Content

U.S. Metallocene LDPE Market Size, Share | CAGR of 6.70%.

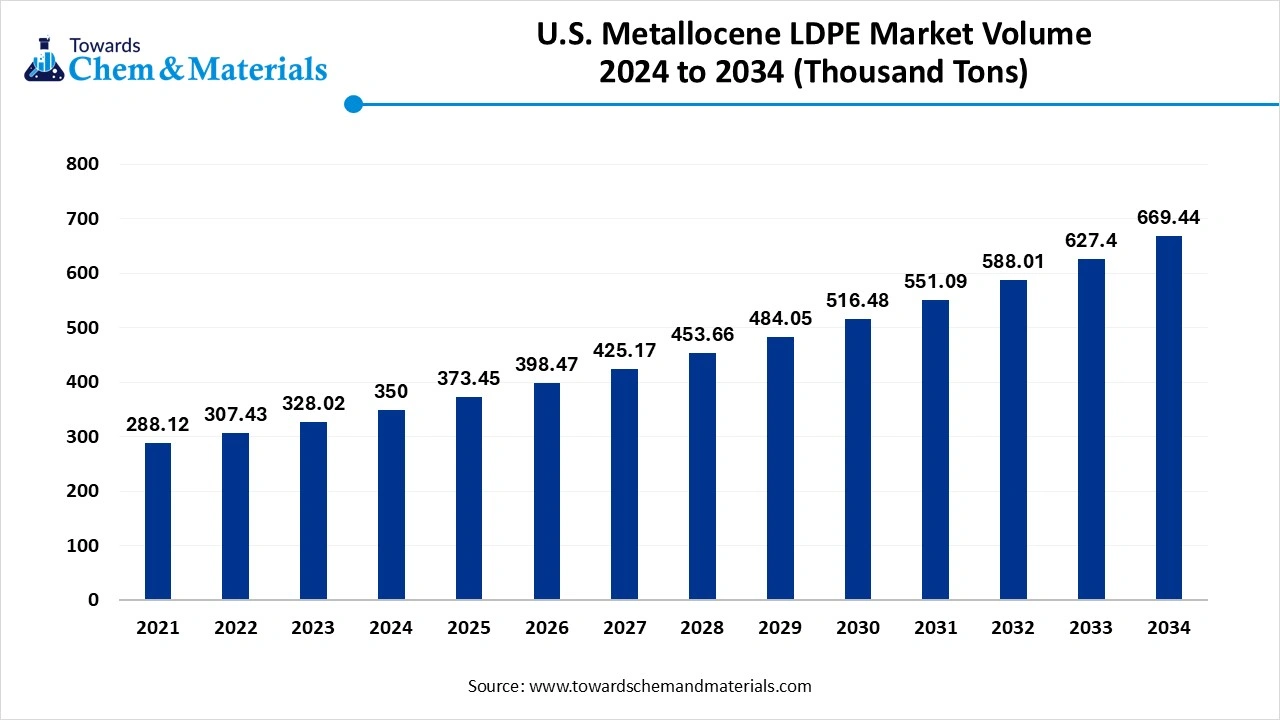

The U.S. metallocene ldpe market volume was reached at 350.00 thousand tons in 2024 and is expected to be worth around 669.44 thousand tons by 2034, growing at a compound annual growth rate (CAGR) of 6.70% over the forecast period 2025 to 2034. Increasing material demand in various applications is the key factor driving market growth. Also, ongoing advancements in recyclable mPE formulations, coupled with the rising shift towards recyclable mono-material packaging, can fuel market growth further.

Key Takeaways

- By country, the South region in the U.S. dominated the U.S. metallocene LDPE market with a 36% share in 2024. The dominance of the region can be attributed to the increasing transition towards recyclable mono-material packaging.

- By country, the West region in the U.S. is expected to grow at the fastest CAGR over the forecast period. The growth of the region can be credited to the ongoing innovations in manufacturing technologies.

- By application, the flexible packaging segment led the market by holding the largest market share of 27% in 2024. The dominance of the segment can be attributed to the superior characteristics of metallocene LDPE as compared to traditional LDPE.

- By application, the medical applications segment is expected to grow at the fastest CAGR over the forecast period. The growth of the segment can be credited to the growing need for sustainable packaging solutions.

