Content

U.S. Green Ammonia Market Size and Growth 2025 to 2034

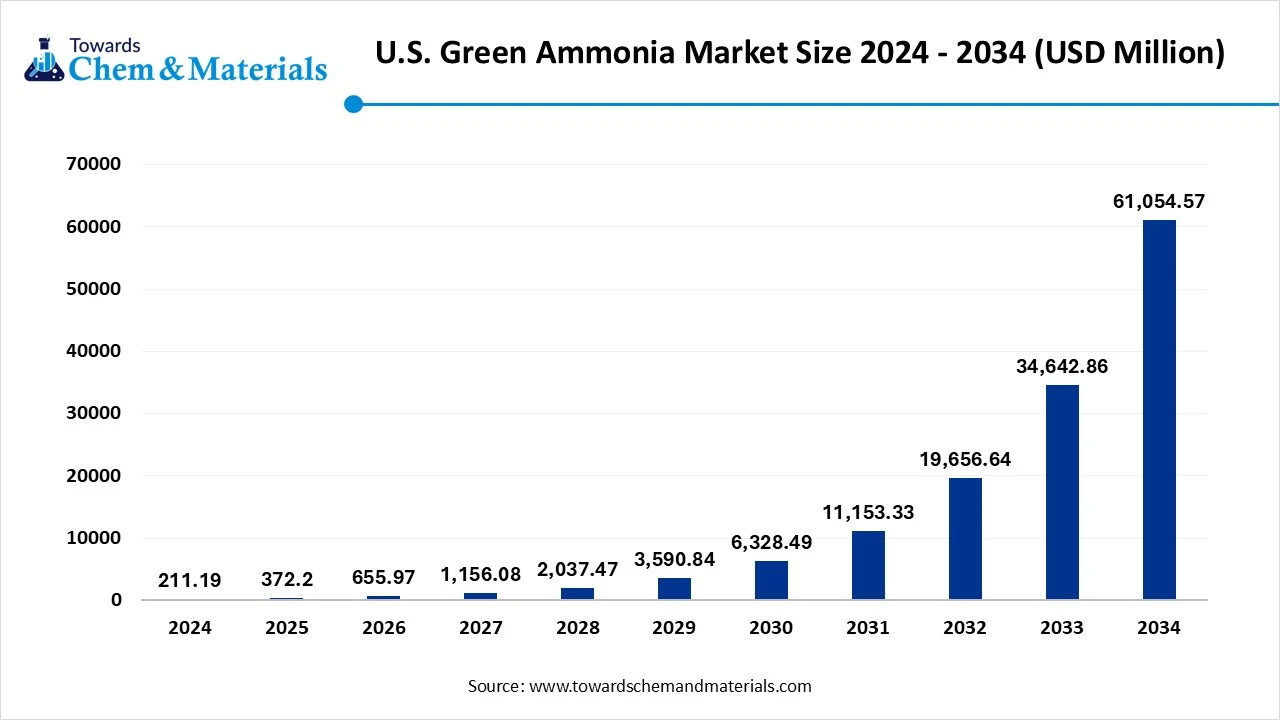

The U.S. green ammonia market size was reached at USD 211.19 million in 2024 and is expected to be worth around USD 61,054.57 million by 2034, growing at a compound annual growth rate (CAGR) of 76.24% over the forecast period 2025 to 2034. Increasing focus on decarbonization in the country is the key factor driving market growth. Also, the surge in demand for green ammonia as a sustainable fertilizer, coupled with the ongoing innovation in electrolyzer technology, can fuel market growth further.

Key Takeaways

- By production technology, the alkaline water electrolysis segment dominated the market with approximately 40% share in 2024. The dominance of the segment can be attributed to the growing investment in renewable energy infrastructure.

- By production technology, the proton exchange membrane (PEM) electrolysis segment is expected to grow at the fastest CAGR over the forecast period. The growth of the segment can be credited to the growing need for low-carbon ammonia.

- By power source, the wind power segment held approximately 45% market share in 2024. The dominance of the segment can be linked to the rising demand for sustainable alternatives and clean energy in transport.

- By power source, the solar power segment is expected to grow at the fastest CAGR over the forecast period. The growth of the segment can be driven by government policies for renewable energy.

- By application, the fertilizers & agriculture segment led the market by holding approximately 50% share in 2024. The dominance of the segment is owed to the growing demand to decarbonize the agricultural sector to fulfil net-zero targets.

- By application, the marine fuel & power generation segment is expected to grow at the fastest CAGR during the forecast period. The growth of the segment is due to the ongoing demand for decarbonization in the maritime and power industries.

- By end user industry, the agriculture & agrochemicals segment dominated the market with approximately 55% share in 2024. The dominance of the segment can be attributed to the growing demand for sustainable fertilizers.

- By end user industry, the energy & shipping segment is expected to grow at the fastest CAGR during the projected period. The growth of the segment can be credited to the ongoing government support.

