Content

U.S. Specialty Chemicals Market Size, Share and Industry Analysis

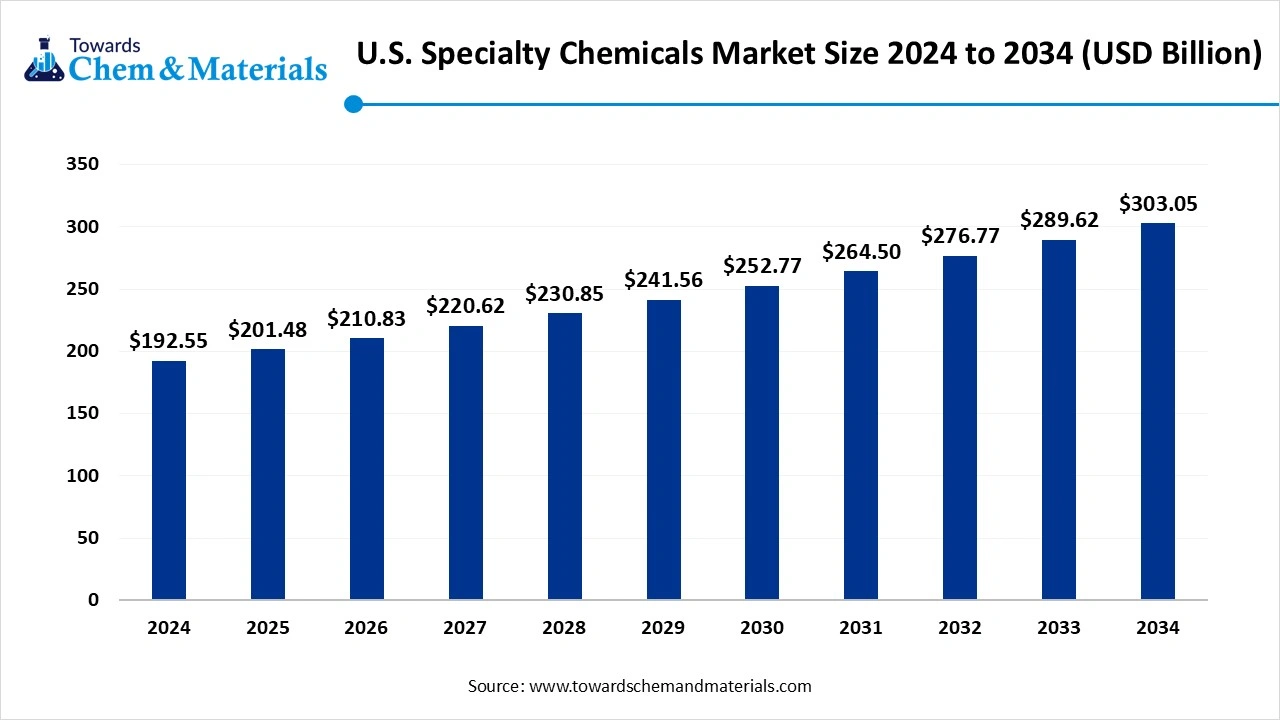

The U.S. specialty chemicals market size was reached at USD 192.55 billion in 2024, grew to USD 201.48 billion in 2025 and is expected to be worth around USD 303.05 billion by 2034, growing at a compound annual growth rate (CAGR) of 4.64% over the forecast period 2025 to 2034.The growing demand across end-user industries like construction, healthcare, electronics, and automotive drives the market growth.

Key Takeaways

- By product type, the coatings & resins segment held an 18% share in the market in 2024 due to the growing infrastructure development.

- By product type, the battery & energy materials segment is expected to grow at the fastest CAGR in the market during the forecast period due to the growing adoption of renewable energy sources.

- By application, the construction & infrastructure segment held a 20% share in the market in 2024 due to the growing residential construction activities.

- By application, the electronics & semiconductors segment is expected to grow at the fastest CAGR in the market during the forecast period due to increasing adoption of electronic devices.

