Content

What is the Current Naphthalene Market Size and Volume?

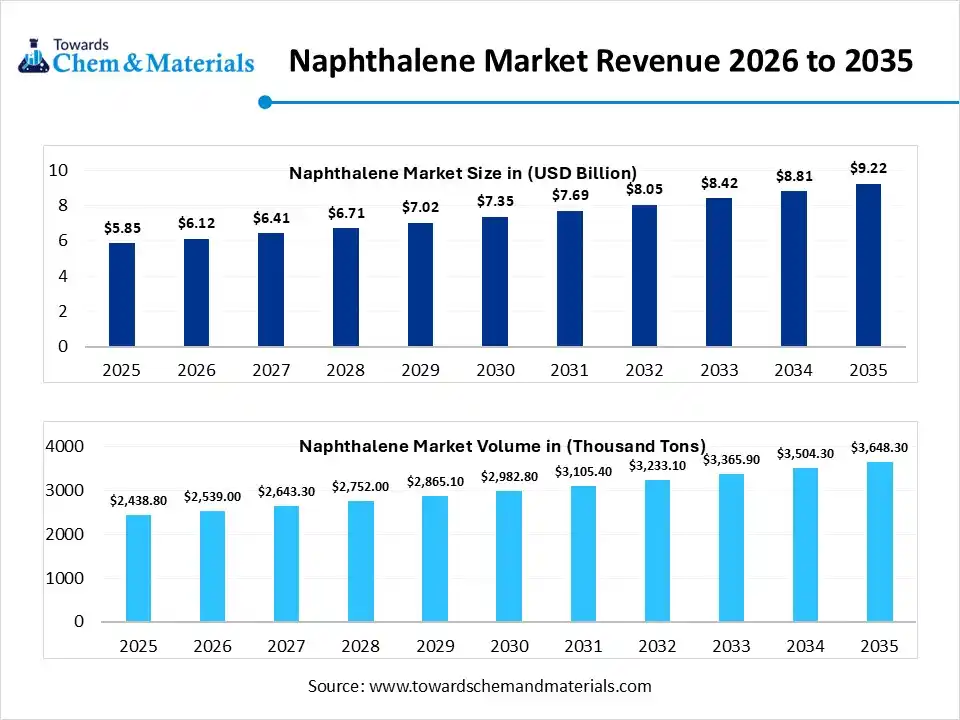

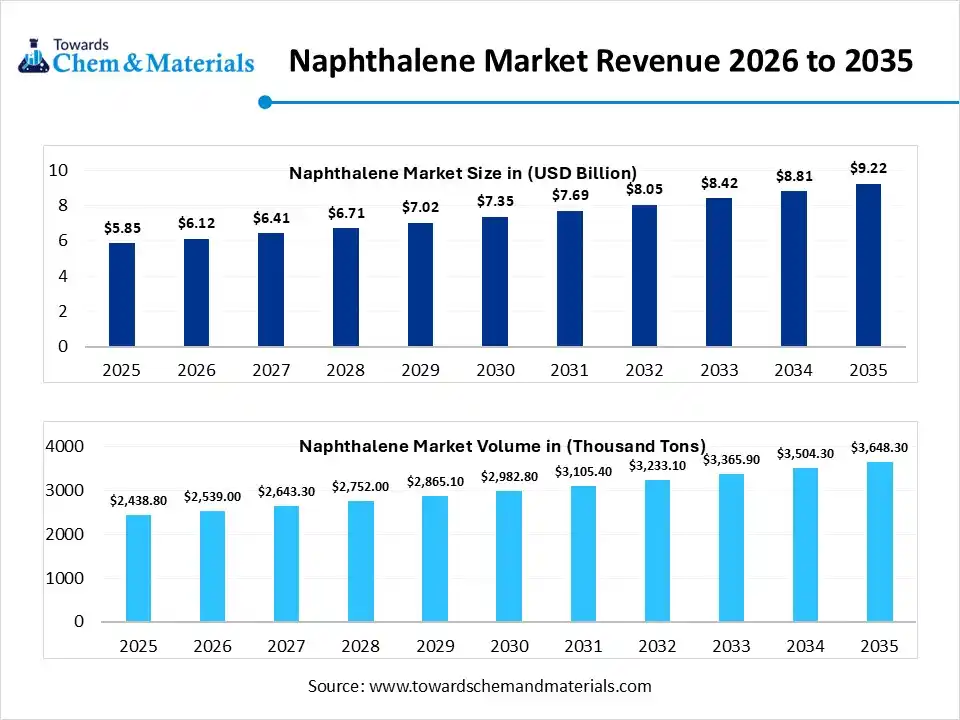

The global naphthalene market size was estimated at USD 5.85 billion in 2025 and is expected to increase from USD 6.12 billion in 2026 to USD 9.22 billion by 2035, growing at a CAGR of 4.66% from 2026 to 2035. In terms of volume, the market is projected to grow from 2,438.8 thousand tons in 2025 to 3,648.3 thousand tons by 2035. growing at a CAGR of 4.11% from 2026 to 2035. Asia Pacific dominated the naphthalene market with the largest share of 48% in 2025. The market is driven by sustainability initiatives, technological advancement, stringent environmental governance and expansion in industry applications.

