Content

U.S. Surfactants Market Size and Growth 2025 to 2034

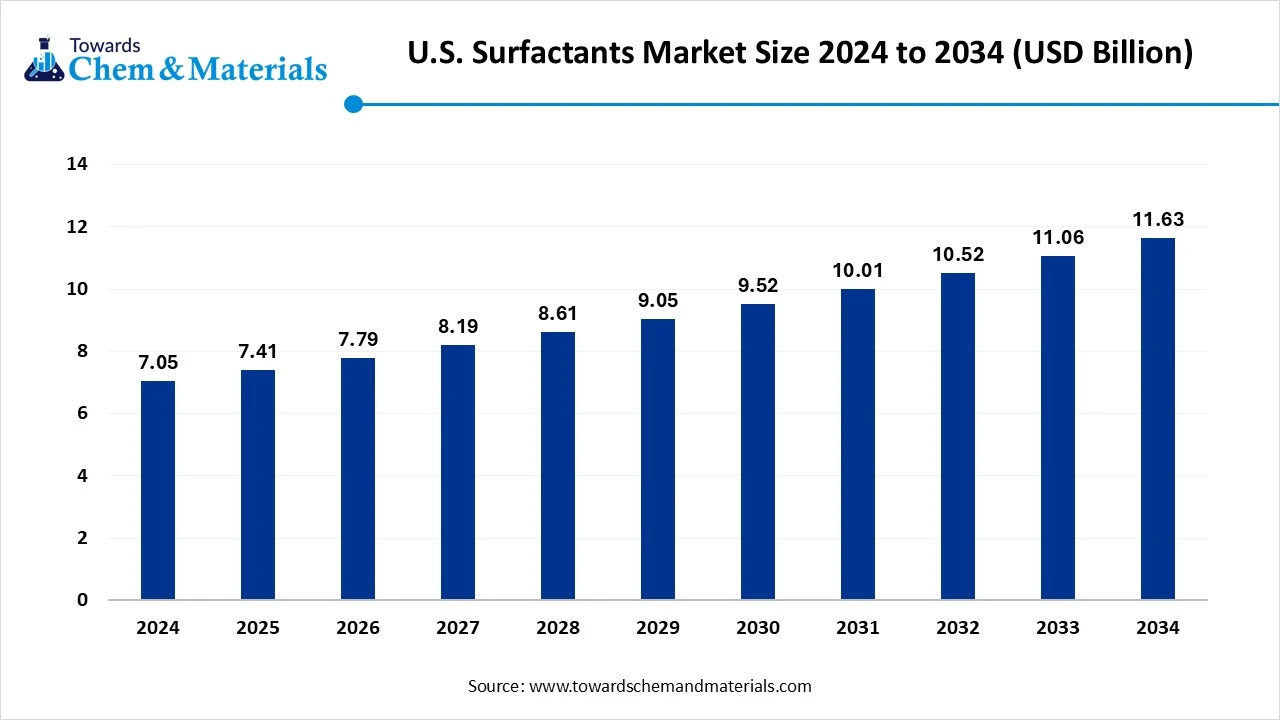

The U.S. surfactants market size was reached at USD 7.05 billion in 2024 and is expected to be worth around USD 11.63 billion by 2034, growing at a compound annual growth rate (CAGR) of 5.13% over the forecast period 2025 to 2034. The growing adoption of bio-based surfactants and the increasing demand for personal care drive the market growth.

Key Takeaways

- Midwest held approximately a 35% share in the U.S. surfactants market in 2024 due to the strong presence of the agricultural sector.

- South is growing at the fastest CAGR in the market during the forecast period due to the well-established oil & gas industry.

- By type, the anionic surfactants segment held approximately a 45% share in the U.S. surfactants market in 2024 due to the increasing demand for cleaning products.

- By type, the nonionic surfactants segment is expected to grow at the fastest CAGR in the market during the forecast period due to the rising environmental concerns.

- By origin, the synthetic surfactants segment held approximately a 70% share in the U.S. surfactants market in 2024 due to the growing production of industrial cleaning.

- By origin, the bio-based/green surfactants segment is expected to grow at the fastest CAGR in the market during the forecast period due to the increasing preference for organic products.

- By form, the liquid surfactants segment held approximately a 60% share in the U.S. surfactants market in 2024 due to the growing utilization of shampoos and body washes.