- By function, the coating & surface protection segment held a 17% share in the U.S. specialty chemicals market in 2024 due to the focus on enhancing vehicle aesthetics.

- By function, the energy storage support segment is expected to grow at the fastest CAGR in the market during the forecast period due to the growing modernization of grid infrastructure.

Role of U.S. Specialty Chemicals in Industrial Applications

The United States specialty chemicals are specialized & high-quality chemical products used for various applications. They are complex formulations and offer precise results. Specialty chemicals use a batch manufacturing process and require proprietary equipment. They offer benefits like process optimization, sustainability, durability, specific safety, and product enhancement. Specialty chemicals are widely used in applications like adhesives, agrochemicals, paints, sealants, and coatings.

Factors like growing construction activities, increasing demand for flavors & food additives in the food & beverage industry, rise in adoption of electric vehicles, increasing production of electronic devices, and rising development of medical devices contribute to the growth of the market.

- The United States exported 798 shipments of the specialty chemical.(Source: www.volza.com)

- SEKISUI SPECIALTY CHEMICALS AMERICA is the leading supplier of specialty chemicals in the World. (Source: www.volza.com)

Growing Automotive Industry Drives the Market Growth

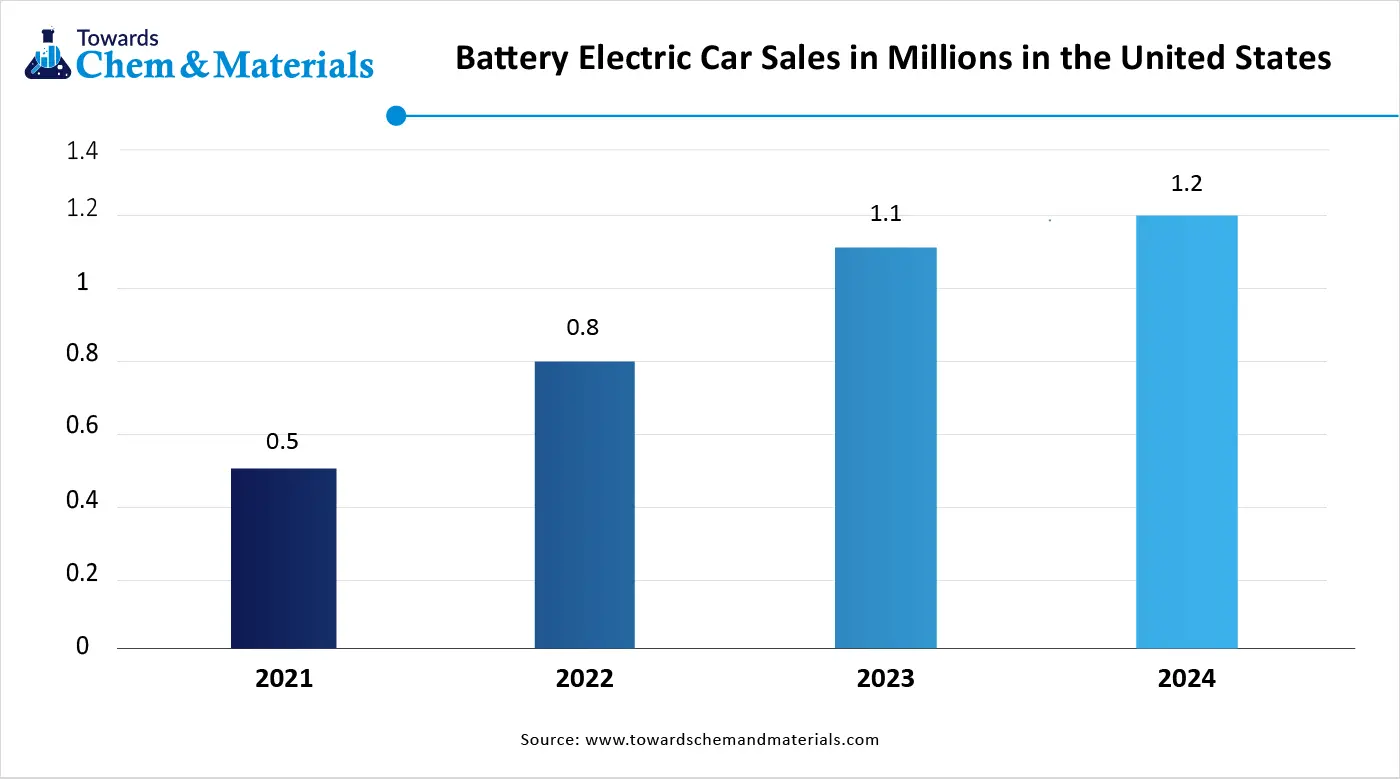

The growing production of various automobiles and the growing automotive industry in the United States increase demand for specialty chemicals. The focus on lowering emissions and enhancing the performance of vehicle engines increases the adoption of specialty chemicals. The rise in electric vehicles increases demand for specialty chemicals for thermal management and the production of batteries.

The focus on enhancing vehicles' aesthetics and protecting various vehicle parts requires coatings that increase demand for specialty chemicals. The need for detailing, cleaning, and polishing of vehicles increases demand for specialty chemicals. The growing production of various exterior vehicle parts and the need for stronger automotive components increase the adoption of specialty chemicals. The growing automotive industry is a key driver for the growth of the U.S. specialty chemicals market.

Market Trends

- Growing Adoption of Electronic Devices: The rise in the adoption of electronic devices like smartphones, laptops, wearables, and computers increases demand for specialty chemicals for the development of ICs, high-performance chips, and other components.