Market Highlights

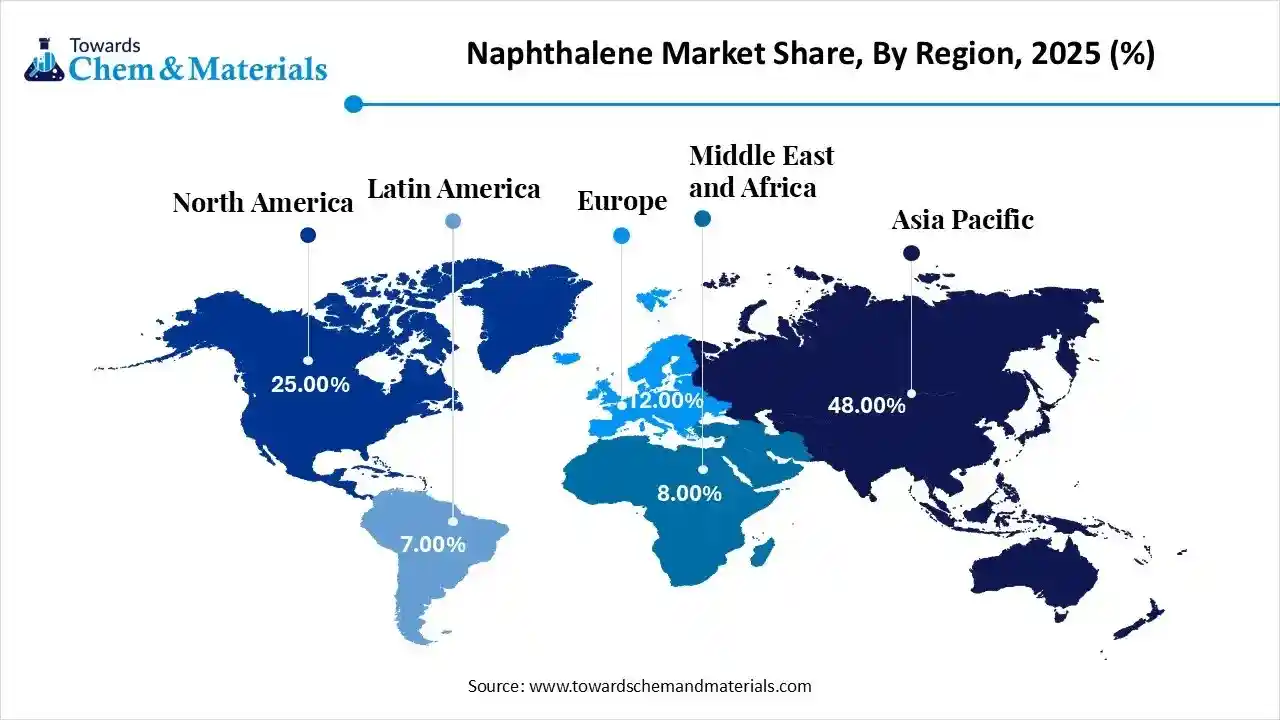

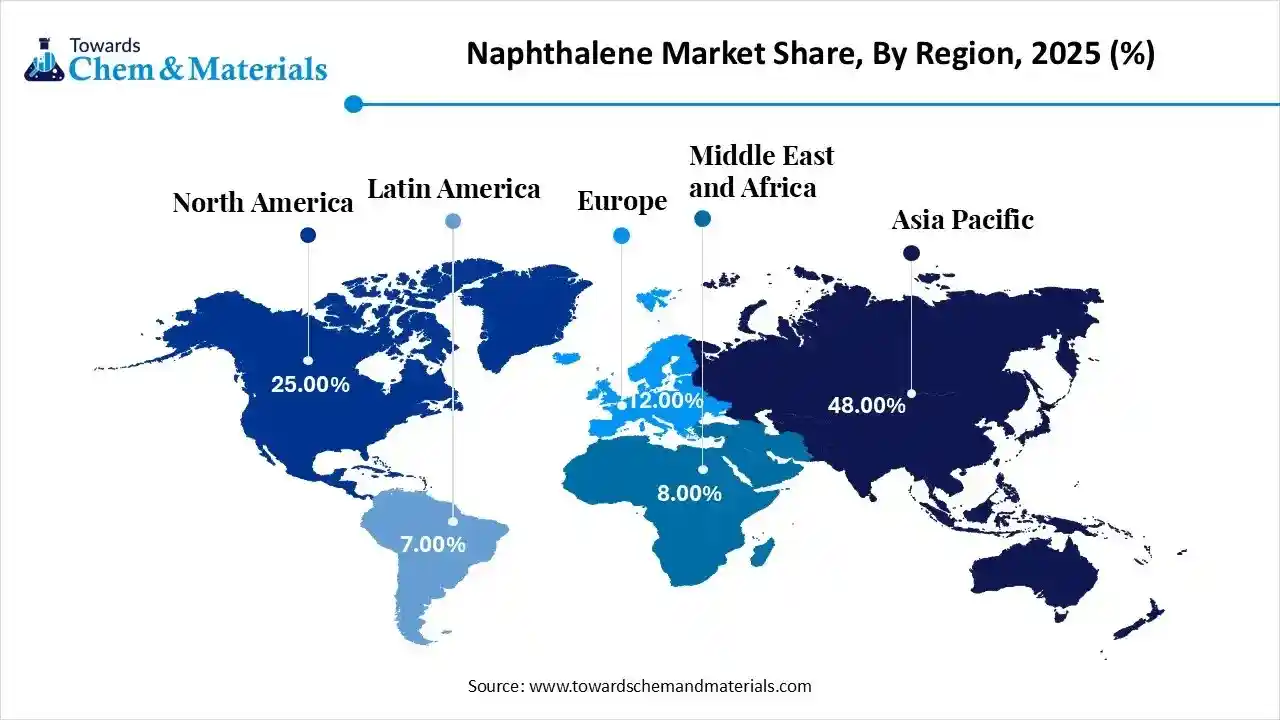

- The Asia Pacific dominated the naphthalene market with the largest revenue share of 48% in 2025.

