Content

What is the Current Alpha Olefin Market Size and Volume?

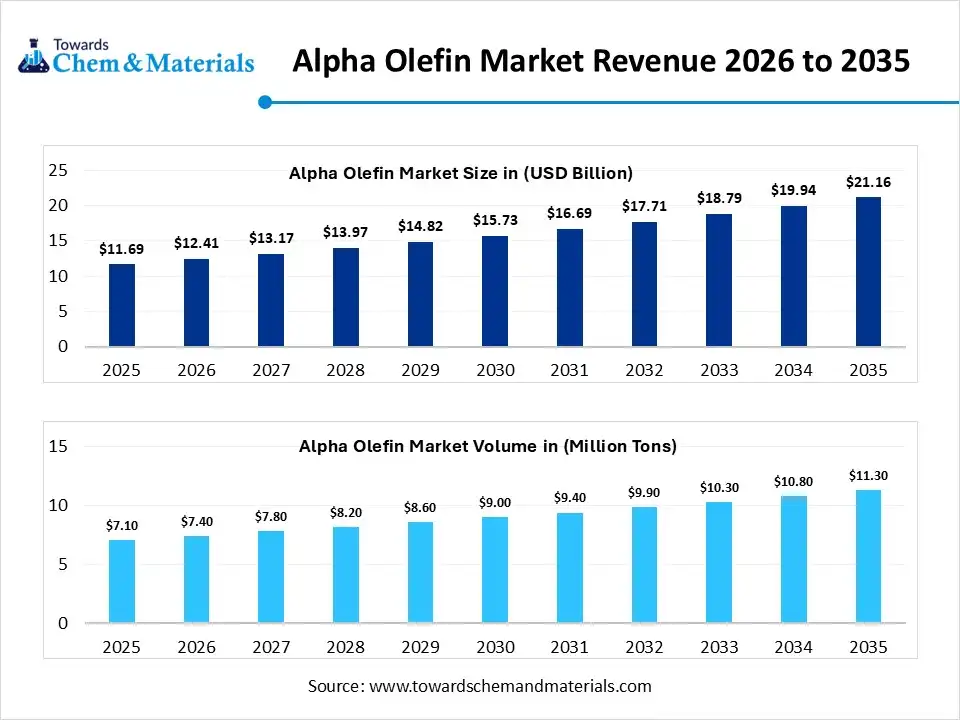

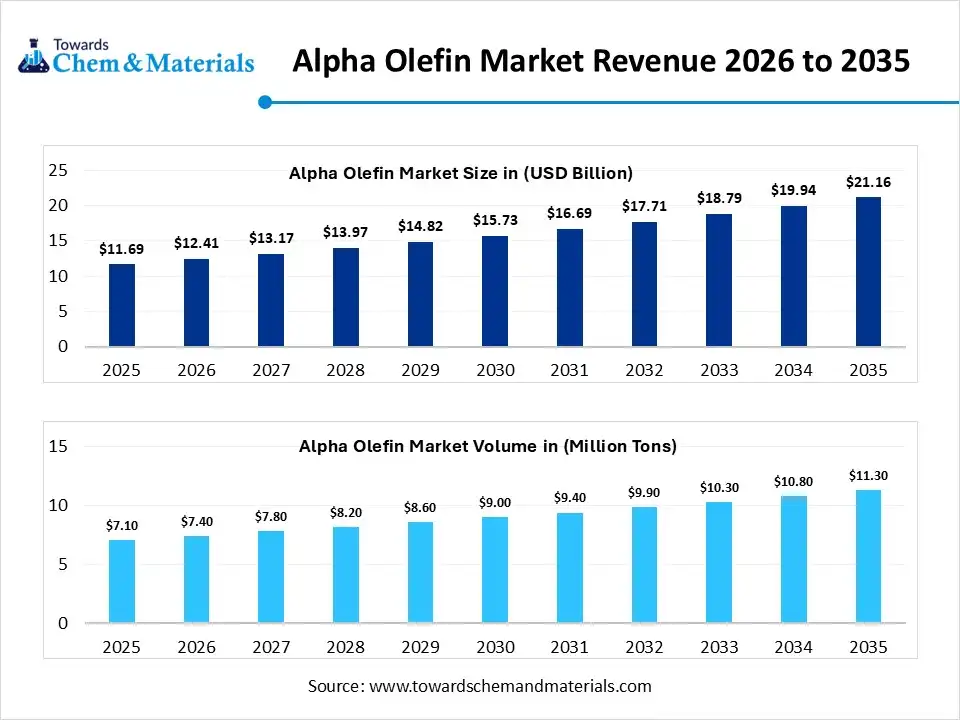

The global alpha olefin market size was estimated at USD 11.69 billion in 2025 and is expected to increase from USD 12.41 billion in 2026 to USD 21.16 billion by 2035, growing at a CAGR of 6.11% from 2026 to 2035. In terms of volume, the market is projected to grow from 7.1 million tons in 2025 to 11.3 million tons by 2035. growing at a CAGR of 4.80% from 2026 to 2035. Asia Pacific dominated the alpha olefin market with the largest volume share of 40.50% in 2025.The demand for stronger plastic products and polyethylene across the globe has fueled the industry's growth in recent years.

Market Highlights

- Asia Pacific dominated the alpha olefin market with the largest volume share of 40.50% in 2025.

- The alpha olefin market in North America is expected to grow at a substantial CAGR of 4.96% from 2026 to 2035.

- Europe alpha olefin market segment accounted for the major volume share of 19.10% in 2025.