- By form, the powder/granular surfactants segment is expected to grow at the fastest CAGR in the market during the forecast period due to the better emulsification properties.

- By end user industry, the consumer goods manufacturers segment held approximately a 55% share in the U.S. surfactants market in 2024 due to the growing demand for cosmetics & personal care products.

- By end user industry, the agriculture & food industry segment is expected to grow at the fastest CAGR in the market during the forecast period due to the increasing demand for food.

Role of U.S Surfactants in Industrial Applications & Everyday Life

The U.S. Surfactants Market covers the production, distribution, and application of surface-active agents used to reduce surface tension between liquids, solids, or gases. Surfactants are widely used as dispersing, cleaning, and emulsifying agents. Surfactants are categorized into different types, like cationic, amphoteric, anionic, and nonionic.

They are derived from synthetic petrochemical feedstocks or bio-based renewable sources. Surfactants are widely used in detergents, personal care products, industrial cleaners, agricultural formulations, oilfield chemicals, and various specialty applications. The growing consumer focus on environmental impact increases demand for bio-based surfactants.

Factors like strong demand for household cleaning products, increasing consumption of personal care products, growing demand for biodegradable surfactants, and growth in the industrial applications contribute to the growth of the U.S. surfactants market.

- According to OEC World, the United States exported $1.02B of organic surfactant for washing, cleaning preparations nes in 2023.(Source: oec.world)

- According to Volza’s Export data, The Dow Chemical Company C O Laticr accounted maximum export share of surfactants with 1106 shipments.(Source: www.volza.com)

- According to Volza’s Export data, from April 2024 to March 2025, the United States exported 333 shipments of the chemical surfactant with a growth rate of 22%.(Source: www.volza.com)

- According to OEC World, the United States exported $3.81B of cleaning products in 2024.(Source: oec.world)

Growing Personal Care Industry Surges Demand for Surfactants

The growing personal care industry and increasing focus on personal hygiene increase demand for various personal care products that require surfactants. The strong consumer focus on grooming and increasing spending on personal care items increases demand for surfactants. The high demand for items like lotions, shampoos, and body washes increases the adoption of surfactants for properties like emulsifying, cleansing, and foaming. The increasing shift towards natural and organic products increases demand for bio-based surfactants. The increasing consumer demand for skin-compatible, foaming, and conditioning products fuels demand for surfactants.

The increasing spending on premium personal care products increases demand for specialized surfactants. The strong consumer focus on specialty cosmetics, skincare, and haircare increases demand for diverse products. The growing utilization of products like soaps, creams, makeup, shampoos, and lotions increases demand for surfactants. The growing personal care industry is a key driver for the growth of the U.S. surfactants market.

Market Trends

- Growing Demand for Home Care Products:- The increasing demand for various home care products like all-purpose cleaners, laundry detergents, bathroom cleaners, and dishwashing liquids increases demand for surfactants for removing dirt and stains from surfaces.

- Increasing demand for Bio-Based Surfactants:- The growing environmental concerns and increasing focus on sustainability increase demand for bio-based surfactants. The utilization of bio-based surfactants helps in reducing the carbon footprint.

- Growing Oil & Gas Industry:- The growing expansion of the oil & gas industry increases demand for surfactants for applications like oil spill remediation, enhanced oil recovery, and drilling operations.

Report Scope

| Report Attribute | Details |

| Market Size in 2025 | USD 7.4 billion |

| Expected Size by 2034 | USD 11.63 billion |

| Growth Rate from 2025 to 2034 | CAGR 5.13% |

| Base Year of Estimation | 2024 |

| Forecast Period | 2025 - 2034 |

| Segment Covered | By Type, By Origin, By Form, By End-User Industry, By region |

| Key Companies Profiled | Chemical Associates, Air Products and Chemicals, BASF, Kraton Corporation, Evonik Industries, SABIC, Univar Solutions, Clariant, Solvay, Croda International, Stepan Company, Eastman Chemical Company, Dow, Nouryon, Huntsman Corporation |

Market Opportunity

Growing Expansion of the Healthcare Industry Unlocks Market Opportunity

The growing expansion of the healthcare sector in the United States and the increasing demand for healthcare services fuel the adoption of surfactants for healthcare applications. The increasing demand for an efficient drug delivery system increases the adoption of surfactants for enhancing the bioavailability and solubility of drugs. The growing development of new drugs and the creation of various pharmaceutical products increases demand for surfactants.