- Rise in Electric Vehicles: The growth in the production of electric vehicles increases demand for specialty chemicals for the development of batteries and customizable interior components.

- Growing Construction Activities: The rapid urbanization and increasing commercial & residential construction activities increase demand for specialty chemicals to enhance the sustainability & durability of construction.

Report Scope

| Report Attributes | Details |

| Market Size in 2025 | USD 201.48 Billion |

| Expected Size by 2034 | USD 303.05 Billion |

| Growth Rate from 2025 to 2034 | CAGR 4.64% |

| Base Year of Estimation | 2024 |

| Forecast Period | 2025 - 2034 |

| Segment Covered | By Product Type, By Application, By Function |

| Key Companies Profiled | Dow, DuPont, Eastman Chemical Company, Celanese Corporation, Albemarle Corporation, Huntsman Corporation, PPG Industries, The Sherwin-Williams Company, Lubrizol Corporation, Ashland Global Holdings, W. R. Grace & Co., Evonik Industries, Solvay, BASF, AkzoNobel, Clariant, Arkema, LANXESS, FMC Corporation, Chemours |

Market Opportunity

Growing Healthcare Sector Unlocks Market Opportunity

The strong presence of the healthcare sector in the United States increases demand for specialty chemicals for various healthcare applications. The increasing production of various drugs requires solvents & excipients, which increases demand for specialty chemicals. The growing manufacturing of advanced medical devices and increasing demand for active pharmaceutical ingredients increase the demand for specialty chemicals. The increasing awareness about hygiene and stricter regulations in the healthcare industry increases demand for specialty chemicals.

The growth in age-related diseases and advancements in drug delivery systems increases demand for specialty chemicals. The growing awareness about various health issues and the rising demand for advanced therapies increase the adoption of specialty chemicals. The growing healthcare sector creates an opportunity for the growth of the U.S. specialty chemicals market.

Market Challenge

High Production Cost Limits the Expansion of the Market

Despite several applications of specialty chemicals in the United States, the high production cost restricts the market growth. Factors like stringent environmental regulations, high investment in R&D, fluctuating raw material prices, intensive energy requirements, and the need for highly skilled labor are responsible for the high production cost. The fluctuations in the prices of raw materials like natural gas and crude oil increase the cost.

