Content

Waterproofing Chemicals Market Size and Forecast 2025 to 2034

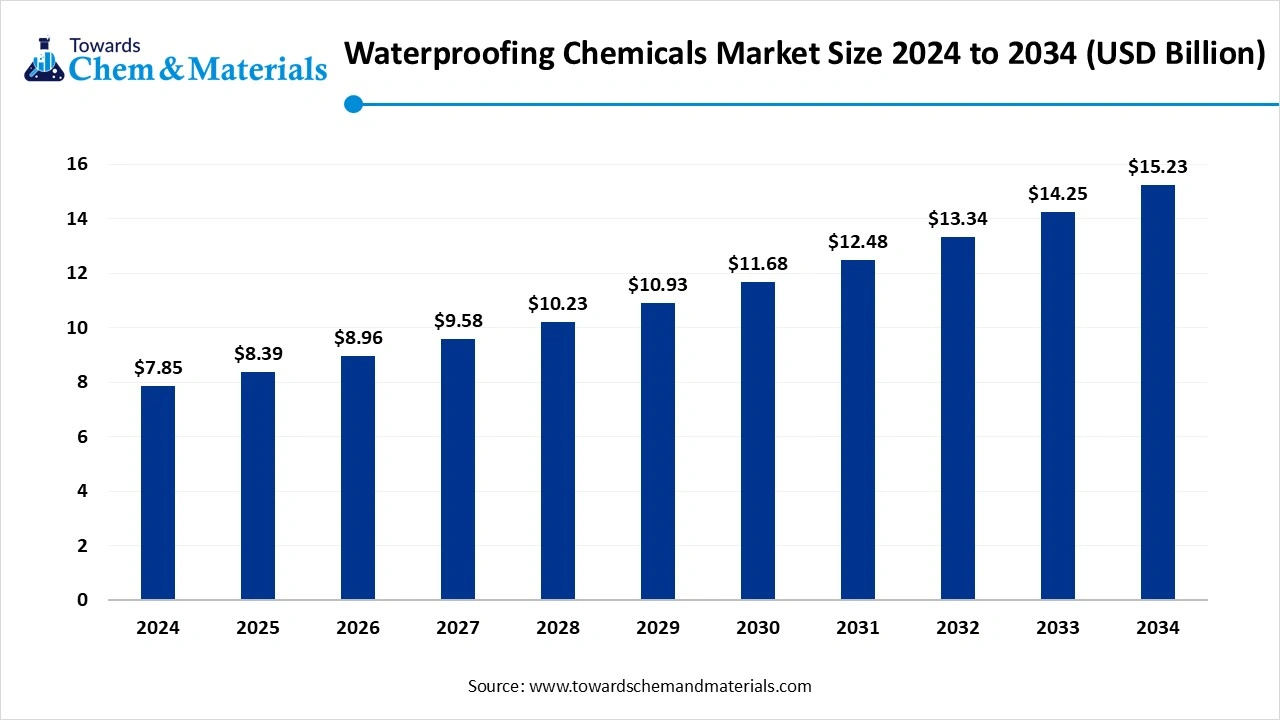

The waterproofing chemicals market size accounted for USD 7.85 billion in 2024 and is predicted to increase from USD 8.39 billion in 2025 to approximately USD 15.23 billion by 2034, expanding at a CAGR of 6.85% from 2025 to 2034.

The growth of the market is driven by the growing construction and infrastructure development due to rapid urbanization and increased awareness, aligning with government initiatives, which drive the growth of the market.