- By processing technology, the blown film extrusion segment held a 52% market share in 2024. The dominance of the segment can be linked to the rising demand for high-performance packaging solutions.

- By processing technology, the extrusion coating/lamination segment is expected to grow at the fastest CAGR over the forecast period. The growth of the segment can be driven by a surge in the adoption of mLDPE in various applications.

- By product grade, the high clarity grade segment dominated the market by holding 29% market share in 2024. The dominance of the segment is owed to the ongoing innovations in metallocene catalyst technology.

By product grade, the UV-resistant grade segment is expected to grow at the fastest CAGR over the forecast period. The growth of the segment is due to the rising need for flexible packaging solutions. - By film thickness, the 10–25 microns (thin films) segment held a 35% market share in 2024. The dominance of the segment can be credited to the superior properties of metallocene LDPE.

- By film thickness, the <10 microns (ultra-thin) segment is expected to grow at the fastest CAGR over the forecast period. The growth of the segment can be driven by rising demand for lightweight and high-performance packaging solutions.

- By end-use industry, the food & beverage segment led the market by holding 31% market share in 2024. The dominance of the segment can be attributed to the surge in demand for flexible packaging.

- By end-use industry, the healthcare & medical segment is expected to grow at the fastest CAGR during the projected period. The growth of the segment can be credited to its exceptional sealing abilities.

The Increasing Demand for sustainable packaging is Expanding Market Growth

Metallocene Low-Density Polyethylene (m-LDPE) is a type of polyethylene produced using metallocene catalysts, resulting in a more uniform molecular structure, superior clarity, scalability, toughness, and puncture resistance compared to conventional LDPE. In the U.S., it is primarily used in flexible packaging, agricultural films, and industrial liners, owing to its performance in thin-gauge film applications. The push for mono-material and recyclable packaging is the major market driver, with metallocene LDPE enabling the creation of recyclable and lightweight films.

What Are the Key Trends Influencing the U.S. Metallocene LDPE Market?

- The rising demand for lightweight and durable materials in various sectors such as pharmaceuticals, food and beverage, and consumer goods is a key trend in the market. This trend has influenced the development of metallocene polyethylene, which offers enhanced elasticity and linearity as compared to conventional polyethylene.

- There is an ongoing shift towards sustainable materials in the country, boosted by consumer preferences and regulatory pressures. Metallocene polyethylene is preferred for its lower carbon footprint and recyclability as compared to traditional materials, which impacts positive market expansion.

- Technological innovation in polymer production, particularly in the development of metallocene catalysts, is propelling market growth in the country. Advancements in polymer processing methods have improved the production quality and efficiency of metallocene polyethylene resins.

Report Scope

| Report Attribute | Details |

| Market Volume in 2025 | 373.45 Thousand Tons |

| Expected Volume by 2034 | 669.44 Thousand Tons |

| Growth Rate from 2025 to 2034 | 6.70% |

| Base Year of Estimation | 2024 |

| Forecast Period | 2025 - 2034 |

| Segment Covered | By Application, By Processing Technology, By Product Grade, By Thickness (Films), By Thickness (Films), By Region (within U.S.) |

| Key Companies Profiled | ExxonMobil Chemical, Dow Inc., Chevron Phillips Chemical Company, LyondellBasell Industries, INEOS Olefins & Polymers USA, Westlake Corporation, SABIC Americas (U.S. Operations), Formosa Plastics Corporation USA, Borealis (through JV with TotalEnergies in U.S.), Braskem America, Shell Polymers (USA), TotalEnergies Petrochemicals & Refining USA, Nova Chemicals Corporation, Reliance Industries (U.S. trading operations), LG Chem America Inc., Mitsui Chemicals America, Hanwha Solutions USA |

Market Opportunity

The Introduction of Recyclable Packaging Films

The rising emphasis on sustainability and minimizing plastic waste has boosted the demand for recyclable packaging. Major players are increasingly launching new initiatives to increase the use of recyclable packaging and to minimize the overall use of plastic. Furthermore, metallocene polyethylene provides many benefits, such as a moisture barrier, superior mechanical properties, and processability, which makes it a flavoured choice for many industries.

