Content

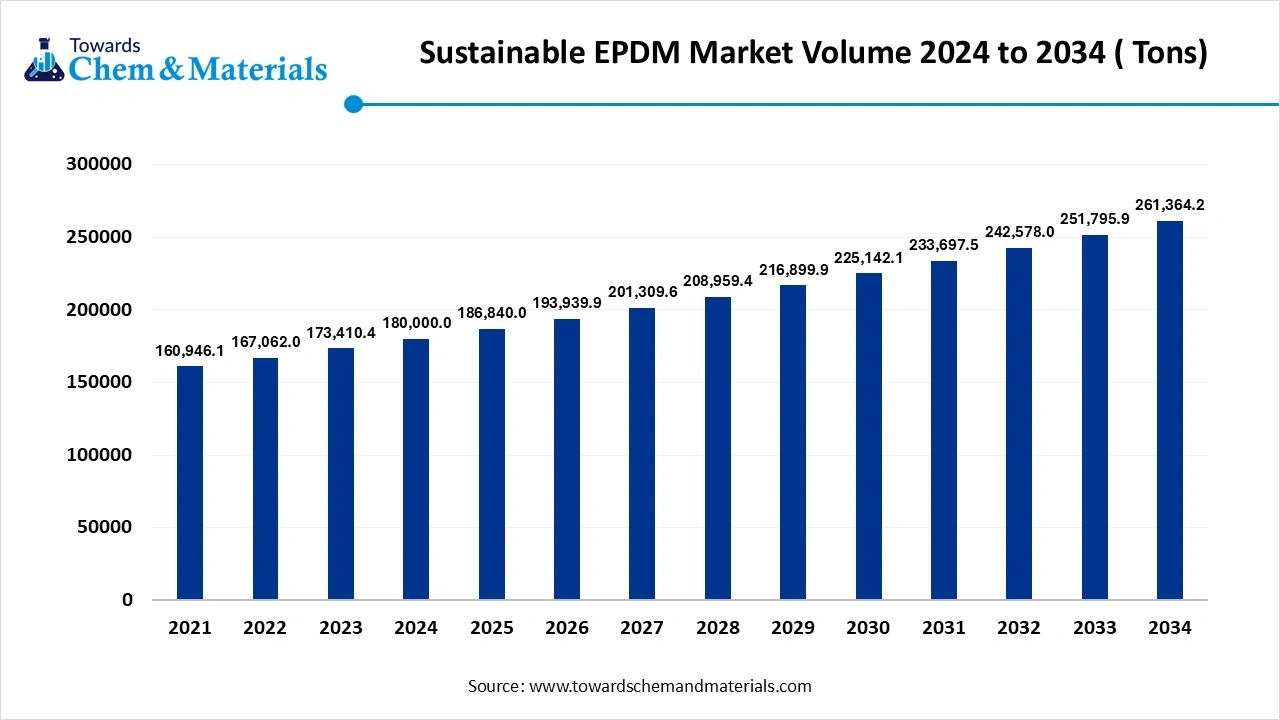

Sustainable EPDM Market Volume and Growth 2025 to 2034

The global sustainable EPDM (ethylene propylene diene monomer) market volume was reached at 1,80,000.0 tons in 2024 and is expected to be worth around 2,61,364.2 tons by 2034, growing at a compound annual growth rate (CAGR) of 3.80% over the forecast period 2025 to 2034. The increased adoption of sustainable material in heavy manufacturing industries has significantly increased industry potential in recent years.