Key Takeaways

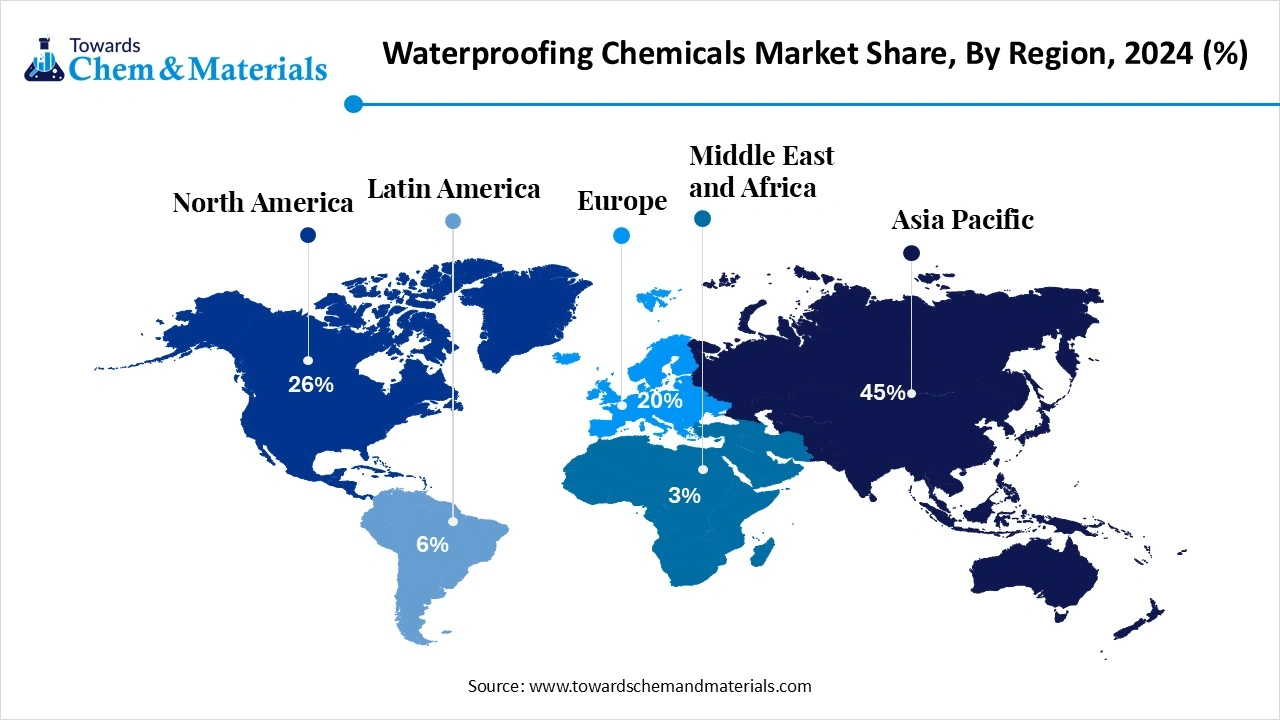

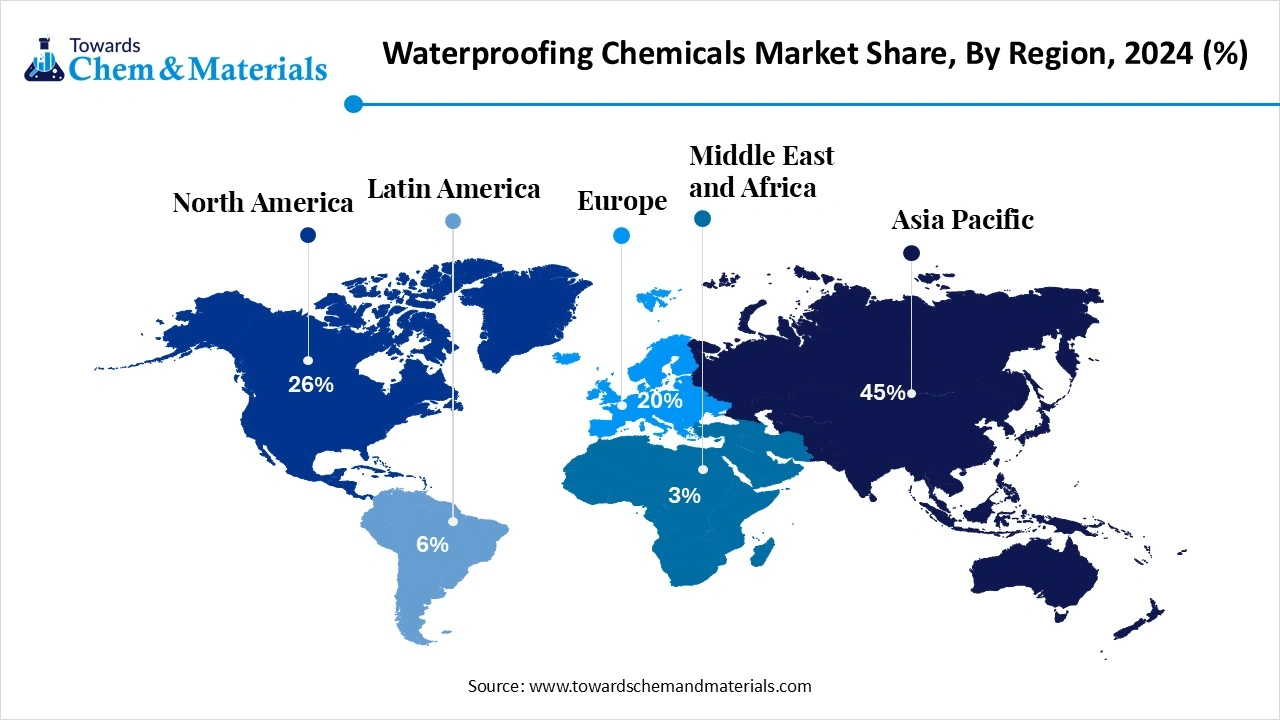

- By region, Asia Pacific dominated the market with a share of 45% in 2024.

- By region, North America is expected to have significant growth in the market in the forecast period.

- By product type, the liquid-applied membranes–single components segment dominated the market with a share of 35% in 2024.

- By product type, the liquid-applied membranes—two-component segment is expected to grow significantly in the market during the forecast period.

- By application area, the roofing segment dominated the market with a share of 22% in 2024.

- By application area, the balconies & podium decks segment is expected to grow in the forecast period.

- By end-use sector, the commercial buildings segment dominated the market with a share of 32% in 2024.

- By end-use sector, the infrastructure & public works segment is expected to grow in the forecast period.

- By distribution channel, the direct project sales segment dominated the market with a share of 42% in 2024

- By distribution channel, the online/e-commerce segment is expected to grow in the forecast period.

- By performance requirement, the high-flexibility/crack-bridging segment dominated the market with a share of 30% in 2024

- By performance requirement, the fast-curing/rapid return-to-service segment is expected to grow in the forecast period.

Market Overview

What Is The Significance Of The Waterproofing Chemicals Market?

The waterproofing chemicals market is important because these materials shield buildings and infrastructure from water damage, enhancing durability, safety, and lifespan.

Market growth is driven by rapid urbanization, demands for climate resilience, technological advancements, increased infrastructure projects, and a global move towards sustainable building methods. These chemicals help prevent expensive structural issues like cracks and mold, reducing maintenance costs and supporting more sustainable construction.

