Content

What is the U.S. Nitrogenous Fertilizer Market Size and Volume?

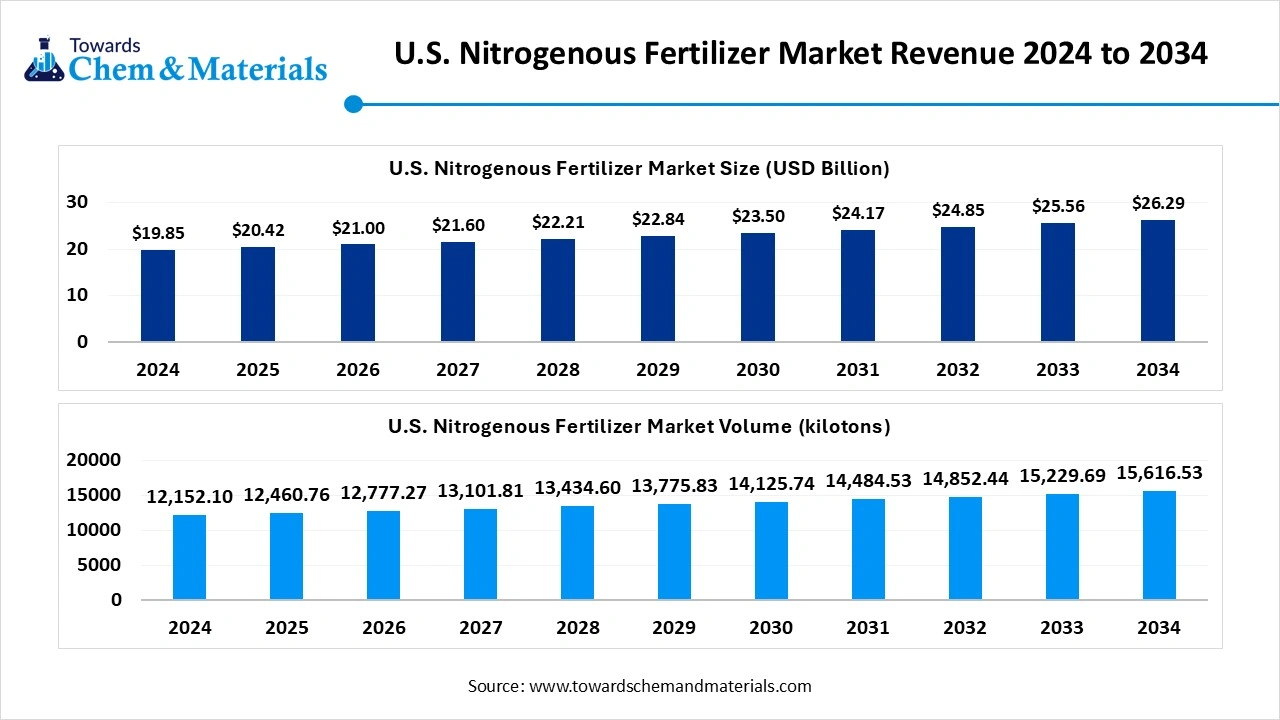

The U.S. nitrogenous fertilizer market stands at 12,460.76 kilotons in 2025 and is forecast to reach 15,616.53 kilotons by 2034, growing at a CAGR of 2.85% from 2025 to 2034. The U.S. nitrogenous fertilizer market size is calculated at USD 20.42 billion in 2025 and is predicted to increase from USD 21 billion in 2026 to approximately USD 26.29 billion by 2034, expanding at a CAGR of 2.85% from 2025 to 2034. The increasing need for better crop yield and ongoing government initiatives towards modern farming is fueling the industry's growth in the current period.

Key Takeaways

- By type, the urea segment emerged as the top-performing segment in 2024 due to its high nitrogen content at a lower cost.

- By type, the NPK segment is likely to experience notable growth during the forecast period, akin to its balanced mix of essential nutrients.

- By application, the agriculture application segment dominated the market in 2024, owing to farming is the largest consumer of nitrogen-based products.

- By application, the industrial application segment is projected to grow significantly over the forecast period due to the expanding applications beyond farming.