Key Takeaways

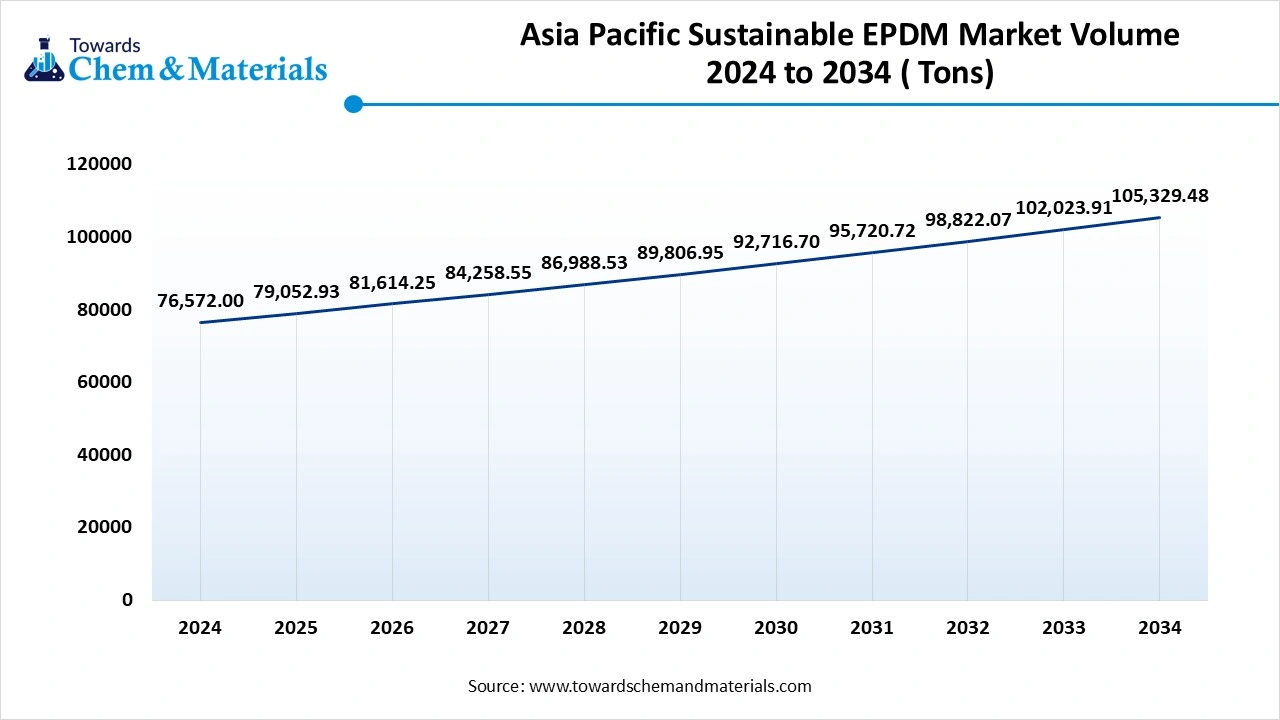

- The Asia Pacific sustainable EPDM market volume is estimated at 79,052.93 tons in 2025 and is expected to reach 105,329.48 tons by 2034, growing at a CAGR of 3.24% from 2025 to 2034.