Waterproofing Chemicals Market Outlook:

- Industry Growth Overview: Between 2025 and 2034, the market is expected to see steady growth, driven by rising demand in infrastructure, residential construction, and industrial projects. Cement-based structures, tunnels, bridges, and high-rise buildings are fueling consumption, especially in emerging economies.

- Sustainability Trends: Sustainability is reshaping the market with increasing adoption of eco-friendly and non-toxic formulations. Demand for water-based, low-VOC, and solvent-free waterproofing solutions is growing, aligned with stricter environmental and safety regulations.

- Global Expansion: Key players are expanding operations in the Asia-Pacific and the Middle East to capture large-scale infrastructure opportunities. Strategic collaborations with construction firms and government agencies are strengthening distribution networks.

Report Scope

| Report Attributes | Details |

| Market Size in 2025 | USD 8.39 Billion |

| Expected Size by 2034 | USD 15.23 Billion |

| Growth Rate from 2025 to 2034 | CAGR 6.85% |

| Base Year of Estimation | 2024 |

| Forecast Period | 2025 - 2034 |

| Dominant Region | Asia Pacific |

| Segment Covered | By Product Type, By Application Area, By End-use Sector, By Distribution Channel, By Performance Requirement, By Region |

| Key Companies Profiled | RPM International (Tremco, Carboline) , Pidilite Industries , Asian Paints , Jotun , Saint-Gobain Weber , Ardex , Carlisle Companies , Kryton International , Soudal , Wacker Chemie , Kemper System , Kerakoll , H.B. Fuller , Huntsman Corporation , Soprema |

Key Technological Shifts In The Waterproofing Chemicals Market :

The key technological shifts in the market include the growing focus on the development of eco-friendly solutions like biobased chemicals and low-VOC materials, with advanced technology aligning with the innovation by development of high-performance materials using technologies such as nanotechnology, with properties such as self-healing and hybrid formulation.