- In September 2024, IndianOil selects Univation's UNIPOL PE Process Technology for the manufacturing line located at IOCL's Paradip, India. The unit is created to obtain a manufacturing capacity of 650,000 tons per annum of polyethylene (PE).(Source: www.indianchemicalnews.com)

Market Challenge

Limited Availability of Catalyst

The limited availability of catalysts is the major factor hampering the growth of the market, which directly affects the manufacturing capacity of metallocene LDPE and can lead to higher production costs. Moreover, the manufacturing of metallocene LDPE often necessitates specialized expertise and equipment, which can pose a barrier to entry for some major industry players in the market.

Country Insight

The south region in the U.S. dominated the market with a 36% share in 2024. The dominance of the region can be attributed to the increasing transition towards recyclable mono-material packaging, along with the consumer preference for durable, lightweight solutions. In addition, the rising focus on state-level packaging regulations and EPR programs is impelling manufacturers to develop high-level mLDPE grades that are more recyclable.

The West region in the U.S. is expected to grow at the fastest CAGR over the forecast period. The growth of the region can be credited to the ongoing innovations in manufacturing technologies and the growing demand for high-performance packaging. Additionally, metallocene LDPE provides improved clarity, strength, and other barrier properties as compared to traditional LDPE, which makes it ideal for medical films, food packaging, and shrink wraps.

U.S. Metallocene LDPE Market Volume Share, By Region, 2024-2034 (%)

| By Region | Volume Share, 2024 (%) | Market Volume Thousand Tons - 2024 | Volume Share, 2034 (%) | Market Volume Thousand Tons - 2034 | CAGR (2025 - 2034) |

| Northeast | 20.10% | 70.35 | 22.12% | 148.08 | 8.62% |

| Southwest | 13.40% | 46.90 | 15.10% | 101.09 | 8.91% |

| West | 27.07% | 94.75 | 23.43% | 156.84 | 5.76% |

| Southeast | 17.12% | 59.92 | 18.21% | 121.91 | 8.21% |

| Midwest | 22.31% | 78.09 | 21.14% | 141.53 | 6.83% |

| Total | 100% | 350.00 | 100% | 669.44 | 6.70% |

Segmental Insight

Application Insight

Which Application Type Segment Dominated the U.S. Metallocene LDPE Market in 2024?

The flexible packaging segment led the market by holding the largest market share of 27% in 2024. The dominance of the segment can be attributed to the superior characteristics of metallocene LDPE as compared to traditional LDPE, including improved clarity, strength, and other barrier properties.

Also, the rising need for flexible packaging solutions across many industries, such as healthcare, food, and hygiene, is impacting positive segment growth further.

The medical applications segment is expected to grow at the fastest CAGR over the forecast period. The growth of the segment can be credited to the growing need for sustainable packaging solutions and materials' superior characteristics of the materials. Additionally, metallocene LDPE provides enhanced mechanical properties as compared to traditional LDPE, such as better sealing performance, which makes it convenient for various medical applications.

Processing Technology Insight

Why did the Blown Film Extrusion Segment Dominated the U.S. Metallocene LDPE Market in 2024?

The blown film extrusion segment held a 52% market share in 2024. The dominance of the segment can be linked to the rising demand for high-performance packaging solutions, as well as the rising emphasis on sustainability by major players. Advancements in extrusion equipment and techniques enable market players to use the benefits of metallocene resins more efficiently.

The extrusion coating/lamination segment is expected to grow at the fastest CAGR over the forecast period. The growth of the segment can be driven by a surge in the adoption of mLDPE in various applications such as medical films, food packaging, and e-commerce packaging. Moreover, metallocene PE's robust adhesion to materials such as foil laminates, paper, and other polymers makes it crucial for applications like woven fabric coatings and paperboard lamination.

Product Grade Insight

How Did the high Clarity Grade Segment Held the Largest U.S. Metallocene LDPE Market Share in 2024?