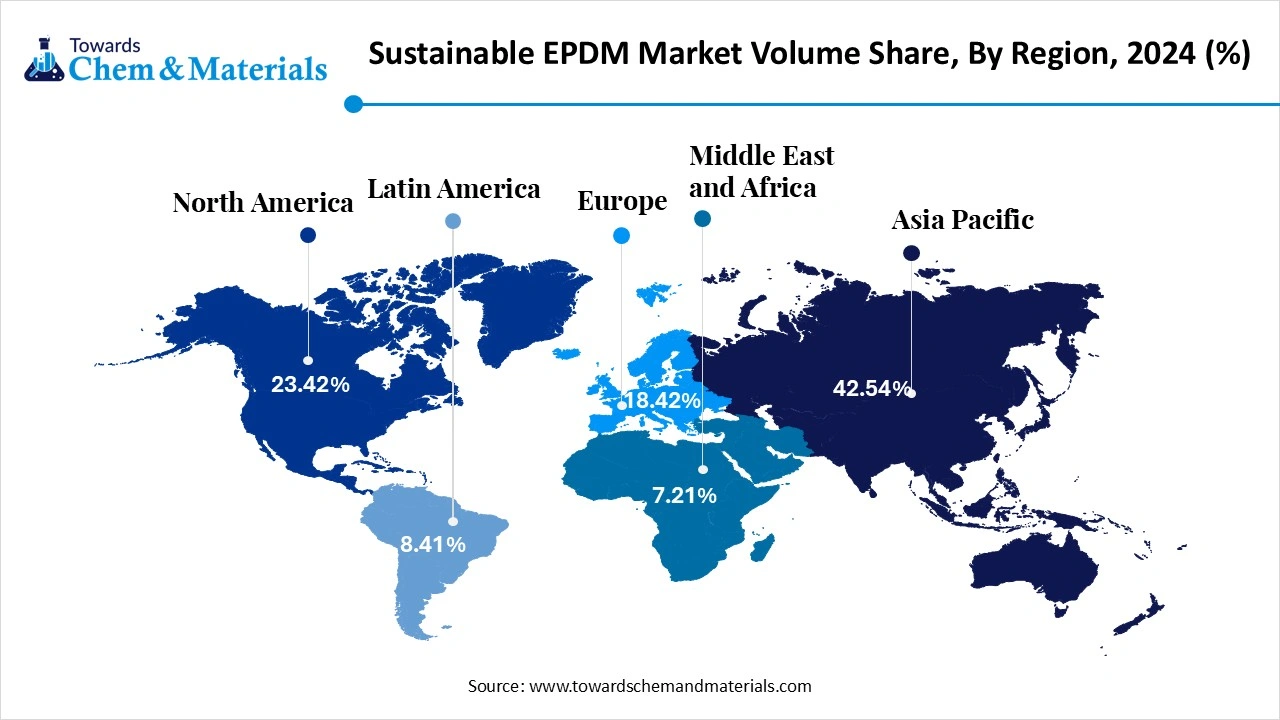

- The Asia Pacific sustainable EPDM market held the largest volume share of 42.54%of the global market in 2024.

- The North America sustainable EPDM market is expected to register the fastest CAGR of 4.63% over the forecast period by 2025-2034.

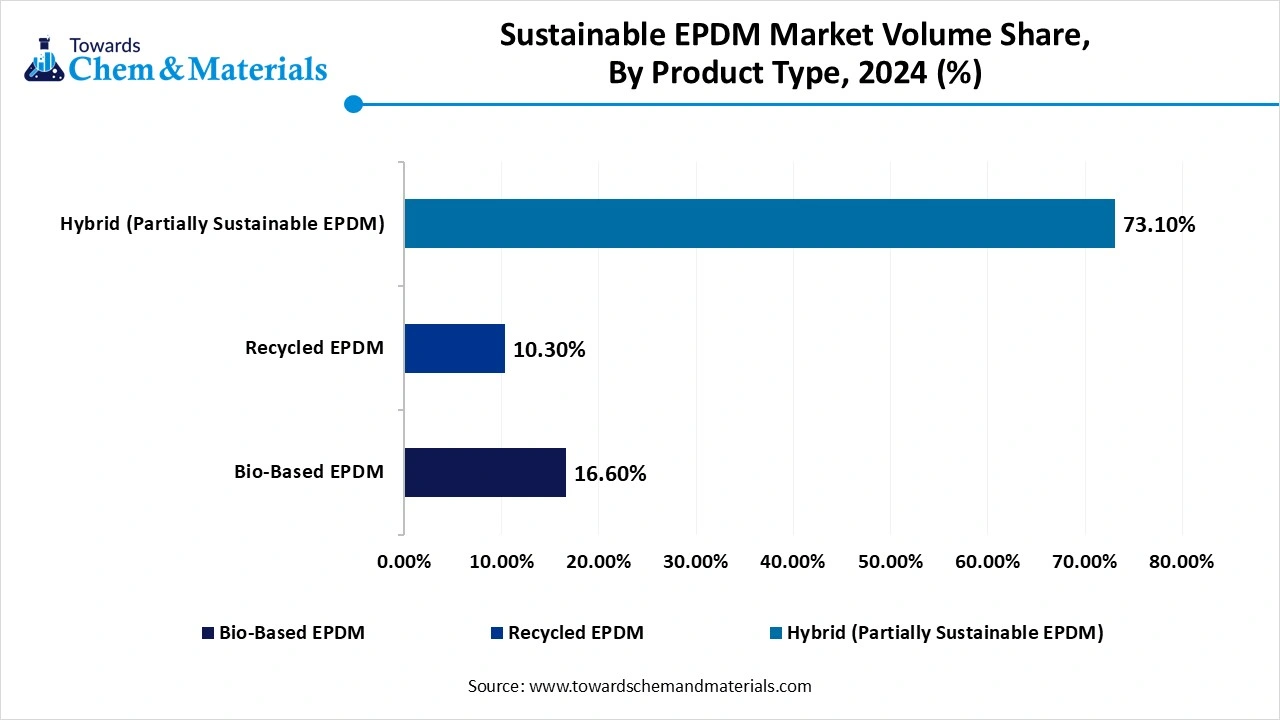

- By Product Type, the Hybrid (Partially Sustainable EPDM) segment dominated the market with the largest volume share of 73.10% in 2024.