The integration of AI and IoT for enhancing the performance and process optimization for real-time monitoring and predictive maintenance creates an opportunity for growth.

Trade Analysis Of The Waterproofing Chemicals Market: Import & Export Statistics

- Globally, the leading exporters were China, South Korea, and Russia from September 2023 to August 2024

- The primary destinations for global Waterproofing Chemical exports in the same period were Vietnam, Uzbekistan, and the United States.

- The world exported approximately 82 shipments of Waterproofing Chemicals between September 2023 and August 2024

- China (60 shipments), followed by South Korea (49 shipments) and Russia (31 shipments).

- The overall export of Waterproofing Chemicals experienced an 11% growth in the period from September 2023 to August 2024 compared to the prior twelve months.

- Vietnam holds a prominent position in global exports, making it a key player in the Asia-Pacific context.

Waterproofing Chemicals Market Value Chain Analysis

- Chemical Synthesis and Processing: The waterproofing chemicals are synthesised and processed by Polyurethanes, Cementitious coatings, Polymer-modified bitumen, and Liquid-applied acrylics.

- Key players: Sika AG, BASF SE, Pidilite Industries (Dr. Fixit), Fosroc, and Mapei.

- Quality Testing and Certification: The waterproofing chemicals require ISO 9001 (Quality Management), ISO 14001 (Environmental Management), GreenPro Certification, and ISO 45001 (Occupational Health and Safety) certification, which is offered by Control Union.

- Key players: ASTM International, Bureau of Indian Standards (BIS), and UL Solutions

- Distribution to Industrial Users: The waterproofing chemicals are distributed to the packaging, automotive, electronics, and construction industries.

- Key players: Pidilite Industries, BASF, Sika AG, Henkel AG & Co. KGaA, and 3 M.

Specialty Chemicals’ Regulatory Landscape: Global Regulations

| Country / Region | Regulatory Body | Key Regulations | Focus Areas | Notable Notes |

| United States | U.S. EPA (Environmental Protection Agency), OSHA, ASTM International | - EPA Clean Air Act (VOC limits for coatings/adhesives) - OSHA Hazard Communication Standard (GHS alignment) - ASTM C836/C898 (standards for liquid-applied membranes) |

- Worker safety - VOC content and emissions - Performance of waterproofing systems |

Green building codes (LEED, Energy Star) encourage low-VOC waterproofing products. ASTM widely governs material performance. |

| European Union | ECHA (European Chemicals Agency), CEN | - REACH (chemical safety and registration) - CLP Regulation (classification & labeling) - EN 1504-2 (products for protection and repair of concrete) |

- Environmental compliance - Hazard labeling - Building material standards |

EU drives stricter VOC restrictions. Sustainability requirements under the EU Green Deal affect waterproofing formulations. |

| China | Ministry of Ecology and Environment (MEE), SAC (Standardization Administration of China) | - GB/T 23445 (polymer waterproof sheets) - GB/T 328.10 (liquid-applied membranes) - MEE Order No. 12 (chemical registration) |

- Product performance - New chemical notification - Construction safety |

Waterproofing chemicals must meet both chemical and building material standards. Strong push toward eco-friendly waterproofing systems. |

| India | BIS (Bureau of Indian Standards), MoEFCC (Ministry of Environment, Forest and Climate Change) | - IS 2645 (integral waterproofing compounds) - IS 15491 (polymer-modified bitumen membranes) - Draft Chemicals (Management & Safety) Rules, 2020 |

- Building durability - Hazard communication - Import & trade compliance |

Waterproofing materials must be BIS-certified. India is moving toward REACH-like chemical regulation, which will affect raw material sourcing. |

| Japan | JIS (Japanese Industrial Standards), MLIT (Ministry of Land, Infrastructure, Transport and Tourism) | - JIS A 6021 (liquid-applied waterproofing membranes) - JIS A 6008 (polymer sheets for waterproofing) |

- Material testing - Construction safety - Chemical safety |

Japan emphasizes long-term durability and seismic-resilient construction. Eco-friendly waterproofing solutions are gaining importance under green building policies. |

Segmental Insights

Product Type

Which Product Type Segment Dominated The Waterproofing Chemicals Market In 2024?

