Content

What is the Steel Rebar Market Volume and Size?

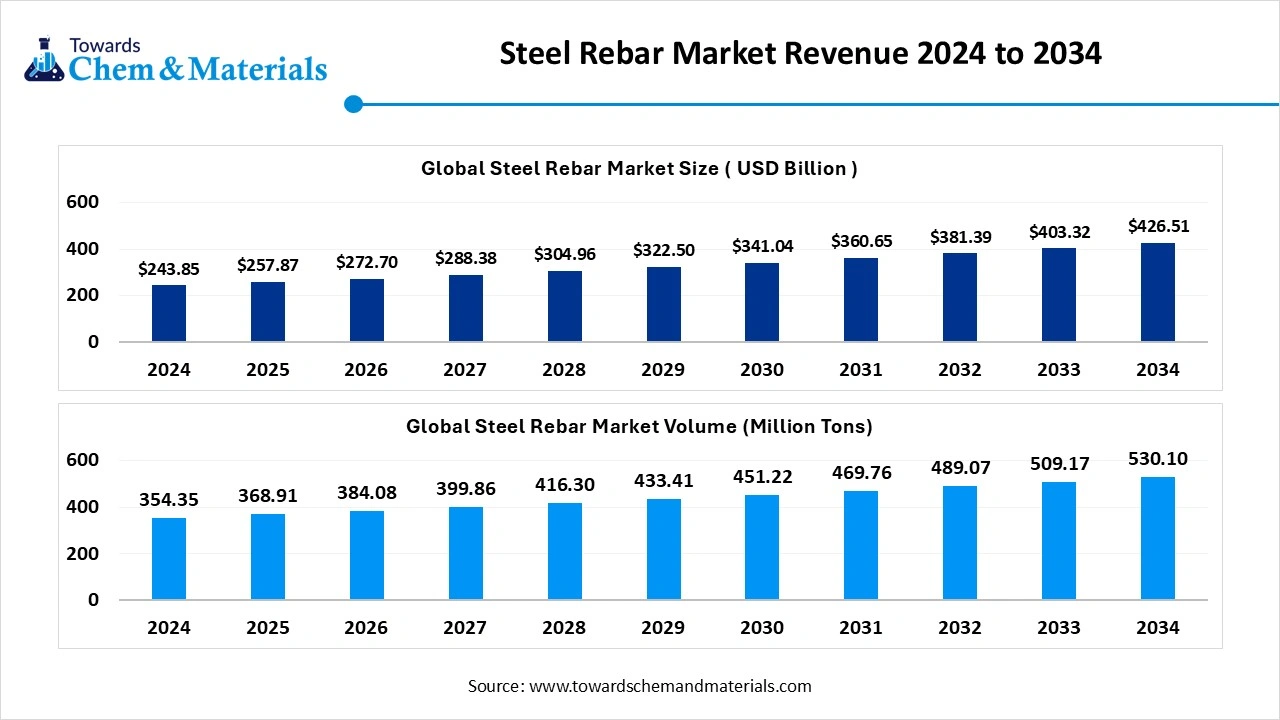

The global steel rebar market stands at 368.91 million tons in 2025 and is forecast to reach 530.10 million tons by 2034, growing at a compound annual growth rate (CAGR) of 4.11% over the forecast period from 2025 to 2034.

The global steel rebar market size was estimated at USD 257.87 billion in 2025 and is predicted to increase from USD 272.70 billion in 2026 to approximately USD 426.51 billion by 2034, expanding at a CAGR of 5.75% from 2025 to 2034.The global shift towards modern infrastructure development is leading the industry sales.