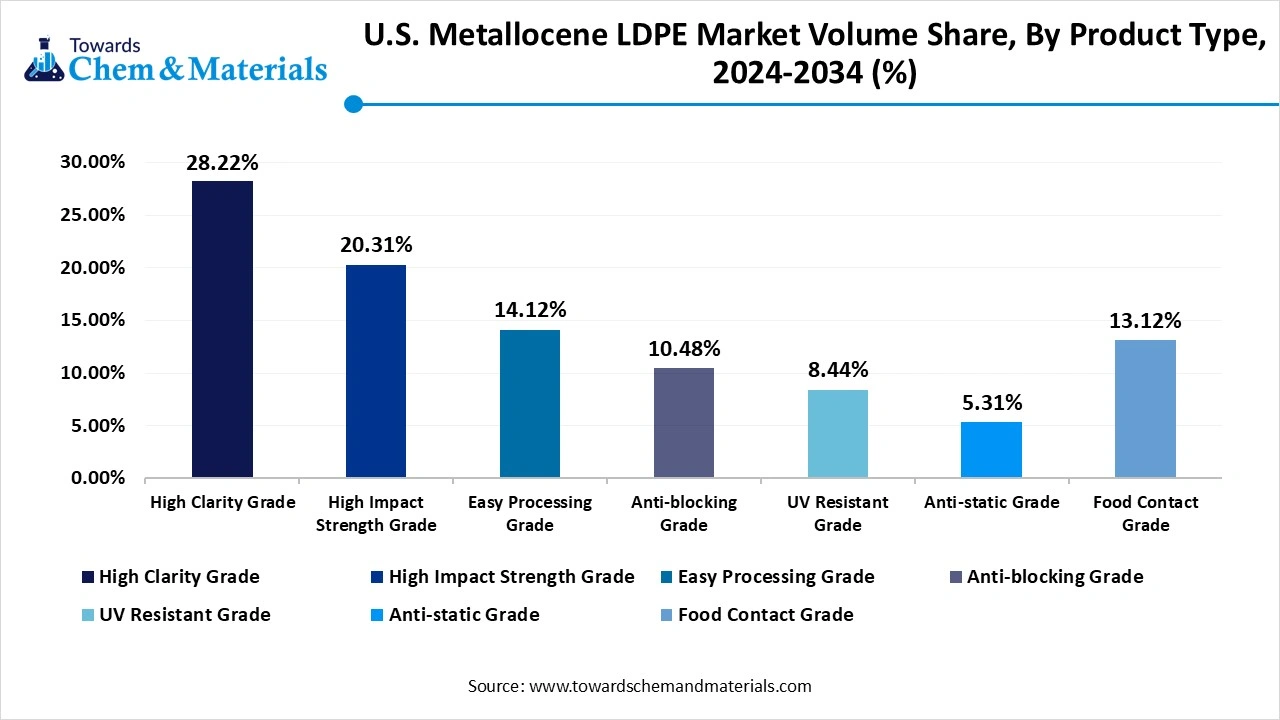

The high clarity grade segment dominated the U.S. metallocene LDPE market by holding 29% market share in 2024. The dominance of the segment is owed to the ongoing innovations in metallocene catalyst technology and manufacturing processes, which have enhanced the overall material properties with greater cost-effectiveness and processability. Furthermore, high clarity metallocene LDPE films are essential for applications like frozen food bags, stand-up pouches, and shrink films, leading to segment growth soon.

The UV-resistant grade segment is expected to grow at the fastest CAGR over the forecast period. The growth of the segment is due to the rising need for flexible packaging solutions, especially in the food and beverage industry, along with innovations in processing technologies. Moreover, UV-resistant grades are extensively utilized in various film applications such as stretch films, shrink films, and agricultural films because of their clarity, tensile strength, and flexibility.

U.S. Metallocene LDPE Market Volume Share, By Product Type, 2024-2034 (%)

| By Product Type | Volume Share, 2024 (%) | Market Volume Thousand Tons - 2024 | Volume Share, 2034 (%) | Market Volume Thousand Tons - 2034 | CAGR (2025 - 2034) |

| High Clarity Grade | 28.22% | 98.77 | 25.56% | 171.11 | 6.30% |

| High Impact Strength Grade | 20.31% | 71.09 | 19.31% | 129.27 | 6.87% |

| Easy Processing Grade | 14.12% | 49.42 | 15.54% | 104.03 | 8.62% |

| Anti-blocking Grade | 10.48% | 36.68 | 11.44% | 76.58 | 8.52% |

| UV Resistant Grade | 8.44% | 29.54 | 9.21% | 61.66 | 8.52% |

| Anti-static Grade | 5.31% | 18.59 | 6.50% | 43.51 | 9.91% |

| Food Contact Grade | 13.12% | 45.92 | 12.44% | 83.28 | 6.84% |

| Total | 100% | 350.00 | 100% | 669.44 | 6.70% |

Film Thickness Insight

Why Did the 10–25 Microns (Thin Films) Segment Dominated the U.S. Metallocene LDPE Market in 2024?