The liquid-applied membranes – single components segment dominated the market with a share of 35% in 2024. They are gaining popularity due to their ease of application, cost-effectiveness, and suitability for small to medium-scale projects.

These membranes are widely used in commercial and residential roofing as well as smaller infrastructure works where quick installation is required. Their user-friendly application reduces labor costs, making them particularly attractive in emerging markets. Growth in residential renovation activities and demand for reliable waterproofing in humid climates are driving the adoption of this product type.

The liquid-applied membranes two-component segment expects significant growth in the waterproofing chemicals market during the forecast period. It provides higher durability, flexibility, and chemical resistance compared to single-component types. They are preferred in large-scale projects such as podium decks, bridges, and public infrastructure, where long-term performance is critical.

Although the application requires skilled labor, the membranes deliver superior crack-bridging capabilities and adhesion, making them ideal for challenging construction environments. Increasing investments in infrastructure modernization and demand for high-performance waterproofing solutions are accelerating the uptake of two-component systems globally.

Application Area Insights

How Did the Roofing Segment Dominated The Waterproofing Chemicals Market In 2024?

The roofing segment dominated the market with a share of 22% in 2024. Roofing remains the largest application area for waterproofing chemicals, accounting for a significant share of demand. Exposure to weather extremes, heavy rainfall, and temperature fluctuations makes roofing surfaces highly vulnerable to leaks and cracks.

The increasing adoption of energy-efficient and green building standards is also influencing the demand for high-performance, sustainable waterproofing solutions in roofing applications across both developed and emerging economies.

The balconies & podium decks segment expects significant growth in the waterproofing chemicals market during the forecast period. Balconies and podium decks require specialized waterproofing solutions to prevent water ingress and structural damage caused by frequent exposure to rain and moisture. Podium decks in urban complexes, shopping malls, and commercial buildings demand durable membranes with strong load-bearing capacity and flexibility. Enhanced aesthetic requirements are also pushing innovation in fast-curing and seamless waterproofing technologies.

End-use Sector Insights

Which End Use Sector Segment Dominated The Waterproofing Chemicals Market In 2024?

The commercial buildings segment dominated the market with a share of 32% in 2024. Commercial buildings such as office complexes, retail centers, and hospitality establishments are major consumers of waterproofing chemicals.

These structures require long-lasting protection against water infiltration to preserve assets and maintain aesthetic value. Additionally, compliance with building safety codes and sustainability standards is influencing the selection of environmentally friendly, high-performance waterproofing membranes in this sector.

The infrastructure & public works segment expects significant growth in the market during the forecast period. Infrastructure and public works, including bridges, tunnels, highways, and water management systems, represent a fast-growing application area for waterproofing chemicals.

Governments worldwide are investing in infrastructure upgrades and new projects, driving substantial demand for waterproofing materials. Public sector projects also emphasize long-term performance, ensuring minimal maintenance costs, which boosts the adoption of premium, two-component liquid-applied membranes and advanced formulations.

Distribution Channel Insights

How Did the Direct Project Sales Segment Dominated The Waterproofing Chemicals Market In 2024?

The direct project sales segment dominated the market with a share of 42% in 2024. Direct project sales dominate the market, especially in large-scale commercial and infrastructure projects. Manufacturers and suppliers collaborate directly with construction companies, architects, and contractors to provide tailored solutions.

The growth of mega-infrastructure projects, particularly in the Asia Pacific and the Middle East, is reinforcing the importance of direct sales, as large buyers prefer negotiated contracts with guaranteed product quality and supply continuity.

The online/e-commerce segment expects significant growth in the waterproofing chemicals market during the forecast period. The online and e-commerce distribution channel is expanding rapidly, driven by the increasing demand from small contractors, retailers, and DIY consumers.

This channel is particularly beneficial for single-component liquid membranes used in smaller residential repairs. The convenience of online platforms, combined with rising digital adoption in the construction materials sector, is expected to accelerate growth in this distribution segment.

Performance Requirement Insights

Which Performance Requirement Segment Dominated The Waterproofing Chemicals Market In 2024?