Key Takeaways

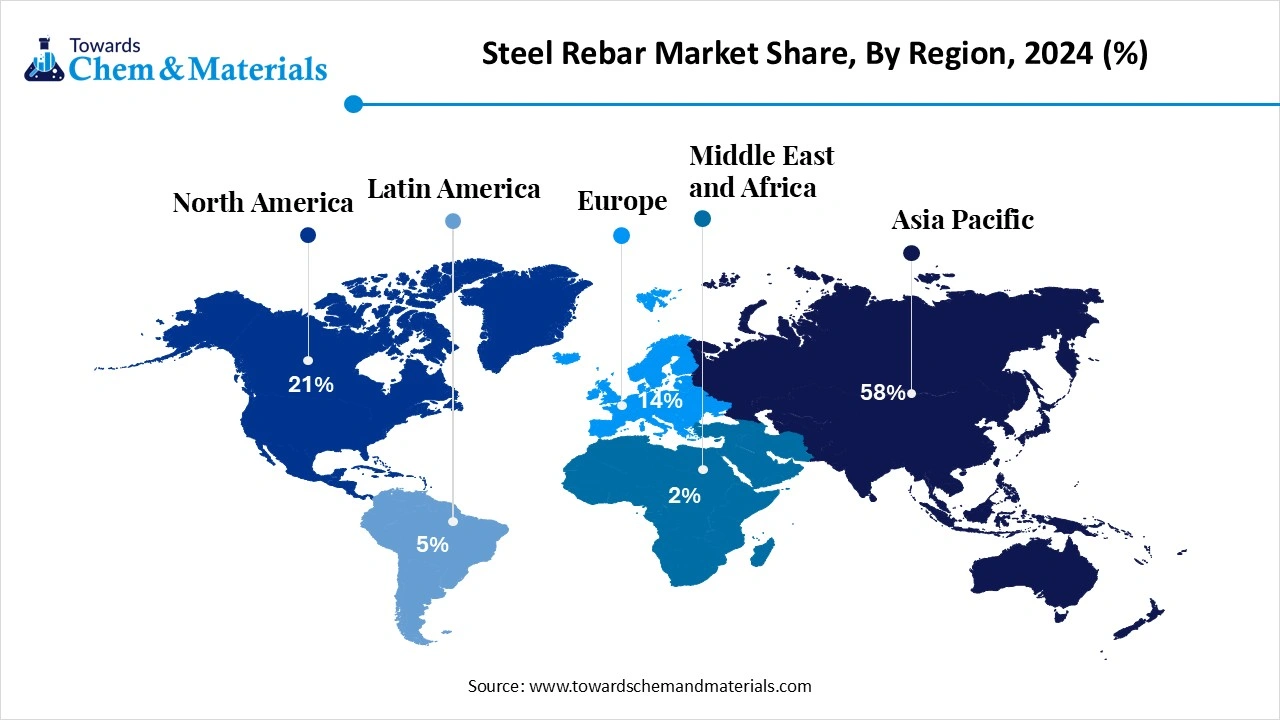

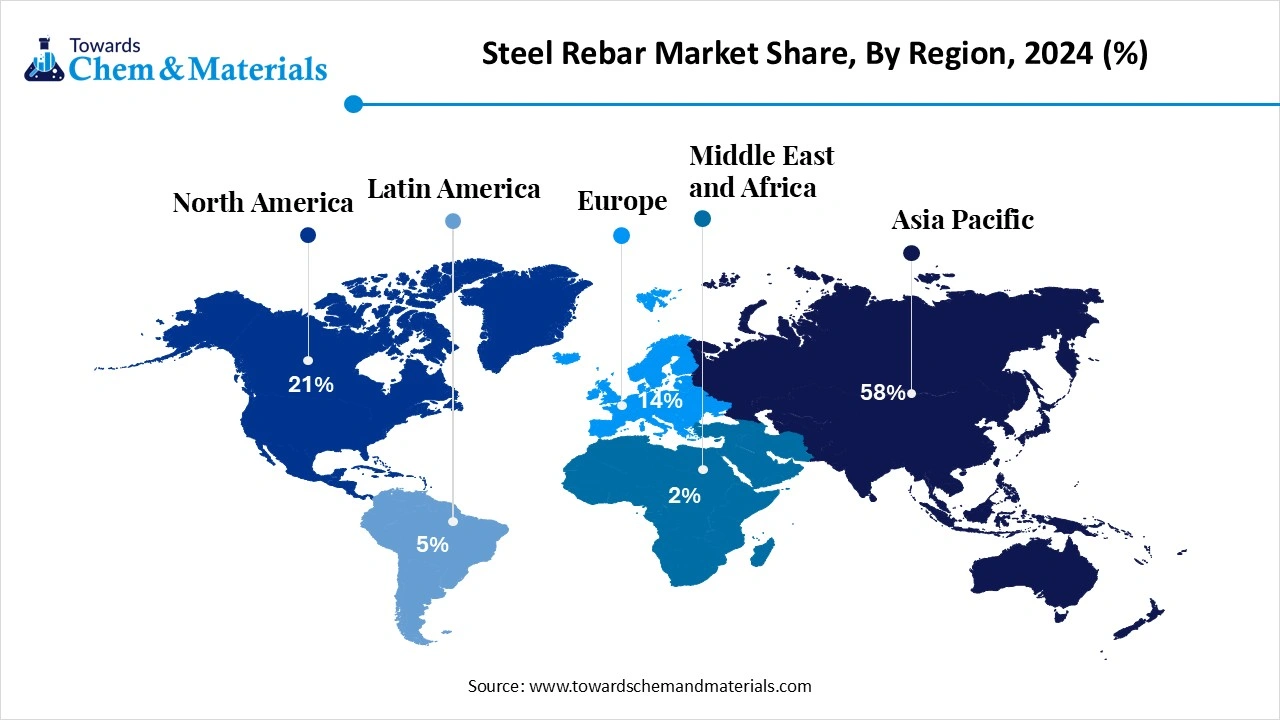

- By region, Asia Pacific dominated the steel rebar market with 58% industry share in 2024.

- By region, North America is expected to grow with a significant CAGR in the future.

- By region, Europe is also a notably growing region in the market.

- By product type, the deformed steel rebar segment dominated the market with 70.65% industry share in 2024.

- By product type, the mild steel rebar segment is expected to grow at the fastest rate in the market during the forecast period.

- By coating type, the plain carbon steel segment dominated the market with 50% industry share in 2024.

- By coating type, the epoxy-coated segment is expected to grow at the fastest rate in the market during the forecast period.

- By process type, the basic oxygen furnace segment dominated the market with 69.28% industry share in 2024.

- By process type, the electric arc furnace segment is expected to grow at the fastest rate in the market during the forecast period.

- By end-use type, the commercial segment dominated the market with 40% industry share in 2024.

- By end-use type, the industrial segment is expected to grow at the fastest rate in the market during the forecast period.

How the Steel Rebar Industry Evolved?

The steel rebar market comprises the production, distribution, and sale of steel reinforcing bars (rebar) used to strengthen concrete and masonry in construction projects (residential, commercial, infrastructure, and industrial). It includes various product forms (ribbed/ deformed bars, plain bars, epoxy-coated, threaded, and fabricated cages), multiple grades and diameters, and distribution channels spanning mills, service centers, and fabricators.

