limited, Rio Tinto Aluminum, Norsk Hydro ASA, Alcoa Corporation.

2. Chemical Synthesis and Processing

Chemical synthesis and processing involve steps like bauxite refining, smelting, lubrication, quenching, heat treatment, and surface finishing. These stages prepare the material for extrusion and enhance its mechanical performance, corrosion resistance, and surface quality. Each process step ensures that the aluminum achieves the right composition and structural properties needed for applications across automotive, construction, and industrial sectors.

- Key Players: Kemira Oyj, Aditya Birla Chemicals, Grauer and Weil Limited, BASF SE, Huber Engineered Materials.

3. Quality Testing and Certifications

Quality testing evaluates properties such as tensile strength, hardness, dimensions, and functional defects, and certifications include BIS, ISO 14001, ISO 9001, and IATF 16949. These assessments ensure that extruded products meet both national and international standards, supporting reliable performance in safety-critical and high-load applications. Strict certification processes help manufacturers maintain credibility and supply high-quality extrusions to global markets.

- Key Players: Element Materials Technology, Intertek, WINTECH, SGS.

Step-by-Step Process for Manufacturing Aluminum Extrusion

| Steps | Description | Equipment Used |

| Die & Billet Preparation | The process ensures shaping tool and raw material are in working condition for a successful manufacturing process. | Furnace, Oven |

| Heating | The process of heating a billet to approximately 400-500 °C to make it malleable & soft. | Furnace |

| Extrusion | The process of transferring a heated billet into a powerful hydraulic press. | Hydraulic Extrusion Press Container |

| Cooling | The processing of cooling billet with air or water. | The processing of cooling billet with air or water. |

| Straightening & Cutting | The straightening process uses a stretcher to remove a twist that occurs during extrusion, and cutting is used to cut a long profile to the desired height. | Cutting Machine Straightening Machine |

| Aging | The cut profiles are placed in the aging oven to enhance their properties. | Aging Oven, Quench tanks, Furnace |

| Post-Extrusion Fabrication | Performing diverse operations on final products, such as anodizing, assembly, painting, & machining, before shipping. | Saws, Shears, Stretching Machine, Shape Corrector, Polishing Machines |

Segmental Insights

Product Type Insights

Why the Shapes Segment Dominates the Aluminum Extrusion Industry?

The shapes segment dominated the aluminum extrusion industry, accounting for 64.40% in 2025. The growing development of curtain walls, roofing systems, window & door frames, and structural frameworks increases demand for shapes. The increased production of automotive components such as engine blocks, battery housings, chassis, and anti-intrusion beams requires aluminum shapes. The development of industrial machinery parts and heat sinks requires aluminum shapes, driving the overall market growth.

The pipes and tubes segment is the fastest-growing segment, with a CAGR of 6.4% during the forecast period. The growing manufacturing of air conditioning, heating, and ventilation systems increases the adoption of pipes and tubes. The strong focus on lowering vehicle weight and the rise in electric vehicles requires pipes & tubes. The growing construction and automotive sectors require pipes & tubes, supporting the overall market growth.

The rods & bars segment is significantly growing in the market. The growing development of infrastructure projects and residential and commercial construction increases demand for rods & bars. The growing deployment of wind turbines and solar panels requires aluminum rods & bars, which support overall market growth.

Alloy Type Insights

How did the 6000 Series Segment Hold the Largest Share in the Aluminum Extrusion Market?

The 6000 series segment held the largest revenue share of 42.30% in the market in 2025. The excellent properties like formability, strength, & corrosion resistance, and high extrudability of the 6000 series help market growth. The growing manufacturing of lightweight vehicle components, window frames, and curtain walls increases the adoption of the 6000 series. The compatibility of the 6000 series with finishing processes such as powder coating and anodizing drives market growth.

The 7000 series segment is growing at a 6.3% CAGR in the market during the forecast period. The growing development of automotive frames, high-performance aircraft components, and chassis increases demand for the 7000 series. The strong focus on lowering vehicle weight and the rise in electric vehicles require the 7000 series. The exceptional strength and high strength-to-weight ratio of the 7000 series support overall market growth.

The 1000-series segment is growing rapidly in the market. The high thermal conductivity, excellent workability, high corrosion resistance, and high electrical conductivity of the 1000 series help market growth. The growing electrical industry and development of architectural products require the 1000 series, supporting the overall market growth.

Alloy Type Strength Insights

Why the Soft Alloys Segment is Dominating the Aluminum Extrusion Industry?