The high-flexibility/crack-bridging segment dominated the market with a share of 30% in 2024. High flexibility and crack-bridging properties are critical in waterproofing applications where structures face thermal expansion, vibrations, or structural movement. These membranes are commonly used in infrastructure works and podium decks to ensure long-term durability.

The demand is rising in regions prone to seismic activity or extreme climate variations, where standard membranes fail to perform. Advanced formulations with elastomeric properties are being developed to meet these requirements, ensuring resilience and extended lifecycle performance.

The fast-curing/rapid return-to-service segment expects significant growth in the market during the forecast period. Fast-curing membranes are increasingly in demand for projects with tight deadlines or those requiring minimal downtime, such as commercial renovations and public infrastructure upgrades.

These products enable quick installation and reduce disruption in service areas like shopping malls, office complexes, and public facilities. With urban infrastructure projects growing rapidly, contractors are prioritizing solutions that balance durability with speed of application. Manufacturers are responding with advanced polymer-modified systems that allow rapid curing without compromising performance.

Regional Insights

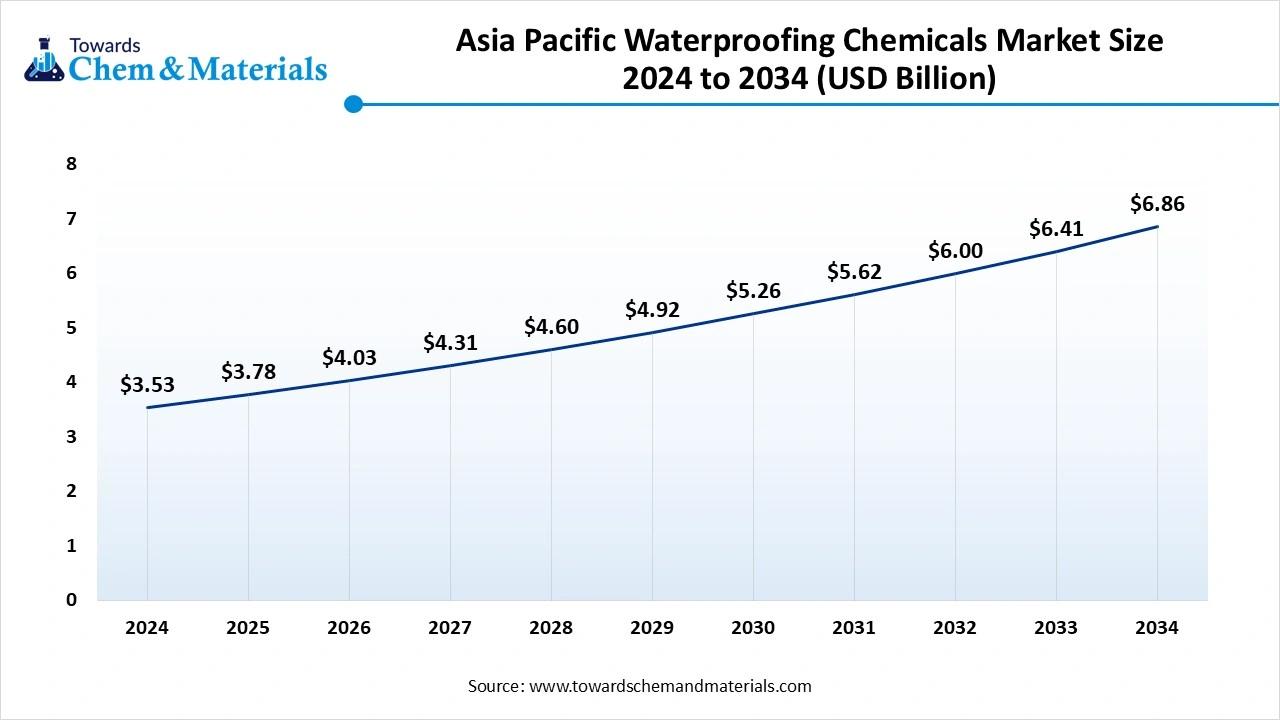

Asia Pacific Waterproofing Chemicals Market Size, Industry Report 2034

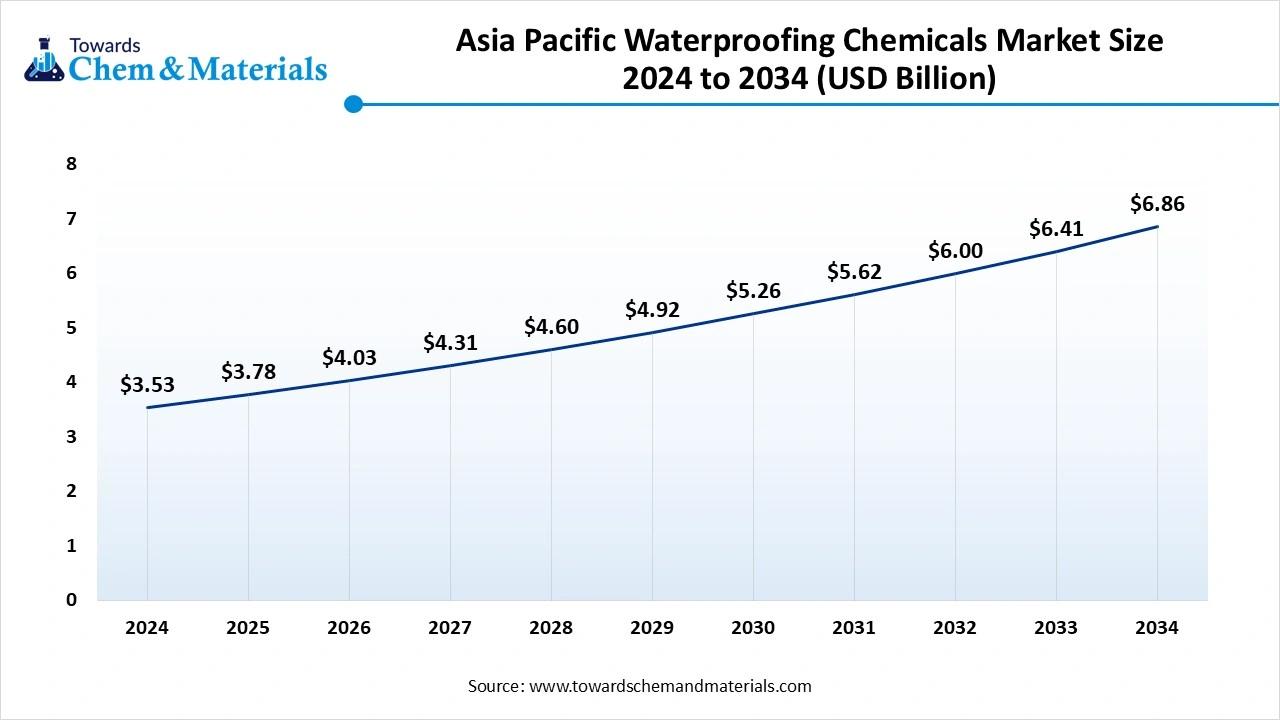

The Asia Pacific waterproofing chemicals market size was valued at USD 3.53 billion in 2024 and is expected to surpass around USD 6.86 billion by 2034, expanding at a compound annual growth rate (CAGR) of 6.87% over the forecast period from 2025 to 2034. Asia Pacific dominated the waterproofing chemicals market in 2024.

The growth of the market is driven by the rapid urbanization and infrastructure development in the region, due to increased investments by the government, which help in the growth of the market. The increased construction activities in the region and demand for both industrial and commercial sectors increase the demand for waterproofing solutions. The growing focus on climate change and sustainability demand in the region further contributes to the growth and expansion of the market.

India Has Seen Growth Due To The Presence Of Significant Players In The Market

India has seen significant growth, driven by the presence of key players in the country like Pidilite Industries, Sika AG, Sunanda Global, CICO Group, and Fosroc, which increases the demand for the market, resulting from growing construction activity in the country due to rising demand, which fuels the growth of the market in the region.

North America Has Seen Significant Growth, Driven By Infrastructure Development

North America is expected to experience significant growth in the market in the forecast period. The growth of the market is driven by demand for infrastructure renewal and maintenance to increase the life of buildings and structures against water infiltration, which drives the growth of the market in the region. The growing awareness of the importance of protecting structures from costly water damage fosters widespread adoption of these products in the region, driving the growth and expansion of the market.

Country-Level Investments & Funding Trends For The Waterproofing Chemicals Industry:

- India: the top destinations for Waterproofing Chemical exports were Ghana, Nepal, and Vietnam.