Key market considerations are raw-material feedstock (scrap and billet/ingot supply), production processes (electric-arc furnace and integrated blast-furnace routes), logistics and fabrication capabilities, regional construction activity and building codes, product quality/certification, and price/short-term volatility tied to steelmaking costs and demand from infrastructure and real-estate sectors.

Steel Rebar Market Report Scope

| Report Attribute |

Details |

| Market size value in 2026 |

USD 272.70 billion |

|

Revenue forecast in 2034 |

USD 426.51 billion |

|

Growth rate |

CAGR of 5.75% from 2025 to 2034 |

| Base year for estimation | 2024 |

|

Historical data |

2018 - 2023 |

|

Quantitative units |

Revenue in USD million/billion, volume in kilotons, and CAGR from 2025 to 2034 |

|

Segments covered |

By Product Type, By Coating Type , By Process Type , By End-Use Industry , By Region |

|

Regional scope |

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa |

|

Key companies profiled |

ArcelorMittal; NIPPON STEEL CORPORATION; NLMK; Nucor; Tata Steel; JSW; POSCO HOLDINGS INC.; Jiangsu Shagang Group; SAIL and Steel Dynamics, Inc. |

Steel Rebar Market Outlook:

- Industry Growth Overview: Between 2025 and 2034, the global shift towards greater and stronger infrastructure development has captured investor and stakeholder interest in the industry. Moreover, the industrialization in its peak, where the developed region has gained a major industry share in the current period. Also, by strengthening the concrete structure, the steel rebar has been flagged as a key area of market interest in recent years.

- Sustainability Trends: The steel rebar manufacturers are seen under heavy pressure to implement eco-friendly manufacturing. Moreover, processes like electric arc furnaces and hydrogen-based steelmaking have raised awareness among venture and corporate backers in the past few years.