The soft alloys segment dominated the aluminum extrusion industry, accounting for 68.50% in 2025. The growing use of lightweight materials in the aerospace and automotive industries increases the adoption of soft alloys. The growing development of infrastructure projects and the rise in construction activities increase the adoption of soft alloys. The cost-effectiveness and high recyclability of soft alloys drive the overall market growth.

The hard alloys segment is expected to grow the fastest, with a 5.8% CAGR, during the forecast period. The presence of high strength and flexibility in the creation of complex designs of hard alloys helps market growth. The expansion of electric vehicles and the development of lightweight vehicle parts require hard alloys. The strong focus on creating unique designs and developing thermal management systems requires the use of hard alloys, which supports overall market growth.

End-use Industry Insights

Which End-Use Industry Held the Largest Share in the Aluminum Extrusion Market?

The construction segment held the largest revenue share of 48.50% in the market in 2025. The rapid urbanization and increasing investment in housing projects require aluminum extrusion. The growing production of architectural elements, facade designs, and window frames is driving the adoption of aluminum extrusions. The growing commercial construction projects and the rise in residential construction activities require aluminum extrusions, driving overall market growth.

The automotive segment is the fastest-growing in the market with a 6.2% CAGR during the forecast period. The stricter regulations on CO2 emissions and a strong focus on reducing vehicle weight are increasing demand for aluminum extrusion. The rise in electric vehicles and focus on enhancing vehicle performance require aluminum extrusion. The growing manufacturing of automotive components, such as body structures, crash management systems, interior parts, and chassis, requires aluminum extrusion, thereby supporting overall market growth.

The electrical segment is significantly growing in the market. The growing adoption of renewable energy, such as wind power & solar panels, increases demand for aluminum extrusions for the development of electrical components. The well-established power distribution & transmission systems, along with the increasing manufacturing of electrical components, drive overall market growth.

Process Type Insights

How the Hot Extrusion Segment Dominated the Aluminum Extrusion Market?

The hot extrusion segment dominated the aluminum extrusion market, accounting for 70.3% in 2025. The growing production of complex shapes and the high demand for aluminum profiles are driving increased hot extrusion. The increased manufacturing of vehicle components and structural construction elements increases the adoption of hot extrusion. The cost-effectiveness and energy-efficiency of production drive overall market growth.

The cold extrusion segment is expected to grow the fastest in the market with a 6.2% CAGR during the forecast period. The focus on lowering thermal distortion and the development of precise dimensional components increases demand for cold extrusion. The growing production of seamless hollow components and the development of smoother surface finishes are driving the adoption of cold extrusion. The growing development of precision parts, such as heat sinks, engine components, and chassis components, supports overall market growth.

Regional Insights

Asia Pacific Aluminum Extrusion Market Trends

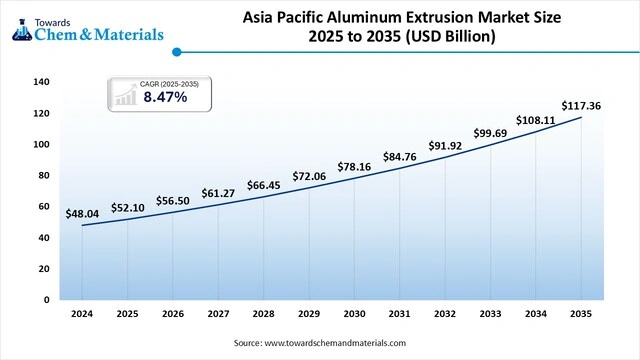

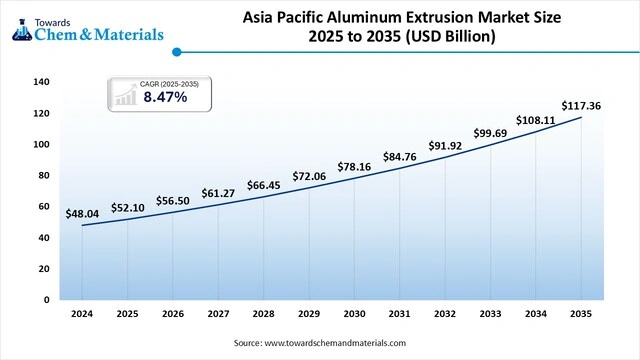

The Asia Pacific aluminum extrusion market is was estimated at USD 52.10 billion in 2025 and is projected to reach USD 117.36 billion by 2035, growing at a CAGR of 8.47% from 2026 to 2035. Asia Pacific dominated the aluminum extrusion market, accounting for 52.30% in 2025.

