Content

U.S. Polymer Foam Market Size, Share | CAGR of 4.65%.

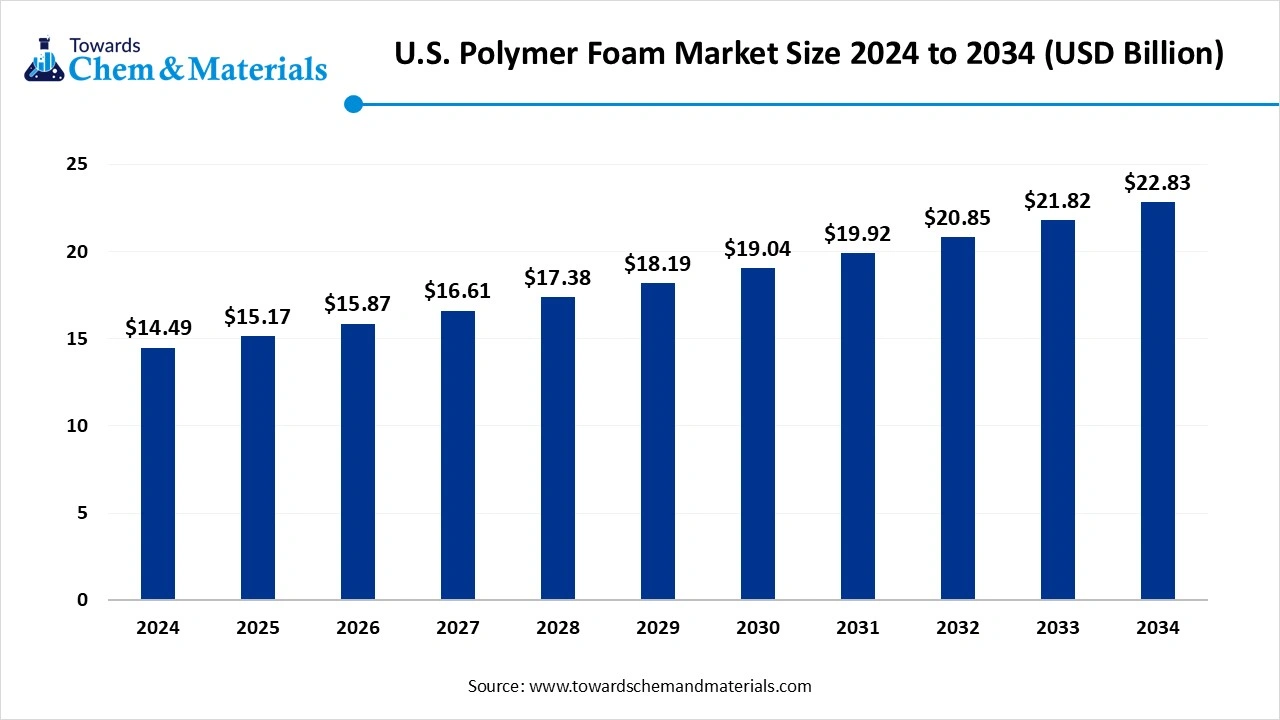

The U.S. polymer foam market size was reached at USD 14.49 billion in 2024, grew to USD 15.17 billion in 2025 and is expected to be worth around USD 22.83 billion by 2034, growing at a compound annual growth rate (CAGR) of 4.65% over the forecast period 2025 to 2034. The need for lightweight material is fueling the expansion of opportunities within the sector.

Key Takeaways

- By type, the polystyrene foams segment led the market with approximately 88% industry share in 2024, due to their versatility and cost-effectiveness, mainly in the packaging and construction industries

- By type, the polyurethane foam segment is expected to grow at the fastest rate in the market during the forecast period, owing to increased demand from industries such as the mattress, furniture, and automotive seating, akin to its superior versatility.

- By form, the flexible foam segment emerged as the top-performing segment in the market with approximately 60% industry share in 2024, because they deliver comfort, cushioning, and ergonomic support, making them ideal for furniture, bedding, and automotive seating-three major United States industries.

- By form, the rigid foam segment is expected to fastest growth in the market in the coming years, due to their unmatched insulation properties that help reduce energy costs in U.S. buildings.

- By density type, the low-density segment led the market with approximately 50% share in 2024, due to its lightweight and cost-efficient nature.

- By density type, the high-density foam segment is expected to grow at the fastest rate in the market during the forecast period, because it offers superior durability, strength, and long-term performance.