- By distribution channel, the direct supply segment led the market by holding approximately 60% share in 2024. The dominance of the segment can be linked to the rising need for sustainable fertilizers in agriculture.

- By distribution channel, the government & institutional procurement segment is expected to grow at the fastest CAGR during the study period. The growth of the segment can be driven by federal policies supporting clean energy.

Technological Advancements Are Expanding Market Growth

The U.S. green ammonia market covers the production, distribution, and utilization of ammonia (NH₃) synthesized using renewable energy sources through electrolysis-based hydrogen production combined with nitrogen separation from air. Unlike conventional ammonia derived from natural gas (SMR-based), green ammonia is produced with zero/low carbon emissions. It is used as a sustainable feedstock for fertilizers, marine fuels, energy storage, power generation, and industrial chemicals.

- Market growth is driven by U.S. decarbonization targets, rising renewable energy capacity (solar, wind), government incentives for clean hydrogen/ammonia projects, and growing adoption of carbon-free fuels in shipping and power sectors.

What Are the Key Trends Influencing the U.S. Green Ammonia Market ?

- The increasing adoption of green ammonia in agriculture is the key trend in the market. Farmers are rapidly transitioning towards low-carbon fertilizers to meet sustainability demands. A conventional ammonia is a major source of greenhouse gas emissions and can be replaced by its green counterpart.

- The growing use of green ammonia in clean energy applications is another major trend shaping a positive market trajectory. Green ammonia is acting as a key solution in the clean energy sectors, acts as a power generation fuel, and also a hydrogen carrier, leading to further market growth.

- The rapid innovations in production technologies are impacting positive market growth. Green ammonia is increasingly becoming cost-competitive with conventional ammonia, fuelled by advancements in production technologies. These advancements are driving the U.S. to become a global leader in green ammonia production.

Report Scope

| Report Attributes | Details |

| Market Size in 2025 | USD 372.20 Million |

| Expected Szie by 2034 | USD 61,054.57 Million |

| Growth Rate from 2025 to 2034 | CAGR 76.24% |

| Base Year of Estimation | 2024 |

| Forecast Period | 2025 - 2034 |

| Segment Covered | By Production Technology, By Power Source, By Application, By End-User Industry, By Distribution Channel |

| Key Companies Profiled | CF Industries, Yara International, Bloom Energy, AmmPower, First Ammonia |

Market Opportunity

Growing Emphasis on Decarbonization

The increasing focus on decarbonization by major market players and the government is the key factor creating lucrative opportunities in the market. Government support for green ammonia includes essential initiatives like the U.S. Department of Energy's (DOE) Industrial Decarbonization Roadmap, which aligns with strategies to minimize carbon emissions across different sectors. Furthermore, recent innovations in nitrogenase and electrochemical processes are improving the efficiency of green ammonia production.

- In February 2025, Landus and TalusAg announced that they commenced commercial green ammonia manufacturing with their only modular systems in NA. This advanced solution ensures proper tolerance in the domestic fertilizer supply chain to help American farmers.(Source: www.businesswire.com)

Market Challenge

Regulatory and Policy Uncertainty

A lack of clarity regarding the regulatory policies and insufficient incentives are the major factors hindering market growth. Delays in getting permits for new projects and a lack of strong private-public partnerships constrained transformation. Moreover, producing green hydrogen, the raw material for green ammonia, is expensive compared to traditional hydrogen production techniques.

Country Insight

U.S. Green Ammonia Market Trends

The Gulf Coast region dominated the market with a 50% share in 2024. The dominance of the region can be attributed to its crucial role in boosting the hydrogen economy, along with the growing demand for sustainable agricultural fertilizers. In addition, the region provides strategic advantages such as current infrastructure for handling, shipping, and distribution of huge amounts of ammonia, which are necessary for export markets.

The West Coast region is expected to grow at the fastest CAGR over the forecast period. The growth of the region can be credited to the supportive government policies and incentives supporting sustainable fertilizers while meeting the demand for renewable energy in modern agriculture. Furthermore, the increasing awareness of greener solutions also propels the demand for green ammonia in the region.

Segmental Insight

Production Technology Insight

Which Production Technology Segment Dominated the U.S. Green Ammonia Market in 2024?

The alkaline water electrolysis segment dominated the market with a 40% share in 2024. The dominance of the segment can be attributed to the growing investment in renewable energy infrastructure, along with the surge in the use of green ammonia in agriculture as an energy carrier. Also, AWE is a robust technology famous for its lower capital expenditure and reliability compared to other electrolysis techniques.

The proton exchange membrane (PEM) electrolysis segment is expected to grow at the fastest CAGR over the forecast period. The growth of the segment can be credited to the growing need for low-carbon ammonia fueled by government incentives and climate goals. Technological innovations in both PEM electrolyzers are lowering costs, which makes green ammonia more economically convenient for various applications.

Power Source Insight

Why Wind Power Segment Dominated the U.S. Green Ammonia Market in 2024?

