Content

What is the Current Biolubricants Market Size and Volume?

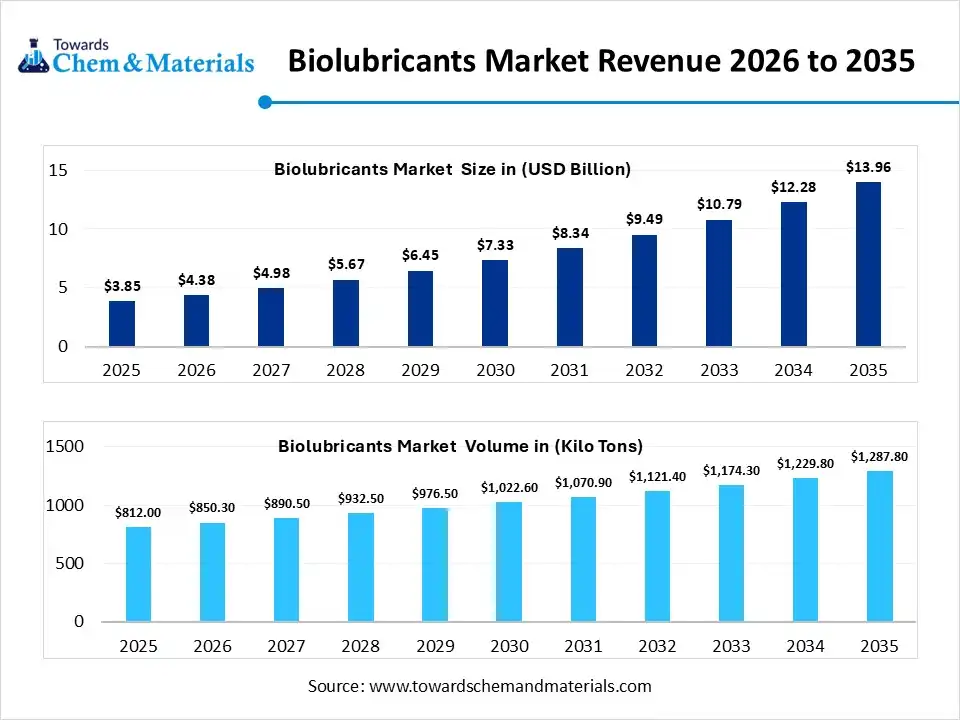

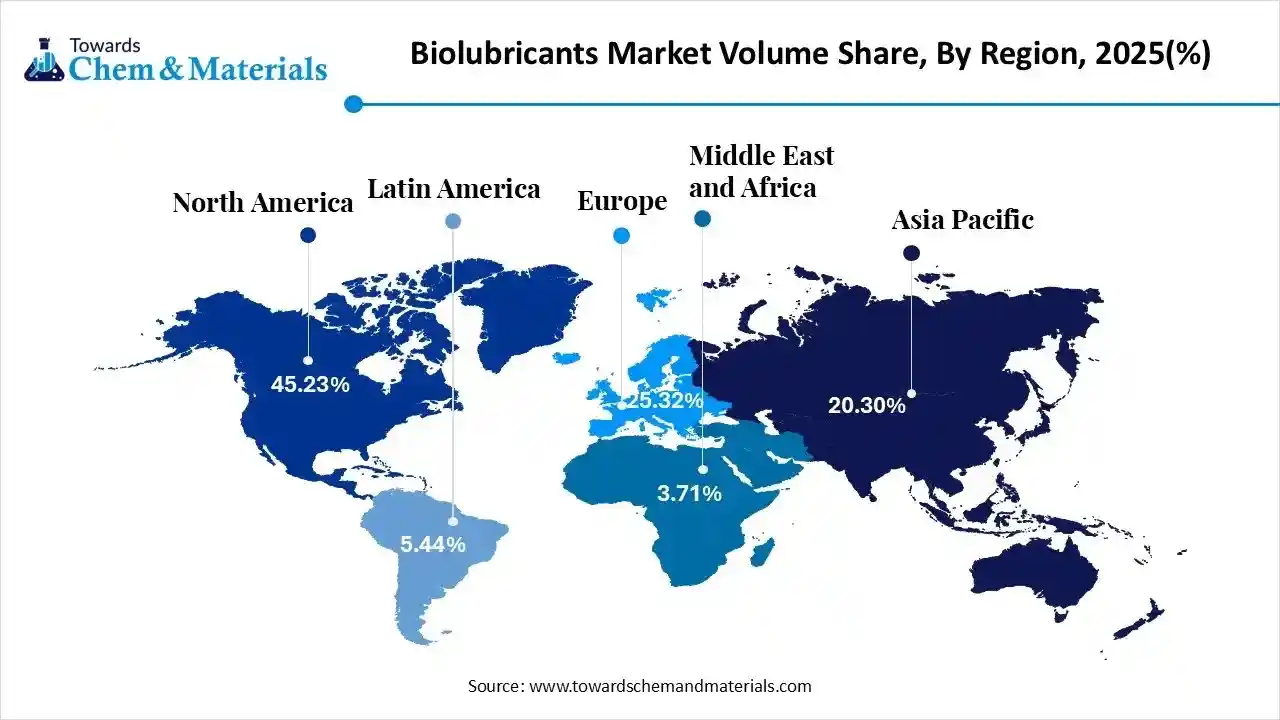

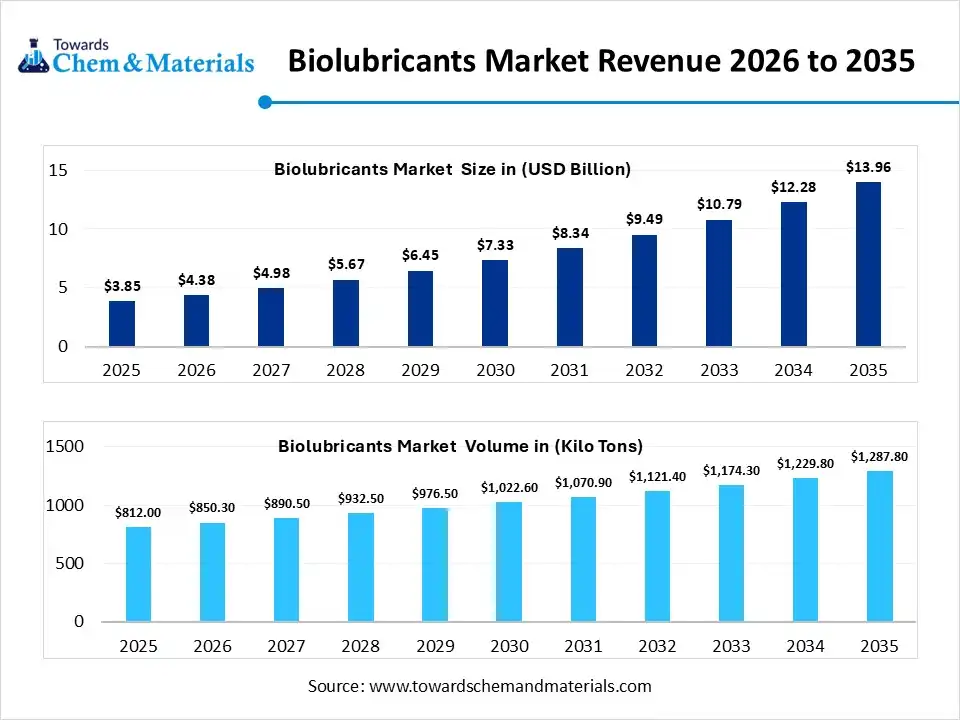

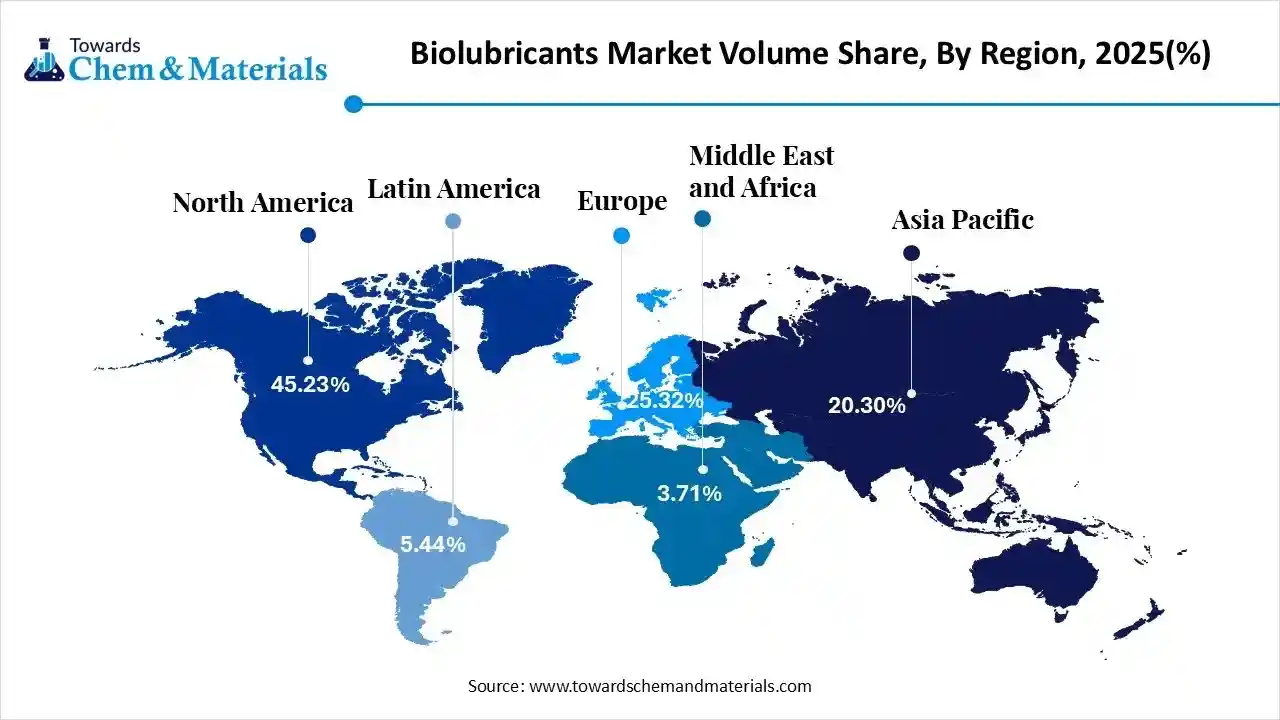

The global bio lubricants market size was estimated at USD 3.85 billion in 2025 and is expected to increase from USD 4.38 billion in 2026 to USD 13.96 billion by 2035, growing at a CAGR of 13.75% from 2026 to 2035. In terms of volume, the market is projected to grow from 812.0 kilo tons in 2025 to 1,287.8 kilo tons by 2035. growing at a CAGR of 4.72% from 2026 to 2035. Asia Pacific dominated the biolubricants market with the largest volume share of 50.31% in 2025. Increasing product demand in the marine, automotive, and agricultural sectors is the key factor driving market growth. Also, growing industrial and consumer awareness about environmental impact, coupled with the ongoing technological innovations, can fuel market growth further.

Market Highlights

- The Asia Pacific dominated the bio-lubricants market with the largest volume share of 50.31% in 2025.