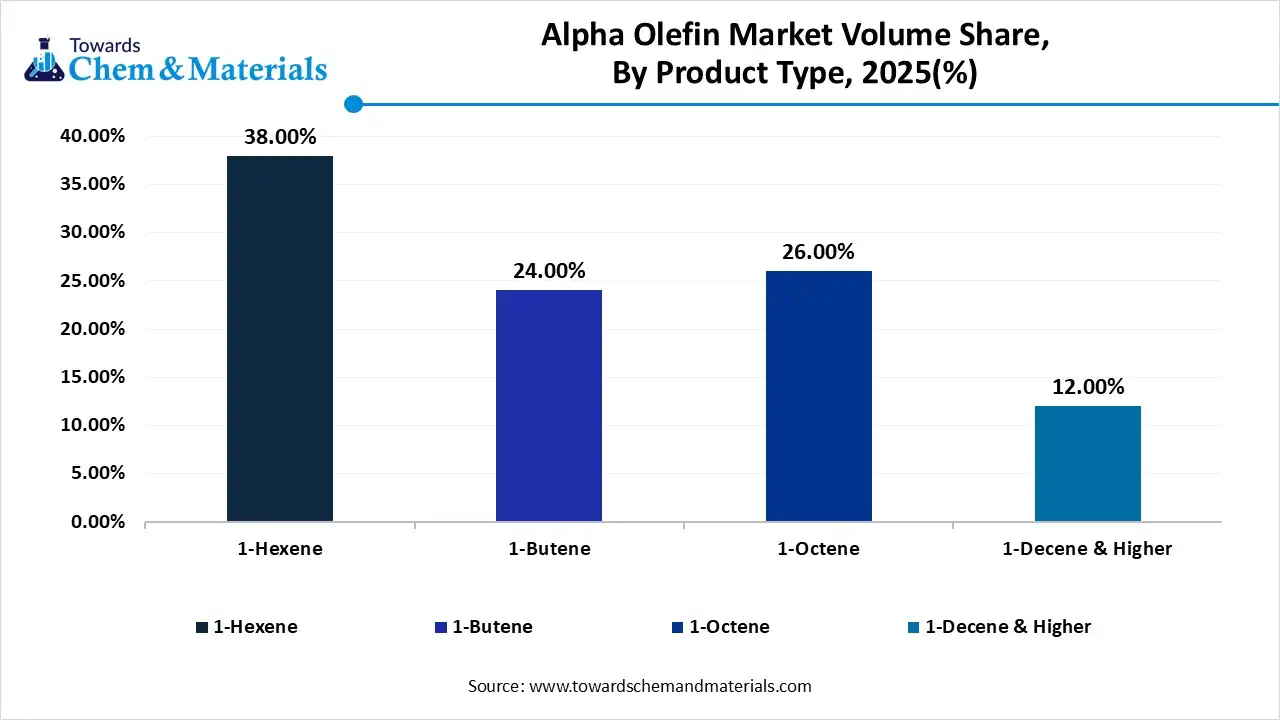

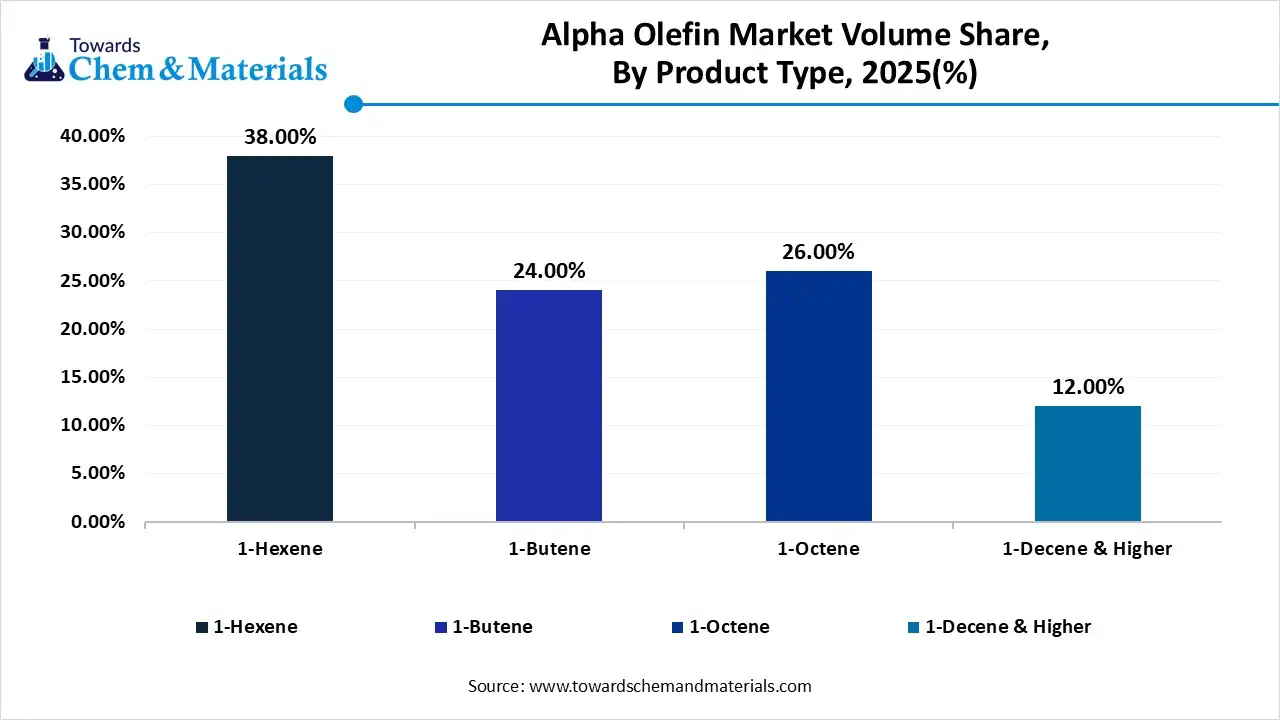

- By product type, the 1-Hexene segment dominated the market and accounted for the largest volume share of 38.00% in 2025.

- By fiber type, the carbon fiber composites segment is expected to grow at the fastest CAGR of 5.56% from 2026 to 2035 in terms of volume.

- By application, the polyethylene comonomers segment led the market with the largest revenue volume share of 56% in 2025.

Alpha Olefins: Building Blocks of Performance

The hydrocarbon that has the double bond at the first carbon position is called the alpha olefin. Moreover, the alpha olefins have emerged as a catalyst for unlocking the plastic, detergents, and chemical sectors' full potential in recent years as a building block. Furthermore, by improving the strength, flexibility, and performance of the products, the alpha olefins have allowed stakeholders to capitalize on growth opportunities in the current period.

Alpha Olefin Market Trends:

- The increasing demand for polyethylene has strengthened the foundation for future sector growth in recent years. These olefins are used as the comonomers to improve the plastic quality as per the recent observation, which provides lightweight, flexibility, and strength to the material.

- The emergence of the synthetic lubricant has stimulated the demand led growth in manufacturing. As the alpha olefins are used to make polyalphaolefins, which provide synthetic lubricants with strength to work well under pressure and extreme temperatures.