- Global Expansion: The steel rebar industry in the Asia Pacific has observed powerful potential, while countries like India and China are leading the production and consumption at the same time. Also, the North America and Europe region has contributed heavily to the market potential by using a greater amount of steel rebar in the old building renovation and modern infrastructure development.

Key Technological Shifts in the Steel Rebar Market:

The technology upgrade is actively supporting the industry evolution nowadays. Moreover, the major manufacturers are shifting towards digitalization for tracking and labeling batches of the rebar. Moreover, the technology enabled the development of high-strength, corrosion-resistant, and even fiber-reinforced polymer rebars in the present period, as per the recent industry survey.

Trade Analysis of the Steel Rebar Market: Import, Export, Consumption, and Production Statistics

- China’s steel bar export reached 13.5 metric tons in 2024, as per the published report.(Source: vietnamsteel.com)

- India produced around 149.4 MT of crude steel in the year 2024, as per the published report.(Source: steel.gov.in)

Value Chain Analysis of the Steel Rebar Market:

- Distribution to Industrial Users : Major end-user sectors include construction of manufacturing plants, oil and gas facilities, and energy infrastructure.

- Chemical Synthesis and Processing : Steel rebar production is a multi-stage chemical and processing operation that transforms iron ore or recycled scrap metal into reinforced steel with specific mechanical and chemical properties.

- Regulatory Compliance and Safety Monitoring : Market participants are subject to extensive regulatory compliance and safety monitoring, driven by international standards, national building codes, and environmental policies.

Steel Rebar Market Regulatory Landscape: Global Regulations

| Country / Region | Regulatory Body | Key Regulations | Focus Areas | Notable Notes |

| United States | Department of Commerce, Environmental Protection Agency (EPA) | Trade laws and Section 232 tariffs, Environmental regulations | Sustainability, reducing emissions | The agency sets and enforces national environmental standards and regulations for industries like steel manufacturing, addressing issues like air and water pollution. |

| European Union | The European Steel Association (EUROFER) | (EU) 2016/1036 | sustainability and reducing the carbon footprint | The agency represents the EU steel industry, engaging with policymakers to advocate for favorable policies on trade. |

| China | Ministry of Industry and Information Technology (MIIT), | Normative Conditions for the Steel Industry 2025 (released in February 2025) | Improving rebar quality, phasing out outdated capacity | This agency supervises and guides the development of the steel industry through industrial policy |

| India | Ministry of Steel, Bureau of Indian Standards (BIS) | National Steel Policy (NSP) 2017 | Infrastructure and housing development | This ministry develops and enforces Indian Standards for rebar and other steel products. |

Segmental Insights

Product Type Insights

How did the Deformed Rebar Steel Segment Dominate the Steel Rebar Market in 2024?

The deformed rebar steel segment dominated the market with 70.65% of industry share in 2024 due to factors such as the high strength and the stronger grip with concrete. Furthermore, by resisting slippage and cracking, the steel rebar has gained major industry attention in recent years. Also, these factors have provided trust initiatives, the steel rebar, and developers of buildings, highways, and bridges are increasingly using the steel rebar in recent years, as per industry observation.

The mild steel rebar segment is expected to grow at a notable rate during the forecast period, owing to its higher flexibility, affordability, and easy weldability in the current period. Moreover, these bars are used in small and medium construction projects where the strength is not a priority. Also, the increased demand for affordable housing and short projects in the developed region, the mild steel bar is likely to gain major industry attention during the forecast period.

Coating Type Insights

Why does the Plain Carbon Steel Segment Dominate the Steel Rebar Market?

The plain carbon steel segment dominated the market with 50% industry share in 2024 because it is affordable, easy to produce, and widely available. It offers good strength and bonding with concrete, making it suitable for most standard construction applications. Contractors prefer it for its low cost and simple handling. It has been the traditional choice in developing regions where large volumes of rebar are needed quickly.

The epoxy-coated segment is expected to grow at a notable rate during the forecast period, because it provides excellent corrosion resistance and longer life. The green epoxy coating acts as a protective layer that prevents moisture and salts from damaging the steel inside the concrete. This makes it ideal for coastal, marine, and humid environments where plain steel corrodes faster. With growing focus on sustainable and low-maintenance infrastructure, many projects now prefer epoxy-coated rebar for bridges, tunnels, and highways.