- By Product Type, the recycled EPDM segment is projected to grow at the fastest CAGR of 6.13% over the forecast period by 2025-2034.

- By manufacturing process, the solution polymerization segment emerged as the top-performing segment in 2024, due to the increased need for high-purity EPDM in the heavy industries in recent years.

- By manufacturing process, the gas phase polymerization segment is expected to lead the market in the coming years, due to having unique properties such as energy efficiency and cost-effectiveness.

- By end-use industry, the automotive and transportation segment led the market in 2024, because EPDM is widely used in vehicles for seals, hoses, belts, and weatherstrips.

- By end-use industry, the construction and infrastructure segment is expected to capture the biggest portion of the market in the coming years, due to increasing use of EPDM in roofing, waterproofing, seals, and insulation.

- By distribution channel, the direct sales segment led the sustainable EPDM (ethylene propylene diene monomer) market in 2024, because it allows manufacturers to build strong relationships with buyers, offer better pricing, and ensure product quality.

- By distribution channel, the online and E-commerce segment is expected to grow at the fastest rate in the market during the forecast period, because it makes purchasing faster, easier, and more transparent.

Market Overview

Sustainable EPDM: Combining Performance with Environmental Responsibility

The sustainable EPDM (ethylene propylene diene monomer) market involves the production and application of EPDM rubber derived from eco-friendly or bio-based feedstocks and manufactured through energy-efficient, low-emission processes. Sustainable EPDM is widely used across construction, automotive, electronics, and industrial sectors due to its excellent resistance to heat, weathering, and UV, along with improved sustainability credentials. It is increasingly favored for reducing carbon footprints and meeting regulatory and ESG mandates.

Which Factor Is Driving the Sustainable EPDM (ethylene propylene diene monomer) market?

The increased need for eco-friendly materials in the heavy industries is spearheading the industry growth in the current period. Moreover, several regional governments and industries are actively seen in pushing green initiatives, which have provided a wider consumer base in recent years. Also, the need for durable, flexible, and weather-resistant materials can drive the growth of the market, as the sustainable EPDM has all the properties.

Market Trends

- The sudden increased demand for the oil-based EPDM has contributed to the industry's growth in recent years. Moreover, these oil-based EPDMs are produced from plant-based materials, as per the observation.

- The heavy need for sustainable EPDM from the automotive sector has driven industry growth over the past few years as automakers are using this rubber in their electric vehicle for its lightweight and weather resistance properties.

Report Scope

| Report Attribute | Details |

| Market Volume in 2025 | 1,86,840.0 Tons |

| Expected Volume by 2034 | 2,61,364.2 Tons |

| Growth Rate from 2025 to 2034 | 3.80% |

| Base Year of Estimation | 2024 |

| Forecast Period | 2025 - 2034 |

| Dominant Region | Asia Pacific |

| Segment Covered | By Type, By Manufacturing Process, By End-User Industry, By Distribution Channel, By Region |

| Key Companies Profiled | LANXESS AG, Dow Inc. , ExxonMobil Chemical , Arlanxeo , JSR Corporation , SK Global Chemical , Versalis (Eni Group), Mitsui Chemicals , Kumho Polychem , Carlisle Companies |

Market Opportunity

Architects and Developers Embrace Green Materials in Modern Design

The increased expansion of green roofing systems and waterproof construction is expected to create lucrative opportunities for manufacturers in the coming years. Moreover, several architects and developers have been using sustainable materials in their constructions in recent years. Also, the global government's push for the eco-friendly initiative is likely to contribute to industry growth in the coming years, as per the observation.

Market Challenge

Sustainable EPDM Faces Growth Barriers Due to Costly Processing Methods

The high production cost of sustainable EPDM is anticipated to hamper industry growth in the coming years, as the raw material and processing methods of the production of sustainable EPDM are seen expensive than the traditional petroleum-based rubber. Also, these expenses can create growth barriers for the new entrants and mid-sized businesses in the coming years.

Segmental Insights

By Product Type Insights

How did the Bio-Based EPDM Segment Dominate the Sustainable EPDM (Ethylene Propylene Diene Monomer) Market in 2024?