- The sudden shift towards the customized and specialty alpha olefins has presented new business models for forward-thinking manufacturers in the current period. Also, the major industries have seen in demanding the tailored made and precision products instead of standard products in the current period.

Report Scope

| Report Attribute | Details |

| Market Size and Volume in 2026 | USD 12.41 Billion / 7.4 Million Tons |

| Revenue Forecast in 2035 | USD 21.16 Billion / 11.3 Million Tons |

| Growth Rate | CAGR 6.11% |

| Forecast Period | 2026 - 2035 |

| Base Year | 2025 |

| Units Considered | Value (Billion / Million), Volume (Million Tons) |

| Dominant Region | Asia Pacific |

| Segment Covered | By Product Type, By Application, By Region |

| Key companies profiled | Chevron Phillips Chemical Company LLC (CPChem), Shell Plc, INEOS Oligomers., ExxonMobil Corporation, Sasol Limited, Qatar Chemical Company Ltd (Q-Chem), Mitsubishi Chemical Corporation, Idemitsu Kosan Co., Ltd., Evonik Industries AG |

Cleaner, Smarter Manufacturing Leads Market Evaluation

The industry has seen a shift towards efficient and flexible production processes, which is likely to lead to robust revenue growth across the sector during the forecast period. Moreover, new catalyst systems allow better control over molecule size and purity. Producers can reduce waste and energy use. Advanced reactors improve yield and consistency. Companies are also focusing on lower-carbon footprint technologies. Digital monitoring helps optimize production in real time.

Trade Analysis of the Alpha Olefin Market:

Import, Export, Consumption, and Production Statistics

- The United States has emerged as the leading exporter of alpha olefins with 21,907 shipments. Also, the leading importers include Brazil, India, and Colombia as per the published report.

- Saudi Arabia has also seen a heavy export of alpha olefins after the United States, with 553 shipments.

Value Chain Analysis of the Alpha Olefin Market:

Distribution to Industrial Users

- The distribution of alpha olefins (AOs) to industrial users is a highly structured global supply chain dominated by major petrochemical producers and a network of regional specialized distributors. The market relies heavily on direct sales for large-scale industrial needs, while specialized distributors handle niche or lower-volume requirements.

- Key Players: Sheell Chemicals and INEOS Oligomers

Chemical Synthesis and Processing

- In the Ziegler Process, triethylaluminum catalysts facilitate the "growth reaction" of ethylene. This typically results in a Schulz-Flory distribution, producing a wide range of even-numbered carbon chains (C4 to C20+). To increase efficiency, manufacturers often use "full range" plants that fractionate these mixtures into specific cuts based on market demand.

- Key Player: Sasol

Regulatory Compliance and Safety Monitoring

- Regulatory compliance and safety monitoring for alpha olefins (AOs) focus on mitigating risks associated with their hazardous properties, such as skin and eye irritation, and potential flammability. These chemicals are governed by a complex framework of international and regional standards to ensure safe industrial handling and environmental protection.

Alpha Olefin Market Regulatory Landscape: Global Regulations

| Country Region | Regulatory Body | Key Regulations | Focus Areas |

| United States | Environmental Protection Agency (EPA) | TSCA Section 8 & Section 5; 21 CFR Part 175 | Chemical reporting (CDR), health/safety data, and food-contact migration limits.. |

| European Union | ECHA | REACH (Annex XVII); CLP Regulation | Substance restriction, hazard classification (CMRs), and supply chain communication. |

| China |

MEE (Ministry of Ecology & Env) & NRCC |

Decree 591; MEE Order 12 | Hazardous chemical licensing, GHS-aligned SDS, and new substance registration. |

Segmental Insights

Product Type Insights

How did the 1-Hexene Segment Dominate the Alpha Olefin Market in 2025?

The 1-Hexene segment dominated the market with approximately 38% share in 2025, due to its being known as the most preferred comonomer for polyethylene manufacturing. Also, by providing better crack resistance, strength, and flexibility to the plastic products, the 1-hexane has increased return on investment for the manufacturers in recent years.

The 1-butane segment is expected to grow with a rapid CAGR 5.56%, owing to the industry's greater shift towards higher volume production and cost efficiency. Moreover, the growing need for affordable packaging of 1-butane is likely to gain major industry attention in the coming as it has seen in using in linear low-density polyethylene for flexible packaging options, as per the latest survey.