- Germany: Germany has been a pioneer in the industrial-scale implementation of chemical recycling technologies, with facilities like those in Berrenrath and SVZ Schwarze Pumpe.

- Germany: Companies like LyondellBasell are investing in advanced recycling centers to process plastic waste into high-quality feedstock for new materials, supporting the circular economy.

- Canada: A focus on developing and upgrading Canadian infrastructure requires significant waterproofing solutions, creating investment opportunities.

- Netherlands: Dow invested in Xycle to support the construction of its first commercial-scale pyrolysis plant in Rotterdam, intending to convert hard-to-recycle plastic waste into circular feedstock for its own products

Recent Developments

- In August 2025, Ramco Cements introduced "Hard Worker," a new brand offering construction chemicals such as tile adhesives and waterproofing. The company targets Rs 2,000 crore in revenue from this division within the next four to five years.(Source:www.icicidirect.com)

- In August 2025, Anurag University and Rehab Technologies partnered to establish a Start-ups Mentoring Centre and a Centre for Construction Chemicals and Research Studies. This collaboration intends to foster innovation in the construction sector through research, training, and support for new entrepreneurs.(Source: telanganatoday.com)

- In July 2024, Shalimar Paints introduced Zero Damp Advance, a waterproofing solution for walls containing hybrid polymers and reinforcing acrylic fibers. This product creates a resilient membrane offering dual seepage resistance and comes with a 12-year warranty.(Source: www.indianchemicalnews.com)

Top Companies In The Waterproofing Chemicals Market & Their Offerings:

- Sika: A global leader in construction chemicals, Sika offers a wide range of waterproofing solutions, including liquid-applied membranes, cementitious coatings, and admixtures for concrete protection.

- MBCC Group: Provides innovative waterproofing chemicals such as membranes, sealants, and admixtures for building and infrastructure projects, with a focus on sustainable construction solutions.

- Fosroc: Specializes in waterproofing systems, including liquid membranes, joint sealants, and protective coatings widely used in industrial, commercial, and infrastructure projects.

- Mapei: Offers advanced waterproofing products such as admixtures, bituminous membranes, and liquid coatings, with strong applications in tunneling, commercial buildings, and infrastructure.

- GCP Applied Technologies: Supplies waterproofing chemicals and systems, including sheet membranes, liquid-applied membranes, and concrete admixtures for construction and civil engineering applications.

Other Top Players Are

- RPM International (Tremco, Carboline)

- Pidilite Industries

- Asian Paints

- Jotun

- Saint-Gobain Weber

- Ardex

- Carlisle Companies

- Kryton International

- Soudal

- Wacker Chemie

- Kemper System

- Kerakoll

- H.B. Fuller

- Huntsman Corporation

- Soprema

Segments Covered

By Product Type

- Liquid-applied membranes single-component

- Liquid-applied membranes two-component

- Sheet membranes bituminous

- Sheet membranes synthetic

- Cementitious waterproofing

- Crystalline waterproofing admixtures

- Bituminous coatings & emulsions

- Injection chemicals & grouts

- Sealants & joint fillers

By Application Area

- Roofing

- Basements & substructures

- Wet areas

- Water tanks & reservoirs

- Tunnels & underground works

- Bridges & highways

- Marine & coastal structures

- Swimming pools & leisure facilities

- Balconies & podium decks

- Car parks & ramps

- Façade & external walls

- Industrial facilities

- Green roofs

By End-use Sector

- Residential

- Commercial buildings

- Institutional

- Industrial

- Infrastructure & public works

By Distribution Channel

- Direct project sales

- Distributors & wholesalers

- Retail

- Online / e-commerce

By Performance Requirement

- Potable-water safe systems

- Chemical/abrasion-resistant systems

- Fast-curing / rapid return-to-service systems

- High-flexibility / crack-bridging systems

- UV/weather-resistant systems

By Region

- North America

- U.S.

- Canada

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Sweden

- Denmark

- Norway

- Asia Pacific

- China

- Japan

- India

- South Korea

- Thailand

- Latin America

- Brazil

- Mexico

- Argentina

- Middle East and Africa (MEA)

- South Africa

- UAE

- Saudi Arabia

- Kuwait