The 10–25 microns (thin films) segment held a 35% of U.S. metallocene LDPE market share in 2024. The dominance of the segment can be credited to the superior properties of metallocene LDPE, such as improved clarity, toughness, and sealing performance, which make it crucial for high-performance packaging applications. The 10–25-micron range is important for mLDPE, especially in applications such as flexibility, strength, and puncture resistance, which are necessary at thinner gauges.

The <10 microns (ultra-thin) segment is expected to grow at the fastest CAGR over the forecast period. The growth of the segment can be driven by rising demand for lightweight and high-performance packaging solutions across various sectors. The thinner films enable significant cost savings and material reduction, while also maintaining sustainability goals by minimizing overall plastic consumption.

End-Use Industry Insight

Which End-Use Industry Segment Dominated the U.S. Metallocene LDPE Market in 2024?

The food & beverage segment led the market by holding 31% market share in 2024. The dominance of the segment can be attributed to the surge in demand for flexible packaging, rising consumer preference for high-quality and sustainable food packaging options, and the expanding food delivery sector across the globe. Also, the Food & Beverage industry is a key consumer of flexible packaging, fueling segment expansion further.

The healthcare & medical segment is expected to grow at the fastest CAGR during the projected period. The growth of the segment can be credited to its exceptional sealing abilities, which make it convenient for creating reliable and secure packaging for pharmaceuticals and medical devices. Furthermore, mLDPE's softness and flexibility are beneficial for medical tubing, enabling maneuverability and easy handling while maintaining patient comfort.

Recent Developments

- In July 2024, IKV introduced a project to enhance LDPE recyclate abilities from household PCR. The project includes the whole plastics recycling value chain, which is meant to extend the boundaries of mechanical recycling to achieve the best possible recyclate qualities.(Source: interplasinsights.com)

- In March 2023, Gerdau Graphene introduced "First" graphene improved PE additive for the packaging application. The company has also collaborated with Sumitomo Corp. for the distribution of its masterbatches in Japan.(Source : www.ptonline.com)

Top Companies List

- ExxonMobil Chemical

- Dow Inc.

- Chevron Phillips Chemical Company

- LyondellBasell Industries

- INEOS Olefins & Polymers USA

- Westlake Corporation

- SABIC Americas (U.S. Operations)

- Formosa Plastics Corporation USA

- Borealis (through JV with TotalEnergies in U.S.)

- Braskem America

- Shell Polymers (USA)

- TotalEnergies Petrochemicals & Refining USA

- Nova Chemicals Corporation

- Reliance Industries (U.S. trading operations)

- LG Chem America Inc.

- Mitsui Chemicals America

- Hanwha Solutions USA

Segments Covered

By Application

- Flexible Packaging

- Food Packaging

- Beverage Packaging

- Personal Care Packaging

- Pharmaceutical Packaging

- Pouches & Sachets

- Industrial Packaging

- Pallet Shrink Films

- Industrial Liners

- Heavy-duty Bags

- Agriculture Films

- Greenhouse Films

- Mulch Films

- Silage Wraps

- Medical Applications

- IV Bags

- Pharmaceutical Tubing

- Blister Packaging

- Consumer Goods

- Housewares

- Toys

- Disposable Items

- Construction

- Vapor Barriers

- Insulation Films

- Roofing Sheets

- Electrical & Electronics

- Cable Sheathing

- Dielectric Films

- Wire Insulation

By Processing Technology

- Blown Film Extrusion

- Cast Film Extrusion

- Injection Molding

- Blow Molding

- Rotational Molding

- Foam Extrusion

- Extrusion Coating/Lamination

By Product Grade

- High Clarity Grade

- High Impact Strength Grade

- Easy Processing Grade

- Anti-blocking Grade

- UV Resistant Grade

- Anti-static Grade

- Food Contact Grade

By Thickness (Films)

- <10 Microns (Ultra-thin)

- 10–25 Microns (Thin Films)

- 26–50 Microns (Medium)

- 50 Microns (Thick Films)

By End-Use Industry

- Food & Beverage

- Healthcare & Medical

- Retail & E-Commerce

- Agriculture

- Industrial Manufacturing

- Consumer Goods

- Construction

- Utilities & Energy

By Region (within U.S.)

- Northeast

- Midwest

- South

- West