Process Insights

How did the Basic Oxygen Furnace Segment Dominate the Steel Rebar Market in 2024?

The basic oxygen furnace segment dominated the market with 69.28% of industry share in 2024 because it has been the most established and large-scale method for steel production. It can process large volumes of steel quickly and efficiently, which makes it ideal for meeting high construction demand. BOF technology also produces consistent quality steel, which is important for structural applications.

The electric arc furnace segment is expected to grow at a notable rate during the forecast period, because it is cleaner, more energy-efficient, and eco-friendly. EAF uses scrap steel instead of raw iron ore, which helps reduce carbon emissions and supports recycling. It can also start and stop easily, making it flexible for modern steel production. As the world moves toward low-carbon manufacturing and sustainability goals, more steelmakers are investing in EAF technology.

End Use Industry Insights

Why does the Commercial Segment Dominate the Steel Rebar Market?

The commercial segment dominated the market with a 40% industry share in 2024 because of rapid growth in office buildings, malls, hotels, hospitals, and educational institutions. These structures require large amounts of rebar for foundations, columns, and slabs to ensure safety and durability. Rising urbanization and commercial development projects in cities have kept this segment in the lead.

The industrial segment is expected to grow at a notable rate during the forecast period, because of rising investment in factories, power plants, warehouses, and manufacturing facilities. As global manufacturing expands and countries promote local production, new industrial infrastructure will require strong and durable rebar. Industries also demand specialized, high-strength, and corrosion-resistant rebars for long-lasting performance in tough conditions.

