Content

U.S. PVC And CPVC Pipe Fittings Market Size and Growth 2025 to 2034

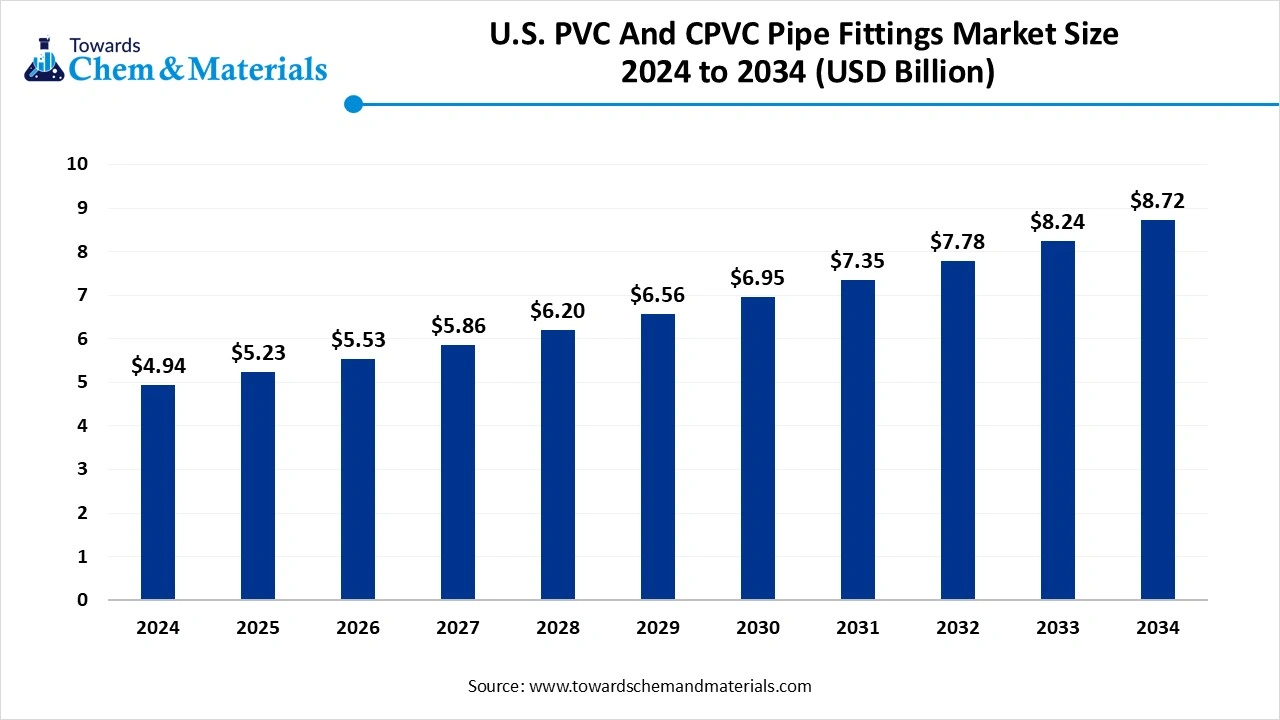

The U.S. PVC and CPVC pipe fittings market size was valued at USD 4.94 billion in 2024 and is expected to hit around USD 8.72 billion by 2034, growing at a compound annual growth rate (CAGR) of 5.85% over the forecast period from 2025 to 2034. the increasing demand for cost-effective and reliable materials is the key factor driving market growth. Also, a growing focus on sustainable building practices, coupled with the rapid modernization of broadband infrastructure, can fuel market growth further.

Key Takeaways

- By material, the PVC fittings segment dominated the market with a 70% share in 2024. The dominance of the region can be attributed to the growing demand for corrosion-resistant and cost-effective solutions.

- By product type, the elbows & couplings segment held a 35% market share in 2024. The dominance of the segment can be linked to the extensive construction sector in the country and technological innovations in installation techniques.

- By application, the plumbing & water distribution segment led the market by holding 45% share in 2024. The dominance of the segment is owing to the surge in investments in sewage and municipal water projects.

- By end-user industry, the residential construction segment dominated the market with a 40% share in 2024. The dominance of the segment can be attributed to the increase in new renovation and home construction projects.

- By distribution channel, the wholesale distributors segment held a 55% market share in 2024. The dominance of the segment can be linked to the ongoing infrastructure upgrades, especially in water and sanitation initiatives.

Aging Infrastructure Replacement is an Expanding Market Growth

The U.S. PVC (Polyvinyl Chloride) and CPVC (Chlorinated Polyvinyl Chloride) Pipe Fittings Market covers the production, distribution, and application of pipe fittings used in plumbing, irrigation, water supply, sewage, HVAC, fire sprinkler systems, and industrial piping. PVC is widely used for cold-water applications, while CPVC, with higher temperature resistance, is used in hot-water and industrial systems. Market growth is driven by rising residential and commercial construction, infrastructure modernization, water management projects, and replacement demand for metal pipes due to corrosion concerns.