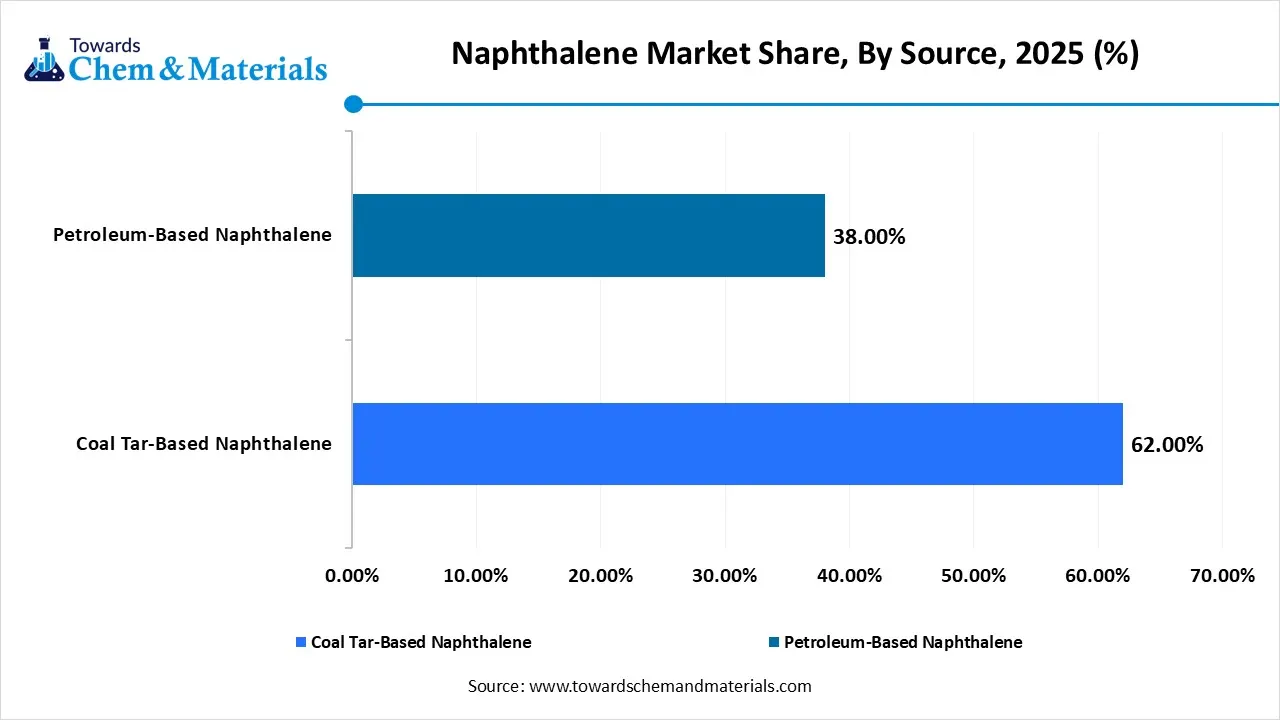

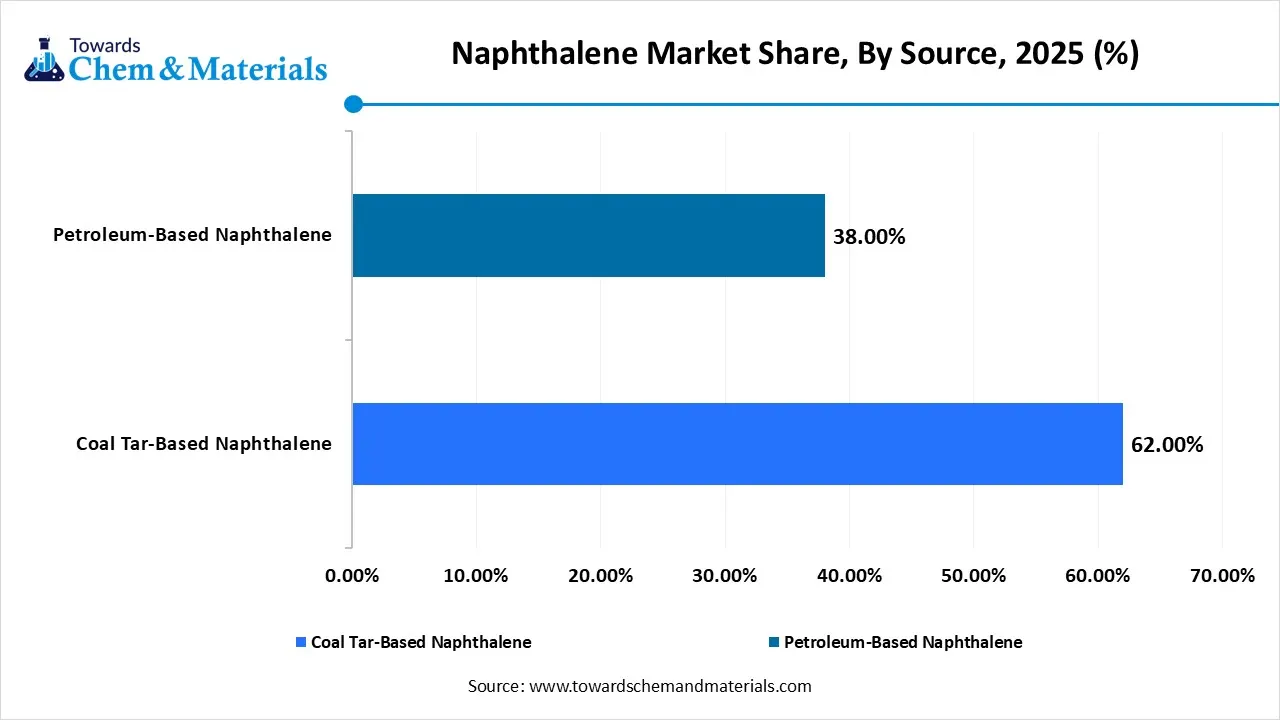

- By source, the coal tar-based naphthalene segment dominated the market and accounted for the largest revenue share of 62.00% in 2025.

- By grade, the industrial grade segment led the market with the largest revenue share of 68.00% in 2025.

- By application, the phthalic anhydride segment dominated the market and accounted for the largest share of 46.00% in 2025.

- By end-user industry, the chemicals & petrochemicals segment led the market with the largest revenue share of 42.00% in 2025.

- By sales channel, the direct sales (Long-term contracts) segment dominated the market and accounted for the largest share of 64.00% in 2025.

Market Overview

Naphthalene is defined by its versatile white crystalline hydrocarbon, derived from coal tar or petroleum, which is dynamic for high-strength intermediate and advanced applications such as construction, lubricants, textile dyes and pharmaceuticals. The stringent environmental governance and innovation with closed-loop refining by integration of digital processes to enhance safety and operational efficiency.

Additionally, the expansion is supported by technical specialization with industrial modernization with the production of phthalic anhydride and the manufacturing of sulfonated formaldehyde condensates, that accelerating the exploration of cleaner synthesis with evolving global safety standards.

Naphthalene Market Trends

- Growing Focus on Sustainability: The market is transitioning towards sustainable and eco-friendly production with substantial investment in the development of bio-based naphthalene to reduce the environmental impact.

- High Demand in Construction and Textiles Industry: The trend shaping the naphthalene derivatives used as superplasticizer in large-scale construction projects, while the demand for naphthalene-based dyes and intermediates in chemical processing for textiles is driving the market.