The stringent environmental regulations and focus on green manufacturing technologies require a high cost. The supply chain complexity, such as natural disasters, geopolitical issues, and production outages, increases the cost. The complex manufacturing processes, such as drying, distillation, and crystallization, require high cost. The high production cost hampers the growth of the U.S. specialty chemicals market.

Regional Insights

South U.S. Specialty Chemicals Market Trends

The South region dominated the U.S. specialty chemicals market in 2024. The well-established industrial base and increasing investment in R&D increase the production of specialty chemicals. The rising adoption of electric vehicles and the growing development of infrastructure projects increase demand for specialty chemicals.

The stringent regulatory environment and well-established infrastructure increase the production of specialty chemicals. The growing utilization of cosmetic & personal care products and the increasing development of medical devices increase demand for specialty chemicals, driving the overall growth of the market.

West U.S. Specialty Chemicals Market Trends

The West region is experiencing the fastest growth in the market during the forecast period. The strong presence of the electronic industry and growing housing projects increases demand for specialty chemicals. The growing expansion of the automotive industry and advancements in nanotechnology increase the adoption of specialty chemicals. The strong presence of pharmaceutical companies and focus on sustainable building practices increases demand for specialty chemicals. The advanced industrial base and high investment in R&D support the overall growth of the market.

Segmental Insights

Product Type Insights

Why did the Coatings & Resins Segment Dominate the U.S. Specialty Chemicals Market?

The coatings and resins segment dominated the market in 2024. The rapid urbanization and growing development of various infrastructure projects increase demand for coatings & resins. The focus on enhancing the appearance of vehicles and the need for extending vehicle lifespan increases demand for resins & coatings.

The increasing demand for protecting manufacturing equipment and lowering maintenance costs increases demand for coatings & resins. The high investment in infrastructure projects and the need for high-performance solutions in various industries increase the adoption of coatings & resins, driving the overall growth of the market.

The battery & energy materials segment is the fastest-growing in the market during the forecast period. The growth in adoption of electric vehicles and the rise in battery production increase demand for battery & energy materials. The advancements in energy storage solutions and strong government support for semiconductors increase demand for battery & energy materials. The growing adoption of renewable energy resources and the rising demand for consumer electronics like wearables, smartphones, & laptops increase demand for battery & energy materials, supporting the overall growth of the market.

Application Insights

Which Application Held the Largest Share in the U.S. Specialty Chemicals Market?

The construction & infrastructure segment held the largest revenue share in the market in 2024. The rapid urbanization and growing infrastructure development, like modernized highways, high-speed rail, & tunnels, increase demand for specialty chemicals. The growing development of non-residential and residential construction increases the adoption of specialty chemicals.

The strong focus on green building and increasing renovations of existing infrastructure increases demand for specialty chemicals. The focus on smart city development and growing commercial construction increases the adoption of specialty chemicals, driving the overall growth of the market.

The electronics & semiconductors segment is experiencing the fastest growth in the market during the forecast period. The growing expansion of 5G technology and the need for advanced semiconductors increase demand for specialty chemicals. The growing adoption of consumer electronics like laptops, wearables, smartphones, & computers, and the rise in smart home gadgets, increases demand for specialty chemicals. The growing miniaturization of semiconductors and electronic devices increases demand for specialty chemicals, supporting the overall growth of the market.

Function Insights

How the Coating & Surface Protection Segment Dominated the U.S. Specialty Chemicals Market?

The coating & surface protection segment dominated the market in 2024. The growing manufacturing of heavy machinery and focus on enhancing vehicle aesthetics increases demand for coating & surface protection. The high government investment in infrastructure development and stricter environmental regulations increases the adoption of coating & surface protection. The growing industrial activities and focus on enhancing product performance increase demand for coating & surface protection, supporting the overall growth of the market.