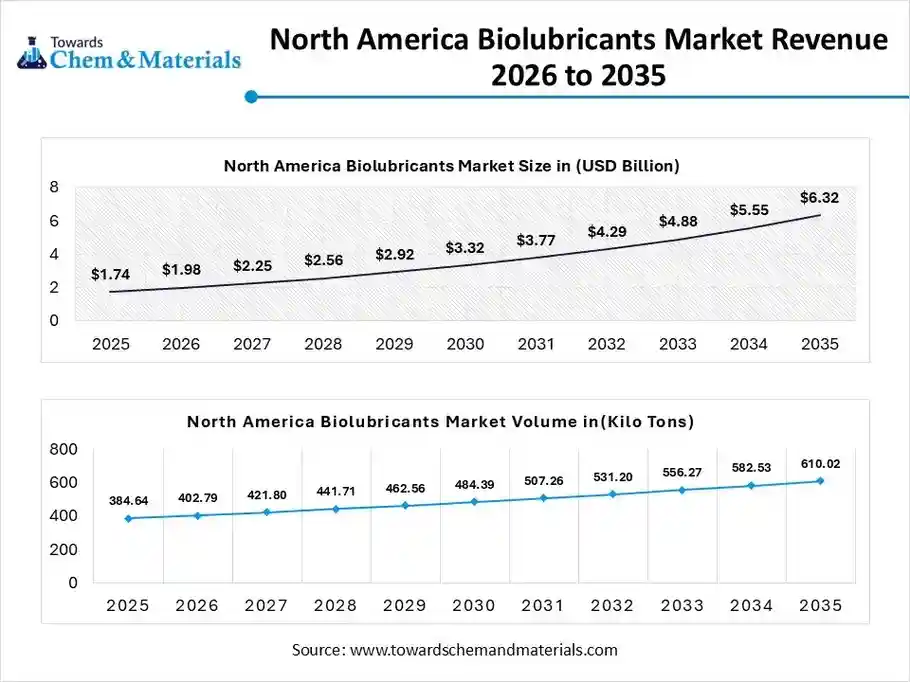

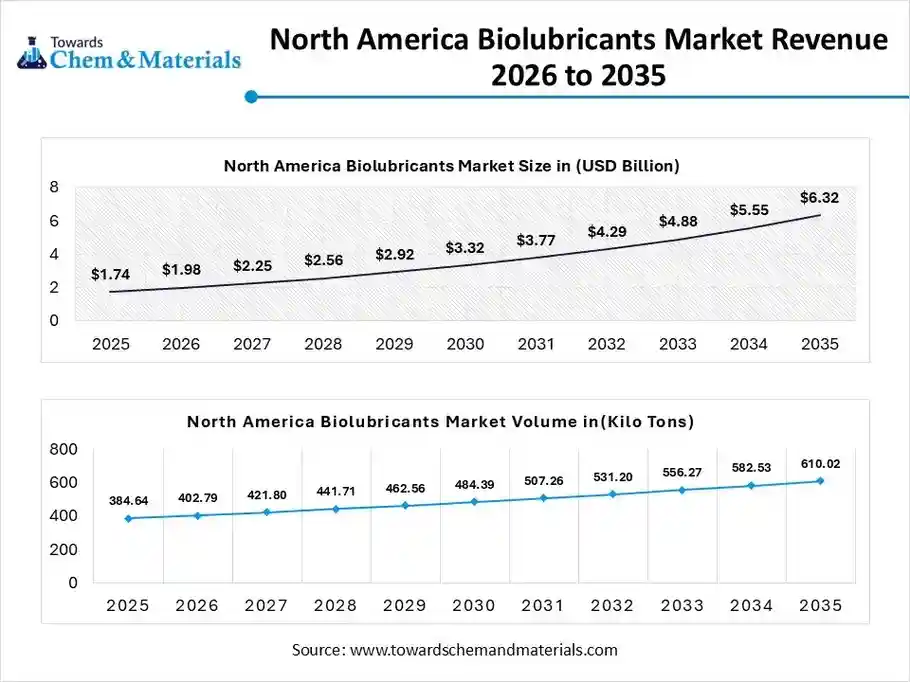

- The bio-lubricants market in North America is expected to grow at a substantial CAGR of 9.00% from 2026 to 2035.

- The Europe bio-lubricants market segment accounted for the major volume share of 17.23% in 2025.