- Stringent Environmental Regulations: The growing concern regarding toxicity and potential health hazards associated with naphthalene led to strict environmental regulations that pushed the industry to comply and seek safer alternatives.

Report Scope

| Report Attribute | Details |

| Market Size and Volume in 2026 | USD 6.12 Billion / 2,539.0 Thousand Tons |

| Revenue Forecast in 2035 | USD 9.22 Billion / 3,648.3 Thousand Tons |

| Growth Rate | CAGR 4.66% |

| Forecast Period | 2026 - 2035 |

| Base Year | 2025 |

| Units Considered | Value (Billion / Million), Volume (Thousand Tons) |

| Dominant Region | Asia Pacific |

| Segment Covered | By Source, By Grade, By Application, By End-User Industry, By Sales Channel, By Region |

| Key companies profiled | BASF SE, ExxonMobil, Rain Carbon Inc., SABIC, JFE Chemical, Arkema, Koppers, Chevron Phillips Chemicals, Mitsubishi Chemical, Nippon Steel Chemical,OCI, Shandong Weijiao Group, Baowu Carbon Materials, Jiangsu SOPO, Shanxi Coking, Himadri Speciality Chemical, Epsilon Carbon, Indian Oil Corporation, Cepsa, Shell Chemicals |

Key Technological Shifts and AI in the Naphthalene Market

The technological advancement is driving automated manufacturing and high-precision refining to meet the demands of advanced industrial applications. The integration of AI and machine learning into the distillation process allows manufacturers for automated shift of thermal gradients to ensure consistent output. The digital twins and predictive maintenance enable equipment exhaustion and optimized feedstock yield. The advancement in melt-crystallisation technology improves the production of naphthalene with lower energy consumption and reduced emissions with high performance product in the global chemical landscape.

Trade Analysis of the Naphthalene Market: Import and Export Statistics

- China exported 1,050 shipments of naphthalene.

- India exported 841 shipments of naphthalene.

- Taiwan exported 668 shipments of naphthalene.

- From June 2024 to May 2025, the world exported 1,192 shipments of naphthalene.

Naphthalene Market: Value Chain Analysis

- Feedstock Procurement: The stage involves extraction from coal tar distillation and naphtha cracking process, with initial production of raw materials.

- Key Players: Baoshan iron & steel Co., Himadri Specialty Chemical Ltd., ExxonMobil Corporation and Formosa Petrochemical Corporation.

- Chemical Manufacturing & Refining: The raw naphthalene is purified and processed into naphthalene derivatives such as alkylated naphthalene and phthalic anhydride, and high-purity specialty grades by using melt crystallization and advanced distillation.

- Key Players: Epsilon Carbon Private Ltd., Koppers Inc., JFE Chemical Corporation, BASF SE, Rain Carbon Inc.

- Distribution to End-Use: The final stage involves the distribution of naphthalene to end-user industries where products are sold as liquid or powder by using suitable logistics.

- Key Players: Brenntag, Clariant AG, BASF Construction and Michelin

Regulatory Framework: Naphthalene Market

| Region | Key Regulations | Regulatory Focus |

| Global | MARPOL, GHS (Globally Harmonised System) | Regulations for the transportation of naphthalene to prevent maritime discharge and standards for safety data sheets to ensure the toxic risks of naphthalene products. |

| United States | EPA IRIS Assessment, TSCA Section 6, Clean Air Act, | Safety standards for naphthalene to control VOC and designates high-priority substance, evaluate the chronic health effects and inhalation toxicity. |

| European Union | REACH Regulation, CLP Regulation, Biocidal Products Regulation | Standard for labelling, packaging safety, and restricting the use of naphthalene in household products |

| China | Decree No. 591, GB 30000 | Focus on safe management of hazardous chemicals, targeting safety to prevent accidents |

| Germany | TA Luft, BimSchV(Federal Emission Control) | Regulation on strict emission limits for chemical plants and filtration technologies, the implementation of strict air purity standards. |

Segmental Insights

Source Insights

Why the Coal Tar-Based Naphthalene Segment Dominates the Naphthalene Market?

The coal tar-based naphthalene segment dominated the market with approximately 62.00%share in 2025, benefiting from deep-rooted synergy integrated with the steel and carbon processing industries. Its high availability and cost-efficiency ensure a reliable, large-scale feedstock for phthalic anhydride and superplasticizers and a key by product of coal carbonization. Additionally, the segment's capacity for distillation from crude to high-purity refined crystals maintains its prominence, outperforming alternative methods in scale and logistics.

The petroleum-based naphthalene segment is the fastest-growing in the market during the forecast period due to its high purity and chemical consistency. It provides high-performance plastics and fine chemicals in the automotive and electronics industries, using refinery processes like aromatic hydrocarbon extraction and hydrodealkylation. Its scalability and refined quality position it as the fastest-growing segment that increasingly prioritize environmental standards.