The growing adoption of disinfectants in healthcare facilities like clinics & hospitals increases demand for surfactants. The growth in disinfection and sterilization procedures increases the adoption of surfactants. The increasing production of pharmaceutical products like injectable solutions, creams, and lotions increases demand for surfactants. The growth in the development of diagnostic tools and medical devices increases demand for surfactants. The growing expansion of the healthcare industry creates an opportunity for the growth of the U.S. surfactants market.

Market Challenge

Fluctuations in Raw Material Prices Limit the Expansion of the Market

Despite several benefits of the surfactants in the United States in various industries, the fluctuations in raw material prices restrict the growth of the market. Factors like supply chain disruptions, volatility in crude oil prices, and stricter environmental regulations are responsible for fluctuations in raw materials prices. The increasing demand for crude oil derived from fatty alcohols and petrochemicals increases the cost.

The stricter environmental regulations for the production of surfactants and regulations on the use of palm oil increase the raw materials cost. The fluctuations in the prices of raw materials like petrochemicals, natural oils, and fatty acids directly affect the market. Supply chain disruptions due to factors like unforeseen circumstances, natural disasters, and political instability increase the cost of raw materials. The fluctuations in raw material prices hamper the growth of the U.S. surfactants market.

Regional Insights

Midwest U.S. Surfactants Market Trends

The Midwest region dominated the U.S. surfactants market in 2024. The well-established agriculture sector increases demand for agrochemicals like fungicides & herbicides that require surfactants. The increasing demand for automotive lubricants, textile treatments, and other products increases the adoption of surfactants. The growing demand for food processing and manufacturing increases demand for surfactants for use as processing aids & food additives.

The increasing adoption of personal care products increases demand for surfactants. The growing manufacturing in sectors like chemicals, automotive, and plastics increases demand for surfactants, driving the overall growth of the market.

South U.S. Surfactants Market Trends

The South region is the fastest-growing in the market during the forecast period. The well-developed oil & gas sector increases demand for surfactants for drilling fluids & enhanced oil recovery. The growing expansion of the agriculture sector and the focus on enhancing crop yields increase demand for surfactants. The increasing demand for home care & personal care products like shampoos, detergents, and soaps increases the adoption of surfactants. The growing development of green surfactants and advancements in surfactant production support the overall growth of the market.

Segmental Insights

By Type

Why did the Anionic Surfactants Segment Dominate the U.S. Surfactants Market?

The anionic surfactants segment dominated the U.S. surfactants market in 2024. The growing demand for cleaning products like dish soaps & laundry detergents increases demand for anionic surfactants. The increasing adoption of linear alkylbenzene sulfonate anionic surfactant in cleaning products helps market growth. The growing spending on personal care products like body washes and shampoos increases demand for anionic surfactants. The growing demand for home care products and the affordability of anionic surfactants drive the overall growth of the market. The nonionic surfactants segment is the fastest-growing in the market during the forecast period. The stringent environmental regulations and growing environmental concerns increase demand for nonionic surfactants.

The increasing consumer preference for eco-friendly products increases the adoption of nonionic surfactants in various products. The increasing demand for hard surface cleaners & laundry detergents increases the adoption of nonionic surfactants. The growing demand for nonionic surfactants in applications like industrial cleaning, personal care, and agrochemicals supports the overall growth of the market.

By Origin

How Synthetic Surfactants Segment Held the Largest Revenue Share of the U.S. Surfactants Market?

The synthetic surfactants segment held the largest revenue share of the U.S. surfactants market in 2024. The increasing demand for household cleaning products and detergents increases the demand for synthetic surfactants. The strong focus on removing stains and dirt increases demand for synthetic surfactants, helping the market growth. Synthetic surfactants have properties like dispersing abilities, foaming, and emulsification. They are made up of petrochemicals and are suitable for large applications. The growing demand for industrial cleaning and personal care products drives the overall growth of the market.

The bio-based/green surfactants segment is experiencing the fastest growth in the market during the forecast period. The growing consumer shift towards natural and clean-label products increases demand for bio-based/green surfactants. The growing consumer awareness about environmental impact and focus on biodegradability increases the adoption of bio-based/green surfactants. The growing demand for organic personal care products like soaps, shampoos, and lotions increases demand for bio-based/green surfactants. The increasing demand for bio-based surfactants in home care, industrial cleaning, and agricultural products supports the overall growth of the market.