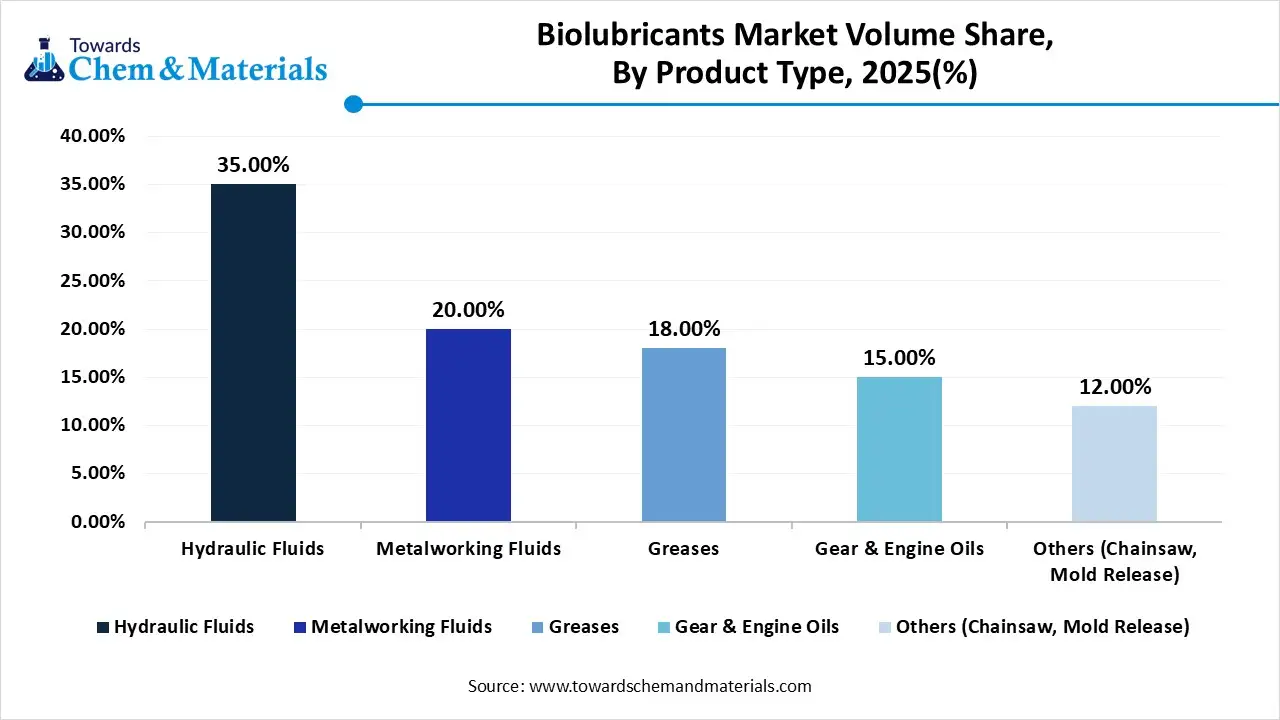

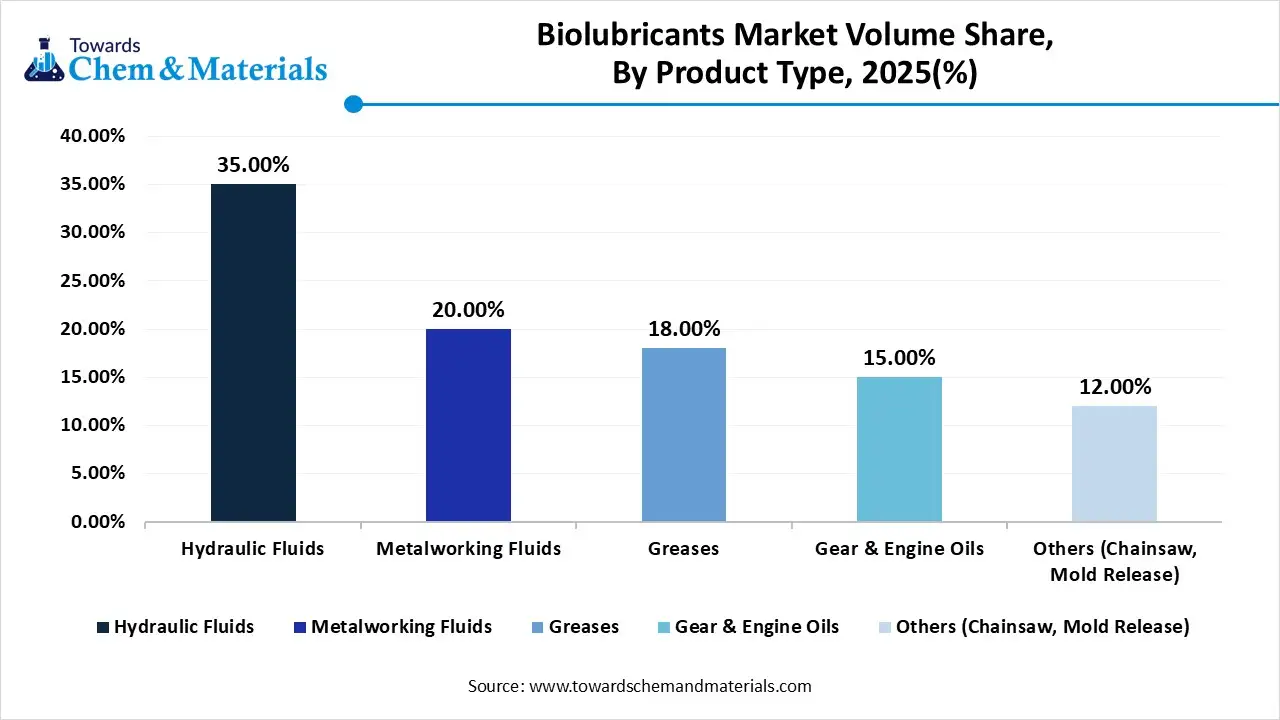

- By product type, the hydraulic fluids segment dominated the market and accounted for the largest volume share of 35.00% in 2025.

- By product type, the greases segment is expected to grow at the fastest CAGR of 4.72% from 2026 to 2035 in terms of volume.

- Based on oil type, the vegetable oils segment led the market with the largest revenue volume share of 85% in 2025.

- By end-use industry, the industrial segment dominated the market and accounted for the largest volume share of 45% in 2025.

What are Biolubricants Market?

The Biolubricants market comprises lubricating fluids derived from renewable biological sources such as vegetable oils, animal fats, or synthetic esters. These products are designed to be biodegradable, non-toxic, and carbon-neutral, providing a sustainable alternative to petroleum-based lubricants in environmentally sensitive sectors like marine, forestry, and agriculture.