What Are the Key Trends Influencing the U.S. PVC and CPVC Pipe Fittings Market?

- The ongoing development in the global construction and infrastructure sector is the latest trend in the market. These fittings are widely used in HVAC, plumbing, and water supply systems across commercial, residential, and industrial facilities. Also, the demand for corrosion-resistant, durable, and easy-to-install piping solutions is increasing with modernization projects.

- The replacement of old pipeline systems plays an important role in propelling the demand for PVC and CPVC pipe fittings. Upgrading to cutting-edge piping systems utilizing PVC and CPVC ensures improved reliability and performance, which also complies with regulatory and sustainability goals.

- Rapid technological advancements within CPVC production fuel market expansion by improving product performance. Enhanced formulations and innovative production methods optimize the making of CPVC, a technologically convenient choice for plumbing and infrastructure solutions.

Report Scope

| Report Attributes | Details |

| Market Size in 2025 | USD 5.23 Billion |

| Expected Size by 2034 | USD 8.72 Billion |

| Growth Rate from 2025 to 2034 | CAGR 5.85% |

| Base Year of Estimation | 2024 |

| Forecast Period | 2025 - 2034 |

| Segment Covered | By Material, By Product Type, By Application, By End-User Industry, By Distribution Channel |

| Key Companies Profiled | Charlotte Pipe and Foundry Company; Nibco Inc.; Lubrizol Corporation; IPEX Inc.; Georg Fischer LLC; Finolex Industries; Supreme Industries; Prince Pipes and Fittings Ltd; Astral Limited. |

Market Opportunity

The Integration of Digital Technologies

The ongoing integration of Industry 4.0 concepts and other digital technologies is a major factor creating lucrative opportunities in the market. These innovations involve the implementation of automation, smart technologies, and data analytics to improve efficiency and enhance product quality. Furthermore, the use of CPVC piping has several benefits over conventional materials, such as galvanized steel, including superior fire and corrosion resistance.

- In August 2024, Aliaxis SA announced that it had made a deal to acquire production assets of Johnson Controls' CPVC pipe and fittings facility for light commercial and residential sprinkler systems. After this acquisition, Aliaxis will give a more detailed portfolio of fire suppression systems for commercial and residential applications (Source: aliaxis)

Market Challenges

Plastic Usage Restrictions

The increasing environmental awareness with stringent government regulations is leading to limitations on non-recyclable plastics, like PVC and CPVC, which is the key factor hindering market expansion. Moreover, sectors such as pharmaceuticals, oil & gas, and food processing have heavy safety, pressure, and material compatibility needs for pipe fittings, posing a significant challenge for the market soon.

Country Insight

U.S. PVC And CPVC Pipe Fittings Market Trends

The south region dominated the market with a 35% share in 2024. The dominance of the segment can be attributed to the ongoing construction and infrastructure development, especially for upgrading aging infrastructure and rapid industrial expansion in sectors such as manufacturing, chemical processing, and energy. Also, regions move toward sustainable building standards, optimising the use of PVC and CPVC further.

The West region is expected to grow at the fastest CAGR over the forecast period. The growth of the region can be credited to the rising need for efficient and sustainable building materials, along with the extensive need for replacing aging water systems in the western region. Furthermore, stringent regulations in this region for sectors such as fire safety, drinking water, and industrial piping require the use of compliant and certified products.

Segmental Insight

Material Insight

Which Material Type Segment Dominated the U.S. PVC And CPVC Pipe Fittings Market in 2024?

The PVC fittings segment dominated the market with a 70% share in 2024. The dominance of the region can be attributed to the growing demand for corrosion-resistant and cost-effective solutions in commercial, residential, and industrial applications. In addition, PVC's inherent resistance to chemicals, corrosion, and weathering makes it crucial for long-term use in harsh environments.

The CPVC fittings segment is expected to grow at the fastest CAGR over the forecast period. The growth of the segment can be credited to the rapid industrialization and urbanization in the U.S., coupled with the CPVC's resistance to corrosion. Additionally, integration of digital technologies such as sensors and IoT into CPVC fittings allows predictive maintenance and real-time monitoring with improved performance in water distribution systems.

Product Type Insight

Why Elbows & Couplings Segment Dominated the U.S. PVC And CPVC Pipe Fittings Market in 2024?

The elbows & couplings segment held a 35% market share in 2024. The dominance of the segment can be linked to the extensive construction sector in the country and technological innovations in installation techniques. CPVC elbows and couplings offer a greater temperature resistance as compared to standard PVC, which makes them convenient for both hot and cold-water distribution systems.