By Form

What Made the Liquid Surfactants Segment Dominate the U.S. Surfactants Market?

The liquid surfactants segment dominated the U.S. surfactants market in 2024. The growing demand for various cleaning agents like detergents, soaps, and other products increases demand for liquid surfactants. The increasing spending on personal care products like body washes & shampoos increases the adoption of liquid surfactants, helping the overall growth of the market. Liquid surfactants are easily combined with any formulation, and they enable effective cleaning. The growing expansion of the food & beverage industry increases demand for liquid surfactants, driving the overall growth of the market.

The powder/granular surfactants segment is the fastest-growing in the market during the forecast period. The strong focus on removing grime, dirt, and grease increases demand for powder/granular surfactants. The growing awareness about personal hygiene and the increasing demand for grooming products increase the adoption of powder surfactants. These surfactants offer better emulsification and wetting. The growing demand for powder surfactants across applications like pharmaceuticals, textiles, oil & gas, food & beverages, and home care supports the overall growth of the market.

By End-User Industry

Which End-User Industry Held the Largest Share of the U.S. Surfactants Market?

The consumer goods manufacturers segment held the largest revenue share of the U.S. surfactants market in 2024. The growing demand for industrial cleaning & household cleaning products like dishwashing liquids, disinfectants, laundry detergents, and surface cleaners increases demand for surfactants. The increasing importance of sanitization and growing demand for premium cleaning products increase the adoption of surfactants. The strong focus on grooming increases demand for personal care items like body washes, shampoos, and facial cleansers that require surfactants. The growth in online buying of cosmetic products and home care products increases the adoption of surfactants, driving the overall growth of the market.

The agriculture & food industry segment is experiencing the fastest growth in the market during the forecast period. The increasing demand for food and the growing demand for higher crop yields increase the demand for surfactants for various agricultural applications. The growing utilization of surfactants in agrochemicals like fungicides, pesticides, and herbicides helps the market growth. The ongoing advancements in farming, like drip irrigation and precision farming, increase demand for surfactants. The growing expansion of the food & beverage industry and increasing demand for various food products like salad dressings, baked goods, mayonnaise, and ice cream increase demand for surfactants, supporting the overall growth of the market.

U.S. Surfactants Market Value Chain Analysis

Chemical Synthesis and Processing

The chemical synthesis of surfactants involves the combination of certain compounds or molecules with hydrophobic and hydrophilic properties.

- Key Players:- Stephan Company, Ashland Global Holdings, Dow, and Huntsman

Distribution to Industrial Users

Surfactants are delivered to industries through various distribution channels, including direct sales, online marketplaces, specialized chemical suppliers, and distributors.

- Key Players:- BASF Corporation, Stephan Company, and Huntsman Corporation.

Regulatory Compliance and Safety Monitoring

The Environmental Protection Agency provides regulations for surfactants in the United States under the Toxic Substances Control Act. TSCA mandates reports on the environmental and human health hazards.

Recent Developments

- In May 2025, Pilot Chemical collaborated with Novvi to launch biobased surfactants, alpha olefin sulfonate, in the United States. The surfactants are useful in industries like personal care, household, and institutional & industrial purposes.(Source: www.fuelsandlubes.com)

- In June 2025, AmphiStar collaborated with Kensing to launch biosurfactants in North America’s personal care market. The product range is widely used in creams, body wash, body lotions, make-up removers, shampoos, and other products.(Source: www.ofimagazine.com)

Top Companies List

- Chemical Associates

- Air Products and Chemicals

- BASF

- Kraton Corporation

- Evonik Industries

- SABIC

- Univar Solutions

- Clariant

- Solvay

- Croda International

- Stepan Company

- Eastman Chemical Company

- Dow

- Nouryon

- Huntsman Corporation

Segments Covered

By Type

- Anionic Surfactants

- Cationic Surfactants

- Nonionic Surfactants

- Amphoteric/Zwitterionic Surfactants

By Origin

- Synthetic Surfactants

- Bio-Based/Green Surfactants

By Form

- Liquid Surfactants

- Powder/Granular Surfactants

- Paste/Gel Surfactants

By End-User Industry

- Consumer Goods Manufacturers

- Industrial & Institutional Cleaning Service Providers

- Agriculture & Food Industry

- Oil & Gas Industry

- Chemical Formulators

By region

- Midwest

- Northeast

- South

- West