The biobased EPDM segment held the largest share of the market in 2024, due to the global reduction of petroleum-based products. By offering similar performance to the traditional EPDM, bio-based EPDM has gained immense industry attention in recent years. Moreover, industries such as automotive, consumer goods, and construction are actively trying to reduce carbon emissions, where the bio-based EPDM can gain a major industry share in the coming years.

The recycled EPDM segment is expected to grow at a notable rate during the predicted timeframe due to the increasing need for cost-effective and waste reduction solutions in heavy manufacturing industries globally. Moreover, as technology advances, it is playing a major role in market expansion while actively improving the quality and consistency of recycled EPDM in recent years.

Sustainable EPDM (ethylene propylene diene monomer) Market Volume Share, By Product Type, 2024-2034 (%)

| By Product Type | Volume Share, 2024 (%) | Market Volume - 2024 | Volume Share, 2034 (%) | Market Volume - 2034 | CAGR (2025 - 2034) |

| Bio-Based EPDM | 16.60% | 29,880.0 | 18.46% | 48,247.8 | 5.47% |

| Recycled EPDM | 10.30% | 18,540.0 | 12.12% | 31,677.3 | 6.13% |

| Hybrid (Partially Sustainable EPDM) | 73.10% | 1,31,580.0 | 69.42% | 1,81,439.0 | 3.63% |

| Total | 100% | 1,80,000.0 | 100% | 2,61,364.2 | 3.80% |

By Manufacturing Process

Why does the Solution Polymerization Segment Dominate the Sustainable EPDM (Ethylene Propylene Diene Monomer) Market by Manufacturing Process?

The solution polymerization segment held the largest share of the sustainable EPDM (ethylene propylene diene monomer) market in 2024, due to the increased need for high-purity EPDM in the heavy industries in recent years. Furthermore, by producing the EPDM, which has greater flexibility, weather resistance, and strength, the solution polymerization process has gained immense industry attention in recent years.

The gas phase polymerization segment is expected to grow at a notable rate due to having unique properties such as energy efficiency and cost-effectiveness. Moreover, by consuming the minimum solvents for production, the gas phase polymerization process can create immense industry opportunities in the upcoming years, as per the recent industry observation.

By End Use Industry

Why Did the Automotive and Transportation Segment Dominate the Sustainable EPDM (Ethylene Propylene Diene Monomer) Market in 2024?

The automotive and transportation segment dominated the market with the largest share in 2024, because EPDM is widely used in vehicles for seals, hoses, belts, and weatherstrips. Its excellent resistance to heat, UV, and chemicals makes it perfect for vehicle interiors and engine parts. With rising vehicle production and growing interest in sustainable components, automakers are switching to bio-based and recycled EPDM to reduce environmental impact. Regulatory standards requiring green materials in cars also support this trend. Since the automotive industry is one of the largest consumers of EPDM, it continues to lead in adopting sustainable alternatives across both passenger and commercial vehicles.

The construction and infrastructure segment is expected to grow at a notable rate due to increasing use of EPDM in roofing, waterproofing, seals, and insulation. Sustainable EPDM materials are preferred in green building projects for their durability, weather resistance, and energy efficiency. As governments push for eco-friendly buildings and smart cities, builders are using more recycled and bio-based materials. EPDM also helps reduce maintenance costs and extends the life of structures.

By Distribution Channel Insights

Why Did The Direct Sales Segment Dominated The Sustainable EPDM

The direct sales segment held the largest share of the sustainable EPDM (ethylene propylene diene monomer) market in 2024, because it allows manufacturers to build strong relationships with buyers, offer better pricing, and ensure product quality. Major users like automotive companies and construction firms prefer buying directly from producers to ensure they get the right material specifications. It also reduces the chances of counterfeit or low-quality products. For manufacturers, direct sales improve margins and offer better market control. This model works especially well in B2B markets, where bulk purchases and long-term contracts are common. That's why, so far, direct sales have been the top distribution method for sustainable EPDM products.

The online and E-commerce segment is expected to grow at a notable rate because it makes purchasing faster, easier, and more transparent. Small and medium-sized buyers can compare prices, read reviews, and place orders without needing large sales teams. With the rise of digital transformation, more industrial buyers are shifting to online platforms to save time and cost. E-commerce also helps manufacturers reach a wider audience globally. As logistics and digital payment systems improve, even bulk materials like EPDM are being bought online. The convenience, cost-efficiency, and growing trust in online sales will drive this segment forward.