The growth of industrial activity and rapid urban development is increasing the demand for aluminum extrusion. Expanding industrial zones, rising construction activity, and stronger investment in manufacturing facilities across the region continue to drive a steady demand for lightweight, durable aluminum components.

The growing production of electric vehicles and a well-established manufacturing base in countries such as Japan, India, China, and South Korea drive overall market growth. These nations host strong automotive, electronics, and industrial sectors that depend on aluminum extrusions for frames, panels, heat exchangers, and precision components. With expanding production capacity and increasing export capability, the Asia Pacific continues to lead the global market.

From Factory to Future: China’s Leadership in the Aluminum Extrusion Industry

China is a major contributor to the aluminum extrusion industry. The growing development of large-scale infrastructure projects and booming construction activities increases demand for aluminum extrusion. Major programs involving urban transportation, commercial buildings, and public facilities continue to use extruded aluminum for structural systems, window frames, and electrical applications due to its strength and corrosion resistance.

The presence of a well-established manufacturing base and high aluminum production supports market growth. The development of lightweight vehicle materials, such as chassis, vehicle frames, and other components, and the rise in electric vehicles support overall market growth. As automakers aim to reduce vehicle weight and improve efficiency, aluminum extrusions are increasingly used in battery housings, support structures, and energy absorption components. This trend, combined with expanding EV production, continues to strengthen China’s role in the global aluminum extrusion market.

- China exported 5874 shipments of aluminum extrusion.(Source: https://www.volza.com)

North America Aluminum Extrusion Market Size and Trends

The North America aluminum extrusion market size is forecast to grow from USD 22.02 billion in 2025 to USD 49.75 billion by 2035, driven by a CAGR of 8.49% from 2026 to 2035.

North America is expected to experience the fastest market growth during the forecast period. The growing development of fuel-efficient vehicles and the rise in the adoption of electric vehicles increase demand for aluminum extrusion. Automakers in the region are increasingly using lightweight aluminum components to improve performance, reduce emissions, and extend driving range, which strengthens the need for extruded parts in frames, battery housings, and structural components.

The rapid industrialization and growing development of new buildings require aluminum extrusion. Commercial construction, residential projects, and industrial facilities rely on aluminum extrusions for window systems, curtain walls, support structures, and HVAC components, due to their durability and corrosion resistance. As new construction projects continue to expand, demand for aluminum extruded products remains strong.

Metal in Motion: U.S. Aluminum Extrusion Manufacturing Brief

The United States is a key contributor to the aluminum extrusion sector. The growing expansion of the transportation sector and the rise in electric vehicles increase demand for aluminum extrusion. The growing development of public infrastructure, such as bridges & highways, requires aluminum extrusion. The growing production of building materials, such as structural elements, window frames, and curtain walls, requires aluminum extrusion, thereby supporting overall market growth.

The growing production of building materials, such as structural elements, window frames, and curtain walls, requires aluminum extrusion, thereby supporting overall market growth. Construction companies rely on extruded aluminum for energy-efficient building systems and architectural designs that offer strength and modern aesthetic appeal. With ongoing commercial and residential development across the country, the demand for extruded aluminum continues to rise.

- The United States exported 11562 shipments of aluminum bars.(Source: https://www.volza.com)

Europe Aluminum Extrusion Market Size and Trends

The Europe aluminum extrusion market size is projected to reach USD 40.78 billion by 2035, expanding from USD 18.07 billion in 2025, at an annual growth rate of 8.48% during the forecast period from 2026 to 2035.

Europe is growing rapidly in the market. The strong focus on reducing vehicle emissions and the rise in electric vehicles are increasing the demand for aluminum extrusion. Automakers across the region are replacing heavier steel components with lightweight aluminum parts to meet emissions targets and improve energy efficiency, thereby strengthening demand for extruded profiles used in engine systems, battery structures, and body frames.

The development of industrial, residential, and commercial buildings increases demand for aluminum extrusion to manufacture components such as seat tracks, body panels, and chassis. Modern construction projects require durable, corrosion-resistant materials for windows, doors, curtain walls, and structural elements, making extruded aluminum an essential material for achieving energy-efficient, long-lasting designs. Rising investment in new buildings and refurbishment projects continues to support this demand.

Germany Excellence in Aluminum Extrusion Technology

Germany is growing rapidly in the market. The growing production of vehicles and the rise of electric mobility are increasing the demand for aluminum extrusion. As German automakers continue to focus on lightweight engineering and energy efficiency, extruded aluminum components are increasingly used in battery housings, safety structures, and interior support systems. This trend aligns with the country’s strong automotive manufacturing base and its shift toward cleaner transportation.