- By end use, the automotive segment emerged as the top-performing segment in the U.S. polymer foams market with approximately 30% industry share in 2024, because of its need for lightweight, comfort-driven, and safety-enhancing materials.

- By end use, the footwear segment is expected to grow at the fastest rate in the market during the forecast period, due to the rise of performance-driven and sustainable shoe designs.

Market Overview

The Polymer Foam Boom: Sustainability, Innovation, And Market Growth

The U.S. polymer foam market has experienced sophisticated growth in recent years, as the region is increasingly shifting towards better lightweight material, insulation, and cushioning, which is continuously improving the financial performance and sector growth at the same time.

Moreover, by packaging fragile items to provide better energy efficiency to buildings, the polymer foams have been widely discussed in technological forums and white papers in the United States in the past few years. Also, the greater investment from the manufacturer for the development and implementation of the sustainable foam production is likely to create greater opportunities in the United States during the projected period.

- The United States is one of the leading polyethylene foam exporters with 3,429 shipments after China in 2024.(Source: www.volza.com)

Polymer Foam Propel Innovation in Key U.S Industries

The increased need for lightweight material from the aerospace and automotive industry is actively driving the sectoral scalability and strategic transformation in the United States. Moreover, these industries are seen under heavy pressure to cut excess fuel consumption, where the polymer foams have gained traction with investment firms and analysts in recent years. Also, having factors like affordability and durability, the polymer foams are expected to usher in a wave of profitable ventures in the coming years.

- For instance, The United States is expected to use 116.4 MT of plastic or lightweight plastic in 2025.(Source: www.oecd.org)

Market Trends

- The adoption and development of 3D printed foams have immensely enhanced market readiness and future industry capabilities in recent years, as additive manufacturing has a major role in the customization of foam structures.

- The trend towards sustainability has put pressure on manufacturers, which leading the greater investments to produce biobased foams in recent years, as per the market survey.

Report Scope

| Report Attributes | Details |

| Market Size in 2025 | USD 15.17 Billion |

| Expected Size by 2034 | USD 22.83 Billion |

| Growth Rate from 2025 to 2034 | CAGR 4.65% |

| Base Year of Estimation | 2024 |

| Forecast Period | 2025 - 2034 |

| Segment Covered | By Type, By Form, By Density, By End-Use Industry, |

| Key Companies Profiled | Owens Corning , BASF Corporation , Dow Chemical Company , Carpenter Co. , Foamcraft Inc. , FXI , Huntsman International LLC , Innocor Foam Technologies , Premier Foam , Rogers Corporation , Saint-Gobain , Sheela Foam Ltd. , UFP Technologies Inc. , Arkema, Covestro AG , Eurofoam S.r.l. , INOAC Corporation , Sekisui Chemical Co., Ltd. , Zotefoams plc , Creative Foam Corporation |

Market Opportunity

Sustainable Foam Paving the Way for Greener Manufacturing

The development of high-performance foams for sports equipment and footwear is seen as the higher-margin opportunity for manufacturers in the coming years. Furthermore, individuals from sports culture or regular fitness are increasingly demanding sports gear and shoes with better cushioning and breathability, where the manufacturers are expected to attract increased capital and a sophisticated consumer base in the upcoming period. Furthermore, the manufacturers can gain major industry attention by establishing a collaboration with premium footwear brands in the United States.

- In March 2023, OrthoLite has established a partnership with Novamont. The motive behind collaboration is to develop and research innovative circular foam material options in footwear, according to the company's claim.(Source: www.novamont.com)

Market Challenge

Green Mandates Rise, Plastic Industry Feels the Heat

The increased pressure from global implementation of the sustainability standards, where plastic is considered the most harmful material for the environment. These sustainability standards are projected to curb capital flow and expansion activities of the industry in the coming years. Also, the United States government has banned single-use plastic in recent years.

Segmental Insights

Type Insights

How Did The Polystyrene Foam Segment Dominate The U.S. Polymer Foam Market In 2024?

The polystyrene foam segment held the largest share of the market in 2024, due to their versatility and cost-effectiveness, mainly in the packaging and construction industries. Moreover, having properties like lightweight, cushioning, and insulation has provided the sophisticated consumer base to the segment in recent years. furthermore, the heavy e-commerce industry in the United States is actively driving the growth of the segment in the current period.