The valves segment is expected to grow at the fastest CAGR during the forecast period. The growth of the segment can be driven by growing investment in water management, commercial, and residential construction. Furthermore, durable and lightweight valves are easy to install, minimizing labor costs and project timelines as compared to conventional metal valves.

Application Insight

How Much Share Did the Plumbing & Water Distribution Segment Held in 2024?

The plumbing & water distribution segment led the market by holding a 45% share in 2024. The dominance of the segment is owing to the surge in investments in sewage and municipal water projects due to rapid urbanization in the region. Also, ongoing innovations in joining technologies and material formulation improve the reliability and overall performance of PVC and CPVC fittings.

The HVAC & fire sprinkler systems segment is expected to grow at the fastest CAGR during the projected period. The growth of the segment is due to the growing need for fire safety systems and the demand to upgrade current infrastructure with CPVC's capability to bear high temperatures and resist corrosion. The increasing adoption of HVAC systems in commercial and residential buildings boosts the demand for CPVC pipe fittings further.

End-User Industry Insight

Which End-User Industry Segment Dominated U.S. PVC And CPVC Pipe Fittings Market in 2024?

The residential construction segment dominated the market with a 40% share in 2024. The dominance of the segment can be attributed to the increase in new renovation and home construction projects and the ongoing trend toward durable and energy-efficient plumbing solutions. Moreover, builders and homeowners are rapidly choosing PVC and CPVC for their durability, reliability, and cost-effectiveness in modern plumbing systems.

The industrial & municipal utilities segment is expected to grow at the fastest CAGR during the study period. The growth of the segment can be credited to the infrastructure development and renewal projects, especially in water management systems. In addition, the latest trend of renovating and retrofitting existing infrastructure in emerging economies will also impact positive segment growth soon.

Distribution Channel Insight

Why Did the Wwholesale Distributors Segment Held the Largest Market Share in 2024?

The wholesale distributors segment held a 55% market share in 2024. The dominance of the segment can be linked to the ongoing infrastructure upgrades, especially in water and sanitation initiatives, coupled with the durability and cost-effectiveness of plastic pipes compared to metals. Rise in urban populations and concerns regarding water scarcity create a greater demand for efficient water management systems.

The online platforms segment is expected to grow at the fastest CAGR over the forecast period. The growth of the segment can be driven by rising demand for online research and purchasing solutions by DIY users and contractors. Furthermore, the ongoing trend towards digital platforms for product ordering and information, along with the requirement for solutions to replace aging infrastructure, is fuelling segment growth shortly.

U.S. PVC And CPVC Pipe Fittings Market - Value Chain Analysis

1. Feedstock Procurement

It is the process of acquiring the necessary raw materials required to produce the finished products. This stage is crucial due to the cost and availability of these raw materials, which directly impact overall manufacturing costs.

2. Chemical Synthesis and Processing

It is the initial production stage involving the manufacturing and formulation of the plastic resins. This stage focuses on creating the core raw materials for pipes and fittings before they turn into final products.

3. Packaging and Labelling

Packaging must protect pipe fittings from physical damage, including dents, impacts, and scratches, that can occur during shipping. It also safeguards against exposure to moisture and UV radiation.

4. Regulatory Compliance and Safety Monitoring

This stage involves adherence to local and national standards to ensure products are safer for public health, such as drinking water, to comply with performance benchmarks.

Recent Developments

- In August 2024, Cosmo Films unveiled seven new film products for the U.S. The films include High shrink label films, Graphic films, PVC films, CPP extrusion lamination films, among others. The company will showcase these products at Labelexpo Americas 2024. (Source: printweek)

U.S. PVC And CPVC Pipe Fittings Market Top Companies

- Charlotte Pipe and Foundry Company

- Nibco Inc.

- Lubrizol Corporation

- IPEX Inc.

- Georg Fischer LLC

- Finolex Industries

- Supreme Industries

- Prince Pipes and Fittings Ltd

- Astral Limited

Segments Covered

By Material

- PVC Fittings

- CPVC Fittings

By Product Type

- Elbows

- Couplings

- Tees

- Adapters

- Caps & Plugs

- Valves

- Others (Reducers, Bushings, Unions, Nipples)

By Application

- Plumbing & Water Distribution

- Sewage & Drainage

- Irrigation (Agriculture, Landscaping)

- HVAC & Fire Sprinkler Systems

- Industrial Piping (Chemicals, Food & Beverages, Pharmaceuticals)

By End-User Industry

- Residential Construction

- Commercial Construction

- Industrial (Process Industries)

- Municipal Infrastructure & Utilities

By Distribution Channel

- Wholesale Distributors

- Retail / Hardware Stores

- Direct Sales to Contractors & Builders

- Online Platforms

By Region (U.S.)

- Northeast (New York, Pennsylvania, Massachusetts)

- Midwest (Illinois, Ohio, Michigan)

- South (Texas, Florida, Georgia)

- West (California, Arizona, Washington)