Regional Insights

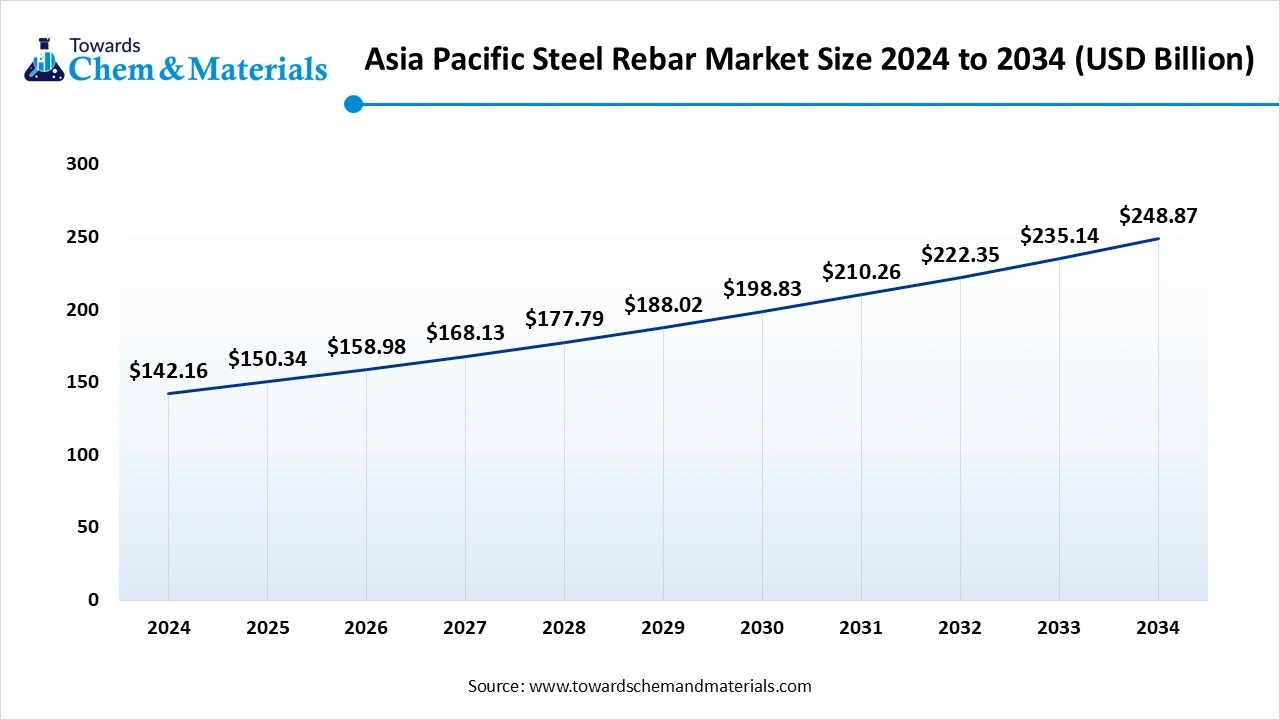

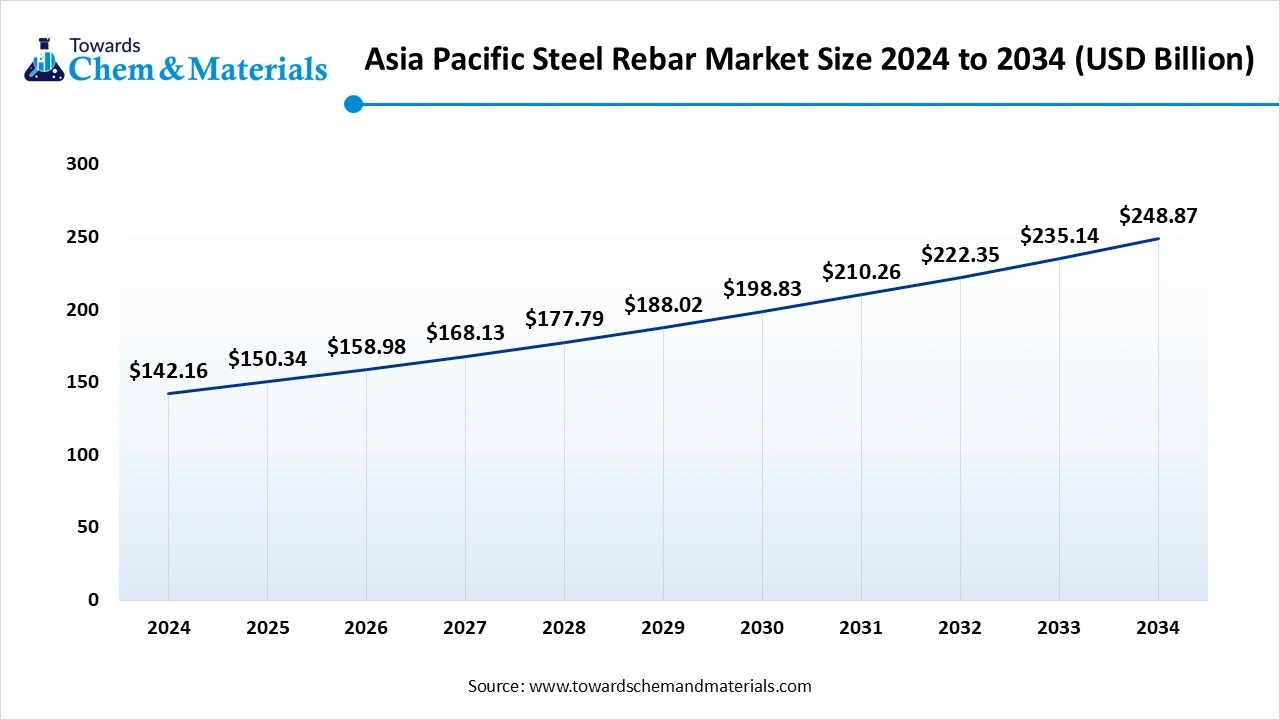

The Asia Pacific steel rebar market size was estimated at USD 150.35 billion in 2025 and is projected to reach USD 248.88 billion by 2034, growing at a CAGR of 5.76% from 2025 to 2034. Asia Pacific dominated the steel rebar market with 58% of the industry share, owing to enlarged steel manufacturing infrastructure and export across the globe. The regional countries, such as India, China, and Japan, are considered the prominent exporters of crude steel and also have huge domestic consumption at the same time. Also, the regional manufacturers are increasingly putting investments into the modern technology of eco-friendly steel production in recent years.

How is China Dominating the Steel Rebar Industry?