Alpha Olefin Market Volume and Share, By Product Type, 2025-2035

| By Product Type | Market Volume Share (%), 2025 | Market Volume (Million Tons)2025 | Market Volume (Million Tons)2035 | CAGR(%) 2026-2035 | Market Volume Share (%), 2035 |

| 1-Hexene | 38.00% | 2.7 | 4.6 | 5.99% | 40.14% |

| 1-Butene | 24.00% | 1.7 | 2.8 | 5.56% | 24.43% |

| 1-Octene | 26.00% | 1.8 | 2.9 | 5.18% | 25.64% |

| 1-Decene & Higher | 12.00% | 0.9 | 1.1 | 2.99% | 9.79% |

Application Insights

How did the Polyethylene Comonomers Segment Dominate the Alpha Olefin Market in 2025?

The polyethylene comonomers segment dominated the market with approximately 56% share in 2025, due to polyethylene being the most used plastic worldwide. Moreover, the alpha olefins improve plastic strength, clarity, and durability. Packaging, construction, agriculture, and consumer goods rely heavily on polyethylene. Comonomers help customize plastic properties for different uses. Demand for flexible packaging and pipes increased rapidly.

The synthetic lubricants (POA) segment is expected to grow, akin to machines becoming more advanced. Also, the alpha olefins are used to make high-performance lubricant base oils. These lubricants last longer and work better under extreme temperatures. Electric vehicles, wind turbines, and industrial equipment need advanced lubrication. Maintenance reduction is a major priority for industries.