Market Overview

Nutrient-Rich Fertilizers Drive the Strong Adoption Across U.S. Farmlands

The U.S. nitrogenous fertilizers market is expected to see rapid growth owing to the increasing need for better crop yield in the current period. Having enriched nutrient qualities is specifically driving the demand for nitrogenous fertilizers in the region, as nitrogenous fertilizers have played a major role in healthy crop development in recent years. Also, the farmers who produce wheat, soybeans, and corn have increasingly been using this fertilizer in recent years, which is continuously providing a higher consumer base in the current period. Furthermore, the steady governmental support and technology advancements are anticipated to lead the future industry growth in the coming years.

What is Driving the Growth of the Nitrogenous Fertilizers Industry in the United States?

The increased governmental subsidies and support for the farming sector are driving U.S. nitrogenous fertilizers market growth in the current period. Moreover, several federal and state programs are actively providing attractive subsidies in the region nowadays while promoting sustainable farming practices. Also, several fertilizer producers have been increasingly observed in research and have launched innovative and effective product lines in the past few years. Furthermore, these supportive policies can reduce the farmers' burden on farmers’ components like the cost of fertilizers, funding for soil improvement, and others, while creating stable demand for this essential fertilizer, like nitrogen-based fertilizers, in recent years, as industry has grown.

Market Trends

- The increasing adoption of precision agriculture tools is spearheading the industry growth in the current period. Moreover, farmers are increasingly using these tools for the application of fertilizers efficiently. Also, it includes technology-advanced equipment like drones, smart sensors, and others, which can guide farmers in the use of nitrogen at the right time with the right amount.

- The sudden surge of eco-friendly nitrogen fertilizers has increasingly driven industry growth in recent years. Also, governments are heavily promoting sustainable agriculture practices, which are heavily contributing to the growth of the market. Also, several companies are developing nitrogen fertilizers that release nitrogen slowly after the application, which supports eco-friendly farming in the current period.

- The introduction of digital platforms can immediately contribute to market growth, as per the recent industry observation. Several farmers are increasingly using mobile applications and various software to track their crop yield. Thus, these digital platforms can help and suggest to farmers a better application of nitrogen with data data-driven approach in the future.

Report Scope

| Report Attributes | Details |

| Market size value in 2026 | USD 21.00 billion |

|

Revenue forecast in 2034 |

USD 26.29 billion |

| Growth Rate from 2025 to 2034 | 2.85% |

| Market Volume in 2026 | 12,777.27 Kilo Tons |

| Expected Volume by 2034 | 15,616.53 Kilo Tons |

| Growth Rate from 2025 to 2034 | CAGR 2.54% |

| Base Year of Estimation | 2024 |

| Forecast Period | 2025 - 2034 |

| Segment Covered | By Product Type, By End Use |

| Key Companies Profiled | CF Industries Holdings, Inc., The Mosaic Company, Yara International, Koch Fertilizer, LLC, LSB Industries, Inc. |

Market Opportunity

Tailored Fertilizer Strategies Poised to Build Loyal Consumer Base

The development of the customized fertilizer blend is expected to create lucrative opportunities for U.S. nitrogenous fertilizers market in the coming years. This fertilizer blend depends on the soil and crop type for the individual farmer's community. Also, this initiative is likely to build a strong relationship between cooperatives and farmers, which is anticipated to lead the heavy consumer base to the industry in the upcoming years. Moreover, this advancement can open the roadmap for premium pricing and the value-added service in the coming years, as per future expectations.

Market Challenge

Natural Gas Price Swings Threaten Stability in Nitrogen Fertilizer Market

The price volatility of natural gas is projected to hamper the U.S. nitrogenous fertilizers market growth during the forecast period. Natural gas plays a major role in the production of nitrogen fertilizers, specifically in production and ammonia. This price fluctuation can impact the whole product pricing, which is expected to create cost challenges for the farmers and sales challenges for the producers in the coming years. Furthermore, companies can face delays and supply chain disruptions, which are likely to impact the overall industry environment in the future.

Segmental Insights

Product Type Insights

How Has Urea Maintained Its Top Position in the U.S. Nitrogenous Fertilizers Market?