Innovations, such as automated processes and die design, support overall market growth. Advanced machinery, improved tooling, and digital process control help German manufacturers enhance product quality, reduce waste, and increase production efficiency. These technological improvements reinforce Germany’s position as a leading contributor to the aluminum extrusion industry.

South America Aluminum Extrusion Market Size and Trends

The South America aluminum extrusion market is set to grow from USD 5.19 billion in 2025 to USD 11.84 billion by 2035, with an expected CAGR of 8.57% over the forecast period from 2026 to 2035.

South America is growing significantly in the market. Growing investments in project development, such as buildings, roads, and bridges, increase demand for aluminum extrusion. These large infrastructure programs rely on lightweight, corrosion-resistant aluminum components for structural systems, supports, frames, and electrical applications, which strengthens regional consumption.

Automakers are increasingly adopting extruded aluminum parts to reduce vehicle weight and improve performance, while residential construction uses extruded profiles for windows, doors, railings, and façade elements. As both sectors expand, the need for reliable aluminum products continues to rise. The growth of solar power and the development of an efficient transportation system require aluminum extrusion, driving overall market growth. Solar mounting structures, rail systems, and modern transport equipment depend on aluminum extrusions for strength, durability, and ease of installation.

Rise of the Aluminum Extrusion Manufacturing in Brazil

Brazil contributes to the growth of the aluminum extrusion market. The growing development of infrastructure projects and the rise in construction activities increase demand for aluminum extrusion. The manufacturing of fuel-efficient vehicles and the focus on lowering vehicle emissions require aluminum extrusion. The growing expansion of wind and solar energy supports the overall market growth.

Automakers in Brazil are increasingly using lightweight aluminum parts to improve performance and meet emission reduction goals. Extruded aluminum is commonly used in chassis components, structural supports, and thermal management systems, which align with the country’s efforts to modernize its vehicle fleet. Renewable energy installations depend on extruded aluminum for mounting structures, support beams, electrical housings, and frame systems because of its durability and ease of fabrication.

Middle East & Africa Aluminum Extrusion Market Size and Trends

The Middle East & Africa aluminum extrusions market size is calculated at USD 2.23 billion in 2025, grew to USD 2.42 billion in 2026, and is projected to reach around USD 5.13 billion by 2035. The market is expected to expand at a CAGR of 8.65% between 2026 and 2035.

The Middle East and Africa are significantly growing in the market. The growing investment in developing urban centers, new airports, and highways requires aluminum extrusion. Large-scale infrastructure programs across the region, including commercial districts, public facilities, and transportation hubs, rely on extruded aluminum for structural framing, façade systems, and electrical applications because of its durability and lightweight properties. As countries continue to diversify their economies, demand for high-quality aluminum profiles continues to grow steadily.

The rise in electric vehicles and the presence of companies such as Ma’aden Aluminum and Emirates Global Aluminum drive overall market growth. These companies strengthen the regional supply chain by producing large volumes of primary aluminum and extruded products used in vehicle frames, battery housings, and lightweight automotive structures. Their strong manufacturing capabilities support both domestic consumption and international exports, further boosting market expansion across the Middle East and Africa.

Saudi Arabia Aluminum Extrusion Market Trends

Saudi Arabia is growing in the aluminum extrusion industry. The growing development of projects like Red Sea and NEOM, and the expansion of the aerospace and automotive industries, are increasing the demand for aluminum extrusions. These large-scale developments rely heavily on lightweight, corrosion-resistant aluminum components for structural systems, transportation networks, and modern architectural designs, thereby strengthening national consumption of extruded products.

The strong government support for domestic manufacturing and the expansion of the transportation sector both require aluminum extrusions, thereby supporting overall market growth. Policies that promote industrial diversification and encourage local production are increasing the use of extruded aluminum in rail systems, airport structures, vehicle frames, and public infrastructure. These initiatives help create a stable and growing demand base within the country. Saudi Arabia exported 189 shipments of aluminum extrusion products.