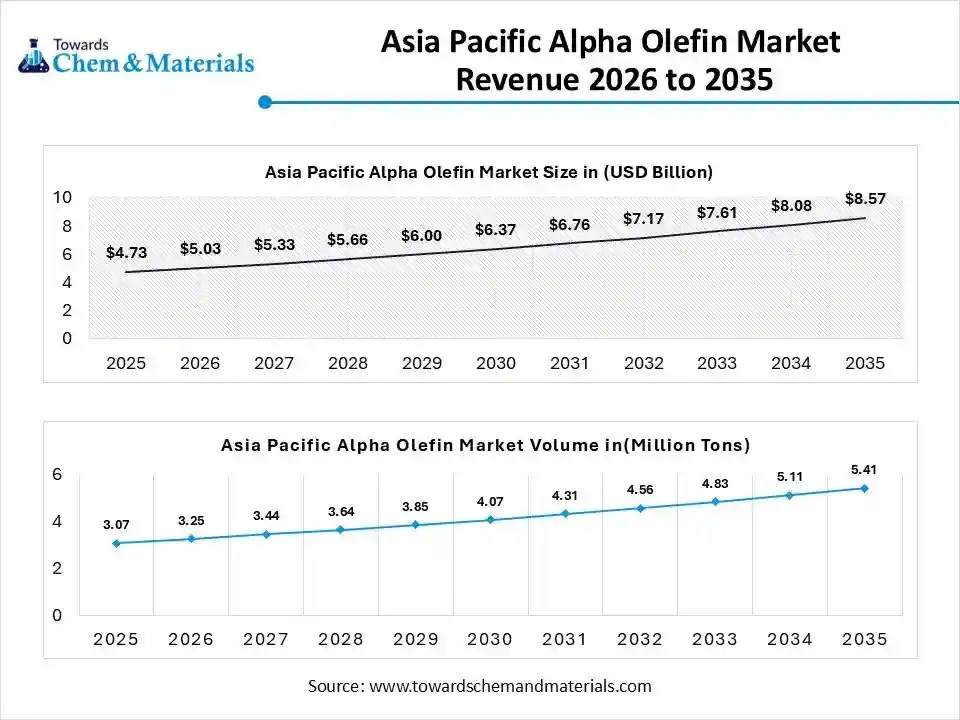

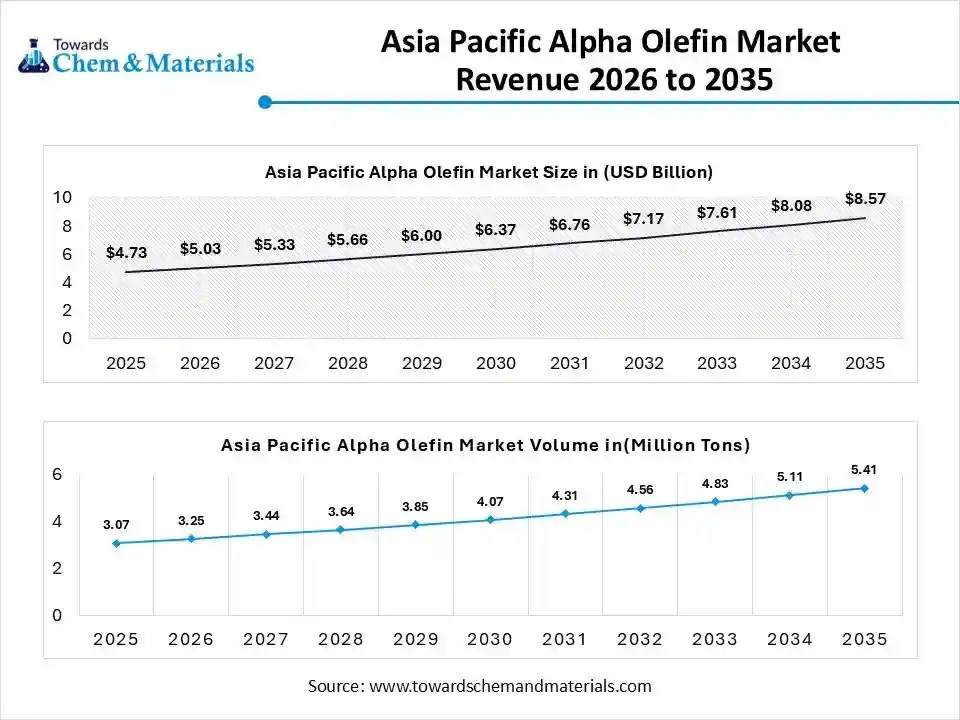

Regional Insights

The Asia Pacific alpha olefin market size was valued at USD 4.73 billion in 2025 and is expected to be worth around USD 8.57 billion by 2035, exhibiting at a compound annual growth rate (CAGR) of 6.12% over the forecast period from 2026 to 2035.The Asia Pacific alpha olefin volume was estimated at 2.9 million tons in 2025 and is projected to reach 4.8 million tons by 2035, growing at a CAGR of 5.83% from 2026 to 2035.

Asia Pacific dominated the alpha olefin market with approximately 40.50% share in 2025, due to massive plastic and chemical production. The region has large manufacturing hubs and fast industrial growth. Packaging, construction, and consumer goods demand is very high. Alpha olefins are used heavily in plastics across Asia. Low production costs and easy raw material access support growth. Governments invest in petrochemical infrastructure.

Massive Plastics Industry Drives Alpha Olefin Market Leadership in China

China maintained its dominance in the market, owing to its huge plastics industry. It is the world's largest producer and consumer of polyethylene. Alpha olefins are needed continuously for plastic manufacturing. China invests heavily in petrochemical plants and refining capacity. Domestic demand from packaging, construction, and agriculture is very strong.

Alpha Olefin Market Evaluation in North America

North America alpha olefin market volume was estimated at 2.1 million tons in 2025 and is projected to reach 3.3 million tons by 2035, growing at a CAGR of 4.96% from 2026 to 2035. North America is expected to capture a major share of the market with a rapid CAGR, owing to technology leadership and shale gas availability in the current period. Moreover, the region has abundant ethylene feedstock, lowering production costs. Advanced catalyst and process technologies support efficient alpha olefin manufacturing. Demand for high-performance plastics and lubricants is growing.

Innovation Anchors United States Olefin Competitiveness

The United States is expected to emerge as a prominent country for the alpha olefin market in the coming years as the United States is central to North America's alpha olefin growth. Shale gas production provides low-cost ethylene. This supports large-scale alpha olefin plants. The United States has advanced chemical companies and strong research capabilities. Demand comes from packaging, automotive, and industrial lubricants. Export capacity is increasing due to surplus production.