Naphthalene Market Share, By Source, 2025 (%)

| By Source | Revenue Share, 2025 (%) |

| Coal Tar-Based Naphthalene | 62.00% |

| Petroleum-Based Naphthalene | 38.00% |

Grade Insights

How did the Industrial Grade Segment hold the Largest Share in the Naphthalene Market?

The industrial grade segment held the largest revenue share of approximately 68.00% in the market in 2025, driven by its versatility in various heavy manufacturing and large-scale chemical synthesis areas as a high-volume chemical intermediate for phthalic anhydride and demand as feedstock for concrete superplasticizer in construction. It plays a central role in agriculture and chemical supply chains, offering cost-effective, large-scale industrial solutions.

The refined/high-purity grade segment is experiencing the fastest growth in the market during the forecast period, driven by the pharmaceutical and fine chemical sectors, focusing on high-purity crystals for active ingredients, dye intermediates, and surfactants due to the transition toward mass-scale synthesis and strict quality standards. The demand for low-impurity fostering advanced moth repellents and high-end dye intermediates. This segment surge in research-driven manufacturing and demand for premium household products, sustaining leadership in market innovation.

Naphthalene Market Share, By Grade, 2025 (%)

| By Grade | Revenue Share, 2025 (%) |

| Industrial Grade | 68.00% |

| Refined/High-Purity Grade | 32.00% |

Application Insights

Which Application Dominated the Naphthalene Market?

The phthalic anhydride segment dominated the market with approximately 46.00% share in 2025, driving large-scale consumption due to its crucial role in synthetic chemistry. It provides support for vinyl plasticizers, dynamic for flexible tubing, cabling, and flooring. Its strength is supported by a surge for alkyd resins and polyester coatings in automotive and aerospace applications, where durability and chemical resistance are required. As a high-capacity intermediate, phthalic anhydride is essential in global manufacturing, making it the most significant naphthalene application.

The pharmaceuticals & fine chemicals segment is anticipated to grow fastest in the market during the forecast period. The growth is fueled by its role in synthesizing complex molecules and expanding chemical synthesis capabilities, with naphthalene as a versatile intermediate in synthesis for next-generation APIs, particularly therapeutic agents and anti-inflammatories. The increased demand for high-purity derivatives to create high-performance additives and specialty fragrances supports high-value applications that boost its role in medical and scientific innovation.

Naphthalene Market Share, By Application, 2025 (%)

| By Application | Revenue Share, 2025 (%) |

| Phthalic Anhydride | 46.00% |

| Dyes & Pigments | 20.00% |

| Agrochemicals | 12.00% |

| Pharmaceuticals & Fine Chemicals | 8.00% |

| Others | 14.00% |

End-User Industry Insights

How did the Chemicals & Petrochemicals Segment hold the Largest Share in the Naphthalene Market?

The chemicals and petrochemicals segment held the largest revenue share of approximately 42.00% in the market in 2025, mainly due to its role as a core intermediate for downstream products like phthalic anhydride and naphthalene sulfonates and large-scale chemical conversion. Industry using naphthalene to produce high-performance resins, dyes, and agricultural chemicals. Additionally, this segment’s specialized refining infrastructure ensures its integration into global production, from heavy industry to fine chemicals.

The plastics & resins segment is experiencing the fastest growth in the market during the forecast period. Expansion fueled by advanced polymer science. The adoption of high-performance polyester resins and alkyd coatings supports industrial components and construction for high-durability flooring, while naphthalene-based plasticizers enhance packaging materials by offering barrier properties and flexibility. As manufacturing shifts towards precision in materials and lightweight efficiency, this segment drives market innovation.

Naphthalene Market Share, By End-User, 2025 (%)

| By End-User | Revenue Share, 2025 (%) |

| Chemicals & Petrochemicals | 42.00% |

| Plastics & Resins | 20.00% |

| Textiles | 15.00% |

| Agriculture | 8.00% |

| Others | 15.00% |

Sales Channel Insights

How did the Direct Sales (Long-Term Contracts) Segment hold the Largest Share in the Naphthalene Market?

The direct sales (long-term contracts) segment held the largest revenue share of approximately 64.00% in the market in 2025. Offering bulk supply contracts that provide steady feedstock and reduce risks from price volatility and supply disruptions with chemical manufacturers and industrial processors. These multi-year agreements ensure continuous production, scheduled product specifications, and resilience in delivery, fostering strategic partnerships that support the chemical value chain.

The distributors & traders’ segment is experiencing the fastest growth in the market during the forecast period. serves regional small and mid-sized producers by breaking bulk quantities into manageable lots and managing logistics and warehousing. The segment is vital for a logistical bridge for specialized chemical distribution by providing inventory buffers that prevent local shortages and keep functional applications supplied, maintaining market accessibility and technical support.