Biolubricants Market Trends

- The growing demand for sustainable lubricants in a climate-aware world is the latest trend in the market. The demand for sustainable lubricants is rising due to conventional lubricants, like petroleum-based ones, which can cause certain environmental damage, making it challenging to clean up.

- Rapid innovations in research and technology are propelling the development of high-performance bio lubricants. Research efforts are emphasizing enhancing the stability, properties, and lubrication performance of bio lubricants to fulfil the different industrial needs.

- The surge in demand for biodegradable and renewable lubricants is another major trend shaping positive market growth. Bio lubricants, extracted from renewable sources such as animal fats and vegetable oils, give a sustainable solution to petroleum-based lubricants, leading to market growth soon.

Report Scope

| Report Attribute | Details |

| Market Size and Volume in 2026 | USD 4.38 Billion / 850.3 Kilo Tons |

| Revenue Forecast in 2035 | USD 13.96 Billion / 1,287.8 Kilo Tons |

| Growth Rate | CAGR 13.75% |

| Forecast Period | 2026 - 2035 |

| Base Year | 2025 |

| Units Considered | Value (Billion / Million), Volume (Kilo Tons) |

| Dominant Region | Asia Pacific |

| Segment Covered | By Base Oil Type, By Product Type, By End-Use Industry, By Region |

| Key companies profiled | Shell plc, ExxonMobil Corporation, TotalEnergies SE, BP p.l.c. (Castrol), Chevron Corporation, FUCHS SE, Cargill, Incorporated, Klüber Lubrication (Freudenberg Group), Panolin AG, Emery Oleochemicals, Renewable Lubricants, Inc., Albemarle Corporation, PETRONAS Lubricants International, RSC Bio Solutions, Environmental Lubricants Manufacturing (ELM) |

How Cutting-Edge Technologies Are Revolutionizing the Biolubricants Market?

Advanced technologies are revolutionizing the market from a niche industry into a sustainable and high-performance alternative to petroleum-based products, boosted by growing demand for non-toxic and biodegradable renewable lubricants. Furthermore, the industry is shifting towards integrating bio-based feedstocks with synthetic chemistry, which results in lubricants that give a longer service life.

Trade Analysis of the Biolubricants Market Import & Export Statistics

Exports

- In 2024, the United States solidified its position as the world's second-largest exporter of lubricating products, with export values reaching $2.12 billion.

- In 2024, the main destinations of the United States' Lubricating Products exports were: Canada ($531M), Mexico ($369M), China ($209M), Singapore ($76.1M), and Brazil ($60.7M).

Imports

- In 2024, the United States ranked as the world's 5th largest importer of Lubricating Products, with imports totaling $423M.

- In 2024, the United States imported Lubricating Products mainly from Germany ($127M), Canada ($121M), Japan ($44.6M), France ($21.1M), and Belgium ($20.1M).

- According to the Lubricant Oil import data in India, in between June 2024 to May 2025 (TTM), reaching 3,323 shipments via 251 verified buyers and 394 suppliers representing the growth of 8% compared to the preceding year.

- Vietnam, Mexico, and Russia have emerged as the leading importers of lubricant oil, while Germany, France, and the United States rank as the top three exporters.

Biolubricants Market Value Chain Analysis

Feedstock Procurement

- It involves the sourcing of biodegradable, renewable, and non-toxic raw materials, mainly animal fats, vegetable oils, and waste oils, to produce sustainable base oils.

- Major Players: Emery Oleochemicals, Cargill, Inc

Chemical Synthesis and Processing

- It includes the technical method utilized to convert renewable, raw feedstocks like soybean, vegetable oils, or animal fats into stable and high-performance lubricants.

- Major Players: Shell plc, FUCHS Petrolub SE

Packaging and Labelling

- It involves the strategic, functional, and sustainable design of containers and the information displayed on them to ensure environmental compliance, product integrity, and brand differentiation.

- Major Players: FUCHS SE, Panolin AG

Regulatory Compliance and Safety Monitoring

- It refers to the compulsory adherence to stringent environmental, toxicological, and performance standards implemented by governments and industry bodies.