China maintained its dominance in the market due to ongoing infrastructure development and the governmental agenda towards high-end infrastructure. China is known for its steel exports. Also, the manufacturer of steel rebar in China is heavily investing in the expansion of their steel production outlets owing to the increased domestic demand in the country nowadays.

North America Steel Rebar Market Analysis

North America is expected to capture a major share of the steel rebar market during the forecast period, due to increasing infrastructure investments, especially in the United States. The aging roads, bridges, and buildings need repair or replacement. The government of the United States has passed major infrastructure bills to fund new highways, public transit, and energy-efficient buildings. There's also a push for local steel production to reduce dependence on imports. New housing projects and commercial construction are rising.

United States Steel Rebar Market Strengthens with Infrastructure Revival

The United States is expected to emerge as a prominent country for the market in the coming years, owing to its renewed focus on rebuilding infrastructure and increasing domestic steel production. The infrastructure investment and Jobs Act is pushing billions of dollars into highways, bridges, and clean energy projects. The country is also focused on using local materials, boosting demand for locally produced rebar. Modern construction methods and smart cities are also increasing steel needs. Environmental standards are pushing the use of stronger, longer-lasting rebar.

Europe Steel Rebar Market Trends

Europe is a notably growing region because of its push toward green infrastructure, sustainable construction, and energy-efficient buildings. Governments are investing in eco-friendly transport, smart cities, and resilient structures. Strict environmental laws also require advanced, high-quality steel products. Furthermore, the region has seen in establishment of the local manufacturing units to avoid dependence on exports.

How Germany is Driving Rebar Market Expansion?

Germany is expected to gain a major industry share because it has a strong construction sector and is transitioning to climate-friendly building materials. Germany also invests in research and technology, helping produce better steel products. This makes Europe, especially Germany, a growing and important player in the global rebar market

Recent Developments

- In October 2024, the SMEL will start the stainless-steel rebar production in the coastal region in India. Also, the company is heavily promoting the Make in India initiative, as per the published report.(Source: stainless-steel-world.net)

Top Vendors in the Steel Rebar Market & Their Offerings:

- ArcelorMittal: A Luxembourg-based multinational corporation and one of the world's largest steel and mining companies.

- China Baowu Steel Group: A state-owned China iron and steel conglomerate headquartered in Shanghai, which has become the largest steel manufacturer in the world by volume.

- HBIS Group: A state-owned China iron and steel manufacturing conglomerate based in Hebei, which is a major global steel producer and integrated service provider.

- Ansteel Group: A state-owned Chinese steel manufacturer from Liaoning

Other Key Players

- Shagang Group

- POSCO (POSCO Holdings)

- Nippon Steel Corporation

- JFE Steel Corporation

- Tata Steel

- JSW Steel

- Nucor Corporation

- Gerdau

- Steel Dynamics, Inc.

- United States Steel Corporation (U.S. Steel)

- NLMK Group (Novolipetsk)

- Evraz plc

- thyssenkrupp Steel

- Jindal Steel & Power

- MMK (Magnitogorsk Iron & Steel)

- Metinvest

Segments Covered in the Report

By Product Type

- Deformed Steel Rebar

- Grade Fe 415

- Grade Fe 500

- Grade Fe 550

- Mild Steel Rebar

- Grade Fe 250

- Grade Fe 415

By Coating Type

- Plain Carbon Steel

- ASTM A615

- ASTM A706

- Epoxy Coated

- ASTM A775

- ASTM A934

- Galvanized Steel

- ASTM A615/A706 with Zinc Coating

By Process Type

- Basic Oxygen Furnace (BOF)

- Integrated Steel Mills

- Blast Furnace–Basic Oxygen Furnace (BF-BOF)

- Electric Arc Furnace (EAF)

- Mini Mills

- Scrap-Based Production

By End-Use Industry

- Commercial

- Office Buildings

- Shopping Malls

- Mixed-Use Complexes

- Residential

- Single-Family Homes

- Multi-Family Units

- Industrial

- Manufacturing Facilities

- Industrial Parks

By Region

- North America

- U.S.

- Canada

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Sweden

- Denmark

- Norway

- Asia Pacific

- China

- Japan

- India

- South Korea

- Thailand

- Latin America

- Brazil

- Mexico

- Argentina

- Middle East and Africa (MEA)

- South Africa

- UAE

- Saudi Arabia

- Kuwait