The wind power segment held a 45% market share in 2024. The dominance of the segment can be linked to the rising demand for sustainable alternatives and clean energy in transport, agriculture, and power generation, propelled by supportive policies. Additionally, Wind energy offers a zero-emission and cost-effective power source for electrolysis, which is crucial for producing green hydrogen from water.

The solar power segment is expected to grow at the fastest CAGR over the forecast period. The growth of the segment can be driven by government policies for renewable energy, along with the decreasing solar PV costs. Moreover, A global transition towards sustainable energy solutions is boosting demand for green alternatives to fossil fuels.

Application Insight

How Much Share Did the Fertilizers & Agriculture Segment Held in 2024?

The fertilizers & agriculture segment led the market by holding 50% share in 2024. The dominance of the segment is owed to the growing demand to decarbonize the agricultural sector to fulfil net-zero targets. In addition, agriculture is the largest segment in the market, boosted by consumer and industry demand for eco-friendly fertilizer options.

The marine fuel & power generation segment is expected to grow at the fastest CAGR during the forecast period. The growth of the segment is due to the ongoing demand for decarbonization in the maritime and power industry, coupled with the benefits of green ammonia as a zero-carbon fuel. The U.S. possesses extensive renewable resources, which are important for creating clean hydrogen for green ammonia synthesis.

End-User Industry Insight

Which End-User Industry Segment Dominated U.S. Green Ammonia Market in 2024?

The agriculture & agrochemicals segment dominated the market with a 55% share in 2024. The dominance of the segment can be attributed to the growing demand for sustainable fertilizers and the expansion of the green hydrogen economy, which are necessary to produce green ammonia. Also, modernization of investment in renewable energy infrastructure, like wind power and solar power, is crucial to power the electrolysis process.

The energy & shipping segment is expected to grow at the fastest CAGR during the projected period. The growth of the segment can be credited to the ongoing government support, like the Inflation Reduction Act, and technological innovations in fuel cells and electrolysis. In addition, innovations in storage infrastructure are important for integrating green ammonia into the energy transportation industry.

Distribution Channel Insight

Why Did The Direct Supply To The End-User's Segment Held The Largest U.S. Green Ammonia Market Share In 2024?

The direct supply segment led the market by holding a 60% share in 2024. The dominance of the segment can be linked to the rising need for sustainable fertilizers in agriculture, along with the utilization of green ammonia for power generation. Furthermore, efforts to minimize the reliance on fossil fuels to diversify energy sources will soon impact positive segment growth.

The government & institutional procurement segment is expected to grow at the fastest CAGR during the study period. The growth of the segment can be driven by federal policies supporting clean energy and significant investments in renewable hydrogen, coupled with the decarbonization regulations of federal agencies such as the Department of Defense, leading to segment expansion shortly.

U.S. Green Ammonia Market Value Chain Analysis

- Feedstock Procurement : In the market feedstock procurement, emphasis is placed on two major components: water and renewable energy, which are utilized to create green hydrogen.

- Chemical Synthesis and Processing : In this stage, various technologies and methods are used to create ammonia with a smaller carbon footprint. The green ammonia production utilizes renewable energy, which makes these processing and synthesis methods crucial to decarbonizing industries.

- Packaging and Labelling : This stage involves strict safety regulations for anhydrous ammonia, imposed by the Department of Transportation (DOT) and the Occupational Safety and Health Administration (OSHA).

- Regulatory Compliance and Safety Monitoring : It involves a tedious framework of federal, state, and industry-oriented rules to ensure the safe and environmentally sound manufacturing, handling, and transport of these hazardous materials.

Recent Developments

- In March 2024, ABB announced the collaboration with Green Hydrogen International (GHI) for a major green hydrogen infrastructure in South Texas, U.S. Hydrogen is to be utilized to create one million tons of green ammonia a year to meet global ammonia demand.(Source: new.abb.com)

U.S. Green Ammonia Market Top Companies

- CF Industries

- Yara International

- Bloom Energy

- AmmPower

- First Ammonia

Segments Covered

By Production Technology

- Alkaline Water Electrolysis

- Proton Exchange Membrane (PEM) Electrolysis

- Solid Oxide Electrolysis

- Hybrid & Emerging Pathways

By Power Source

- Solar Power

- Wind Power

- Hydropower

- Others (Geothermal, Hybrid Renewables)

By Application

- Fertilizers & Agriculture

- Power Generation & Energy Storage

- Marine Fuel (Shipping Industry)

- Hydrogen Carrier & Industrial Feedstock

- Chemicals & Pharmaceuticals

By End-User Industry

- Agriculture & Agrochemicals

- Energy & Utilities

- Shipping & Transportation

- Chemicals & Industrial Manufacturing

By Distribution Channel

- Direct Supply to End-Users (fertilizer producers, utilities, ship operators)

- Commodity Traders & Chemical Distributors

- Government & Institutional Procurement Programs