- Major Players: Cargill, Inc, Panolin AG

Biolubricants Market's Regulatory Landscape: Global Regulations

| Country/Region | Key Regulations |

| North America | USDA BioPreferred Program: Sets specific minimum bio-based content thresholds for federal procurement, such as 72% for multipurpose greases and 44% for hydraulic fluids. |

| European Union | Europe's shift toward a bioeconomy is supported by a mature regulatory framework, with the EU Ecolabel for Lubricants serving as a key standard. To qualify, lubricants must meet stringent criteria regarding low aquatic toxicity and high biodegradability. Furthermore, under updated regulations, products branded as "biolubricants" must contain a minimum of 25% bio-based, renewable content. |

| South America | By Feb 1, 2026, Brazil will begin enforcing tighter NORMAM-401/DPC rules for ships. Concurrently, Colombia plans to release its industrial chemical prioritization criteria in early 2026. |

Segmental Insights

Product Type Insights

Which Product Type Segment Dominated Biolubricants Market in 2025?

The hydraulic fluids segment held the largest market share of approximately 35% in 2025. The dominance of the segment can be linked to its growing usage in machinery, hydraulic elevators, and construction equipment. Also, high demand for better performance in motor graders, hydraulic systems for forklifts, municipal machinery, and front-end loaders is impacting positive segment growth soon.

The greases segment is expected to grow at the fastest CAGR over the forecast period. The growth of the segment can be driven by strict environmental regulations about oil-to-sea interfaces in marine applications, coupled with the growing production adoption in the automotive sector. Furthermore, greases are favoured for applications where leakage can lead to some hazards, like agriculture, marine, and forestry equipment.

Biolubricants Market Volume and Share, By Product Type, 2025-2035

| By Product Type | Market Volume Share (%), 2025 | Market Volume (Kilo Tons)2025 | Market Volume (Kilo Tons)2035 | CAGR(%) 2026-2035 | Market Volume Share (%), 2035 |

| Hydraulic Fluids | 35.00% | 284.2 | 425.0 | 4.57% | 33.00% |

| Metalworking Fluids | 20.00% | 162.4 | 246.0 | 4.72% | 19.10% |

| Greases | 18.00% | 146.2 | 257.6 | 6.50% | 20.00% |

| Gear & Engine Oils | 15.00% | 121.8 | 197.3 | 5.51% | 15.32% |

| Others (Chainsaw, Mold Release) | 12.00% | 97.4 | 162.0 | 5.81% | 12.58% |

Base Oil Type Insights

How Much Share Did the Vegetable Oils Segment Held in 2025?

The vegetable oils segment dominated the market with the largest share of nearly 85% in 2025. The dominance of the segment can be attributed to increasing product demand from the automotive and agriculture/forestry sectors. In addition, vegetable oils are favoured for their better biodegradability, low toxicity, and high viscosity index, leading to segment growth soon.

The synthetic esters segment is expected to grow at the fastest CAGR over the forecast period. The growth of the segment can be credited to its superior oxidation/thermal stability and better temperature resistance. Moreover, synthetic esters are heavily used in electric vehicles (EVs) thermal management, turbine engines, and high-performance lubricants.

End-Use Industry Insights

Which End Use Type Segment Dominated Biolubricants Market in 2025?

The industrial segment dominated the market with the largest share of nearly 45% during the projected period. The growth of the segment is owing to the rise in demand for hydraulic fluids and greases, particularly in manufacturing and marine sectors. Biolubricants give enhanced properties over mineral oils, such as consistent viscosity, higher flash points, and improved lubricity.

The commercial transport segment is expected to grow at the fastest CAGR during the study period. The growth of the segment is due to increasing demand for high-performance and biodegradable alternatives to petroleum lubricants. Additionally, commercial fleets are rapidly adopting sustainable lubricants to minimize their ecological footprint.

Regional Insights

The North America bio lubricants market size was valued at USD 1.74 billion in 2025 and is expected to be worth around USD 6.32 billion by 2035, exhibiting at a compound annual growth rate (CAGR) of 13.77% over the forecast period from 2026 to 2035.

The North America bio lubricants volume was estimated at 367.3 kilo tons in 2025 and is projected to reach 556.3 kilo tons by 2035, growing at a CAGR of 4.72% from 2026 to 2035. North America dominated the market with the largest share of nearly 45.23% in 2025. The dominance of the region can be attributed to the increasing product adoption in the industrial and automotive sectors, along with the strict environmental regulations. In addition, the region has a unique benefit with an abundant supply of rapeseed oil and soybeans, which promotes high biodiesel production and offers essential raw materials.

U.S. Biolubricants Market Trends

In North America, the U.S. led the market due to the growing demand for biodegradable and sustainable alternatives to petroleum, along with the high product demand in the industrial and automotive sectors. Also, growing strategic collaboration, surged in R&D, initiatives, and ongoing product lacunes by market players are propelling the development of high-performance biolubricants.