The urea segment held the largest share of the market in 2024, due to its high nitrogen content at a lower cost in the current period. Also, it is easy to produce, store, and transport, making it a preferred choice for farmers across the country. Moreover, urea quickly provides nitrogen to crops, which helps boost plant growth and yields. It can also be applied in different ways by spreading, spraying, or through irrigation systems, which adds to its flexibility. In recent years, the affordability and fast-acting results of urea have made it a go-to fertilizer for major crops like corn and wheat. Moreover, farmers trust it because it’s effective and widely available.

The NPK compound segment expects substantial growth in the market during the forecast period, owing to its balanced mix of three essential nutrients, such as nitrogen (N), phosphorus (P), and potassium (K). Also, these blends help crops grow stronger and healthier by supporting root development, flowering, and disease resistance. Moreover, as farmers move toward more efficient and smart farming practices, they prefer fertilizers that give complete nutrition in one application. NPK compounds reduce the need for multiple products, saving time and labor. With precision farming tools and soil testing becoming more common, customized NPK blends that match specific crop and soil needs are gaining popularity.

End Use Insights

What Makes Agriculture Use Segment the Top Contributor to U.S. Nitrogenous Fertilizer Sales?

The agriculture use segment held the dominant share of the U.S. nitrogenous fertilizers market in 2024 due as farming is the largest consumer of nitrogen-based products. Crops like corn, wheat, and soybeans need high amounts of nitrogen to grow well and produce more yield. Farmers across the U.S., especially in the Midwest, rely on fertilizers to meet growing food and biofuel demands. Nitrogen fertilizers help increase crop quality, support healthy plant growth, and make land use more efficient. In recent years, due to rising population and food export needs, farmers have focused on improving productivity per acre, which increases the use of fertilizers. Agricultural subsidies and crop insurance programs also support fertilizer use. Since nitrogen is essential for plant growth, its importance in daily farming operations remains high, as per the observation.

The industrial use segment expects significant growth in the market during the predicted timeframe, owing to expanding applications beyond farming. Industries use nitrogen products like urea and ammonium nitrate in making resins, adhesives, plastics, and pollution control chemicals. As manufacturing, construction, and automotive sectors grow, so does the need for these chemical ingredients. Urea is also used in diesel exhaust fluid (DEF), which helps reduce vehicle emissions, a growing need with stricter air quality regulations. Additionally, nitrogen-based chemicals are used in mining, refrigeration, and textile industries. Industrial buyers prefer consistent supply and high-quality materials, which encourages long-term contracts and stable demand. With farming practices becoming more efficient and regulated, the non-agricultural demand for nitrogen products offers a strong growth path.

Manufacturers Perspective

After the country’s industry observation, demand for nitrogen fertilizers is strong due to the country's large-scale farming infrastructure, and the increasing need for high-yield crops like wheat and corn. Moreover, the manufacturers must adopt sustainable production facilities as the government is increasingly implementing tighter, environmentally friendly rules, and ongoing raw materials price fluctuation. Also, manufacturers can create products that can match the modern precision farming tools, which is expected to create significant opportunities for manufacturers in the coming years. Furthermore, investment in research and development activities can give the first mover advantages to the producers, as per the observation of ongoing industry advancements.

Recent Developments

- In February 2025, Ther Willbur-Ellis unveiled their latest production of the organic nitrogen fertilizer recently. Moreover, fertilizer includes ammonium nitrate for a greater crop yield, as per the company's claim. Also, this sustainable-derived product is named Ben Vireo Terra Lux as per the report published by the company. (Source: growingproduce )

- In October 2024, the USDA introduced its latest fertilizer transportation dashboard to guide the transportation market with publicly available data. The dashboard includes innovative features like indicators for fertilizer production and others, as per the published report.(Source: farmweekknow )

Top Companies list

- CF Industries Holdings, Inc.

- The Mosaic Company

- Yara International

- Koch Fertilizer,

- LLC

- LSB Industries, Inc.

Segment Covered in the report

By Product Type

- Urea

- NPK Compound

- Nitrates

- Ammonium Phosphate

- Others

By End Use

- Agricultural Use

- Industrial Use

- Residential And Consumer Use