Recent Developments

- In September 2025, Vedanta Aluminum launched 5-inch billets at ALUMEX India 2025. The billets are useful in applications seamless tubes, hollow profiles, production of small to medium profiles, and micro-tubes. The company is expanding its billet casting capacity to 1.25 MTPA (Source: https://pragativadi.com)

- In July 2025, H&H Aluminum launched India’s largest solar frame plant in Rajkot. The annual production capacity of the plant is 24000 tonnes, and the company invested $1.8 million in the plant. (Source: https://www.alcircle.com)

- In January 2024, Jindal Aluminum launched a new fabrication division. The division is equipped with cutting-edge machinery and advanced technology. The division performs operations like slot milling, tapping, grooving, drilling, angle drilling, and pocket milling (Source: https://www.constructionweekonline.in)

The Key Aluminum Extrusion Market Company Insights

- Hindalco Industries Ltd.: The India-based company, leading producer and recycler of aluminum, that supports various industries like automotive, consumer appliances, construction, and packaging.

- Norsk Hydro ASA: The Norwegian-based renewable energy and aluminum company manufactures products like extrusion ignots, foundry alloys, high purity aluminum, aluminum, sheet ignots, and wire rods.

- Constellium SE: The company manufactures and designs aluminum solutions & products like automotive structures, soft alloys, large profiles, and hard alloys to support various industries like packaging, automotive, and aerospace.

- Arconic Corporation: The leading provider of aluminum extrusions, advanced aluminum sheet, and plate for industries like construction, aerospace, and automotive.

- China Zhongwang Holdings Limited: The company manufactures aluminum products like aluminum alloy formwork, industrial extrusion, and deep-processed products for sectors like electrical engineering, transportation, and machinery.

- UACJ Corporation : UACJ manufactures a wide range of aluminum products including extrusions, sheets, and fabricated components used in automotive, construction, electronics, and industrial applications. The company emphasizes high-strength alloys and advanced processing technologies.

- Kaiser Aluminum Corporation : Kaiser Aluminum specializes in high-performance aluminum extrusions and fabricated products for aerospace, automotive, industrial, and defense markets. Its offerings focus on precision, lightweighting, and corrosion resistance.

- Gulf Extrusions Co. LLC: Gulf Extrusions is a major Middle Eastern producer of aluminum extruded profiles used in construction, transportation, industrial machinery, and consumer applications. The company emphasizes custom profiles and high structural integrity.

- Bonnell Aluminum : Bonnell Aluminum manufactures custom aluminum extrusions, fabricated components, and thermal barrier profiles for building systems, transportation, and industrial markets. It focuses on innovation in extrusion design and finishing.

- Hulamin Ltd. : Hulamin produces aluminum extrusions, rolled products, and fabricated components serving automotive, packaging, and engineering industries. The company is known for lightweight solutions and strong recycling integration.

- Talco Aluminium Company : Talco produces aluminum extrusions and related products for construction, industrial equipment, and infrastructure projects. The company emphasizes durable alloys and cost-effective solutions.

- Banco Aluminium Ltd. : Banco Aluminium manufactures extruded aluminum profiles for automotive, electrical, HVAC, and industrial applications. The company specializes in custom extrusion design and precision machining.

- Jindal Aluminium Ltd. : Jindal Aluminium is one of India’s largest producers of extruded aluminum profiles and rolled products. It serves construction, electrical, automotive, and consumer durable industries with high-quality extrusions.

- ETEM Gestamp S.A. : ETEM Gestamp produces aluminum extrusion-based automotive components, structural parts, and energy-efficient building profiles. The company combines extrusion expertise with advanced engineering for mobility applications.

- Bahrain Aluminium Extrusion Company (BALEXCO) : BALEXCO manufactures architectural and industrial aluminum extrusions used in windows, doors, facades, and custom engineering applications. The company focuses on high-quality finishing and a strong regional presence.

Top Key Aluminum Extrusion Companies:

- Alupco

- Arconic Corp.

- Bahrain Aluminum Extrusion Company

- Constellium N.V.

- Gulf Extrusions Co. LLC

- Hindalco Industries Ltd.

- Kaiser Aluminum

- Norsk Hydro ASA

- QALEX

Global Aluminum Extrusion Market Report Segmentation

This report forecasts volume & revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2035. For this study, Towards Chemical and Materials has segmented the global aluminum extrusion market report based on product, application, and region.

Segments Covered

By Product Type

- Shapes

- Rods & Bars

- Pipes & Tubes

By Alloy Type

- 6000 Series

- 1000 Series

- 7000 Series

- 2000 Series

- 5000 Series

By Alloy Type Strength

- Hard Alloys

- Soft Alloys

By End-use Industry

- Construction

- Automotive

- Electrical

- Industrial Machinery

- Renewable Energy

- Consumer Durables

By Process Type

- Hot Extrusion

- Cold Extrusion

By Regional

- North America

- Europe

- Asia Pacific

- South America

- Middle East and Africa (MEA)