The polyurethane foam segment is expected to grow at the fastest rate during the predicted timeframe, owing to increased demand from industries such as the mattress, furniture, and automotive seating, akin to its superior versatility. Also, the polyurethane foams can be able to be engineered into flexible and rigid which is likely to provide greater attention to the segment in the upcoming years as per future industry expectations.

Form Insights

Why Does The Flexible Foam Segment Dominate The U.S. Polymer Foam Market By Form Type?

The flexible foam segment held the largest share of the market in 2024, because they deliver comfort, cushioning, and ergonomic support, making them ideal for furniture, bedding, and automotive seating-three major U.S. industries. Consumers in the region are highly brand-conscious in furniture and bedding, and flexible foams allow companies to create premium designs without significantly raising costs. Their softness, resilience, and ability to mold into different shapes make them preferred in comfort-related applications.

The rigid foams segment is expected to grow at the fastest rate during the forecast period, due to their unmatched insulation properties that help reduce energy costs in U.S. buildings. With stricter building codes and net-zero energy targets, demand for high-performance insulation is surging. Rigid foams, especially polyurethane and polyisocyanurate, offer superior thermal resistance, making them crucial in construction

Density Type Insights

How did the Low-Density Segment Dominate the U.S. Polymer Foam Market in 2024?

The low-density segment dominated the market with the largest share in 2024 due to its lightweight and cost-efficient nature. They are easy to process, widely used in disposable packaging, and popular in furniture cushions where softness and comfort matter more than durability. The e-commerce industry boosted low-density foam use for protective packaging solutions.

The high-density foam segment is expected to grow at the fastest rate during the forecast period, because it offers superior durability, strength, and long-term performance. As U.S. consumers demand higher-quality mattresses, automotive seating, and footwear, high-density foams provide better resilience and longevity compared to low-density types. In construction, high-density rigid foams are essential for insulation and structural stability, meeting strict building codes.

End Use Insights

How did the Automotive Segment Dominate the U.S. Polymer Foam Market in 2024?

The automotive segment held the largest share of the market in 2024, because of its need for lightweight, comfort-driven, and safety-enhancing materials. Foams are essential for seating, headrests, armrests, Insulation, and noise reduction. With nearly every vehicle part requiring foam, the automotive sector has been the largest consumer. U.S. automakers focus heavily on comfort and safety standards, making foam irreplaceable in design.

The footwear segment is expected to grow at the fastest rate during the forecast period, due to the rise of performance-driven and sustainable shoe designs. Regional consumers increasingly demand lightweight, shock-absorbing, and eco-friendly footwear, especially for sports, athleisure, and everyday wear. Polymer foam, particularly engineered polyurethane and EVA blends, provide superior cushioning, flexibility, and breathability.

U.S. Polymer Foam Market Value Chain Analysis

- Distribution to Industrial Users: The industries in the United States can buy foam from the specialized chemical distributors and direct sales from manufacturers.

- Chemical Synthesis and Processing: The chemical synthesis of polymer foam in United States has included steps such as CBA decomposition, reaction-based foaming, and physical foaming.

- Regulatory Compliance and Safety Monitoring: The safety monitoring and regulatory compliance of foam in the United States is mainly under the regulatory agencies, like the FDA.

Recent Development

- In September 2024, Future Foam established a collaboration with BASF for the launch of its latest and innovative foam product line. The newly launched flexible foam is specifically designed for the bedding industry and made up of the Biomass Balance (BMB) Lupranate® T 80 toluene diisocyanate (TDI).(Source: www.basf.com)

U.S. Polymer Foam Market Top Companies

- Owens Corning

- BASF Corporation

- Dow Chemical Company

- Carpenter Co.

- Foamcraft Inc.

- FXI

- Huntsman International LLC

- Innocor Foam Technologies

- Premier Foam

- Rogers Corporation

- Saint-Gobain

- Sheela Foam Ltd.

- UFP Technologies Inc.

- Arkema

- Covestro AG

- Eurofoam S.r.l.

- INOAC Corporation

- Sekisui Chemical Co., Ltd.

- Zotefoams plc

- Creative Foam Corporation

Segment Covered

By Type

- Polyurethane Foam

- Polystyrene Foam

- Polyvinyl Chloride (PVC) Foam

- Polyolefin Foam

- Melamine Foam

- Phenolic Foam

- Others

By Form

- Flexible Foam

- Rigid Foam

By Density

- Low-Density Foam

- Medium-Density Foam

- High-Density Foam

By End-Use Industry

- Automotive

- Construction

- Packaging

- Furniture & Bedding

- Footwear

- Sports & Recreational

- Others