Regional Insights

The Asia Pacific sustainable EPDM market volume was estimated at 76,572.00 tons in 2024 and is anticipated to reach 105,329.48 Tons by 2034, growing at a CAGR of 3.24% from 2025 to 2034.

Asia Pacific dominated the market in 2024 , owing to fast-paced industrialization and green construction development. Moreover, the regional countries such as India, China, and Japan have been actively involved in the heavy promotion of sustainable manufacturing infrastructure in recent years. Furthermore, the region has heavy usage of recycled EPDM, which can lead to an industry demand in the coming years.

How are China’s Sustainability Goals Shaping its Industrial Future?

China is expected to rise as a dominant country in the region in the coming years, owing to the stronger government push for sustainability initiatives in recent years. Also, the country is actively planning to start the local production units due to the country’s own heavy domestic consumption of rubber over the years. Moreover, industries such as automotive and construction have been actively contributing to the industry's potential in the past few years.

Europe expected to capture a major share of the market during the forecast period, akin to the heavy implementation of the strong environmental regulations. Moreover, the region is benefiting from initiatives such as the early adoption of green materials and stricter carbon goals in recent years. Furthermore, sectors like automotive, construction, and industrial are seen under the heavy replacement of traditional rubber with bio-based alternatives in the current period.

How are Germany’s Automotive and Chemical Giants Driving EPDM Innovation?

Germany maintained its dominance in the sustainable EPDM (ethylene propylene diene monomer) market, owing to the presence of the heavy and advanced automotive and chemical industries. Moreover, these industries are actively looking for sustainable alternatives for their manufacturing process, where biobased EPDM has emerged as the ideal option in the past few years. Also, the German manufacturers are actively involved in putting investment development and improving the performance of the biobased EPDM nowadays.

Sustainable EPDM (ethylene propylene diene monomer) Market Volume Share, By Region, 2024-2034 (%)

| By Region | Volume Share, 2024 (%) | Market Volume - 2024 | Volume Share, 2034 (%) | Market Volume - 2034 | CAGR (2025 - 2034) |

| North America | 23.42% | 42,156.0 | 24.23% | 63,328.5 | 4.63% |

| Europe | 18.42% | 33,156.0 | 19.31% | 50,469.4 | 4.78% |

| Asia Pacific | 42.54% | 76,572.0 | 39.02% | 105,329.48 | 3.24% |

| Latin America | 8.41% | 15,138.0 | 9.31% | 24,333.0 | 5.42% |

| Middle East & Africa | 7.21% | 12,978.0 | 8.13% | 21,248.9 | 5.63% |

| Total | 100% | 1,80,000.0 | 100% | 2,61,364.2 | 3.80% |

Recent Developments

- In July 2024, Dow introduced their latest biobased EPDM in DKT 2024. Also, these EPDMs are specifically designed for the automotive and consumer application named NORDELTM REN as per the report published by the company.(Source: corporate.dow.com)

- In April 2024, Hutchinson unveiled their latest product line of EPDM rubber. the newly launched rubber is specially designed for electric vehicles, as per the company's claim.( Source: www.chemanalyst.com)

Top Companies List

- LANXESS AG

- Dow Inc.

- ExxonMobil Chemical

- Arlanxeo

- JSR Corporation

- SK Global Chemical

- Versalis (Eni Group)

- Mitsui Chemicals

- Kumho Polychem

- Carlisle Companies

Segment Covered

By Product Type

- Bio-Based EPDM

- Recycled EPDM

- Hybrid (Partially Sustainable EPDM)

By Manufacturing Process

- Solution Polymerization

- Suspension Polymerization

- Gas-Phase Polymerization

By End-User Industry

- Automotive & Transportation

- Construction & Infrastructure

- Electrical & Electronics

- General Manufacturing

- Others (Healthcare, Consumer Products)

By Distribution Channel

- Direct Sales (B2B)

- Distributors & Wholesalers

- Online / E-commerce Platforms

By Region

- North America

- U.S.

- Mexico

- Canada

- Europe

- Germany

- UK

- France

- Italy

- Asia Pacific

- China

- India

- Japan

- South Korea

- Central & South America

- Brazil

- Argentina

- Middle East & Africa

- Saudi Arabia

- UAE