Asia Pacific Biolubricants Market Trends

The Asia Pacific bio lubricants volume was estimated at 164.8 kilo tons in 2025 and is projected to reach 283.4 kilo tons by 2035, growing at a CAGR of 6.21% from 2026 to 2035. Asia Pacific is expected to grow at the fastest CAGR over the forecast period. The growth of the region can be credited to the rapid urbanisation in emerging economies, along with the surge in production adoption in the automotive sector. The region also has robust access to raw materials for vegetable-based oils, which are famous for their high biodegradability and lubricity, contributing to regional growth in the near future.

China Biolubricants Market Trends

In the Asia Pacific, China dominated the market owing to the growing government pressure to minimize carbon emissions and environmental damage, which is propelling the transition from mineral-based to bio-based lubricants. Moreover, the strong presence of major market players like Sinopec and PetroChina boosts the shift from traditional mineral oils to bio-based alternatives.

Biolubricants Market Volume and Share, By Region, 2025-2035

| By Region | Market Volume Share (%), 2025 | Market Volume (Kilo Tons)2025 | Market Volume (Kilo Tons)2035 | CAGR(%) 2026-2035 | Market Volume Share (%), 2035 |

| North America | 45.23% | 367.3 | 556.3 | 4.72% | 43.20% |

| Europe | 25.32% | 205.6 | 331.7 | 5.46% | 25.76% |

| Asia Pacific | 20.30% | 164.8 | 283.4 | 6.21% | 22.01% |

| Latin America | 5.44% | 44.2 | 73.4 | 5.81% | 5.70% |

| Middle East & Africa | 3.71% | 30.1 | 42.9 | 4.00% | 3.33% |

Europe bio lubricants volume was estimated at 205.6 kilo tons in 2025 and is projected to reach 331.7 kilo tons by 2035, growing at a CAGR of 5.46% from 2026 to 2035. Europe is expected to grow at a notable CAGR over the forecast period. The growth of the region can be driven by the growing demand for better performance and rising sustainability commitments in the industrial/automotive sectors. Furthermore, major market players are increasingly switching to greener alternatives to fulfil goals, further fuelling adoption.

Germany Biolubricants Market Trends

The growth of the market in the country can be fuelled by the rapid enforcement of strict EU environmental regulations, along with the increase in consumer awareness about sustainable products. Innovations in technology have enhanced the performance of bio-lubricants, with many now exceeding conventional petroleum-based products in some applications.

Recent Developments

- In July 2023, UMW Grantt International Sdn Bhd, a UMW Group subsidiary, entered the eco-friendly market with a new range of biodegradable bio-hydraulic lubricants. This move highlights their dedication to sustainability, with plans to further expand their green product offerings.(Source: themalaysianreserve.com)

Biolubricants Market Companies

- Shell plc: Shell plc is a top-tier player in the global biolubricants market, leveraging its position as the world's largest finished lubricant supplier a title it has held for 19 consecutive years.

- ExxonMobil Corporation: ExxonMobil is a key player in the global biolubricants market, leveraging its strong brand (Mobil) and technical expertise to develop high-performance, environmentally friendly lubricants.

- TotalEnergies SE: TotalEnergies SE is a major, proactive player in the global biolubricants market, leveraging its extensive R&D capabilities and existing lubricants infrastructure to develop sustainable, high-performance, and biodegradable solutions.

- BP p.l.c. (Castrol)

- Chevron Corporation

- FUCHS SE

- Cargill, Incorporated

- Klüber Lubrication (Freudenberg Group)

- Panolin AG

- Emery Oleochemicals

- Renewable Lubricants, Inc.

- Albemarle Corporation

- PETRONAS Lubricants International

- RSC Bio Solutions

- Environmental Lubricants Manufacturing (ELM)

Segments Covered in the Report

By Base Oil Type

- Vegetable Oils (Soy, Rapeseed, Sunflower)

- Animal Fats

- Others (Synthetic Esters, Bio-PAO)

By Product Type

- Hydraulic Fluids

- Metalworking Fluids

- Greases

- Gear & Engine Oils

- Others (Chainsaw, Mold Release)

By End-Use Industry

- Industrial (Manufacturing/Power)

- Commercial Transport

- Consumer Automotive

- Others (Marine, Forestry)

By Region

- North America

- U.S.

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Asia Pacific

- China

- India

- Japan

- South Korea

- Latin America

- Brazil

- Argentina

- Middle East & Africa

- Saudi Arabia

- South Africa