Alpha Olefin Market Volume and Share, By Region, 2025-2035

| By Region | Market Volume Share (%), 2025 | Market Volume (Million Tons)2025 | Market Volume (Million Tons)2035 | CAGR(%) 2026-2035 | Market Volume Share (%), 2035 |

| North America | 30.10% | 2.1 | 3.3 | 4.96% | 29.12% |

| Europe | 19.10% | 1.4 | 2.3 | 5.95% | 20.10% |

| Asia Pacific | 40.50% | 2.9 | 4.8 | 5.83% | 42.21% |

| Latin America | 6.44% | 0.5 | 0.6 | 3.37% | 5.43% |

| Middle East & Africa | 3.86% | 0.3 | 0.4 | 2.96% | 3.14% |

Europe Alpha Olefin Market Examination

Europe alpha olefin market volume was estimated at 1.4 million tons in 2025 and is projected to reach 2.3 million tons by 2035, growing at a CAGR of 5.95% from 2026 to 2035. Europe is notably growing in market, owing to its focus on quality and sustainability. The region is actively prioritizing advanced materials and efficient chemical processes. Demand for high-performance plastics and specialty lubricants is increasing. Strict environmental regulations push innovation in alpha olefin usage. Recycling-friendly and lightweight materials are preferred in the region nowadays as per the recent survey.

Automotive Leadership Drives Chemical Advancements in Germany

Germany is expected to gain a significant market share due to its strong chemical and automotive industry base. Alpha olefins are used in engineering plastics and lubricants. Germany focuses on high-quality, precision materials. Automotive manufacturing drives lubricant demand. Sustainability goals push advanced plastic formulations. Strong research institutions support innovation.

Recent Developments

- In May 2025, The Pilot Chemical Company established a partnership with Novvi LLC. Also, the main motive behind the strategic collaboration is to develop biobased alpha olefin sulfonate surfactant technology CalCare® AOS in the North American industry as per the published report.(Source: pilotchemical.com)

- In June 2025, The Stepan has decided to increase its alpha olefin sulfonate production in the coming years. Also, the company is expected to increase this production by 25% with the strategic capital investments, as per the company's claim.(Source: www.indianchemicalnews.com)

Top Vendors in the Alpha Olefin Market & Their Offerings:

- Chevron Phillips Chemical Company LLC (CPChem): A joint venture between Chevron and Phillips 66, CPChem is a premier global producer of Normal Alpha Olefins (NAO). Utilizing proprietary Ziegler technology, they operate major facilities in Texas and Belgium. Their portfolio focuses on high-purity C4 through C30+ fractions, primarily serving polyethylene, lubricant, and surfactant markets. They are industry leaders in product stewardship, providing extensive technical data for global regulatory compliance.

- Shell Plc : Shell is a dominant force in the alpha olefin market through its proprietary Shell Higher Olefin Process (SHOP). This unique technology allows Shell to "tailor" carbon chain lengths through isomerization and metathesis, maximizing the production of high-demand fractions. Their olefins are essential feedstocks for NEODOL detergents and high-performance synthetic lubricants. Shell maintains a massive global footprint with strategic manufacturing hubs in the US and Singapore.

- INEOS Oligomers.: As a division of the global powerhouse INEOS, this entity is one of the world’s largest merchant suppliers of alpha olefins. They specialize in LAO (Linear Alpha Olefins) and PAO (Polyalphaolefins), operating key plants in Canada, Belgium, and the US. INEOS is critical to the supply chain for synthetic motor oils and high-end plastics, known for high reliability and a wide range of specialized carbon fractions.

- ExxonMobil Corporation: ExxonMobil is a vertically integrated leader, leveraging its massive refinery network to produce high-quality alpha olefin feedstocks. They are a primary manufacturer of 1-hexene and 1-octene, used extensively in their own high-performance polyethylene resins (like Exceed™ XP). Additionally, they are the world’s largest producer of PAO base oils, providing the chemical foundation for advanced synthetic lubricants used in aerospace and automotive industries.

- SABIC

- Sasol Limited

- Qatar Chemical Company Ltd (Q-Chem)

- Mitsubishi Chemical Corporation

- Idemitsu Kosan Co., Ltd.

- Evonik Industries AG

Segments Covered in the Report

By Product Type

- 1-Hexene

- 1-Butene

- 1-Octene

- 1-Decene & Higher

By Application

- Polyethylene Comonomers

- Synthetic Lubricants (PAO)

- Surfactants & Detergents

- Drilling Fluids

By Region

- North America

- U.S.

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Asia Pacific

- China

- India

- Japan

- South Korea

- Latin America

- Brazil

- Argentina

- Middle East & Africa

- Saudi Arabia

- South Africa