The energy storage support segment is the fastest-growing in the market during the forecast period. The growing adoption of wind and solar energy increases demand for energy storage support. The rise in electric vehicle production and the increasing modernization of grid infrastructure increase demand for energy storage support. The strong focus on energy security and growing sectors like telecommunications & data centers increases demand for energy storage support, driving the overall growth of the market.

U.S. Specialty Chemicals Market Value Chain Analysis

- Feedstock Procurement: The feedstock procurement for specialty chemicals in the United States includes petrochemical feedstocks like natural gas liquids, crude oil, & natural gas, and bio-based feedstocks like fats, vegetable oils, & sugars.

- Chemicals Synthesis & Processing: The chemical synthesis & processing involve the production of high-quality, complex substances or molecules for various applications. The processes used for the production of specialty chemicals are batch processing in the United States.

- Key Players:- SMC Global, Dow, Solvay, Inhance Technologies

- Quality Testing & Certification: The quality testing involves various tests, such as physical property testing, safety & toxicity testing, analytical testing, contamination & residue testing, and batch-to-batch consistency and certifications like ISO 9001, NSF 60, & TSCA compliance.

Recent Developments

- In December 2024, PCC Group plans to build a chlor-alkali facility at Chemours' titanium oxide plant in DeLisle, MS. The yearly capacity of the new facility is 340000 metric tons and uses state-of-the-art technology.(Source: www.businesswire.com)

- In June 2025, Nouryon launched an innovation center for oilfield solutions in Houston, U.S. The center focuses on creating sustainable & safe products and supports research & development. The center provides a platform for training & workshops and has state-of-the-art testing. Source: www.indianchemicalnews.com)

- In February 2025, LBB Specialties collaborated with Kerry Group to launch specialty ingredients for personal care products. The new product line includes fermentation-derived actives, emollients, & emulsifiers for cosmetics, skin care, and personal care products. The collaboration focuses on enhancing end-user experiences and creating unique solutions.(Source: www.prnewswire.com)

U.S. Specialty Chemicals Market Top Companies

- Dow

- DuPont

- Eastman Chemical Company

- Celanese Corporation

- Albemarle Corporation

- Huntsman Corporation

- PPG Industries

- The Sherwin-Williams Company

- Lubrizol Corporation

- Ashland Global Holdings

- W. R. Grace & Co.

- Evonik Industries

- Solvay

- BASF

- AkzoNobel

- Clariant

- Arkema

- LANXESS

- FMC Corporation

- Chemours

Segments Covered

By Product Type

- Adhesives & Sealants

- Catalysts

- Coatings & Resins

- Construction Chemicals

- Electronic Chemicals

- Flavors & Fragrances

- Food Additives (Non-flavor)

- Oilfield Chemicals

- Personal Care Ingredients

- Pharmaceutical Chemicals

- Pigments & Colorants

- Specialty Polymers

- Performance Additives

- Specialty Surfactants

- Textile & Leather Chemicals

- Water Treatment Chemicals

- Metalworking & Lubricant Additives

- Agricultural Chemicals

- Photochemicals

- Specialty Solvents

- Battery & Energy Materials

- Specialty Gases

By Application

- Automotive

- Construction & Infrastructure

- Electronics & Semiconductors

- Oil & Gas

- Pharmaceuticals & Biotech

- Personal Care & Cosmetics

- Food & Beverage

- Agriculture

- Industrial Manufacturing

- Water & Wastewater Treatment

- Textiles & Leather

- Packaging

- Energy Storage

By Function

- Adhesion & Bonding

- Catalysis

- Coating & Surface Protection

- Construction Enhancement

- Electronic Processing

- Flavoring & Fragrance

- Food Preservation & Processing

- Oilfield Performance

- Personal Care Enhancement

- Pharmaceutical Support

- Coloration & Pigmentation

- Polymer Modification

- Performance Enhancement

- Surfactancy & Wetting

- Textile & Leather Treatment

- Water Treatment

- Metalworking & Lubrication

- Agricultural Support

- Photochemical Processing

- Solvation & Dissolution

- Energy Storage Support

- Gas Purity & Processing