Naphthalene Market Share, By Sales Channel, 2025 (%)

| By Sales Channel | Revenue Share, 2025 (%) |

| Direct Sales (Long-Term Contracts) | 64.00% |

| Distributors & Traders | 36.00% |

Regional Insights

How did Asia Pacific Dominate the Naphthalene Market?

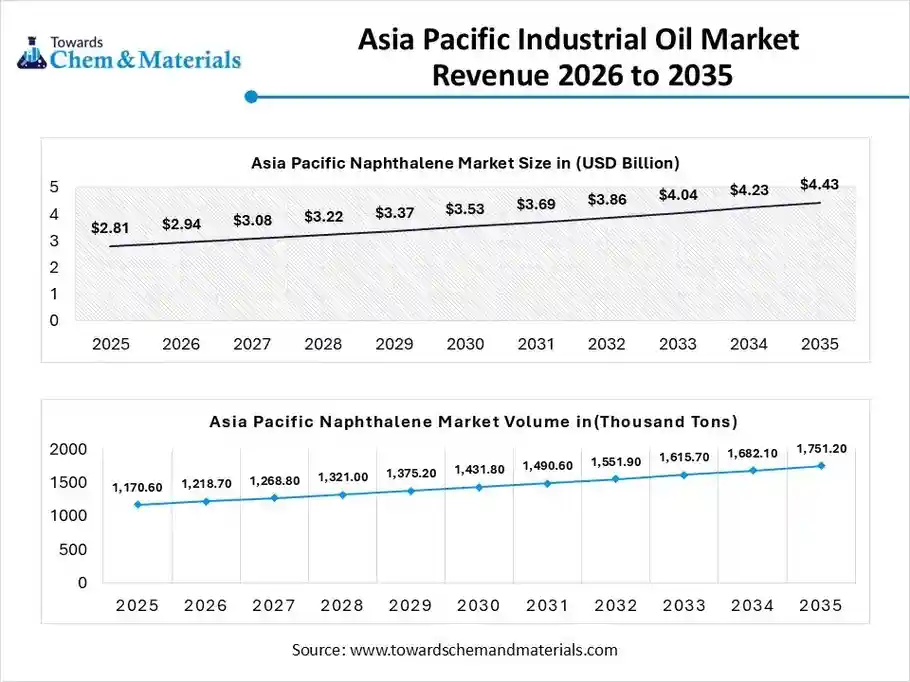

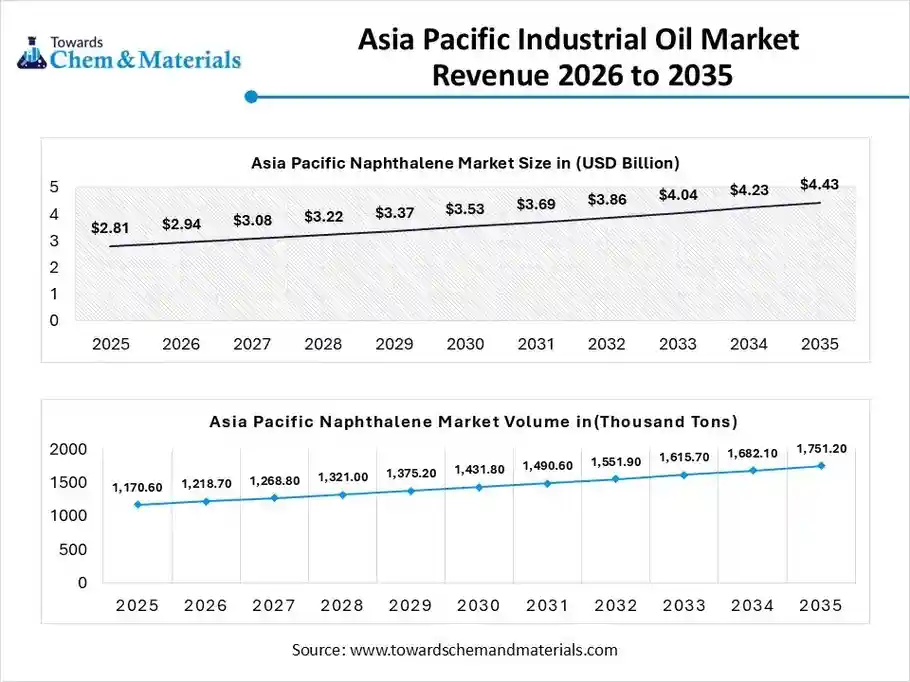

The Asia Pacific naphthalene market size was valued at USD 2.81 billion in 2025 and is expected to be worth around USD 4.43 billion by 2035, exhibiting at a compound annual growth rate (CAGR) of 15.98% over the forecast period from 2026 to 2035.

The Asia Pacific naphthalene volume was estimated at 1,170.6 thousand tons in 2025 and is projected to reach 1,751.2 thousand tons by 2035, growing at a CAGR of 3.90% from 2026 to 2035. Asia Pacific dominated the market with approximately 48.00% share in 2025 through rapid industrial growth, deep chemical infrastructure, and significant investments in infrastructure projects. It is the main consumer of naphthalene sulfonate formaldehyde for high-performance concrete and generates steady demand for naphthalene-containing dye intermediates and surfactants from the textile industry. The abundance of raw materials, such as coal tar from the regional steel and energy sectors, along with government support promoting the maintenance of its competitive edge and innovation in areas like agrochemicals and pharmaceuticals.

China Naphthalene Market Growth Trends

China maintains its dominance as a global player driven by surging demand for refined naphthalene in large infrastructure projects for the production of high-performance concrete superplasticizers and textile projects. By adopting advanced purification technologies to meet strict quality demands. The industrial reliance on coal tar and investing in modernisation to meet environmental regulations, which shifted from household uses, remains a key growth driver.

Europe Naphthalene Market Growth Trends

Europe is expected to grow at the fastest CAGR in the market during the forecast period, characterised by a shift toward high-purity refined grades and sustainable synthesis, driven by strict regulations focused on low emissions and environmentally friendly processes in production. The demand for specialized concrete admixtures for architectural projects and infrastructure restoration, with leadership in pharmaceutical and agrochemical research, boosts its growth. The market is also moving toward applications in specialty resins and automotive coatings, driven by green innovation and technological advancement.

Naphthalene Market Share,By Region, 2025 (%)

| By Region | Revenue Share, 2025 (%) |

| North America | 25.00% |

| Europe | 12.00% |

| Asia Pacific | 48.00% |

| Latin America | 7.00% |

| Middle East & Africa | 8.00% |

Germany Naphthalene Market Growth Trends

Germany maintains its leadership, which focuses on high-end specialty derivatives, developing ultra-high-purity naphthalene for polymers, pigments, automotive and pharmaceuticals. The market redeveloped by decarbonization goals with digital optimization and energy-efficient distillation to offset high domestic costs. Overall, the carbon-neutrality targets and strict safety regulations are encouraging Germany pivot toward sustainable synthesis and circular supply chains.

Recent Developments

- In February 2025, ExxonMobil announced the largest investment for naphtha shipments for the newly established petrochemical complex in China, signalling the forthcoming inauguration of commercial operation. This move by U.S. energy to impact the Asian naphtha market is boosting petrochemical feedstocks.(Source: www.chemanalyst.com)

- In July 2024, the American Petroleum Institute (API) and the American Chemistry Council (ACC) established the naphthalene workgroup that focuses on regulations concerning naphthalene and educates stakeholders on EPA and ATSDR assessments. (Source: www.alchempro.com)

Top Market Players in the Naphthalene Market and their Offerings

- BASF SE: The global chemical leader focuses on naphthalene derivatives used as chemical intermediates in various sectors like textiles, agriculture and construction.

- ExxonMobil: The major player offers alkylated naphthalene base stocks with exceptional thermal and oxidative stability used as blend stocks, compressors and gear oils.

- Rain Carbon Inc.: The market player provides naphthalene intermediates, phthalic anhydride, and polynaphthalene sulfonates for dispersants that focus on the conversion of oil refining and steel production byproducts into carbon-based products.

- SABIC

- JFE Chemical

- Arkema

- Koppers

- Chevron Phillips Chemicals

- Mitsubishi Chemical

- Nippon Steel Chemical

- OCI

- Shandong Weijiao Group

- Baowu Carbon Materials

- Jiangsu SOPO

- Shanxi Coking

- Himadri Speciality Chemical

- Epsilon Carbon

- Indian Oil Corporation

- Cepsa

- Shell Chemicals

Segment Covered in the Report

By Source

- Coal Tar-Based Naphthalene

- Petroleum-Based Naphthalene

By Grade

- Industrial Grade

- Refined/High-Purity Grade

By Application

- Phthalic Anhydride

- Dyes & Pigments

- Agrochemicals

- Pharmaceuticals & Fine Chemicals

- Others

By End-User Industry

- Chemicals & Petrochemicals

- Plastics & Resins

- Textiles

- Agriculture

- Others

By Sales Channel

- Direct Sales (Long-Term Contracts)

- Distributors & Traders

By Region

- North America

- U.S.

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Asia Pacific

- China

- India

- Japan

- South Korea

- Latin America

- Brazil

- Argentina

- Middle East & Africa

- Saudi Arabia

- South Africa